Month: October 2013

Ericsson Sales Under Pressure; Wireless Network Infrastructure Market in Transition

Ericsson today reported 3Q-2013 earnings that were less than the consenus forecast. Third-quarter net income of 2.92 billion kronor missed the 3.07 billion kronor average analyst estimate. Profit rose 34 percent from the year-earlier period, helped by lower costs and the company exiting an unprofitable chip venture with STMicroelectronics. More importantly, revenue fell 3 percent, to 52.9 billion kroner, also below analysts’ average estimate, of 54.3 billion kroner.

The Stockholm-based manufacturer of telecommunications infrastructure, the world’s largest, is struggling in an increasingly competitive environment and has cuts thousands of jobs in Sweden over the past year to slash costs. Ericsson holds about a 35 percent global market share in the wireless network infrastructure used by carriers like Verizon Wireless and China Mobile.

Business slowed in the U.S. and Japan where projects to make wireless carriers’ networks speedier are nearing completion. “It’s hard to offset the slowdown in the largest projects in North America and Japan,” Ericsson’s chief executive, Hans Vestberg, said in a telephone interview with the NY Times. He said that currency fluctuations also were taking a toll on the company’s international sales.

In its earnings report, Ericsson said that a number of its high-profile mobile network projects in both North America and Japan were either completed or nearly so. Sales in Northeast Asia, including Japan, fell 28 percent, to 6.1 billion kroner, in the third quarter, compared with the same period a year earlier. The region is the second largest market by sales for the Swedish company, after North America.

“We are currently seeing sales coming under some pressure,” Ericsson CEO Hans Vestberg said. In addition to negative currency effects, the comparable sales figure was hurt by the completion of two large mobile broadband coverage projects in North America. “We also saw impact from reduced activity in Japan where we are getting closer to completion of a major project,” Vestberg said.

“While the sales level was disappointing in the quarter, such volatility is not unusual in the industry, and increasing spending outside the U.S. is expected to lead to future growth,” said Janardan Menon, a telecommunications analyst at Liberum Capital in London.

“The projects that peaked in the first half in North America are starting to have an effect,” said Fredrik Thoresen, an analyst at DNB ASA in Oslo with a hold rating on the stock. Slowing sales in North America, a high-margin region for Ericsson, bring down its profitability, he said.

Both North American and Northeast Asia have been engines of growth for Ericsson in recent years, while investment in other parts of the world, notably Europe, has waned.

Vestberg said that uncertainty still remains in certain parts of the world, although the macroeconomic climate has stabilized in many markets and the “long-term fundamentals in the industry remain attractive.”

“Ericsson now sees growth in several European markets and margins are also improving as the network modernization projects gradually come to an end and we engage more in new capacity and LTE business,” he said, referring to the high-speed data standard for mobile phones.

References:

http://abcnews.go.com/International/wireStory/ericsson-q3-net-profit-jumps-strong-margins-20665659

http://www.ericsson.com/thecompany/investors

Wireless Network Infrastructure Market Overview:

The global mobile network infrastructure business is in transition as the major equipment vendors reorganize. The manufacturers are eager to take advantage of the growth of mobile data, as consumers around the world shift away from making voice calls on their smartphones to accessing the Internet on phones and tablets.

Nokia now owns all of Nokia Siemens Networks, which had previously spun off its optical division. Alcatel-Lucent is also revamping, having announced this month that it would cut 10,000 jobs, or 14 percent of its global work force. Alcatel-Lucent wants to increase its profitability after several years of declining growth.

Market analysts say that Nokia or another mobile infrastructure company may look to acquire the struggling Alcatel-Lucent, as rivals position themselves for an expected increase in investment from cellphone carriers into high-speed fourth-generation networks.

Ericsson and its U.S./European network equipment competitors, however, are also under threat from Asian rivals like Huawei, ZTE and Samsung, which are looking to increase their own market shares in local and international markets alike. Bloomberg reported this week that Nokia- which divested its handset division to Microsoft- will attempt to acquire Alcatel-Lucent.

“This deal makes complete sense,” Sami Sarkamies, a Helsinki-based analyst at Nordea Bank AB, said in a phone interview. “Nokia will have the financial flexibility to do this kind of deal and Alcatel needs to slim down. There is a relatively high likelihood of this deal happening.”

Nokia has evaluated options including a combination with Alcatel-Lucent’s mobile-phone networks business, a person with knowledge of the matter said last month. An acquisition would open the U.S. market to Nokia, helping the Finnish company shrink the gap with market leader Ericsson

Several European carriers like Telefónica of Spain and Telecom Italia are struggling to reduce their debt burdens and have put off infrastructure upgrades to their mobile phone networks. One bright spot in Europe is the British carrier Vodafone, a big Ericsson customer, which announced in September that it would invest £6 billion, or $9.7 billion, after it sold its stake in the American company Verizon Wireless to its partner, Verizon Communications, for $130 billion.

Meanwhile AT&T continues to build out it’s LTE network footprint, which lags far behind Verizon’s which is available in over 500 U.S. cities.

http://www.verizonwireless.com/b2c/support/coverage-locator

Meanwhile, small cells

Wireless Network Operators identify small cell challenges and buildout plans

Introduction:

Infonetics Research released excerpts from its 2013 Small Cell Coverage Strategies: Global Service Provider Survey, for which Infonetics interviewed wireless, incumbent, and competitive operators around the world about their small cell buildout plans.

SMALL CELL SURVEY HIGHLIGHTS:

•83% of respondent operators have deployed small cells, an increase of 11% from Infonetics’ 2012 survey

•78% of respondents rate “multimode” and “seamless integration with macrocellular networks” as very important small cell features

•Small cell backhaul staged a comeback as a barrier to deploying small cells in this year’s survey, but overall barriers are waning with the exception of outdoor site acquisition, which remains challenging

•Respondents don’t expect small cells to take the place of distributed antenna systems (DAS) anytime soon, instead viewing the technologies as complementary

•New alternatives to small cells like Ericsson’s Radio Dot System hold the potential to reduce the need for DAS in very specific applications such as medium and large enterprises

•A majority of survey respondents say they will definitely require self-organizing networks (SON) and coordinated multipoint (CoMP) to optimize network performance while diminishing the need for units

ANALYST NOTES:

“As evidenced by our latest small cell study, operators are seriously gearing up small cells for significant macrocellular network enhancements,” says Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

“Since service providers will be adding small cells to existing macro sites in very specific parts of their networks, there’s good reason to believe the total number of small cells will surpass that of macrocell sites, but definitely not by large proportions,” continues Téral. “Operators need to look at their spectrum resources and apply them as the need for capacity increases. This means selecting the right tool in the coverage and capacity toolbox.”

From a previous Infonetics report on Small Cells: https://techblog.comsoc.org/2013/10/04/infonetics-small-cell-market-ramp-wont-happen-this-year

“The large service providers remain committed to their small cell deployment plans, but the pace of deployment is much slower than expected due to a sad reality: Small cell and macrocell rollouts share nothing in common,” explains Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. Téral continues: “Each technology requires its own internal business processes, which have been in place for decades with macrocells but have to be built from the ground up for small cells taking into consideration things like footfall, building dimensions, backhaul availability, and wireless technology. There is no cookie-cutter template for small cell deployments!” Co-author of the report Richard Webb, directing analyst for microwave and carrier WiFi at Infonetics, adds: “Given that service providers are in the process of retooling their plan of attack, we’re not expecting the small cell ramp to happen in 2013.”

SMALL CELL SURVEY SYNOPSIS:

For its 28-page small cell survey, Infonetics interviewed independent wireless, incumbent, and competitive operators from Europe, North America, Asia, and Latin America about their small cell buildout plans. The study helps manufacturers and operators better understand the use cases for small cells, the number and types of small cells needed, frequency bands required, and best-suited architectures.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Separately, Amdocs says that mobile operators say that the cost of rolling out small cells is currently around five times too high. Amdocs presented a new solution designed to speed up small cell deployment and cut costs. “Existing planning tools are not up to the job. They lack automation,” said Phil Bull, product marketing manager at Amdocs.

As it stands, designing and rolling out the backhaul for small cells can take weeks, but operators need to reduce this to just a few days or even a single day, he said. “It’s a complicated challenge to do it manually.”

Amdocs offers an inventory-centric solution that can help operators automatically generate a network design that reduces both cost and complexity. “[The solution] is being rolled out now,” Bull said. Amdocs is working with pilot customers in North America, where the small cells market is more advanced than in many other markets.

http://www.totaltele.com/view.aspx?ID=483930

Video: Manage Signaling Impact of Small Cells on LTE network:

Alcatel-Lucent categories: metro, enterprise and residential small cells http://www.youtube.com/watch?v=mupyGC4r4FI

FBR: Communications Market Transition + Assessment of Juniper, F5 Networks, & Motorola Solutions

From Scott Thompson of FBR Capital Markets:

We continue to expect the service provider march toward commodity hardware, NFV, and SDN technologies to accelerate through 4Q, with the impact beginning to show in guides as early as 4Q and more significantly in 1H14. We expect enterprise vertical to remain largely steady, at least relative to the changes taking place as webscale, government, and service provider verticals continue to shift toward cloud-based architectures.

Longer term, we continue to expect a marked shift in spend from routing into optical and from hardware into software.

Assessment of Juniper, F5 Networks and Motorola Mobility:

1. Juniper Networks (JNPR) is poised to top earnings estimates again. We are raising 3Q13 EPS to $0.34.

Juniper is scheduled to report 3Q13 earnings Tuesday, Oct. 22nd after the close, and to hold its earnings call at 5 p.m. EDT (877-407-8033). We expect the JNPR story to remain challenged, despite what we believe will be a strong quarter report. There does appear to be a substantial core routing upgrade developing in the service provider (SP) vertical. However, we expect competitive pressure from ALU could continue to rise, particularly in the core network. Additionally, we expect current core upgrades will be more muted and less routing intensive than past cycles. Longer term, we believe Juniper could be challenged to transition away from its legacy core routing and switching business and toward a more optical and software-based revenue stream. While our 12-month view on JNPR remains cautious, we raise our 3Q13 EPS estimate to $0.34, above the $0.31 consensus estimate. We are lowering our 4Q revenue estimates nearly 3% below consensus, driving our EPS estimate down to $0.34 for 4Q13.

Oct 23rd Update:

JNPR posted yet another quarter of record MX routing revenues, which drove 3Q results above consensus. While Juniper is performing well against consensus estimates, we are increasingly starting to question how long the MX product family can drive upside to results.

Carriers like AT&T and Verizon, which have each traditionally and consistently driven over 10% of revenues for years, are no longer doing so. This data seems to partially validate our thesis that carriers will spend less on traditional routing and switching going forward. In their place, however, is surging demand from web scale and cable companies, representing a diversification of the client base that we view positively. We are increasingly concerned that after more than four quarters of strong edge routing upgrades, Juniper continues to struggle to find products to serve as new sources of growth. New products, while reaching over $110M in revenues in 3Q, are contributing but remain ~10% of revenue. Regardless, Juniper continues to throw off an impressive amount of cash. We continue to believe, however, that the SP business is likely to deteriorate for Juniper, leaving its earnings power for 2014 well short of consensus.

2. F5 Networks (FFIV) positioned for a strong quarter.

F5 Networks is scheduled to report F4Q13 earnings after the close Wednesday, Oct. 23rd and will hold an earnings call at 4:30 p.m. EDT (800-857-3834, password “F5 Networks”). We expect F5’s F4Q13 to reveal a business re-accelerating product growth. Enterprise is likely to remain robust on the back of new product sales and SP is likely to be improving due to an emerging trend where carriers are virtualizing special purpose hardware for NFV-like deployments. We continue to believe, however, that tech vertical (approximately 18% of revenues) may continue to slowly shift away from F5’s traditional hardware platforms in favor of custom software-based load balancing solutions. While we expect shares of FFIV could run over the next few quarters, we believe the risk/reward profile of FFIV is less favorable than leading names in the optical sector.

3. Motorola Solutions (MSI) needs to deliver in 2H13. [Note that Motorola Mobility is now owned by Google]

Motorola Solutions is scheduled to report 3Q13 earnings before market open Wednesday, Oct. 23rd and will hold the earnings call at 8:00 a.m. EDT (866-952-1906, password “MSIQ313”). After a relatively weak 1H, management has positioned investors to expect a stronger performance in 2H13, particularly on the margin front. All eyes will be on MSI’s government business as it is set to report what is normally its strongest quarter of the year, tapping strong order backlog built up in 1H13. We expect enterprise spend to continue to be soft as tablets and smartphones are increasingly substituted for ruggedized laptops and bar code scanners. MSI’s share repurchase program is likely to pick up where organic growth leaves off this year, providing a near-term floor for shares. We remain on the sidelines in search of stronger organic growth.

Utility Telephone: competitive business voice, data, and Internet services in CA and NV

Utility Telephone, Inc. is is an Integrated Communications Provider and Competitive Local Exchange Carrier (CLEC) which provides a variety of Internet, data and telephone services to businesses and non profit organizations in both California and Nevada.

Specific services include: Internet access and secure data services; private line services for dedicated point-to-point communications; local phone service (PSTN), business voice solutions, auto attendant, on-demand conference, hosted PBX-IP business trunking, music on hold, VoIP phone, and DSL and web server hosting services.

Unlike many other competitive carriers that resell tier 1 carrier services, Utility operates its own switching and fiber-optic OC-48 networks, including over 30 ILEC collocation sites and a datacenter in Los Angeles, CA.

Utility Telephone’s Virtual Private Network (VPN) and IP-Multi-Protocol Label Switching (MPLS) are two robust and secure service offerings for business customers that want the benefits of a private network using managed IP transport.

1. VPN allows business locations to seamlessly communicate over a private and secure connection, sharing information and maximizing productivity across multiple locations.

2. IP-MPLS captures your data for specific user groups, establishing a private network that cannot be accessed by any unathorized viewers, whether they are in different buildings, cities or countries.

The IP- MPLS service has the following benefits for business customers:

- Reduces overhead

- Removes firewalls

- Improves performance-faster throughput and lower latency

- Simple implementation and configuration

- Capital investment savings (CAPEX)

This privately held company was founded in 1996 and has its headquarters in Stockton, California. Utility is noted for providing “Customer First” support and service to businesses within its serving areas. Long-term customer relationships are valued highly by the company’s executive team.

You can read customer testimonials at: http://www.utilitytelephone.com/company_testimonials.php

The company has been a Better Business Bureau (BBB) Accredited Business since 10/14/2008.

For further info on the company, please contact me at: [email protected]

Regulation: All CLECs (and ILECs) operating in CA are regulated by the CA Public Utility Commision (CPUC). The CPUC serves the public interest by protecting consumers and ensuring the provision of safe, reliable utility service and infrastructure at reasonable rates, with a commitment to environmental enhancement and a healthy California economy.

North America OTN switching revenue up 80% Y-O-Y in 1st half of 2013

Infonetics Research just released its latest OTN and Packet Optical Hardware report, which tracks optical transport network (OTN) switching and transport equipment and packet-optical transport systems (P-OTS).

OTN AND P-OTS MARKET HIGHLIGHTS

- In the 1st half of 2013 (1H13), worldwide OTN revenue (OTN transport and switching equipment) was up 23% from 1H12, to $3.9 billion

- OTN switching spending in North America more than tripled in 1H13, growing 80% from a year ago

- Fujitsu’s OTN hardware revenue market share spiked 152% in 1H13 from 1H12

- Globally, P-OTS equipment revenue is up 41% year-over-year in 1H13

- Incumbents Alcatel-Lucent, Ciena, Cisco, Fujitsu, and Tellabs are the P-OTS market leaders, but new players BTI, Cyan, Ericsson, and Transmode are challenging with pure-play P-OTS platforms

ANALYST NOTE:

“OTN switching is experiencing breakout growth in North America and EMEA (Europe, Middle East, Africa), where service providers are adopting integrated WDM and OTN switching and rolling out 100G coherent in the core,” notes Andrew Schmitt, principal analyst for optical at Infonetics Research. Schmitt adds: “Meanwhile, P-OTS growth in the first half of 2013 was healthy as a result of tier-1 carriers ramping spending versus 2012. We’re seeing some of the SONET/SDH spending that went away come back in the form of increased packet-optical activity.”

Infonetics’ biannual OTN and packet optical report provides worldwide and regional market size, vendor market share, forecasts through 2017 and analysis for OTN transport and switching equipment and P-OTS metro edge and metro regional hardware, including port revenue forecasts by type and speed. Vendors tracked: Adtran, Adva, Alcatel Lucent, Ciena, Cisco, Coriant, Cyan, ECI, Ericsson, Fujitsu, Huawei, Infinera, NEC, NSN, Tellabs, Transmode, ZTE, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Infonetics Research Brief: Optical

Week of October 14–18

Data highlighted in this research brief:

- Coherent 100G WDM shipments tripling this year

- Operators name Ciena, ALU, Cisco and Huawei tops in P-OTS

- 100G network port revenue to surpass $6 billion by 2017

- North America OTN switching revenue more than triples in 1st half of 2013

http://www.infonetics.com/newsletters/Optical-October-2013.html

Research & Markets: Optical Transport Network (OTN) Equipment – Global Strategic Business Report

This report analyzes the worldwide markets for Optical Transport Network (OTN) Equipment in US$ Million by the following Product Segments: OTN Transport Equipment, and OTN Switching Equipment. The report provides separate comprehensive analytics for the US, Canada, Europe, Asia-Pacific, Middle East, and Latin America. Annual estimates and forecasts are provided for the period 2009 through 2018.

The report profiles 47 companies including many key and niche players such as ADTRAN Inc., ADVA Optical Networking SE, Alcatel-Lucent, Aliathon Technology Ltd., Ciena Corporation, Cisco Systems, Inc., ECI Telecom Ltd., Ericsson, Fujitsu Limited, Huawei Technologies, Infinera Corporation, JDS Uniphase Corporation, NEC Corporation, Tellabs, Inc., and ZTE Corporation.

http://www.researchandmarkets.com/research/lh99cn/optical_transport

Infonetics: M2M services to hit $31 billion, M2M connections to top 4 billion by 2017+ Other M2M mkt forecasts

Infonetics Research released excerpts from its new M2M Connections and Services by Vertical report, which provides market size, analysis, and forecasts for machine-to-machine (M2M) connections and services by technology, vertical, and geographic region.

ANALYST NOTE

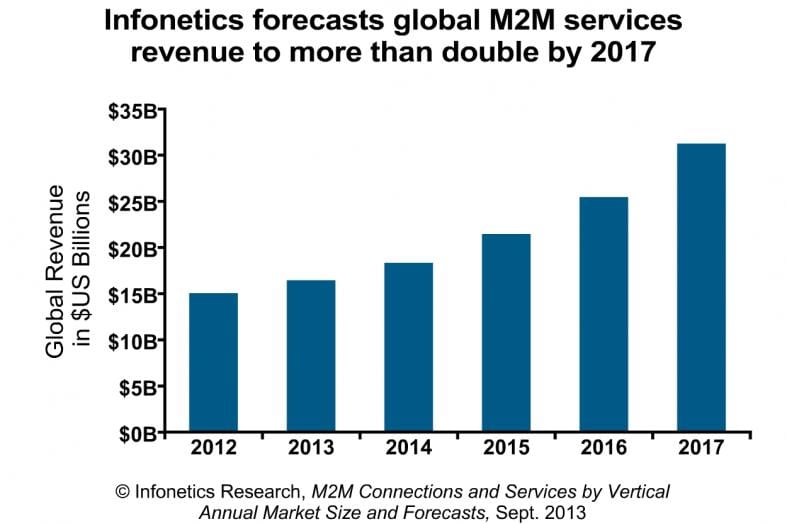

“M2M is one of the fastest-growing major new segments for service providers,” affirms analyst Godfrey Chua, who directs Infonetics Research’s M2M and Connected World program. “We forecast global revenue from M2M services to more than double between 2012 and 2017, from just under $15 billion to $31 billion.”

“What’s often overlooked about M2M is that it will be delivered to the world by way of a portfolio of access technologies,” Chua adds. “Cellular networks represent the most meaningful revenue opportunity for operators, but by far the most popular way to connect to M2M services is via PAN (personal area network) wireless technologies, such as WiFi, Zigbee, Bluetooth, and IP500, which do not generate connection revenue. It’s critical that mobile operators incorporate a broader view of the various M2M access technologies into their M2M strategies.”

M2M MARKET HIGHLIGHTS

. There were nearly 1.4 billion M2M connections worldwide in 2012, with PAN wireless technologies comprising the vast majority

. Making up just under 190 million connections today, M2M connections via cellular and other WAN wireless technologies are projected to nearly triple by 2017, becoming the largest growth engine for operator revenue

. More than 16% of total M2M service revenue, almost $2.4 billion, is derived from M2M “backhaul” services

. The automotive, transport, and logistics sector made up 1/3 of total M2M service revenue in 2012, driven by vehicle tracking, navigation, and delivery applications

. North America and Europe are the key centers of M2M service growth, together accounting for 72% of the total market

. In 2012, China Mobile overtook AT&T in M2M connections leadership, but AT&T remains the revenue leader due to higher ARPC (average revenue per connection)

ABOUT THE M2M REPORT

Infonetics’ M2M connections and services report analyzes M2M market drivers, M2M ecosystem players, and M2M technologies to help businesses make informed decisions and plans related to the M2M market. The report provides worldwide and regional market size, forecasts through 2017, and trends for M2M connections and services by technology (GSM/GPRS/EDGE, CDMA2000/EV-DO, W-CDMA/HSPA, LTE, TD-SCDMA, cellular, other WAN wireless, PAN, wireless, wireline, backhaul) and vertical (utilities/smart grid, automotive/transport/logistics, security/surveillance, retail/vending, healthcare, other).

The report includes an M2M Strategies Tracker with activity by mobile operators including AT&T, China Mobile, China Telecom, Deutsche Telekom, Everything Everywhere, KDDI, KT, Orange, Sprint, Telecom Italia, Telefónica, Telenor Group, TeliaSonera, T-Mobile, Verizon, and Vodafone. To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp.

RELATED RESEARCH http://www.infonetics.com/market-research-report-highlights.asp

. Latest Infonetics M2M and Connected World research brief: http://bit.ly/GIr8Ot

. Mobile M2M module segment of the M2M market hits $1.5 billion

. APIs playing key role in service delivery platform and M2M markets

. W-CDMA driving worldwide smartphone market

. Survey identifies operators’ LTE deployment challenges, top LTE vendors

. Infonetics launches M2M and Connected World market research program

. Operators look to monetize networks, stave off OTT threat via service delivery platforms

. Analyst note: M2M Ecosystem: Apple Alumni and Innovation in M2M

. Analyst note: Huawei Looks to Sprint Ahead in M2M

. Analyst note: M2M in Emerging Markets: the Transport Vertical, an Early Business Model, and the OTT Challenge

UPCOMING M2M REPORTS, SURVEYS & SCORECARDS

Download Infonetics’ 2013 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login.

. Infonetics’ new 2014 Market Research Lineup

. Mobile M2M Modules: Market Size and Forecasts (Oct.)

. M2M Strategies by Vertical: North American Enterprise Survey (Oct. 2013)

. M2M Strategies: Global Service Provider Survey (Nov. 2013)

. Worldwide M2M Service Provider Leadership Scorecard (Dec. 2)

. Analyst Research Notes CRS: M2M and Connected World (Ongoing)

M2M WEBINAR

Join analyst Godfrey Chua Oct. 22 at 11:00 EDT for The Business Rationale for M2M, a live webinar on M2M market drivers, key verticals, applications, challenges and real-world examples:

http://w.on24.com/r.htm?e=692264&s=1&k=E11E819714BBADA61010905FA274EF45

TO BUY INFONETICS REPORTS, CONTACT:

N. America (West), Asia Pacific: Larry Howard, [email protected], +1 408-583-3335

N. America (East), Midwest, L. America: Scott Coyne, [email protected], +1 408-583-3395

EMEA, India, Singapore: George Stojsavljevic, [email protected], +44 755-488-1623

Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

Another view of the M2M Market:

According to a new market research report, “Machine to Machine (M2M) Market” Global Forecast & Analysis (2012 – 2017) by Hardware Components, Technologies & Applications published by MarketsandMarkets, the total M2M market is expected to reach $85.96 billion by 2017 at a CAGR of 26.1% from 2012 to 2017.

Browse 83 tables spread through 195 pages and in-depth TOC on “Machine to Machine (M2M) Market Global Forecast & Analysis (2012 – 2017) by Hardware Components [Sensors, Actuators, RFID, Memory, Processor & ADC/DAC, Power Module, Communication Module], Technologies [2G, Ethernet, Powerline, ZigBee, Wi-Fi] & Applications [Consumer Electronics, Automotive & Transportation, Retail, Utilities, Security & Surveillance, Healthcare]”.

http://www.marketsandmarkets.com/Market-Reports/machine-to-machine-market-732.html

ITU-T Update: Internet of Things, Cloud Computing Security and Software Defined Networking (SDN)

Latest Technology Watch Report: spatial standards for the IoT

ITU-T’s latest Technology Watch report introduces readers to location (spatial) standards and their role in enabling the Internet of Things, describing how communications infrastructure has increased people’s associations with the natural and built environment as well as how this can be leveraged to improve governance and service delivery by revealing new insights into how we interact with one another and the services and infrastructures that surround us.

Authored by staff and members of the Open Geospatial Consortium (OGC), with support from ITU-T, the report is titled “ Location matters: Spatial standards for the Internet of Things” and can be downloaded free of charge here.

The report discusses the technologies and standards emerging in support of location-based services (LBS), analyzing shortfalls in interoperability and highlighting where global standardization can tap the full potential of these fast-maturing technologies and the valuable data they return.

Spatial standards’ role in the marketplace is critiqued with a view to uncovering clear trends or market drivers, and readers will discover that location matters in a wide range of sectors, with examples being made of emergency and disaster management and response; smart infrastructure; smart water management; and, of course, transportation.

The report goes on to describe the spatial standards landscape, looking at the activities of the involved standardization bodies and concluding with an analysis of the greatest obstacles to be overcome in the spatial standards arena.

New ITU standards on cloud computing security & digital object architecture

ITU members have agreed new international standards (ITU-T Recommendations) outlining security considerations essential to cloud computing and, crucial to the long-term preservation and utility of IP-based resources, a ‘framework for the discovery of identity management information’ to enable interoperability across heterogenous information systems.

Recommendation ITU-T X.1600 “Security framework for cloud computing”, having reached first-stage approval (‘determined’) and now undergoing a final review, describes security threats in the cloud computing environment and, through a framework methodology, matches threats with the security capabilities advised to be specified in mitigating them. ITU-T X.1600 will act as a ‘handbook’ guiding the future standardization of identified threat-mitigation techniques; in addition providing an implementation reference for systems-level cloud security.

Recommendation ITU-T X.1255 “Framework for the discovery of identity management information”, approved and soon to be freely available on ITU’s website, details an open architecture framework in which identity management (IdM) information – identifying ‘digital objects’ and enabling information sharing among entities including subscribers, users, networks, network elements, software applications, services and devices – can be discovered, accessed and represented by heterogenous IdM systems representing IdM information in different ways, supported by a variety of trust frameworks and employing different metadata schemas.

ITU-T X.1255 lays out a framework that enables discovery of identity-related information and its provenance; identity-related information attributes, including but not limited to visual logos and human-readable site names; and attributes and functionality of applications. The framework, in addition, describes a data model and protocol to enable meta-level interoperability in the management of this information across heterogeneous IdM environments.

The Recommendation is a first step towards the Digital Object Architecture (DOA) advocated by the Corporation for National Research Initiatives (CNRI), which is intended to achieve the “universal information access” possible with uniquely identifiable digital objects structured so as to ensure their machine and platform independence.

For a succinct description of the history, motivation and promise of the DOA, see Peter J. Denning & Robert E. Kahn, “The Long Quest for Universal Information Access”, Communications of the ACM, Vol. 53 No. 12, Pages 34-36.

The new Recommendations were agreed at a meeting of ITU-T Study Group 17 (Security) in Geneva, 26 August to 04 September, which also saw the establishment of three new work items, on: •high-speed Abstract Syntax Notation (ASN.1) Octet Encoding Rules (OER) needed by the financial services sector to gain milliseconds on the trading floor; •updating the Cryptographic Message Syntax (CMS) to eliminate all obsolete ASN.1 features in the interests of making the CMS usable with all ASN.1 standardized encoding rules; and, •new challenges for Public-Key Infrastructure (PKI) standardization presented by mobile networks, machine-to-machine (M2M) communication, cloud computing and smart grid.

More information on the work of ITU-T Study Group 17 can be found at: http://www.itu.int/en/ITU-T/studygroups/2013-2016/17/Pages/default.aspx

SDN Activities:

ITU-T SG 13 Chairman Chae Sub Lee explains the importance of ITU’s work on Software Defined Networks (in Korean with English subtitles): http://www.youtube.com/watch?v=biCpFf5oCd8&list=PLpoIPNlF8P2PacVXmmIdJDVhJjk4ptutO&index=23

ITU-T work on SDN can be accessed through their new SDN portal: http://www.itu.int/en/ITU-T/sdn/Pages/default.aspx “

“SDN is considered a major shift in networking technology which will give network operators the ability to establish and manage new virtualized resources and networks without deploying new hardware technologies. ICT market players see SDN and network virtualization as critical to countering the increases in network complexity, management and operational costs traditionally associated with the introduction of new services or technologies. SDN proposes to decouple the control and data planes by way of a centralized, programmable control-plane and data-plane abstraction. This abstraction will usher in greater speed and flexibility in routing instructions and the security and energy management of network equipment such as routers and switches.”

Infonetics: Small cell market ramp won’t happen this year!

Introduction:

Aren’t you a little tired of hearing all the rosy forecasts for deploying small cells- both nano base station and femtocells- in cellular networks as a solution to the mobile data capacity crunch? Infonetics says to sober up to the reality that it’s not happening nearly as fast as pundits predicted! Turns out that Asia Pacific will drive small cell growth according to the market research firm.

Noted telecom market research firm Infonetics just released excerpts from its latest Small Cell Equipment market size and forecast report, which tracks 3G microcells, picocells, and metrocells and 4G LTE mini eNodeBs and metrocells.

SMALL CELL MARKET HIGHLIGHTS:

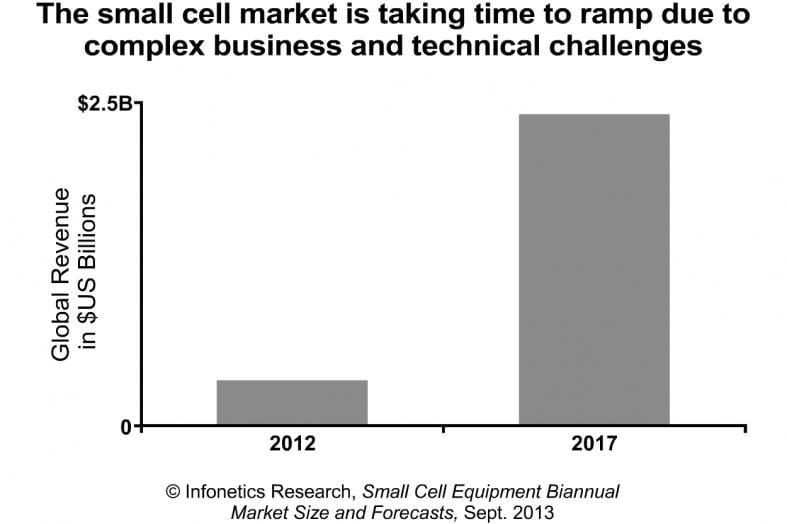

Wireless network operators’ chief purpose for deploying small cells is to complement and enhance the macrocell layer from a capacity standpoint, to enrich the mobile broadband experience. Beginning in 2014, 4G metrocells will become the main growth engine in the small cell market, driven by in-building deployments in retail malls, stadiums, transportation stations, hotels, and event venues . Asia Pacific is where the action is and where it will stay through 2017: The largest macrocell network density, with more than 100,000-site footprints, can be found in China, Japan, and South Korea. Infonetics forecasts the global small cell market to grow at a 48% compound annual growth rate (CAGR) from 2012 to 2017, to $2.4 billion

ANALYST NOTES:

“The large service providers remain committed to their small cell deployment plans, but the pace of deployment is much slower than expected due to a sad reality: Small cell and macrocell rollouts share nothing in common,” explains Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Téral continues: “Each technology requires its own internal business processes, which have been in place for decades with macrocells but have to be built from the ground up for small cells taking into consideration things like footfall, building dimensions, backhaul availability, and wireless technology. There is no cookie-cutter template for small cell deployments!”

In an email to this author, Stéphane Téral wrote: “We don’t do market shares for this because the market is too small! Sounds logical, right, this is small cell after all!”

Co-author of the report Richard Webb, directing analyst for microwave and carrier WiFi at Infonetics, adds: “Given that service providers are in the process of retooling their plan of attack, we’re not expecting the small cell ramp to happen in 2013.”

REPORT SYNOPSIS:

Infonetics’ biannual small cell report provides worldwide and regional market size, forecasts through 2017, analysis, and trends for 3G microcells, picocells, and metrocells and 4G (LTE) mini eNodeB and metrocells. The report also includes a small cell strategies tracker. Vendors tracked: Airspan, Airvana, Alcatel-Lucent, Alvarion, Argela, BelAir, Contela, Ericsson, Huawei, ip.access, Juni, Minieum, NEC, NSN, Samsung, SK Telesys, SpiderCloud, Ubiquisys, ZTE, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Other Small Cell Market Forecasts:

http://www.smallcellforum.org/resources-reports by Informa

http://www.delloro.com/assets/CapacityMagazine_SmallCellForecast_011013.pdf

http://www.arcchart.com/reports/heterogeneous-networks-hetnets-report.asp