Infonetics: Small cell market ramp won’t happen this year!

Introduction:

Aren’t you a little tired of hearing all the rosy forecasts for deploying small cells- both nano base station and femtocells- in cellular networks as a solution to the mobile data capacity crunch? Infonetics says to sober up to the reality that it’s not happening nearly as fast as pundits predicted! Turns out that Asia Pacific will drive small cell growth according to the market research firm.

Noted telecom market research firm Infonetics just released excerpts from its latest Small Cell Equipment market size and forecast report, which tracks 3G microcells, picocells, and metrocells and 4G LTE mini eNodeBs and metrocells.

SMALL CELL MARKET HIGHLIGHTS:

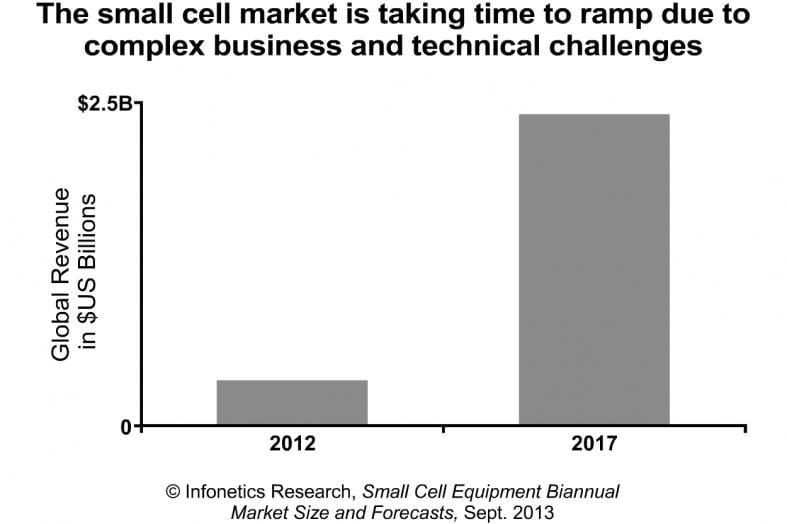

Wireless network operators’ chief purpose for deploying small cells is to complement and enhance the macrocell layer from a capacity standpoint, to enrich the mobile broadband experience. Beginning in 2014, 4G metrocells will become the main growth engine in the small cell market, driven by in-building deployments in retail malls, stadiums, transportation stations, hotels, and event venues . Asia Pacific is where the action is and where it will stay through 2017: The largest macrocell network density, with more than 100,000-site footprints, can be found in China, Japan, and South Korea. Infonetics forecasts the global small cell market to grow at a 48% compound annual growth rate (CAGR) from 2012 to 2017, to $2.4 billion

ANALYST NOTES:

“The large service providers remain committed to their small cell deployment plans, but the pace of deployment is much slower than expected due to a sad reality: Small cell and macrocell rollouts share nothing in common,” explains Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Téral continues: “Each technology requires its own internal business processes, which have been in place for decades with macrocells but have to be built from the ground up for small cells taking into consideration things like footfall, building dimensions, backhaul availability, and wireless technology. There is no cookie-cutter template for small cell deployments!”

In an email to this author, Stéphane Téral wrote: “We don’t do market shares for this because the market is too small! Sounds logical, right, this is small cell after all!”

Co-author of the report Richard Webb, directing analyst for microwave and carrier WiFi at Infonetics, adds: “Given that service providers are in the process of retooling their plan of attack, we’re not expecting the small cell ramp to happen in 2013.”

REPORT SYNOPSIS:

Infonetics’ biannual small cell report provides worldwide and regional market size, forecasts through 2017, analysis, and trends for 3G microcells, picocells, and metrocells and 4G (LTE) mini eNodeB and metrocells. The report also includes a small cell strategies tracker. Vendors tracked: Airspan, Airvana, Alcatel-Lucent, Alvarion, Argela, BelAir, Contela, Ericsson, Huawei, ip.access, Juni, Minieum, NEC, NSN, Samsung, SK Telesys, SpiderCloud, Ubiquisys, ZTE, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Other Small Cell Market Forecasts:

http://www.smallcellforum.org/resources-reports by Informa

http://www.delloro.com/assets/CapacityMagazine_SmallCellForecast_011013.pdf

http://www.arcchart.com/reports/heterogeneous-networks-hetnets-report.asp