Global Optical Network Hardware Sales Down, but Up in North America

Infonetics Research released vendor market share and preliminary analysis from its 3rd quarter 2013 (3Q13) Optical Network Hardware report. (Full report published November 26.) Seems like North America tier 1 carriers are spending big on 100G optical links.

3Q13 OPTICAL MARKET HIGHLIGHTS:

. Globally, the optical network hardware market (WDM and SONET/SDH) is down 7% sequentially in 3Q13, and down 1% from the year-ago quarter

. Total optical spending is flat on a rolling 4-quarter basis, with WDM growth accelerating and notching a 5th consecutive quarter of growth in 3Q13

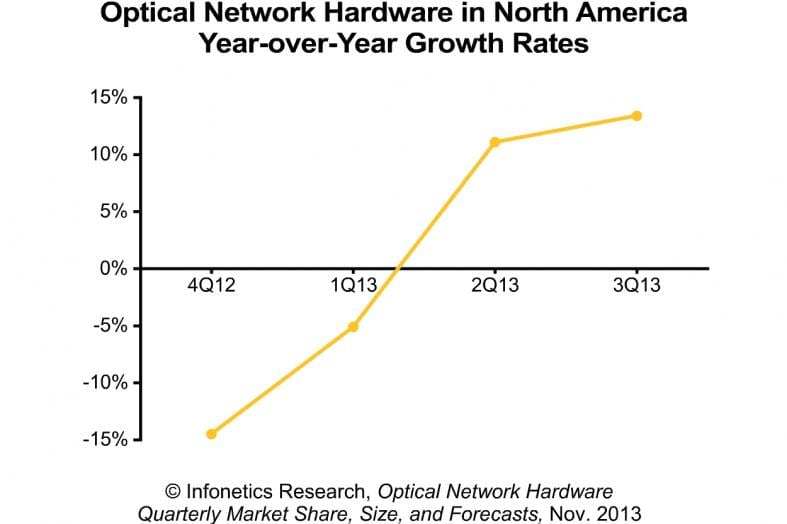

. North America optical spending jumped 13.4% year-over-year in 3Q13 following an 11.1% YoY increase the previous quarter, driven by aggressive 100G rollouts by tier 1 operators

. In 3Q13, EMEA (Europe, the Middle East, and Africa) WDM spending declined on a year-over-year and sequential basis, nearing the record low set in 1Q13

. Japan dragged down the Asia Pacific optical market in 3Q13, a result of spending retracing huge gains in 2012

. Huawei, Ciena, and Alcatel-Lucent are the WDM market share leaders in 3Q13

ANALYST NOTE:

“In the third quarter of 2013, sales of WDM optical equipment are up 4% from a year ago and remain at the elevated levels reached earlier in the year, but overall optical spending is down on a quarter-over-quarter and year-over-over basis,” says Andrew Schmitt, principal analyst for optical at Infonetics Research.

Schmitt adds: “Looking ahead, we expect tier 1 carriers to dial back spending. Capex was so strong in the first and second quarters of 2013, it’s unreasonable to anticipate a big flush in the fourth quarter, especially in North America. There’s a general weakness in the market, even from carriers that didn’t aggressively ramp spending earlier this year.”

ABOUT THE OPTICAL REPORT:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, forecasts through 2017, analysis, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/POS ports, and WDM ports. Vendors tracked: Adtran, Adva, Alcatel-Lucent, Ciena, Cisco, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Coriant (NSN), Tellabs, Transmode, Tyco Telecom, ZTE, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Market research firm Ovum has a different forecast. The optical networks (ON) market will exceed US$17.5bn by 2018, for a 3.1 percent CAGR from 2012, predicts global analyst firm Ovum. An exceptionally strong 2Q13 has signaled the beginning of a spending bounce-back. 2Q13 was the strongest quarter in the last six and was the 7th highest quarter in the last 10 years.

In a new forecast analysis*, Global ON is projected to be up 1.1 percent in 2013 compared to 2012 based on positive growth forecasts for North America, SLTE, Asia-Pacific and South & Central America.

“Ovum’s 9.1 percent growth projection for North American ON sales in 2013 signals a solid bounce-back year after two years of non-growth” says Ian Redpath, Analyst, Network Infrastructure and author of the report. “Network core investments are resuming and 100G is being deployed in volumes. The North American tier-1 communications service providers (CSPs) and cable operators are investing in their core network to support all traffic types. ”

Huawei is leading the global optical networking (ON) space with 21 percent market share in the third quarter of 2013, said Ovum. Huawei’s Chinese rival ZTE has 13 percent market share in Q3 in ON. Alcatel Lucent is in the third position with 11 percent ON market share.

The Ovum report says telecom vendors Ciena, Fujitsu and Infinera grew revenues sequentially and year over year, thanks to their presence in North America. Infinera moved into the top 10 globally, ousting Coriant.

Global optical networking spending decreased 9 percent to $3.7 billion in Q3.

Ron Kline, principal analyst – Network Infrastructure at Ovum, said total spending may be under pressure, but when it comes to deploying the latest infrastructure to support exploding bandwidth requirements, the demand for 100G, OTN and packet switching capabilities provided by CPO gear continues to see strong growth among telecom operators.

The Ovum report says sequential and year-over-year gains in North America have mitigated declines in Asia-Pacific, EMEA and South & Central America. Market spending continues to fluctuate by quarter depending on region/sub region and seasonal spending patterns, resulting in stagnant sales on a global level.

The telecom analysis from Ovum says there will be 1 percent growth in ON in 2013 to $14.8 billion and exceeding $17.5 billion by 2018.

Strong Tier-1 N.A. operator spending drove increased converged packet optical (CPO) and 100G deployments in the North America. ON revenues in the region topped $1.1 billion in Q3.

Ovum says spending for ROADM, 40G and 100G all increased slightly over the prior quarter. CPO revenues fell due to lower spending in Asia-Pacific. Annualized CPO spending surpassed $7 billion for the first time.

CPO represents more than 50 percent of ON spending. The data center is the new central office, and operators are refreshing network technology to address changing traffic patterns as the steady march to IP continues.