GSMA’s Global LTE Market Forecast; Infonetics: LTE Advanced Backhaul drives Microwave Market

The GSM Association (GSMA) ‘s research arm, GSMA Intelligence, put out its latest 4G projections which predict that LTE will account for one in eight, or 1 billion out of 8 billion, global mobile connections in the next three years. That’s up from the 176 million LTE connections reached to date.

The GSMA says nearly 500 LTE networks will be in service across 128 countries in 2017, roughly doubling the number of currrent LTE networks. The biggest difference will be where the networks are. Today, about 20% of the global population is within an LTE network coverage range, but that number climbs to 90% in the US alone compared to 47% in Europe and 10% in Asia.

The US currently makes up 46% of global LTE connections, but by 2017, the GSMA expects Asia to account for 47% of the global connections as more networks are rolled out in markets such as China and India. Right now, South Korea is the world leader with half of its connections on LTE, compared to 20% in Japan and the US.

GSMA also found that LTE users consume an average of 1.5GB of data per month, almost twice the amount consumed by non-LTE users. And, in developing countries, LTE users can generate ARPU that’s seven to 20 times greater than non-LTE users. In developed markets, ARPU is around 10% to 40% higher.

LTE networks have been deployed in 12 different frequency bands to date, but four out of five live LTE networks are in one of four bands: 700MHz, 800MHz, 1800MHz, or 2600MHz.

GSMA research found that:

- In most cases, the migration to 4G-LTE is happening considerably faster than the earlier migration from 2G to 3G

- LTE users consume 1.5 GB of data per month on average – almost twice the average amount consumed by non-LTE users

- In developing economies, operators have noted that LTE users can generate ARPU seven to 20 times greater than non-LTE users, while in developed markets operators have found that LTE can generate an ARPU uplift ranging from 10% to 40%

- Four out of five mobile operators that have acquired ‘new’ spectrum since January 2010 have been allocated airwaves aimed at supporting the launch of LTE networks

- LTE networks worldwide have been deployed in 12 different frequency bands to date, although four out of five live LTE networks today are deployed in one of four bands: 700 MHz, 800 MHz, 1800 MHz or 2600 MHz

- The average retail price (before discounts and subsidies) of LTE smartphones in developed markets such as the US has remained unchanged at around $450 for the last few years

- Handset subsidies have contributed considerably to the increase in LTE penetration over the last two years, but operators have also become more innovative in their pricing

For more information see: Global LTE network forecasts and assumptions, 2013–17

Infonetics Research released excerpts from its 3rd quarter 2013 (3Q13) Microwave Equipment report, which tracks time-division multiplexing (TDM), Ethernet, and dual Ethernet/TDM microwave equipment. In that report, Richard Webb, directing analyst for microwave and carrier WiFi at Infonetics Research wrote:

“The next round of backhaul market growth will be driven by macro LTE-Advanced upgrades and small cell deployments, both of which will require very low latency solutions,” continues Webb. “This will begin to make an impact from 2014 and boost the market for a few years.”

“The next round of backhaul market growth will be driven by macro LTE-Advanced upgrades and small cell deployments, both of which will require very low latency solutions. This will begin to make an impact from 2014 and boost the market for a few years,” Webb added.

3Q13 MICROWAVE MARKET HIGHLIGHTS:

. Globally, in 3Q13 the microwave equipment market totaled $1.16 billion, up 2% from 2Q13, but down 7% from 3Q12

. All-packet microwave accounted for around 23% of total microwave equipment revenue

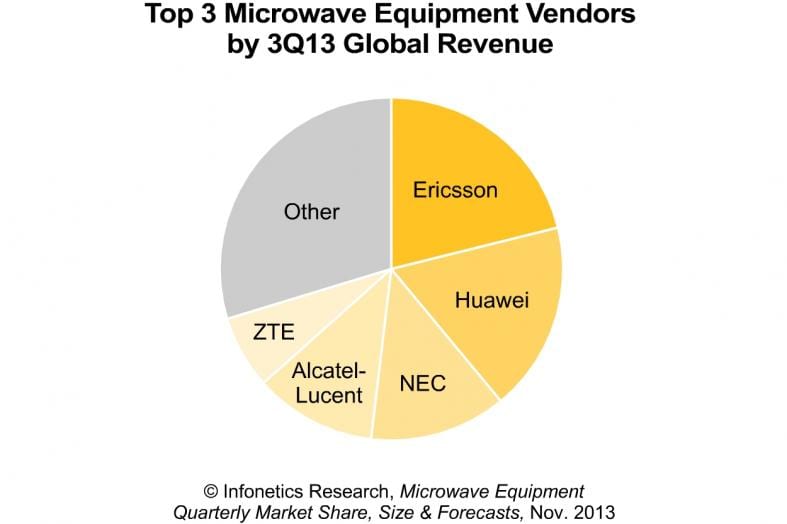

. Ericsson is again the microwave revenue market share leader in 3Q13, followed by Huawei, who reclaimed 2nd position from NEC

. The overall microwave equipment market will grow at just a 1.4% compound annual growth rate (CAGR) from 2012-2017, as the healthy growth of Ethernet microwave is masked by the disappearing TDM microwave segment and the rapidly declining dual Ethernet/TDM microwave segment

TO BUY INFONETICS REPORTS, CONTACT:

N. America (West), Asia Pacific: Larry Howard, [email protected], +1 408-583-3335

N. America (East, Midwest), L. America: Scott Coyne, [email protected], +1 408-583-3395

EMEA, India, Singapore: George Stojsavljevic, [email protected], +44 755-488-1623

Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp