Infonetics: Service Provider CAPEX to Grow at 2% CAGR to 2017

Infonetics Research released excerpts from its latest Service Provider Capex, Revenue, and Capex by Equipment Type report, which tracks telecom operator revenue and capital expenditures (capex) by operator type, region, and equipment segment and provides insight into telecom spending trends.

CAPEX REPORT HIGHLIGHTS:

. Europe’s Big 5-Deutsche Telekom, Orange, Telecom Italia, Telefónica, and Vodafone-slightly increased their capex year-over-year, a sign they remain committed to investing in their networks despite revenue declines

. Infonetics projects most equipment segments to grow in 2013, with the exception of voice, broadband aggregation, and video infrastructure

. Global telecom services revenue is anticipated to hit US$2 trillion in 2013

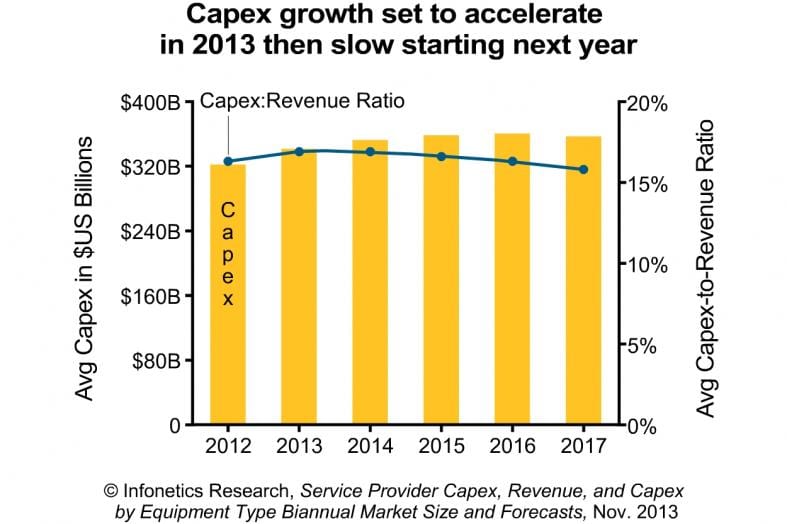

. Global telecom carrier capex is forecast by Infonetics to grow at a 2% compound annual growth rate (CAGR) from 2012 to 2017, reaching US$355 billion

. Wireless players are expected to continue their capex foray through 2017 at the expense of incumbents, who will see their share shrink

. Asia Pacific will remain the world’s largest spender through at least 2017

Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research wrote:

“Despite slow growth in 2012, the fundamentals are intact and 2013 is shaping up as the third year of an investment cycle characterized by capped capex in western countries, a hike in Japan, and the return of BRIC (Brazil, Russia, India, and China), which will provide most of the fuel for 6% year-over-year growth globally.”

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Comment: Infonetics’ sobering forecast is a far cry from the late 1990s CAPEX boom years. It appears that most of the Western world’s infrastructure is already built-out and growth is coming from developing countries. We’re quite surprised that new LTE networks, initial deployments of LTE Advanced, 100G b/sec fiber optic core network backbones, fiber to the premises/ node/ commercial buildings, SDN/NFV, and upgraded cloud network access aren’t contributing more to Service Provider CAPEX.

“The (network) core is a fraction of our capex, our costs are in the radio access network, mostly in radios, and those aren’t going to be virtualized right now,” said Fred Feisullin, senior network architect in the CTO’s office of Sprint. “The bigger gains are the new revenue sources that can be generated, then followed on by lower opex which will take much longer to be realized, then capex, maybe,” he added.

http://www.lightreading.com/carrier-sdn/sdn-architectures/carriers-say-s…