Optical Network Equipment Spending flat in 4Q13 as North America sags and EMEA surges!

Infonetics Research released vendor market share and preliminary analysis from its 4th quarter 2013 (4Q13) and year end Optical Network Hardware report. (Full report to be published by February 24.)

OPTICAL MARKET HIGHLIGHTS:

. Worldwide optical network hardware revenue, including WDM and SONET/SDH, was essentially flat in 4Q13, totaling $3.1 billion

. For the full year 2013, the overall optical network hardware market is down 3%

. On a positive note, the WDM segment posted a 6th consecutive quarter of growth in 4Q13 and ended the full year 2013 up 11% as 100G deployments hit the ground

. Though the traditional 4Q capex flush was in full effect in EMEA, the region recorded a 5th straight year of spending declines; Infonetics expects EMEA to revert back to being a third of global spending within 1-2 years

. The Chinese optical market closed 2013 up only 6%, but performance is anticipated to improve in 2014 as 100G rollouts pick up steam

. EMEA optical heavyweights Alcatel-Lucent, Ciena, Coriant, and Huawei all had a big 4Q13

ANALYST NOTE

“Optical spending flattened in the fourth quarter of 2013, though it wasn’t distributed evenly around the world or by vendor. Weakness was concentrated in North America, but a year-end capex surge in EMEA evened things up,” notes Andrew Schmitt, principal analyst for optical at Infonetics Research.

Schmitt adds: “All indications are that an all-clear from Verizon and AT&T is forthcoming and the Q4 drop was a pause rather than a reversal – and this is in line with our forecasts.”

ABOUT THE OPTICAL REPORT:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, forecasts through 2018, analysis, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/POS ports, and WDM ports. Vendors tracked: Adva, Alcatel-Lucent, Ciena, Cisco, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Coriant, Tellabs, Transmode, Tyco Telecom, ZTE, and others. To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp.

RELATED REPORT EXCERPTS:

. Operators answer the big questions about metro 100G and ROADM deployments

. Pricing pressures drive down ROADM component market in first half of 2013

. Carriers dialing back spending on optical equipment; WDM segment outpaces the market

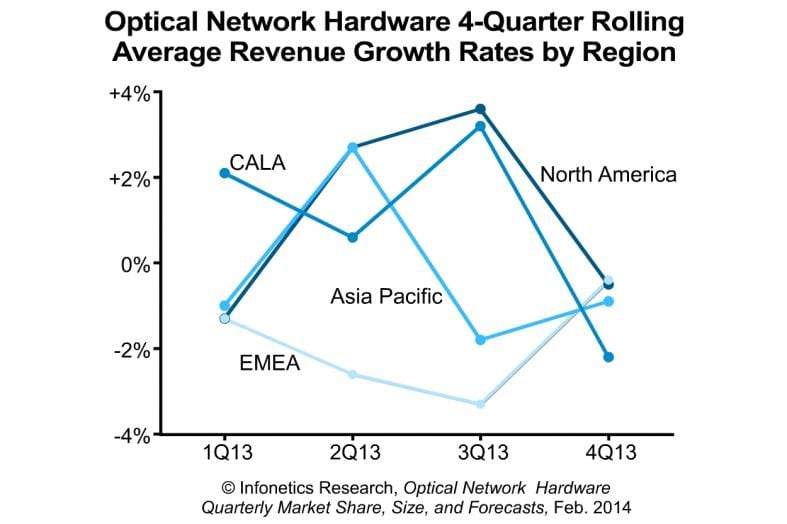

Note the steep decline in N America & Caribbean and Latin America (CALA) Optical Network Equipment Spending in the chart below:

RECENT AND UPCOMING OPTICAL RESEARCH:

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login

References:

https://techblog.comsoc.org/2013/12/20/fbrs-scott-thompson-ex…

http://www.cablinginstall.com/articles/2014/02/cir-400g-report.html

http://www.lightwaveonline.com/articles/2014/02/400g-optical-transport-m…

http://www.fiercetelecom.com/story/network-infrastructure-2014-market-ou…

http://www.sdncentral.com/news/ericsson-drops-optical-partners-ciena/201…

100G WEBINAR:

Join analyst Andrew Schmitt and JDSU, MRV, and Transmode on Wednesday, February 19, for 100G in the Metro: When and Where It Will Be Economical, a live event covering new approaches and technologies for cost-effectively deploying 100G in the metro. Register today:

http://w.on24.com/r.htm?e=737721&s=1&k=4C4FEAE8EA6BE2BE5618AD600E607F5D

Addendum:

Frontier offers wavelength service in 25 states:

Frontier Communications’ Frontier Optical Transport Service, a 10-gigabit wavelength service, was rolled out Monday in 25 states. The company will install optical fiber to buildings of customers that order the service. “If we don’t lay the fiber, someone else will,” Frontier’s Lisa Partridge said. “We believe it’s necessary because of how quickly bandwidth is doubling and tripling.” Telecompetitor.com