Global optical spending down y-o-y, but up 8% for WDM; 100G takes off in Core+ PON Market report

OPTICAL MARKET HIGHLIGHTS:

. Global optical spending is down yet again as legacy SONET/SDH continues to slide: Optical network hardware revenue, including WDM and SONET/SDH, declined 2% year-over-year in 1Q14

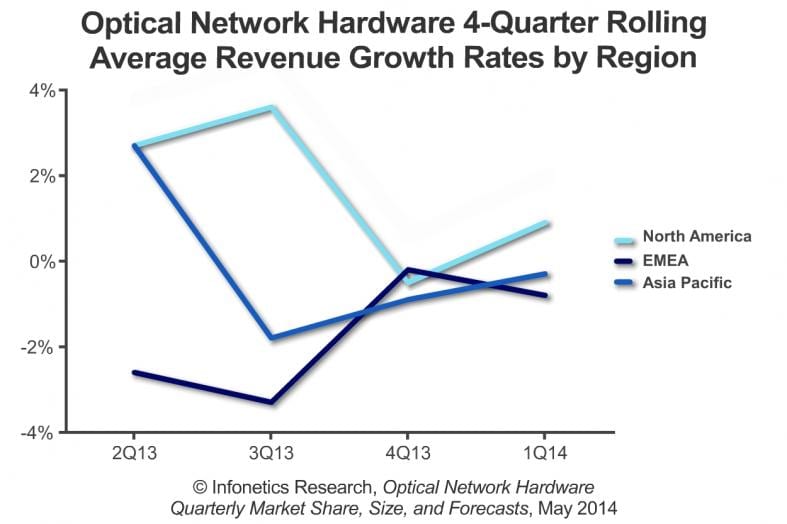

o On a rolling 4-quarter basis, total optical spending was roughly flat

. The WDM segment notched its 7th straight quarter of year-over-year growth, up 8%

. EMEA experienced a seasonal 4Q to 1Q drop, but this effect is no longer evident in the U.S., a result of large carriers changing spending patterns and smaller carriers operating on a more project-oriented, rather than calendar-oriented, purchasing cycle

. On a year-over-year basis for 1Q14, Huawei’s revenue market share slipped, Ciena’s soared 26%, and Alcatel-Lucent’s lifted 8%

ABOUT THE OPTICAL REPORT:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, forecasts through 2018, analysis, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/POS ports, and WDM ports. Vendors tracked: Adtran, Adva, Alcatel-Lucent, Ciena, Cisco, Coriant, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Padtec, Transmode, Tyco Telecom, ZTE, and others.

. Networking ports hit $39 billion; 40G booming in the data center, 100G taking off in the core

. Infinera, Fujitsu, Cisco, Ciena, and Huawei top new optical networking vendor scorecard

. OTN switching is booming; Alcatel-Lucent, Ciena, and Infinera cashing in

. Optical gear spending flat in 4Q13 as North America sags and EMEA surges

“And this revenue is flowing primarily into the hands of five companies: Alcatel-Lucent, Ciena, Cisco, Huawei, and Infinera,” adds Schmitt.

RECENT OPTICAL RESEARCH from Infonetics:

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login.

. Analyst Note: Post-OFC Analysis-Equipment (Apr.)

. Analyst Note: Ericsson-Ciena Deal: P-OTS, SDN & 100G for Routers (Apr.)

. Analyst Note: 100G Market Update-4x Growth in 2013 (Apr.)

. ROADM Components Market Size & Forecasts (May)

. Packet-Optical, MPLS & Control Plane Strategies: Global Service Provider Survey (May)

INFONETICS WEBINARS:

Visit https://www.infonetics.com/infonetics-events to register for upcoming webinars, view recent webinars on demand, or learn about sponsoring a webinar.

. The Role of Service Delivery Platforms in M2M and IoT (May 20: Attend)

. Unlocking Revenues with Carrier Ethernet 2.0 Wholesale E-Access (May 29: Attend)

. How to Get the Best Out of DAS, Small Cells, and WiFi (June 5: Attend)

. Diameter Signaling Control for LTE Networks (June 12: Attend)

. The Roadmap for ROADM Network Expansion (View on-demand)

. 100G in the Metro: When and Where It Will Be Economical (View on-demand)

. Coherent Optics: Cheaper, Better, Faster (July 24: Sponsor)

TO BUY REPORTS, CONTACT:

- N. America (West), Asia Pacific: Larry Howard, [email protected], +1 408-583-3335

- N. America (East, Midwest), L. America: Scott Coyne, [email protected], +1 408-583-3395

- EMEA, India, Singapore: George Stojsavljevic, [email protected], +44 755-488-1623

- Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

Research and Markets released a related optical networking report today:

Passive Optical Network (PON) Equipment Market – Global Industry Analysis, Size, Share, Growth, Trends And Forecast, 2013 – 2019

Passive optical network (PON) is a point to multipoint telecommunication network. PON is a fiber to home/premises (FFTH/FFTP) architecture which serves multi premises through unpowered optical splitters and a single optical fiber. Optical fiber splitters do not require electricity for signal transmission, which makes it an energy saving technology. The split ratio depends on the structure of the PON used, such as Gigabyte passive optical network (GPON) and Ethernet passive optical network (EPON) among others.

Major market participants profiled in this report include Huawei Technologies Comp. Ltd., Alcatel-Lucent S.A., Calix Inc., ZTE Corp. and Tellabs Inc. among others.

http://www.researchandmarkets.com/research/5h62hk/passive_optical