Month: August 2014

2014 Hot Interconnects: Death of the God Box….or maybe NOT?

Introduction:

We compare and contrast two keynote speeches from opening day (Aug 26th) of the 2014 IEEE Hot Interconnects conference, held at Google’s campus in Mt View, CA. The focus is on disruptive innovation giving rise to radically new hardware..or not?

Abstract: The God Box is Dead, by J.R. Rivers of Cumulus Networks

The maturing landscape in both interconnect technology and consumer expectations is leading a time of innovation in network capacity and utility. Complex systems are being realized by loosely coupling available and emerging open components with relevant, consumable technologies enjoying rapid times to deployment. This talk will highlight the historical precedence and discuss these implications on future system architectures.

Presentation Summary:

In his 2014 Hot Interconnects keynote talk J.R. Rivers, co-founder and CEO of Cumulus Networks, said: “The God Box is dead.” That meant not to expect any new revolutionary pieces of hardware (like the IBM 360 maintrame in the 1960s to Apple’s iPhone in 2007) anytime in the near future. “The IT industry is unlikely to create a new piece of hardware that will elevate a market that is mature,” he added.

Author’s Note: The first time I heard about a “God Box” was during the 1998-2000 fiber optic buildout boom. Many start-ups were making “Multi-Service Provisioning Platforms (MSPPs), which they claimed could do any and all networking functions. Hence, MSPPs were referred to as “God Boxes.” After the fiiber and dot com bust in 2001-2002, many of the new age carriers (CLECs) went bankrupt. They (and not the ILECs) planned to run fiber to commercial buildings in support of either n x G/10G Ethernet OR SONET/SDH OC12 or OC48 access. After their demise. most of the MSPP companies disappeared.

Among the reasons Rivers cited to support his position:

1. The decline of research: Government investment in research is declining, while corporate R & D for most companies is much more Design then Research (Google is a likely exception). Venture Capital and corporate research is evolutionary, seeking incremental improvements in existing technologies and products.

2. The (semiconductor?) supply chain is mature. [No clarification provided]

3. Components improve (in price-performance, power, size, etc) faster than they can be re-invented. Microprocessors vs Network Processors was given as an example, where the former has evolved to lower performance gaps with the latter (due to continuation of Moore’s law).

Other observations and advice for researchers and new product developers:

1. “Go places no man has ever gone before. Don’t rehash a design just to make incremental improvements.”

2. Aim at a broad market- especially for components. Niche markets disappear quicker than most think.

3. Tracking a benchmark is better than the current generation of silicon. To clarify this point, J.R. wrote in a post conference email: “The point here is that many companies work on a piece of technology based on the current version of that technology (for example my CPU is way better that today’s i7) without taking into account likely evolutions in the current form as well as planning a roadmap based what the incumbents are likely to build towards. A recent example of this in the interconnect world is the Fulcrum Microelectronics story.”

4. Need a 4 X speed improvement over what’s available today in silicon, e.g. switch silicon (Broadcom), network processors (Cavium), I/O and Bus interconnect (PLX Technology- recently acquired by Avago Technologies). If that can’t be achieved, the newly targeted silicon won’t gain significant market share.

For a systems developer, time to market and flexibility are vital to success. The hardware produced should facilitate rapid provisioning of services and be able to run various types of software/firmware. J

J.R. shared an experience he had as a systems designer at Cisco where he helped develop their Nuova switches: “After releasing some recent ASIC-heavy products, Cisco found that what really mattered to customers was the provisioning system and the software. In the end, that provisioning system could have sat on industry-standard servers and been almost as successful,” Rivers said.

Q&A:

ONF Executive Director Dan Pitt (Alan’s IEEE colleague for 30+ years) asked J.R. to please tell us how his talk applied to Cumulus Networks – a very innovative software company. Mr. Rivers respectively declined to do so, even though the audience (by a show of hands) indicated they were very interested in Cumulus. In fact, it was one of the reasons I attended the first day of the conference! Rivers said he’d talk to audience members off line about Cumulus, but then he disappeared as the morning break began (at least I couldn’t find him then or later).

Prof. David Patterson (UC Berkeley) challenged Rivers by saying that when Moore’s law ends (perhaps in 2020), there’ll be a lot more opportunities for tech innovation.

Abstract: Flash and Chips: A Case for Solid-State Warehouse-Scale Computers WSC) using Custom Silicon, by David Patterson, PhD and Professor UC Berkeley

The 3G-WSC design emphasis will shift from hardware cost-performance and energy-efficiency to easing application engineering. The reliance on flash memory for long-term storage will create a solid-state server that has both much faster and more consistent storage latency and bandwidth. Custom SoCs connected by optical links will enable servers in a 3GWSC to have better network interfaces and be one- to two-orders of magnitude larger than the servers of today, which should simplify both application development and WSC operations. Thus, a WSC of 2020 will be composed of ~400 3G-WSC servers instead of ~100,000 4U servers.

Such a 3GWSC server would certainly be considered a supercomputer, but unlike those for high performance computing, it will be multiprogrammed—for both interactive and batch applications—be fault tolerant so as to be available 24×7, and be tail tolerant to deliver predictable response times.

Presentation Highlights:

Prof. Patterson noted that new market opportunities happen when existing engineering technologies change. One recent example is server architecture changes with virtualization and the move to cloud resident data centers.

The Professor observed that Moore’s law (doubling of transisters per same size die every 18 to 24 months) to three years and will slow to five+ years before it becomes defunct for SRAMs and DRAMs in 2020. Flash memories may or may not perpetuate Moore’s law.

[During my interview with him at 2014 Flash Memory Summit, Professor Simon Sze1 said that Moore’s law for SRAM/DRAMs actually stopped around 2000 or 2001, but continued for Flash memories.]

Note 1. History Session @ Flash Memory Summit, Aug 7th, Santa Clara, CA: Interview with Simon Sze, Co-Inventor of the Floating Gate Transistor by Alan J Weissberger

http://ithistory.org/blog/?p=2163

When Moore’s law is dead or slowing to a crawl, there will be new opportunities for innovative custom silicon, according to Prof. Patterson. “When scaling (of transistors) stops, custom chips costs will drop,” he said. There will then be more ASICs developed and that will be supported by new hardware description languages to facilitate new designs.

All that will give rise to the next generation of Warehouse Scale Computers (WSC). It will be imperative to address “tail tolerance” in order to build new computing machines with predictable response times for all operations. Then, we actually may see new God boxes emerge, the UC Berkeley Professor concluded.

In a post conference email, Prof. Patterson wrote: “The God Box is not dead. The iPhone created the smartphone phenomena in 2007 and the iPad led to the tablet in 2010, both of which outsell PCs. The past is prelude, and the recent past suggests more God Boxes are coming in the near future.”

This author agrees as there are likely to be more instances of disruptive tech innovation in the coming years.

Reference:

http://www.hoti.org/hoti22/keynotes/

Addendum:

In a post conference email, Mr Rivers responded to Prof Patterson’s comment about the iPhone:

“Prof. Patterson’s comments around iPhone and iPad as related to the PC… the point he missed is that in both the smartphone and tablets, Apple’s hardware innovations are not their differentiators and that world is rife with industry standard hardware… there is not a God Box in that industry anymore (I’ll hold up the iPhone as a GodBox for the first 4 years of existence).”

3 other articles on the excellent 2014 Hot Interconnects conference are at: viodi.com

Infonetics: Global Carrier Router & Switch Market up strongly in 2Q14, but down 4% YoY

Infonetics Research released vendor market share and preliminary analysis from its 2nd quarter 2014 (2Q14) Service Provider Routers and Switches report. (Full report available by Aug. 29.). Also see companion report highlights below.

2Q14 CARRIER ROUTER AND SWITCH MARKET HIGHLIGHTS:

. Worldwide service provider router and switch revenue, including IP edge and core routers and carrier Ethernet switches (CES), is up 20% in 2Q14 over 1Q14, to $3.9 billion

. Though the quarter’s increase was solid, the long-term trend is reflected in the decline of 4% from the year-ago quarter (2Q13)

. The IP edge router, IP core router, and CES segments all had double-digit revenue gains in 2Q14 from 1Q14

. On a year-over-year basis, EMEA is the only region to achieve positive revenue growth (+3%) in the carrier router and switch market in 2Q14, while all regions-North America, EMEA, Asia Pacific, and CALA-are up quarter over quarter

. The usual suspects continued to battle it out for the top 4 router and CES market share spots: Cisco stayed in the lead in 2Q14, with Alcatel-Lucent, Huawei, and Juniper (listed in alphabetical order) in a fight for the 2-4 positions

. Infonetics expects global service provider router and switch revenue to grow at a 2.8% CAGR from 2013 to 2018

Analyst Comment:

“As we’ve been cautioning, service providers of all sizes are being more guarded with their router spending habits as massive network transformation goals involving software-defined networking (SDN) and network functions virtualization (NFV) translate into specific activities and milestones. But this does not mean router and switch spending will tank or even take a sizeable downturn,” notes Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research.

Continues Howard: “Core router upgrades and replacements prompted by the move to 100GE and paired with many aging core routers drove the core router segment to 11% sequential growth in the second quarter of 2014, and with a lot of capacity ‘in the ground,’ we believe core routers will stay positive for the full year.”

ROUTER & SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly service provider router and switch report provides worldwide, regional, China, and Japan market share, market size, forecasts through 2018, analysis, and trends for IP edge and core routers and carrier Ethernet switches. Vendors tracked: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Coriant, Ericsson, Fujitsu, Hitachi, Huawei, Juniper, NEC, UTStarcom, ZTE, others. To buy the report, contact Infonetics:

www.infonetics.com/contact.asp

Companion Report: Router and Switch Vendor Leadership: Global Service Provider Survey

Infonetics Research released excerpts from its annual Router and Switch Vendor Leadership: Global Service Provider Survey, which explores service providers’ perceptions of edge router and carrier Ethernet switch (CES) manufacturers and their criteria for choosing vendors.

ROUTER / SWITCH SURVEY HIGHLIGHTS:

. In addition to being named the top router/CES manufacturers by carriers in Infonetics’ survey, Alcatel-Lucent, Cisco, Huawei, and Juniper are also the leading vendors worldwide in router/CES revenue market share

. Making up a distant second tier of vendors as rated by service providers are, in alphabetical order, Adtran, Ciena, Ericsson, Overture Networks, Tellabs, and ZTE

. In the survey, operators also rank vendors of carrier Ethernet switches and routers based on 10 specific criteria: technology innovation, security, management software, price to performance ratio (value), product reliability, pricing, product roadmap, financial stability, solution breadth, and service and support

. Over 80% of service provider router and switch spending is on edge routers and carrier Ethernet switches (CES)

Analyst Comment:

“The carriers participating in our latest router/switch survey tell us that when it comes to choosing an edge router/CES manufacturer, it’s product reliability, value, and service and support that matter most,” notes Michael Howard, Infonetics Research’s co-founder and principal analyst for carrier networks.

Howard continues: “Then in an open-ended question, we asked carriers to name the top 3 edge router/CES manufacturers and Cisco came out on top, with 90% of our respondents naming them, followed by Juniper, Alcatel-Lucent, and Huawei. Three out of these four vendors earn top marks from our service providers in at least two of the top vendor selection criteria.”

ABOUT THE SURVEY:

For its 18-page router/switch vendor leadership survey, Infonetics interviewed network equipment purchase-decision makers at 31 incumbent, competitive, and mobile operators and MSOs from Europe, the Middle East, and Africa (EMEA), Asia Pacific, North America, and the Caribbean and Latin America (CALA). Together, the operators represent 41% of global telecom capex. The survey sheds light on how service providers select router and carrier Ethernet switch (CES) manufacturers, whose equipment they have installed and will evaluate for future purchases, and which manufacturers they consider to be leaders in key manufacturer selection criteria. To buy the report, contact Infonetics:

www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS:

. Infonetics’ August Carrier Routing, Switching, and Ethernet research brief:

http://www.infonetics.com/2014-newsletters/Carrier-Routing-Switching-and-Ethernet-August.html

. Operators plan to move security, QoS, VPN, other services to virtual routers, shows survey

. Infonetics Research unveils new logo

. $1 trillion to be spent on telecom and datacom equipment and software over next 5 years

. Ethernet 10G and 100G service revenue set to grow to 300% by 2018

. Telecom operators spending $150 billion over 5 years on carrier Ethernet gear, driven by IP

SDN WEBINAR:

Join Michael Howard Sept. 4 at 11:00 AM EDT for Making Your Network Run Hotter With SDN to examine SDN architectural concepts that address challenges operators face today, including a look at actual operator SDN deployments. Attend live or access the replay at: http://w.on24.com/r.htm?e=828549&s=1&k=F60165254CA9F9103599DE4F83EDD3BC.

ANALYST CONFERENCE CALL FOR CLIENTS:

Clients, join Michael Howard Sept. 11 at 12:30 PM EDT for his live carrier routing and switching market recap and outlook, or view on-demand: www.infonetics.com/cgp/login.asp?id=865.

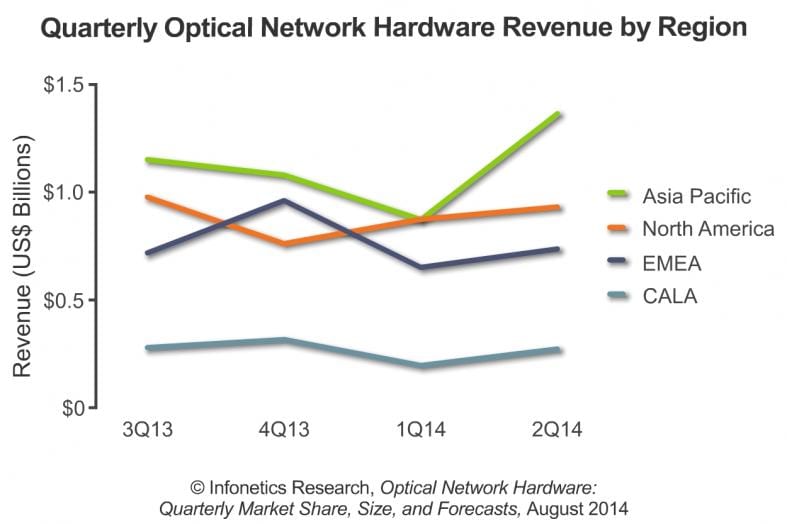

Infonetics: Global optical network spending flat, despite strong Asia-Pacific & demand from NA Internet Content Providers

Infonetics Research released vendor market share and preliminary analysis from its 2nd quarter 2014 (2Q14) Optical Network Hardware report. (Full report published by August 25.). Kim Peinado, VP Marketing at Infonetics wrote in an email: “While our headline focuses on Internet Content Providers boosting North America’s growth this quarter, Asia had an even bigger spike, led by Huawei and ZTE, which helped the global market offset year-over-year declines in other regions (see notes in the bullet points of the release).”

OPTICAL MARKET HIGHLIGHTS:

- In North America, internet content providers (ICPs) such as Google and others generated a wave of optical spending at a handful of vendors including Adva, BTI, and Infinera, altogether accounting for an estimated $40 million surge in 2Q14

- Worldwide optical network hardware revenue, including SONET/SDH and WDM, totaled $3.3 billion in 2Q14, a sequential gain of 27% aided by strong seasonal performances from Huawei and ZTE

- Global optical spending is roughly flat year-over-year (2Q14 from 2Q13) as strength in Asia Pacific offset weakening spending trends in EMEA

- Worldwide WDM equipment revenue in 2Q14 is up 6% year-over-year

- The 1st half of 2014 brought another huge flood of 100G WDM shipments by Alcatel-Lucent, Ciena, Cisco, Huawei, and Infinera

- Ciena’s and Infinera’s North American optical revenue grew rapidly on a year-over-year basis in 2Q14, while Fujitsu’s and Alcatel-Lucent’s decreased

OPTICAL ANALYST COMMENT:

“While the term ‘tier-1’ is traditionally associated with the incumbent operators of Europe and RBOCs in North America, it is now qualitatively clear that tier-1 spending growth is coming from the competitive dark fiber and internet exchange carriers. These carriers, as well as vertically-integrated internet content providers (ICPs), provide a growing portion of core internet connectivity and intra-datacenter capacity,” notes Andrew Schmitt, principal analyst for carrier transport networking at Infonetics Research.

OPTICAL ANALYST CONFERENCE CALL FOR CLIENTS:

Clients, log in to join Andrew Schmitt Sept. 5 at 9:00 a.m. PDT for his live optical hardware market recap and outlook, or view on-demand: www.infonetics.com/cgp/login.asp?id=874.

ABOUT THE OPTICAL REPORT

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, forecasts through 2018, analysis, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/POS ports, and WDM ports. Vendors tracked: Adtran, Adva, Alcatel-Lucent, Ciena, Cisco, Coriant, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Padtec, Transmode, Tyco Telecom, ZTE, and others.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

Related news article: Telstra Picks Ericsson, Ciena for Optical, SDN/NFV

http://www.lightreading.com/nfv/nfv-elements/telstra-picks-ericsson-ciena-for-optical-sdn-nfv/d/d-id/710370

Highlights of Peer 2.0 Conference: Aug 3-4, 2014 in Palo Alto, CA

On Monday, August 4th, I attended the Peer 2.0 Internet engineering conference, put on by the Peer 2.0 Foundation. The sessions I attended were excellent tutorials that would be of great value to network engineers, Internet architects and business leaders. Due to an auto accident and damage to my car, I had to leave at 2pm Monday and unfortunately missed all sessions that took place afer that.

For the complete program, please visit: http://peer2.org/schedule/

“One of the things that’s important about this event is that the networking business is changing,” SiliconANGLE founder observed to co-host Jeff Frick in their opening segment for the two-day event. The market is going through a once-in-a-decade transition that is not only reshaping the technology landscape but the competitive playing field as well, and not necessary for the better. “We’re seeing a huge changing of the guard between who runs these big networks, Comcast and Time Warner are in a merger situation, if they control access to the Internet we might not see the next Netflix, we might not see the next Google,” he warned.

“It’s nice that the guys who pioneered a lot of the innovation, founded a lot of the early companies like Equinix, are now providing the education and giving back to the next engineers that are coming up through the system who will help us define what the future holds,” Frick said during his opening remarks. ”Traditionally the network has enabled innovation on top of it but now the mode seems to be flipping around and innovation is going to be dictated to the network form the top of the stack,” he added.

The first day’s focus was on “Interconnection/Peering 101” highlighting the traditional interconnection paradigms, processes, motivations and business cases for connecting to the core of the Internet.

Bill Norton of IIX provided the necessary background during his three Monday morning tutorials: Internet Transit, Network Peering, The Business Case for Peering and Next Generation Interconnection, The Evolution of the U.S. Peering Ecosystem.

The following topics were covered with quizes for the audience along the way:

Internet Transit Service – the model used by the overwhelming majority of all Internet connections between ISPs and network/content providers. In particular, between larger (tier 1) and smaller (tier 2) ISPs/ network providers.

Internet transit is the business relationship whereby an entity provides (usually sells) access to the Internet. Transit service permits network traffic to cross or “transit” an IP network, usually used to connect a smaller Internet service provider (ISP) to the larger Internet.

[An Internet Service Provider (ISP), also called a “Transit Provider”is an entity that sells access to the Internet.]

Internet Transit service consists of two bundled services: The advertisement of customer routes to other ISPs, thereby soliciting inbound traffic toward the customer from them The advertisement of other ISPs’ routes (usually but not necessarily in the form of a default route or a full set of routes to all of the destinations on the Internet) to the ISP’s customer, thereby soliciting outbound traffic from the customer towards these networks.

The transit service is typically priced per megabit per second per month, and customers are often required to commit to a minimum volume of bandwidth, and usually to a minimum term of service as well. Some transit agreements provide “service-level agreements” which purport to offer money-back guarantees of performance between the customer’s Internet connection and specific points on the Internet, typically major Internet exchange points (IXPs) within a continental geography such as North America. These service level agreements (SLAs) still provide only best-effort delivery since they do not guarantee service the other half of the way, from the Internet exchange point to the final destination

Some of the techniques used by some of the most intelligent network coordinators to optimize their transit purchases were also discussed.

Network Peering; The Business Case for Peering and Next Generation Interconnection. The Business Case for direct interconnection, selecting an IXP, and Public vs. Private interconnection were explained.

Evolution of the U.S. Peering Ecosystem: This talk described how the major ISPs and other players got involved in Internet tiering. Network peering is a direct connection between entities- usually Tier 1 ISPs (free peering), but more recently between a Tier 1 ISP and a Content Provider (paid peering).

[A Tier 1 ISP is an ISP that has access to the entire Internet Region routing table only through its settlement free peering relationships.]

[Tier 2 ISP is an ISP thathas to buy transit from someone toreach some destinations in the Internet Region]

[A Content Provider focuses on content production and usually buys transit.service with the exception of “paid peering” – see description below.”]

The cablecos/MSOs got involved in peering when @Home went bankrupt and they needed to connect with one another and other ISPs to make their cable modem Internet services work.

“Paid peering” was described as something network providers do, but don’t talk about. The most recent example was the paid peering deal Netflix struck with AT&T.

The presentation with Q & A helped me understand the interconnect political dynamics of the tier 1/ tier 2 ISPs and content providers.

I attended only the first two talks in the afternoon. Both were excellent:

Surviving a DDoS Attack – What Every Host Needs to Know, Martin Levy of CloudFlare

The magnitude of the attacks was startling and only getting worse. The source of the attacks, best practices for good protocol hygiene, what steps to take to implement infrastructure ACLs and how to build relationships upstream in order to survive were all described.

Peering Improves Performance, Zaid Ali Kahn, LinkedIn & Ritesh Maheshwari, LinkedIn

This tag team presentation presented the performance benefits observed from peering over millions of page loads. A monitoring tool was described that can assess and be used to improve web page loading latency.

The second day of the conference (which I did not attend) was to address the more advanced and evolving aspects of interconnection, with discussions and panels led by experienced industry professionals.]

ETSI releases 9 NFV documents for industry comment; Start with Infrastructure Overview

At the 7th meeting of ETSI’s Network Functions Virtualisation (NFV) Industry Specification Group (ISG), co-hosted by Citrix and Ericsson in Santa Clara from 29 July to 1 August 2014, nine draft NFV documents were released for industry comment, a new leadership team was elected and plans for the next phase of NFV were laid down.

The nine draft documents made openly available for comment this week will together complete the first release of NFV when published at the end of the year. The ISG NFV has adopted a policy of making draft specifications openly available to the industry in order to encourage feedback. The documents released this week describe an infrastructure overview, the virtualized network functions architecture and the compute, hypervisor and infrastructure network domains. They also cover management and orchestration, resiliency, interfaces and abstractions, and security.

These drafts are now available for industry comment from http://docbox.etsi.org/ISG/NFV/Open, and will be completed and published before the end of 2014.

As well as focusing on the technical content of the first release at this meeting, plans for the content and structure of the second phase of NFV were discussed and laid down. The main objectives of this next phase are to build on the achievements made in the first two years of the ISG and include interoperability, formal testing, as well as working closer with projects developing open source NFV implementations. The activities will include both normative and informative work.

NFV ISG has chosen a new management team to carry the group forward. Dr. Steven Wright, of AT&T, was elected as chairman, and Mr. Nakamura Tetsuya, of NTT DoCoMo, was chosen as vice-chairman. Both are elected for a period of two years.

Dr. Wright commented “I’d like to thank the outgoing chair, Prodip Sen, and all the ISG participants, for their hard work to bring the ISG to this point. I look forward to assisting the ISG as it continues to progress towards its goal of an open NFV ecosystem with interoperable implementations.”

The ETSI NFV ISG held its first meeting in January 2013. Since then it has grown to over 220 participating organizations, with over 300 delegates attending this last meeting. The first five ETSI Group Specifications resulting from the NFV ISG’s work were published in October 2013.

References:

http://www.etsi.org/technologies-clusters/technologies/nfv

http://www.etsi.org/index.php/news-events/news/700-2013-10-etsi-publishe…

http://docbox.etsi.org/ISG/NFV/Open/Latest_Drafts/NFV-INF001v036-Infrast…

About ETSI

ETSI produces globally-applicable standards for Information and Communications Technologies (ICT), including fixed, mobile, radio, converged, aeronautical, broadcast and internet technologies and is officially recognized by the European Union as a European Standards Organization. ETSI is an independent, not-for-profit association whose more than 700 member companies and organizations, drawn from 63 countries across five continents worldwide, determine its work programme and participate directly in its work.