Enterprise Router Market Declines 9% while Service Provider Edge Router Market gains 4% Y-o-Y

Infonetics Research released excerpts from its 2nd quarter 2014 (2Q14) Enterprise Routers report, which tracks high end, mid-range, branch office, and low-end/SOHO router revenue and ports. There was no seasonal rebound in enterprise router sales in 2Q14, as the market was down 9% from one year ago.

2Q14 ENTERPRISE ROUTER MARKET HIGHLIGHTS:

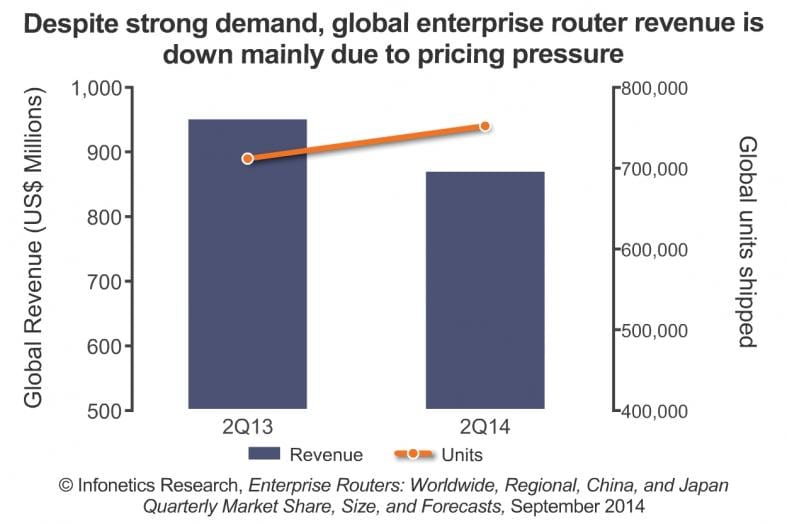

. Worldwide enterprise router revenue totaled $867 million in 2Q14, just a 1% sequential gain in a quarter that typically sees a strong seasonal pickup; Unit shipments are still growing, up 6% year-over-year

. Meanwhile, enterprise router sales dipped 9% in 2Q14 from the year-ago quarter (2Q13)

. The good news in 2Q14: demand for higher-performance routers was strong; High-end and mid range router unit shipments were up by double digits year-over-year, while branch office and low-end routers posted more muted growth

. Asia Pacific is once again the top-performing region for enterprise routers in 2Q14; North American sales tumbled 19% year-over-year, and EMEA sales fell 11%

. U.S. vendor performance for enterprise routers was mostly down on a year-over-year basis in 2Q14, while Chinese vendors gained as preferences in China shift to local vendors Huawei and ZTE as well as the H3C division of HP

ANALYST NOTE:

“For the second quarter in a row, enterprise router sales disappointed, and revenue is now trending downward. Demand for routers is still strong, as indicated by rising unit shipments, but discount pressure, preferences for local and lower-cost vendors in China, and lower public sector sales drove down revenue,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research.

ENTERPRISE ROUTER REPORT SYNOPSIS:

Infonetics’ quarterly enterprise router report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for high-end, mid-range, branch office, and low-end/SOHO router revenue and ports. Vendors tracked: Adtran, Alcatel-Lucent, Brocade, Cisco, HP, Huawei, Juniper, NEC, OneAccess, Yamaha, ZTE, others.

To buy report, contact Infonetics:

www.infonetics.com/contact.asp.

RELATED REPORT EXCERPTS:

. Cloud is our number-one networking initiative, say enterprises in Infonetics’ latest survey

. Tight battle for 2nd after Cisco in Infonetics’ enterprise networking infrastructure scorecard

. $1 trillion to be spent on telecom and datacom equipment and software over next 5 years

. Infonetics releases Global Telecom and Datacom Market Trends and Drivers report

. Enterprise router market off to a rough start, plunges 14% sequentially

In sharp contrast to the enterprise router market, Dell’Oro Group,reports that the Service Provider Edge Router market grew to its highest level ever, gaining four percent in the second quarter of 2014 versus the year-ago period, contributing to a record quarter for the Service Provider Router market overall.

“Demand drivers varied by country as all regions grew versus last year,” said Alam Tamboli, Senior Analyst at Dell’Oro Group. “In the United States, demand for routers in the backhaul for LTE networks has been one of the primary motives for investment in recent years, however this quarter service providers in the region also invested heavily into fixed networks. In much of the world, routers used for LTE mobile backhaul networks continued to drive investment in the edge,” Tamboli added. –

The top Four SP Router Vendors Combined Accounted for Over 93% of the Market

:#1 Cisco Systems: Remained the first-ranked vendor with increased revenue into EMEA and Asia.

#2 Alcatel-Lucent: Achieved record Service Provider Edge Router sales, increasing revenue in every major region.

#3 Juniper Networks: Delivered a record quarter in Edge Router revenues driven primarily by sales into North America.

#4 Huawei Technologies: Saw a shift in demand as Service Providers in its domestic market, China, focused on mobile backhaul and cut back on routers for fiber deployments.

More info at: http://www.delloro.com/news/service-provider-edge-router-market-reaches-record-levels