Month: November 2014

Infonetics: NFV will have big impact on Deep Packet Inspection (DPI) market; We disagree!

Infonetics Research released excerpts from its latest Service Provider Deep Packet Inspection Products report, which tracks deep packet inspection (DPI) software solutions and related hardware deployed in wireless and fixed-line networks.

DPI MARKET HIGHLIGHTS:

. The global deep packet inspection (DPI) market is forecast by Infonetics to grow at a 22% CAGR from 2013 to 2018

. Sandvine maintained its leading market share position in the overall DPI market, while Cisco narrowly took the lead in mobile DPI

. Traffic management remains the primary driver behind DPI deployments, particularly in markets such as Asia where video traffic is growing exponentially

. There is a growing interest in leveraging DPI to support more innovative service plans and content bundles, particularly in markets where net neutrality is an issue

. LTE is driving spending on DPI in developed markets, where the additional bandwidth is igniting more video consumption

. DPI suppliers are capitalizing on the demand for analytics solutions by providing tools and dashboards that analyze the data their products derive, allowing operators to gain insight into network, service, application, device, and subscriber behavior

“The path that network functions virtualization (NFV) will take remains a bit uncertain as standards crystallize and operators develop their strategies, but we believe that NFV will ultimately have a significant impact on the deep packet inspection (DPI) market,” notes Shira Levine, directing analyst for service enablement and subscriber intelligence at Infonetics Research.

Rebuttal: We think NFV is years away from having an impact on any market. There are no standards for protocols, interfaces, APIs, management & orchestration, service chaining, etc. Therefore, all NFV solutions will be proprietary and may not be able to effectively communicate with legacy equipment with the same functionality as the “virtual appliance” using NFV which is software running on an off the shelf compute server. There is also the issue of NFV performance, particularly if there’s no hardware assists/accelerators built into the server or NICs. And performance is crucial for DPI support of real time/streaming video traffic which requires low latency and jitter. For more info see:

http://viodi.com/2014/11/18/sdn-and-nfv-takeaways-from-light-readings-network-components-conference-in-santa-clara/

http://viodi.com/2014/09/25/light-readings-nfv-and-the-data-center-operator-keynotes-security-summary-part-2/

Levine continues: “As DPI functionality becomes decoupled from the underlying hardware, operators will be able to extend it further out into the network more cost effectively, driving continued market growth. As this occurs, the line between DPI platform vendors and suppliers of DPI components will begin to blur, creating a shift in the vendor landscape.”

DPI REPORT SYNOPSIS:

Infonetics’ biannual DPI report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for deep packet inspection products used in wireless and fixed-line service provider networks. Companies tracked: Allot, Arbor, Cisco, Huawei, Procera, Qosmos, Sandvine, and others.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS (http://www.infonetics.com/market-research-report-highlights.asp)

. Infonetics forecasts carrier SDN and NFV market to reach $11 billion by 2018

. US$1 trillion to be spent on telecom and datacom equipment and software over next 5 years

. Network expansions driving convergent charging market, dominated by Asia Pacific

. Data brokering is next frontier for subscriber data management

. Huawei, Ericsson top Infonetics policy management scorecard; Oracle, Amdocs in hot pursuit

RECENT AND UPCOMING RESEARCH (http://www.infonetics.com/research.asp?cvg=NextGenOSSandPolicy)

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at www.infonetics.com/login.

. Infonetics’ 2015 Market Research Lineup

. Analyst Note: Service Delivery Innovation Wrap-Up: Connected Cows, the Death of the Long Tail, and Deep Thoughts about SDPs (Sept.)

. Analyst Note: Oracle OpenWorld: All about NFV (Oct.)

. Subscriber Intelligence Strategies: Global Service Provider Survey (Nov.)

. Subscriber Data Management Software and Services Forecast (Nov.)

. Policy Management Strategies and Vendor Leadership: Service Provider Survey (Dec.)

Infonetics 3Q14 IP Telephony reports cover SP VoIP, IMS Equipment/Subscribers + Enterprise UC & Voice Equipment

Infonetics Research released vendor market share and forecasts from its 3rd quarter (3Q14) Service Provider VoIP and IMS Equipment and Subscribers report and it’s 3rd quarter 2014 (3Q14) Enterprise Unified Communications (UC) and Voice Equipment report (Full analysis to be published Dec. 2nd).

VOIP AND IMS MARKET HIGHLIGHTS:

- Globally, the service provider VoIP and IMS market grew 5% in 3Q14 from 3Q13, to $1 billion.

- The only product segments to post year-over-year growth in 3Q14 were softswitches, voice application servers, CSCF servers, and session border controllers (SBCs).

- 11 operators across the globe-in the U.S., South Korea, Hong Kong, Japan, and Singapore-have launched commercial VoLTE services .

- Infonetics expects additional operators in Asia Pacific and Europe to launch VoLTE services in 2015; Apple’s support of VoLTE and voice over WiFi (VoWiFi) has accelerated activity .

- On a regional basis, EMEA (Europe, Middle East, Africa) and CALA (Caribbean and Latin America) notched revenue gains in 3Q14 from the year-ago quarter, North America was down slightly, and Asia Pacific declined after a strong Q2.

- The top 4 revenue leaders in the carrier VoIP and IMS market in 3Q14 are, in alphabetical order, Alcatel-Lucent, Ericsson, Genband, and Huawei.

“We expected growth in the service provider VoIP and IMS equipment market to slow this year as large operators such as AT&T, Verizon, and NTT DoCoMo commercially launch voice over LTE (VoLTE) and utilize capacity on IMS networks. Following a tremendous 2013, revenue growth has tapered in 2014, though is still positive, with the market up 5% in the third quarter from a year ago,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “VoLTE deployments will remain the most important driver, though wireline is still making strong contributions.” she added.

ENTERPRISE TELEPHONY MARKET HIGHLIGHTS:

. The worldwide PBX market – including TDM, hybrid, and pure IP – dipped 7% year-over-year in 3Q14, but is up 5% sequentially

. In 3Q14, PBX license shipments are down 2% from 3Q13

. The Asia Pacific region typically posts growth in Q3, and it didn’t disappoint, notching a double-digit revenue gain in 3Q14 from a year ago

. Leading global PBX revenue market share in 3Q14 are Avaya, Cisco, and NEC (in alphabetical order), with Microsoft the forerunner in unified communications

(UC) applications

. UC applications continue on a steady upward trajectory, rising 21% in 3Q14 from 3Q13

“The enterprise telephony market continues to struggle as businesses hold off new PBX purchases. Companies are evaluating cloud alternatives and investing in unified communications (UC) applications instead of PBXs, and purchase cycles are getting longer,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “There is competitive pressure as well, but not as much as in the past.”

Myers adds: “North America again had the toughest quarter of all the regions, with a double-digit decline from the year-ago third quarter.”

VOIP AND IMS REPORT SYNOPSIS:

Infonetics’ quarterly carrier VoIP and IMS report provides worldwide and regional market share, market size, forecasts through 2018, analysis, and trends for trunk media gateways, SBCs, media servers, softswitches, voice application servers, HSS, CSCF, BGCF, MGCF, IM/presence application servers, and subscribers. Vendors tracked: Alcatel-Lucent, BroadSoft, Dialogic, Ericsson, Genband, Huawei, Mavenir, Metaswitch, NEC, Nokia Networks, Oracle, Radisys, Sonus, ZTE, and others.

ENTERPRISE TELEPHONY AND UC REPORT SYNOPSIS:

Infonetics’ quarterly enterprise telephony report provides global and regional market size, vendor market share, forecasts through 2018, analysis, and trends for TDM PBXs, hybrid and pure IP PBXs, IP PBXs by system size, VoIP gateways, unified communications, and IP desk phones and softphones. Vendors tracked: Alcatel-Lucent, Audiocodes, Avaya, Cisco, Ericsson-LG Enterprise, Microsoft, Mitel, NEC, Polycom, Samsung, ShoreTel, Toshiba, Unify, Yealink, others.

To buy the reports, contact Infonetics: www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS (http://www.infonetics.com/market-research-report-highlights.asp)

. Infonetics’ latest Enterprise Voice, Video, and UC research brief: http://www.infonetics.com/2014-newsletters/Enterprise-Voice-Video-UC-December.html

. SIP trunking services market expected to top $8 billion by 2018

. Over 3/4 of N. American businesses surveyed plan to use SIP trunking by 2016

. Shift to software and services in enterprise videoconferencing market tamps revenue growth

. Enterprise session border controller (eSBC) market up 8% in 2Q14

. PBX market struggles linger in first half of 2014; UC market up 31% from year ago

. Cloud PBX and unified communication services a $12 billion market by 2018

RECENT AND UPCOMING VOICE, VIDEO, AND UC RESEARCH:

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at www.infonetics.com/login.

. Infonetics’ 2015 Enterprise Voice / Video / UC Market Research Lineup

. SIP Trunking Services Forecast (Oct. 6)

. Analyst Note: Unify in Transition, Launches Circuit (Oct. 28)

. Analyst Note: Vonage Solidifies Cloud UC with Telesphere (Nov. 6)

. Enterprise Unified Communications and Voice Equipment Market Analysis (Dec. 2)

. Enterprise Session Border Controllers Forecast (Dec. 9)

. Enterprise Telepresence and Video Conferencing Equipment Forecast (Dec. 12)

Net Neutrality Primer: Efforts to Regulate Broadband Services Prove Fruitless; Heavy-Handed Tool the Next Step?

by David Dixon, – FBR Capital Markets [edited by Alan J Weissberger]

Backgrounder:

The FCC has long sought to impose rules requiring Internet providers to offer “net neutral” treatment to all Web traffic but has faced litigation over its legal authority at every step. The FCC’s next move following Verizon’s successful appeal of the FCC’s Open Internet Order has implications for the evolution of the Internet and, potentially, the 2016 presidential race. Stakeholders are fighting hard to influence Congress, the White House, and the FCC. A Title II-based ruling on fixed broadband appears likely, as are efforts to expand FCC oversight to wholesale interconnection. Litigation is likely for years to come. [Please see Addendum for history and definition of terms]

Regulatory uncertainty comes at a difficult time for the telecom sector, which is facing multiple challenges:

(1) increased wireless competition;

(2) improved cable network competitive positioning due to the extensive fiber-based network reach and WiFi-based wireless network potential;

(3) continued erosion of value up the stack to more innovative application service providers; and

(4) a necessary (but net present value negative) increase in wireline fiber network platform investment to support the ever-increasing bandwidth requirements of the less regulated wireless segment.

Irrespective of the regulatory outcome, with major wireless networks out of spectrum in many major markets, significant cell site densities and fiber-to-the-home investments are needed to improve competitive positioning, relative to cable, and to address poor indoor wireless coverage and capacity challenges.

The market is pricing in a continuance of a light regulatory touch in the wireless and wireline broadband segments. Importantly, it is not pricing in upside from higher interconnection revenues, specialized services, or specific content-distribution agreements. We expect the FCC to maintain a light regulatory touch (expanded to interconnection and WiFi networks), but it may decide to maintain this position in the fixed-broadband segment through the introduction of a heavy-handed legacy framework that provides flexibility to immediately withdraw regulatory oversight in areas such as rate regulation. This decision, along with expanded regulatory scope and uncertainty regarding litigation outcomes, is likely to negatively affect sentiment toward the sector.

What’s at stake?

The regulatory outcome for broadband services will shape the Internet’s future direction. Proponents of net neutrality argue that paid prioritization will divide the Internet between the “haves” and “have nots”; opponents claim this would prompt infrastructure upgrades. Furthermore, opponents argue that Title II reclassification will (1) stymie innovation and investment and (2) impede broadband adoption.

Regulatory oversight to incorporate wholesale interconnections (e.g. paid peering):

From a cable and content sector perspective, the FCC would like to establish greater regulatory oversight on interconnection agreements between last-mile providers and content providers (the major issue for Comcast/TWC and, therefore, a likely merger condition), but legal authority is unclear.

The FCC is not seeking to end direct-paid peering agreements or regulate wholesale interconnection pricing. Our FCC checks suggest content providers must be prepared to pay a reasonable amount for carriage. There is more evidence of wholesale arbitrage from content players than monopolistic behavior. Last-mile providers want the flexibility to charge appropriate interconnection rates (and to seek to increase these rates over time). The FCC will seek legal authority to keep rates just and reasonable. The consent decree for CMCSA/TWC will likely include such a requirement.

Our position on Net Neutrality Net neutrality has become a high-profile topic, particularly after the White House tossed its hat into the ring. While the issue will likely become even more politicized in the lead-up to the FCC’s decision, we see FCC Chairman Wheeler attempting to thread the needle between the White House’s positions despite his appointment by President Obama. We think a pragmatic approach by the FCC could with stand challenges in court.

In fixed broadband, Title II, with forbearance, appears likely, and this will be met with litigation. The hybrid approach is an interesting alternative that could gain industry support over time. In this scenario, Internet traffic would be classified as either “wholesale” or “retail,” but this would not preclude paid prioritization. Data exchange between content originators and ISPs (wholesale) would be governed under Title II, and traffic between ISPs and end users (retail) would be regulated under Section 706. Given market competitiveness, the FCC would likely forebear additional requirements, in our view. Moreover, we believe interconnection fees will garnerfurther scrutiny as the FCC is sensitive to access abuses but still favors a light regulatory touch, providedthe ISP industry maintains a fair and just fee basis for network traffic imbalances with intermediaries.

While less favorable, other approaches under FCC consideration include:

(1) full Title II reclassification,

(2) full Section 706 implementation, and

(3) Title II reclassification but with Section 706 application.

The FCC willcontinue to push for clarity on three fronts, and its rules will vary by service. These thrusts include:

(1) Capital Hill legislation, which would likely be a four- to six-year cycle. The FCC has always been responsive to Congress, but long cycles are problematic. A contentious FCC position could accelerate Republican efforts on the Hill and slow FCC progress at the same time.

(2) The courts: the FCC understands it must provide rules that are legallydefensible and, as such, is biased to Title II–based rules.

(3) Merger conditions will expand on the Comcast/NBC Universal consent decree to include oversight of wholesale interconnection and WiFi networking.

Rules will likely vary by service: (1) fixed broadband, (2) mobile broadband, (3) interconnection, (4) special services, and (5) WiFi.

We expect a decision on fixed broadband rules in 1Q-2015 followed by rules on mobile broadband and interconnection in mid 2015, coincident with regulatory approval and merger conditions imposed on Comcast/Time Warner Cable.

From a fundamental perspective, while there was a substantial valuation shift in the 2000s from the cable sector to the content sector due to higher payments for broadcast content distribution rights, and the table stakes are high for ISPs in the Internet interconnection domain, it is too early to determine the extent of any potential valuation shift in favor of ISP carriage over content.

Addendum: A Brief History of Net Neutrality and FCC Efforts to Regulate Broadband Services

In 2002, the FCC issued the Cable Modem Order, which established broadband service as a lightly regulated(Title I–based) information service, versus a heavily regulated (Title II–based) telecommunications service.This Order was unsuccessfully appealed by Brand X to the Supreme Court, which was seeking wholesaleaccess to high-speed Internet access services.

The Supreme Court ruled in 2008 that administrative agencies(such as the FCC) have the authority to interpret ambiguous statutes. Specifically, the Court found that,if a statute (e.g., Telecom Act of 1996) is ambiguous, and if the implementing agency’s constructionis reasonable, precedent requires the Court to accept the agency’s construction of the statute, evenif the agency’s reading differs from what the Court believes is the best statutory interpretation. This interpretation trumped precedent established by the Court of Appeals unless the Court found the statuteto be unambiguous.

In 2004, FCC Chairman Powell introduced an unenforceable Internet policy statement, known as the“four Internet freedoms,” to encourage broadband deployment and preserve and promote the open andinterconnected nature of the public Internet:

(1) Freedom to Access Content: consumers should haveaccess to their choice of legal content;

(2) Freedom to Use Applications: consumers should be able to runapplications of their choice;

(3) Freedom to Attach Personal Devices: consumers should be permitted toattach any devices they choose to the connection in their homes; and

(4) Freedom to Obtain Service Plan Information: consumers should receive meaningful information regarding their service plans.

Although the FCC did not adopt rules in this regard, it planned to incorporate these principles into its ongoing policy making activities.In 2005, FCC Chairman Martin adopted a wireline broadband report and order and notice of proposed rulemaking that classified wireline broadband Internet access services as information services.

This brought these services, including DSL service, out from under the Title II regulatory regime and in line with theTitle I–based regulatory treatment of cable modem services. The determination was sought by the major telecom service providers that were investing capital to deploy DSL service in an effort to catch the market leadership position established by the cable sector.

In 2007, the U.S. Court of Appeals denied a petition forreview of the FCC’s Wireline Broadband Order. FCC Chairman Martin responded, saying, “I am pleased that the Court affirmed the FCC’s decision to remove outdated, decades-old regulations from today’s broadband services. By removing such regulations, the Commission encouraged broadband investment and fostered competition. As a result of the Commission’s deregulation policies, broadband adoption has increased and consumers have benefited in the form of lower prices and improved broadband service.”

The FCC also released an Internet Policy Statement in 2005 that endeavored to ensure that broadband consumers would have access to all lawful internet content and that all lawful applications could be used on the networks. Similarly to Chairman Powell’s four Internet freedoms, the Statement outlined four principlesto encourage broadband deployment and preserve and promote the open and interconnected natureof the public Internet:

(1) Consumers are entitled to access the lawful Internet content of their choice;

(2) consumers are entitled to run applications and services of their choice (subject to the needs of lawenforcement);

(3) consumers are entitled to connect their choice of legal devices that do not harm thenetwork; and

(4) consumers are entitled to competition among network providers, application and serviceproviders, and content providers.

These principles were limited by the needs of broadband providers toreasonably manage their networks. The FCC applied one of the agreed-upon conditions to the October 2005 approval of both the Verizon/MCIand the SBC/AT&T mergers. The companies agreed to commit, for two years to conduct business in a way thatcomported with the Internet policy statement. In a further action, AT&T included in its concessions to gain FCC approval of its merger to BellSouth to adhering, for two years, to significant net neutrality requirements.

Under terms of the merger agreement, which was approved on December 29, 2006, AT&T agreed to notonly uphold, for 30 months, the Internet Policy Statement principles, but also committed, for two years (expired in December 2008), to stringent requirements to maintain a neutral network and neutral routing in its wireline broadband Internet access service.

In 2005, Vonage, a voice-over-IP (VoIP) service provider, complained to the FCC that MadisonRiver Communications, a small North Carolina–based rural telephone company also operating as anInternet service provider (ISP), had inserted filters into its ISP network to block VoIP traffic. Madison River Communications was the former Mebane Home Telephone Company that fought Carterfone, the 1968 decision that first allowed subscribers to attach their own equipment to telephone lines.

Although it was the”poster child” for anti-competitive behavior, blocking VoIP traffic meant that it was impossible for Vonageto offer competitive VoIP service to customers of Madison River’s Internet service. Madison River and the FCC agreed to a consent decree that said that Madison River Communications would not block VoIP trafficfor at least 30 months. The consent decree was backed up by an FCC order. The consent decree said that theinvestigation into Madison River regarded its compliance with section 201(b) of the Communications Actof 1934, but it did not provide any legal finding that Madison River had actually violated the Act.

The FCC stepped in to stop an ISP from blocking the ability of its customers to purchase Internet-based services from whomever they wanted.

(1) There was no legal finding that blocking VoIP is wrong meant that a betterfunded provider not compromised by an IPO could test the precedent;

(2) the resolution was VoIP specific:Madison River could block anything else;

(3) the decree was limited to 30 months, after which Madison Rivercould start blocking again; and

(4) the Act that the FCC referred to may not cover Internet service providersthat are not part of a telephone company.

In 2006, the two major trade associations representing both the cable sector (National Cable and Telecommunications Association) and telecom sector (United States Telecom Association) publicly committed to the Internet Policy Statement at a Senate Commerce Committee Hearing on net neutrality in February 2006.

In 2008, the FCC ordered Comcast to stop interfering with BitTorrent traffic. ISPs had been throttling BitTorrent traffic for years. Specifically, Comcast was actively disconnecting BitTorrent seeds. FCC Chairman Martin noted that BitTorrent throttling was “arbitrary” and that the company had violated the FCC’s Internet Policy Statement. Chairman Martin said that Comcast slowed down BitTorrent users independently of theamount of traffic they use, and that the company failed to communicate its network management practices to consumers.

Comcast appealed the FCC decision, saying that the agency’s order was outside the scopeof its authority. In 2010, a unanimous decision by the Federal Appeals Court ruled that the FCC lacked the authority to force Internet service providers to keep their networks open to all forms of content.

The U.S. Court of Appeals for the D.C. Circuit found that the FCC lacked the power to stop Comcast from slowing traffic to BitTorrent,a popular file-sharing site. The decision focused on the narrow principle of whether the FCC had the right to regulate Comcast’s network principles. The opinion was written so narrowly as to prompt the former legal counsel for the FCC, Sam Feder, to classify it as the worst of all worlds for the F.C.C. In his estimation,the Court case made it all but impossible for the FCC to expect an appeal victory, but it also opened upenough alternatives for the FCC to accomplish its same goals.

Thus, the Court’s decision prompted the FCC to review ways to more concretely establish the agency as a regulator of Internet services. The Court ruled that the FCC relied on laws that give it some jurisdiction over broadband services but not enough to make theaction against Comcast permissible: “For a variety of substantive and procedural reasons, those provisions cannot support its exercise of ancillary (Title 1) authority over Comcast’s network management practices.”

The decision came as Comcast pursued FCC approval of its proposed $30 billion merger with NBC Universal, which put a library of content under the control of the nation’s largest cable provider. In a consent decreeas part of the merger approval for Comcast/NBC Universal, Comcast promised to support the FCC’s Open Internet Order and to keep the Internet “neutral” until 2020. Comcast agreed not to block its customers’ability to access lawful Internet content, applications, or services. Throttling would still be an option as longas it was part of standard network management procedure, or targeted at unauthorized transfers.

In December 2010, the FCC adopted its Open Internet Order, which was law from 2010–2014. Prior to 2010,the principles of an open Internet encapsulated net neutrality from 2005 until the establishment of the Open Internet Order; but these standards were unenforceable. The Open Internet Order created two classes of Internet access: one for fixed-line providers, and the other for wireless providers.

The net neutrality stance towards fixed-line broadband providers was more stringent than the approach towards wireless providers. Wireless carriers were less regulated because these companies were much more constrained than fixed-lineconnections. The Open Internet Oder followed three specific rules:

■ Transparency. Fixed and mobile broadband providers must disclose the network management practices, performance characteristics, and terms and conditions of their broadband services

■ No blocking. Fixed broadband providers may not block lawful content, applications, services, or nonharmfuldevices; mobile broadband providers may not block lawful Web sites or block applications thatcompete with their voice or video telephony services.

■ No unreasonable discrimination. Fixed-broadband providers may not unreasonably discriminate intransmitting lawful network traffic.

In mid 2014, in Verizon v. FCC, the United States Court of Appeals for the District of Columbia Circuit vacated the “no blocking” and “no unreasonable discrimination” rules of the Open Internet Order. The Court upheld the “Transparency” rule in the same ruling. The FCC has continued to encounter difficulties in its efforts to establish an open Internet policy. The court’s decision emphasized the FCC’s distinction between information services (broadband providers) and telecommunications services, which are treated as common carriers.

Because the FCC had previously chosen not to classify broadband providers as a telecommunications service, the court ruled them exempt from treatment as common carriers. More specifically, the non-blocking andnon-discrimination violated the Telecommunications Act of 1996’s ban imposing common carrier obligationson ISPs, which the FCC refused to classify as common carriers. The FCC did not appeal the ruling but planned to reissue rules under Section 706 of the Telecommunications Act.

Section 706 focuses on the FCC’s role to oversee the virtuous circle of innovation, with innovation from edge providers driving increased demand for broadband, driving network improvement, and driving further innovation from edge providers. In Verizon v.FCC, the Court found in favor of the FCC in the following areas:

• Section 706 is an independent grant of authority to the FCC.

• The FCC reasonably interpreted section 706 as empowering it to regulate broadband access providers.

• There is substantial evidence supporting “virtuous circle” justification for rules.

Title II versus Section 706 of the Telecommunications Act of 1996 Under Title II, consumer broadband would be reclassified as “common carriers” and entail all of the rights and responsibilities that it implies. Title II offers both anti-blocking and anti-discrimination protection forconsumers, while ISPs are provided greater protection regarding copyright content being transmitted acrosstheir networks, compared to the Digital Millennium Copyright Act (DMCA). However, it also burdens ISPs with additional obligations. Furthermore, many believe potential Title II reclassification would also lead to additional government requirements that neither proponents nor opponents would like to see, such as universal broadband access at the same price, or FCC-set pricing and rules around access and peering.

While burdensome, the FCC does have the authority to forebear these additional responsibilities. Given the FCC’s track record, it is likely the FCC would choose to forebear if consumer broadband is reclassified under Title II. The FCC appears to have the most solid legal case to implement Title II–based regulation, but this is the most politically difficult solution, which will be subject to intense Congressional pressure on the FCC.

In contrast, Section 706 requires the FCC to promote (not regulate) broadband use in the U.S., and it does not mandate onerous requirements on ISPs (i.e., tariffs and set prices on peering). While many ISPs would favor this approach, it also comes with fewer protections. For example, under the Section 706 scenario, an ISP would be permitted to negotiate rates directly with individual content providers/originators (i.e., Netflix) for faster, prioritized access while limiting other providers to the standard (and slower) service. However, ISPs would not be protected from anti-discrimination rules.

© 2014 FBR CAPITAL MARKETS & CO. Institutional Brokerage, Research, and Investment Banking

Infonetics Surveys: Perceived top NA Cloud Service Providers; Google, IBM, Amazon lead in various categories

1. Infonetics Research released excerpts from its 2014 Cloud Service Strategies: North American Enterprise Survey, which explores businesses’ plans for the adoption and usage of cloud services.

Infonetics survey respondents rated Microsoft, IBM, Amazon, Google and Cisco top cloud service providers (CSPs). Note that those companies are perceived as the top CSPs, independent of their actual market share, revenue or profits derived from delivering cloud services.

Infonetics asked survey respondence somewhat of an open-ended question: “Whom do you consider to be the top 3 cloud service providers?”

Marketing Director Kim Peinado explains, “We ask this question in a lot of our surveys, because it provides a good view of overall brand strength. Typically, the larger the provider (e.g., broad product portfolio) and the more visible their brand, the better they fare in this question.”

From the report: “The majority of the CSPs named by respondents as top three cloud providers have a long history as a software vendor and professional services provider or were a very early entrant into the off-premises cloud services market. Cisco is the one exception, having been able to leverage its dominant position in networking and communications to launch a Web collaboration offering with significant market recognition.”

CLOUD SERVICE SURVEY HIGHLIGHTS:

. When asked whom they consider to be the top cloud service providers (CSPs), Infonetics’ survey participants most often named Microsoft, IBM, Amazon, Google and Cisco

. Factors driving enterprise respondents’ adoption of off-premises cloud include increased performance, agility, scalability, and reduced costs

. Cloud-as-a-service (CaaS) adoption grows through 2016, while infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS) decline

o CaaS appeals to businesses because it is an automated and pre-configured application execution environment operated on their behalf by a CSP

. The cloud spells disruption and opportunity for network equipment vendors: Respondents believe that shifting to the cloud will make it necessary to consider alternate vendors and demand better LAN and WAN performance

. For over 3/4 of businesses surveyed, a CSP’s security reputation is a critical factor in the vendor selection process

“Our latest cloud strategies study shows that hybrid cloud will see a significant increase in adoption over the next two years, growing from 30% of respondent enterprises today to 46% by 2016,” notes Cliff Grossner, Ph.D., directing analyst for data center, cloud, and SDN at Infonetics Research.

Grossner continues: “This is driving a new architecture for the data center with virtualized servers, storage, and networks where applications are automatically deployed by data center orchestration software.”

CLOUD SURVEY SYNOPSIS:

For its 29-page annual cloud service strategies survey, Infonetics interviewed qualified IT decision-makers with detailed knowledge of and influence in their organizations’ cloud service plans and purchase decisions at 155 North American enterprises. Survey participants were asked about their current usage of and plans for deploying cloud services, including IaaS, CaaS, PaaS, SaaS deployment drivers and barriers, uses, technologies, and architectures (public, private, community, hybrid), as well as their opinions of cloud service providers (CSPs).

2. Infonetics Research released excerpts from its new Cloud Services for IT Infrastructure and Applications market size, market share, and forecasts report, which tracks the off-premises cloud services market and the vendors who play in this space.

The new 18-page cloud services report provides detailed analysis of the off-premises cloud services market, which consists of applications and computing infrastructure delivered from a cloud service provider’s (CSP) data center, including infrastructure as a service (IaaS), cloud as a service (CaaS), platform as a service (PaaS), and software as a service (SaaS).

CLOUD SERVICES MARKET HIGHLIGHTS:

. Software as a service (SaaS) represents more than 2/5 of all off-premise cloud service revenue out to 2018

. North America is where off-premise cloud services started, and it will remain the lead market through at least 2018

. Google is the market share leader for CaaS and PaaS, IBM is #1 for SaaS, and Amazon is tops in IaaS

“We continue to see new tools to automate data centers and technology for developers appear in the market, driving innovation around cloud as a service (CaaS) and platform as a service (PaaS), the revenue growth engines for off-premises cloud services,” notes Cliff Grossner, Ph.D., directing analyst for data center, cloud, and SDN at Infonetics Research.

Grossner adds: “The move to hybrid cloud architectures fuels the adoption of CaaS as enterprises migrate their on-premises data centers to a cloud architecture, where servers, storage, and networks are virtualized and applications are automatically deployed by data center orchestration software.”

CLOUD SERVICES REPORT SYNOPSIS:

Infonetics’ cloud services forecast report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for off-premises cloud services, including IaaS, CaaS, PaaS, and SaaS. The report also tracks SaaS subscribers. Vendors tracked include Amazon, AT&T, CA Technologies, CenturyLink, Cisco, Citrix, Deutsche Telekom, Equinix, Google, IBM, Internap, Microsoft, NTT, Oracle, Rackspace, Salesforce, SAP, Time Warner Cable, Verizon, and others.

To buy any of the reports, contact Infonetics:

www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS:

. Infonetics’ November Data Center and Cloud research brief: http://www.infonetics.com/2014-newsletters/Data-Center-and-Cloud-November.html

. Infonetics forecasts carrier SDN and NFV market to reach $11 billion by 2018

. Orchestration software is the new battleground in the data center

. White box switching having a big impact on data center networking, up 95% from a year ago

. QLogic moves into #3 spot in converged data center network adapter market

. Data center and enterprise SDN market grows legs, soars 192% year-over-year

. 87% of medium and large North American enterprises surveyed by Infonetics intend to have SDN live in the data center by 2016

Alan’s Issues & Questions related to Cloud Services and Networking:

1. With all the price wars, especially for public cloud, which CSPs (if any) or making money? That’s not generally reported by the companies in this market!

2. Access bandwidth- many cloud computing/storage apps will require fiber to the building- not bonded copper (n x DSL or n x T1 or T3).

Highlights of Infonetics’ Carrier SDN and NFV Hardware and Software market size and forecast report

Infonetics’ first-ever Carrier SDN and NFV Hardware and Software market size and forecast report, led by Chief Analyst & Infonetics Co-founder Michael Howard. has just been released. Tthe report tracks network functions virtualization (NFV) and software-defined networking (SDN) hardware and software used in service provider networks. It complements a Sept 2014 Infonetics report on SDN for different market segments –Data Center and Enterprise SDN Hardware and Software.

The new 46-page report provides detailed analysis of the SDN and NFV markets and their many facets-from SDN router and switch hardware and software, to the many categories of NFV, particularly the virtualized network functions (VNFs) comprising policy (policy and charging rules function [PCRF] and deep packet inspection [DPI]), the mobile packet core and evolved packet core (EPC), IP multimedia subsystem (IMS), and security. To buy the report, contact Infonetics.

NFV AND SDN MARKET HIGHLIGHTS:

. NFV represents the lion’s share of the combined SDN and NFV market, from 2014 out to 2018

. The value of NFV is in the virtualized network functions software-the applications-rather than the orchestration and control; VNF makes up over 90% of the NFV software segment

. SDN and NFV exemplify the telecom industry’s shift from hardware to software: SDN and NFV software are projected to make up of three-quarters of total SDN/NFV revenue in 2018

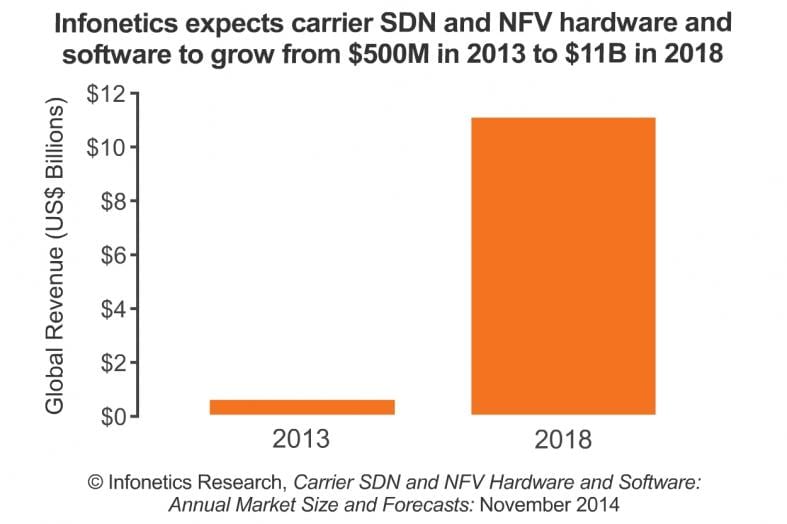

“For three years, the telecom industry has been abuzz over SDN and NFV, with anticipation and hard work developing the vision, goals, architectures, use cases, proof-of-concept projects, field trials, and even some commercial deployments. We’ve been gathering data in this early market for nearly two years and are projecting the global service provider SDN and NFV market to reach $11 billion in 2018,” says Michael Howard, Infonetics Research’s co-founder and principal analyst for carrier networks.

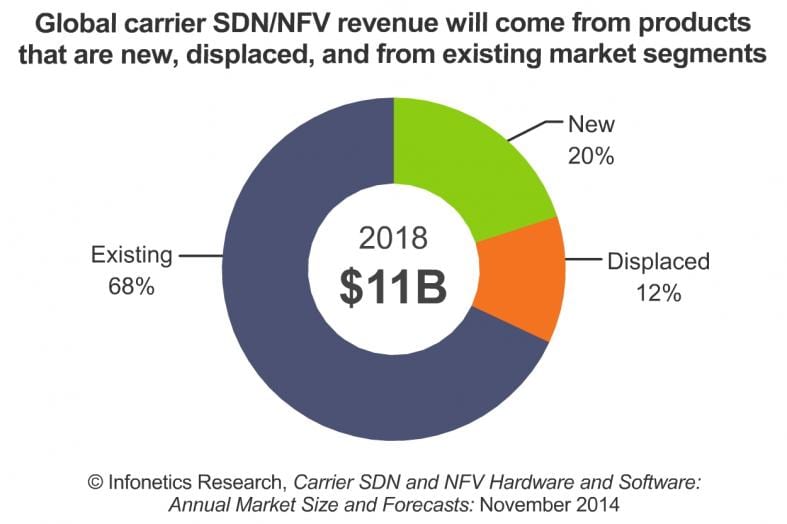

To better understand spending in this emerging market, Infonetics classifies SDN and NFV hardware and software in three distinct categories:

- First, revenue from brand new SDN and NFV software, which we expect to make up 20% of the total SDN and NFV market in 2018.

- Second, revenue that comes from products that companies will buy instead of buying something else-what we refer to as ‘displaced’ revenue, including NFV infrastructure (NFVI) hardware (servers, storage, switches) purchased instead of network hardware (routers, DPI, firewalls, etc.). This segment will make up about 12% of the market in 2018.

- Third, revenue that comes from newly identified segments of existing markets: mostly the virtualized network functions (VNFs), and also ports on routers, switches, and optical gear that have become SDN capable. This last segment makes up the largest slice of the SDN and NFV pie, 68% in 2018.

“This forecast took a ton of work to get to and involved a lot of our analysts. Hopefully it provides useful data for the industry,” said Kim Peinado, Infonetics’ VP of Marketing (and the single best Marketing Communications professional this author has ever worked with in 42 years of tech writing.

REPORT SYNOPSIS:

Infonetics’ new carrier NFV and SDN report provides worldwide and regional market size, forecasts through 2018, in-depth analysis, and trends for the network functions virtualization and software defined networking markets. The report tracks NFV hardware (NFVI servers, storage, switches) and NFV software (NFV MANO, VNF software). It also covers SDN capable service provider telecom hardware (in-use and not in-use routers, switches, and other hardware) and SDN orchestration and controller software and network applications.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

Note: In 2015, Infonetics will publish separate, more in-depth reports for the service provider SDN and NFV markets.

RELATED REPORT EXCERPTS:

. Mobile operators evaluating SDN and NFV for more flexible and cost-effective backhaul

. Strong sequential growth for carrier routers and switches in 2Q14 masks long-term trend

. Operators plan to move security, QoS, VPN and other services to virtual routers

. Carriers name Cisco the top router and switch vendor in Infonetics survey

. Data center and enterprise SDN market grows legs, soars 192% year-over-year

. SDN and NFV to bring about shift in data center security investments