Ethernet Switch Market: 40G growth; 2.5G and 25G Ethernet coming, but not IEEE 802.3 standards yet

Infonetics Research released excerpts from its 3rd quarter 2014 (3Q14) Ethernet Switches report, which tracks unmanaged, web-managed, and fully-managed fixed and chassis switches by port speed (100ME, 1GE, 10GE, 40GE, 100GE).

3Q14 ETHERNET SWITCH MARKET HIGHLIGHTS.

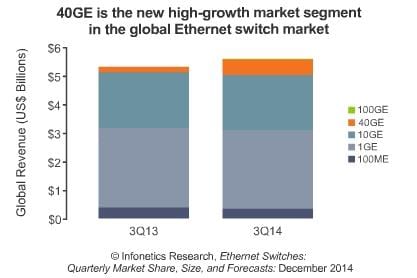

- Globally, Ethernet switch revenue grew 4% sequentially in 3Q14, to $5.6 billion;

- Year-over year growth stood at 5%, thanks to demand from the public and financial services sectors.

- Web-managed and fully-managed fixed switches notched double-digit year-over-year revenue growth in 3Q14; unmanaged and chassis switches declined .

- 10GE port shipments were up 26% year-over-year in 3Q14, falling short of expectations at this stage in the adoption cycle.

- 40GE is taking over from 10GE as the new high-growth market segment: 40GE port shipments more than doubled year-over-year in 3Q14, with growth especially strong in the white box market.

- 100GE took a breather after a strong 2Q, but its arrival on fixed switches and the introduction of lower-cost optics will drive growth in 2015

“Recent momentum in the Ethernet switch market carried through to the third quarter, and 2014 is on track for record revenue. Looking ahead, we expect growth to accelerate, thanks in part to the introduction of 2.5G and 25G Ethernet. These new Ethernet speeds will be a premium offering relative to 1GE and 10GE to address bandwidth constraints in data center and campus networks, and should provide an additional boost to revenue,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research.

Alan’s comment: Unknown to most is that 2.5G and 25G Ethernet is NOT being standardized by IEEE 802.3! It is being specified by the “MGBase-T Alliance.” The specification adopted by this Alliance leverages many of the fundamental technologies in Ethernet standards as defined in the IEEE 802.3 10GBASE-T, enabling faster time to market with minimal research and development efforts for ecosystem vendors. The specification is available royalty-free to all members.

The IEEE has formed a study group to understand the need for these new speeds that will meet the high demand for Ethernet between 1G and 10G, which are the only standard options available today for high-speed networking over UTP cables.

With advanced technologies in enterprise networks and increasing numbers of wireless computing devices connecting to next-generation cloud infrastructure, 1000BASE-T Ethernet is limited in bandwidth while 10GBASE-T Ethernet requires UTP Cat6a cabling, a costly upgrade to the install base of Cat5e and Cat 6 cables that constitutes the majority of the cabling installed base today. The addition of the 2.5G and 5G Ethernet link protocol speeds will enable the cost effective scaling of network bandwidth delivered to enterprise access points and provide IT professionals with more data rate options.

Top IEEE member discussion list contributor and former IEEE 802.3 chair Geoff Thompson wrote in an email:

The theory behind this standardization effort is twofold.

1) The implementation is relatively easy as a back off form earlier work and implementations of 10GBASE-T.

2) There is a major market driver in the links between closet switches and next generation WiFi access points.

(i.e. > 1G and 100 meter Cat 5e).

The driving target market is very specific to Wireless Access Points (WAPs), rather than data centers.

You can see the presentation on this standards effort at the Nov 2014 IEEE 802 meeting at:

http://www.ieee802.org/3/cfi/1114_1/CFI_01_1114.pdf

The call for interest (CFI) at the July 2014 IEEE 802 plenary session:

http://www.ieee802.org/3/cfi/0714_1/CFI_01_0714.pdf

The material from the teleconferences that have taken place since then can be found at:

More info at:

http://www.mgbasetalliance.org/

http://tinyurl.com/mhzx2bx

http://www.ethernetalliance.org/blog/2014/06/23/tef-2014-the-rate-debate/

What about White Box Switches (AKA Bare Metal Switches)?

“White box (or bare metal) switches account for <1% of all Ethernet switch ports, but if you look at 10/40GE (where white box switches are used), its 12% of 10/40GE ports last quarter (3Q14)," Matthias wrote in an email to this author.

ETHERNET SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly Ethernet switch report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for Ethernet switches, including: revenue and ports by port speed; unmanaged, web-managed, and fully-managed switches; fixed configuration and chassis switches; and PoE. Vendors tracked: Adtran, Alaxala, Alcatel-Lucent, Arista, Avaya, Brocade, Cisco, D-Link, Dell, Extreme, Hitachi Metals, HP, Huawei, IBM, Juniper, Netgear, Ruby Tech, TP-Link, ZTE, others.

To buy the report, contact Infonetics:

www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS:

- Enterprise router market improves in 3Q; Cloud, economic expansion drive growth in 2015.

- Nearly a quarter of all WLAN access points are now 802.11ac.

- Infonetics study: Security is #1 concern for enterprise access networks.

- Tight battle for 2nd place after Cisco in Infonetics’ enterprise networking scorecard