Month: February 2015

Google leads Network Operator Consortium to Specify Automated, Vendor Neutral Provisioning/Configuration

Introduction:

Google’s keynote talk on this topic at last Thursday’s Light Reading New IP conference was very profound. Google and its eight partners (identified below) in this OpenConfig initiative want to specify a vendor neutral type of provisioning & configuration system that will work with any type or brand of network equipment. It’s called OpenConfig. In this post, I provide a brief summary of why it’s important and to provide links to other articles about it.

Why it’s important:

3. Here’s a link to most recent IEEE ComSocSCV session on Open Networking I helped organized and recruited the speakers (Guido & Christos). Their presentos can be downloaded once you open the url.

SDN & NFV -Oct 2014 meeting: http://comsocscv.org/showevent.php?id=1409231402

Anonymous Comment from IEEE Member Discussion Group (IEEE members may join for free at comsocscv.org)

“It will be interesting to see if Google can 1) hang together and play nicely, and if 2) if they can come to an agreement. One must remember that, right now at least, Google has “googles” of money. Not all their consortium pals are so flush. This (in my opinion) would impact the kinds of decisions they make, based on who can afford the different options posed. It might also impact how much involvement and dedication they can afford to put into the consortium. I know that when things have gotten ‘tight’ in my former employment, cooperation with our competitors was one of the first things to get funding cuts, even if it was potentially beneficial to our company. Most companies are worried about profits right now, and next quarter’s financial reports. Worrying about next year is right out of the question.”

Global Cloud Service Strategies: Infonetics Survey Sees Disconnect on Public Cloud as a Service (CaaS)

Infonetics Research, now part of IHS Inc. (NYSE: IHS), conducted in-depth surveys with service providers around the world about their cloud service plans and learned that 82 percent plan to offer hybrid cloud CaaS (cloud-as-a-service) by 2016.

Infonetics interviewed pure-play cloud service providers and incumbent, competitive and mobile operators for its latest study, Cloud Service Strategies: Global Service Provider Survey, which examines all types of off-premises cloud services, including infrastructure-as-a-service (IaaS), cloud-as-a-service (CaaS), platform-as-a-service (PaaS) and software-as-a-service (SaaS).

Note: some vendors use the acronym CaaS to mean Communications as a Service

CLOUD SERVICE SURVEY HIGHLIGHTS

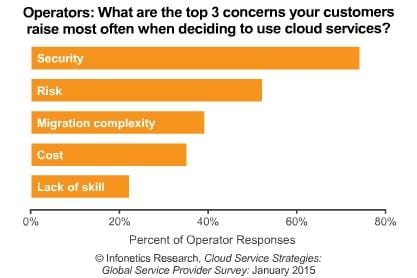

. A large majority of providers surveyed indicate security is a top customer concern when adopting cloud services

. Infonetics continues to see a disconnect on public cloud CaaS: Cloud service providers (CSPs) continue to invest in public cloud CaaS, while CaaS-using enterprises are signaling a shift from public cloud to private and hybrid cloud architectures

. Key go-to-market strategies for cloud service providers include offering a comprehensive range of services and bundling off-premises cloud services with network connectivity

“Cloud service providers are catching the hybrid cloud CaaS wave, an emerging market where we can expect lots of innovation as the introduction of new IaaS and SaaS off-premises cloud services begin to wane,” Cliff Grossner, Ph.D., directing analyst for data center, cloud and SDN at Infonetics Research, said.

“Cloud providers’ top challenges are non-technical: Meeting customer concerns about loss of control over private data, and helping customers overcome resistance to procedural change or understand how to take advantage of off-premises cloud services,” Grossner said.

CLOUD SURVEY SYNOPSIS:

For its 32-page cloud service strategies survey, Infonetics interviewed operators in North America, EMEA and Asia Pacific about their deployment of off-premises cloud services and plans for evolving their cloud services offerings over the next two years. The study provides insights into operators’ target market segments and verticals, go-to-market strategies, challenges, and cloud service offerings by type (IaaS, CaaS, PaaS, SaaS).

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

RELATED RESEARCH (http://www.infonetics.com/market-research-report-highlights.asp)

. Cloud services to top $200 billion by 2018; Google, IBM, Amazon lead market

. Growth spike expected in virtual security appliances market, driven by SDN and NFV

. Survey respondents rate Microsoft, IBM, Amazon, Google, Cisco top cloud providers

KPMG Survey Report:

The Cloud Takes Shapereport is based on the responses of more than 650 senior executives in some 16 countries representing multiple industries, and provides a valuable perspective on the challenges and complexities of cloud adoption facing today’s organizations. As clients move more of their core business processes to the Cloud, they’re finding it challenging to connect their legacy applications and new Cloud solutions – data integration and data management are key potential trouble spots that must be managed closely.