Mobile Infrastructure Spending in China Jumped 51% in 2014 (Infonetics); Grafting Probe to End 4G Party in China?

Infonetics Research, now part of IHS Inc. (NYSE: IHS), today reported that mobile infrastructure spending soared in 2014, led by W-CDMA network expansion at China Unicom and robust TD-LTE eNodeB deployments at China Mobile.

Based on Infonetics’ 2015 global Mobile Infrastructure Equipment report, the country specific Mobile Infrastructure and Subscribers in China market share, size and forecasts report tracks the 2G, 3G and LTE infrastructure markets and subscribers in China.

MOBILE INFRASTRUCTURE IN CHINA MARKET HIGHLIGHTS:

. The Chinese mobile infrastructure market came to US$11.1 billion in 2014, a 51 percent jump over 2013

. China’s mobile operators added 58 million mobile subscribers in 2014, pushing the number of total subscribers to 1.3 billion

. Around 60 percent of Chinese mobile subscribers are on China Mobile’s network

. Huawei and ZTE together commanded over 60 percent of China’s 2014 base transceiver station (BTS) unit shipments

“Looking at mobile capex, China delivered again in 2014 via a balancing act that had China Telecom cutting capex by nearly a third, China Unicom increasing spending by almost a quarter and China Mobile shelling out more than the two combined,” said Stéphane Téral, research director for mobile infrastructure and carrier economics at Infonetics Research, now part of IHS.

“China Mobile blew up its own target of TD-LTE rollouts, ending the year with 720,000 TD-LTE eNodeBs. That’s 570,000 above last year and well in excess of its own plan of bringing the footprint up to 500,000, illustrating China Mobile’s commitment to exit the TD-SCDMA era as fast as possible,” Téral said.

CHINESE MOBILE REPORT SYNOPSIS:

Infonetics’ annual China mobile equipment report provides market size, vendor market share, forecasts through 2019, analysis and trends for 2G GSM, 3G CDMA2000 (TD SCDMA, W-CDMA) and 4G LTE (E-UTRAN, EPC) mobile network equipment and subscribers in China. The report also includes an LTE deployment tracker. Vendors tracked: Alcatel-Lucent, Datang Mobile, Ericsson, Fiberhome, Huawei, Potevio, Newpostcom, Nokia Networks, ZTE, others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

EJL Wireless Research today announced a new report that analyzes the near and mid term impact on the global wireless telecom infrastructure market due to the current grafting probe in China.

“We have analyzed the current grafting probe in China and we believe that the impact on the wireless telecom sector is far more severe than the industry is currently anticipating and may have significant consequences for key wireless OEMs. Our current outlook for the situation in China has shifted from being a bright star in the wireless universe to one that has gone supernova and is now a tremendous black hole. The 4G party is prematurely over in China until the situation has stabilized and operations return to a new normal in China. Wireless equipment demand has sharply declined since the middle of Q1 2015 and our current outlook for Q2 and the second half of 2015 is cautious with an extremely negative bias,” said founder and President, Earl Lum.

The wireless infrastructure equipment ecosystem has suffered through a feast and famine situation since early 2014 due to the roll out of 4G TDD-LTE by China Mobile. This has severely strained the supply chain within the industry as double and triple bookings and expedited orders have been replaced with order push outs and cancellations. Our analysis reveals that three base station equipment OEMs have the greatest exposure from the slowdown in China. They are Alcatel-Lucent, Huawei Technologies, and ZTE. There are also two key RF semiconductor suppliers that have significant risk and exposure. They are Freescale Semiconductor and NXP Semiconductors, says Lum.

EJL Wireless Research continues to lead the wireless market research segment with innovative and cutting edge research such as its “Under the Radar” series of products.

The report is currently available for purchase and information can be downloaded at: http://www.ejlwireless.com

Reference: http://www.giiresearch.com/report/ejl328559-china-wireless-infrastructure-industry-outlook.html

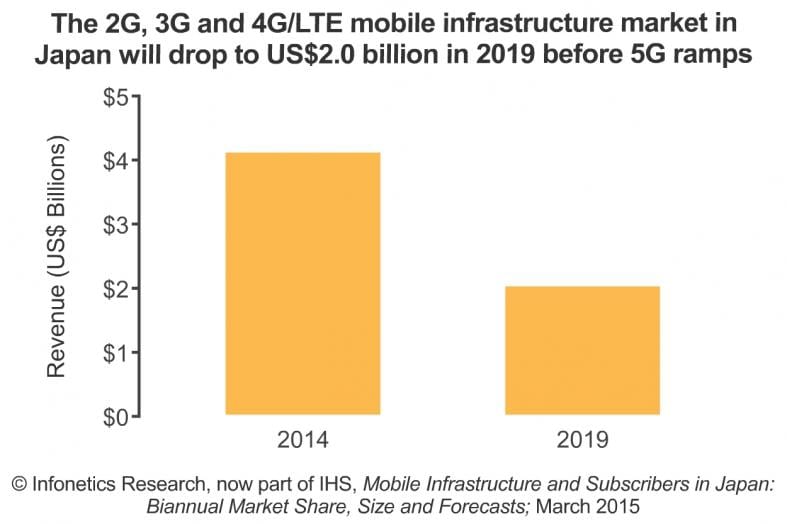

Separately, Infonetics reported that the mobile infrastructure market in Japan fell 19% year-over-year in 2014, to $4.1 billion, as 3G investments in the region stalled.

“As we forecast, the Japanese mobile infrastructure dropped by double digits in 2014 as a severe cut in 3G investments drove a decline that LTE could not offset despite the addition of over 100,000 eNodeBs,” said Stéphane Téral, research director for mobile infrastructure and carrier economics at Infonetics Research, now part of IHS.

“All three Japanese mobile operators, KDDI, NTT DOCOMO and SoftBank Mobile, have passed critical LTE mass deployments and will be tactically adding new macro eNodeBs while gearing up for 3.5GHz small cell deployments for capacity upgrades in 2016,” Téral said.

JAPAN MOBILE INFRASTRUCTURE MARKET HIGHLIGHTS:

. The Japanese government, which requires operators to continually invest in mobile infrastructure, freshly freed up the 3.5GHz band, which will shift the action from FDD to TDD LTE

. Among Japan’s mobile operators, only KDDI and NTT DOCOMO increased LTE spending in 2014; Softbank Mobile slashed its total mobile spend by a quarter

. Nokia Networks is king of the Japanese radio market, owing largely to its LTE prowess

. Japan had 145,053,600 mobile subscribers in 2014, up 6 percent over 2013

. Infonetics/IHS expects the 2G, 3G and 4G/LTE mobile infrastructure market in Japan to fall to $2 billion in 2019, a 2014-2019 CAGR of -13 percent, before 5G ramps up

JAPANESE MOBILE REPORT SYNOPSIS:

Infonetics’ biannual Japan mobile equipment report provides market size, vendor market share, forecasts through 2019, analysis and trends for 3G (W-CDMA, CDMA2000) and 4G LTE (E-UTRAN, EPC) mobile network equipment and subscribers in Japan. The report also includes an LTE deployment tracker. Vendors tracked: Ericsson, Fujitsu, Hitachi, Huawei, NEC, Nokia Networks, Panasonic, Samsung, ZTE and others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

VoLTE WEBINAR:

Join Infonetics analyst Stéphane Téral on May 7 at 11:00 AM ET for The Path to VoLTE, an event exploring the architectural challenges of voice over LTE and how to overcome them using real-world use cases. Join live or watch on-demand at http://w.on24.com/r.htm?e=975258&s=1&k=7AC297AEFFA3005C5D20DF360C468B35