IHS: Network Functions Virtualization Market Worth Over $15 Billion by 2020

The global network functions virtualization (NFV) market, which includes NFV hardware, software and services, will be worth $15.5 billion by 2020, according to the latest NFV Hardware, Software, and Services Annual Market Report from IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

“Between 2015 and 2020, the service provider NFV market will grow at a robust compound annual growth rate (CAGR) of 42 percent — from $2.7 billion in 2015 to $15.5 billion in 2020,” said Michael Howard, Senior Research Director, Carrier Networks, at IHS Markit.

NFV represents the shift in the telecom industry from a hardware focus to a software focus, with operators making much larger investments in software than in server, storage and switch hardware.

“NFV software will comprise 80 percent of the $15.5 billion total in 2020 — or around $4 out of every $5 spent on NFV,” said Howard.

In 2020, only 11 percent of NFV revenue will be attributable to new software and services. Sixteen percent will come from network functions virtualization infrastructure (NFVI) — servers, storage, switches — acquired in place of purpose-built network hardware such as routers, deep packet inspection (DPI) products and firewalls. The remaining 73 percent will originate from existing market segments, primarily virtual network functions (VNFs).

The main value of NFV is in its applications, that is, the VNFs. “The service provider NFV market is larger than the software-defined networking (SDN) market throughout our forecast horizon of 2020, due to the pre-existing and ongoing VNF market,” said Howard. “We expect strong growth in NFV markets in 2020 and beyond, driven by service providers’ desire for service agility and operational efficiency.”

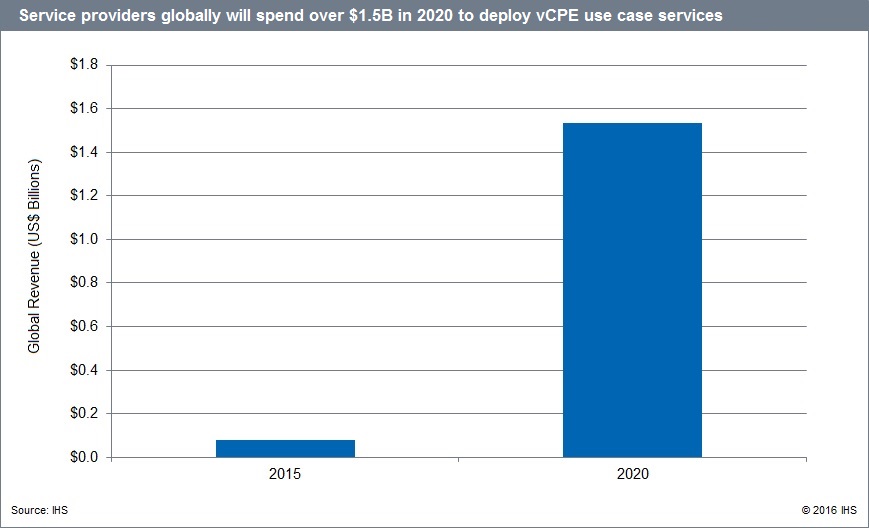

This latest NFV report tracks, for the first time, what service providers spend on NFV hardware and software to deliver software-based services to customers via the consumer virtual customer premises equipment (vCPE) and enterprise vCPE use cases. The vCPE use case opportunity, including spending to deploy consumer and enterprise services, is forecast to reach over $1.5 billion worldwide by 2020.

About the NFV Report

The 2016 IHS Markit NFV Hardware, Software, and Services Annual Market Report tracks service provider NFV hardware, including NFVI servers, storage and switches; NFV software split out by NFV MANO and VNF software, including vRouters and the software-only functions of mobile core and EPC, IMS, PCRF and DPI, security, video CDN and other VNF software; NFV services outsourced services for NFV projects; and NFV uses cases. The report provides worldwide and regional market size, forecasts through 2020, in-depth analysis and trends.

####

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 key business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

Here’s an excerpt of a SDx Central report on SDN and NFV market size:

SDN and NFV Market Size Report 2015 Executive Summary

The adoption of software-defined networking (SDN), network function virtualization (NFV), network virtualization (NV), and white box (gray box and brite box) initiatives has dramatically changed the networking landscape over the past few years. In response to the demand for data around the size and scope of the market, SDxCentral has updated its 2013 Market Sizing Report to reflect the realities of today. This 2015 Market Sizing Report not only provides market data, but also includes a comprehensive analysis of the SDx Networking trends, influences and use cases that are impacting uptake. Our updated model predicts the combined revenue of SDN, NFV and other next-generation networking initiatives (SDx Networking) will exceed $105B per annum by 2020. The rapid emergence of SDxN as an influencer in network purchasing decisions will dramatically impact what has been a largely stagnant network vendor competitive landscape. It’s expected these technologies will influence almost 80% of the purchasing decisions associated with all networking revenue by the end of 2020, affecting virtually every customer segment within the networking space. New SDxN use cases could open the market to new entrants for the first time in more than a decade. Combined with the trend towards more converged IT organizations, SDx Networking could enable a new type of networking decision maker who has less experience with and weaker ties to incumbent vendors. Cloud providers have been leading the charge into the new network paradigm and are expected to remain the largest consumer of new network technologies through 2020.