Month: August 2016

ZAYO Group Assessment: Global network provider grows through 37 acquisitions

by David Dixon of FBR &Co (edited by Alan J Weissberger)

Overview:

ZAYO Group has a global network which provides bandwidth and connectivity over fiber optics network infrastructure. Founded in 2007, Zayo has grown exponentially via acquisitions, taking advantage of transactional demand from hyperscale service providers for bandwidth infrastructure, with its meteoric rise driven by 37 acquisitions in its nine-year history. The company has assembled an attractive services mix, with potential for leveraging its dense metro, regional, and long-haul fiber networks. Industry bandwidth demand continues to increase.

ZAYO reported mixed fiscal 4Q16 results, with the Allstream acquisition driving consolidated revenue growth of 40.2% YoY. On April 1, 2016, Zayo acquired Clearview International, LLC, a Dallas-based collocation and cloud infrastructure services provider for $18.3M in cash. Clearview generated $2.3M in revenues and $0.7M in adjusted EBITDA in the March quarter.

Dixon’s Opinion:

Zayo’s ability to benefit from the exponential growth in bandwidth demand considering technology shifts in wireline and wireless segments, could be gating factors.

The company remains confident about achieving $3M in net installs and $7M in bookings in the next handful of quarters (excluding Zayo Canada).

Acquisition synergies ahead of plan; expected to continue.

As expected, Zayo is extracting significant cost savings from Zayo Canada through an aggressive head-count reduction of 1,700 employees (from 2,200 to 500) as part of the transformation of a mature relationship-based company to a transaction-based company. In the quarter, Zayo generated $7.3M in synergies ($29M annualized); we expect annualized synergies to peak by mid 2017. Management is in the heavy-lifting integration phase; our checks with signature accounts suggest a high likelihood of greater-than-expected high-margin enterprise revenue erosion, which we are closely monitoring.

Q&A:

1. What is the impact of an architecture shift on Zayo business model? Do telecom and cable companies have sufficient metro fiber in place to deploy distributed compute networks?

We see limited competition from other dark fiber and mobile infrastructure providers but believe the real question is the impact of network technology changes underway on the outlook for demand for Zayo s products and services. In the metro fiber segment, we see a move underway within the telecom and cable segments toward distributed compute bandwidth and storage platforms, potentially on fiber infrastructure already in place. This will likely serve as the foundation for transferring data traffic from Internet content and applications from the core network to mini datacenters at the edge of the network in each metro location. This is similar to the content (not computing) challenge solved by Akamai in the early days of the Internet.

2. Are there wireless technology shifts underway disruptive to Zayo’s business model?

On the mobile infrastructure front, there are multiple trends underway: (1) more heavy lifting by low-cost super Wi-Fi-like indoor, versus outdoor, LTE deployments on commodity servers; (2) new cloud-based, shared spectrum bands; and (3) the use of wireless back-haul and front-haul in lieu of fiber connections to cell sites.

3. Synergy potential is high at Allstream, but what is Zayo’s ability to execute its largest and most complex acquisition to date?

While Zayo expects $60 million in annualized cost synergies, we see key challenges, including: (1) a horizontal-based, versus vertical-based, sales and profitability platform (Canadian enterprise customers may not transition well to a transactionalbased relationship); (2) an entrepreneurial, versus mature, business culture; (3) Zayo s limited experience in managing a cybersecurity service portfolio, which may increase churn and lower revenue growth; (4) similarly, management’s lack of experience in managing a mature voice service platform (still a key part of an enterprise customer solution), which may result in increased customer and revenue churn; (5) the transition of Allstream SMB business to a pure reseller, which may increase customer churn.

From the Motley Fool:

CEO and co-founder Dan Caruso was generally pleased with the company’s progress. During the conference call following the announcement, Caruso pointed to the high potential of the overall movement toward 5G network technology, saying, “I can’t think of one macro trend that doesn’t play in favor of having deep, dense fiber networks and a communication infrastructure strategy.” That should bode well for the company’s overall business.

The nice thing about Zayo’s situation right now is that it has time to move forward at a healthy but measured pace. Thanks to its debt restructuring, Zayo has bought considerable time to consider expansion plans, with its new offering of notes maturing in 2025 allowing for longer-term strategic thinking. It’s true that the quarter’s GAAP loss was largely due to the immediate impact on Zayo’s financial statements that the extinguishment of the restructured debt had. But the long-term impact to Zayo’s business prospects should be extremely positive going forward.

Giving some of Zayo’s moves a higher profile would be one good way to bolster future growth. The company entered into an agreement with the Denver Public Schools system, connecting 153 sites and two data centers using more than 600 miles of network assets. An even larger school-district network in Texas also helped Zayo identify what could become a growth niche as education requires greater connectivity.

http://www.fool.com/investing/2016/08/26/zayo-group-hopes-for-faster-growth.aspx

IHS: Ericsson, Huawei, NEC and Nokia are 2016 Microwave Equipment Leaders

IHS Markit (Nasdaq: INFO), a global business information provider, today released excerpts from its 2016 Microwave Network Equipment Vendor Scorecard. The scorecard profiles and analyzes the top seven revenue producers for microwave equipment.

Listed in the scorecard, in alphabetical order, were Aviat Networks, Ceragon, Ericsson, Huawei, NEC, Nokia and SIAE. The scorecard evaluates the microwave equipment vendors on criteria such as direct feedback from buyers, vendor market share, market share momentum, financials, brand recognition, reputation for innovation and other benchmarks. Vendors are classified as leader, established or challenger based on their overall score.

For 2016, Ericsson, Huawei, NEC and Nokia received the leader designation for microwave network equipment, while Aviat Networks, Ceragon and SIAE were identified as challengers.

Among the leaders, Ericsson ranked first in market presence and fourth in market momentum; Huawei placed first in momentum and third in presence; NEC ranked second in both presence and momentum; and Nokia was fourth in presence and fifth in momentum.

“The microwave equipment market is strongly driven by demand for mobile backhaul connectivity from mobile operators. The rapid rise in mobile data traffic drives backhaul and thus microwave equipment market growth,” said Richard Webb, directing analyst for mobile backhaul and small cells at IHS Markit. “The leaders in our scorecard report have positioned microwave products to support their mobile radio access network (RAN) equipment business, but they’re very much microwave specialists too. They innovate technology-wise—often as part of an extensive mobile backhaul equipment portfolio—while maintaining large customer bases of tier-1 mobile operators.”

Strong competition for backhaul from fiber and developments such as 5G and network virtualization are changing the architecture of networks, affecting the long-term outlook for microwave equipment.

“As the mobile network continues to evolve, it’s more important than ever that microwave equipment vendors innovate, expand their product portfolios to a variety of backhaul scenarios including small cells, and maintain a healthy balance sheet to preserve market position,” Webb said.

Alphabet Access, Nokia, Intel, Qualcomm, Ruckus Wireless (Brocade) form Citizens Radio Broadband Service (3.5 GHz) alliance

by Scott Bicheno & edited by Alan J Weissberger

Six of the world’s biggest technology companies have joined forces in order to work out how best to exploit the 150 MHz of unlicensed spectrum that has been made available for commercial use.

The spectrum is in the 3.5 GHz band (specifically 3550-3700 MHz) and is being referred to as the Citizens Radio Broadband Service, so the joint effort is called the CBRS Alliance. The founding members consist of: Google, Intel, Nokia, Qualcomm,Ruckus Wireless and Federated Wireless. This partnership was first publicly discussed back at MWC this year but it seems to have taken them half a year to get their act together.

The availability of the 3.5 GHz band has been spoken about for a while, but the rules governing the coexistence of incumbent users with new entrants were only formalised earlier this year. The presence of a significant chunk of unlicensed spectrum so close to licensed bands has intrigued many companies, recently causing Google to reassess is fibre plans.

“There is ever-growing demand for LTE-based solutions in 3.5 GHz bands and expansion of the wireless footprint,” said Neville Meijers, VP of small cells for Qualcomm and chairman of the board for the CBRS Alliance. “Working together, the CBRS Alliance aims to enable the entire industry to address demand by expanding the capacity of new technologies.”

“Working together, the Alliance will ultimately build LTE-based solutions for the CBRS band – creating one of the many paths that will make it possible to help meet challenges associated with the coming data capacity crunch, which experts predict will reach over 30 exabytes per month by 2020,” blogged Intel’s Shawn Covell who moved there from Qualcomm.

“Federated Wireless has been instrumental in leading the creation of the shared spectrum ecosystem that will enable carriers and enterprises to seamlessly and cost effectively alleviate the challenges of sharing and managing spectrum while improving the performance and capacity of wireless networks for their customers,” said Iyad Tarazi, CEO of Federated Wireless. “The CBRS Alliance can be a critical driver to the success of the shared spectrum deployment in the CBRS band, which we believe has great potential to drive innovation, support new business models and spur economic growth.”

This move brings together two prevailing trends in the wireless industry right now: the exploitation of unlicensed spectrum and the formation of partnerships. It speaks volumes about the potential of this resource that so many industry heavyweights are staking a claim but you do have to wonder why the likes of AT&T and Verizon aren’t part of the gang.

http://telecoms.com/475034/google-intel-nokia-qualcomm-and-other-form-3-5-ghz-alliance/

In February, the companies announced their commitment to build an ecosystem of industry participants and make LTE-based solutions in the CBRS band widely available. This followed the U.S. Federal Communications Commission (FCC) ruling for CBRS, which opened 150 MHz of spectrum (3550-3700 MHz) for commercial use. The Alliance also actively supports the Wireless Innovation Forum’s efforts to develop and drive the adoption of standards around the unique aspects of operation in the CBRS band, which include providing standardized radio interfaces to the spectrum access system (SAS), interfaces between SASs, protection of federal and incumbent use operations, and managing the coexistence among those sharing the band.

With the impending allocations of 3400-3600 MHz for IMT in several countries, there is increased demand for LTE solutions worldwide, creating economies of scale. The Alliance believes that LTE-based solutions in the CBRS band, utilizing shared spectrum, can enable both in-building and outdoor coverage and capacity expansion at massive scale. In order to maximize CBRS’s full potential, the CBRS Alliance aims to enable a robust ecosystem towards making LTE CBRS solutions available.

The Alliance will work towards LTE CBRS field trials in the second half of this year and is developing an official certification process towards successful deployments of CBRS infrastructure.

Google’s CRBS member is Alphabet’s Access, which is focused on increasing access to fast, abundant Internet through efforts such as Google Fiber and wireless initiatives.

Contact: CBRS Alliance

Elizabeth Conroy-Yockim

[email protected]

IHS: Most Service Providers Will Deploy NFV by 2017; Light Reading: 4 Top NFV Carriers

By Michael Howard, Senior Research Director Carrier Networks, IHS Markit

Key Points:

- 100 percent of service providers participating in the IHS Markit NFV strategies survey say they will deploy network functions virtualization (NFV) at some point, with 81 percent expecting to do so by 2017

- Moreover, 59 percent of operator respondents have deployed or will deploy NFV this year

- Integrating NFV into existing networks is an issue for a majority of survey respondents, as is the lack of carrier-grade products

IHS Analysis:

Service providers around the globe are moving toward NFV, which the latest NFV strategies study by IHS Markit bears out. These carriers believe that NFV and its software-defined networking (SDN) companion are a fundamental change in telecom network architecture that will deliver benefits in automation; new, more agile services and revenue; operational efficiency; and capex savings.

Many carriers in 2016 are moving from their NFV proof-of-concept (PoC) tests and lab investigations and evaluations to working with vendors that are developing and productizing the software, which is being deployed commercially.

The carrier mind-set toward NFV is changing quickly. In 2014, there was one standout barrier: operations and business support systems (OSS/BSS). In 2015 and 2016, the top barriers—integrating NFV into existing networks and non-carrier-grade products—show that carriers are very serious about deploying NFV.

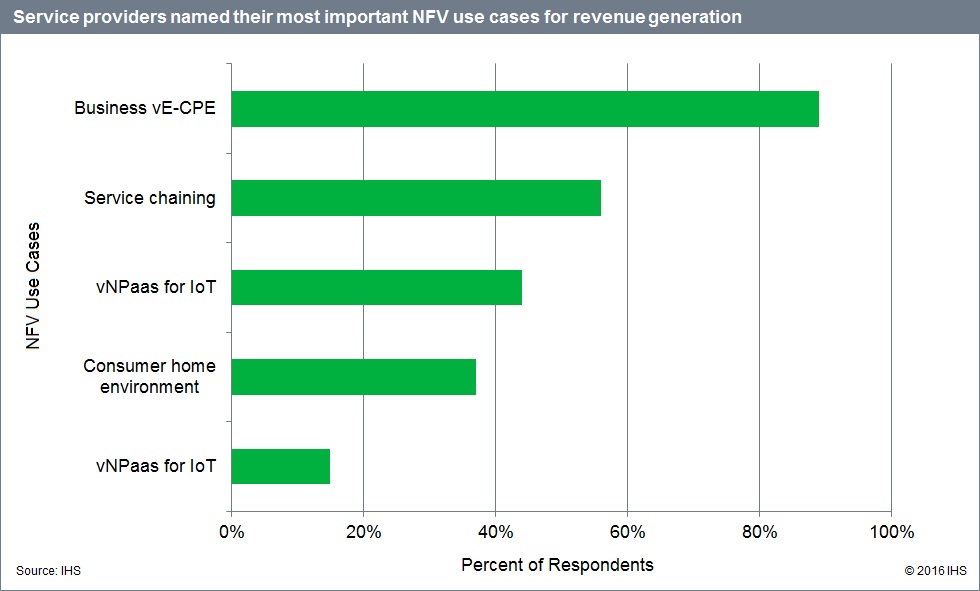

The vast majority of early NFV deployments in the next year, and overall, will be for business virtualized enterprise customer premises equipment (vE-CPE), also known as vBranch or enterprise vCPE. Growing in importance over the last several years, business vE-CPE can assist with revenue generation because it allows operators to replace physical CPEs with software so they can quickly innovate and launch new services.

The industry is still in the early stages of a long-term transition to SDN and NFV architected networks. Carriers will learn that some avenues are not as fruitful as expected, and telecom equipment manufacturers and software suppliers may well invent new approaches that open up newfound applications.

NFV Survey Synopsis:

The 26-page IHS Markit NFV strategies survey is based on interviews with purchase-decision makers at 27 service providers around the world that have deployed NFV in their networks or plan to do so in the future. Operators were asked about their strategies and timing for NFV, including deployment drivers and barriers, target use cases, applications and more.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

From Light Reading website by Ray Le Maistre, Editor-in-Chief, Light Reading

Network/Data Center Operator category.

AT&T — AT&T Managed Internet Service on Demand

AT&T is one of the NFV standard-bearers that is being tracked by the rest of the industry as it forges ahead with the launch of commercial services based on NFV and SDN capabilities.

As the operator itself puts it, it is “putting software rather than hardware at the center of our network, which translates to lowered costs, accelerated rollout of new services and greater control to our customers. The Network on Demand platform is the first commercial offering in the US letting business customers order, change, and provision network services on their own and in near real time.” The operator also believes it is a global first deployment at the kind of scale AT&T has deployed.

Key to AT&T’s proposition is making life easier for its enterprise customers by enabling them to manage their services via an online self-service portal: “On Demand capabilities dramatically change how AT&T customers do business and manage systems, platforms and software. They speed up and simplify the process, and give users more flexibility in managing their own network,” notes the operator.

It’s fair to say that AT&T is putting into practice what many operators have been hoping to achieve from their SDN and NFV strategies.

Boingo Wireless — Offices and Networks Go Virtual

WiFi networking specialist Boingo hasn’t made a lot of noise about its NFV deployment strategy but it’s a smart approach that has helped the company build new business and operational opportunities.

Its NFV capabilities, developed in-house, are at the heart of its S.M.A.R.T. network strategy, which provides faster speeds and a differentiated, tiered connected experience to respective groups of consumers. Boingo’s NFV technology allows it to “dynamically scale to meet capacity demand created by consumers looking to download video, upload large files and stream media,” the company says.

That capability has played a critical role in Boingo’s relationship with Sprint, for which it offloads data traffic as part of a roaming agreement. When the Sprint relationship kicked in, the mobile carrier began “automatically offloading tens of millions of devices to Boingo networks in real time… Boingo was able to auto-scale from six servers to more than 50 immediately, without time-consuming configuration and launch processes.”

Boingo’s NFV strategy is a classic case of emerging technology being put to targeted business use.

Masergy Communications — Masergy Managed Network Functions f(n)

Here’s a statement that should be music to the ears of every company looking for virtualization inspiration: “Masergy deployed NFV solutions that actually solve a problem for its customers rather than just implementing technology that cuts its own operating costs.”

That quest to deploy cutting edge technology to engage with, and improve service experience for, customers began in 2014 but was commercialized in 2015 with the Virtual f(n) launch, which uses NFV technology to enable enterprise users to download virtual network functions (VNFs) such as routers, firewalls and session border controllers as simple software downloads to a shared hardware platform, in a similar way to a smartphone user downloading an app. “With Virtual f(n), Masergy was able to add incredibly agile and flexible solutions to its family of distributed, fully managed network functions,” the company notes.

Another case of NFV being deployed to meet real business needs.

SmartSky Networks — SmartSky 4G

If you want evidence that NFV is taking off, look no further than SmartSky Networks, which is using Brocade’s vEPC running on VMware’s vCloud NFV for its air-to-ground broadband network, SmartSky 4G, connecting airline passengers. The SmartSky network comprises more than 250 cell sites across the US located to provide airborne users with “an online experience comparable with that in their office or at home.”

According to SmartSky, the vEPC system manages the traffic to and from aircraft and enables “deployment in a commercial IaaS environment supporting rapid and cost-effective deployment of the geographically distributed network.” Using the vEPC will enable SmartSky to provide 4G services without the need to deploy redundant functions, helping to lower costs and boost performance compared with physical, node-based mobile packet core systems.

IHS: Welcome to 4G Land: LTE-Advanced Goes Mainstream

By Stéphane Téral, senior research director, mobile infrastructure and carrier economics, IHS Markit

Key Points:

- The migration from basic Long Term Evolution (LTE) to true 4G is well underway:

84 percent of IHS Markit’s service provider respondents are already running LTE‑Advanced (LTE-A) networks - Barriers to deploying 4G are nonexistent at this point, and the main driver for 4G is the lower cost per megabyte of data

- Easy upgradability and standards compliance are the top two LTE features among those surveyed

- Respondent carriers view Ericsson as the top LTE vendor, followed by Nokia and Huawei

IHS Markit Analysis:

IHS Markit asked service providers participating in its 4G survey whether they had deployed LTE-Advanced and found that a vast majority (84 percent) are already running a 4G network. This is significantly higher than a year ago, when around half of survey respondents were running LTE-Advanced—a clear indication of a quick migration from initial LTE rollouts to 4G through the implementation of carrier aggregation.

Case in point: according to recent Global Mobile Suppliers Association (GSA) data, 521 operators have now commercially launched LTE, LTE-Advanced or LTE-Advanced Pro networks in 170 countries. 147 of these operators have deployed LTE-Advanced, and 9 have commercially launched LTE-Advanced Pro. LTE-Advanced has now moved into mainstream deployments, and the GSA has raised its forecast to 560 LTE network deployments by the end of 2016.

The most deployed LTE-Advanced feature among operator respondents is inter-band carrier aggregation, followed by enhanced inter-cell interference coordination and LTE‑Advanced coordinated multipoint. Three- and four-component carrier aggregation is rising fast, and five component is coming soon.

Voice over LTE (VoLTE) is exploding: three-quarters of those surveyed are offering VoLTE, up from just a quarter last year. This will not necessarily lead to imminent 2G or 3G shutdown, but 2G is rising on the agenda.

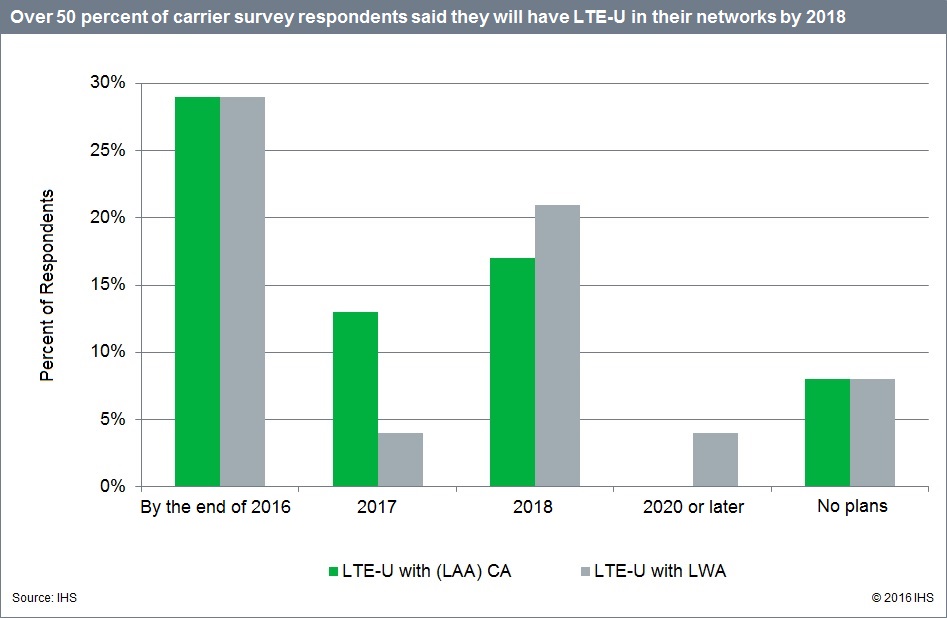

And when it comes to LTE in unlicensed spectrum (LTE-U), over 50 percent of respondents plan to deploy LTE-U by 2018. These respondents are operating in very competitive markets that push them to use as many spectrum ammunitions as possible to stay ahead of the capacity crunch curve to keep their subscribers happy and, of course, on their networks.

4G Survey Synopsis

For the 24-page 4G survey, IHS Markit interviewed purchase-decision makers at 24 global service providers that have deployed or trialed LTE or will do so by the end of 2017. The study covers LTE features and upgrade drivers and barriers; LTE-Advanced timing and features; LTE-U; VoLTE service timing and data/voice roaming; and operator ratings of LTE manufacturers (Ericsson, Huawei, Nokia, Samsung and ZTE). The operators participating in the study represent about half of the world’s telecom capex and revenue.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or[email protected].

Verizon LTE Advanced covers more than 450 cities from coast to coast.

https://www.verizonwireless.com/featured/lte-advanced/?cmp=SOC-C-HQ-NON-S-AW-NONE-lTEATWFirstView-2S0OO0-CO-P-TWT-RE-PP-083016LTE

Complete Deep Research Report on 4G LTE Wireless Broadbandmarket spread across 103 pages, profiling 09 companies and supported with 101 tables and figures is at

http://www.deepresearchreports.com/contacts/inquiry.php?name=225815

The report provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The 4G LTE Wireless Broadband industry analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status.

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, cost, price, revenue and gross margins.

Key Manufacturers Analysis of 4G LTE Wireless Broadband Industry: Gemalto NV, Huawei Technologies Co. Ltd., Sierra Wireless Inc., Telit Communications SpA, Novatel Wireless, Option, Quectel Wireless Solutions, u-blox and ZTE.

AT&T Joins Intel "Super 7" to collaborate on NFV & Integrated cloud platform

Executive Summary

AT&T has become the newest member of Intel’s Super 7 initiative, a coalition of technology companies — including Facebook, Google and Microsoft — that are seeking to revolutionize the data center. Under a new partnership, AT&T will use Intel’s semiconductor technology to advance its network virtualization strategy and integrated cloud platform.

AT&T SDN/NFV Initiatives

Several years ago AT&T initiated an ambitious plan that entailed making use of SDN and NFV as the means to transform and upgrade its network infrastructure, SVP Andre Fuetsch, Senior Vice President of Domain 2.0 Architecture & Design, recounts in an Aug. 17 blog post.

Andre Fuetsch is responsible for delivering the architecture and design of AT&T’s future networking evolution. This transformation will utilize software-defined networking and network function virtualization to deliver products and services to the customer with greatly reduced time to market and significant operational efficiencies. He leads a team of over 2,000 engineers and computer scientists working on programs encompassing both the business and mass market customer segments.

Recognizing the benefits collaboration could bring with the dominating leader of the server microprocessor market, AT&T management struck up a cloud network innovation partnership with Intel to realize its strategic aims. AT&T and Intel have been collaborating on projects aimed at incorporating next-generation 5G broadband wireless and unmanned aerial vehicle (UAV) drone technology into its evolving new ¨software-centric¨ network architecture,

Mr. Fuetsch wrote:

“Intel and AT&T have worked together for a long time. Most recently, we’ve been collaborating on technologies including 5G and drones. Bringing them into our software-centric network program was a natural fit. We’ll also be joining Intel’s “Super 7”. These are influential web and cloud companies on the cutting edge of network and data center design. We’re the first connectivity company to join this group. Call it the “Super 7+1”.

We’ll be optimizing NFV packet processing efficiency for our AT&T Integrated Cloud, or AIC. We’ll also define reference architectures and align NFV roadmaps to speed up our network transformation.

This means we’ll continue to get new software-based network services and capabilities to our customers faster than ever, just as we did with Network on Demand and Network Functions on Demand. Open source software running on hardware powered by Intel chips will enable many of these virtualized network functions. So we’re asking the developer community to stay engaged, too. Open source groups like OpenStack, OPNFV, OpenDaylight, ON.lab, OpenContrail, the Open Compute Project and others are vital to us.”

AT&T is joining Intel’s ¨Super 7,¨ a group of leading Web and cloud companies aiming to push the envelope and improve network and data center design. AT&T would be the first broadband carrier to join the group, making it ¨Super 7+1,¨ Fuetsch wrote.

Intel says its future depends on the new applications enabled by networks like AT&T’s, elevating the carrier into the same elite group of public and large private cloud computing companies it calls the “Super 7”: Amazon.com, Microsoft, Google, Facebook, Baidu, Alibaba and Tencent. Like those companies, AT&T will get early access to Intel silicon and other technologies. Patrick Moorhead, president of Moor Insights & Strategy, said it was odd to include AT&T in the group of the largest cloud companies, but it could help Intel ensure that its chips and devices will run well on 5G networks.

As a ¨Super 7¨ member, AT&T is looking to optimize NFV packet processing efficiency for the AT&T Integrated Cloud (AIC). Company researchers will also define reference NFV architectures and align them with its network transformation plans in a bid to bring them to fruition sooner.

Faster, lower cost introduction of new cloud software and services are among the key prospective benefits AT&T, Intel and others are looking to gain from SDN and NFV. Making use of open source software and Intel processors are core facets of their collaborative efforts. That includes staying actively engaged with open source groups such as OpenStack, OPNFV, OpenDaylight, ON.lab, OpenContrail, the Open Compute Project and others, Fuetsch noted.

Opinion: It remains to be seen if this and other SDN/NFV partnerships can be commercially successful in the absence of any definitive interoperability standards and their implementation by carriers and cloud service providers. We are HUGE SKEPTICS at this time!

References:

http://fortune.com/2016/08/17/intel-and-att-partnership-data/

http://www.telecompetitor.com/att-joining-intels-%C2%A8super-71%C2%A8-sdnnfv-initiative/

http://www.rcrwireless.com/20160818/telecom-software/att-deepens-intel-p…

http://siliconangle.com/blog/2016/08/17/intel-bets-on-5g-wireless-networks-and-ai-to-power-its-future/

IHS: 100G+ WDM & China Spending drives Global Optical Network Equipment Market Growth

by Heidi Adams, senior research director, transport networks, IHS Technology:

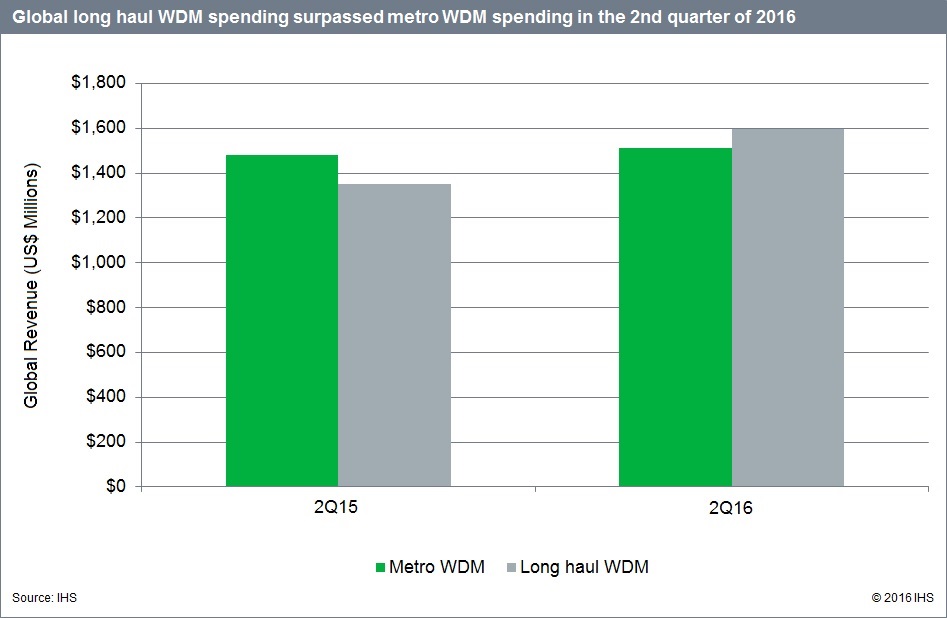

- The long-haul wavelength-division multiplexing (WDM) segment of the optical network hardware market outperformed the metro WDM sector in Q2 2016, with spending increasing 23 percent sequentially and 18 percent from a year ago

- Optical spending in China got a huge uplift in Q2 2016, growing 41 percent quarter-over-quarter and 22 percent year-over-year; China comprised over a quarter of global optical gear spending in the quarter

- Riding the wave of the strong spending cycle in China—coupled with solid gains in EMEA (Europe, Middle East, Africa) and CALA (Caribbean and Latin America—Huawei notched a 41 percent year-over-year revenue uptick in Q2 2016 and grabbed a 32 percent share of the optical hardware market

IHS Analysis

Driven by 100G+ long-haul WDM and a spending spree in China, the global optical network equipment market grew 15 percent sequentially in Q2 2016 and 7 percent from the year-ago quarter, to $3.5 billion.

In Q2 2016, the WDM equipment segment notched gains of 13 percent quarter-over-quarter and 10 percent year-over-year as 100G long-haul deployments accelerated and 200G+ deployments started to ramp. WDM long haul comprised just over half of WDM spending in the quarter.

Metro WDM growth was more muted in Q2 2016, increasing just 2 percent from Q2 2015. However, IHS Markit expects metro WDM growth to pick up toward the end of 2016 as new metro data center interconnect (DCI)–oriented products start shipping in volume and as major metro deployments in North America—principally by Verizon—begin to ramp.

The Synchronous Optical Networking (SONET) and Synchronous Digital Hierarchy (SDH) segment increased sequentially in Q2 2016 driven by project-specific spending, but it maintained its longer-term overall decline with spending down 8 percent year-over-year.

Optical Report Synopsis

The IHS Markit optical network hardware report tracks the global market for metro and long-haul WDM and SONET/SDH equipment, Ethernet optical ports, SONET/SDH ports and WDM ports. The report provides market size, market share, forecasts through 2020, analysis and trends. Vendors tracked include ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, NEC, Nokia, ZTE and others.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or[email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

IHS References:

Optical Network Hardware Market Tracker – Regional, China, Japan, India

https://technology.ihs.com/Services/550805/optical-networks-intelligence-service

Comprehensive Mobile Market Assessment from Chetan Sharma, Mobile Marketing Expert

Highlights of the US Mobile Market Q2 2016

· 12 years ago, US mobile data revenues were less than 5% of the overall revenues. In Q2 2016, mobile data revenues crossed the 75% threshold becoming the second country after Japan to do so.

· Service revenue declined again, down 2% YoY. Overall revenue was flat as device revenue made up for the decline.

· Mobile data revenues increased 8% YoY while Voice revenues declined 31%.

· The overall ARPU was below $40 again.

· Net income saw a nice bump, increasing by 10% YoY with AT&T leading the way with 14% increase.

· Sprint’s capex was lowest in recent memory dropping almost 80% YoY.

· Device revenues declined sharply as consumers are upgrading at a slower pace than before and new device launches haven’t really motivated consumers to upgrade.

· The postpaid upgrade cycle was the slowest in recorded history reaching over 4.4 years in Q2. The overall industry upgrade cycle is over 2.5 years now.

· For the first time, IoT (including connected cars) net adds exceeded phone and tablets combined.

· There were more connected cars net-adds than there were phone net-adds. For the 7th straight quarter, AT&T added more cars than phones and tablets combined.

· AT&T is dominating the IoT Revenues and with Verizon, the duo is pretty much cleaning up the IoT revenue stream in the operator segment.

· AT&T’s connected car onboarding pace is 2x that of its connected tablets pace. Operator is expected to reach 10M connected car subscriptions very soon in roughly 12 quarters compared to 25 quarters it took for the tablets.

· Verizon and T-Mobile have captured the bulk of the postpaid growth in the last three years.

· EBITDA and Net Income saw double digit gains indicating operators are running a much tighter ship than before.

· Churn is at historic lows. Despite all the commotion in the market, fewer customers are churning each quarter. Next churn opportunity is coming next month with the new iPhone release.

· US is well positioned to cross 400M in subscriptions in 2016. As of Q2 2016, the subscription tally stood at roughly 390M.

· The mobile data consumption continues to rise. US is third behind Finland and Korea in terms of GB consumed per sub/month and first amongst nations with more 60M population.

· Verizon’s IoT+Telematics rose 25% YoY to $205M inching towards a $1B/yr run rate.

· Apple’s service revenue is now consistently greater than iPad and Mac revenue streams making it the number two revenue stream behind the gargantuan iPhone bucket.

· AT&T and Verizon on average made $17 per sub/mo while T-Mobile and Sprint roughly $1.6/sub/mo.

· Android ecosystem revenues and profits improved slightly primarily on the back of Samsung’s quarterly results. As expected, iPhone units and revenues dipped again.

· FCC’s Incentive Auction created a massive $86B clearing hurdle which is likely to translate into some issues with the process.

· Pokemon Go became the latest app sensation growing at almost 4x the rate of the last rocket ship- Angry Birds2

What’s next for the mobile broadband industry?

The logical conclusion is that mobile data growth will continue. The usage growth supports that view. In fact, we believe, that mobile data will subsume voice and messaging revenue streams and they will disappear from operator financials soon. It has already happened for some.

If you have been paying attention to our 4th wave analysis, you would have noticed that 4th wave already supplanted mobile data in terms of share. Mobile data revenue share peaked in 2012 and as expected, the industry is now completely dominated by the 4th wave. US became the first country to have 4th Wave revenue exceed access revenues in 2014 and in 2015, 4th wave revenues were greater than all the three major operator revenue streams – voice, messaging, and data.

Of course, operators like AT&T and Verizon haven’t been sitting idle. They have created new revenue streams, AT&T in particular has diversified its revenue stream to become a more complete “solution provider.” Verizon’s recent forays into digital with acquisitions of AOL and Yahoo are classic 4th wave execution plays. The intent shows a clear shift in management thinking on creating new revenue streams and look beyond their own subscriber base. IoT is also serving the top two operators well and the revenue curves in the early days mimic the early growth days of mobile data.

4th Wave Index

5 years ago, we put forth the theory of 4th wave to explain the upcoming changes in the mobile ecosystem. For the most part, the industry changes and tribulations have tracked the 4th wave curves. Last year, voice revenues declined by 23%, messaging revenues by 18%, while data revenues grew by 23%. 4th wave revenues which now dominate the ecosystem now grew by a 60% YoY.

The 4th Wave thesis captures the underlying shifts in industry dynamics that the value is shifting dramatically from access to applications. The quality of networks, the power of devices, the sophistication of applications and services have upended the industry landscape. The competitive dynamics are changing right in front of our eyes, predictably, but dramatically. Consider the fact that Uber is valued more than T-Mobile and Sprint combined, Facebook is valued more than AT&T or Verizon, and Google is valued more than all the US wireless operators combined. The success of the 4th Wave economy is not limited to a handful of Internet players from the US but rather it is a global phenomenon and it is happening across all industry verticals.

So, how does one value an operator vs. an app, a leading device manufacturer vs. a new wearable entrant. If you had a dollar to invest, where would you invest? Infrastructure, devices, platforms, or in services? It was clear that the industry needs a better way to benchmark progress of various companies as well as understand the competitive dynamics. It is also useful to understand the positioning of these companies in a very complex ecosystem. We need to assess a corporation’s strengths across multiple key dimensions in various sub categories and understand how these companies are prepared to compete in the 4th Wave economy.

Our 4th Wave Index offered first view on how a complex ecosystem can be studied. We took a look 29 key variables across four key dimensions: Infrastructure, Devices, Platforms, and Services and calculates the 4th Wave index. It is a useful benchmarking exercise to see if companies are slipping competitively or are making progress. Additionally, the model provides a view into what it will take these players to move from aspirants to challengers to leaders.

5G Economics

5G is gaining steam. All the major players have outline their preliminary plans to do trials on 5G with Verizon being the most aggressive in its intent. FCC become the first major regulator to set aside spectrum for 5G. There has been a lot of discussion on 5G from the technology point of view but not much from an economics point of view. We are taking a deeper look at the economics questions that the industry ought to be asking. Stay tuned for our research paper on the subject. We will discuss – what will be the cost structures, ROI, and the TCOs that will make it worthwhile for the operators to deploy 5G profitably. 5G is going to be a different ecosystem than the first four generations and the current cost model of building out networks might not be sustainable given the demand.

US is likely to be the key driving force in setting the standards and pushing the trials to deployments even though there is no Olympics as a motivator. But competition sure is.

Service Provider to Solution Provider

In our 2012 paper, “Operator’s Dilemma: The 4th Wave,” we argued that to stay relevant in the next phase of industry evolution, mobile operators need to focus on becoming digital lifestyle solution providers else their role will be relegated to access providers. While we are still early in the cycle, in the US, AT&T and Verizon are making investments to diversify their revenue streams. AT&T in particular has done a better job across multiple streams – content, home, IoT, health, transportation, retail, security, and other verticals. Some of the progress is visible in the financials and for others, one must dig deeper.

Verizon’s strategy has been two fold – IoT/Telematics and Media (advertising). It is clearly making excellent progress on the former while it is early to opine on the latter. Sprint has mostly retreated from its early 4th initiative to focus on nuts and bolts of the business. T-Mobile’s Binge-on strategy gives it a media play but something that prevents churn rather than generates “new” revenue.

Cable players have been reluctant participants in the mobile ecosystem but given the pressure on their core content business, wireless is their best bet to ensure the next decade of growth and sustainability. Comcast is expected to launch its MVNO later this year. How far will it go remains to be seen? Over the long-haul, cable service providers will have to become solution providers too.

IoT Revenue Streams and what it means for the ecosystem

Service provider IoT revenue passed the important $1B mark back in 2013. So far it is tracking the growth of the early days of mobile data. However, they are different curves influenced by different factors. Mobile data was relatively an easier curve to climb as the revenues went up with more data handsets coming online. The sales, business case, and ROI was straight forward. IoT is a bit more complicated as it across multiple vertical areas and it is not just about the data network, it is about the complete solution. The sales cycle and execution strategy is different and requires patience and resilience.

Spectrum Auction

FCC’s incentive auction began last quarter and ended with an $86 billion price tag. There isn’t that much reserve laying around to bid for the spectrum so we are likely to see more rounds of speculation and intrigue. No non-traditional player made it to the second round. The next round of action begins next week.

Regulations for the new age

Some of the regulations in the communications space are over a 100-year-old. Communications itself has drastically changed though the principle of transferring the bits from point A to B remains the same. T-Mobile reported that 54%+ of its voice calls are on VoLTE. IP messaging is many times the SMS global volume. Gradually, almost all voice and messaging will be on the IP layer – voice and messaging will just become apps on the data layer. So pretending and regulating these services as if it were 2000 doesn’t help. An ideal strategy for consideration should be that the IP layer gets regulated for fair pricing, competition, and consumer good while everything on the top of the IP layer gets regulated on a “same service, same rules” principle. The interconnection between apps to deliver services like connection to PSTN, E911, etc. can be addressed by fair market pricing principles. VR is going to become the next communication platform; IP messaging the next application development and commerce platform. To keep the regulatory regime simple and in with the times, by focusing on the access layer, one can guarantee that whatever takes place on the top has the opportunity to grow as the market desires. Similarly, data rules across all apps and services on top of the IP layer should be the same irrespective of the provider. This market shift is required to make the market more competitive and fair.

Commercial (with no pay to this author or IEEE- unlike SPONSORED CONTENT):

Our paper on 5G covers the past, present, and future of the network evolution.

Our Mobile Future Forward Summit in Sept will tackle the questions in-depth with some seasoned experts.

Mobile Future Forward – Sept 27th 2016, Seattle, WA

Mobile Future Forward is mobile industry’s premier thought-leadership summit that attracts the most influential minds in mobile who are instrumental in shaping the industry and in managing its growth of revenue and profits. We will explore the evolving universe ofconnected intelligence.

Extraordinary Participants. Invaluable Insights. Peerless Networking.

In proud partnership with Hyla Mobile, Netcracker, Neustar, OpenMarket, Oracle Communications, SAP, Tata Communications, and VoiceBox. Inquiries[email protected]

Can US Cellular Survive as a Regional Wireless Carrier with 4 Stronger National Carriers? David Dixon, FBR &Co

Can U.S. Cellular survive long term as a regional player against four much stronger national carriers in the same region? by David Dixon, FBR & Co.

Notes:

1. The 4 US national carriers are: AT&T, Verizon, Sprint and T-Mobile USA.

2. U.S. Cellular, is a regional wireless carrier which owns and operates the fifth-largest wireless telecommunications network in the United States, serving 4.9 million customers in 426 markets in 23 US states as of the first quarter of 2016. The company has its headquarters in Chicago, Illinois.

3. The Chicago White Sox (MLB-American League) play there home games at U.S. Cellular Field, formerly Comiskey Park. This author attended a White Sox-Cubs game there in July 2005.

U.S. Cellular has retained most of its subscribers in recent years, but the question remains how it will compete against four national carriers with nationwide LTE coverage that will likely extend to the U.S. Cellular region. The company has refocused on its strength as a core rural market operator, but the increasing pace of technology adoption suggests that U.S. Cellular will be challenged to keep pace with its larger competitors.

A greater alignment with AT&T through interoperability may help lower device costs. An LTE roaming agreement with AT&T or Sprint could benefit both companies as follows:

(1) AT&T and Sprint would avoid the deployment cost of a separate rural LTE network where it makes less economic sense (AT&T does not have 700 MHz LTE A block in rural areas, and Sprint has a limited network presence in the region), while AT&T and Sprint customers would benefit from additional coverage as their respective bases are seeded with 700 MHz LTE Band 12 devices over time;

(2) U.S. Cellular would benefit in urban areas by relying on the AT&T network or Sprint network where it has not deployed an LTE network. However, one-sided LTE roaming costs are likely to be high, which may pressure EBITDA more than expected. Yet a reciprocal LTE roaming agreement with Sprint should not be ruled out and is, in our view, more likely than an acquisition of the company as Sprint focuses its capital spending in urban areas.

We see greater than generally expected declines in high-margin roaming revenues as Sprint seeks to regain owner economics through a comprehensive roaming-reduction plan that includes additional geographic coverage. An overbuild by Sprint would pressure EBITDA.

We believe T-MobileUSA (TMUS) aggressive rollout of extendedrange LTE on 700 MHz may have driven the acceleration in roaming revenue declines. TMUS recently acquired 12 MHz of 700 MHz A-block spectrum from Leap Licenseco, Inc. in the Chicago metropolitan area. We expect this spectrum to be put into use very quickly, which could further weigh on USM’s high-margin roaming revenues.

2Q16 Results Recap:

- Consolidated revenues were $980.0M (+0.4% YOY), with company-defined adjusted EBITDA of $218.0M, versus consensus of $211.7M, and EPS of $0.32, versus consensus of $0.28.

- Total net customer adds were 50,000 (+100% YOY), composed of postpaid net adds of 36,000 (+111.8% YOY) and prepaid net adds of 14,000 (+75.0% YOY).

- Postpaid churn was 1.20%, and prepaid churn was 4.86%

References:

https://www.uscellular.com/coverage-map/coverage-indicator.html

Policy Scholar says CLECs better positioned than incumbent carriers

Note: This is an edited excerpt of a US Telecom article at:

https://www.ustelecom.org/blog/clecs-thriving-%E2%80%93-regulatory-help-not-needed

According to a research paper by Anna-Maria Kovacs, a visiting senior policy scholar at the Georgetown Center for Business and Public Policy, cash flow analysis shows that the competitive local exchange provider (CLEC) industry is better positioned than incumbent providers (ILECs & MSOs/CableCo’s), who once dominated the marketplace.

As AT&T points out, the incumbents’ copper-based TDM services are in a free fall as customers increasingly choose alternative, higher-speed services. Kovacs finds that the shift away from these legacy services has attracted cable industry competition and allows CLECs to compete effectively against the incumbents. Kovacs also points out that CLECs and cable companies (MSOs or CableCo’s) enjoy higher stock valuations than the wireline segments of the largest incumbent providers, illustrating that investors expect them to grow revenues and cash flow more rapidly.

The low cash flow for incumbent providers is a reflection of the continuously increasing cost of sustaining a nationwide network that now services about a third of the lines for which it was engineered. Meanwhile, the traditional CLECs have only built in high density areas to maximize revenue and preserve cash flow, the report said.

To help it compete in what has become a vibrant marketplace, CLECs are leaning on the Federal Communications Commission (FCC) for regulatory assistance, calling for monopoly-era regulation on last-mile fiber Ethernet connections.

Market data for Carrier Ethernet show that market is highly competitive with incumbents, CLECs, cable companies and others investing billions to build out infrastructure for business broadband services.

A better policy is establishing a framework in which broadband providers “compete vigorously and consumers enjoy the fruits of that competition,” said John Mayo, executive director of the Georgetown Center, in recommending the Kovacs report as a contribution to the policy discussion.

CLEC References:

http://blog.tmcnet.com/on-rads-radar/2016/07/the-last-clec-pivot.html