IHS: Most Service Providers Will Deploy NFV by 2017; Light Reading: 4 Top NFV Carriers

By Michael Howard, Senior Research Director Carrier Networks, IHS Markit

Key Points:

- 100 percent of service providers participating in the IHS Markit NFV strategies survey say they will deploy network functions virtualization (NFV) at some point, with 81 percent expecting to do so by 2017

- Moreover, 59 percent of operator respondents have deployed or will deploy NFV this year

- Integrating NFV into existing networks is an issue for a majority of survey respondents, as is the lack of carrier-grade products

IHS Analysis:

Service providers around the globe are moving toward NFV, which the latest NFV strategies study by IHS Markit bears out. These carriers believe that NFV and its software-defined networking (SDN) companion are a fundamental change in telecom network architecture that will deliver benefits in automation; new, more agile services and revenue; operational efficiency; and capex savings.

Many carriers in 2016 are moving from their NFV proof-of-concept (PoC) tests and lab investigations and evaluations to working with vendors that are developing and productizing the software, which is being deployed commercially.

The carrier mind-set toward NFV is changing quickly. In 2014, there was one standout barrier: operations and business support systems (OSS/BSS). In 2015 and 2016, the top barriers—integrating NFV into existing networks and non-carrier-grade products—show that carriers are very serious about deploying NFV.

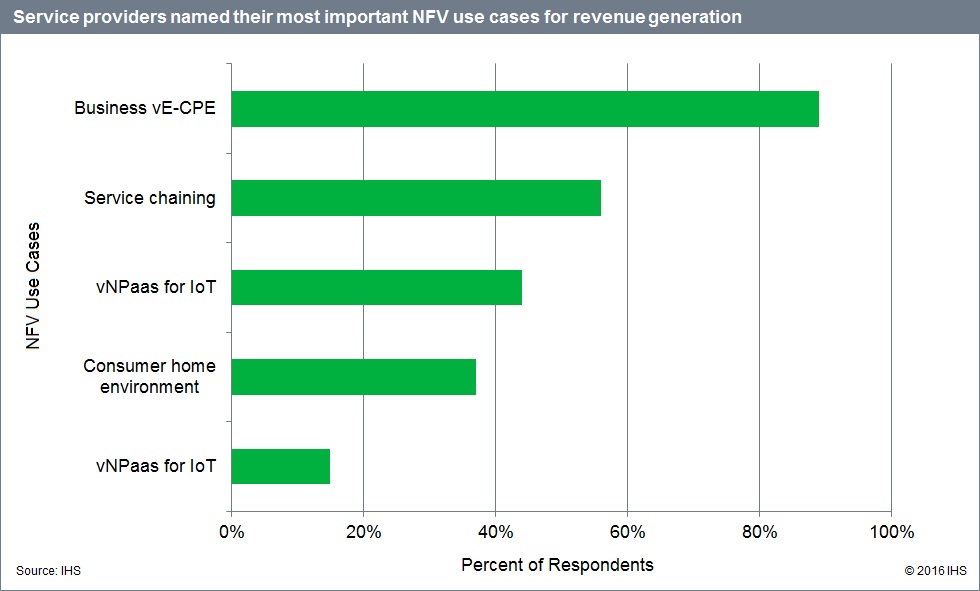

The vast majority of early NFV deployments in the next year, and overall, will be for business virtualized enterprise customer premises equipment (vE-CPE), also known as vBranch or enterprise vCPE. Growing in importance over the last several years, business vE-CPE can assist with revenue generation because it allows operators to replace physical CPEs with software so they can quickly innovate and launch new services.

The industry is still in the early stages of a long-term transition to SDN and NFV architected networks. Carriers will learn that some avenues are not as fruitful as expected, and telecom equipment manufacturers and software suppliers may well invent new approaches that open up newfound applications.

NFV Survey Synopsis:

The 26-page IHS Markit NFV strategies survey is based on interviews with purchase-decision makers at 27 service providers around the world that have deployed NFV in their networks or plan to do so in the future. Operators were asked about their strategies and timing for NFV, including deployment drivers and barriers, target use cases, applications and more.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

From Light Reading website by Ray Le Maistre, Editor-in-Chief, Light Reading

Network/Data Center Operator category.

AT&T — AT&T Managed Internet Service on Demand

AT&T is one of the NFV standard-bearers that is being tracked by the rest of the industry as it forges ahead with the launch of commercial services based on NFV and SDN capabilities.

As the operator itself puts it, it is “putting software rather than hardware at the center of our network, which translates to lowered costs, accelerated rollout of new services and greater control to our customers. The Network on Demand platform is the first commercial offering in the US letting business customers order, change, and provision network services on their own and in near real time.” The operator also believes it is a global first deployment at the kind of scale AT&T has deployed.

Key to AT&T’s proposition is making life easier for its enterprise customers by enabling them to manage their services via an online self-service portal: “On Demand capabilities dramatically change how AT&T customers do business and manage systems, platforms and software. They speed up and simplify the process, and give users more flexibility in managing their own network,” notes the operator.

It’s fair to say that AT&T is putting into practice what many operators have been hoping to achieve from their SDN and NFV strategies.

Boingo Wireless — Offices and Networks Go Virtual

WiFi networking specialist Boingo hasn’t made a lot of noise about its NFV deployment strategy but it’s a smart approach that has helped the company build new business and operational opportunities.

Its NFV capabilities, developed in-house, are at the heart of its S.M.A.R.T. network strategy, which provides faster speeds and a differentiated, tiered connected experience to respective groups of consumers. Boingo’s NFV technology allows it to “dynamically scale to meet capacity demand created by consumers looking to download video, upload large files and stream media,” the company says.

That capability has played a critical role in Boingo’s relationship with Sprint, for which it offloads data traffic as part of a roaming agreement. When the Sprint relationship kicked in, the mobile carrier began “automatically offloading tens of millions of devices to Boingo networks in real time… Boingo was able to auto-scale from six servers to more than 50 immediately, without time-consuming configuration and launch processes.”

Boingo’s NFV strategy is a classic case of emerging technology being put to targeted business use.

Masergy Communications — Masergy Managed Network Functions f(n)

Here’s a statement that should be music to the ears of every company looking for virtualization inspiration: “Masergy deployed NFV solutions that actually solve a problem for its customers rather than just implementing technology that cuts its own operating costs.”

That quest to deploy cutting edge technology to engage with, and improve service experience for, customers began in 2014 but was commercialized in 2015 with the Virtual f(n) launch, which uses NFV technology to enable enterprise users to download virtual network functions (VNFs) such as routers, firewalls and session border controllers as simple software downloads to a shared hardware platform, in a similar way to a smartphone user downloading an app. “With Virtual f(n), Masergy was able to add incredibly agile and flexible solutions to its family of distributed, fully managed network functions,” the company notes.

Another case of NFV being deployed to meet real business needs.

SmartSky Networks — SmartSky 4G

If you want evidence that NFV is taking off, look no further than SmartSky Networks, which is using Brocade’s vEPC running on VMware’s vCloud NFV for its air-to-ground broadband network, SmartSky 4G, connecting airline passengers. The SmartSky network comprises more than 250 cell sites across the US located to provide airborne users with “an online experience comparable with that in their office or at home.”

According to SmartSky, the vEPC system manages the traffic to and from aircraft and enables “deployment in a commercial IaaS environment supporting rapid and cost-effective deployment of the geographically distributed network.” Using the vEPC will enable SmartSky to provide 4G services without the need to deploy redundant functions, helping to lower costs and boost performance compared with physical, node-based mobile packet core systems.