IHS Markit: 100GE Router Port Purchases to More Than Double from 2016 to 2018

By Michael Howard, senior research director and advisor, carrier networks, IHS Markit

Highlights:

- IHS Markit’s operator respondents say that 100GE will make up 38 percent of their 10/40/100GE port purchases during 2018—more than two times that of 2016

- 70 percent of operators surveyed are deploying packet-optical transport systems (P-OTS) or plan to do so by 2018

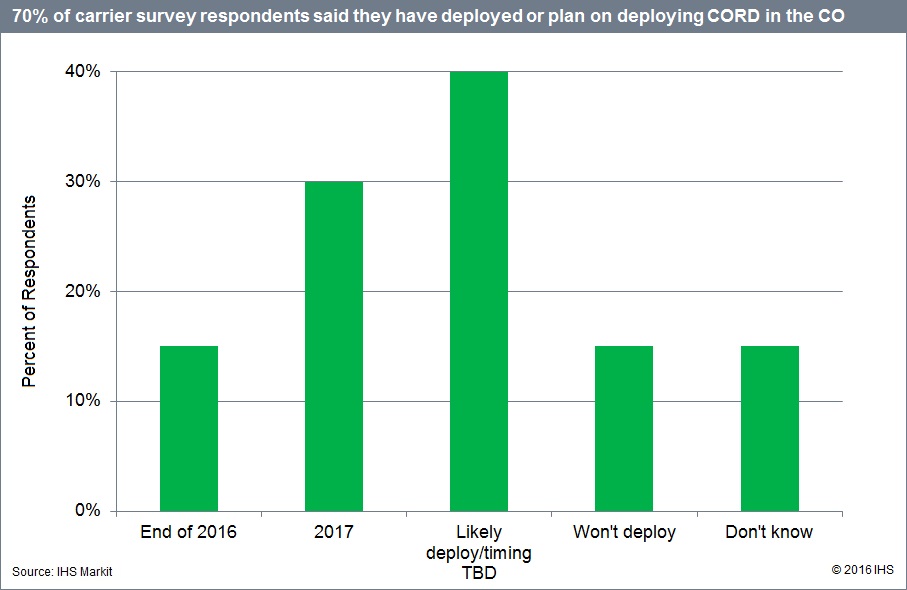

- 70 percent of respondents plan to deploy central office re-architected as a data center (CORD) in their smart central offices (COs)

IHS Markit Analysis:

Our routing, network functions virtualization (NFV) and packet-optical study covers hot and emerging topics in the carrier Ethernet, routing and switching space, with a focus on the IP edge—the area where architectural changes are occurring closer to the customer. The survey looks at operator deployment plans and strategies, deployment locations, router bypass, port mix, expected price per port, and more.

What’s clear from this latest survey is that telecom is moving to 100G now. Sixteen percent of the 10/40/100GE router ports our survey participants purchased in 2016 were 100GE on average, and these service providers expect their 100GE port purchases to more than double to 38 percent in 2018.

In 2017, almost all operator respondents (88 to 96 percent) expect to be paying “10GE parity” or less in three main areas of their networks. “Parity” means that a 100GE port is priced at ten times the price of a 10GE port.

P-OTS remains an integral part of carrier network architecture. Seventy percent of respondents are deploying P-OTS or plan to do so by 2018. Between 2016 and 2018, the percentage of nodes with P-OTS is anticipated to grow six-fold in core/long haul and almost double in access, aggregation, metro core and regional. We believe these plans will keep a damper on router sales. And despite much industry talk, respondents have little current demand for a multi-layer data/transport control plane.

95 percent of operators surveyed are using or planning to use smart COs by deploying servers and storage in selected COs to create mini data centers to offer cloud services and to use them as the NFV infrastructure on which to run virtual network functions (VNFs).

……………………………………………………………………………………………………………………………………………..

For this year’s survey we added questions about CORD. CORD combines NFV and software-defined networking (SDN) software to improve elasticity and bring data center economics and cloud agility to the telco CO. Seventy percent of respondents plan to deploy CORD in their smart COs—30 percent by the end of 2017 and an additional 40 percent in 2018 or later.

Routing, NFV and Packet-Optical Survey Synopsis:

The 25-page 2016 IHS Markit routing, NFV, and packet-optical strategies survey is based on interviews with router/CES purchase decision-makers at 20 global service providers that control 36 percent of worldwide telecom capex and a third of revenue. The survey provides insights into plans for moving router functions from physical routers to software vRouters and VNFs; 100GE adoption and use of IPoDWDM; router and CES protocols; planned uses of vRouters; plans to deploy P-OTS versus routers; and metro architectural changes and deployment of CORD in smart COs.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]