Month: February 2017

GSA Meetup: Cyber Security Continues as Major Obstacle for IoT Adoption

Overview:

As 2016 ended as another year of consolidation within the semiconductor industry, GSA Global examined what’s ahead for 2017 and what are the driving factors at the February 22, 2017 GSA Meetup in San Jose, CA. Most forecasts predict 2017 to be a growth year for the semiconductor industry and those were explained at the Meet Up. Five presentations from market research, private equity and systems integrator firms addressed the status and market drivers for the chip industry.

Highlights:

At the February 22, 2017 GSA Meetup in San Jose, CA, several market research firm presentations referenced the Internet of Things (IoT) as a key market driver for the semiconductor industry. Many new IoT forecast were made and several significant survey results were revealed.

One of the most important was that 92% of potential IoT users are concerned about cyber-security, according to Vijay Joshi of KPMG. That includes security functions like authentication, encryption, threat mitigation, anti-malware protection, etc.

There’s been a rapid increase in “ransomware,” where a hacker demands a ransom after penetrating a connected car, factory with connected devices, or a wearable connected device. One solution would be to embed security functions noted above in hardware or firmware in the IoT connected device along with default credentials. [Author opines that there don’t appear to be any widely accepted standards for the actual security mechanisms to be used-see note below.] In addition to hardware based security functions, an “unpatched OS” (Linux, Android) was recommended, but not defined by the KPMG speaker.

Public and private sector IoT adapters must know what is going on around them so that they can identify when an attack has taken place or when an attack is imminent. Hence, real time monitoring and analytics are mandatory. That is best achieved by including comprehensive cyber-security within an IoT framework.

Author’s Note: We completely agree, but don’t see solid IoT security happening yet. The LPWA (Low Power Wide Area) networks and wireless LAN standards organizations/spec writing bodies are not incorporating network security into their standards/specifications which primarily deal with only the network access (MAC and PHY).

……………………………………………………………………………………………………………………………………………………………..

Golnar Pooya of Accenture noted that IoT has become an increasingly complex landscape. She made several interesting IoT forecasts:

- 40% of all data transmitted/received will come from connected sensors by 2020

- 50B connected devices expected by 2020

- 4.2B people will access 4G-LTE networks by 2020

- 80% of Fortune 100 could offer public APIs

- 31 Exabytes of Mobile data traffic per month by 2020

- IoT will produce an “outcome based economy,” where the “proper outcome (?)” will come from new connected ecosystems, an IoT platform enabled marketplace (see Platform Wars below, and a shared risk environment.

IoT Vision and Value:

IoT vision will have (Internet or Gateway connected) devices talk to each other and also to cloud based compute and storage servers.

Value of IoT is to draw insights and drive action from the raw data. Lots of data transmitted has limited value unless analyzed to generate insights that drive decisions and/or actions.

IoT Platform Wars:

There are currently over 300 IoT Platforms, with different functionality and implementations. The resulting “platform wars” are causing confusion which is reducing the rate of IoT adoption. Mr Pooya predicted that only 10% of the IoT Platforms would succeed in the market. Software and analytics will be the key differentiating factors.

Example of Ecosystem Strategic Partnerships: Intel & Accenture ESP:

• Bring end-to-end solutions to market

• One stop shop / one partner to manage

Author’s Note: The details of this partnership were not described. However, we found this link which provides a thumbnail sketch of the strategic partnership: https://www.accenture.com/us-en/service-accenture-intel

Recommendations [Author ?s]:

- Suppress the Platform Suppression [How to narrow down the number of platforms when there is no reference model for the functionality an IoT platform should contain?]

- Pick the Right Teammates/Partners [How to evaluate partners?]

- Support Standards Bodies [Which one’s- official or private alliances/forums?]

- Prioritize Use Cases and Outcomes [Methods and procedures to do this?]

…………………………………………………………………………………………………

Consider the connected car/vehicle as a huge potential IoT market. According to Jim Hines of Gartner, 80% of all new vehicle models in mature markets will have built-in data connectivity by 2020. Several different types of car connectivity were hypothesized, including: wireless and wireline Ethernet connections within the car, Vehicle to Home, Vehicle to Vehicle (V2X), Vehicle to Smart City/Smart Factory, Intermodal (not defined).

The connected vehicle will be characterized by:

- Human-Machine Interface

- Digital Security

- Data Analytics

- In-Vehicle Ethernet

- OTA (over-the-air) Updating

- Vehicle Information Hub Location-Based Services

- Embedded OS (no specific OS suggested)

Hines said that “automotive applications are leading semiconductor market growth.” [Perhaps that’s why Qualcomm is acquiring NXP- a leader in automotive semiconductors]

His recommendations were as follows:

Focus on the key technologies for enabling connected car functions: – Sensing technologies – Human-machine interface – High-performance processing – Wireless communications

Align your product and service offerings with connected car leaders

View automobiles as mobile sensors and connected devices that will enable new digital business models

…………………………………………………………………………………………………

Dan Hutchinson of VLSI Research said that IoT will drive a data supply chain explosion. It’s one of the strong engines of the next “virtuous cycle” for the IC industry, which will propel the demand for semiconductors. The other drivers, according to a chart attributed to Gary Dickerson of Applied Materials are: visual computing, artificial intelligence and cloud computing/storage). The “smart factory,” presumably chock full of IoT devices, is projected to generate 1M Gbytes of data per day (timeframe not provided).

The cyclicality of the semiconductor industry has moderated for semiconductors, but not for semiconductor production equipment, according to Hutchinson. [Yet semiconductor/chip growth has declined sharply from 2000-2005 period as per a chart shown.]

Summary & Conclusions:

- Moore’s Law has created $13 Trillion of market value for semiconductors

- Without semiconductors: – All those Unicorns would be hornless – No Google – No Facebook – No Amazon – No Netflix – Just to name a few …

- Things are looking up for 2017 & 2018

- However … Let’s NOT party like it’s 1999

………………………………………………………………………………

IoT Conclusions [Author’s Opinion]:

IoT certainly offers tremendous potential and power to create an entire new ecosystem and supply chain. However, the problems identified 10 years ago for Machine to Machine (M2M) communications and IoT have still not been resolved. At least the security problem was discussed at length by the KPMG presenter and noted by the Accenture speaker. That’s a good start, but follow up by IoT industry participants and official standards bodies is urgently needed.

………………………………………………………………………………..

About GSA:

GSA is comprised of 375 members that represent nearly 75% of the $350B industry and boasts the broadest group of executive membership from the entire semiconductor ecosystem.

![]()

GSA is the only organization that brings together the entire semiconductor ecosystem in order to represent industry-wide interests and thoughts.

GSA provides a neutral environment for executives within the semiconductor industry to meet and collaborate on ways to improve efficiencies and address industry wide topics and concerns.

GSA identifies and discusses emerging trends & opportunities, and how our membership can best participate and impact change.

GSA encourages and supports entrepreneurship through various Leadership Councils, Technical Interest Groups and Resources.

GSA promotes the visibility of our members and their contributions to our industry. Testimonials: http://www.gsaglobal.org/gsa-membership/testimonials/

Two New GSA Interest Groups:

- VLSI design trends

- Materials, Manufacturing, Packaging and Test

GSA will be providing an opportunity for our members to join us in two individual interest groups to address the technical and business challenges unique to their specific ecosystem.

Opportunity to discuss technology, materials, scale, equipment and manufacturing, as well as common issues and concerns.

Plan is to meet twice a year

AT&T and Nokia test DIRECTV Now streaming over 39GHz mm Wave “Airscale” Technology

AT&T has completed a lab test of streaming broadband fixed-wireless signals of its DIRECTV Now (Internet TV streaming service) over 39 GHz millimeter wave airwaves using Nokia’s AirScale technology. The test, which Nokia termed a global first, showed how high-frequency spectrum can support over-the-top service delivery. The trial was conducted at the AT&T Labs facility in Middletown, N.J.

“With this trial, we’re doing something that no other operator has done – regionally or globally,” Tom Keathley, SVP of wireless network architecture and design at AT&T, said in a statement. “We expect 39 GHz to be an important 5G band in the United States, and we look forward to continuing our collaboration with Nokia to further advance 5G technology in this band.”

AT&T has stated plans to trial 5G services using the 28 GHz and 39 GHz bands, with the former offering better propagation characteristics, while the latter has more available resources. The carrier is set to pick up control of 39 GHz spectrum through its recently announced purchase of FiberTower.

AT&T earlier this year announced plans with Ericsson and Qualcomm to conduct interoperability testing and over-the-air trials based on what they expect to be 5G technical specifications and using millimeter wave spectrum bands. The companies said the tests will tap spectrum in the 28 GHz and 39 GHz bands in an effort to bolster their expectations for the 5G “New Radio” specifications being worked on by the Third Generation Partnership Project as part of the expected LTE Release 15 standard.

Both bands are also included in the Federal Communications Commission’s Spectrum Frontiers proceedings, which has the federal government looking to open up nearly 11 gigahertz of spectrum above the 24 GHz band in support of mobile telecom services. The 28 GHz band has been receiving more attention from operators, with Verizon Communications, Sprint, T-Mobile US, C Spire and U.S. Cellular all announcing use of the band for 5G network trials.

Read more at:

http://www.multichannel.com/news/distribution/nokia-att-test-5g-streaming-directv-now/411054

451 Alliance- Wireless Service Provider Trends: T-Mobile Leads

| Overview:

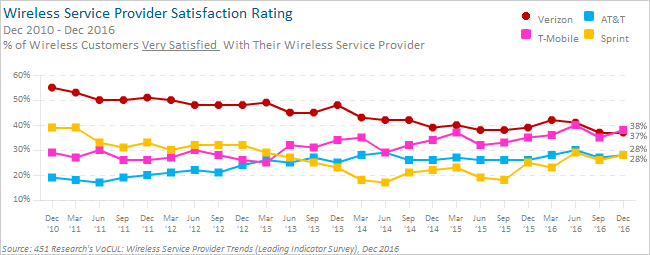

T-Mobile has been closing the gap on Verizon’s lead in our surveys over the past three years. The latest results show T-Mobile has now moved into the top spot in overall customer satisfaction, loyalty, and preferences among planned switchers. Verizon still leads in satisfaction with coverage, reliability, speed of network and streaming video quality. But T-Mobile continues to challenge the status quo by pressuring the competition with non-traditional offerings while remaining sensitive to price. The survey of 4,125 primarily North American respondents from 451 Research’s Leading Indicator panel looks at key wireless industry trends – including data plans and usage, as well as the impact of T-Mobile’s One unlimited data plan. T-Mobile Leads Highly Competitive Wireless Market:T-Mobile (38% Very Satisfied) now leads the wireless industry in customer satisfaction, up 3 points since the previous survey in September 2016. Verizon (37%; unchanged) is a close second, but remains at its all-time low in satisfaction. |

| Sprint (28%; up 2 points) has moved into a tie with AT&T (28%; up 1 point) for third place. We note this is the first time Sprint has ranked third in over three years.

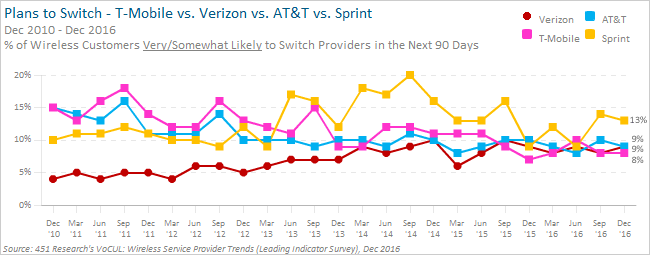

Customer Loyalty: Wireless subscriber churn remains in check despite aggressive promotions around devices and data plans among the four major carriers. In the latest survey, less than one-in-ten (9%) respondents plan to change wireless carriers in the next 90 days – down 1 point since September, but unchanged from a year ago. T-Mobile (8%) has a slim edge over the competition, registering the industry’s lowest churn rate. Verizon (9%) and AT&T (9%) customers are nearly as loyal. |

| Customer retention is more of a concern for Sprint (13%). Though the current results are an improvement since the previous survey, it is 4 points worse compared to a year ago.

Why Subscribers Switch or Stay: Cost remains the key reason for switching among Sprint (36%), AT&T (41%), and Verizon (57%) customers. On the other hand, just 16% of T-Mobile subscribers plan on switching because of cost. What’s the most important reason why you’re likely to change wireless service providers?

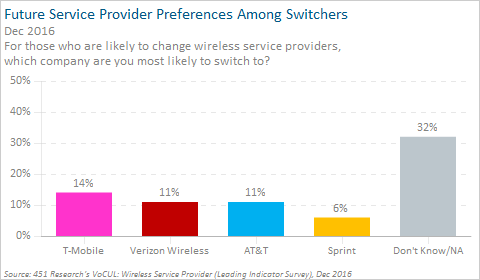

Mobile network performance remains the biggest reason why T-Mobile customers want to switch (31% Poor Reception/Coverage), but their low overall churn rate suggests that T-Mobile customers consider the trade-off with lower price worthwhile. The trade-off is the opposite for Verizon customers. Verizon’s relatively low churn is an indication that their subscribers are willing to pay a higher price for network performance, with just 6% citing Poor Reception/Coverage. According to Rich Karpinski, 451 Research Principal Analyst – Mobile Operator Strategies, “T-Mobile passing Verizon in the all-important Very Satisfied metric is a significant milestone. Ultimately, it reveals two things: happy customers at T-Mobile and questioning customers at Verizon. As we saw in Verizon’s latest earnings results, our VoCUL Leading Indicator survey results track closely to reality. “Verizon retail postpaid churn – while still low – has been inching higher. Competition has also cut into Verizon’s Average Revenue Per Account (ARPA) for its shared data plans, which has declined more than 10% in Q4 2016 vs. Q4 2015. That said, Verizon has done a lot right lately to try to stem the tide but it has yet to find a magic bullet. Meanwhile, T-Mobile keeps its Uncarrier momentum chugging along, Sprint continues applying pricing pressure and AT&T takes its flyer at video and content.” Future Service Provider Preferences: T-Mobile (14%) is the most preferred wireless service provider among planned switchers in the latest survey. Verizon (11%) and AT&T (11%) rank second. For AT&T, this is the best result in the past two years, while for Verizon this is the provider’s worst mark over the same time frame. Sprint has been unable to move the needle in its favor, as just 6% of switchers say they would most prefer to sign up with Sprint.

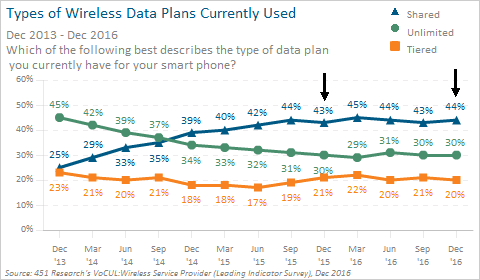

Wireless Data Plans:Unlimited data plans have roared back into the wireless conversation, a trend that has largely resulted from the rollout of new T-Mobile and Sprint wireless plans, along with AT&T’s DirecTV bundled unlimited offering. But as the following chart shows, actual use of unlimited data plans (30%) are relatively flat over the past year:

The lack of a jump for unlimited data plans is somewhat surprising, despite recent marketing efforts promoting unlimited offerings. “Unlimited plans will make their mark, but it may take some time. Device financing and upgrade plans – as well as a variety of limited time promos and grandfathered offers – mean that T-Mobile and Sprint customers won’t all jump to unlimited at once. Plus T-Mobile only moved to exclusively offering its T-Mobile One unlimited plan in January,” notes Karpinski. “The relatively higher cost compared to tiered or shared data plans could also slow the move to unlimited plans. And though unlimited customers get more for their buck, they also pay more out-of-pocket. In the long run, the value and price certainty of current unlimited offers will attract a large share of mobile users.” A Closer Look at T-Mobile’s One Unlimited Data Plan: This latest survey shows 15% of T-Mobile subscribers have signed up for the One unlimited plan, and another 20% are considering signing up in the next 90 days. Importantly, more than a quarter of T-Mobile One subscribers (27%) say they switched from a different wireless provider to sign up. Note that the survey was conducted before T-Mobile announced its updated One plan which now includes taxes and fees as part of its advertised price. Previous Wireless reports highlighted how T-Mobile’s BingeOn offering acted as catalyst for higher customer satisfaction. Being able to stream unlimited video without using monthly data allowance was a strong incentive, as customer satisfaction among BingeOn users was higher than all other T-Mobile subscribers. Is the T-Mobile One plan having a similar impact? Yes, T-Mobile One customers rated their service higher than all T-Mobile customers nearly across the board – with the biggest margin being in Value (50% T-Mobile One vs. 43% all T-Mobile customers).

Data Plan Satisfaction: Turning to customer satisfaction with specific aspects of their data plans, we see the narrowest disparity among the major providers for Quality of Streaming Video. Verizon (36% Very Satisfied) has an edge over the competition, but T-Mobile (34%) and Sprint (34%) customer satisfaction is only 2 points lower, even though both cap most streaming video at standard definition quality (i.e., 480p). How satisfied are you with each of the following aspects of your current data plan?

AT&T customers (31%) are relatively less satisfied with their video quality, but it’s not far behind the other three providers. This may however change as AT&T will now limit video traffic to 480p quality across most plans through its ‘Stream Saver’ feature. In terms of other aspects, Verizon wins big in Coverage (54% Very Satisfied) and Reliability (51%), but when it comes to Speed of Network, Verizon (38%) holds a small lead over the next closest competitor T-Mobile (35%).

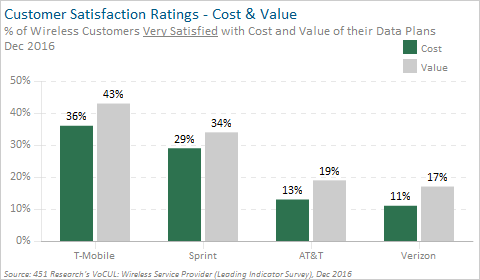

The satisfaction ratings for Cost and Value clearly show that despite limits on video streaming and network performance, T-Mobile and Sprint customers feel they’re getting a greater bang for their buck. Cost and perceptions of value remain a challenge for AT&T and Verizon.

Data Plan Changes – Next 90 Days: Just one-in-ten (11%) respondents say they’ll change their type of data plan over the next 90 days. Tiered (14%) and shared (12%) plan customers remain more likely to say they’ll make a change than unlimited users (7%). At the provider level, Verizon customers (13%) are most likely to change their type of plan, while Sprint and T-Mobile customers are least likely (7%). Importantly, more than half of respondents changing their data plan (55%) also plan on switching wireless service providers. And among customers sticking with their current wireless carrier, 88% say they’re unlikely to change their data plan. How likely are you to change the type of data plan you have over the next 90 days?

Among all respondents changing data plans, two-in-five (42%) want an unlimited plan. This is largely driven by those who are also switching wireless providers, as nearly half (47%) of this group say they want an unlimited data option. Subscribers staying with their current carrier are equally likely to choose either an unlimited (33%) or shared (34%) option when they change their data plan. Which type of data plan will you most likely switch to?

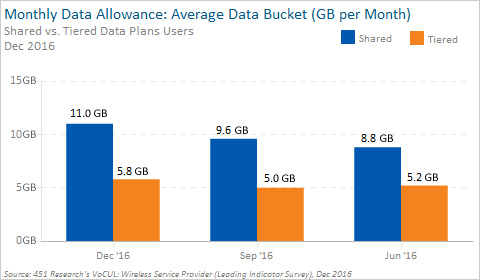

Data Usage – Shared vs. Tiered Customers:Among shared plan users, the average data bucket now consists of 11 GB per month – an increase of more than 2 GB since June 2016. Some of this increase can be attributed to AT&T and Verizon now offering higher amounts of data across their shared plans.

The average data allowance for a tiered plan is nearly 6 GB per month, which has stayed relatively stable since June 2016. How do shared and tiered plan users manage their data use to prevent overages? It’s a combination of using Wi-Fi hotspots (43%), avoiding streaming music or video apps (41%) and limiting use of their phone while not connected to Wi-Fi (36%). Which of the following measures – if any – do you take to manage data usage on your smartphone? (Check All That Apply)

Concerns about Data Overages: The survey asked how concerned respondents were about exceeding their monthly data plan allowance, and found Verizon subscribers (35%) most concerned – despite the availability of ‘Safety Mode’ on the new Verizon Plan, which allows users to browse at 2G speeds after running out of data. Just 10% of Verizon customers say they’ve enabled Safety Mode on their plan, but this may be due to customers being required to opt into this feature. “Price certainty, above any other concern, drives customer wireless decisions. Our survey data backs that up. Customers don’t want to pay more than expected for their wireless service. Verizon’s Safety Mode approach offers price certainty – as does the throttling approach that many carriers offered the past few years,” says Karpinski. “Unlimited is simply a better approach to price certainty. Unlimited users – unless they are extremely heavy users – don’t have to look for Wi-Fi or avoid streaming. T-Mobile’s latest move folds taxes and fees into its pricing, enabling an even greater degree of price certainty. The price on the tag is the price on the bill. That appeals to consumers.” Putting this in context, AT&T also offers overage protection on its new plans, but it’s automatically enabled. Sprint and T-Mobile no longer charge overages by default for all plans. This could explain why AT&T (27%), Sprint (22%) and T-Mobile (16%) subscribers are less concerned compared to Verizon. Bottom Line:T-Mobile is the new industry leader in customer satisfaction, loyalty and preferences among switchers. This is not surprising, with our surveys over the past three years showing consistent momentum for T-Mobile as it rolled out its Uncarrier strategy of disruptive services while being sensitive to price. Verizon’s advantage remains the strength of its network – coverage, reliability, streaming video quality, and speed of network – all categories in which Verizon still rates the best. While Verizon has added more GB to its plans in the second half of 2016, it still does not offer an unlimited data plan option. In its place Verizon now offers Safety Mode to avoid overages, and PopData, which allows subscribers to buy 30-60 minute increments of unlimited data use. Karpinski concludes, “Trendlines being trendlines, it wasn’t difficult to foresee this day coming. T-Mobile’s Uncarrier strategy has been winning subscribers, at the rate of 8 million net-adds per year for the past three years. It is simply gaining more customers, and keeping them happier with its creative and aggressive approach. “That said, there are some wildcards that we’ll be watching closely. New products like AT&T’s DirecTV Now OTT service could turn the market’s attention from growing subscribers to boosting revenue. The bigger wildcard is potential M&A activity such as a T-Mobile/Sprint combo or a Verizon/cableco merger, which could dramatically alter the market’s balance of power. The FCC is expected to significantly loosen regulatory reins, which could also encourage a major reshuffling of the players. If that happens, the US mobile services market will see yet another wave of disruption and change in 2017.” Summary of Key Findings

|

Would SoftBank give up Sprint for a T-Mobile deal? FBR Analysis

SoftBank could be interested in relinquishing control of Sprint and retaining a minority stake if that’s what it takes to merge the US carrier with T-Mobile US, Reuters reports, adding that the parties might enter talks after the spectrum auction ends. Deutsche Telekom has said it wants to keep its stake in T-Mobile.

SoftBank has not yet approached Deutsche Telekom to discuss any deal because the U.S. Federal Communications Commission (FCC) has imposed strict anti-collusion rules that ban discussions between rivals during an ongoing auction of airwaves.

After the auction ends in April, the two parties are expected to begin negotiations, the sources told Reuters this week.

Two and a half years ago, SoftBank abandoned talks to acquire T-Mobile for Sprint amid opposition from U.S. antitrust regulators. That deal would have put SoftBank in control of the merged company, with Deutsche Telekom becoming a minority shareholder.

T-Mobile was worth around $30 billion at the time, but its market value has since risen to more than $50 billion as it overtook Sprint as the No. 3 wireless carrier by subscribers. Sprint’s market value is around $36 billion, roughly the same as in 2014.

Deutsche Telekom Chief Executive Tim Hoettges has said in recent months that the German company is no longer willing to part with T-Mobile, prompting SoftBank to explore a new strategy towards a potential combination, the people said. Deutsche Telekom owns about 65 percent of T-Mobile.

SoftBank, which owns about 83% of Sprint, has been frustrated with its inability to grow significantly on its own in the U.S market, which is dominated by Verizon Communications Inc and AT&T, the two largest U.S. carriers.

While SoftBank is still open to discussing other options, it is now willing to surrender control of Sprint and retain a minority stake in a merger with T-Mobile, the sources said. They asked not to be identified because the deliberations are confidential.

The Reuters report sent shares of T-Mobile surging as much as 7.9% before they eased back to close up 5.5% at $63.92. Shares of Sprint ended 3.3 percent higher at $9.30.

Investors have said a merger between T-Mobile and Sprint, ranked third and fourth respectively, would still face antitrust challenges, but made strategic sense as the industry moves to fifth-generation wireless technology.

Carriers will need to spend billions of dollars to upgrade to 5G networks that promise to be 10 times to 100 times faster than current speeds.

“We may buy, we may sell. Maybe a simple merger, we may be dealing with T-Mobile, we may be dealing with totally different people, different company,” SoftBank Chief Executive Masayoshi Son told analysts on the company’s latest quarterly earnings call earlier this month.

With the advent of 5G, Deutsche Telekom may receive offers for T-Mobile from other U.S. companies, such as DISH Network Corp and Comcast Corp. Sprint could also be an acquisition target for other companies, the sources said.

Dish declined to comment and Comcast did not immediately respond to a request for comment.

Under CEO John Legere, T-Mobile has rolled out unlimited data plans and international roaming packages. Combined with aggressive marketing, this has boosted T-Mobile customer base at the expense of its rivals.

T-Mobile said it had 71.5 million total customers while Sprint had 59.5 million at the end of 2016.

T-Mobile is now almost as big as Deutsche Telekom’s German business. “We are not in the mood of selling the business,” Hoettges told investors last November.

While Sprint’s customer base has also grown under CEO Marcelo Claure and financials have improved, the growth was primarily driven by heavy price discounts. Despite new investment, the company’s network is still viewed by many consumers as weaker than its rivals.

Reuters could not determine how much of a premium SoftBank may want Deutsche Telekom to pay for control of Sprint.

Barclays analysts wrote in a note in December that a merger of T-Mobile and Sprint could result in $25 billion to $30 billion in synergies but said, “it is not imminently clear to us that the various regulatory agencies would reverse course having already blessed the outcome of a four-player market.”

The FCC and the U.S. Department of Justice sent strong messages in 2014 that they did not want Verizon, AT&T, Sprint and T-Mobile to merge among themselves.

Since then, AT&T acquired satellite television provider DirecTV and signed an agreement to buy media giant Time Warner Inc, though that deal is still under regulatory review and has attracted criticism from U.S. President Donald Trump. Verizon has also been exploring other acquisitions.

Antitrust experts said it was difficult to predict how the Trump administration would view a T-Mobile-Sprint merger since key antitrust appointments at the Justice Department have not been made. It is also not clear how such a combination would be viewed by the FCC, whose new chairman Ajit Pai is viewed as more business-friendly than his predecessor.

“I am of the camp that that will not happen even in a Trump administration,” Christopher Marangi, co-chief investment officer at GAMCO Investors Inc, said on the prospects of a T-Mobile-Sprint combination. “That kind of merger means lots of job cuts in the U.S.”

Craig Moffett, an analyst at MoffettNathanson, said price wars between Sprint and T-Mobile have driven down overall wireless prices for consumers.

“Antitrust regulators could well argue that this is precisely the dynamic they would want to preserve,” Moffett added.

Son has said he expects his company to benefit from Trump’s promised deregulation of the U.S. economy. After meeting Trump in early December, Son pledged to invest $50 billion and create 50,000 jobs in the United States.

……………………………………………………………………………………..

FBR Comment & Analysis:

Regarding the above Reuters article citing Softbank’s plans to make an offer to Deutsche Telekom for a merger between S and TMUS, in which Softbank will give up control of S for a minority stake in the combined company.

Current FCC anti-collusion rules bar carrier discussions during the broadcast incentive auction. The auction will enter the last stage (the assignment phase) on March 6 and is anticipated to conclude in April, when Softbank could approach Deutsche Telekom. Despite a solid set of data on the record at the FCC and DOJ endorsing a four-player market, and in contrast to 2014, we believe a merger in 2017 would pass regulatory muster due to:

(1) a political and regulatory Administration change,

(2) less spectrum capacity at T-Mobile, and

(3) commitments to increase coverage and competition in rural areas.

■ Déjà vu. In 2014, Softbank failed to convince the Democratic-led FCC commission that a merger would strengthen sustainable competition. Sprint argued that the wireless carrier market would move from a two-player dominant market to a more viable three-player market. Since then, while cutting capital spending, S has made solid strides in improving its network performance, stabilizing its subscriber base, innovating around its spectrum assets, growing EBITDA, and improving liquidity. While the industry remains in a negative Net Present Value (NPV) situation for incremental capital spending, we think that Sprint, with High Performance User Equipment (HPUE), can maintain low capex spending and is on a path toward positive free cash flow, despite a more fierce-than-ever competitive backdrop.

We believe a deal also makes sense to T-Mobile, due to its ability to tap Sprint’s treasure trove of more valuable HPUE-based spectrum, which should help maintain subscriber momentum.

■ Strategic timing makes sense. An M&A announcement is slightly ahead of our expectations—but makes sense. We never believed a DISH/TMUS combination made sense, due to a lack of synergies/ wireless experience and declining spectrum value; many DISH bulls believe its approaching spectrum buildout milestones would force the company to sell or make a carrier acquisition. Softbank is wise to move now, with both CMCSA and CHTR looking to launch their MVNOs later this year and next, respectively. Moving later risks Sprint being left in the cold with major downside risk if a cable company, having learned more about the wireless disruptive opportunity through its own assets and an MVNO model, subsequently moved to acquire T-Mobile.

■ Market is undervaluing synergies. We see substantial upside to the $3B in synergies being priced in by the market today. (Applying a 7x EV/EBITDA multiple on the EV of the combined entity and deducting the combined EBITDA of both companies would yield the $3B in opex synergies.) However, we believe there is major capex synergy upside, which we do not think the market anticipates, as it does not appear to be pricing in major capex saving benefits from high-power spectrum for the combined S/TMUS entity.

■ Positive implications for Shenandoah Telecommunications Company (SHEN), negative for United States Cellular Corp (USM). We believe a combined S/TMUS would provide a stronger partner network for SHEN. However, given TMUS’s growing focus on rural coverage, a merger would lessen the likelihood of TMUS acquiring USM, and its buildout poses significant risk to USM’s high-margin roaming revenues from Sprint. USM acquired 700 MHz spectrum in the Midwest region in recent years, likely as a hedge against declining roaming revenues and to better position itself as a takeout candidate, in our view. This spectrum is compatible with TMUS, which is rapidly rolling out coverage in Chicago on 700 MHz A-Block. However, if an S/TMUS does materialize, the potential for a USM acquisition will greatly diminish.

AT&T Expands Cellular Network for IoT in US & Mexico

By Benny Evangelista, San Francisco Chronicle

Pushing beyond mobile phones, AT&T is expanding its cellular network to connect commercial smart devices, from water meters that detect excess toilet flushes to soda dispensers that learn what people prefer to drink.

The company has tested the technology in San Ramon, CA and this week it announced plans to expand its upgraded network throughout the United States by this summer and into Mexico by the end of 2017.

With the Gartner research group projecting as many as 20 billion Internet-connected devices of all types installed around the world by 2020, the potential revenue stakes are high for AT&T and its wireless rivals Verizon, Sprint and T-Mobile, which are locked in price wars to retain mobile-phone customers as the market reaches saturation.

“They see this as a real pathway to growth over the next decade or more,” said Bill Menezes, Gartner principal research analyst for wireless services.

That compares to the mobile wireless business, which is “flattening,” Menezes said. “What you see there is a lot of customers moving from one carrier to another. That’s a business where you’re not going to see a ton of growth.”

AT&T Labs began testing its upgraded network, called LTE-M, in October, with its first commercial pilot project in and around its San Ramon facility. That includes special testing rooms lined with a foam-composite material to isolate radio signals. The company has opened a second test area in Columbus, Ohio.

The low-power, wide-area network uses the same transmission equipment needed for AT&T’s standard LTE wireless phone network. But adding the new capabilities requires only a software upgrade, which will speed the introduction of the technology, said David Allen, director of advanced product development for the company’s Internet of Things division.

“One of the goals is that we can scale this for the Internet of Things,” he said.

One test partner is Capstone Metering, a Plano, Texas, firm that makes smart water meters for public utilities. The upgraded network is designed to connect devices that use small amounts of power, which applies to products like underground water meters with batteries that are supposed to last up to 10 years.

Capstone tested a meter on a San Ramon home this week and immediately reported the signature of a toilet leak — precisely 1.6 to 1.9 gallons of water used every 27 minutes, meaning the toilet kept refilling itself.

“We couldn’t do that two years ago,” said Capstone CEO Scott Williamson. “We have the ability with the technology to tell you when you’re washing your hands. It’s data that you need to know if you’re trying to manage and conserve water.”

AT&T also worked with shipping pallet company RM2, which plans to use the network to track some of its latest products, and with PepsiCo, which has a smart soft drink dispenser called Pepsi Spire.

The dispenser can tell Pepsi what the more popular drinks are in different regions or countries, acting as “its own focus group no matter where it is,” said Darren Koenig, Pepsico’s senior director of digital innovation and Internet of Things.

Verizon operates a downtown San Francisco innovation center that’s working on a similar program, called ThingSpace.

Menezes said AT&T, Verizon and wireless networking companies like Sigfox see potential in connecting a wide universe of inanimate devices that don’t need to transmit a lot of data and,

unlike human customers, “are not going to move from carrier to carrier in order to grab an extra 10 percent in savings.”

Benny Evangelista is a San Francisco Chronicle staff writer. Email: [email protected] Twitter: @ChronicleBenny

Next Generation WiFi Silicon from Qualcomm based on IEEE 802.11ax

Qualcomm (Atheros Division) plans to sample chips using the IEEE 802.11ax specification this year. They will provide faster wireless transmission of data while consuming less power.

The company’s QCA6290 system-on-a-chip device for Wi-Fi access points is expected to be released this June. It can use both the 2.4GHz and the 5GHz bands at the same time for peak speeds up to 1.8Gbps, the company said. It’s designed for uses that include 4K Ultra HD video streaming and videoconferencing and in-car Wi-Fi with multiple video streams.

The IEEE 802.11ax standard isn’t expected to be signed off until late next year, but it’s common for some components using a new standard to ship before that step takes place.

802.11ax is particularly aimed at high-density Wi-Fi deployments, improving not only speed, but the ability of connections to stay active even when interfered with heavily. If you’ve been to a technology convention or trade show lately, you’ll know that the existing co-existence features built into Wi-Fi aren’t really sufficient to particularly dense environments.

The specification includes using multiple antennas to send as many as 12 streams of data at the same time. But it also uses technologies from the cellular world, including traffic scheduling, which gets devices on and off the network efficiently so they don’t have to contend with each other as much.

This can help cut the power consumption of Wi-Fi by as much as two-thirds, Qualcomm says. Even users with current 11ac and older 11n devices should see better performance when they use an 11ax network, according to the company.

IEEE 802.11ax is the next generation of Wi-Fi after 802.11ac, which is already capable of gigabit speeds with the right features and conditions. That technology is still finding its way into consumers’ devices and corporate and service-provider networks. This author has an an AT&T Uverse Residential Gateway which has a built in 802.11ac WiFi AP/Router.

For more information:

FBR: Pressure from Unlimited Data Reintroduction at Verizon

by David Dixon and Mike He of FBR & Co. (edited by Alan J Weissberger)

Shares of the four US national wireless carriers are under pressure following Verizon’s announcement this morning of the return of an unlimited data plan. Verizon (VZ) eliminated unlimited plans following the launch of its 4G LTE network due to higher data usage challenges from early adopters but has resurrected this plan against a backdrop of a higher-than-ever competitive landscape.

We are in a mature environment with four major players where incremental pricing cuts and capex expenditures are NPV [1] negative. Following several quarters of subscriber net add weakness and elevated churn associated with competitive pricing from T-Mobile and Sprint that was capped by Sprint’s free third to fifth line pricing plan announcement on Friday, February 10th, it seems Verizon has accelerated plans to reintroduce its Verizon unlimited plan as a retention tool, in our view.

Note 1. Net present value is a calculation that compares the amount invested today to the present value of the future cash receipts from the investment.

Why now? In contrast to the first unlimited plan iteration back in 2011, Verizon now has the ability to monitor data consumption and manage abuse. But the primary driver is elevated churn as T-Mobile US (TMUS) and Sprint (S) have become more price aggressive. In particular, TMUS has been drawing more quality postpaid customers from Verizon of late.

■Verizon unlimited plan details: The plan includes $80 for one line, $120 for two lines, $160 for three lines, or $180 for four lines of unlimited data/talk/text and 10 GB/month of LTE tethering with e-billing and autopay. While the plan had been under wraps for a few weeks, we believe Sprint’s announcement of the “$90 for two lines with lines three to five for free” promotion tipped Verizon’s hand. To control abuse, after 22 GB/month has been reached, VZ reserves the right to de-prioritize traffic during network congestion.

■ Likely limited financial impact to VZ. Today, VZ has a very evenly distributed data usage base thanks to its reluctance to embrace unlimited plans. This compares to Sprint and TMUS, where their highest 20% of data users generate 80% of data traffic. VZ introduced a more simplified plan structure last year followed by a self-provisioning capability (Safety Mode) under the My Verizon app. The app allowed customers to completely turn off data access for the remainder of the billing period if the monthly data cap had been reached, thereby avoiding data overages. While VZ took a financial hit, it also saw customer satisfaction increase as it right-sized its data consumption. As a result, we do not believe Verizon unlimited will have a material negative impact as most customers have already right-sized. Reception has been positive thus far, so it should be an effective retention tool. Furthermore, Verizon unlimited is a promotional offer; Verizon can change the time and pricing at any time, which will be a function of its success.

■ Market implications: We expect VZ’s new plan to have more negative implications for TMUS than S. Recently, the bulk of VZ’s customer defections has been to TMUS. We believe today’s unlimited plan announcement could slow the loss of customers to TMUS to a greater extent. However, this could also constrain gross add momentum at Sprint as it ramps up distribution this year.

FBR Telecom Services: Akamai Earnings Report Analysis; Q&A

by David Dixon, FBR & Co.

Overview:

Facing lofty expectations, CDN leader Akamai (AKAM) delivered solid 4Q16 results that beat consensus’ estimates. The performance and security solutions segment again achieved double-digit growth: 16.7% YoY. Consolidated revenues were $616.1M (+6.44% YoY).

However, guidance for elevated CAPEX and an EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization) margin contraction in the securities products segment was a surprise.

AKAM management is in a race to gain market share as quickly as possible in this fast moving, but high-growth, segment. The bulk of securities growth has come from the installed base. As the largest Internet platform customers’ revenue contributions diminish, management needs to expand the securities base to replace lost media delivery revenues.

………………………………………………………………..

Q&A:

1. Will sales force investments and international expansion pay off?

Akamai continues to accelerate investment in its sales force. Most of the company hiring will be done with a focus on international, where the company believes the revenue opportunity could one day equal North America. We think that the growth seen in international revenue supports the company decision to aggressively expand sales capacity and that the move could ultimately pay off.

2. Can newer products contribute enough to offset maturing core markets and drive sustained mid-teens, or better, growth?

Akamai s focus over the past few years has been to increasingly diversify its business beyond media delivery and Web performance. Through acquisitions and investments, the company entered new end markets and doubled its addressable market. Akamai s newer product groups Web security, carrier products, and hybrid cloud optimization are growing well, but overall growth is still determined by performance in Akamai s slowing core markets. These businesses are achieving scale, but the rate of slowing in the core CDN business is occurring faster than expected, and the magnitude and timing of OTT opportunities are unclear.

3. Will Akamai s business model be pressured over time by the irreversible mix shift of Internet traffic toward twoway increasingly distributed on cloud-based architectures that provide compute and storage?

While the amount of Internet traffic is growing, there is an increase in DIY CDN business, and the amount of static, Akamaicacheable data on the Web is falling as a percentage of the total amount of data with which customers interact. In 1999, the Web was a read-only medium with very little user-generated content, customization, etc. Today, the flow is much more bidirectional (and therefore uncacheable). We do not see that Akamai has a play here; it may resist this architecture shift, as moving into these growth areas would likely cannibalize the CDN revenue base. More acquisitions to enhance the enterprise security portfolio in the interim are likely as the company continues to diversify away from the commodity CDN business segment. Yet the market has responded to the unification of software accessing three types of storage by moving toward distributed, layered IaaS/PaaS systems (e.g., AWS) using HTTPS APIs (versus FTP), providing compute and storage (versus caching of object storage). Improved performance, reliability, and scale are occurring fast, and we expect many cloud customers that are not scaled up will still require a CDN for performance enhancement.

Alibaba negotiating with SP’s to provide free Internet in India

Chinese Internet giant Alibaba’s UCWeb is currently negotiating with telecom service providers (SP’s) and Wi-Fi providers to provide free Internet service in India, Jack Huang, President of Overseas Business, Alibaba Mobile Business told Business Insider India.

“We will definitely look at the opportunity to work together with service providers or even some Wi-Fi providers. We are trying to offer lower cost data to users and better connectivity, even free of cost connectivity. Wi-Fi providers and other players can be potentials and we are in talk (stage).”

The Chinese company is considering providing free Internet services to states that have connectivity problems. “We actually think in geographic way because in India not every state is suffering from connectivity problem so we will focus more on providing this kind of services to states that are suffering more and also we will have comprehensive analysis on already existing consumers who will actually need this kind of service,” added Huang.

………………………………………………………………………………..

This will not be the first time an international Internet behemoth has tried to provide free internet in India.

- Social networking leader Facebook had launched its internet.org and then Free Basic initiatives in India but both failed to get past the regulations in the country. There were only a limited amount of sites that the users could access for free with Facebook’s initiative. The plans hit a major roadblock with Indian telecom regulator TRAI. Techcrunch reported:

Facebook discovered that scaling in India is not so simple. While most of the debate around Free Basics, and its subsequent defeat, centered around net neutrality, the saga is really the result of a set of larger, incorrect assumptions by Facebook on how to reach and on-ramp rural customers.

However, Facebook’s Internet initiatives met with heavy backlash in India from “net neutrality” advocates, who claimed that Free Basics only allowed access to selected websites thus violating the principle that the entire Internet should be available to everyone on equal terms. Current rules in India do not allow anyone to connect content with usage and the telecom regulator is in the process of defining Net Neutrality for the country. If Alibaba is looking at connecting its own content to the free usage it will inevitably have issues with the telecom regulator as was seen in Facebook’s Free Basics.

- Google’s (free for now) managed WiFi service was available in 100 railway stations in India at year end 2016. Google collaborated with RailTel, the communication arm of the Indian Railways to provide the free WiFi service.

Availability is scheduled to double to 200 rail stations in 2017.

Last September, Google CEO Sundar Pichai announced a fairly ambition plan to bring free WiFi to 400 railway stations across India, a goal that would cover 10 million passengers a day by the company’s count. That would make a relatively small, but meaningful impact on the estimated one billion-plus people in the country who aren’t connected to the Internet.

……………………………………………………………..

Alibaba is reportedly still working on the plans around its free Internet service in India and is still in talks with “potential partners.” The company has not stated what wireless technologies might be used for Internet access, but WiFi is probably the top choice. Also, nothing has been said about whether wire-line Internet access for business or homes would also be included in Alibaba’s free Internet plans for India.

Verizon Completes $1.8B Acquisition of XO Communications

Verizon has completed its $1.8 billion acquisition of XO Communications’ fiber business in a deal announced almost one year ago. The company expects to achieve synergies by incorporating XO’s fiber assets as part of its current network operations, with the total operating and expense savings estimated at over $1.5 billion. The XO takeover is expected to help boost Verizon’s enterprise and wholesale business, as well as improve backhaul for its mobile network. Integration of all XO operations and facilities is expected to commence immediately, Verizon said.

Verizon also says it will lease wireless frequencies from NextLink Wireless, a former XO affiliate, in a deal that gives the carrier an option to buy NextLink. That might help the mega telco with its plan to offer high speed wireless broadband (4G or 5G).

In September, Verizon’s CFO Fran Shammo told the audience at a Goldman Sachs & Co. conference that Verizon’s fixed wireless 5G, with 1 Gbit/s connections to the home, will take on cable, “or any broadband connection for that matter,” and that deploying 5G will be much cheaper than deploying FiOS. (See Verizon CFO: Eat Our (Fixed) 5G Dust!)

Shammo also said that the company’s key advantage in deploying 5G is the rights to lease 28GHz bandwidth from NextLink. “That covers 40% of the US,” he said then, adding “That’s all licensed for fixed wireless use for the time being, as per the Federal Communications Commission (FCC) rules. We’re hoping that’ll become mobile at some point down the road.”