Month: March 2017

FBR: MWC Conference part II: Implications for US Telcos & Wireless Telecom Equipment Industry

by David Dixon, FBR Technology, Media & Telecom group (edited by Alan J Weissberger, IEEE ComSoc Content Manger)

Editor’s Note:

U.S. wireless telcos + DISH Network are covered in this detailed FBR report along with Nokia and several smaller network/ telecom equipment vendors.

Takeaways for AT&T, Verizon & Nokia:

AT&T is poised to win the FirstNet contract to build a nationwide public safety network, with a Court decision expected as early as next week. We think this will drive an AT&T capex mix shift to wireless as parallel deployment of 700 MHz, AWS-3, AWS-1, and WCS spectrum gets underway in 1H17. AT&T sees a relative industry spectrum advantage.

Verizon is likely to accelerate its spectrum plans as well, and the industry may benefit from more sub-6 GHz access spectrum coming down the pipeline. Meanwhile, in the short run, Verizon is making a tactical shift from small cells to macro densification.

Nokia has created a wireless network wrinkle for Verizon, AT&T, and T-Mobile to a lesser extent, by discontinuing support for Alcatel equipment forcing a costly swap.

If AT&T deploys on schedule, a spectrum advantage is possible if 3.5 GHz industry momentum slows. However, our checks suggest that this is not occurring, a negative for DISH, in our view.

From a derivative perspective, we think AT&T’s wireless push and Verizon’s macro densification push are positive for tower, radio equipment, and antenna equipment providers.

Companies in these sectors include: American Tower, Crown Castle, SBA Communications, Nokia, Commscope, and ARRIS.

Conclusions for AT&T:

■ We view AT&T as likely to be the imminent beneficiary of $6.5B in federal funds to build a nationwide public safety network on behalf of FirstNet. This front-end-loaded network is scheduled to be completed over the next five years. A lawsuit between FirstNet and AT&T’s competing bidder, Rivada Networks, has delayed deployment but is quickly drawing to a close.

Our industry checks indicate:

(1) Oral arguments of two hours each were provided to a very engaged Judge, who clearly understood the legal basis and arguments;

(2) a decision could come as early as the end of this week or, more conservatively, by the end of March.

–>We think AT&T is the likely winner of the FirstNet contract, even in the unlikely event that Rivada wins the lawsuit and is readmitted to the bidding process because, we believe, AT&T is using its balance sheet (if necessary) to ensure bidding victory.

Importantly, certain major states have opted out of the FirstNet network build, (including Florida, New York, California, Texas). AT&T may need to work harder to provide option incentives. These markets will be targeted by Rivada Networks, in our view, should its bid be unsuccessful.

■ AT&T capex mix shift to wireless as ramp in 1st half of 2017 gets underway. AT&T capex has recently been weighted to the wireline segment. For months, AT&T has been waiting for the FirstNet contract to be awarded, frustrated by the Rivada lawsuit. At the conclusion of the lawsuit, assuming AT&T is declared the winner, we believe the company will commence adding substantial wireless network capacity. AT&T has delayed adding capacity using the combination of its non-utilized AWS-3, AWS-1, and WCS spectrum due to the costly nature of the upgrade. It planned, instead, to wait for the FirstNet contract to be awarded and piggyback the 700 MHz buildout program.

■ Assuming a win, AT&T gains access to 2×10 MHz of 700 MHz spectrum to be deployed on 20,000 cell sites, complementing deployment of 40 MHz of non-utilized spectrum in the AWS-3, AWS-1, WCS bands (recently proposed as a lease to utilities as a shared priority-access network). If it deploys on schedule, there is a potential spectrum advantage; we think this could occur in the event that 3.5 GHz industry momentum slows, either through FCC approval delay, denial for license changes to be requested by Verizon, or delayed FCC certification of Spectrum Access System.

Verizon Also About to Move Fast on Spectrum:

At the conclusion of the broadcast incentive auction, we expect Verizon to seek FCC approval for license changes to the 3.5GHz band; 150 MHz of this band was approved by the FCC for indoor and outdoor use, with 80 MHz reserved for general access and 70 MHz reserved for priority access licenses. These priority access licenses are currently based on 70,000 census blocks across the U.S. and for three-year license terms. We think Verizon will seek approval to have this changed to only 400 market areas and license terms extended to 10 years. This should mitigate interference challenges in adjacent areas because interference protection contours were impossible to manage in such small areas. Once approved we see Verizon and T-Mobile moving fast to endorse and deploy low-cost 3.5 GHz spectrum and see device support in 2018 and 2019. This is significant because investors rightly point out that 3.5 GHz spectrum is not a differentiated spectrum band since all market participants and new entrants can access this spectrum. However, once the spectrum is fully utilized and congested, priority-access licenses can create differentiation.

Much More Sub-6 GHz Access Spectrum Coming Down Pipeline:

We point out potential for: (1) an additional 500 MHz of spectrum in the 3.7 GHz to 4.2 GHz band, which may be utilized for both 4G and 5G; (2) as a TDD spectrum, operators that deploy could benefit from a change to High Performance User Equipment (HPUE), first approved for Sprint’s 2.6 GHz band, but could be applied to any TDD spectrum band globally. This would substantially lower network deployment costs by increasing the cell-site area when using higher-power devices.

We maintain that Verizon and T-Mobile are not likely to pursue DISH spectrum, and Verizon is less spectrum challenged strategically than the market assumes.

Verizon Tactical Shift to Macro Densification in Short Term:

Verizon recently issued an RFP to build fiber in 20 to 30 cities, where it plans to deploy additional wireless network capacity using its fiber based Cloud-Radio Access Network architecture.

Our industry checks indicate Verizon recently made a tactical switch from small cell to macro densification to alleviate capacity constraints in certain areas. We think this is due in part to Mobilitie (a Sprint partner) having created zoning approval havoc in many markets. Our checks indicate that the small cell zoning approval time frame has lengthened from six months to two years.

T-Mobile Focused on 600 MHz Deployment ahead of 3.5 GHz:

From a T Mobile perspective, vendor checks indicate that T Mobile is doing OK on the network front but is being pushed very hard to get 600MHz spectrum deployed in every market where they do not have 700MHz coverage.

T Mobile’s network remains the fastest network in many metro markets (and is the surprising roaming partner of choice for international carriers we spoke with in many more markets than we had assumed). However, its Achilles heel is that they still do not have good coverage away from urban markets in areas where there is less competition.

Nokia Creates a Wireless Network Wrinkle for Verizon, AT&T, and T- Mobile to a Lesser Extent:

Following the merger of Nokia and Alcatel, Nokia mandated the sunset of Alcatel network equipment, deployed on approximately half the AT&T and Verizon networks. T-Mobile is also affected to a lesser extent because certain Nokia equipment is also being discontinued. This equipment will have to be replaced on each network because software features will no longer be supported. At a minimum, this will be a costly, unexpected capital outlay. All operators are frustrated because they do not have a choice. Nokia is the only vendor option and will likely dictate pricing.

Although we expect the migration to be well managed (this is not a network rip-and-replace) this could create network performance challenges.

Implications for AT&T, Verizon, and DISH:

If AT&T wins the FirstNet bid and deploys on schedule, there is a potential spectrum advantage. We think this could occur in the event that 3.5 GHz industry momentum slows, either through FCC approval delay, denial for license changes to be requested by Verizon, or a delay in FCC certification of the Spectrum Access System.

However, our Mobile World Congress (MWC) checks suggest this is not likely. On the contrary, we see 3.5 GHz momentum accelerating across the industry, including from the cable sector. This has negative implications for DISH, in our view.

From a derivative perspective, we think AT&T’s wireless push and Verizon’s macro densification push are positive for tower, radio equipment, and antenna equipment providers. Companies in these sectors include: American Tower, Crown Castle, SBA Communications, Nokia, Commscope, and ARRIS.

………………………………………………………………………………………………..

Company-Specific Disclosures:

FBR acts as a market maker or liquidity provider for the company’s securities: AT&T Inc., DISH Network Corporation and TMobile US, Inc.

For up-to-date company disclosures including price charts, please click on the following link or paste URL in a web browser: www.fbr.com/disclosures.

General Disclosures Information about the Research Analyst Responsible for this report:

The primary analyst(s) covering the issuer(s), David Dixon, certifies (certify) that the views expressed herein accurately reflect the analyst’s personal views as to the subject securities and issuers and further certifies that no part of such analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the analyst in the report. The analyst(s) responsible for this research report has received and is eligible to receive compensation, including bonus compensation, based on FBR’s overall operating revenues, including revenues generated by its investment banking activities.

Highlights of OCP Summit: Mar 8-9, 2017, Santa Clara CA

Key Takeaways:

- Microsoft was everywhere- presenting at the Wednesday morning keynotes, announcing partnerships and new initiatives during Thursday engineering workshops. Progress on the SONIC protocol stack (announced last year) and the new Project Olympus were described in detail.

- Facebook revealed details of it’s “server refresh” and 100GE fiber optic switch-to-switch Data Center network (see section below).

- Yahoo – Japan explained that lower electricity cost was the reason the company has a Data Center in Washington state. They showed a video demonstrating how simple and quick it was to swap out an OCP hardware module in their Washington Data Center.

- Nokia talked about its vision for Telco Cloud, which is actually quite mature. In a different session, they discussed the company’s experience with OCP hardware, including backgrounds and incentives, what choices were made and why. Hardware management interfaces and related improvement needs were disclosed.

- SK Telecom shared its experiences in a trial deployment and maintenance of OCP gear, while also stating its future directions. They conducted an OCP trial for telco infrastructure with three objectives in mind: (1) Analysis of OCP System Deployment Environment, (2) Evaluation of Efficiency, Serviceability, and Performance, (3) Application Test. The company says that the OCP ecosystem in Korea is not mature and has a relatively small market. To minimize risk, SK Telecom would very much like to collaborate with other OCP telco members on practical issues like: vendor selection, existing data center deployments, technical support, compatibility, etc.

- AT&T provided status and updates on several specifications AT&T has or will share with OCP. These include the XGS-PON specs as well as the new G.Fast specs. [Both specs are part of Project CORD which is hosted by the Linux Foundation. Much of the open source code done for Cord is done at ON.Lab.] It was interesting to learn that G.Fast will operate on both low grade copper twisted pairs as well as coax.

- AT&T also revealed its future direction in disaggregated Line Termination Equipment (LTE): remove the processor from the box and replace it with redundant communications links (for failover) to a compute server. That would enable one compute server to control and manage many LTEs. AT&T favors dis-aggregation of network elements, which permits cloud software strategies to be used in place of firmware type applications in telecom equipment. By creating more flexible relationships between hardware and software, new availability and management models are possible.

- EdgeCore highlighted the achievements made in the OCP networking group over the last four years, overview of that latest advancements in Open Networking, and a glimpse into the future of Open Networking. The company is one of two 100GE CWDM-4 optical switch suppliers for Facebook’s 100G Data Center network, as described in the section below.

- HPE talked about the challenges and risks of moving to an open source environment. Citing Gartner Group market research, the company claimed it was the #1 brand for compute and storage servers and #2 in networking.

- Intel presented Rack Scale Design (Intel® RSD) – a logical architecture whose open standard APIs offer infrastructure manageability that is compatible with the hardware designs being contributed and adopted by OCP members.

- Radisys described the OCP Carrier Grade OpenRack-19 specification for the telco data center. It’s a scalable carrier-grade rack level system that integrates high performance compute, storage and networking in a standard rack. Key points covered included:

(1) The telecom industry’s transformation from the traditional Central Office (CO) to virtualized Data Centers and how this transition is driving demand for open hardware solutions from OCP.

(2) Why adapting the OCP base model to the telecom environment must take into account new requirements to accommodate existing Central Offices.

(3) The specific requirements for carrier-grade OCP, including Physical, Content/Workload, Management, and Networking/Interconnect.

(4) How the CG-OpenRack-19 specification aligns with the principles of OCP. Panelists will discuss in-depth how the spec meets requirements for efficient design, scale-out ready architecture, open source and creating a meaningful positive impact.

(5) A real-world example of a CG-OpenRack-19 based hardware solution being deployed in a live network.

Verizon said they will use the OCP Carrier Grade-OpenRack-19 specification to simplify data center deployments and speed up failed equipment replacement time.

- Ericsson discussed their collaboration in open source software projects in order to provide a common management agent framework and sample agent for Ericsson’s hyperscale data center solutions. In a different session, the company discussed solutions for hardware that needs to remain operational in telco data centers which may be deployed in high-temperature (up to 50 degrees centigrade = 122 degrees fahrenheit) situations. A few examples based on Ericsson’s BSP 8100 telco-grade blade servers were presented.

- Google was present, but kept a very low profile, with no keynote presentation(s) or exhibit hall booth. OCP Operations Director & Community Manager Amber Graner wrote in an email to this author:

“Google was there. They were presenting in the Engineering Workshops for the 48v rack standard as part of the Rack and Power Group. They engaged and involved in the community.”

Personally, the best session for me was saved for end of the conference. The very last session on the last day (Thursday):

100G Optics Deployed in Facebook’s Data Centers

FBR: Mobile World Congress -Spectrum not so scarce!

by David Dixon, FBR & Co. (edited by Alan J Weissberger)

Overview:

We saw mounting evidence at Mobile World Congress (MWC) last week that a new technology cycle is being quickly embraced by the cellular industry, which is generating no top-line growth and has an intense focus on costs (including spectrum, network, BSS and OSS platforms, and device subsidies).

This software-based technology cycle is expected to dramatically lower costs to rival WiFi economics and shift the equipment industry from hardware to a service based model built on commodity hardware.

Key Points & Implications for Cellcos & DISH:

■ Increasing spectrum reuse is challenging the spectrum supply scarcity thesis. As a spectrum asset play, despite the risk of a near-term sale of low band spectrum, we saw mounting evidence at MWC last week that:

(1) software and major changes in architecture design that are exponentially driving up spectrum reuse and improving the economics for new equipment deployed using current and future spectrum bands; and

(2) an increase in supply of capacity spectrum that rivals WiFi economics and is coming on stream faster than expected.

■ The implication is that in a 4G/5G environment, there may not be a spectrum supply challenge. If upcoming global “5”G mobility trials (using 28GHz and 3.5GHz spectrum) do not scale well due to an unacceptable increase in cell site density, then “5G” may be less of a major infrastructure investment and more of a discrete capacity overlay investment in dense areas, similar to 3G and 4G deployments.

■ Near term densification masks the technology shift:

Near term, wireless network capacity challenges continue to be addressed through higher cost macro densification and (to a lesser extent lately, due to extended zoning approval timeframes) small cell densification. But in this note we discuss below why it is misleading to determine a company’s spectrum shortage by simply calculating and comparing spectrum per customer.

■ We think Verizon’s larger strategic threat is cable, not lack of spectrum. Based on MWC regulatory checks, we also see greater likelihood of a Sprint (S)/T-Mobile USA (TMUS) merger, which would provide TMUS with useful low cost High Performance User Equipment (HPUE) and mid band spectrum at 2.5GHz and 2.6GHz. We think TMUS favors this over DISH spectrum due to the ability to immediately leverage capacity with device support this year.

Editor’s Note: Sprint says HPUE has been in development for more than two years and that it will extend its 2.5 GHz coverage by up to 30 percent, including indoors where the majority of wireless traffic is generated.

■ Even if a S/TMUS merger were to fall through, we think a TMUS/DISH deal is unlikely. We see the wireless ecosystem quickly embracing this new low cost software-based technology cycle at a time when incremental investments in spectrum and network are negative, so we see a TMUS/DISH combination as unlikely.

■ DISH has assembled a potentially solid spectrum position, but the market values this spectrum too highly today. First, it needs to be combined with PCS, G, H, and AWS-4 bands to be optimal. Second, DISH is positioning its spectrum as downlink only, but with the advent of the smartphone camera and enterprise mobility, uplink and downlink traffic will become more balanced. Third, in light of declining wireless revenues, the wireless industry is undergoing a major strategic rethink with respect to spectrum utilization (i.e., use of unlicensed spectrum for low-cost small cell deployments where 80% of traffic is occurring).

■ The key to valuation is how soon the buyer of spectrum needs to move and the appetite for regulatory approval. AT&T and Verizon appear to be prime candidates, with major spectrum challenges in major markets, but they have the highest degree of regulatory risk and are in the midst of a strategic shift regarding their spectrum utilization paths going forward. Furthermore, even if there were appetite for a deal, we do not think a deal will be successful for either of the two major wireless operators until Sprint and/or T-Mobile US become significantly stronger operators. While the AWS-3 auction provided important market direction in valuing DISH s spectrum portfolio, DISH continues to face increased erosion of its pay TV customer base and needs to move quickly, in our view, despite extended build-out milestones.

■ Post-SoftBank and post-Clearwire, Sprint is well positioned on capacity for four or five years and does not need to move quickly; T-Mobile is well positioned on spectrum to manage capacity needs for four to five years, according to Ericsson, so we believe DISH should move to acquire T-Mobile ahead of a Comcast MVNO launch, but we see more strategic alliance opportunities between T-Mobile and Comcast or Google.

■ DISH faces a continued, competitive ARPU and churn disadvantage to cable operators and can only resell broadband. Network trials confirm major challenges with the fixed-broadband business model. We see a more challenging cash flow outlook as a result. Today, as the business slows, margin expansion comes from lower success-based installation costs, but fixed costs rise when DISH loses customers. DISH has to do something soon on the strategic front, particularly as AT&T is positioning to deploy fiber deeper across its access networks in additional markets, potentially covering an incremental 10 million to 15 million homes.

IHS on Mobile Infrastructure Market: 2016 revenue -10% despite strong Q4

By Stéphane Téral, senior research director and advisor, mobile infrastructure and carrier economics, IHS Markit

Highlights

- A solid Q4 2016 was not enough to save the year for the mobile infrastructure market

- LTE (Long Term Evolution) was down by double digits in Q4 and is expected to see further declines in 2017

- Ericsson, Huawei and Nokia led mobile infrastructure market share in 2016

IHS Markit Analysis

In Q4 2016, the global macrocell mobile infrastructure market totaled $11 billion, rising 7 percent sequentially, driven by strong activity in a few Asian countries such as India, Myanmar and Vietnam. On a year-over-year basis, the market declined 14 percent, dragged down by all regions—and confirming that the market has entered the post-LTE-peak era.

LTE was somewhat the bright spot, up 6 percent quarter-over-quarter driven by E-UTRAN (evolved UMTS terrestrial radio access networks), but down 16 percent year-over-year. 2G/3G was up 10 percent sequentially, kept alive by W-CDMA (wideband code division multiple access) in Japan.

But none of this was enough to save the year for mobile infrastructure.

Looking at the full-year 2016, worldwide mobile infrastructure revenue totaled $43 billion, falling 10 percent from 2015’s $48 billion and also dragged down by all regions, with China in the driver’s seat. Revenue for the software that goes with 2G, 3G and 4G networks grew just 2 percent in 2016 from 2015, to $15.5 billion, mostly driven by LTE-A (LTE-Advanced) upgrades.

In the battle for market share, Ericsson, Huawei and Nokia nabbed the top three spots in 2016. The Chinese vendors were hit by the decline in China, a market where they are the most exposed.

As of January 30, 2017, 581 total commercial LTE networks have been launched. All indicators point to a year of LTE decline in 2017 as a result of diminishing rollouts worldwide. Moreover, we forecast the LTE market to decline at a CAGR (compound annual growth rate) of -12.4 percent from 2016 to 2021, sinking to $12 billion from its peak of $25.9 billion in 2015.

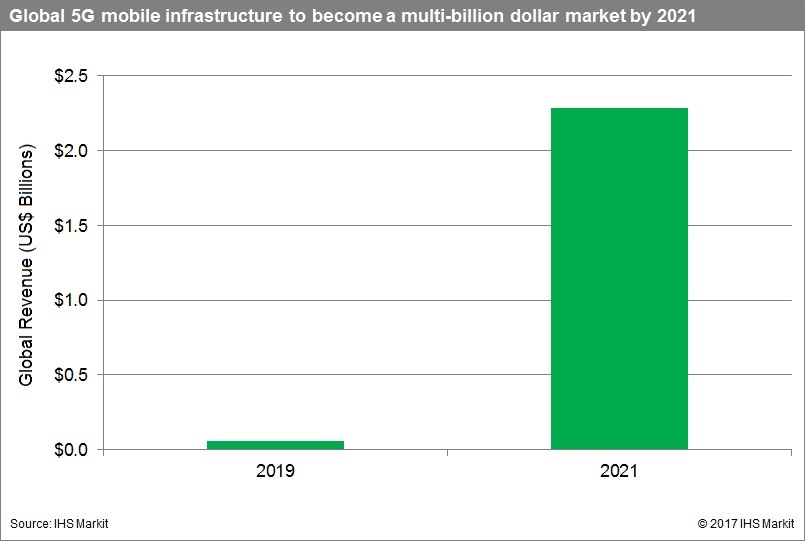

Early 5G rollouts won’t be enough to push the overall market back into growth territory, although by 2021 5G mobile infrastructure is projected to be a multibillion-dollar market worldwide.

Mobile Infrastructure Report Synopsis

The quarterly IHS Markit mobile infrastructure report tracks more than 50 categories of equipment, software and subscribers based on all existing generations of wireless network technology, including radio access networks, base transceiver stations, mobile softswitching, packet core equipment and E-UTRAN macrocells. The report provides worldwide and regional market size, vendor market share, forecasts through 2021 (including a preliminary 5G forecast), deployment trackers, in-depth analysis and trends.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or AmericasLead [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or[email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

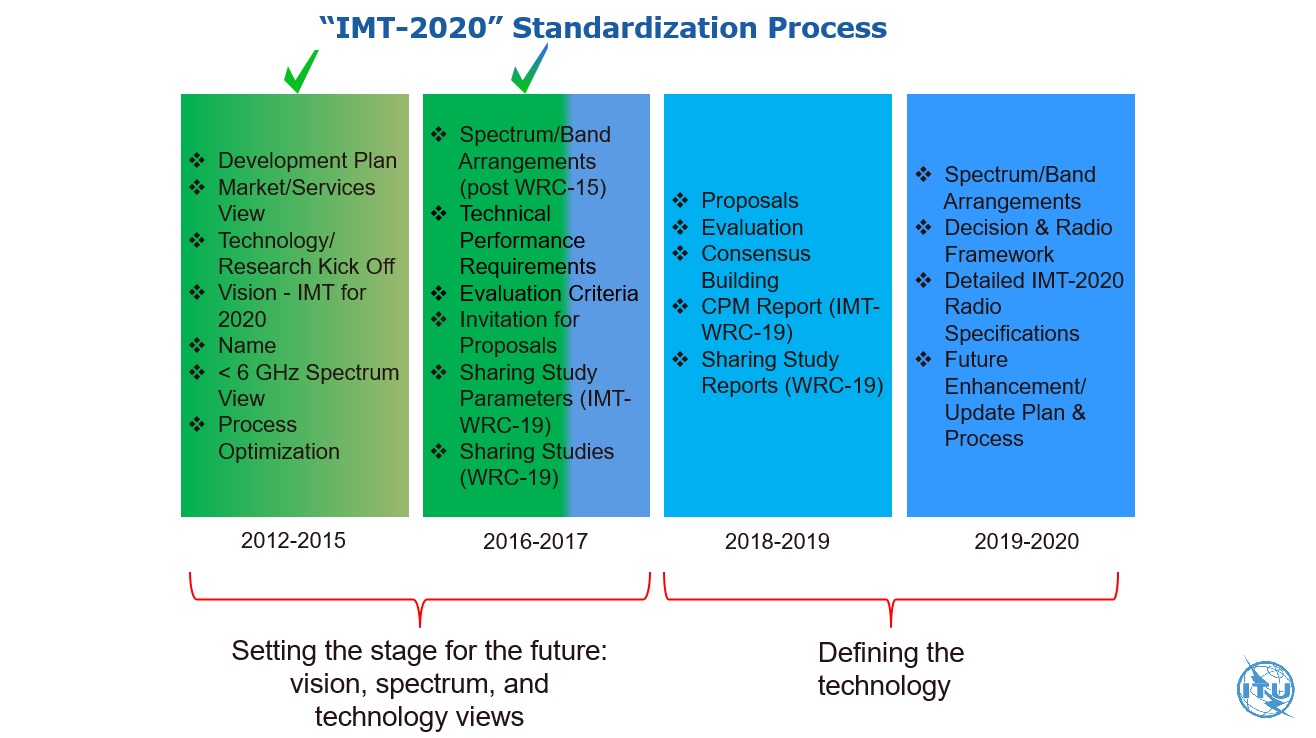

Schedule for Development of IMT-2020 “5G” Radio Interface Recommendations

Editor’s Note:

While Verizon [1] and many other wireless network operators plan to roll out their “5G” services between 2018 and 2020, that will be in ADVANCE OF THE ITU-R IMT 2020 “5G” standard. We believe these “5G” roll-outs are extremely negative for the REAL market for standardized “5G,” which won’t begin till 2021 at the earliest.

Note 1. According to Light Reading, a Verizon executive said that the operator’s home-brewed fixed 5G service will get up in running in 2018 but that he doesn’t expect true mobile 5G to arrive until 2020.

John Stratton, executive vice president and president of operations for Verizon Communications Inc., talking at the Deutsche Bank 25th Annual Media & Telecom Conference in Florida, said that Verizon will deliver fixed 5G in 2018. It is working on customer trials in 11 US cities now. (See Verizon Fixed 5G Tests to Top 3Gbit/s? and Verizon to Start Fixed 5G Customer Trials in April.)

Stratton promised a “meaningful commercial deployment of 5G” in 2018 from Verizon. He was cagey about what exact services the fixed system will provide, but it seems clear that a wireless alternative to cable/DSL services is high on Verizon’s priority list.

“The way we’re thinking about 5G… the ability to leverage the full scale of our business is an important factor,” Stratton added.

The customer trials, Stratton says, will allow Verizon to better understand the signal propagation characteristics of the fixed 5G system and “the load per node.” Verizon has previously said that it has been testing at ranges of up to 1,500 feet in diverse environments for its fixed option.

…………………………………………………………………………………………………………..

| Draft REVISION of ITU-R WP5 document IMT-2020/2: |

| Submission, evaluation process and consensus building for IMT-2020 |

This document describes the process and activities identified for the development of the IMT‑2020 terrestrial components radio interface Recommendations.

1. Time schedule

The time schedule described below applies to the first invitation for candidate RITs (Radio Interface Technologies) or SRITs (Set of Radio Interface Technologies). Subsequent time schedules will be decided according to the submissions of proposals.

Submission of proposals may begin at 28th meeting of Working Party 5D (WP 5D) (currently planned to be 3-11 October 2017) and contribution to the meeting needs to be submitted by 1600 hours UTC, 7 calendar days prior to the start of the meeting. The final deadline for submissions is 1600 hours UTC, 7 calendar days prior to the start of the 32nd meeting of WP 5D in July 2019. The evaluation of the proposed RITs and SRITs by the independent evaluation groups and the consensus-building process will be performed throughout this time period and thereafter. The detailed schedule can be found in Figure 1.

2 Process

2.1 General

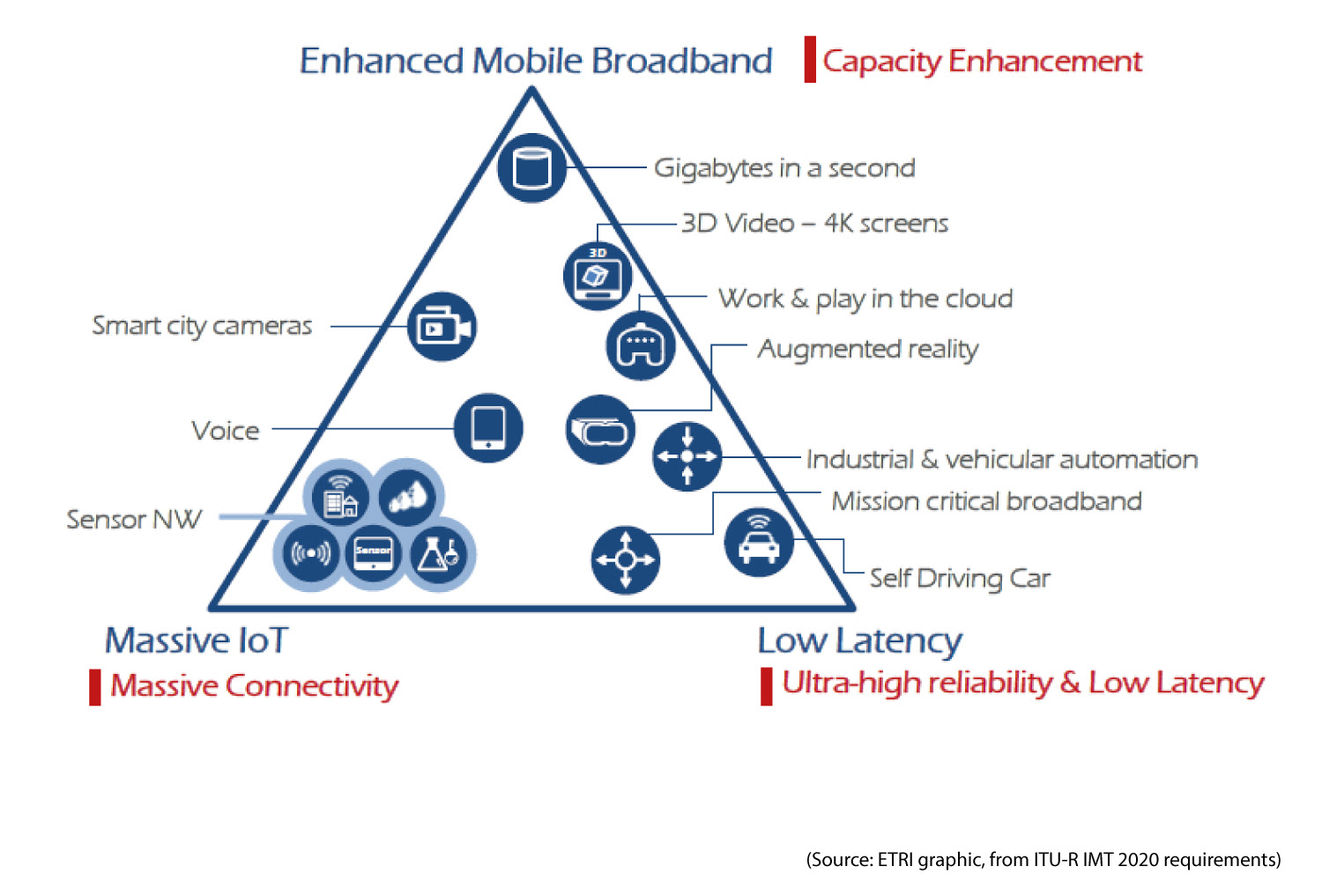

Resolution ITU-R 65 on the “Principles for the process for future development of IMT for 2020 and beyond” outlines the essential criteria and principles that will be used in the process of developing the Recommendations and Reports for IMT-2020, including Recommendation(s) for the radio interface specification.

Recommendation ITU-R M.2083, IMT Vision – “Framework and overall objectives of the future development of IMT for 2020 and beyond” identifies three usage scenarios for IMT-2020 and envisions a broad variety of capabilities, tightly coupled with intended usage scenarios and applications for IMT-2020, resulting in a great diversity/variety of requirements. Recommendation ITU-R M.2083 also identifies the capabilities of IMT-2020, recognising that they will have different relevance and applicability for the different use cases and scenarios addressed by IMT‑2020, some of which are currently not foreseen. In addition, IMT-2020 can be applied in a variety of scenarios, and therefore different test environments are to be considered for evaluation purposes.

A test environment is defined as the combination of usage scenario and geographic environment as described in the draft new Report ITU-R M.[IMT-2020.EVALUATION]

2.2 Detailed procedure

The detailed procedure is illustrated in Figure 2 and is described below. Some activities are external to ITU-R and others are internal.

IMT-2020 terrestrial component radio interface development process

Step 1 – Circular Letter to invite proposals for radio interface technologies and evaluations

The ITU Radiocommunication Bureau, through Circular Letter 5/LCCE/59, invites the submission of candidate RITs or SRITs addressing the terrestrial component of IMT-2020. Addenda to the Circular Letter provide further details on the invitation for submission of proposals (including technical performance requirements, evaluation criteria and template for submission of candidate technologies).

This Circular Letter and its Addenda also invite subsequent submission of evaluation reports on these candidate RITs or SRITs by registered independent evaluation groups in addition to the initial evaluation report endorsed by the proponent.

Step 2 – Development of candidate RITs or SRITs

In this step, which is typically external to ITU-R, candidate terrestrial component RITs or SRITs are developed to satisfy a version of the minimum technical performance requirements and evaluation criteria of IMT-2020 currently in force (as defined in Resolution ITU-R 65, resolves 6 g)) that will be described in the Draft New Report ITU-R M.[IMT‑2020.SUBMISSION][4].

The required number of test environments for an RIT or SRIT to be fulfilled is as follows:

An RIT needs to fulfil the minimum requirements for at least three test environments; two test environments under eMBB and one test environment under mMTC or URLLC.

An SRIT consists of a number of component RITs complementing each other, with each component RIT fulfilling the minimum requirements of at least two test environments and together as an SRIT fulfilling the minimum requirements of at least four test environments comprising the three usage scenarios.

Step 3 – Submission/reception of the RIT and SRIT proposals and acknowledgement of receipt

The proponents of RITs or SRITs may be Member States, Sector Members, and Associates of ITU‑R Study Group 5, or other organizations in accordance with Resolution ITU-R 9-5.

The submission of each candidate RIT or SRIT must include completed templates (these templates will be provided in draft new Report ITU-R M.[IMT-2020.SUBMISSION], together with any additional inputs which the proponent may consider relevant to the evaluation. Each proposal must indicate the version of the minimum technical performance requirements and evaluation criteria of the IMT-2020 currently in force that it is intended for and make reference to the associated requirements.

The entity that proposes a candidate RIT or SRIT to the ITU-R (the proponent) shall include with it either an initial self-evaluation or the proponents’ endorsement of an initial evaluation submitted by another entity. The submission will not be considered complete without an initial self-evaluation or the proponents’ endorsement of an initial evaluation submitted by another entity.

Proponents and IPR holders should indicate their compliance with the ITU policy on intellectual property rights, as specified in the Common Patent Policy for ITU‑T/ITU-R/ISO/IEC available at: http://www.itu.int/ITU-T/dbase/patent/patent-policy.html (See Note 2 in Section A2.6 of Resolution ITU-R 1-7).

The Radiocommunication Bureau (BR) receives the submission of technical information on the candidate RITs and SRITs and acknowledges its receipt

Submissions should be addressed to the Counsellor for ITU-R Study Group 5, Mr. Sergio Buonomo ([email protected]). These submissions will be prepared as inputs to ITU-R Working Party

Working Party 5D (WP 5D) and will also be made available on the ITU web page for the IMT-2020 submission and evaluation process.

Step 4 – Evaluation of candidate RITs or SRITs by independent evaluation groups (mid 2018-2010)

Candidate RITs or SRITs will be evaluated. The ITU-R membership, standards organisations, and other organizations are invited to proceed with the evaluation. Organizations wishing to become independent evaluation groups are requested to register with ITU-R[6] preferably before the end of 2017. The independent evaluation groups are kindly requested to submit evaluation reports to the ITU-R. The evaluation reports will be considered in the development of the ITU-R Recommendation describing the radio interface specifications.

The evaluation guidelines, including criteria and test models, will be provided in draft new Report ITU‑R M.[IMT-2020.SUBMISSION] as announced in Circular Letter 5/LCCE/59 and its Addenda.

In this step the candidate RITs or SRITs will be assessed based on draft new Report ITU-R M.[IMT-2020.SUBMISSION]. If necessary, additional evaluation methodologies may be developed by each independent evaluation group to complement the evaluation guidelines in draft new Report ITU-R M.[IMT-2020.SUBMISSION]. Any such additional methodology should be shared between independent evaluation groups and sent to the BR for information to facilitate consideration of the evaluation results by ITU-R.

Coordination between independent evaluation groups is strongly encouraged to facilitate comparison and consistency of results, to assist ITU-R in developing an understanding of differences in evaluation results achieved by the independent evaluation groups and to form some preliminary consensus on the evaluation results. Consensus building is encouraged, such as grouping and/or syntheses by proponents in order to better meet the requirements of IMT-2020.

Each independent evaluation group will report its conclusions to the ITU-R. Evaluation reports should be addressed to the Counsellor for ITU-R Study Group 5, Mr. Sergio Buonomo ([email protected]).

The evaluation reports will be prepared as inputs to WP 5D and will also be made available on the ITU web page for the IMT-2020 submission and evaluation process.

The technical performance requirements and evaluation criteria for IMT-2020 are subject to reviews which may introduce changes to the technical performance requirements and evaluation criteria for IMT-2020. Proponents may request evaluation against any of the existing versions of the technical performance requirements and evaluation criteria that are currently in force for IMT-2020.

Step 5 – Review and coordination of outside evaluation activities

WP 5D will act as the focal point for coordination between the various independent evaluation groups. In this step, WP 5D monitors the progress of the evaluation activities, and provides appropriate responses to problems or requests for guidance to facilitate consensus building.

Step 6 – Review to assess compliance with minimum requirements

In this step WP 5D makes an assessment of the proposal as to whether it meets a version of the minimum technical performance requirements and evaluation criteria of the IMT-2020 in draft new Report ITU-R M.[IMT-2020.SUBMISSION].

In this step, the evaluated proposal for an RIT/SRIT is assessed as a qualifying RIT/SRIT, if an RIT/SRIT fulfils the minimum requirements for the five test environments comprising the three usage scenarios.

Such a qualified RIT/SRIT will go forward for further consideration in Step 7.

According to the decision of the proponents, earlier steps may be revisited to complement, revise, clarify and include possible consensus-building for candidate RITs or SRITs including those that initially do not fulfil the minimum requirements of IMT-2020 that will be described in the draft new Report ITU-R M.[IMT-2020.SUBMISSION].

WP 5D will prepare a document on the activities of this step and assemble the reviewed proposals and relevant documentation. WP 5D will keep the proponents informed of the status of the assessment.

Such documentation and feedback resulting from this step can facilitate consensus building that might take place external to the ITU-R in support of Step 7.

Step 7 – Consideration of evaluation results, consensus building and decision

In this step WP 5D will consider the evaluation results of those RITs or SRITs that have satisfied the review process in Step 6.

Consensus building is performed during Steps 4, 5, 6 and 7 with the objective of achieving global harmonization and having the potential for wide industry support for the radio interfaces that are developed for IMT-2020. This may include grouping of RITs or modifications to RITs to create SRITs that better meet the objectives of IMT-2020.

An RIT or SRIT will be accepted for inclusion in the standardization phase described in Step 8 if, as the result of deliberation by ITU-R, it is determined that the RIT or SRIT meets the requirements of Resolution ITU-R 65, resolves 6 e) and f) for the five test environments comprising the three usage scenarios.

Step 8 – Development of radio interface Recommendation(s)- mid 2018 till Dec 2020

In this step a (set of) IMT-2020 terrestrial component radio interface Recommendation(s) is developed within the ITU-R on the basis of the results of Step 7, sufficiently detailed to enable worldwide compatibility of operation and equipment, including roaming.

This work may proceed in cooperation with relevant organizations external to ITU in order to complement the work within ITU‑R, using the principles set out in Resolution ITU-R 9-5.

Step 9 – Implementation of Recommendation(s)

In this step, activities external to ITU-R include the development of supplementary standards (if appropriate), equipment design and development, testing, field trials, type approval (if appropriate), development of relevant commercial aspects such as roaming agreements, manufacture and deployment of IMT-2020 infrastructure leading to commercial service.

________________

[1] The term RIT stands for Radio Interface Technology.

[2] The term SRIT stands for Set of RITs.

[3] The draft new Report ITU-R M.[IMT-2020.EVAL] is under development and will be finalized in June 2017.

[4] The draft new Report ITU-R M.[IMT-2020.SUBMISSION] is under development and will be finalized in June 2017.

[5] Provides the confirmation to the sender that the submission was received by the BR and that the submission will be forwarded to WP 5D for subsequent consideration.

[6] Independent evaluation group registration forms are available at:

http://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx.

[7] As defined in Step 2, each component RIT of the SRIT needs to still fulfil the minimum requirements of at least two test environments.

[8] As defined in Step 2, each component RIT of the SRIT needs to still fulfil the minimum requirements of at least two test environments.

IDC Directions 2017: IoT Forecast, 5G & Related Sessions

Introduction:

As several IDC telecommunications analysts were attending Mobile World Congress this week, there were very few communications/networking sessions or data points at this year’s IDC Directions conference, February 28, 2017 in Santa Clara, CA. In this event summary, we touch on an IDC forecast for IoT, it’s relationship to “5G,” and cellular communications opportunities for the Connected Car. We also provide Author’s Notes on the current status and future directions of various standards, e.g. 5G/IMT 2020, V2X, and V2V.

1. Frank Gens Keynote on Digital Transformation (DX) and the New Economy:

Abstract:

In 2017–2020, we’ll see the emergence of digital transformation at a macroeconomic scale — the dawn of the “DX economy.” In this new economy, enterprises in every industry will compete based on their ability to hit and exceed a new set of demanding performance benchmarks enabled by cloud, mobility, cognitive/AI, the Internet of Things, immersive interface, and other technologies — and the digital transformations enabled by these technologies. In the DX economy, every growing enterprise — no matter its age or industry — will become a “digital native” in the way its executives and employees think and operate. And tech industry leaders will need to align with this new customer reality — bringing the right technologies, ecosystems, and customer insight to the fight for IT market share.

Key Points on IoT:

- IoT is highly verticalized (i.e, many different industry vertical market segments) and is tapped into DX use cases.

- IDC predicts $1.3T in IoT spending by 2020. At 22%, manufacturing will be the largest IoT vertical industry segment.

- Every industry has an IoT strategy or initiative to be implemented in the near future.

- By 2019, 43% of IoT data will be processed at the edge of the cloud.

- IDC forecast for “connected things” = IoT endpoints: 15B by 2016, 30B by 2020, 80B by 2025

2. Carrie MacGillivray on 5G: Five Reasons IoT Drives the Collision of Mobility and IoT:

Reasons Why IoT will need 5G:

- Speed and/or Reliability? Many IoT applications will require low latency, high throughput and/or ultra reliable operation (always available).

- Universe of Connections, Standardized for all. Challenge: in IoT today there are multiple “standards” (industry specifications) at the network, device, and security levels. “Mobile has standardized for the most part, but they are still bifurcated.”

Author’s Note: There was no mention of the 5G standards bodies, which at this time are led by ITU-R WP5D IMT 2020 project (AKA “5G” standard). ITU-R IMT 2020 initial recommendations are scheduled to be completed by November 2020 and to be published the following month. Nonetheless, over a dozen mobile network operators are conducting “5G” trials this year and next, based on their own proprietary “5G” specs.

3. Edge Computing Gets More Interesting- But what is edge computing? According to Carrie: “The Edge is the farthest point from the enterprise Data Center or cloud, where processing, compute and/or storage occurs.”

4. Need for Complementary On-Ramps – WLANs (e.g. WiFi, Zigbee), short range (e.g. Blue Tooth)/near field (NFC), LPWA (Low Power Wide Area networks), cellular backhaul, satellite communications.

5. 5G Drives Next Gen Tech- as innovation accelerates and gains market traction, connectivity becomes an enabler of IoT and mobility. Some next gen technologies to be enabled by 5G include: Voice-as-an-Application, AR/VR, Artificial Intelligence, and Machine Learning.

Examples of 5G-IoT Applications:

- Remote monitoring of oil rigs, generators, other industrial equipment where a quick response (low latency) is required. One benefit could be predictive maintenance.

- Remote surgery with ultra short lag time between surgeon’s movements and (robotic) action on patient.

- Remote control of machinery, e.g. machines that cut down/fall large trees which could be dangerous to a human being.

- Surveillance & security – Emergency response times and human safety.

Carrie’s Conclusions:

- 5G will create the intersection point for IoT and mobility.

- Video, remote “control”, human-interactive applications are the use cases to lead adoption.

- 5G will provide the backbone for many edge use cases for mobile and IoT 5G is the Mobile Internet (for things and people).

- IoT forecast to be released next week: By 2025, there will be 82.2B connected IoT endpoints of which ~17B (or ~20%) will use 5G for connectivity.

3. Brian Haven and Heather Ashton on “the Connected Car”:

5G: Two Value Propositions for the Connected Car:

a] Enhanced Mobile Broadband (EMB):

- Evolution of today’s 4G network

- Higher throughput speeds than LTE

- Standardization process underway (in ITU-R IMT 2020), commercial rollout in 2020 (Author’s Note: December 2020 is when the first IMT 2020 set of ITU-R recommendations will be published so any 2020 rollout will be in advance of the ITU-R “5G” standards.)

b] Next-Gen Capabilities:

- Important enabler for V2X+ (Vehicle to Everything is not part of IMT 2020 “5G”)

- Low latency, high density, speed and bandwidth

- Will rollout later than EMB, in the 2021-2022 timeframe

The Role of the Operator and Network:

- 5G will be involved to varying degrees (not specified how?)

- Degree of operator involvement will be based on subjective service/technology

- Focused on meaningful insertion in value chain (what is meaningful?)

+ Author’s Note on V2X Standardization History:

WLAN-based V2X communication is based on a set of standards drafted by the American Society for Testing and Materials (ASTM). The ASTM E 2213 series of standards looks at wireless communication for high-speed information exchange between vehicles themselves as well as road infrastructure. The first standard of this series was published 2002. Here the acronym Wireless Access in Vehicular Environments (WAVE) was first used for V2X communication. V2X encompases V2V (vehicle to vehicle) and V2I(vehicle to Infrastructure interaction).

From 2004 onwards the IEEE started to work on wireless access for vehicles under the umbrella of their standards family IEEE 802.11 for Wireless Local Area Networks (WLAN). Their initial standard for wireless communication for vehicles is known as IEEE 802.11p and is based on the work done by the ASTM. Later on in 2012 IEEE 802.11p was incorporated in IEEE 802.11.

……………………………………………………………………………………………………………….

In September 2016, 3GPP completed an initial Cellular V2X standard. In February, 2017, 3GPP announced a first set of LTE-V2X Physical layer standards (in 3GPP Release 14) that use a radio technology based on a LTE sidelink,which specifically addresses communications at vehicular speeds. This standard is NOT based on IMT 2020/5G!

………………………………………………………………………………………………

Here’s a recent 5GAA presentation by Dino Flore on 5G – V2X: The automotive use-case for 5G

………………………………………………………………………………………………….

Author’s Note: IoT/MMC and “5G”

IoT (often referred to as Machine to Machine Communications or MMC) is an important use case for the “5G” IMT 2020 set of recommendations. Please refer to “Usage Scenarios of IMT 2020” in this ITU-R report on IMT 2020 Background.

In a recent IHS-Markit survey, IoT was rated by 79% of network operator respondents as the top use case for 5G, up from 55% in last year’s study.

A February 6, 2017 U.S. contribution to the ITU-R WP5D meeting proposed a new ITU-R report titled:

The Use of the Terrestrial Component of International Mobile Telecommunication (IMT) for Narrowband and Broadband Machine-Type Communications

It remains to be seen if that report will be approved and if it impacts the IMT 2020 “5G” standardization work in ITU-R WP 5D. A few excerpts of the contribution follow:

Machine-type communications (MTC) are penetrating into our daily life and promising to deliver a more convenient, intelligent and hyper-connectivity world. MTC is expanding with a rapid speed and has tremendous market potential. There are many kinds of services and applications of MTC with diversified requirements targeting different market segments, such as asset tracking, smart home, video surveillance, etc. posing distinct challenges in terms of coverage, power consumption, cost, data rate and etc.

MTC/IoT is a subject of high interest for the information and communication technology industry, as well as end users, regulators and other sectors that can benefit from this new communication technology or pattern. International Mobile Telecommunication (IMT) networks are expected to play a critical role as network infrastructures to support MTC applications and IoT.

Relevant ITU-R Recommendations and Reports:

- Recommendation ITU-R M.2012 – Detailed specifications of the terrestrial radio interfaces of International Mobile Telecommunications Advanced (IMT-Advanced)

- Recommendation ITU-R M.2083 – IMT Vision – Framework and overall objectives of the future development of IMT for 2020 and beyond

Technical and Operational Aspects of IMT-based Radio Networks and Systems to Support Narrowband and Broadband Machine-Type Communication:

In recent 3GPP releases standardization enhancements for Machine-Type Communication (MTC) have also been introduced, including support for congestion control, improved device battery lifetime, ultra-low complexity devices, massive number of devices and improved indoor coverage.

Recent releases of the 3GPP standards have introduced enhancements for Machine Type Communications (MTC), e.g. 3GPP Release 13: LTE Physical Layer Enhancements for MTC (eMTC) (LTE), Narrow band Internet of Things (NB-IoT), etc have evolved into LTE category M1 (AKA LTE M).

Important References:

IMT Vision – Framework and overall objectives of the future development of IMT for 2020 and beyond

IDC Directions 2016: IoT (Internet of Things) Outlook vs Current Market Assessment

ITU-R agrees on key performance requirements for IMT-2020=”5G”

Source: ITU-R, Geneva, 23 February 2017

Membership of ITU including key industry players, industry forums, national and regional standards development organizations, regulators, network operators, equipment manufacturers as well as academia and research institutions together with Member States, gathered in Geneva today, as the working group responsible for IMT systems, and completed a cycle of studies on the key performance requirements of 5G technologies for IMT-2020.

Draft New Report ITU-R M.[IMT-2020.TECH PERF REQ] is expected to be finally approved by ITU-R Study Group 5 at its next meeting in November 2017.

“IMT-2020 will be the global cornerstone for all activities related to broadband communications and the Internet of Things for the future – enriching lives in ways yet to be imagined,” said ITU Secretary-General, Houlin Zhao.

“The IMT-2020 standard is set to be the global communication network for the coming decades and is on track to be in place by 2020. The next step is to agree on what will be the detailed specifications for IMT-2020, a standard that will underpin the next generations of mobile broadband and IoT connectivity,” said François Rancy, Director of ITU’s Radiocommunication Bureau.

We can anticipate that there will now be a number of early technical trials, market trials and deployments of 5G technologies based on the foreseen developments slated for IMT-2020. These systems may not provide the full set of capabilities envisaged for IMT-2020, but the results of these early activities will flow forward into, and assist the development of, the final complete detailed specifications for IMT-2020.

ITU claims that IMT is the on-going enabler of new trends in communication devices – from the connected car and intelligent transport systems to augmented reality, holography, and wearable devices, and a key enabler to meet social needs in the areas of mobile education, connected health and emergency telecommunications.

E-applications are transforming the way we do business and govern our countries, and smart cities are pointing the way to cleaner, safer, more comfortable lives in our increasingly urbanized world.

A complete ITU-R roadmap, detailing all the next steps leading up to IMT 2020, is available here

……………………………………………………………………………………………..

To be truly classified as 5G (according to the above referenced IMT 2020 Performance Requirements report), “5G” cellular networks are expected to meet the following minimum requirements:

-

Downlink peak data rate of 20 Gbit/sec

-

Uplink peak data rate of 10 Gbit/sec

-

Downlink peak spectral efficiency of 30 bit/s/Hz

-

Uplink peak spectral efficiency of 15 bit/s/Hz

-

Downlink user experienced data rate of 100 Mbit/sec

-

Uplink user experienced data rate of 50 Mbit/sec

………………………………………………………………………………………………………………………………………………………….

…………………………………………………………………………………………………………………………………….

Reference – Press Release:

http://www.itu.int/en/mediacentre/Pages/2017-PR04.aspx

Reference – Presentation on IMT 2020:

https://www.itu.int/en/membership/Documents/missions/GVA-mission-briefing-5G-28Sept2016.pdf

Usage Scenarios- page 4

Verizon Talks 5G, Virtualization and XO Acquisition at Mobile World Congress

Two Verizon executives offered more insights this week into the telecom’s plans to introduce fixed-broadband 5G service in 2018, as well as its strategies for virtualization. According to Sanyogita Shamsunder, Verizon’s Director of Network Infrastructure Planning, the 5G trials are about more than just testing fixed 5G in real world situations – they’re more about data gathering. That data, she said, will not only allow Verizon to determine what works and what doesn’t in fixed wireless, but it will also apply to mobile use cases as well.

“This is really the first proving ground on how millimeter wave with beamforming and all that works in various environments,” she said. “Like with anything else 5G is a technology that will serve multiple use cases, like IoT and broadband. And if you think about it, fixed wireless is enhanced broadband. Whether it’s mobile or fixed, a lot of our customers today use a phone sitting down in their home in their offices. So, it’ll slide right into a broader use case of mobility.”

“With software defined networking and NFV we can channel the resources of the network,” Shamsunder said. “We are on the path to virtualization with a lot of our core network, and even today with our 4G network. That provides a lot of flexibility for us. We have several parts of our network which are already virtualized and then as we go to 5G, virtualized network is the only way we want to be deploying 5G, including parts of the radio network. We’re talking about things like (virtualized RAN) and (extensible RAN) and we’re working with 3GPP and all the standards bodies to have the flexibility to build a software-based RAN as well as core.”

“We have several parts of our network which are already virtualized and then as we go to 5G, virtualized network is the only way we want to be deploying 5G,” Ms. Shamsunder added.

Read more at:

………………………………………………………………………………………………………………………………………………………………….

Verizon’s fixed 5G plans include offering fixed wireless broadband service outside the company’s traditional local service footprint, said Matt Ellis, Verizon chief financial officer and executive vice president today. Ellis made his comments in a question and answer session at an investor conference, where he outlined the Verizon 5G roadmap.

Verizon 5G Roadmap

Verizon currently has 5G fixed wireless technology testing underway in “eleven geographies” and “different environments” including urban and suburban settings, Ellis said.

The company expects to have results from those tests in “a few months” and to be “in a position to launch [service] in 2018,” according to Ellis. That launch would use spectrum in the 28 GHz band, which Verizon gained use of through its purchase of XO Communications.

That purchase could give Verizon an edge, as the FCC has yet to establish a date for a planned auction of high-frequency spectrum suitable for 5G.

Verizon anticipates layering mobile service onto the fixed 5G infrastructure around 2020, Ellis said. Densification, which takes the form of small cell deployments, “adds significant capacity and pre-provisions the network for 5G,” Ellis said. He also noted that Verizon was instrumental in organizing industry groups that helped accelerate the standards process for 5G.

This year’s Verizon capex budget will be spent on boosting 4G coverage, density and capacity and on fiber, with “a bit of spending” on 5G, the CFO noted.

Verizon’s CFO Matt Ellis

Read more at:

Verizon CFO Ellis Shares Verizon 5G Roadmap, Including Nationwide Fixed 5G Plans