Month: August 2017

Windstream’s Enhanced Cloud Connect Service vs Zayo’s/Others (Google Comment)

Backgrounder:

During the early years of public cloud computing/storage, users had few good options to securely connect to the cloud service provider(s) of their choice- unless that same cloud service provider (CSP) offered an IP-MPLS VPN that terminated at its cloud point of presence (PoP). Both Century Link (via Savvis acquisition) and AT&T offered that access solution for customers of its cloud computing services.

Equinix’s Cloud Exchange and AT&T’s Netbond made it much easier by offering an intermediate network/switching center to connect to any one of several CSPs, which provide good quality, secure cloud connections with the flexibility to change CSPs without re-configuring the customer’s cloud access network.

However, there’s no industry standard API or common set of processes these cloud interconnect service providers follow. That’s not really a problem as long as they provide secure and reliable connectivity to multiple CSPs.

We examine a few Cloud Connection services in this blog post, including Windstream’s just announce offering.

Windstream Cloud Connect Service:

The Windstream Cloud Connect service now offers software-defined WAN (SD-WAN) and wavelength connectivity. It provides connectivity to Amazon Web Services, Oracle Fast Connect, Salesforce, Google Cloud, IBM Bluemix and Microsoft Azure cloud services.

Windstream Cloud Connect service was launched just over a year ago, with cloud connectivity via: switched Ethernet, MPLS, VPN and point-to-point services to AWS and Azure ExpressRoute.

Speeds currently available for Windstream Cloud Connect range from 50 Mbps to 10 Gbps, the company said in today’s press release. The offering is supported by technical assistance engineers who are available 24/7, the company said.

The company intends to compete, at least in part, based on cost with its Cloud Connect offering. “We are confident that Windstream Cloud Connect will deliver a better and more cost-effective experience for large and mid-sized enterprises than any of our competitors,” said a Windstream executive in today’s previously reference press release.

Joseph Harding, Windstream’s executive vice president and enterprise chief marketing officer, told Channel partners the offering creates new opportunities for medium and large enterprises across all verticals that are looking to move their traffic to hyperscale providers to enable their cloud initiatives.

“By offering customers this connectivity, we give our partners the ability to meet the growing service and bandwidth needs of their customers,” he said. “With the expectation for cloud services in the United States to double in the next five years, it’s a trend we believe our partners will be interested in.”

…………………………………………………………………………………………………………

Zayo’s CloudLink Service:

Zayo Group is one of several other network providers offering public cloud connect services. The company’s CloudLink delivers “the Fast Lane to the cloud that you require – addressing your public internet network connectivity issues. And is delivered on a global network by a trusted, consultative, and flexible partner – Zayo.”

CloudLink provides direct network connectivity to over 50 cloud service providers and over 150 cloud on-ramps globally. Whether you need multiple cloud connections or just one, we utilize our industry-leading fiber communications infrastructure across Dark Fiber, Wavelengths, Ethernet and IP Services, including pre-provisioned network connections up to 10Gbps, to deliver cloud connectivity solutions more flexibly, cost effectively, and with greater performance than traditional network service providers and cloud exchanges.

CloudLink as a subnetwork connecting enterprise customers to CSPs via Zayo’s global network (Source: Zayo Group)

………………………………………………………………………………………………………

CloudLink provides enterprises and data centers with an on-ramp to Zayo’s secure network, supporting high-performance bandwidth options across dark fiber, layer-1, -2, and -3 configurations, and scalable connectivity directly to all major cloud providers. API integration enables efficient provisioning, and as demand increases to actively manage network topologies, software-defined network (SDN) technology will support full automation and dynamic network configurations.

Other Cloud Connect Network Providers:

“Our business is to provide access network connectivity. By putting our POPs in key data centers and central offices and then interconnecting over 250 suppliers, we connect anywhere — cable to ILECS, Fiber Providers to CLECs, etc. We basically manage a network of networks.Now it’s not a pure resale model. We will go in very opportunistically and source managed and dark fiber to connect where there is demand. In fact last year we lit seven metro rings that connected many of the carrier hotels, data centers and ILEC LSOs that we were getting demand to and from.

And then on top of it all we built a Marketplace application that allows our customers to type in an address and we’ll push back to them all the products we have at that address. And it could be Ethernet, fiber, internet, broadband, cable — you name it.

The final and fastest growing segment is our business services group focused on application, over the top, and cloud service providers. What we do there is jointly sell the circuit that delivers the application — because the customer really needs both. So we have customers like 8×8, Mindshift and Thinking Phones.

They bring opportunities to us. Today most of those guys, particularly the cloud service providers like Google and AWS, aren’t interested in buying the circuit and bundling it. So it’s a joint sale. We become the carrier of record for that service.”

China’s 5G network trials announced; commercial service in 2020

China’s three main telecommunications providers are proceeding smoothly with a 5G pilot in major cities such as Shanghai and Beijing, the state-owned Economic Information Daily reported, citing unspecified sources close to the telcos and the communications ministry.

During the later half of this year, China Mobile, China Telecom and China Unicom will start the 5G pilot in major cities such as Beijing, Shanghai, Chongqing, Nanjing, Suzhou and Ningbo, the report said. Around 10 cities from provinces such as Jiangxi, Hainan, Shanxi, Shandong, Hebei will also be selected for the pilot.

–>That will position China for the commercial implementation of a 5G network as early as 2020, the report stated. China Telecom said it expects to launch commercial 5G services in 2020.

…………………………………………………………………………………………….

Editor’s Note: Again, the ITU-R standards for 5G (IMT – 2020) won’t be completed till the end of 2020.

…………………………………………………………………………………………….

Separately, China Telecom plans to trial 5G networks in six cities across the country. China Telecom will carry out field trials in six cities, as well as develop R&D applications and services in cooperation with partners from various industries.

“We are deeply devoted to engaging in 5G standard formulation and technology trial runs while proactively exploring and researching the networking plan for the evolution from 4G,” the company said.

According to China Telecom’s chairman and CEO Yan Jie, the business model for commercial 5G service “will not be like 4G, 3G and 2G, where you have universal, comprehensive, seamless network coverage”. The executive believes that LTE and next-generation technologies will certainly coexist for a long time. He also announced that China Telecom is open to cooperation with market competitors China Mobile and China Unicom on future infrastructure deployments.

China Mobile, the world’s largest mobile telephony operator in terms of subscribers, will wait until 5G technologies and business models are more mature to determine the capex of its future 5G network infrastructure, China Mobile chairman Shang Bing recently said during the telco’s earnings call presentation.

The executive said China Mobile is currently focusing on 5G tests and that is key for the telco to consider the return of investments of its future 5G networks. China Mobile plans to conduct 5G field tests over the next two years, with large-scale pre-commercial trials planned in 2019 and commercial deployments in 2020.

……………………………………………………………………………………………………..

This past May, China completed planning of a 30-site 5G test field in Huairou district. The trial has been planned by the IMT-2020 (5G) Promotion Group. Operators participating in the IMT-2020 Promotion Group include China Mobile, China Telecom, China Unicom and Japanese telecoms operator NTT DoCoMo. Vendors which are part of the initiative include Huawei, ZTE, Ericsson, Nokia, Datang and Samsung. Chipset and test measurement vendors Qualcomm, Intel, Mediatek, Ctec, Keysight Technologies and Rohde & Schwartz are also part of the initiative.

During the pilots, the carriers will construct base stations and carry out application and technological tests. “Once commercial use of 5G becomes a reality, it will lay a network basis for the development of industries, including the Internet of Things, Big Data, artificial intelligence and cloud computing,” said Huang Yuhong, vice director of China Mobile Research Institute.

The increase in speed from 4G to 5G will bring about increases in connectivity to other sectors such as big data, drones and home appliances, according to analysts interviewed by Economic Information Daily.

The communication industry will step into a new development stage after the 5G network is commercialized. As well as the aforementioned sectors, such industries as chips, electronic components and smart hardware will also be upgraded and enjoy huge development potential, the report added.

…………………………………………………………………………………………………………

This past June, a report from China’s Acadaemy of Information and Communications Technology, as detailed by the South China Morning Post, predicts China’s three carriers–China Mobile, China Unicom and China Telecom–will spend $411 billion on deploying 5G networks in the decade ending in 2030.

According to reports, the government agency expects peak spending to hit in 2023, as well as that the as-yet un-standardized network standard will have broader implications for the Chinese economy, accounting for 3.2% of GDP in 2025.

Reporting on the key takeaways of the report in Business Insider, Rayna Hollander wrote, “Legacy and emerging mobile services and technologies alike will see more adoption due to 5G speeds…[which]will power nascent tech like augmented and virtual reality (VR), connected homes, M2M communications, and large-scale operations of IoT devices.”

Jefferies analyst Edison Lee told the South China Morning Post, “We believe this paper represents the government’s official position on 5G, and its analysis largely explains why China will aggressively support 5G roll-out.”

Telecom industry watcher Xiang Ligang told the China Daily:

“The report underestimates the impact of 5G on social economy. It isn’t yet more than five years since 4G was launched, but it has had a huge influence in boosting the development and popularization of mobile payments.”

…………………………………………………………………………………………………

References:

http://www.atimes.com/article/chinas-advanced-5g-network-set-adoption-2020/

http://en.ce.cn/main/latest/201707/06/t20170706_24050396.shtml

https://www.telecompaper.com/news/china-telecom-to-launch-5g-trial-networks-in-6-cities–1209462

Report: China will spend $411 billion on 5G from 2020 to 2030

IEEE ComSoc Webinar: 5G: Converging Towards IMT-2020 Submission

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

3. Heavy Reading:

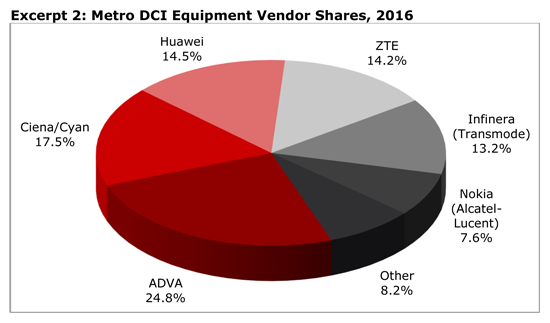

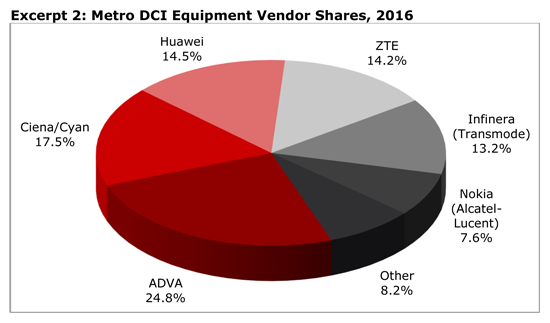

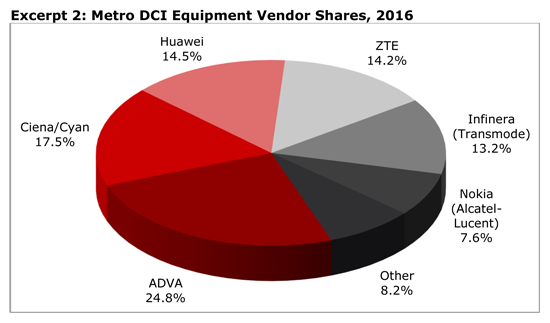

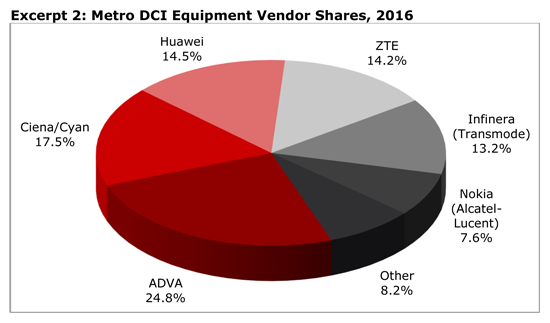

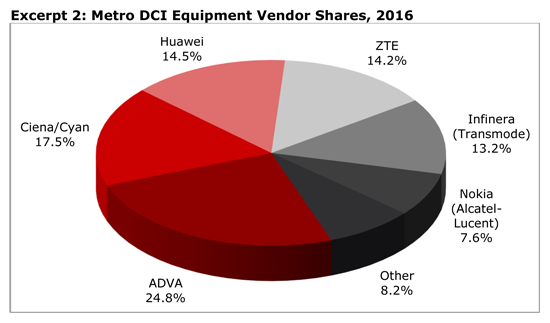

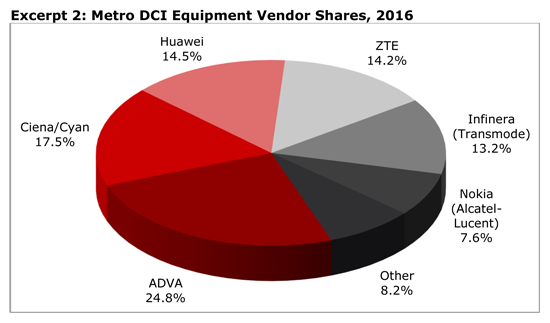

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

3. Heavy Reading:

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

Summary:

U.S. wireless network operators will realize about $1 billion in revenue from 5G fixed wireless access (FWA) networks by the end of 2019, market research firm SNS Telecom predicts in a newly released report “5G for FWA (Fixed Wireless Access): 2017 – 2030 – Opportunities, Challenges, Strategies & Forecasts.” The report predicts that the market will reach $40 billion by 2025. It will enjoy a compound annual growth rate (CAGR) of 84 percent between the expected beginning of standardized deployments of 5G fixed wireless access in 2019 and 2025, according to a press release.

Verizon and AT&T are seen as the leaders to deploy 5G FWA networks in the United States. Verizon has made no secret of their 5G FWA plans, announcing an initial roll out of the technology in 11 markets, including Ann Arbor; Atlanta; Bernardsville (NJ); Brockton (MA); Dallas; Denver; Houston; Miami; Sacramento; Seattle; and Washington, D.C. Some, if not all of these markets will utilize a Samsung 5G access platform, operating in the 28 MHz spectrum band. The carrier has promised gigabit type performance, even suggesting it as comparable to FTTH.

AT&T is already active as well, with 5G FWA trials in Austin and Middleton (NJ), that also feature DIRECTV NOW video streaming. These trials are in prep for a 2018 commercial 5G FWA launch, the company reported back in June.

Juniper Research Ltd. analysts recently said that they expect 1 million 5G connections to go live in 2019. If the SNS predictions are right, then many of those connections may be for FWA services in the US.

………………………………………………………………………………………

About the Report:

The SNS Telecom report has the following key findings:

• 5G-based FWA subscriptions are expected to account for $1 Billion in service revenue by the end of 2019 alone. The market is further expected to grow at a CAGR of approximately 84% between 2019 and 2025, eventually accounting for more than $40 Billion.

• SNS Research estimates that 5G-based FWA can reduce the initial cost of establishing last-mile connectivity by as much as 40% – in comparison to FTTP (Fiber-to-the-Premises). In addition, 5G can significantly accelerate rollout times by eliminating the need to lay cables as required for FTTP rollouts.

• The 28 GHz frequency band is widely preferred for early 5G-based FWA deployments, as many vendors have already developed 28 GHz-capable equipment – driven by demands for early field trials in multiple markets including the United States and South Korea.

• Millimeter wave wireless connectivity specialists are well-positioned to capitalize on the growing demand for 5G-based FWA. However, in order to compete effectively against existing mobile infrastructure giants, they will need to closely align their multi-gigabit capacity FWA solutions with 3GPP specifications.

• While many industry analysts believe that 5G-based FWA is only suitable for densely populated urban areas, a number of rural carriers – including C Spire and U.S. Cellular – are beginning to view 5G as a means to deliver last-mile broadband connectivity to under-served rural communities.

………………………………………………………………………………………..

The report provides answers to the following key questions:

How big is the opportunity for 5G-based FWA?

What trends, challenges and barriers will influence the development and adoption of 5G-based FWA?How have advanced antenna and chip technologies made it possible to utilize millimeter wave spectrum for 5G-based FWA?

What are the key application scenarios for 5G-based FWA?

Can 5G-based FWA enable mobile operators to tap into the pay TV market?

How can mobile operators leverage early deployments of 5G-based FWA to better prepare their networks for planned 5G mobile service rollouts?

What will be the number of 5G-based FWA subscriptions in 2019 and at what rate will it grow?

Which regions and countries will be the first to adopt 5G-based FWA?

Which frequency bands are most likely to be utilized by 5G-based FWA deployments?

What is the cost saving potential of 5G-based FWA for last-mile connectivity?

Who are the key market players and what are their strategies?

What strategies should 5G-based FWA vendors and service providers adopt to remain competitive?

References:

AT&T Moves Aggressively on G.fast & Expansion of its Fiber Network

AT&T Expands G.fast & FTTH Deployments:

In sharp contrast to Verizon’s decision NOT to deploy G.fast, AT&T has announced expansion of its G.fast service for multi-dwelling units (MDUs) and its fiber-to-the-home network (AT&T Fiber).

The mega telco will extend its all-fiber network in two markets — Biloxi-Gulfport, MS and Savannah, GA. AT&T will also be offering its hybrid fiber-coax service for MDUs in 22 metropolitan markets.

The AT&T G.fast deployments will use “fiber runs to the telecom closet on the property, and individual coax runs to each apartment unit,” an anonymous AT&T spokesperson said to Telecompetitor.

Residents of properties served will also be able to obtain DIRECTV service without installing a dish at their individual units. Instead, the video service will be delivered over D2 Advantage, which the AT&T spokesperson described as “a centrally wired satellite dish that is shared among residents in the property.”

AT&T announced eight metro areas where G.fast can be deployed immediately, including Boston, Denver, Minneapolis, New York City, Philadelphia, Phoenix, Seattle and Tampa. In 14 other markets, consumers in target MDUs can order service now for deployment in “the near future,” the company said.

AT&T is one of multiple carriers that are looking at G.fast as part of their broadband strategy. The technology can support considerably higher speeds than DSL or fiber-to-the-neighborhood (FTTN) services – and although bandwidth is lower than it might be for a fiber-to-the-home deployment, the cost is considerably less.

The news that AT&T is deploying G.fast is not surprising, as the company already has conducted a trial of the service in Minneapolis and executives have indicated deployment plans. At this year’s Open Network Summit (ONS), AT&T’s Tom Anschutz told an audience that G.fast would improve the speed and signal quality of data transmission on older, low grade twisted pair, which is used in many MDUs and in condominium complexes (where this author lives). He hinted that market segment would be a focus area for AT&T.

…………………………………………………………………………………………

AT&T is extending the reach of its fiber network:

AT&T claims to have the largest fiber network in its 21-state home broadband footprint, reaching more than 5.5 million residential and commercial locations across the 57 markets after adding over 1.5 million sites since January 1st. Plans call for extending service availability to another 1.5 million locations by year’s end, boosting the total to 7 million.

Of those 5.5 million homes and businesses now reached by AT&T Fiber, the mega telco said it has signed up more than 2 million broadband subscribers. The company did not, however, break out how many of those subs are new ones, as opposed to DSL customers who have been upgraded to the new FTTH network.

AT&T is the US’s third-largest broadband provider after Comcast Corp and Charter Communications Inc with nearly 15.7 million subscribers at the end of June, 2017.

However, the mega telco ranks #1 on Vertical Systems U.S. Fiber Lit Buildings (Fiber to commercial buildings) leaderboard:

References:

http://about.att.com/story/att_g_fast_on_sale_now_to_apartment_and_condominium_properties.html

https://techblog.comsoc.org/2017/08/16/verizon-passes-on-g-fast-in-favor-of-fttp-for-mdus/

AT&T Moves Aggressively on G.fast & Expansion of its Fiber Network

AT&T Expands G.fast & FTTH Deployments:

In sharp contrast to Verizon’s decision NOT to deploy G.fast, AT&T has announced expansion of its G.fast service for multi-dwelling units (MDUs) and its fiber-to-the-home network (AT&T Fiber).

The mega telco will extend its all-fiber network in two markets — Biloxi-Gulfport, MS and Savannah, GA. AT&T will also be offering its hybrid fiber-coax service for MDUs in 22 metropolitan markets.

The AT&T G.fast deployments will use “fiber runs to the telecom closet on the property, and individual coax runs to each apartment unit,” an anonymous AT&T spokesperson said to Telecompetitor.

Residents of properties served will also be able to obtain DIRECTV service without installing a dish at their individual units. Instead, the video service will be delivered over D2 Advantage, which the AT&T spokesperson described as “a centrally wired satellite dish that is shared among residents in the property.”

AT&T announced eight metro areas where G.fast can be deployed immediately, including Boston, Denver, Minneapolis, New York City, Philadelphia, Phoenix, Seattle and Tampa. In 14 other markets, consumers in target MDUs can order service now for deployment in “the near future,” the company said.

AT&T is one of multiple carriers that are looking at G.fast as part of their broadband strategy. The technology can support considerably higher speeds than DSL or fiber-to-the-neighborhood (FTTN) services – and although bandwidth is lower than it might be for a fiber-to-the-home deployment, the cost is considerably less.

The news that AT&T is deploying G.fast is not surprising, as the company already has conducted a trial of the service in Minneapolis and executives have indicated deployment plans. At this year’s Open Network Summit (ONS), AT&T’s Tom Anschutz told an audience that G.fast would improve the speed and signal quality of data transmission on older, low grade twisted pair, which is used in many MDUs and in condominium complexes (where this author lives). He hinted that market segment would be a focus area for AT&T.

…………………………………………………………………………………………

AT&T is extending the reach of its fiber network:

AT&T claims to have the largest fiber network in its 21-state home broadband footprint, reaching more than 5.5 million residential and commercial locations across the 57 markets after adding over 1.5 million sites since January 1st. Plans call for extending service availability to another 1.5 million locations by year’s end, boosting the total to 7 million.

Of those 5.5 million homes and businesses now reached by AT&T Fiber, the mega telco said it has signed up more than 2 million broadband subscribers. The company did not, however, break out how many of those subs are new ones, as opposed to DSL customers who have been upgraded to the new FTTH network.

AT&T is the US’s third-largest broadband provider after Comcast Corp and Charter Communications Inc with nearly 15.7 million subscribers at the end of June, 2017.

However, the mega telco ranks #1 on Vertical Systems U.S. Fiber Lit Buildings (Fiber to commercial buildings) leaderboard:

References:

http://about.att.com/story/att_g_fast_on_sale_now_to_apartment_and_condominium_properties.html

https://techblog.comsoc.org/2017/08/16/verizon-passes-on-g-fast-in-favor-of-fttp-for-mdus/

Huawei & Smart Axiata launch 4.5G (???) network in Cambodia

Executive Summary:

Cambodia’s mobile telecommunications company Smart Axiata, in partnership with global ICT solutions provider Huawei, launched the 4.5G [1] network in Cambodia on Monday, August 21st.

Cambodian Minister of Posts and Telecommunications Tram Iv Tek said Smart Axiata was the first telecom operator that introduced 4.5G evolution technology to Cambodia. Tram said:

“This latest evolution of mobile technology will enable subscribers to enjoy better and faster mobile internet,” he said during the launching ceremony. “Fast access to the internet is indeed an important tool in developing a digital economy.”

Thomas Hundt, chief executive officer of Smart Axiata, said 4.5G network is capable of providing an Internet speed 8 times higher than that of 4G. [However, he didn’t state what attributes 4.5G has and what, if any standard it’s based on.]

“We strive to be the most progressive telco in the country. Smart Axiata will continue to seek new and better ways to ensure our subscribers receive the best possible service,” he said. “After being the first telco introducing 4G LTE in Cambodia in 2014, 4G+ in 2016, and now 4.5G, and 5G is surely not far away.”

……………………………………………………………………………………..

[1] What is 4.5G?

There is no official definition of 4.5G by any standards body or forum. ITU-R doesn’t even have a definition of 4G. We assume that 4.5G is anything better than LTE-Advanced (as defined by 3GPP). Note that ITU-R had originally said that LTE Advanced was 4G, before marketing organizations hijacked the term to mean anything better than the 3G network they had deployed.

Huawei’s website says there are three core concepts in 4.5G: Gbps, Connection+, and Experience 4.0. The company says that “4.5G further increases data rates for better user experience and expands applications in vertical industries. This helps operators create new business applications in vertical industries. This helps operators create new business opportunities and gain a competitive edge in the next few years.”

Huawei notes that “3GPP approves LTE-Advanced Pro as New Marker for LTE Evolution System (4.5G).”

Meanwhile, the 3GPP website doesn’t refer to LTE Advanced Pro as 4.5G. It states:

LTE-Advanced Pro will allow mobile standards users to associate various new features – from the Release’s freeze in March 2016 – with a distinctive marker that evolves the LTE and LTE-Advanced technology series.

The new term is intended to mark the point in time where the LTE platform has been dramatically enhanced to address new markets as well as adding functionality to improve efficiency.

…………………………………………………………………………………………………………………

Promise and Potential of 4.5G:

Li Xiongwei, chief executive officer of Huawei Technologies Cambodia, said Huawei was very pleased to cooperate with Smart to launch 4.5G and to bring Cambodia closer to next generation technology.

“The 4.5G will certainly bring significant network improvements from today’s 4G network, while acting as a bridge for future mobile data applications when 5G is launched in the future,” he said.

Cambodia has six mobile phone operators and about 30 Internet service providers.

According to Cambodia’s Ministry of Posts and Telecommunications, approximately 8 million out of the country’s 15 million people have access to the Internet. About 45 percent of the population is still offline, the minister said, adding that the country expected that 100 percent of the urban dwellers and 80 percent of the rural dwellers would use the Internet by 2020.

Huawei Partners with Smart Axiata to Launch the First 4.5G Network in Cambodia

………………………………………………………………………………………………

Huawei’s 5G oriented X-Haul:

On August 14th, Huawei officially released its 5G-oriented mobile bearer solution called X-Haul. The new fronthaul and backhaul network has four core values: providing flexible access capabilities that can match the scenario of any site; implementing agile network operations based on a cloud architecture; enabling new service innovation through end-to-end network slicing; and supporting smooth evolution from 4G bearer networks to 5G bearer networks.

Flexible networking is implemented through IP, microwave, and OTN access technologies, enabling unified fronthaul and backhaul whether or not fiber optic cables are used.

Addendum:

1. Via email, Thomas Hundt wrote:

“4.5G aka LTE Advanced Pro is the latest evolution of 4G networks, in line with 3GPP release 13 and 14. By using technologies such as 4×4 MIMO, 256QAM modulation the network capacity is significantly increased which leads to much faster end user speeds provided a 4.5G enabled phone is used.”

2. Derek Kerton of the Telecom Council/Kerton Group wrote via email that Nokia has introduced 4.9G technology: Nokia Introduces 4.9G as Next Incremental Step to 5G

……………………………………………………………………………..

References:

http://news.xinhuanet.com/english/2017-08/21/c_136543584.htm

http://www.huawei.com/en/news/2017/8/Huawei-SmartAxiata-First4dot5G-Network-Cambodia

http://www.huawei.com/minisite/4-5g/en/

http://www.huawei.com/minisite/4-5g/en/gbps-4-5-g.html

http://www.3gpp.org/news-events/3gpp-news/1745-lte-advanced_pro

http://www.huawei.com/en/news/2017/8/5G-oriented-Mobile-Bearer-Solution-X-Haul

https://www.wirelessweek.com/news/2016/09/nokia-introduces-49g-next-incremental-step-5g?

Huawei & Smart Axiata launch 4.5G (???) network in Cambodia

Executive Summary:

Cambodia’s mobile telecommunications company Smart Axiata, in partnership with global ICT solutions provider Huawei, launched the 4.5G [1] network in Cambodia on Monday, August 21st.

Cambodian Minister of Posts and Telecommunications Tram Iv Tek said Smart Axiata was the first telecom operator that introduced 4.5G evolution technology to Cambodia. Tram said:

“This latest evolution of mobile technology will enable subscribers to enjoy better and faster mobile internet,” he said during the launching ceremony. “Fast access to the internet is indeed an important tool in developing a digital economy.”

Thomas Hundt, chief executive officer of Smart Axiata, said 4.5G network is capable of providing an Internet speed 8 times higher than that of 4G. [However, he didn’t state what attributes 4.5G has and what, if any standard it’s based on.]

“We strive to be the most progressive telco in the country. Smart Axiata will continue to seek new and better ways to ensure our subscribers receive the best possible service,” he said. “After being the first telco introducing 4G LTE in Cambodia in 2014, 4G+ in 2016, and now 4.5G, and 5G is surely not far away.”

……………………………………………………………………………………..

[1] What is 4.5G?

There is no official definition of 4.5G by any standards body or forum. ITU-R doesn’t even have a definition of 4G. We assume that 4.5G is anything better than LTE-Advanced (as defined by 3GPP). Note that ITU-R had originally said that LTE Advanced was 4G, before marketing organizations hijacked the term to mean anything better than the 3G network they had deployed.

Huawei’s website says there are three core concepts in 4.5G: Gbps, Connection+, and Experience 4.0. The company says that “4.5G further increases data rates for better user experience and expands applications in vertical industries. This helps operators create new business applications in vertical industries. This helps operators create new business opportunities and gain a competitive edge in the next few years.”

Huawei notes that “3GPP approves LTE-Advanced Pro as New Marker for LTE Evolution System (4.5G).”

Meanwhile, the 3GPP website doesn’t refer to LTE Advanced Pro as 4.5G. It states:

LTE-Advanced Pro will allow mobile standards users to associate various new features – from the Release’s freeze in March 2016 – with a distinctive marker that evolves the LTE and LTE-Advanced technology series.

The new term is intended to mark the point in time where the LTE platform has been dramatically enhanced to address new markets as well as adding functionality to improve efficiency.

…………………………………………………………………………………………………………………

Promise and Potential of 4.5G:

Li Xiongwei, chief executive officer of Huawei Technologies Cambodia, said Huawei was very pleased to cooperate with Smart to launch 4.5G and to bring Cambodia closer to next generation technology.

“The 4.5G will certainly bring significant network improvements from today’s 4G network, while acting as a bridge for future mobile data applications when 5G is launched in the future,” he said.

Cambodia has six mobile phone operators and about 30 Internet service providers.

According to Cambodia’s Ministry of Posts and Telecommunications, approximately 8 million out of the country’s 15 million people have access to the Internet. About 45 percent of the population is still offline, the minister said, adding that the country expected that 100 percent of the urban dwellers and 80 percent of the rural dwellers would use the Internet by 2020.

Huawei Partners with Smart Axiata to Launch the First 4.5G Network in Cambodia

………………………………………………………………………………………………

Huawei’s 5G oriented X-Haul:

On August 14th, Huawei officially released its 5G-oriented mobile bearer solution called X-Haul. The new fronthaul and backhaul network has four core values: providing flexible access capabilities that can match the scenario of any site; implementing agile network operations based on a cloud architecture; enabling new service innovation through end-to-end network slicing; and supporting smooth evolution from 4G bearer networks to 5G bearer networks.

Flexible networking is implemented through IP, microwave, and OTN access technologies, enabling unified fronthaul and backhaul whether or not fiber optic cables are used.

Addendum:

1. Via email, Thomas Hundt wrote:

“4.5G aka LTE Advanced Pro is the latest evolution of 4G networks, in line with 3GPP release 13 and 14. By using technologies such as 4×4 MIMO, 256QAM modulation the network capacity is significantly increased which leads to much faster end user speeds provided a 4.5G enabled phone is used.”

2. Derek Kerton of the Telecom Council/Kerton Group wrote via email that Nokia has introduced 4.9G technology: Nokia Introduces 4.9G as Next Incremental Step to 5G

……………………………………………………………………………..

References:

http://news.xinhuanet.com/english/2017-08/21/c_136543584.htm

http://www.huawei.com/en/news/2017/8/Huawei-SmartAxiata-First4dot5G-Network-Cambodia

http://www.huawei.com/minisite/4-5g/en/

http://www.huawei.com/minisite/4-5g/en/gbps-4-5-g.html

http://www.3gpp.org/news-events/3gpp-news/1745-lte-advanced_pro

http://www.huawei.com/en/news/2017/8/5G-oriented-Mobile-Bearer-Solution-X-Haul

https://www.wirelessweek.com/news/2016/09/nokia-introduces-49g-next-incremental-step-5g?

What’s the real status of Internet access in Cuba?

by Matteo Ceurvels of eMarketer (edited with Notes by Alan J Weissberger)

Few people in Cuba have regular access to the Internet, and those who do encounter slow download speeds, according to an eMarketer study. Although Cuba’s state-run service provider (see details below) has built WiFi hotspots throughout the country, the relatively high rate of $1.50 an hour is too much for most Cubans to pay. [Please see references below for additional information on the WiFi hotspots in Cuba- mostly in Havana]

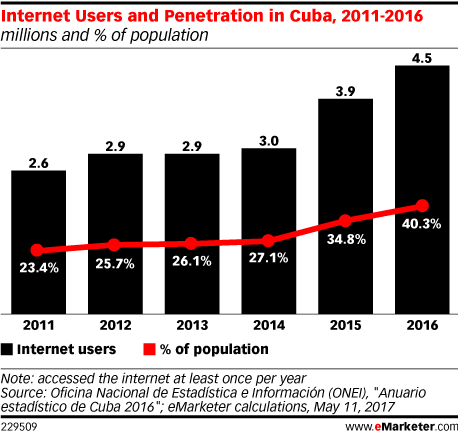

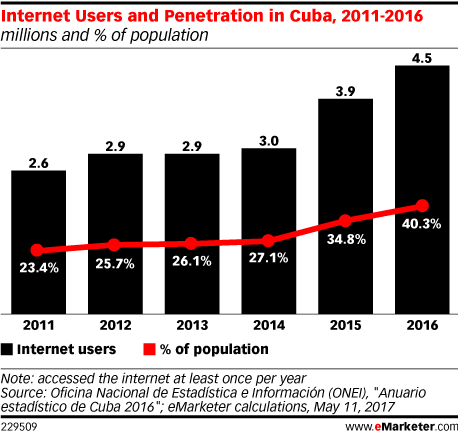

eMarketer estimates that there will be 360.4 million internet users in Latin America in 2017. While the market research firm does not break out specific metrics for Cuba, the latest figures from the government’s National Office of Statistics and Information (ONEI) show that over 4.5 million people, or roughly 40.3% of the total population, accessed the Internet at least once during 2016.

…………………………………………………………………………………………………………..

Editor’s Note: The actual ONEI ICT report (via Google Translate) states that for 2016 there were 403 people that accessed the Internet out of every 1,000 people living on the island. That compares with 348, 271, 261, 257 and 232 people for the years 2015, 2014, 2013, 2012, 2011, respectively.

The same report (which I don’t trust) says the mobile population coverage (not usage) has been 85.3% of the population from 2012-2016, up from 83.7% in 2011.

…………………………………………………………………………………………………..

The number of people with internet access in their homes was significantly lower: The BBC reported in March of last year that the at-home internet penetration rate was roughly 5%.

Web access in the country remains relegated to a few options. State-run telecom Empresa de Telecomunicaciones de Cuba S.A. (ETECSA), which first began offering public Wi-Fi spots in 2015, claims to provide 391 such spots across the country. But at a cost of about $1.50 per hour, access remains too expensive for most Cubans, and internet speeds are reportedly excruciatingly slow.

ETECSA also began a pilot program in December of last year to provide some 2,000 users in Havana, Cuba’s capital, with fixed broadband internet access for a free two-month trial period. In March, ETECSA said 358 participants in the program signed up to pay for the service, which offered data speeds of between 128 kilobits per second (Kbps) and 2 megabits per second (Mbps).

And when residents of the country do manage to get online, they are subject to strict internet censorship overseen by the government. Some websites and services are blocked, and communications can easily be monitored by government figures.

During parliamentary sessions held in July, Vice President Miguel Díaz-Canel acknowledged that Cuba has one of the lowest internet access rates, but rejected the notion that its society was “fully disconnected.”

He added that tech companies that had entered into agreements with the country’s government to provide them with the infrastructure necessary to expand internet access had been met with “fierce financial prosecution.”

Despite these claims, the government has sought out partnerships with some of the world’s leading tech companies. In April, Google brought servers in the country online for the first time, making it the first foreign tech firm to host its own content in Cuba.

At the parliamentary sessions, Díaz-Canel also claimed that the penetration of social media platforms had grown by 346% in 2016. (The government did not respond to eMarketer’s request to verify this figure.)

However, Martín Utreras, vice president of forecasting at eMarketer, noted that the majority of social media users in the country were most likely foreign tourists looking to stay connected while on vacation.

According to data from StatCounter, there are signs that Facebook is a leading social media platform in the country. Facebook was responsible for 83.3% of page views resulting from social network referrals in Cuba in July, more than either Pinterest (8.4%) or Twitter (4.3%). (StatCounter’s figures take into consideration website referral traffic from both locals and visitors in Cuba.)

Despite signs that internet access is increasing in the country, Cuba still has a long way to go before getting online is something residents consider normal. In fact, many in the country rely on “el paquete semanal,” or the weekly package—a hard drive that is loaded with contraband content such as news, music, TV shows and other videos and passed from person to person.

“Cuba’s journey resembles that of similar trends we’ve seen in the case of China or Vietnam,” Utreras said. “Although Cuba is still many years behind in terms of private telecom investment, infrastructure development and overall internet adoption, by comparison, the immediate future will most likely be driven by government interests rather than the market itself.”

……………………………………………………………………………………………..

References:

https://www.emarketer.com/Article/Cuba-on-Slow-Crawl-Toward-Increased-Internet-Access/1016352

http://www.one.cu/aec2016/17%20Tecnologias%20de%20la%20Informacion.pdf

http://www.businessinsider.com/is-there-internet-in-cuba-2017-1

https://insightcuba.com/blog/2017/03/05/havanas-wifi-hotspots-and-getting-online-cuba

Cuba to expand Internet access and lower price of WiFi connections