Cignal AI’s Forecast for 100G & 400G Coherent WDM Shipments

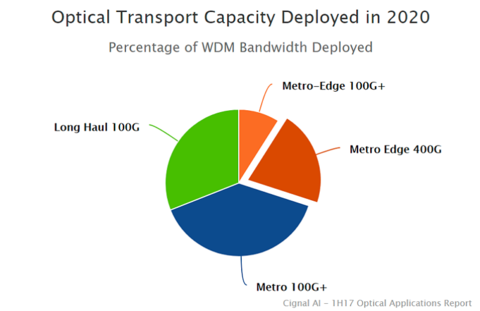

Ciena and Cisco rank as the predominant vendors of 100G and 400G Coherent WDM optical network equipment for 2017, respectively according to Cignal AI in their Optical Applications Report. The networking component and equipment market research firm notes that 400G coherent WDM system shipments are ramping up this year. The market research firm estimates that 400G technology will account for nearly one-quarter of all deployed WDM bandwidth in 2020.

The report also predicts that revenue for equipment originally designed for the data center interconnect (DCI) market will reach $1 billion by 2019, as these systems become widely adopted outside of traditional DCI applications.

Editor’s Note:

The lead author is the very well respected Andrew Schmitt, formerly with Infonetics (now IHS-Markit). Both 100G and 400G coherent will be widely adopted at the edge of the network by the end of 2021, according to the market research firm.

…………………………………………………………………………………

Cignal Al said that Cisco is growing 100G port deployments faster than all other vendors in the market. Meanwhile, Chinese coherent 100G port deployments grew at a healthy pace in the first half of 2017.

Complementing the 400G and 100G growth are two other key innovations—compact modular equipment and packet-OTN switching.

While modular equipment was initially designed to accommodate data center deployments, a host of traditional incumbent, wholesale, and cable MSOs will use these systems incorporated with open software to build disaggregated optical networks.

Cignal Al noted that compact modular equipment spending more than tripled in the first half of 2017 over the same period last year. Ciena, Cisco, and Infinera are the dominant suppliers for this sector. At the same time, traditional service providers such as Verizon are expanding advanced packet-OTN deployments. Packet-OTN systems revenue grew in the double digits in the first half of 2017, up from the same period in 2016. Cignal Al said Verizon’s deployment of these systems is rising and will affect vendor market share more materially in the second half of 2017.

“Cignal AI has close relationships with equipment and component manufacturers, as well as end users, and these relationships give us a unique insight into the optical equipment market. From this vantage point, we can forecast emerging technologies such as coherent 400G WDM usage,” states Andrew Schmitt, lead analyst for Cignal AI. “Pluggable 400G ZR modules should enter the market by 2019, and they will be the final nail in the coffin for 10G WDM networks.”

100G+ Coherent WDM:

- 400G coherent WDM volume starts to ramp this year, led by Ciena deployments and then followed by other suppliers six to nine months later.

- The introduction of small form factor 100G and 400G pluggable models will spur the largest optical market transformation since the “Optical Reboot” of 2012-2015 by virtually eliminating most 10G WDM deployments from the world’s optical infrastructure.

- Both 100G and 400G coherent will be widely adopted at the edge of the network by the end of 2021.

- Cisco is growing 100G port deployments faster than all other vendors in the market.

- Despite widespread expectations to the contrary, Chinese coherent 100G port deployments grew at a healthy pace in the first half of 2017.

About the Report:

This report tracks optical equipment spending and port shipments for specific types of equipment designed to meet the needs of a specific application. Cignal AI collects shipment information and guidance from equipment companies as well as the supply chain each quarter, and estimate each companies shipments in each of the defined categories. Forecasts are based on expected spending and shipment trends for given applications on a regional basis.

The report features revenue-based market size and share for the hardware categories and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include Acacia, Adtran, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Fujitsu, Huawei, Infinera, Inphi, NTT Electronics (NEL), Nokia and ZTE.

The report contains details on the following areas:

- Compact Modular hardware market share and forecasts

- 100G+ Coherent port shipments vendor market share

- 100G, 200G, and 400G+ Coherent and Direct Detect port shipments and forecast

- Advanced Packet-OTN Switching market share and forecasts

References:

https://cignal.ai/2017/09/cignal-ai-issues-industrys-first-forecast-for-400g-coherent-wdm-shipments/

https://cignal.ai/2017/09/1h17-optical-applications-report/

https://cignal.ai/marketresearch/opteq_ap/

http://www.ciena.com/insights/what-is/What-Is-Coherent-Optics.html

http://www.gazettabyte.com/home/2017/9/15/has-coherent-optical-transmission-run-its-course.html

https://www.nextplatform.com/2017/09/14/rare-peek-inside-400g-cisco-network-chip/amp/

https://www.cisco.com/c/en/us/solutions/service-provider/100-gigabit-solution/index.html

http://www.ciena.com/insights/articles/Move-Over-200G-400G-is-the-New-Sexy.html

Addendum:

Vodafone New Zealand just announced the world’s first live deployment of a 400G per wavelength optical system to carry core IP traffic between its Auckland data centers, using Ciena’s WaveLogic Ai coherent optics. AT&T’s recent trial of 400GbE also used Ciena’s WaveLogic Ai chipset

These two factors, illustrated above, enable the transport of 400Gb/s per wavelength and 30.4Tb/s of capacity per fiber, higher capacity than any other solutions available on the market, according to Ciena.

One thought on “Cignal AI’s Forecast for 100G & 400G Coherent WDM Shipments”

Comments are closed.

This past August, Andrew Schmitt, the founder of Cignal AI tweeted: “100G coherent port shipments in China during 2Q17 came in much higher than I or anyone else I know expected. Record quarter at Huawei.”

https://thefly.com/landingPageNews.php?id=2588191