Microwave Market

Nokia introduces new Wavence microwave solutions to extend 5G reach in both urban and rural environments

Nokia today announced the availability of the UBT-m XP, the latest addition to its Wavence product family designed to support mobile operators and enterprises with premium coverage in both dense urban and rural environments. Nokia’s newest E-Band radio is a high-capacity outdoor unit with a small, light form factor and the highest transmit power available on the market; ideal for urban microwave transport applications.

Nokia SteadEband, a stabilized three-foot antenna that combats common E-Band issues [1.], was also announced to complement UBT-m XP. It includes tower vibrations and movements due to thermal effects. Combined with the UBT-m XP, it can increase the typical E-Band link distance by up to 50 percent, helping mobile operators deliver multi-gigabit 5G connectivity to their customers. These new products address all use cases for improving link distance as well as the energy efficiency of the Wavence portfolio.

Note 1. The E-Band is 71-76 and 81-86 GHz, standardized worldwide, commonly referred to as “80 GHz,” but it’s always that range, said Nokia Microwave Radio Links VP Giuseppe Targia, noting that the E-Band is suitable for both urban and suburban environments.

Urban Coverage Boost:

The UBT-m XP is a single ultra-broadband transceiver with an integrated modem and diplexer, offering best-in-class energy efficiency with twice the transmit power compared to the industry average. In recent tests, Nokia demonstrated a 12-kilometer-long link using the Nokia UBT-m XP and the SteadEband antenna.

Rural Broadband Extension:

Nokia also announced the launch of the Outdoor Channel Aggregator (OCA) to support mobile operators looking to expand the reach and capacity of their networks for rural broadband applications. The OCA aggregates multiple UBT-T XP radios, Nokia’s high-capacity, high-power, outdoor dual-band radio, for N+0 operations and allows for increased throughput with improved system gain of up to 10 dB compared with traditional aggregation methods. This is important in increasing the link distance or to optimize OPEX/CAPEX by removing the requirement for larger antenna or repeater systems.

Nokia is also introducing the Carrier Aggregation High Density (CAHD) card, which adds ‘single pipe’ capacity to the backhaul to support the link distance. The innovative CAHD module enables 10 Gbps backhaul capacity over multiple channels and supports seamless migration from existing low-capacity backhaul to high capacity hence preserving an operator’s investment.

Nokia’s ‘Simplified RAN Transport’ solution optimizes radio access base station and microwave radio transport hardware to the minimum. This provides enhanced serviceability and operations without the need for dedicated indoor microwave equipment. Nokia’s solution saves 30 percent more energy versus a traditional microwave site solution, due to a reduced number of units and less air conditioning requirements. Additionally, it also enables lower TCO and reduced site footprint.

Nokia’s comprehensive Wavence portfolio provides a complete microwave solution for all use cases covering short-haul, long-haul, E-Band, and SDN-based management both for mobile operators and Enterprises. Its zero-footprint implementation for full-outdoor architectures can be integrated directly with RAN and IP devices with common management. This contributes to an overall reduction in network energy consumption and its software features and automation help to achieve further energy-saving targets.

“It’s no secret that capacity and radio efficiency are driving the market, said Emmy Johnson, Chief Analyst, Sky Light Research. “According to Sky Light Research’s latest forecast, the high-capacity E-band market is expected to grow north of 60 percent in 2023. Nokia’s newest products answer this call but with the added benefit of high power and energy efficiency. The sustainability and power metrics are impressive, as they not only lower TCO but also help meet climate change guidelines.”

Giuseppe Targia, Vice President, Microwave Radio Links at Nokia, said: “We are further strengthening our industry-leading Wavence portfolio with the addition of these next-generation products. The winning combination of the UBX-m XP and the SteadEband offers our customers a high-performance transport solution with leading capacity and coverage for both urban and rural environments. Microwave links are cost-efficient and fast to deploy, representing a robust alternative to fiber backhaul.”

Nokia’s Wavence UBT-mX

……………………………………………………………………………………………………………………………………………..

References:

Wavence – Microwave transmission

https://www.nokia.com/networks/mobile-networks/wavence-microwave-transmission/e-band-portfolio/

Ericsson to build 5G network in Greenland; demos 5G microwave backhaul with O2 Telefónica

Swedish telecom equipment maker Ericsson has been contracted to build a 5G network in Greenland, initially covering three towns, local telecom service provider Tusass said on Friday.

Deploying Ericsson equipment and Netgear routers, Tusass will bring high-speed wireless internet to the sparsely populated island without resorting to expensive and hard-to-deploy cables, the company said. A further 10 towns, including Greenland’s capital Nuuk, are set to follow next.

Tusass said it plans to invest around 1 billion Danish crowns ($131.3 million) to secure and expand Greenland’s infrastructure and improve communication.

Greenland, an island of just 56,000 people, is part of the Kingdom of Denmark but has broad autonomy.

…………………………………………………………………………………………………………………………………………….

Separately, Ericsson and O2 Telefónica successfully demo 5G wireless backhaul for non-urban areas. In the latest of their joint projects in mobile transport, Ericsson and O2 Telefónica have successfully demoed 5G wireless backhaul for rural and suburban coverage. This technology milestone has shown that the companies can deliver speeds of up to 10 Gbps over a distance of more than 10 km and demonstrate fiber-like microwave connectivity.

The result of this important demo showed that microwave backhaul over traditional bands can support the continued build-out of high-performing 5G networks and enhanced mobile broadband services from urban to suburban and rural areas – one of the key challenges facing communications service providers in scaling up their 5G deployment.

“We deliver fast mobile 5G connections to millions of customers across Germany. Bringing digitalization to suburban and rural areas through mobile connectivity and fast 5G network rollout has therefore priority for us,” says Aysenur Senyer, Director of Transport Networks at O2 Telefónica.

“Together with our partner Ericsson, we are pioneering new powerful microwave solutions using Carrier Aggregation and MIMO technology to backhaul 5G traffic over long distances in rural areas, when fiber is not an option. This type of technology enables us to deliver fiber-like connectivity via microwave and further accelerate our 5G deployment.”

Ricardo Queirós, Head of Microwave Systems, Business Area Networks, Ericsson, says: “Access to high-speed mobile services is key to bridging the digital divide. This joint demo with O2 Telefónica in Germany demonstrates how microwave backhaul can efficiently spread high-performing 5G to regions outside the traditional dense urban areas.”

“Wireless backhaul has been instrumental to the success of mobile networks and their nationwide coverage. Now it is time to push the boundaries and evolve microwave transmission technology to enable high-performance 5G coverage on a much broader scale,” Queirós adds.

The shift to working from home during the Covid-19 pandemic illustrated the need for fast and reliable connectivity in non-urban environments, and the challenge has been to maintain telecom-grade availability beyond distances of two to three kilometers.

The ability to deliver such high data speeds over distances of more than 10 km – the cruising altitude of a commercial jet – opens up a new world of possibilities for the delivery of low-latency, reliable broadband in harder-to-reach areas.

Traditionally, such areas have been difficult to service, as high capacities require broad bandwidths that usually only have been available in millimeter wave frequency bands (E-band). The E-band is more impacted by rain compared to the lower frequency bands, which makes it more difficult to deliver consistent service over long distances during adverse weather conditions.

Technical details

In the joint demo with O2 Telefónica in Germany, the key innovation is the ability to use MIMO with high modulation in the 112MHz channels (commercial MIMO solutions support up to 56 MHz channels), which were combined with Carrier Aggregation to enable similar capacities to E-band in the lower frequency bands. The demo solution has extended the hop-length with extremely high capacity even in less favorable weather conditions.

The backhaul link utilized the 18GHz frequency band, dual antennas in a MIMO configuration, and commercial MINI-LINK radios together with a pre-commercial baseband algorithm that allowed the use of MIMO in 2x 112 MHz channels. MIMO ensures the efficient use of limited spectrum resources. The same capacity without MIMO would demand a 448 MHz bandwidth in a cross-polar setup.

Microwave backhaul is commonly seen as a more cost- and time-efficient option compared to fiber deployment. The O2 Telefónica demo has shown that high availability and high capacity can also be achieved with wireless transport.

The demo is the latest in a series of collaborations with O2 Telefónica in Germany stretching back over several years. Ericsson is one of the service provider’s main suppliers in all areas of microwave technology and the two companies have carried out several successful joint projects around microwave technology, with more planned for the future.

References:

https://www.reuters.com/business/media-telecom/ericsson-wins-greenland-5g-deal-2022-09-30/

Wireless Backhaul Breakthrough: 40G bps & sub 1 usec Latency; 5G NR Call on 2.6 GHz

Ericsson announced on Friday that it has teamed with Deutsche Telekom to demonstrate a 40 Gbps mmWave wireless transmission link with sub 100-microsecond latency.

Ericsson said the test took place at the Deutsche Telekom Service Center in Athens. The test used millimeter wave (E-band) spectrum for transmission over a distance of 1.4 kilometers. The round-trip latency performance of the link tested was less than 100 microseconds, which confirmed the positive contribution of wireless backhaul technologies to satisfy network-specific latency targets.

Alex Jinsung Choi, SVP Strategy & Technology Innovation, Deutsche Telekom, says: “A high-performance transport connection will be key to support high data throughput and enhanced customer experience in next-generation networks. While fiber is an important part of our portfolio, it is not the only option for backhaul. Together with our partners, we have demonstrated fiber-like performance is also possible with wireless backhauling/X-Haul solutions. This offers an important extension of our portfolio of high-capacity, high-performance transport options for the 5G era.”

Per Narvinger, head of product area networks for Ericsson said: “Microwave continues to be a key technology for mobile transport by supporting the capacity and latency requirements of 4G and future 5G networks. Our joint innovation project shows that higher capacity microwave backhaul will be an important enabler of high-quality mobile broadband services when 5G becomes a commercial reality.”

Ericsson has a five-year contract with Deutsche Telekom, which kicked off in December 2017. Ericsson’s senior VP Arun Bansal says that they can deliver a 5G network in that time frame. “We listened to Deutsche Telekom and understood their urgency to have 5G-ready infrastructure in order to stay at the forefront.” They’ll run 4G on their 5G hardware until it is installed across the entire network, then they’ll launch 5G with the flip of a switch sometime in the next few years.

Technical setup included the use of Ericsson’s latest mobile transport technology including Ericsson’s MINI-LINK 6352 microwave solution and Router 6000.

……………………………………………………………………………………………………………………………………………………………………..

Separately, Ericsson and Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, have achieved a non-standalone (NSA) 5G New Radio (NR) data call on 2.6 GHz, adding a new frequency band to those successfully tested for commercial deployment.

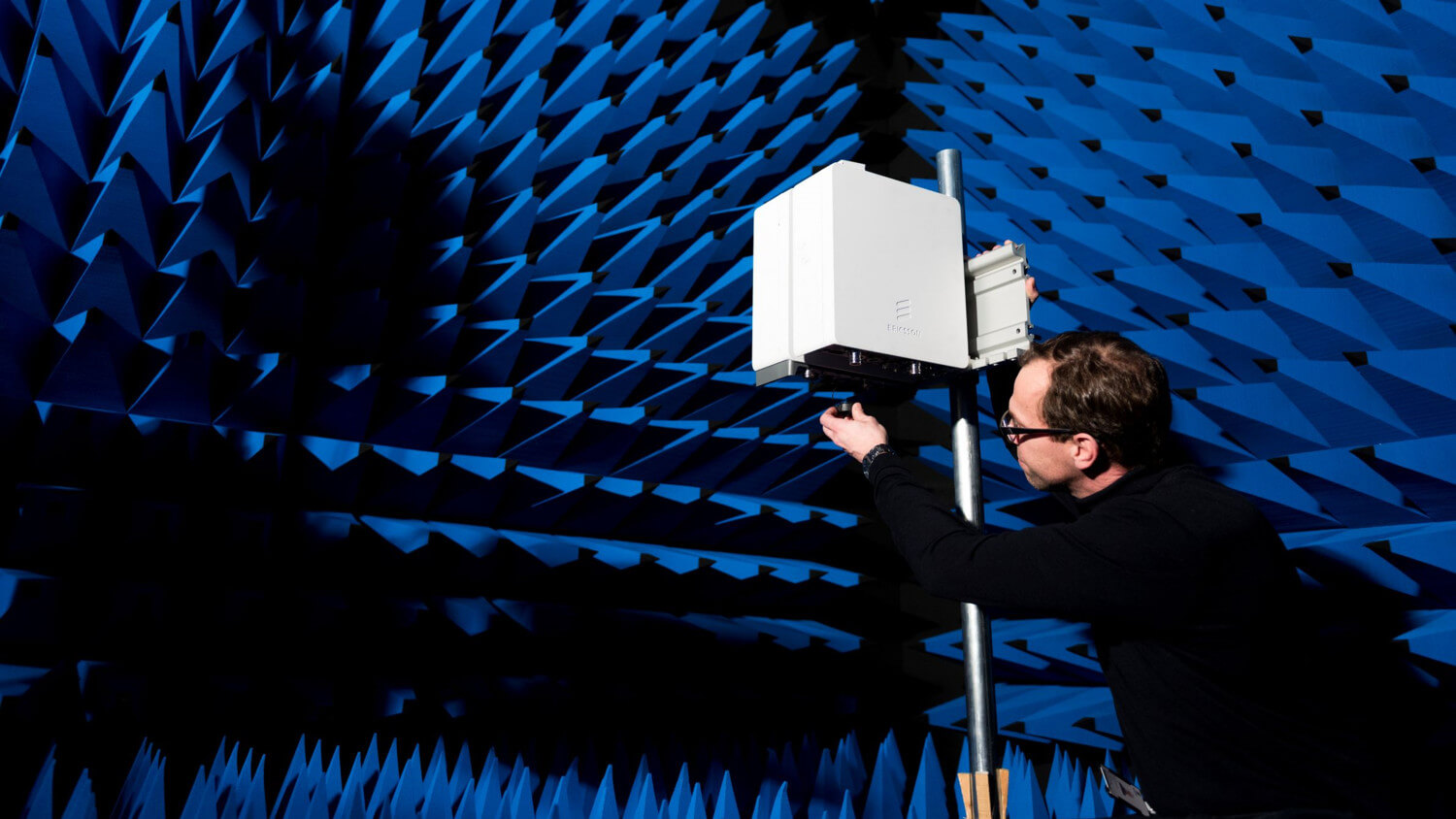

The bi-directional downlink and uplink data call was made at the Ericsson Lab in Kista, Sweden last December 20. It brings a new sub-6 frequency band one step closer to commercial rollout.

This latest Interoperability Development Testing (IoDT) data call is compliant with the 3GPP Rel-15 “early drop” specification that was frozen in March 2018 but further stabilized in September, and which is the basis for commercial launches expected in the first half of 2019.

IHS Markit: Microwave Network Equipment Market -1%; YoY; 5G to Boost Growth

By Richard Webb, associate director of research and analysis, service provider technology, IHS Markit

Highlights:

- The total worldwide microwave network equipment market declined by 5 percent quarter over quarter – and by 1 percent year over year – in the second quarter of 2018 (Q2 2018), falling to $1.03 billion.

- Revenue in the second quarter was comprised of 80 percent backhaul, 7 percent transport and 13 percent access. Also within revenue, 16 percent was dual Ethernet/TDM, 71 percent was Ethernet only, 2 percent was V-band millimeter wave and 11 percent was E-band millimeter wave.

- Regionally, 10 percent of revenue in the second quarter came from North America, 39 percent from Europe, Middle East and Africa (EMEA), 37 percent from Asia Pacific, and 13 percent from Caribbean and Latin America (CALA).

- Ericsson (see Addendum) led the microwave network equipment market share ranking with 21.6 percent of revenue, followed by Huawei at 18.6 percent, Nokia at 12.5 percent, NEC at 10.6 percent, Ceragon at 8.5 percent, Aviat Networks at 4.2 percent, SIAE at 4 percent and ZTE at 3.8 percent.

IHS Markit Analysis:

Microwave equipment market declines in the second quarter of 2018 followed a stronger-than-expected first quarter, with second half of the year expected to be flat-to-slightly up.

Aside from performance by individual vendors, the market has been slow over the last two years. Mobile operators are typically cash conservative, and many operators in developed markets have undergone most of their backhaul upgrades for LTE. Although upgrades for LTE-A and LTE-Pro (and late-phase LTE deployment in developing regions) prop up the market, the early shoots of growth driven by 5G are now visible and will gain momentum over the next two to three years.

In the long term, the market will get an injection from 5G upgrades, driven by demand for higher-capacity backhaul combined with growing traction for outdoor small cell deployments. Although market growth will be muted in the short term, these drivers will push the market back to revenue growth in 2019 and beyond.

The effect of 5G on the microwave equipment market will be mainly felt in two ways:

- Backhaul and fronthaul for mobile broadband: Increased capacity requirements for macrocells and small cells or remote radio heads to deliver high-speed mobile broadband connectivity.

- Fixed-wireless access: In-home broadband for consumers, utilizing millimeter wave as a wireline (DSL/cable/fiber) equivalent, to deliver high-speed fixed broadband connectivity.

SDN, NFV and network slicing will impact transport networks over the next few years. Although they will make backhaul more flexible, they do not reduce the need for equipment at the endpoint of the backhaul link. However, the fact that SDN enables coordination between the radio access network (RAN) and backhaul network to optimize traffic and allocated network resources, is likely to strengthen the opportunity for microwave vendors with RAN portfolios to increase market share. Over the past few years, the market has been experiencing some consolidation among microwave-only specialists.

Microwave Network Equipment Quarterly Market Tracker:

The “Microwave Network Equipment Market Tracker” examines the vendors, markets and trends related to wireless radio equipment that uses microwave to transmit digital or analog signals between two locations on a radio path. The report tracks Ethernet, TDM microwave, Dual Ethernet/TDM microwave, and V-Band and E-Band millimeter wave equipment by spectrum, capacity, form factor, architecture and line of sight.

…………………………………………………………………………………….

Addendum:

Huawei Launches the Industry’s First 5G Microwave Equipment at MWC 2018