Bundenetzagentur: 5G was 28.5% of broadband speed measurements in Germany (Oct 2022 thru Sept 2023)

German Federal Network Agency Bundenetzagentur (BNetzA) annual report said that 5G readings made up 28.5% of the broadband speed measurements up from 6% in the previous (2020/2021) reporting period.

“I’m pleased that the network operators are pushing ahead rapidly with the 5G rollout. More and more mobile customers are benefiting from very high speeds. This trend will pick up even more in the coming years,” said Klaus Müller, President of the Bundesnetzagentur.

It’s possible to achieve very high data transmission rates with 5G (?), which are sometimes well over the contractually agreed estimated maximum of the relevant tariff. This year’s annual report includes a special examination of such measurements.

Results for fixed broadband connections

The proportion of fixed broadband users whose connection had a download speed of at least half their contractually agreed maximum speed was 85.5% (2021/2022: 84.4%). The proportion of users whose connection had a speed equivalent to or higher than their contractually agreed maximum speed was 43.5% (2021/2022: 42.3%). Slight improvements on the previous year were thus evident.

Most end-users (79.1%; 2021/2022: 78.2%) were satisfied with the performance of their provider (rating of 1 to 3 on a scale of 1 to 6, with 1 being the highest). 10.4% of customers (2021/2022: 10.9%) gave their connection a rating of 5 or 6. These results show that customer satisfaction was slightly higher than in the previous year. The actual speeds measured by satisfied end-users were closer to the contractually agreed maximum speeds.

Results for mobile broadband connections

For mobile broadband connections, general performance was again considerably lower than for fixed broadband. The proportion of users across all bandwidth categories and providers whose connection had at least half their contractually agreed estimated maximum speed was 25.5% (2021/2022: 23.2%). The proportion of users whose connection had a speed equivalent to or higher than their contractually agreed estimated maximum speed was 4% (2021/2022: 3%).

The large majority of end-users (70.4%) once again gave their providers a rating of 1 to 3. This is a very small decline on the previous 12-month period (2021/2022: 70.8%). The fact that at the same time the broadband speeds measured as a percentage of the contractually agreed estimated maximum speeds were again low still suggests that mobile broadband users rated mobility and absolute speeds higher than actually receiving their contractually agreed maximum speeds.

Speed test results do not allow conclusions on broadband coverage

The test results depend on the tariffs agreed between the users and their providers. It is therefore not possible to draw conclusions from the broadband speed checker results about broadband coverage or the availability of broadband internet access. Rather, the tests show if the providers supply their customers with the contractually agreed bandwidth.

Annual report on broadband speed tests

The eighth annual report covers the period from 1 October 2022 to 30 September 2023. A total of 305,035 valid tests were made using the desktop app (2021/2022: 398,747 valid tests). For the mobile sector, the number of valid tests was 563,363 (2021/2022: 623,581).

References:

https://breitbandmessung.de/interaktive-darstellung

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

Vodafone Germany deploys Ericsson 5G radio to cut energy use up to 40%

With 85% 5G coverage in Germany; only 40% have used a 5G network

Vodafone Germany plans to activate 2,700 new 5G cell sites in 1H 2023

Deutsche Telekom launches 5G private campus network with Ericsson; Sovereign Cloud for Germany with Google in Spring 2022

Germany and France to fund private 5G projects with ~EUR 18 million

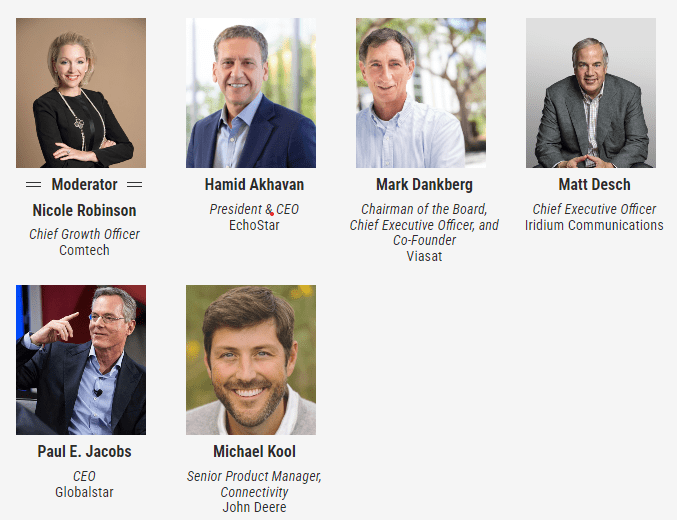

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

Converged terrestrial and satellite connectivity is a given, but the path is strewn with unknowns and sizable technological and business challengers, according to satellite operator CEOs. Hopefully, 3GPP Release 18 will contain the necessary specifications for it to be implemented as we explained in this IEEE Techblog post.

During Access Intelligence’s Satellite 2024 conference in Washington DC this week, Viasat CEO Mark Dankberg said satellite operators must start thinking and acting like mobile network operators, creating an ecosystem that allows seamless roaming among them. Terrestrial/non-terrestrial network (NTN) convergence requires “a complete rethinking” of space and ground segments, as well as two to three orders of magnitude improvement in data pricing, Dankberg said. Standards will help get satellite and terrestrial to fit together, but that evolution will happen slowly, taking 10 to 15 years, Iridium CEO Matt Desch said. It remains to be seen how direct-to-device services will make money, he added. Satellite-enabled SOS messaging on smartphones “is becoming free, and our satellites are not free — we need to make money on it some way,” Desch added.

The regulatory environment around satellite has changed tremendously during the past decade, with the FCC very oriented toward mobile networks’ spectrum needs and now satellite matters making up most of the agenda for the 2027 World Radiocommunication Conference, Desch said. However, there will be regulatory challenges to resolve in satellite/terrestrial convergence, he predicted. There are significant synergies in having a 5G terrestrial network and satcom assets under one roof, he said. Blurring the lines between terrestrial and non-terrestrial makes it easier for manufacturers to build affordable equipment that operates in both modes, Desch concluded.

That inevitable convergence is being driven by declining launch costs, maturing technologies and improved manufacturing, all of which make non-terrestrial network connectivity more economically competitive, said EchoStar CEO Hamid Akhavan. He said the EchoStar/Dish Network combination (see 2401020003) was driven in part by that convergence, consolidating EchoStar’s S-band spectrum holdings outside the U.S. with Dish’s S-band holdings inside the country. The deal also melds Dish’s network operator expertise with Hughes’ satellite expertise.

Wednesday Opening General Session: Are Satellite and Cellular Worlds Converging or Colliding?

To ensure space’s sustainability, missions must follow the mantra of “leave nothing behind,” sustainability advocates said. Space operators should have more universal protocols and vocabulary when exchanging space situational awareness data, as well as more uniformity in what content gets exchanged, said Space Data Association Executive Director Joe Chan. When it comes to space sustainability, clutter isn’t necessarily dangerous, and any rules fostering sustainability should avoid restricting the use of space, he said. Space lawyer Stephanie Roy of Perkins Coie said a mission authorization framework covering space operations that fall outside the regulatory domain of the FCC, FAA and NOAA is needed. Space operators and investors see sustainability rules as inevitable and want to ensure they allow flexibility and don’t mandate use of any particular technology, she added. Many speakers called for a “circular economy” in space, with more reuse of materials via refueling, reuse or life extension.

Separately, space sustainability advocates urged a mission authorization regulatory framework and universal use of design features such as docking plates enabling on-orbit serving or towing. Meanwhile, conference organizers said event attendance reached 14,000.

Also, ITU Secretary-General Doreen Bogdan-Martin urged the satellite industry to join ITU’s Partner2Connect digital coalition aimed at addressing digital divide issues, particularly in the least-developed nations and in landlocked and small island developing countries. The digital divide “is right up there” with climate change as a pressing issue for humanity, said Bogdan-Martin. She noted the coalition has received $46 billion in commitments, with a target of $100 billion by 2026.

References:

https://communicationsdaily.com/article/view?BC=bc_65fb60473d5de&search_id=836928&id=1911572

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

https://www.3gpp.org/specifications-technologies/releases/release-18

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

China Mobile increased revenue 7.7% to 1.009 trillion Chinese yuan (US$140 billion) in 2023, with earnings up 3.7%. China Mobile’s biggest growth drivers were cloud computing and storage, which grew 66% to RMB83 billion ($11.5 billion), and 5G enterprise, which hiked sales by 30% to RMB47.5 billion ($6.6 billion). It also revealed it had earned RMB5.4 billion ($750 million) in 5G private networking revenue, up 113%. Its “new business” segment, which covers international, investments and applications, expanded 28% to RMB49.3 billion ($6.9 billion).

China Mobile’s capital spending was RMB180.3 billion ($25 billion), a 2.6% decrease from 2022. It gave no guidance for 2024, but CAPEX will surely decrease in 2024 and coming years due to a recent change to retain existing 5G network equipment longer than previously planned.

China Mobile’s Board on Thursday voted to extend the depreciable life of its 5G assets from seven years to ten years, based on the belief that much of its 5G network equipment will continue to be deployed after the arrival of 6G (IMT 2030) at the end of this decade (or later). The state owned telco said it expects “that 5G network investments shall be reused in 6G network infrastructure to the maximum extent, and therefore it is expected that 5G/6G networks will coexist after commercialization of 6G and 5G equipment will have a relatively long life cycle.”

The immediate effect of this decision will be to cut a massive 18 billion yuan ($2.5 billion) out of China Mobile’s depreciation bill this year. It’s the first time any major telco has formally declared that not only is it reluctant to spend on new 6G equipment, but that it also intends to keep its 5G assets as long as possible. That sends a clear warning that in the aftermath of the 5G capex binge, telcos have little appetite for big technology bets without a clear ROI.

…………………………………………………………………………………………………………………..

Meanwhile, China Unicom boosted net profit by 11.8% and topline revenue by 5.0%. Unicom said it had grown its cloud business by 42% to RMB51 billion ($7.1 billion), while its new computing and digital services business recorded RMB75 billion ($10.4 billion) in sales, up 13%.

“With 5G network coverage nearing completion, the Company’s investment focus is shifting from stable Connectivity and Communications (CC) business to high-growth Computing and Digital Smart Applications (CDSA) business. CAPEX was RMB73.9 billion in 2023. Network investment saw an inflection point.”

In 2023, Connectivity and Communications (CC) business, which encompasses mobile connectivity, broadband connectivity, TV connectivity, leased line connectivity, communications services as well as information services, achieved revenue of RMB244.6 billion. It contributed to three quarters of the service revenue of CC and CDSA combined. The Company’s connectivity scale further expanded, with the total number of CC subscribers exceeding one billion, representing an increase of about 140 million from the end of 2022.

China Unicom capital spending was flat at RMB73.9 billion ($10.3 billion), and it revealed it will slash CAPEX this year by RMB8.9 billion ($1.2 billion) or 12%.

References:

https://www.lightreading.com/5g/china-mobile-unicom-raise-red-flags-on-network-spend

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0321/2024032100246.pdf

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0319/2024031900241.pdf

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China Mobile verifies optimized 5G algorithm based on universal quantum computer

Omdia: China Mobile tops 2023 digital strategy benchmark as telcos develop new services

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

Light Source Communications Secures Deal with Major Global Hyperscaler for Fiber Network in Phoenix Metro Area

Light Source Communications is building a 140-mile fiber middle-mile network in the Phoenix, AZ metro area, covering nine cities: Phoenix, Mesa, Tempe, Chandler, Gilbert, Queen Creek, Avondale, Coronado and Cashion. The company already has a major hyperscaler as the first anchor tenant.

There are currently 70 existing and planned data centers in the area that Light Source will serve. As one might expect, the increase in data centers stems from the boom in artificial intelligence (AI).

The network will include a big ring, which will be divided into three separate rings. In total, Light Source will be deploying 140 miles of fiber. The company has partnered with engineering and construction provider Future Infrastructure LLC, a division of Primoris Services Corp., to make it happen.

“I would say that AI happens to be blowing up our industry, as you know. It’s really in response to the amount of data that AI is demanding,” said Debra Freitas [1.], CEO of Light Source Communications (LSC).

Note 1. Debra Freitas has led LSC since co-founding in 2014. Owned and operated network with global OTT as a customer. She developed key customer relationships, secured funding for growth. Currently sits on the Executive Board of Incompas.

……………………………………………………………………………………………………..

Light Source plans for the entire 140-mile route to be underground. It’s currently working with the city councils and permitting departments of the nine cities as it goes through its engineering and permit approval processes. Freitas said the company expects to receive approvals from all the city councils and to begin construction in the third quarter of this year, concluding by the end of 2025.

Primoris delivers a range of specialty construction services to the utility, energy, and renewables markets throughout the United States and Canada. Its communications business is a leading provider of critical infrastructure solutions, including program management, engineering, fabrication, replacement, and maintenance. With over 12,700 employees, Primoris had revenue of $5.7 billion in 2023.

“We’re proud to partner with Light Source Communications on this impactful project, which will exceed the growing demands for high-capacity, reliable connectivity in the Phoenix area,” said Scott Comley, president of Primoris’ communications business. “Our commitment to innovation and excellence is well-aligned with Light Source’s cutting-edge solutions and we look forward to delivering with quality and safety at the forefront.”

Light Source is a carrier neutral, owner-operator of networks serving enterprises throughout the U.S. In addition to Phoenix, several new dark fiber routes are in development in major markets throughout the Central and Western United States. For more information about Light Source Communications, go to lightsourcecom.net.

The city councils in the Phoenix metro area have been pretty busy with fiber-build applications the past couple of years because the area is also a hotbed for companies building fiber-to-the-premises (FTTP) networks. In 2022 the Mesa City Council approved four different providers to build fiber networks. AT&T and BlackRock have said their joint venture would also start deploying fiber in Mesa.

Light Source is focusing on middle-mile, rather than FTTP because that’s where the demand is, according to Freitas. “Our route is a unique route, meaning there are no other providers where we’re going. We have a demand for the route we’re putting in,” she noted.

The company says it already has “a major, global hyperscaler” anchor tenant, but it won’t divulge who that tenant is. Its network will also touch Arizona State University at Tempe and the University of Arizona.

Light Source doesn’t light any of the fiber it deploys. Rather, it is carrier neutral and sells the dark fiber to customers who light it themselves and who may resell it to their own customers.

Light Source began operations in 2014 and is backed by private equity. It did not receive any federal grants for the new middle-mile network in Arizona.

………………………………………………………………………………………………………..

Bill Long, Zayo’s chief product officer, told Fierce Telecom recently that data centers are preparing for an onslaught of demand for more compute power, which will be needed to handle AI workloads and train new AI models.

…………………………………………………………………………………………………………

About Light Source Communications:

Light Source Communications (LSC) is a carrier neutral, customer agnostic provider of secure, scalable, reliable connectivity on a state-of-the-art dark fiber network. The immense amounts of data businesses require to compete in today’s global market requires access to an enhanced fiber infrastructure that allows them to control their data. With over 120 years of telecom experience, LSC offers an owner-operated network for U.S. businesses to succeed here and abroad. LSC is uniquely positioned and is highly qualified to build the next generation of dark fiber routes across North America, providing the key connections for business today and tomorrow.

References:

https://www.lightsourcecom.net/services/

https://www.fiercetelecom.com/ai/ai-demand-spurs-light-source-build-middle-mile-network-phoenix

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Türk Telekom and ZTE trial 50G PON, but commercial deployment is not imminent

Türk Telekom and ZTE have carried out a 50G PON trial in Turkey. The two firms announced that their trial delivered speeds in excess of 50 Gbps in the downstream over a single fiber and did so in a way that was compatible with existing PON generations already deployed in Türk Telekom’s network. The PON technologies used were GPON and XGS-PON – the latter offering 10 Gbps symmetrical speeds – technologies alongside 50G PON.

“This interoperability significantly expands the OLT’s potential applications, paving the way for future services such as ultra-high bandwidth access, mobile xHaul, and deterministic campus networks in both home and enterprise environments,” ZTE said.

Yong Jie, CEO of ZTE Türkiye, said: “At the MWC 2022, ZTE unveiled the world’s first precise 50G PON prototype. In 2022, the 50G PON standard was finalized and received wide attention in the industry. It is expected that by 2025, the 50G PON industry chain will be ready for commercialization. As a frontrunner in the transformative journey to 50G PON, ZTE is pleased to empower Türk Telekom to accelerate the realization of their vision to provide unparalleled connectivity solutions to customers across Türkiye.”

In February, ZTE introduced the industry’s first symmetric 50G PON ONU, ZXEN G300-N9, featuring a 50G Ethernet optical port and seamless integration with the symmetric 50G PON Combo line card to meet high-speed access needs for government and enterprise campuses.

…………………………………………………………………………………………

Mehmet Beytur, Support Services and Procurement Management Assistant General Manager of Türk Telekom, said:

“As Türk Telekom, we are at the forefront of our country’s digital transformation, constantly spearheading innovative projects. Our successful collaboration with ZTE on the 3-in-1 50G PON Combo trial exemplifies this commitment. We will continue to take pioneering steps in innovative solutions.”

…………………………………………………………………………………….

However, 50G PON commercial deployment is not imminent as 25G PON is what’s being rolled out now by fiber facilities based telcos. Network operators have repeatedly indicated that they do not want to disrupt their optical distribution networks (ODNs) by moving to a new technology too quickly.

There are a number of technological barriers to 50G PON, one of which is alluded to in the ZTE announcement: while 50G PON can offer 50 Gbps-plus downstream speeds, it is not yet symmetrical, uplink speeds being half that or less.

Nonetheless, the trial is an important step in the ongoing development of 50G PON, even if future deployments are perhaps further away than the vendor community might like.

Dell’Oro pointed out that the coexistence of 50G PON with previous PON generations, and the implementation of combo PON, will be critical to the successful rollout of the technology. The analyst firm noted that “much more significant growth is expected after 2027, as operators begin to evolve their 10Gbps PON networks to next-generation technologies.”

References:

https://www.telecoms.com/fibre/t-rk-telekom-and-zte-trial-50g-pon

Nokia’s launches symmetrical 25G PON modem

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Omdia: Cable network operators deploy PONs

Omdia Surveys: PON will be a key part of network operator energy reduction strategies

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

The AI boom is changing how data centers are built and where they’re located, and it’s already sparking a reshaping of U.S. energy infrastructure, according to Barron’s. Energy companies increasingly cite AI power consumption as a leading contributor to new demand. That is because AI compute servers in data centers require a tremendous amount of power to process large language models (LLMs). That was explained in detail in this recent IEEE Techblog post.

Fast Company reports that “The surge in AI is straining the U.S. power grid.” AI is pushing demand for energy significantly higher than anyone was anticipating. “The U.S. electric grid is not prepared for significant load growth,” Grid Strategies warned. AI is a major part of the problem when it comes to increased demand. Not only are industry leaders such as OpenAI, Amazon, Microsoft, and Google either building or looking for locations on which to build enormous data centers to house the infrastructure required to power large language models, but smaller companies in the space are also making huge energy demands, as the Washington Post reports.

Georgia Power, which is the chief energy provider for that state, recently had to increase its projected winter megawatt demand by as much as 38%. That’s, in part, due to the state’s incentive policy for computer operations, something officials are now rethinking. Meanwhile, Portland General Electric in Oregon, recently doubled its five-year forecast for new electricity demand.

Electricity demand was so great in Virginia that Dominion Energy was forced to halt connections to new data centers for about three months in 2022. Dominion says it expects demand in its service territory to grow by nearly 5% annually over the next 15 years, which would almost double the total amount of electricity it generates and sells. To prepare, the company is building the biggest offshore wind farm in the U.S. some 25 miles off Virginia Beach and is adding solar energy and battery storage. It has also proposed investing in new gas generation and is weighing whether to delay retiring some natural gas plants and one large coal plant.

Also in 2022, the CEO of data center giant Digital Realty said on an earnings call that Dominion had warned its big customers about a “pinch point” that could prevent it from supplying new projects until 2026.

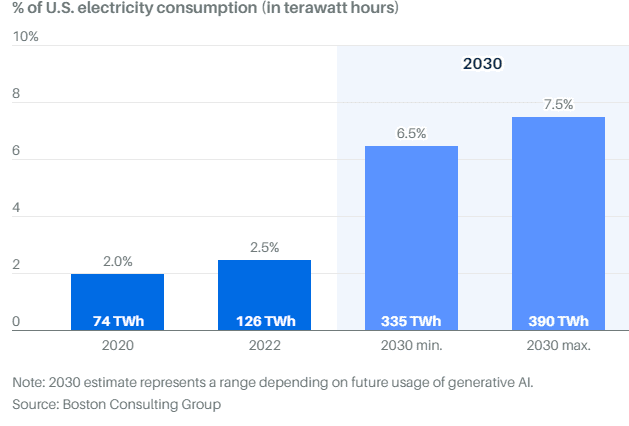

AES, another Virginia-based utility, recently told investors that data centers could comprise up to 7.5% of total U.S. electricity consumption by 2030, citing data from Boston Consulting Group. The company is largely betting its growth on the ability to deliver renewable power to data centers in the coming years.

New data centers coming on line in its regions ”represent the potential for thousands of megawatts of new electric load—often hundreds of megawatts for just one project,” Sempra Energy told investors on its earnings call last month. The company operates public utilities in California and Texas and has cited AI as a major factor in its growth.

There are also environmental concerns. While there is a push to move to cleaner energy production methods, such as solar, due to large federal subsidies, many are not yet online. And utility companies are lobbying to delay the shutdown of fossil fuel plants (and some are hoping to bring more online) to meet the surge in demand.

“Annual peak demand growth forecasts appear headed for growth rates that are double or even triple those in recent years,” Grid Strategies wrote. “Transmission planners need long-term forecasts of both electricity demand and sources of electricity supply to ensure sufficient transmission will be available when and where it’s needed. Such a failure of planning could have real consequences for investments, jobs, and system reliability for all electric customers.”

According to Boston Consulting Group, the data-center share of U.S. electricity consumption is expected to triple from 126 terawatt hours in 2022 to 390 terawatt hours by 2030. That’s the equivalent usage of 40 million U.S. homes, the firm says. Much of the data-center growth is being driven by new applications of generative AI. As AI dominates the conversation, it’s likely to bring renewed focus on the nation’s energy grid. Siemens Energy CEO Christian Bruch told shareholders at the company’s recent annual meeting that electricity needs will soar with the growing use of AI. “That means one thing: no power, no AI. Or to put it more clearly: no electricity, no progress.”

The technology sector has already shown how quickly AI can recast long-held assumptions. Chips, for instance, driven by Nvidia, have replaced software as tech’s hottest commodity. Nvidia has said that the trillion dollars invested in global data-center infrastructure will eventually shift from traditional servers with central processing units, or CPUs, to AI servers with graphics processing units, or GPUs. GPUs are better able to power the parallel computations needed for AI.

For AI workloads, Nvidia says that two GPU servers can do the work of a thousand CPU servers at a fraction of the cost and energy. Still, the better performance capabilities of GPUs is leading to more aggregate power usage as developers find innovative new ways to use AI.

The overall power consumption increase will come on two fronts: an increase in the number of GPUs sold per year and a higher power draw from each GPU. Research firm 650 Group expects AI server shipments will rise from one million units last year to six million units in 2028. According to Gartner, most AI GPUs will draw 1,000 watts of electricity by 2026, up from the roughly 650 watts on average today.

Ironically, data-center operators will use AI technology to address the power demands. “AI can be used to improve efficiency, where you’re modeling temperature, humidity, and cooling,” says Christopher Wellise, vice president of sustainability for Equinix, one of the nation’s largest data-center companies. “It can also be used for predictive maintenance.” Equinix states that using AI modeling at one of its data centers has already improved energy efficiency by 9%.

Data centers will also install more-effective cooling systems. , a leading provider of power and cooling infrastructure equipment, says that AI servers generate five times more heat than traditional CPU servers and require ten times more cooling per square foot. AI server maker Super Micro estimates that switching to liquid cooling from traditional air-based cooling can reduce operating expenses by more than 40%.

But cooling, AI efficiency, and other technologies won’t fully solve the problem of satisfying AI’s energy demands. Certain regions could face issues with their local grid. Historically, the two most popular areas to build data centers were Northern Virginia and Silicon Valley. The regions’ proximity to major internet backbones enabled quicker response times for applications, which is also helpful for AI. (Northern Virginia was home to AOL in the 1990s. A decade later, Silicon Valley was hosting most of the country’s online platforms.)

Today, each region faces challenges around power capacity and data-center availability. Both areas are years away making from the grid upgrades that would be needed to run more data centers, according to DigitalBridge, an asset manager that invests in digital infrastructure. DigitalBridge CEO Marc Ganzi says the tightness in Northern Virginia and Northern California is driving data-center construction into other markets, including Atlanta; Columbus, Ohio; and Reno, Nev. All three areas offer better power availability than Silicon Valley and Northern Virginia, though the network quality is slightly inferior as of now. Reno also offers better access to renewable energy sources such as solar and wind.

Ultimately, Ganzi says the obstacle facing the energy sector—and future AI applications—is the country’s decades-old electric transmission grid. “It isn’t so much that we have a power issue. We have a transmission infrastructure issue,” he says. “Power is abundant in the United States, but it’s not efficiently transmitted or efficiently distributed.”

Yet that was one of the prime objectives of the Smart Grid initiative which apparently is a total failure! Do you think IEEE can revive that initiative with a focus on power consumption and cooling in AI data centers?

References:

https://www.barrons.com/articles/ai-chips-electricity-usage-2f92b0f3

https://www.supermicro.com/en/solutions/liquid-cooling

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

FCC increases broadband speed benchmark (x-satellites) to 100/20 Mbit/s

The U.S. FCC voted this week to implement a 4x increase to its “broadband” benchmark, from 25/3 Mbit/s to 100/20 Mbit/s (download/upload speeds). The Commission’s Report was issued pursuant to section 706 of the Telecommunications Act of 1996. The FCC concluded “that advanced telecommunications capability is not being deployed in a reasonable and timely fashion based on the total number of Americans.”

Using the agency’s Broadband Data Collection deployment data for the first time rather than FCC Form 477 data, the Report shows that, as of December 2022:

• Fixed terrestrial broadband service (excluding satellite) has not been physically deployed to approximately 24 million Americans, including almost 28% of Americans in rural areas, and more than 23% of people living on Tribal lands;

• Mobile 5G-NR (ITU-R M.2150/3GPP Release 16) coverage has not been physically deployed at minimum speeds of 35/3 Mbps to roughly 9% of all Americans, to almost 36% of Americans in rural areas, and to more than 20% of people living on Tribal lands;

• 45 million Americans lack access to both 100/20 Mbps fixed service and 35/3 Mbps mobile 5G-NR service; and

• Based on the new 1 Gbps per 1,000 students and staff short-term benchmark for schools and classrooms, 74% of school districts meet this goal.

The Report also sets a 1 Gbps/500 Mbps long-term goal for broadband speeds to give stakeholders a collective goal towards which to strive – a better, faster, more robust system of communication for American consumers.

FCC Chairwoman Jessica Rosenworcel said in a statement discussing the agency’s new 100/20 Mbit/s benchmark.

“This fix is overdue. It aligns us with pandemic legislation like the Bipartisan Infrastructure Law and the work of our colleagues at other agencies. It also helps us better identify the extent to which low-income neighborhoods and rural communities are underserved. And because doing big things is in our DNA, we also adopt a long-term goal of 1 Gigabit down and 500 Megabits up.”

“One more thing. The law requires that we assess how reasonable and timely the deployment of broadband is in this country.”

Don’t expect much change. As noted by Engadget, U.S. Internet Service Providers (ISPs) offering speeds under the new benchmark won’t be able to call their services “broadband” on the new telecom information labels the FCC will soon begin requiring. However, ISPs and network providers are not required to hit the FCC’s new 100/20 Mbit/s speeds.

Moreover, it will not impact the NTIA’s massive $42.45 billion Broadband Equity, Access, and Deployment (BEAD) program, which already requires 100/20 Mbit/s speeds on networks receiving government subsidies.

……………………………………………………………………………………………………….

The FCC’s definition of broadband excludes satellites at a time of frenzied investments in Internet services from space. Championed by Elon Musk’s Starlink, companies ranging from Amazon to OneWeb to Telesat are planning similar low-Earth orbit (LEO) satellite constellations for space-based Internet.

Starlink’s parent company – SpaceX – this week conducted another test of its massive Starlink rocket. That rocket is in part intended to launch Starlink’s second generation satellites.

However, the FCC has excluded such satellite efforts from most of its broadband programs. For example, it rejected Starlink’s application for government funding through its Rural Digital Opportunity Fund (RDOF) program.

“It is evident that fixed wireless access (FWA) offerings already compete aggressively with traditional wired broadband services, and LEO satellite-based services are poised to do the same. Accordingly, all three should be treated as robust rivals within a single ‘home Internet’ product market,” wrote the Free State Foundation, another think tank.

According to FCC Commissioner Brendan Carr, a Republican, the agency specifically excludes Starlink from its overall efforts because he thinks President Biden dislikes SpaceX chief executive Elon Musk. “The Biden Administration is choosing to prioritize its political and ideological goals at the expense of connecting Americans,” Carr alleges.

With its roughly 5,000 satellites, Starlink currently offers median speeds of around 64 Mbit/s, according to Ookla, and counts around 2.6 million customers globally.

References:

https://docs.fcc.gov/public/attachments/DOC-401205A1.pdf

https://docs.fcc.gov/public/attachments/DOC-401205A2.pdf

BroadbandNow Research: Best & Worst States for Broadband Access

FCC proposes 100 Mbps download as U.S. minimum broadband speed

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

GAO: U.S. Broadband Benchmark Speeds Too Slow; FCC Should Analyze Small Business Speed Needs

FCC Says Broadband Deployment Lacking; Redefinition (25M/3M) Has Huge Implications for AT&T, Verizon & Comcast

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

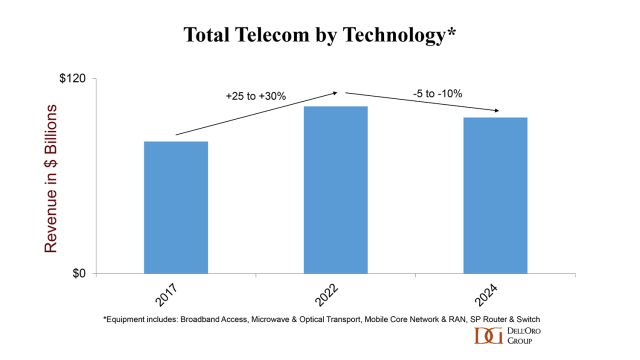

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Preliminary Dell’Oro Group data found that worldwide telecom equipment revenues across the six telecom programs tracked – Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch – declined 5% year-over-year (YoY) for the full year 2023, performing worse than expected. First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments. This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and Service Provider routers.

The North America telecom equipment market declined faster than expected. Initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth. The gains in the USD against the Yuan and the Yen are impacting USD-based equipment revenue estimates in China and Japan.

………………………………………………………………………………………………………………………………………………………………………………………………

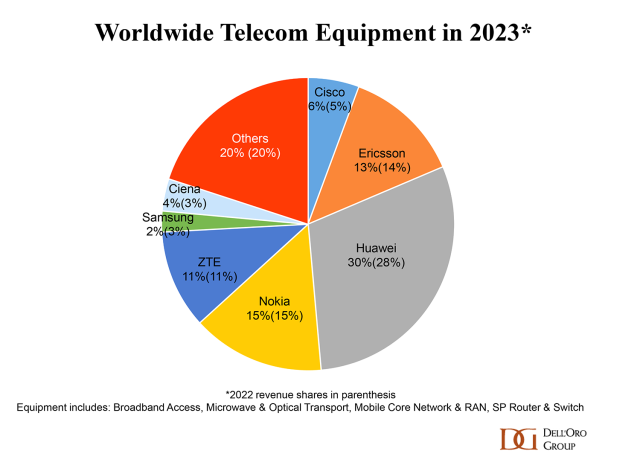

Dell’Oro says that Huawei maintained its lead as the top global telecom equipment company by revenue in 2023, despite efforts by the U.S. government and other countries to limit its addressable market and access to Android and the latest chips and semiconductor technology from TSMC. In fact, Dell’Oro’s assessment is that Huawei’s lead widened in 2023, in part because its limited exposure to the North America region was a benefit in 2023 on a relative basis.

Supplier rankings were mostly unchanged. However, vendor revenue shares shifted slightly in 2023. Still, the overall concentration has not changed – the top seven suppliers accounted for around 80% of the overall market.

Market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024. Risks are broadly balanced. In addition to currency fluctuations, economic uncertainty, and inventory normalization, there are multiple regions/technology segments that are operating in a non-steady state.

References:

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

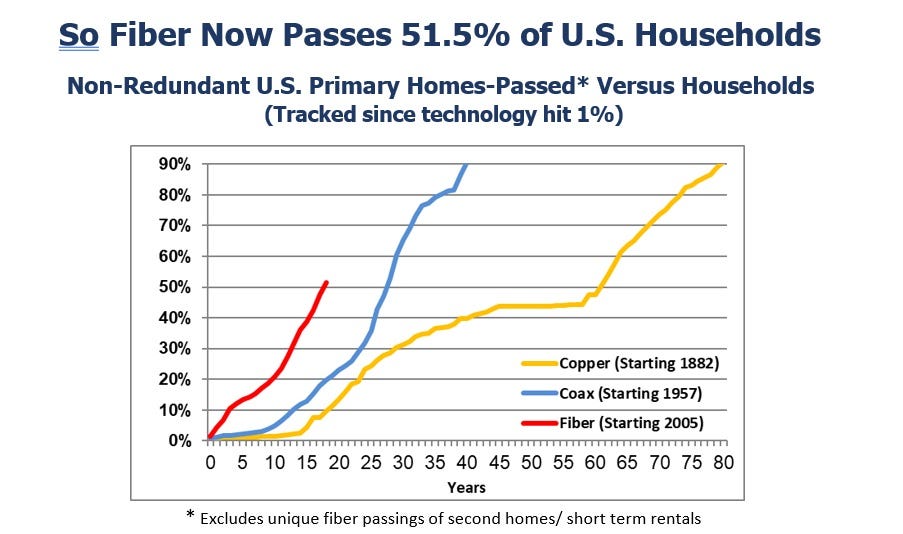

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

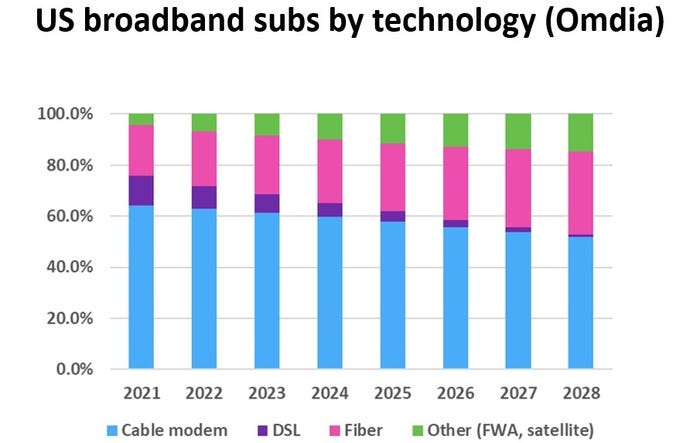

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

Nokia’s launches symmetrical 25G PON modem

Nokia today announced the launch of a new symmetrical 25G PON [1.] fiber modem. Helping to further accelerate 25G PON deployments, the compact solution can easily be installed on a wall, inside a building, or in an outdoor enclosure to immediately deliver internet speeds that are 20x faster than current gigabit solutions. Once deployed, operators can leverage their existing fiber network to offer new premium residential, business, or anyhaul services that unlock additional revenue streams.

Note 1. 25G PON, also known as 25GS PON, is a next-generation PON that offers a number of benefits. It can provide 10Gb/s services or higher, premium enterprise services, and 5G transport.

Demand for high-speed broadband access is accelerating with end-users increasingly seeking quality multi-gigabit services to power their homes and businesses. From the Metaverse and cloud gaming to cyber security, and Industry 4.0 applications, users want multi-gigabit services that can meet their evolving broadband needs.

Nokia’s new 25G PON fiber modem allows operators to establish a future-ready network that can immediately address the growing demand for more capacity and enhanced broadband services. The new 25G PON solution enables operators to quickly upgrade their existing GPON or XGS PON network to deliver true 10Gbs speeds and beyond with unprecedented ease. For enterprises, this can help significantly improve business productivity and enhance connectivity to the cloud or value-added applications located in data centers. For consumers and power users, the solution provides immediate access to additional capacity needed to support bandwidth-hungry applications such as AI, gaming, or security.

25G PON Wavelength Plan:

Image Credit: Nokia

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Geert Heyninck, General Manager of Broadband Networks at Nokia, said: “The 25G PON eco-system is growing and with it, the technology that continues to bring concrete business benefits to customers. The market for 25G PON is here and with the new fiber modem, we have a very efficient 25G solution that can support all types of services and applications in the fiber-for-everything era. 25G PON continues to be the easiest, most cost-effective and power-efficient way for services providers to upgrade and maximize the use of their existing fiber network to deliver ultra-fast broadband access.”

Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group, said: “25G PON deployments and the 25GS-PON MSA (Multi-Source Agreement) Group has grown substantially over the past year. One of the driving factors for the growing interest in 25GS-PON is its ability to coexist with GPON and XGS-PON without having to deploy additional feeder fiber, splitters, or other ODN elements. This past year we’ve seen large operators like Google indicate plans to make 25G PON service available to its customers while the MSA continues to expand, encompassing a diverse range of service providers, equipment vendors, and component suppliers.”

The new 25G PON fiber modem complements Nokia’s growing 25G PON portfolio, which includes the Lightspan FX, DF and MF fiber access platforms (OLTs) and the industry’s first 25G PON sealed fiber access node designed for cable operators.

25G PON ONT product details:

- Coexistence with GPON, XGS-PON and 50G PON on the same ODN

- Hardened and compact design for various deployment practices and environments

- Symmetrical 25 Gb/s throughput using pluggable optics

- Frequency and time-of-day synchronization functions for mobile transport

- Can be used to connect cell sites to transport mobile traffic over PON network in plug-and-play mode, delivering the required capacity, latency and synchronization required for 5G networks.

- Supports demarcation point functions for enterprise and wholesale services.

- Nokia has shipped more than one million 25G PON ready ports to date.

- 25G PON is ready to be activated in more than 150 networks worldwide.

- The eco-system for 25G PON is mature with more than 60 operators, system vendors, chipset and optical suppliers part of a MSA focused on standardizing and accelerating the technology.

- Some of the operators currently deploying 25G PON include Google Fiber, EPB, Vodafone Qatar and OGI.

- There are more than 30 operators trialing 25G PON for residential, mobile fronthaul and business connectivity applications.

References and additional information:

Nokia 25G ONT

Lightspan FX

Lightspan SF-8M sealed fiber access node

Lightspan MF fiber platform

25G PON

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Passive Optical Network (PON) technologies moving to 10G and 25G

Nokia and Proximus (Belgium) demonstrate 1st implementation of 25GS-PON