5G Americas

Cheerleading from 5G Americas contradicts disappointing financial results from 5G telcos

Chris Pearson, President of 5G Americas said,”5G continues to make significant progress throughout the world. The foundation of this new era of innovation is spectrum, standards (lack thereof?) and a growing ecosystem of key technologies that are being adopted by operators, vendors and end users.”

With 75 countries reporting 5G connections, most recent data from Omdia suggests 433 million global 5G connections were added from Q3 2021 to Q3 2022, almost doubling connections from 489 million to 922 million. Overall, those figures represent 14.4 percent sequential quarterly growth from 806 million in Q2 2022 to 921 million in Q3 2022. Global 5G connections are forecast to again accelerate in 2023, approaching 2 billion and reaching 5.9 billion by the end of 2027.

North America is a leader in the uptake of wireless 5G connections with a total of 108 million 5G and 506 million LTE connections by the end of Q3 2022. 5G penetration of the population in the North American market is approaching 30 percent, as the region added 14 million 5G connections for the quarter – a gain of 15.47 percent over Q2 2022. Overall, a total of 137 million 5G connections is projected to come from North America by the end of 2022, bolstered by strong 5G smartphone shipments in the US. IDC predicts the US 5G smartphone market will reach 118.1 million units shipped in 2022, showing a 27% increase from 2021.

Kristin Paulin, Principal Analyst at Omdia said, “There is still much more to come from 5G that will drive growth. Expanding mid-band coverage will bring a better 5G experience, balancing coverage and speed. And the standalone 5G deployments in progress will enable new applications that take 5G to the next level.”

In comparison, 4G LTE is expected to remain strong in Latin America and the Caribbean through the end of 2022. In Q3 2022, there were 530 million 4G LTE connections, representing 2.14 percent quarterly growth with the addition of 11 million new LTE subscriptions. Latin America and the Caribbean is projected to have 22 million 5G connections by year end of 2022, and 399 million by 2027.

According to Jose Otero, Vice President of Caribbean and Latin America for 5G Americas, “With over half a billion connections, 4G LTE is the foundation of mobile wireless connectivity throughout the Latin America region. Yet, as we look forward to the future, 5G will begin to play a bigger and bigger role for citizens in the region as deployments and connections increase significantly.”

Overall, the number of 5G commercial networks globally has reached 250, according to data from TeleGeography and 5G Americas. That number is expected to reach 253 by the end of 2022 and 397 by the end of 2025 representing strong 5G network investment growth in many regions throughout the world.

The number of 5G and 4G LTE network deployments as of December 14, 2022, are summarized below:

5G:

- Global: 250

- North America: 14

- Caribbean and Latin America: 28

4G LTE:

- Global: 702

- North America: 17

- Caribbean and Latin America: 131

Visit www.5GAmericas.org for more information, statistical charts, infographic and a list of LTE and 5G deployments by operator and region. Subscriber and forecast data is provided by Omdia and deployment data by TeleGeography (GlobalComm).

About 5G Americas: The Voice of 5G and LTE for the Americas

5G Americas is an industry trade organization composed of leading telecommunications service providers and manufacturers. The organization’s mission is to facilitate and advocate for the advancement and transformation of LTE, 5G and beyond throughout the Americas. 5G Americas is invested in developing a connected wireless community while leading 5G development for all the Americas. 5G Americas is headquartered in Bellevue, Washington. More information is available at 5G Americas’ website and Twitter.

5G Americas’ Board of Governors Members include Airspan Networks Inc., Antel, AT&T, Ciena, Cisco, Crown Castle, Ericsson, Intel, Liberty Latin America, Mavenir, Nokia, Qualcomm Incorporated, Samsung, Shaw Communications Inc., T-Mobile US, Inc., Telefónica, VMware, and WOM.

Contacts

5G Americas

Viet Nguyen

+1 206 218 6393

[email protected]

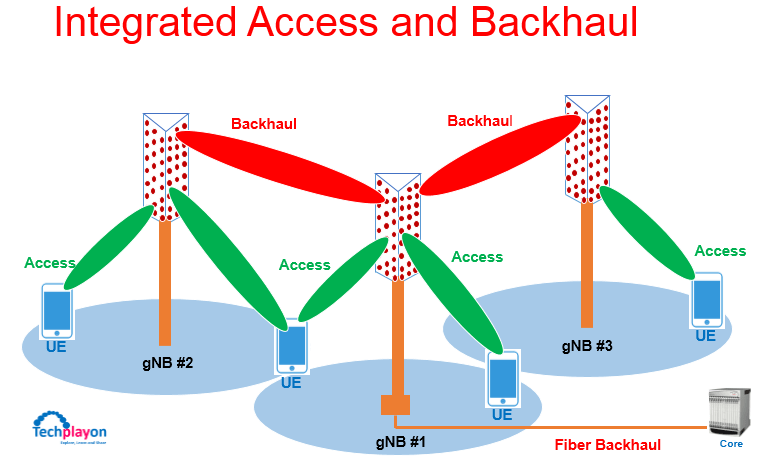

AT&T and Verizon to use Integrated Access and Backhaul for 2021 5G networks

AT&T sketched out its plans to start testing Integrated Access and Backhaul (IAB) technology during 2020, saying it can prove a reliable backhaul alternative to fiber in certain cases, such as expanding millimeter-wave locations to reach more isolated areas. Verizon also confirmed, without adding any details, that it plans to use IAB, which is an architecture for the 5G cellular networks in which the same infrastructure and spectral resources will be used for both access and backhaul. IAB will be described in 3GPP Release 16 (see 3GPP section below for more details).

…………………………………………………………………………………………………………………………………………..

“Fiber is still required in close proximity to serve the capacity coming from the nodes, so if it can be extended to each of the nodes, it will be the first choice,” said Gordon Mansfield, VP of Converged Access and Device Technology at AT&T. in an statement emailed to FierceWireless.

“From there, IAB can be used to extend to hard to reach and temporary locations that are in close proximity. As far as timing, we will do some testing in 2020 but 2021 is when we expect it to be used more widely,” he said.

Verizon also told Fierce that it has plans to incorporate IAB as a tool. It doesn’t have any details to share at this time, but “it’s certainly on the roadmap,” an unknown Verizon representative said.

Earlier this year, Mike Dano of Lightreading reported:

Verizon’s Glenn Wellbrock said he expects to add “Integrated Access Backhaul” technology to the operator’s network-deployment toolkit next year, which would allow Verizon to deploy 5G more easily and cheaply into locations where it can’t get fiber.

“It’s a really powerful tool,” Glenn Wellbrock, director of architecture, design and planning for Verizon’s optical transport network, explained during a keynote presentation here Thursday at Light Reading’s 5G Transport & the Edge event.

Wellbrock said IAB will be part of the 3GPP’s “Release 16” set of 5G specifications, which is expected to be completed by July 2020. However, Wellbrock said it will likely take equipment vendors some time to implement the technology in actual, physical products. That means 2020 would be the earliest that Verizon could begin deploying the technology, he added.

Wellbrock said IAB would allow Verizon to install 5G antennas into locations where routing a fiber cable could be difficult or expensive, such as across a set of train tracks.

However, Wellbrock said that IAB will be but one tool in Verizon’s network-deployment toolbox, and that Verizon will continue to use fiber for the bulk of its backhaul needs. Indeed, he pointed out that Verizon is now deploying roughly 1,400 miles of new fiber lines per month in dozens of cities around the country.

He said Verizon could ultimately use IAB in up to 10-20% of its 5G sites, once the technology is widely available. He said that would represent an increase from Verizon’s current use of wireless backhaul technologies running in the E-band; he said less than 10% of the operator’s sites currently use wireless backhaul. He said IAB is better than current wireless backhaul technologies like those that use the E-band because it won’t require a separate antenna for the backhaul link. As indicated by the “integrated” portion of the “integrated access backhaul” moniker, IAB supports wireless connections both for regular 5G users and for backhaul links using the same antenna.

………………………………………………………………………………………………………………………………………..

According to 5G Americas, the larger bandwidths associated with 5G New Radio (NR), such as those found in mmWave spectrum, as well as the native support of massive MIMO and multi-beams, are expected to facilitate and/or optimize the design and performance of IAB.

5G Americas maintains that the primary goals of IAB are to:

- Improve capacity by supporting networks with a higher density of access points in areas with only sparse fiber availability.

- Improve coverage by extending the range of the wireless network, and by providing coverage for isolated coverage gaps. For example, if the user equipment (UE) is behind a building, an access point can provide coverage to that UE with the access point being connected wirelessly to the donor cell.

- Provide indoor coverage, such as with an IAB access point on top of a building that serves users within the building.

5G Americas also said that in practice, IAB is more relevant for mmWave because lower frequency spectrum may be seen as too valuable (and also too slow) to use for backhaul. The backhaul link, where both endpoints of the link are stationary, is especially suitable for the massive beam-forming possible at the higher frequencies.

……………………………………………………………………………………………………………

3GPP Release 16 status of work items related to IAB:

(Note: Study is 100% complete, but others are 0% or 50% complete):

| 750047 | FS_NR_IAB | … Study onNR_IAB | 100% |

| 820170 | NR_IAB-Core | … Core part: NR_IAB | 0% |

| 820270 | NR_IAB-Performance | 850002 | – | … CT aspects of NR_IAB | 0% |

| 830021 | FS_NR_IAB_Sec | … Study on Security for NR_IAB | 50% |

| 850020 | – | … Security for NR_IAB | 0% |

| 850002 | – | … CT aspects of NR_IAB | 0% |

References:

https://www.fiercewireless.com/wireless/at-t-expects-to-test-iab-2020-use-it-more-widely-2021

5G Americas: LTE & LPWANs leading to ‘Massive Internet of Things’ + IDC’s IoT Forecast

A new by 5G Americas whitepaper, titled “LTE Progress Leading to the 5G Massive Internet of Things”is an overview of the technological advancements that will support the expanding IoT vertical markets, including connected cars and wearables. The term Massive IoT (MIoT) has been recently created by the telecom industry to refer to the connection for potentially large number of devices and machines that will call for further definition in the standards for LTE and later for 5G.

The generic requirements for IoT are low cost, energy efficiency, ubiquitous coverage, and scalability (ability to support a large number of connected machines in a network). To legacy operators, IoT services should ideally be able to leverage their existing infrastructure and co-exist with other services. In the 3GPP Release

13 standard, eMTC and NB-IoT were introduced. These technologies met the above generic IoT requirements. They support in-band or guard band operations. Device cost and complexity are reduced. A large quantity of IoT devices can be supported in a network while battery life is extended. Many of the related features were covered in the 5G Americas whitepaper, LTE and 5G Technologies Enabling the Internet of Things.

Jean Au, staff manager, technical marketing, Qualcomm Technologies, and co-leader of the whitepaper said: “Some cellular service providers in the U.S. are already adding more IoT connections than mobile phone connections, and the efforts at 3GPP in defining standards for the successful deployment of a wide variety of services across multiple industries will contribute to the growing success for consumers and the enterprise.”

At present, low-power wide area networks (LPWANs) are already gaining popularity and it is expected that cellular-based technologies including LTE-M (Machine) and Narrowband-IoT (NB-IoT) will emerge as the foremost standards for LPWA by 2020.

Wireless network operators will have the option to choose from several Cellular IoT (CIoT) technologies depending on their spectrum portfolio, legacy networks and requirements of the services they offer.

Vicki Livingston, head of communications, 5G Americas, said:

“There will be a wide range of IoT use cases in the future, and the market is now expanding toward both Massive IoT deployment as well as more advanced solutions that may be categorized as Critical IoT.”

According to Research and Markets, the global IoT platform market will grow at a CAGR of 31.79 percent from 2017 to 2021. The large number of active IoT devices collect data through sensors and actuators and transmit the back to a centralized location. The IoT platform empowers the end-user to make informed decisions using the data. Together with design innovations in 5G architectures, cloud-native edge computing platforms ensure Industrial IoT (IIoT) applications can be run in a cost-effective manner.

References:

http://www.5gamericas.org/files/3514/8121/4832/Enabling_IoT_WP_12.8.16_FINAL.pdf

………………………………………………………………………………………

Addendum: IDC’s IoT Forecast

Worldwide spending on the Internet of Things (IoT) is forecast to reach $772.5 billion in 2018, an increase of 14.6% over the $674 billion that will be spent in 2017. A new update to the International Data Corporation (IDC) Worldwide Semiannual Internet of Things Spending Guide forecasts worldwide IoT spending to sustain a compound annual growth rate (CAGR) of 14.4% through the 2017-2021 forecast period surpassing the $1 trillion mark in 2020 and reaching $1.1 trillion in 2021.

IoT hardware will be the largest technology category in 2018 with $239 billion going largely toward modules and sensors along with some spending on infrastructure and security. Services will be the second largest technology category, followed by software and connectivity. Software spending will be led by application software along with analytics software, IoT platforms, and security software. Software will also be the fastest growing technology segment with a five-year CAGR of 16.1%. Services spending will also grow at a faster rate than overall spending with a CAGR of 15.1% and will nearly equal hardware spending by the end of the forecast.

“By 2021, more than 55% of spending on IoT projects will be for software and services. This is directly in line with results from IDC’s 2017 Global IoT Decision Maker Survey where organizations indicate that software and services are the key areas of focused investment for their IoT projects,” said Carrie MacGillivray, vice president, Internet of Things and Mobility at IDC. “Software creates the foundation upon which IoT applications and use cases can be realized. However, it is the services that help bring all the technology elements together to create a comprehensive solution that will benefit organizations and help them achieve a quicker time to value.”

The industries that are expected to spend the most on IoT solutions in 2018 are manufacturing ($189 billion), transportation ($85 billion), and utilities ($73 billion). IoT spending among manufacturers will be largely focused on solutions that support manufacturing operations and production asset management. In transportation, two thirds of IoT spending will go toward freight monitoring, followed by fleet management. IoT spending in the utilities industry will be dominated by smart grids for electricity, gas, and water. Cross-Industry IoT spending, which represent use cases common to all industries, such as connected vehicles and smart buildings, will be nearly $92 billion in 2018 and rank among the top areas of spending throughout the five-year forecast.

“Consumer IoT spending will reach $62 billion in 2018, making it the fourth largest industry segment. The leading consumer use cases will be related to the smart home, including home automation, security, and smart appliances,” said Marcus Torchia, research director, Customer Insights & Analysis. “Smart appliances will experience strong spending growth over the five-year forecast period and will help to make consumer the fastest growing industry segment with an overall CAGR of 21.0%.”

Asia/Pacific (excluding Japan) (APeJ) will be the geographic region with the most IoT spending in 2018 – $312 billion – followed by North America (the United States and Canada) at $203 billion and Europe, the Middle East, and Africa (EMEA) at $171 billion. China will be the country with the largest IoT spending total in 2018 ($209 billion), driven by investments from manufacturing, utilities, and government. IoT spending in the United States will total $194 billion in 2018, led by manufacturing, transportation, and the consumer segment. Japan ($68 billion) and Korea ($29 billion) will be the third and fourth largest countries in 2018, with IoT spending largely driven by the manufacturing industry. Latin America will deliver the fastest overall growth in IoT spending with a five-year CAGR of 28.3%.

The Worldwide Semiannual Internet of Things Spending Guide forecasts IoT spending for 14technologies and 54 use cases across 20 vertical industries in eight regions and 53 countries. Unlike any other research in the industry, the comprehensive spending guide was designed to help vendors clearly understand the industry-specific opportunity for IoT technologies today.

https://www.idc.com/getdoc.jsp?containerId=prUS43295217