Calix

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Broadband wireline network operators (telcos and MSOs/cablecos) have cutback on CAPEX with decreased spending for network equipment. In its latest earnings call, Calix warned that broadband operator spending might not increase until 2025, when BEAD subsidies have been allocated. However, fiber vendor Corning and others suggested spending might increase earlier than that.

Calix specializes in providing optical network access equipment to smaller broadband service providers and has seen significant revenue growth in recent years, but near-term growth will be challenged. Calix management’s guidance was that the 2024 fiscal year will be soft for its business. Despite that softness, the company still believes that it has years of growth ahead for itself starting in 2025 due to BEAD regulatory stimulus that should prove beneficial for the enterprise.

The U.S. government’s BEAD program promises to funnel a massive $42 billion in subsidies through US states to telecom companies willing to build networks in rural areas. However, allocation of those funds is taking longer than expected, forcing network operators to stall their deployment plans until they have a better sense of how much funding they might get.

“We have seen a significant broadening in the number of customers interested in competing for BEAD [Broadband Equity Access and Deployment program] funds. Today, nearly all our customers are either assembling a BEAD strategy or actively pursuing funds,” Calix CEO Michael Weening said during the company’s quarterly earnings call, according to Seeking Alpha.

“While they do this, they slow their new [network] builds as BEAD money could be used instead of consuming their own capital, and thus, we’ll slow our appliance shipments until decisions are made and funds are awarded,” Weening said. “At that point, the winners will move ahead and those who decided to skip the BEAD program or did not receive BEAD funding, we’ll begin investing to ensure that the winner does not impinge on their market. This represents a delay but also represents a unique opportunity for Calix.”

……………………………………………………………………………………………………..

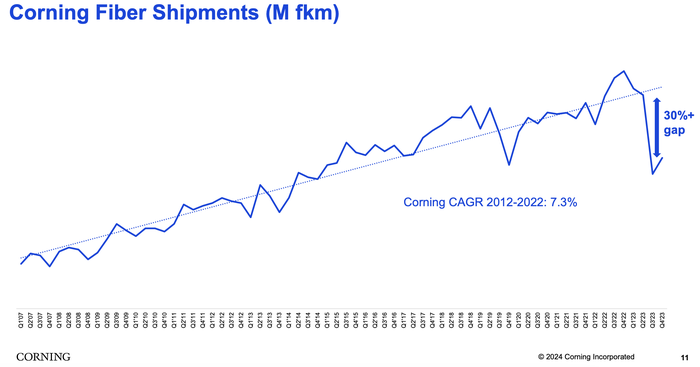

Corning manufactures and sells most of the physical fiber cabling used in U.S. fiber networks. Sales in Corning’s optical business unit – which houses its fiber products – continued to slide in the fourth quarter of 2023.

“We anticipate optical communications sales will spring back because we believe and our carrier customers have confirmed that they purchased excess inventory during the pandemic and that they’ve been utilizing this inventory to continue deploying their networks,” said Corning CEO Wendell Weeks during his company’s quarterly earnings call, according to Seeking Alpha.

“We believe these carriers will soon deplete their inventory and execute on the increased broadband deployment plans they’ve communicated to us over the last several months,” Weeks said. “As a result, we expect them to return to their normal purchasing patterns to service their deployments.”

He also noted that operators are waiting for BEAD funding. “We continue to expect BEAD funding really to start to translate into demand, the beginning of it, sort of late this year. They are progressing with awarding the grants and it will just take a bit for those to turn into real programs,” Weeks said.

Weeks suggested that the company is starting to see the glimmer of an uptick in demand from its broadband operator customers, but nothing definite yet. “We’ll know more in the coming months,” he said in his concluding remarks.

Meanwhile, executives at vendor Harmonic said this week they expect sales in the first half of this year to be relatively soft and then accelerate in the second half of the year as operators start to ramp up network upgrades, including moves to DOCSIS 4.0 technologies.

Calix touts GigaSpire as smart home solution for ISPs

To do so, broadband Internet providers will need to go to battle with a wide variety of companies who are now aiming to capture growing smart home revenue as their own, including blue chip technology companies like Google and Amazon. Those two are joined by a growing number of device manufacturers from well known brands like Netgear and Linksys to emerging smart home ecosystem enablers like Ring and Iris.

Patching all of these platforms together can be challenging and frustrating to end customers, and service providers often get the brunt of this frustration in the form of tech support inquiries, whether it’s the provider’s fault or not. Many providers have ventured into managed Wi-Fi services to help curtail this issue, while hoping to generate additional revenue in the process. GigaSpire takes this strategy much further, according to Calix.

In an analyst briefing, Calix EVP of Field Operations Michael Weening says GigaSpire far surpasses any Wi-Fi gateway platform that end customers can buy from any retail or online environment.

GigaSpire Platform (Source: Calix)

………………………………………………………………………………………………………………………………………………………………………………………………………..

GigaSpire runs Calix’s EXOS operating system, which was introduced last year and extends their AXOS access operating system platform into the customer premises. Other GigaSpire features include:

- Wi-Fi 6 (802.11ax) capable, with up to 12 Wi-Fi streams

- Intelligent bandwidth optimization using MU-MIMO technology

- Universal and managed IoT supporting Zigbee, ZWave, combo BlueTooth Low-Energy and BlueTooth Classic

- Amazon Alexa is integrated into the GigaSpire MAX

- Instrumentation and analytics providing telemetry, performance and behavioral analytics that CSPs can leverage through the Calix Cloud

Calix also intends to build an ecosystem of smart home applications that will ride the GigaSpire platform, allowing service providers to offer and perhaps monetize smart home IoT applications. Examples provided include smart home device management, home security and network security.

Two Calix customers are acting as launch customers for GigaSpire, including Nebraska-based Allo Communications and Dubai-based du.

“Calix has been a great partner as we’ve built up our home Wi-Fi enabling the best connectivity but also the best customer service through ongoing network management,” said Brad Moline, president and CEO of ALLO Communications in press release. “This new smart home solution is anticipated to build on that connectivity advantage and really put it to use by delivering customized and differentiated service bundles to our subscribers.”

Smart Home-as-a-Service Goals

Calix’s goal with GigaSpire is to create an end-to-end smart home platform that service providers can take to the residential market and offer smart home-as-a-service. Whether that’s through better integration of existing smart home applications customer’s already have, or by introducing new ones through a smart home app ecosystem enabled through Calix designated partners. Calix will extend the GigaSpire platform to the SMB segment with a business focused smart IoT platform in 2019.

References:

Verizon to deploy NG-PON2 in Tampa, FL using Calix network equipment

Verizon will initiate its NG-PON2 deployments in Tampa, FL, with Calix network equipment. The telco is expected to use the technology for higher-speed enterprise broadband, small-cell and fixed wireless backhaul. “We’re looking at this platform to cover residential, business and wireless carriers,” said Verizon’s Vincent O’Byrne.

Verizon and other carriers are expected to use NG-PON2 to support higher-speed business services, as well as backhaul for small cell networks. In Verizon’s case, the technology also will be used to provide backhaul for fixed wireless, according to O’Byrne.

“As we go forward, we’re looking at this platform to cover residential, business and wireless carriers,” said O’Byrne. NG-PON2 will be the access portion of Verizon’s vision for the “intelligent edge” network, which also will comprise unified transport and core network changes, he said. “NG-PON2 is the part that hits customers,” he added.

Although the Tampa, FL NG-PON2 deployment will use equipment from Calix, Verizon continues to test a second supplier in the lab, O’Byrne said.

Verizon NG-PON2

Vincent O’Byrne

The NG-PON2 equipment that service providers initially will deploy will support four wavelengths, but providers can turn up just a single wavelength to start or can add an additional four wavelengths in the future, O’Byrne said.

Each wavelength can support 10 Gbps in each direction, supporting speeds of up to 8.5 Gbps for customer traffic. NG-PON2 standards specify a bonding option that would enable a service provider to combine multiple wavelengths together to support a single higher-speed connection, he explained.

Verizon has been testing NG-PON2 in the laboratory for several years. The Tampa customer trials, which will run for about three months, will make sure the carrier has the IT systems in place to support the offering, O’Byrne noted. A key function that will be examined is the ability to move services between wavelengths — a capability that will provide added protection from the consumer perspective and will enable Verizon to load balance. O’Byrne noted that during light traffic periods, Verizon might reduce the amount of power used by shifting customers to a single wavelength and turning off some line cards.

“You would have to be within Verizon to see the amount of positivity that is there that is similar to when we started to launch FiOS,” said O’Byrne, in an interview with Light Reading.

“We have a lot of big initiatives. These are exciting times. We do see ourselves on a positive cusp or tide of deploying new technologies and making a lot of changes to the network.” Vincent O’Byrne in an earlier video interview with Broadband World News. Vincent O’Byrne in an earlier video interview with Broadband World News. Those changes fit into what Verizon calls its Intelligent Network Edge strategy, designed to simplify and reduce costs across its network by eliminating the need for three separate network infrastructures and also speed its ability to deliver higher-speed services and bring fiber backhaul to the growing set of antennas that 5G deployment will require. Verizon had named two vendors for NG-PON 2 — ADTRAN Inc. and Calix.

It’s now moving forward initially with Calix because that vendor “was, from a timeline perspective, ahead and ready to go out and we have a need to get this deployment out there,” O’Byrne said.

Calix CEO and President Carl Russo shares O’Byrne’s excitement about what this move might mean for the bigger market. He credits Verizon with being willing and able to move quickly in adopting not just a new PON technology but a new overall approach to access networks. “When someone like Verizon, who is known for technical leadership and engineering orientation starts to deploy, it’s kind of like firing off the starting gun to the market saying, ‘Okay guys, this technology is go,’ ” he says in an interview.

“That doesn’t mean everybody rushes to it, it means you now have that legitimacy, that this is a production choice [operators] can make, as opposed to, ‘I’m not quite sure it’s ready.’ Now the market begins.”

Russo was impressed with the speed at which Verizon is working and the Agile processes it is using. “It has been an interesting partner approach because they have functioned as an Agile partner, it has been quite enjoyable,” he says. “It’s been hard, too, but they have engaged in a way that a lot of large customers find difficult to engage. There is a lot more exciting stuff coming, this market is real and it is going to get realer.” Verizon isn’t saying where it will initially deploy NG-PON 2 in Tampa because that will be a marketing decision, O’Byrne says, and will be driven by customer demand. Because NG-PON 2 can use the same physical fiber infrastructure that is already in use by GPON, Verizon will choose to deploy where customers need more than 1 Gbit/s service, he says. Because it’s newer, NG-PON 2 technology costs more than GPON, but those costs are offset by savings in many areas, as part of the transition to an intelligent edge and software-defined access.

For example, the AXOS E9-2 Intelligent Edge System combines subscriber management, aggregation and optical line terminal (OLT) functions into a single box, which offers both power and space savings and significant operational efficiencies, including greater automation, O’Byrne says. The net result is speeds up to 40 Gbit/s throughput and tunable optics for essentially the same cost. “The ability to move all three service sets into one box saves us an inordinate amount of money from processing, and just the ability to increase the speed at which we can provision systems reduces our OSS complexities that we would have,” O’Byrne says.

“That is why this overall intelligent edge network, we kind of see it as a big emphasis within the company.”

The Verizon executive says the company is continuing to work in the labs with Adtran. He calls it “standard practice” to work with two vendors, and move forward first with one and then the other. Thanks to the interoperability trial work that Verizon has already done, producing the Verizon OMCI specification — which is being incorporated into the ITU-T G.988 standard — Calix and Adtran gear will have common interfaces, he says. (See Verizon Proves NG-PON2 Interoperability). For Calix, however, this does represent market validation of its five-year journey to become a software platform company, Russo said.

“This helps people understand just how much that transformation has been completed,” he says. “AXOS being deployed at this level should make it clear what is going on with us, as a platform software company.” When Verizon was doing OSS work on FiOS we were working with the group in Tampa to make it operational. They were doing all the development there. That is consistent with your post Carol. The real question is this part of the rollout of 5G or is it a residential play. My guess is the former. Verizon was quiet open about the services to be offered when FiOS rolled out.

According to a Verizon spokesman, the company still has facilities in Tampa, and that is where they are doing the production testing of the systems and the various technology elements involved in the Intelligent Edge Network, including NGPON2. As Vincent O’Byrne says in the story, the company hasn’t publicly announced what services it will be offering as that is a marketing choice. The spokesman says that “over time we expect to support residential, business and wireless use cases. Once the testing is completed, I expect we’d have more to announce in terms of details.”

While the backhaul connection to the central office for GPON is 2.5 Gbps, that number rises to as much as 80 Gbps for NG-PON2, explained Calix CEO Carl Russo in a separate interview. But “that’s actually not the big thing” about NG-PON2, according to Russo. The big thing, he said, is “all the wavelengths and what they can do for you.”

The way Calix thinks about NG-PON2, he said, is that “it delivers the physical layer we’ve been in pursuit of for 10 years.”

The “efficiency of a shared PON,” he said, includes “the ability of a wavelength to run in a non-shared fashion – you can basically have a point-to-point connection.”

NG-PON2, he said, could be thought of as “the physical layer for unified access.”

Carl Russo

Calix had to make some modifications to its existing NG-PON2 equipment to meet Verizon’s needs for its converged access network, Russo noted. A key requirement was the ability to switch wavelengths on the fly in less than 25 milliseconds.

“That is a very challenging target to hit,” Russo said.

According to Russo, Verizon also will use Calix’s AXOS software-based management system to support “always on” operation. Modifications can be made to the network without taking the network out of service, Russo said.

Russo expects to see carriers deploying both GPON and NG-PON2 for years to come. The technology that may get squeezed is XGS-PON – an alternative approach to boosting FTTP speeds and capacity that adds only a single wavelength to existing PON infrastructure and which some people viewed as an intermediate technology until NG-PON2 was available, he said.