Ethernet Access Device (EAD)

IHS Markit: Enterprises Evaluating SD-WAN; Ethernet Access Device Market up 8% YoY

Companies Evaluating SD-WAN As Enterprises Embrace the Cloud, IHS Markit Survey Says

LONDON (April 25, 2018) – IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions, today released findings from its WAN Strategies North American enterprise survey, which reviews the evolving requirements for wide-area networks (WANs) of medium-to-large companies, including the adoption of software-defined WAN (SD-WAN). Nearly three-quarters (74 percent) of respondents conducted SD-WAN lab trials in 2017; by 2018, many will move into production trials and then to live production.

The latest annual survey of network managers from IHS Markit shows that investments in WANs continue unabated, driven by traffic growth, company expansion, adoption of the Internet of things (IoT), the need for greater control over the WAN, and the need to put WAN costs on a sustainable path. Security in particular is the number one network change by a wide margin, and the top reason to invest in new infrastructure, as companies must fend off the constant threat of cyber attacks.

“As companies shift a greater portion of their IT infrastructure into the cloud, and expand their physical presence to go after new markets or be closer to customers and partners, the need for reliable, secure and high-performance WAN and internet connectivity has never been greater,” saidMatthias Machowinski, senior research director for enterprise networks at IHS Markit. “However, companies don’t have unlimited budgets to fund growing WAN bandwidth consumption, which is why a majority are planning to deploy software-defined WAN in the next three years, to better control how their WANs are used.”

Following are some additional data points from the survey:

- Respondents expect their WAN bandwidth usage to grow over 20 percent annually — data center usage is the highest, while branch offices are experiencing the highest growth, at nearly 30 percent per year.

- Reflecting the significant demands placed on WANs, total WAN expenditures rose nearly 20 percent annually, to reach $300,000 per respondent in 2017.

- 71 percent of respondents will use off-premises cloud service providers by 2018, which will become the top application strategy in 2018.

………………………………………………………………………………………………………………

Ethernet access device market up 8 percent year over year in 2017

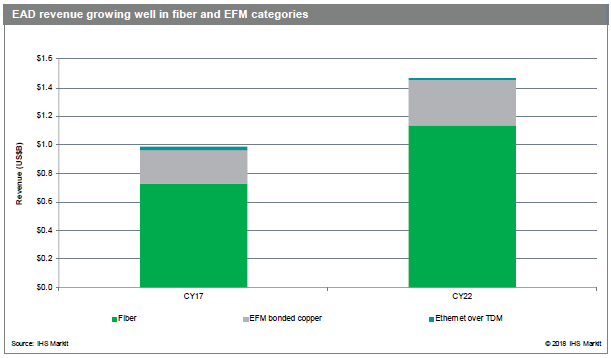

Worldwide Ethernet access device (EAD) revenue totaled $987 million in 2017, increasing 8 percent over 2016. The market is forecast to reach $1.47 billion in 2021, achieving a 2017–2022 compound annual growth rate (CAGR) of 8 percent.

“The EAD market is growing as a direct reflection of the continuous, steady demand from operators for mobile backhaul and wholesale services — and from business, broadband and building applications,” said Richard Webb, associate director, mobile backhaul and small cells research at IHS Markit.

“A new sub-segment is beginning to make an impact in the EAD market: the universal CPE, or ‘uCPE’ — a device that provides a ‘pico cloud’ of computing, storage and switching capable of executing virtualized functions,” Webb said. “Still, there will be an ongoing role for EADs even as virtual CPE takes off.”

Additional EAD market highlights

- Increasing demand for fiber-connected EADs will be the main driver of the market though at least 2022; in 2017, there was a 6 percent increase in the fiber segment

- Ciena was number one in EAD revenue market share for 2017, followed by ADVA, RAD, Actelis and MRV

- North America remained the largest market for EADs in 2017, with 50 percent of EAD revenue; Europe, the Middle East and Africa (EMEA) had 24 percent, Asia Pacific held 20 percent and the Caribbean and Latin America (CALA) had 6 percent

- For now and in the foreseeable future, North America maintains its lead through the early adoption of higher-capacity ports over fiber

Ethernet Access Devices Market Tracker

The biannual EAD report from IHS Markit tracks fiber and copper (EFM bonded and EoTDM bonded) Ethernet access devices by port speed, form factor and application. It also tracks uCPE. The report provides worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends.

FCM9003: Ethernet Access Device solution

Image courtesy of Metrodata in the U.K.

……………………………………………………………………………………………………….

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.