Huawei

Huawei Connect 2022: It’s Cloud Native everything!

Huawei’s annual flagship event, Huawei Connect 2022 –“Unleash Digital” opened in Bangkok, Thailand today.

- Ken Hu, the Rotating Chairman of Huawei, spoke about the importance of cloud adoption for enterprises to achieve leap-forward development.

- Zhang Ping’an, CEO of Huawei Cloud, announced the launch of two new Huawei Cloud regions in Indonesia and Ireland, as well as the “Go Cloud, Go Global” program for enterprises to access expertise and experience from Huawei Cloud’s global ecosystem partners.

- By the end of this year, Zhang said that Huawei Cloud will be deployed in 29 regions and 75 availability zones, covering 170 countries and regions worldwide. At the core of its offering is Everything as a Service built on a cloud-native foundation to enable enterprises to innovate faster and accelerate digital transformation.

Zhang Ping’an, CEO of Huawei Cloud

Editor’s Note: The top four Cloud service providers in China are Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu. That’s very different from the U.S. where the leaders are Amazon AWS, Microsoft Azure, and Google Cloud.

Huawei Cloud has already set up 13 localized service centers in the Asia Pacific, with more than 1,000 certified engineers to provide tailored services. In addition, ecosystem development has been fruitful, with more than 2,500 local partners generating more than 50% of the revenue of Huawei Cloud. Huawei Cloud is also forging ahead with industry-government-academia collaboration in the Asia Pacific. Investment in the Huawei ASEAN Academy and the Seeds for the Future Program will be used to cultivate more than 1 million digital experts over the next five years.

Huawei Cloud serves 80% of the 50 biggest Internet companies in China and more than 200 major Internet companies in the Asia Pacific. In Sarawak, Malaysia, Huawei Cloud, together with its partners, has built cloud native infrastructure to support the collaboration of more than 30 government departments in five fields, and provided more than 80 digital government and smart city services to ensure more efficient and better-informed decision-making. In Indonesia, Huawei Cloud has provided a unified data foundation to help CT Corp migrate its media, retail, and finance services to the cloud, enabling precise recommendations for 200 million Internet users. The cloud native technologies of Huawei Cloud have helped Siam Commercial Bank (SCB) in Thailand quickly roll out its digital loan service. Loan approval and issuance, which used to take one month of work, is now fully automated and can be completed in just five minutes.

…………………………………………………………………………………………………………………………………………… …..

To address this pain point and unleash digital productivity for thousands of industries, Zeng Xingyun, President of Huawei Cloud, APAC, shared a three-pronged approach: to act with strategic resolve, embrace cloud-native and cultivate digital talent.

Zeng Xingyun, President of Huawei Cloud, APAC

Zeng emphasized long-term planning and a top-down approach to drive collaboration between IT and business departments to modernize blueprints and architecture based on cloud-native technologies. With 90% of enterprises in developed countries already using cloud technologies and 80% of all applications to be cloud-native by 2023, Zeng noted that cloud-native delivers efficient use of resources, agile applications, intelligent services and a secured system that helps government and enterprises stay compliant and grow sustainably.

In his speech, Zeng noted that Huawei Cloud has served more than 200 top Internet enterprises in Asia Pacific and 80% of the top 50 Internet enterprises in China. Huawei Cloud has 13 service centers in Asia Pacific, but more notably, Huawei Cloud is the first public cloud vendor to build local nodes in Thailand, with three availability zone data centers serving the local market.

He spoke about how cloud-native drives digital transformation in public and private sector, elaborating on how Huawei Cloud supports Siam Commercial Bank’s (SCB) automated processes to approve large volumes of loan requests within minutes, helping SCB attract 45,000 digital users and a credit limit worth THB 204 million within a quarter.

He also highlighted the importance of a talent ecosystem to address a digital talent shortage amounting to 47 million by 2030 in Asia Pacific. Through industry-academia cooperation such as the ASEAN Academy and the Seeds for the Future Program, more than 1 million digital talents will be cultivated in the next five years. Meanwhile, the Huawei Cloud Startup Program, aimed to help regional startups adopt cloud agilely, has already attracted more than 120 Asian enterprises since its recent launch. One such enterprise is ReverseAds, a Phuket-founded startup that has successfully secured US$24 million in funding to expand beyond Thailand.

The summit also saw the joint launch of Cloud Native Elite Club (CNEC) APAC by Huawei Cloud and Cloud Native Computing Foundation (CNCF). First established in China two years ago, CNEC gathers over 200 members working collaboratively to develop industry standards and promote cloud-native technologies in China. Likewise, the APAC branch will look to further cloud-native technologies.

Cloud-Native 2.0 for Industry Enablement:

An important driving force for service innovation, cloud-native technologies such as container, microservice, and dynamic orchestration empower enterprises to build and run scalable applications in modern, dynamic environments.

As cloud-native enters a new developmental stage, Fang Guowei, Chief Product Officer of Huawei Cloud, shared that Cloud Native 2.0 is a new phase for the intelligent upgrade of enterprises, focused on delivering Everything as a Service incorporating Infrastructure as a Service, Technology as a Service and Expertise as a Service to yield breakthroughs in digital transformation for government and enterprises.

An advocate of cloud-native innovations with open source, Huawei Cloud has contributed to the CNCF with open source projects including KubeEdge, Volcano and Karmada, hence growing the CNCF community from 1 Kubernetes project in 2015 to more than 20 categories and over 1,100 projects today.

Huawei Cloud delivers cost-effective cloud services with the innovative full-stack QingTian Architecture, featuring ultra-fast I/O engine, end-to-end security and enhanced operations and maintenance.

Adding to its offerings are more than 15 cloud-native products and services introduced to the global market for the first time. Elaborating on two core cloud-native innovations, Fang introduced the Cloud Container Engine (CCE) Turbo as a new cloud-contained engine that yields increased resource utilization, reduced access latency by up to 40%, and scale out 3,000 pods per minute to cope with traffic surges.

He also featured the Ubiquitous Cloud-Native Service (UCS), a distributed cloud-native service that allows enterprises to connect thousands of Kubernetes clusters to deliver a consistent experience through multi-cloud, cross-region applications.

Introductions were made to new services based on four pipelines: ModelArts to help AI developers effectively achieve one-stop data-tagging/model training; DataArts for an efficient and intelligent data governance pipeline; DevCloud for a secure and productive software development pipeline; and MetaStudio to provide better media experience. Other upcoming offerings include MacroVerse aPaaS such as KooMessage, KooSearch and KooGallery.

Fang also took the opportunity to release the Cloud-Native 2.0 Architecture White Paper to help enterprises embark on digital transformation.

Articulating the impact of Huawei Cloud’s innovations on industries, Hu cited AI adoption in the Pangu Drug Molecule Model to yield faster drug discovery for the First Affiliated Hospital of Xi’an Jiaotong University – successfully reducing R&D costs by 70% and development to approval time from a decade to a month for the world’s first broad-spectrum antimicrobial drug.

As one global network, Huawei Cloud has launched more than 240 cloud services, aggregating more than 38,000 partners and 3 million developers to release more than 7,400 applications in the cloud market.

With cloud-native technologies becoming a key engine to unleash digital productivity, Huawei Cloud demonstrates a commitment to harness cloud-native, Everything as a Service to spur economies.

References:

China to accelerate 5G roll-outs while FCC faces “rip and replace” funding shortfall

China Daily reports that local governments in China are doubling down on plans to accelerate 5G rollouts in 2022. More than 20 provincial and municipal governments in China have emphasized efforts to accelerate construction of “new infrastructure” like 5G and data centers in their work plans for this year.

Shanghai plans to build more than 25,000 5G base stations this year (do you really believe that?) to push forward the in-depth coverage of the superfast wireless network. The city also has ambitions to build super large computing power platforms to meet growing demand.

Zhao Zhiguo, spokesman for the Ministry of Industry and Information Technology, China’s top industry regulator, said earlier:

“2022 is a critical year for the large-scale development of 5G applications. We will continue to improve 5G network coverage and accelerate the in-depth integration of 5G and vertical industries.”

One of the priorities is to moderately speed up the coverage of 5G in counties and rural towns in China, Zhao said.

Ten ministries, including the Cyberspace Administration of China, recently unveiled a digital rural development action plan for the period from 2022 to 2025, which called for an intensified push to promote digital infrastructure upgrades in rural areas.

Telecom operators are also moving fast. China Mobile, the nation’s largest telecom carrier, said it aims to achieve continuous 5G coverage in rural towns across the country by the end of this year.

Telecom carriers’ 5G plans seek to harness the power of more than 1.4 million 5G base stations that were deployed in China by the end of last year (but can you really trust that China government reported number?). 5G signals are already available in urban areas of all of China’s prefecture-level cities, more than 98% of county-level towns and 80 percent of rural towns, MIIT data showed.

5G Cell Tower in China. Image courtesy of China Daily

…………………………………………………………………………………………………………………………….

In the U.S., it’s a different story. The Federal Communications Commission (FCC) found a shortfall in funding for its plan to replace Chinese telecom equipment. Inadequate finance is likely to pose connectivity challenges to people in remote areas in the US, experts said.

According to a report on MobileWorld Live, a telecom industry website, the FCC said local telecom operators’ requests for funding to replace network equipment made by Chinese companies Huawei and ZTE totaled $5.6 billion, almost three times the $1.9 billion allocated by the US federal government. Network operators serving less than 10 million customers which used government subsidies to buy Huawei or ZTE equipment before 30 June 2020 were eligible to apply for funding to cover costs associated with removing, replacing and disposing of the Chinese network equipment.

In a statement released last week, FCC Chairwoman Jessica Rosenworcel said that 181 carriers submitted initial reimbursement application requests totaling approximately $5.6 billion. Carriers are required to remove and replace existing network gear from Huawei and ZTE after the vendors were deemed national security risks. Congress in late 2020 set aside around $1.9 billion to fund and carry out the effort under the Secured and Trusted Communications Act 2019.

“Last year Congress created a first-of-its kind program for the FCC to reimburse service providers for their efforts to increase the security of our nations communications networks,” Rosenworcel said. “We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat,” she added.

The FCC banned U.S. telecom carriers from buying Huawei and ZTE’s equipment via federal subsidies, citing what it alleged were national security concerns. The two Chinese tech companies have repeatedly denied the accusations, which they said are groundless.

Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association in China, said Huawei and ZTE’s products are currently used by US telecom carriers to offer network and broadband services in some of the most remote regions in the US. Xiang said that the U.S. order to replace Huawei/ZTE wireless network equipment in rural areas will result in the lack of quality telecom services.

Steve Berry, president and CEO of the Competitive Carriers Association, a trade group for about 100 wireless providers in the US, issued a statement calling on the U.S. government to ensure the FCC program is fully funded so that connectivity is maintained during the operators’ transition to new wireless telecom equipment for their cellular networks.

…………………………………………………………………………………………………………………………….

Table 1: All the companies asking for FCC “rip and replace” funding

| Company | Applicant | Wireless | Wireline | Total | Vendor |

| Viaero Wireless | NE Colorado Cellular Inc | X | $1,194,000,000 | Ericsson | |

| Union Wireless | Union Telephone Company | X | $688,000,000 | Nokia | |

| ATN International | Commnet Wireless, | X | $418,768,726 | ||

| Gogo | Gogo Business Aviation LLC | X | $332,770,202 | ||

| NTCH | PTA-FLA, Inc. | $273,971,426 | |||

| Lumen | Level 3 Communications, LLC | X | $269,999,994 | ||

| Stealth Communications | X | $199,066,226 | |||

| SI Wireless, LLC | X | $181,023,489 | |||

| United Wireless Communications, Inc. | X | $173,471,477 | |||

| Hotwire Communications, Ltd. | X | $141,299,003 | |||

| Latam Telecommunications, L.L.C. | $138,060,092 | ||||

| NEMONT TELEPHONE COOPERATIVE INC | X | $125,551,024 | |||

| NTUA Wireless, LLC | X | $124,447,019 | |||

| Windstream Communications LLC | X | $118,271,652 | |||

| Rise Broadband | Skybeam, LLC | X | $106,159,884 | ||

| Pine Telephone Company | X | $87,095,419 | |||

| Mediacom Communications Corporation | X | $86,171,976 | |||

| Flat Wireless, LLC | X | $76,284,671 | |||

| Pine Belt Cellular, Inc. | X | $74,856,191 | |||

| James Valley Cooperative Telephone Company | X | $53,000,000 | |||

| AST Telecom, LLC d/b/a Bluesky | X | $49,959,592 | |||

| Country Wireless LLC | X | $47,508,982 | |||

| Point Broadband Fiber Holding, LLC | X | $47,172,086 | |||

| Board of Trustees, Northern Michigan University | X | $45,796,636 | |||

| Hargray Communications Group, Inc. | X | $42,785,933 | |||

| NfinityLink Communications, Inc. | $37,535,905 | ||||

| Plateau Telecommunications, Incorporated | X | $30,000,000 | |||

| Texas 10, LLC | $29,088,795 | ||||

| Mark Twain Communications Company | X | $29,000,000 | |||

| Panhandle Telecommunication Systems Inc | $28,925,552 | ||||

| TelAlaska Cellular, Inc. | X | $26,567,517 | |||

| Central Louisiana Cellular, LLC | X | $26,264,528 | |||

| TRANSTELCO INC. | X | $25,573,213 | |||

| Beamspeed, L.L.C. | X | $19,596,157 | |||

| Triangle Telephone Cooperative Association, Inc. | X | $18,336,507 | Mavenir | ||

| Eastern Oregon Telecom, LLC | X | $18,122,185 | |||

| Puerto Rico Telephone Company, Inc. | X | $16,857,851 | |||

| Vitelcom Cellular, Inc. d/b/a Viya Wireless | X | $15,716,011 | |||

| Santel Communications Cooperative, Inc. | X | $14,604,337 | |||

| MHG Telco LLC | X | $14,456,482 | |||

| WorldCell Soutions, LLC | X | $12,673,559 | |||

| LIGTEL COMMUNICATIONS INC. | X | $12,000,000 | |||

| Point Broadband Fiber Holding, LLC | X | $11,344,724 | |||

| Copper Valley Wireless, LLC | X | $11,151,417 | |||

| Premier Holdings LLC | $9,759,680 | ||||

| Eltopia Communications, LLC | X | X | $7,741,951 | ||

| Metro Fibernet, LLC | X | $7,567,518 | |||

| Bestel (USA), Inc. | $6,887,500 | ||||

| PocketiNet Communications Inc. | $6,741,452 | ||||

| Carrollton Farmers Branch ISD | X | $5,943,974 | |||

| Windy City Cellular | X | $5,562,067 | |||

| Bristol Bay Cellular Partnership | X | $5,269,183 | |||

| Kings County Office of Education | $5,221,191 | ||||

| Interoute US LLC | $4,867,140 | ||||

| Pasadena ISD | $4,387,311 | ||||

| Velocity Communications, Inc. | X | $4,158,729 | |||

| Advantage Cellular Systems, Inc. | X | $3,479,000 | |||

| New Wave Net Corp | $3,365,772 | ||||

| FirstLight Fiber, Inc. | $3,306,644 | ||||

| Gigsky, Inc. | X | $3,128,678 | |||

| Triangle Communication Systems Inc | $2,779,371 | ||||

| FIF Utah LLC | X | $2,662,538 | |||

| Gallatin Wireless Internet, LLC | X | $2,399,162 | |||

| Moore Public Schools | $2,023,243 | ||||

| HUFFMAN ISD | $1,920,588 | ||||

| Crowley ISD | $1,720,496 | ||||

| Castleberry Independent School District | X | $1,672,527 | |||

| One Ring Networks, Inc. | $1,649,281 | ||||

| University of San Francisco | $1,570,437 | ||||

| Leaco Rural Telephone Cooperative, Inc. | $1,511,617 | ||||

| Zito West Holding, LLC | X | $1,453,469 | |||

| Southern Ohio Communication Services Inc | $1,312,844 | ||||

| Xtreme Enterprises LLC | X | $1,097,283 | |||

| Virginia Everywhere, LLC | X | $562,001 | |||

| South Canaan Telephone Company | $542,139 | ||||

| Palmer ISD | $520,146 | ||||

| Waxahachie ISD | X | $457,396 | |||

| Hunter Communications & Technologies LLC | $432,348 | ||||

| Utah Telecommunication Open Infrastructure Agency | $413,760 | ||||

| COMMSELL | $302,400 | ||||

| VTel Wireless, Inc. | X | $283,618 | |||

| Trinity Basin Preparatory, Inc. | $242,510 | ||||

| NTInet, inc | $198,340 | ||||

| LakeNet LLC | X | $193,277 | |||

| IdeaTek Telcom, LLC | X | $181,899 | |||

| Millennium Telcom, L.L.C., dba OneSource Communications | $165,195 | ||||

| Inland Cellular LLC | X | $117,183 | |||

| Roome Telecommunications Inc | $92,144 | ||||

| Milford Independent School District | $40,399 | ||||

| Angeles Enterprises | X | $33,368 | |||

| Crystal Broadband Networks | X | $28,704 | |||

| Natural G.C. Inc. | $27,313 | ||||

| Webformix Internet Company | X | $22,400 | |||

| Northern Cambria School District | $14,400 | ||||

| Deer Creek Independent School District | $- | ||||

| $5,609,338,024 | |||||

| This FCC data was initially compiled by vendor Mavenir and then expanded, checked and edited by Light Reading staff. | |||||

“We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat. While we have more work to do to review these applications, I look forward to working with Congress to ensure that there is enough funding available for this program to advance Congress’s security goals and ensure that the US will continue to lead the way on 5G security,” FCC Chairwoman Jessica Rosenworcel said in a statement.

References:

http://www.chinadaily.com.cn/a/202202/09/WS620303dfa310cdd39bc85734.html

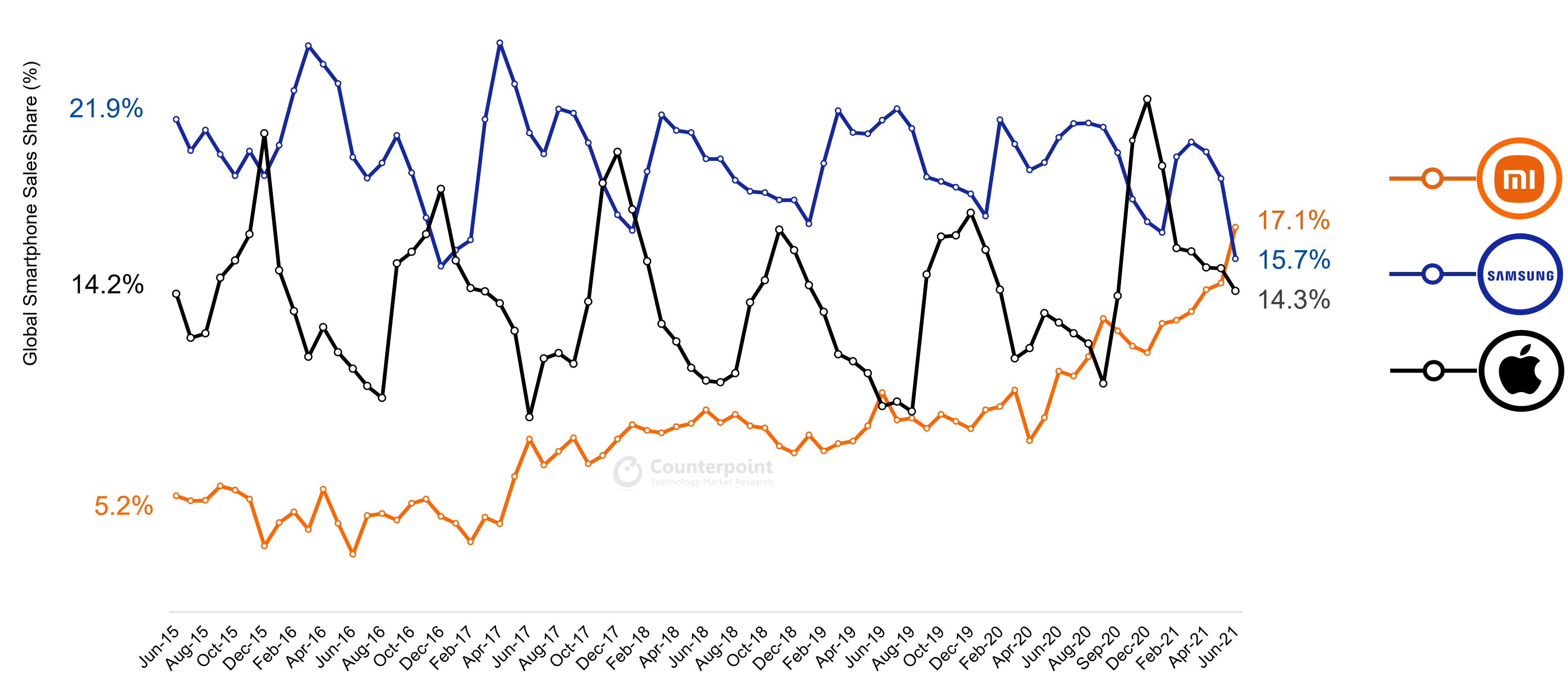

Counterpoint: Xiaomi #1 in global smart phone sales for 1st time

Chinese smartphone maker Xiaomi surpassed Samsung and Apple in June 2021 after a 26% month-on-month increase in sales to become the number one smartphone brand in the world for the first time ever, according to Counterpoint Research’s monthly Market Pulse Service.

Xiaomi was also the number two brand globally for Q2 2021 in terms of sales, and cumulatively, has sold close to 800 million smartphones since its inception in 2011, the report underlined.

Research Director Tarun Pathak noted that Xiaomi has been on a war footing to fill the gap created by the decline of Huawei.

“Ever since the decline of Huawei commenced, Xiaomi has been making consistent and aggressive efforts to fill the gap created by this decline. The OEM has been expanding in Huawei’s and HONOR’s legacy markets like China, Europe, Middle East and Africa. In June, Xiaomi was further helped by China, Europe and India’s recovery and Samsung’s decline due to supply constraints.” Pathak wrote.

Senior Analyst Varun Mishra stated, “China’s market grew 16% MoM in June driven by the 618 festival, with Xiaomi being the fastest growing OEM, riding on its aggressive offline expansion in lower-tier cities and solid performance of its Redmi 9, Redmi Note 9 and the Redmi K series. At the same time, due to a fresh wave of the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A series.” the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A-series,” Mishra commented on Samsung’s performance.

Going forward, the market research firm expects Samsung’s production to be affected if the situation in Vietnam does not improve while Xiaomi will continue to gain share from the Korean brand.

Exhibit: Global Monthly Smartphone Sales Share Trends (%)

Some of our other smartphone market analyses for Q2 2021:

- Apple Achieves Record June Quarter Shipments, Xiaomi Becomes the Second-Largest Smartphone Brand Globally

- India Smartphone Market Stays Resilient During Second COVID-19 Wave, Crosses 33 Million Shipments

- China Smartphone Market Sees Lowest Q2 Sales Since 2012; vivo Leads as Huawei Plummets

- Podcast: How Xiaomi, Qualcomm are Delivering 5G, AI-based Experiences to Consumers

- Q2 2021: Europe Smartphone Market’s Bumpy Road to Recovery

- MEA Smartphone Market Sees Best Q2 on Record; Samsung Leads but TECNO, Xiaomi Close Gap

- Chinese Players Capture Half of Vietnam Smartphone Market in Q2 2021

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (Technology, Media and Telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

References:

Monthly Pulse: Xiaomi Becomes #1 Smartphone Brand Globally for First Time Ever

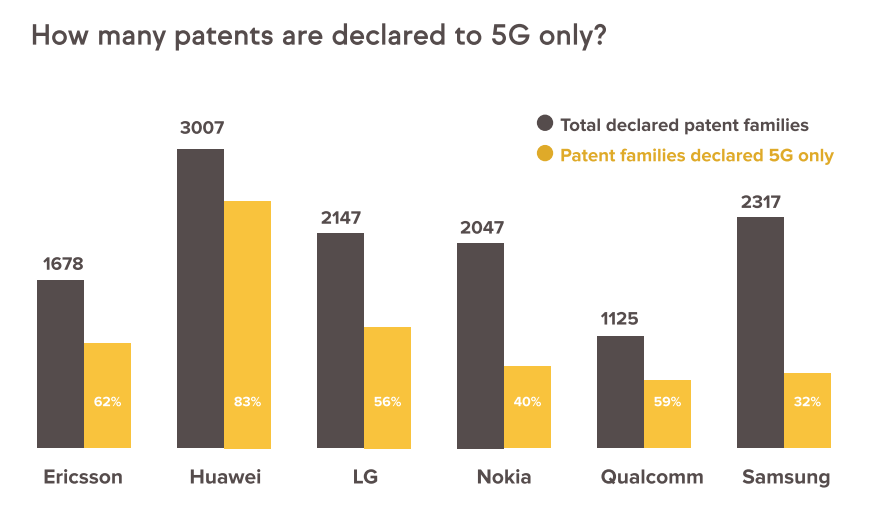

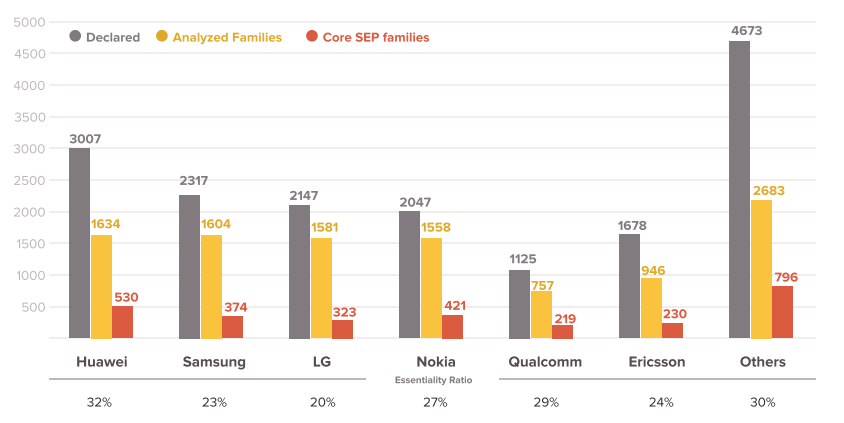

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

A new report, jointly released by IP consulting and analysis companies, Amplified and GreyB, disclosed that the top 6 companies (Huawei, Samsung, LG, Nokia, Ericsson, Qualcomm) account for 64.9% in 18,887 declared patent families. In granted 10,763 declared patent families, 2,893 families have been identified as core SEPs where top 6 companies account for 72.5%.

Huawei was first with 530 patent families and a ratio 18.3%. Nokia and Samsung were ranked No. 2 and No. 3 with 14.6% and 12.9%. respectively.

The report is an update of the previous report “Exploration of 5G Standards and Preliminary Findings on Essentiality” released on May 26, 2020.

………………………………………………………………………………………………………………………………

Separately, Samsung Electronics Co., Ltd. announced on March 10th that it has ranked first in 5G Standard Essential Patent (SEP)¹ shares according to a patent essentiality study conducted by IPlytics2, a Berlin-based market intelligence firm comprised of economists, scientists and engineers. The findings were published in IPlytics’ recent report: “Who is leading the 5G patent race? A patent landscape analysis on declared SEPs and standards contributions.”

Samsung also ranked second in two other categories: share of 5G granted3 and active patent4 families5, and share of 5G granted and active patent families with at least one of them granted by the EPO (European Patent Office) or USPTO (United States Patent and Trademark Office).

Last year, Samsung also led in 5G patents as a result of its research and development of 5G standards and technologies.

the top 10 companies own more than 80% of all granted 5G patent families, while the top 20 own more than 93% of all 5G granted patent families. These numbers confirm that there are only a few major large 5G patent owners, but looking at overall 5G declarations, the IPlytics Platform database identified more than 100 independent companies, which have declared ownership of at least one 5G patent.

The 5G patent family statistics presented in Table 1 are not based on verified SEP families. Neither ETSI nor the declaring companies have published independent assessments of the essentiality or validity of the declared 5G patents. Thus, the 5G patent families presented are only potentially essential. Many well-known SEP studies estimate that between 20% and 30% of all declared patents are essential. However, the essentiality rate differs across patent portfolios. To better understand the essentiality rate across portfolios, IPlytics created a data set of 1,000 5G-declared patent families (EPO/USPTO granted), which independent experts have mapped to 5G specifications. Here, the experts mapped the patents for six hours in a first check and then EPO/USPTO patent attorneys double-checked the mapping for a further three hours.

Table 1. Top 5G patent declaring companies (with >1% share)

| Current Assignee | 5G families | 5G granted and active families | 5G EPO/USPTO granted and active families | 5G EPO/USPTO granted and active families not declared to other generations |

| Huawei (CN) | 15.39% | 15.38% | 13.96% | 17.57% |

| Qualcomm (US) | 11.24% | 12.91% | 14.93% | 16.36% |

| ZTE (CN) | 9.81% | 5.64% | 3.44% | 2.54% |

| Samsung Electronics (KR) | 9.67% | 13.28% | 15.10% | 14.72% |

| Nokia (FN) | 9.01% | 13.23% | 15.29% | 11.85% |

| LG Electronics (KR) | 7.01% | 8.7% | 10.3% | 11.48% |

| Ericsson (SE) | 4.35% | 4.59% | 5.25% | 3.79% |

| Sharp (JP) | 3.65% | 4.62% | 4.66% | 5.50% |

| Oppo (CN) | 3.47% | 0.95% | 0.64% | 1% |

| CATT Datang Mobile (CN) | 3.44% | 0.85% | 0.46% | 0.68% |

| Apple (US) | 3.21% | 1.46% | 1.66% | 2.15% |

| NTT Docomo (JP) | 3.18% | 1.98% | 2.25% | 1.9% |

Source: IPlytics

………………………………………………………………………………………………………………………………..

Superscript Notes:

[1] “A patent that protects technology essential to a standard”, European Commission report – “Setting out the EU approach to Standard Essential Patents”, p1, November 2017.

[2] “IPlytics derived the “essential rate” by creating a random data set of 1,000 5G-declared patent families (EPO/USPTO granted) and mapping it to 5G specifications.” . Available : https://www.iam-media.com/who-leading-the-5g-patent-race-patent-landscape-analysis-declared-seps-and-standards-contributions

[3] “a patent that is granted by at least one of patent offices”, IPlytics report – “who is leading the 5G patent race”, p5, November 2019.

[4] “in active status, which means it has not lapsed, been revoked or expired”, IPlytics report – “who is leading the 5G patent race”, p3, November 2019.

[5] “a collection of patent applications covering the same or similar technical content”, . Available: https://www.epo.org/searching-for-patents/helpful-resources/first-time-here/patent-families.html

…………………………………………………………………………………………………………………………………………….

References:

https://www.amplified.ai/news/

https://www.greyb.com/5g-patents/

https://news.samsung.com/us/samsung-extends-leadership-5g-patents/

Dell’ Oro: Huawei still top telecom equipment supplier; optical transport market +1% in 2020

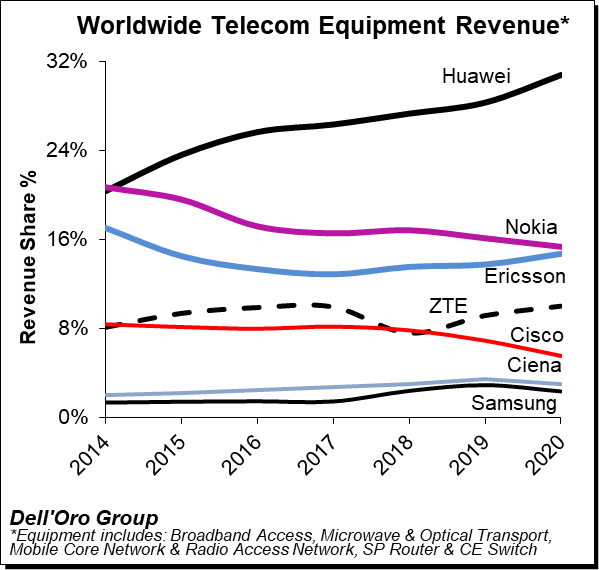

Huawei has increased its lead as the#1 global telecoms network equipment vendor, boosting its revenue share by a three percentage points last year, according to Dell’Oro Group. Nokia lost one percentage point of revenue share year-on-year, as did Cisco, the latter falling to 6%. Ericsson gained one percentage point to match Nokia at 15% of the market and ZTE also saw a 1% uptick to 10% of the global telecom market. (Please refer to chart below).

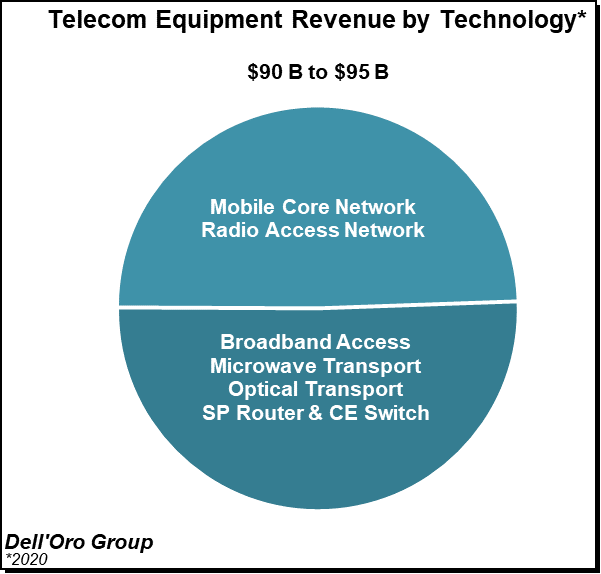

Dell’Oro Group’s preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES) – advanced 7% year-over-year (Y/Y) for the full year 2020, growing at the fastest pace since 2011.

The telecom and networking market research firm suggests revenue rankings remained stable between 2019 and 2020, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for 80% to 85% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets. While both Ericsson and Nokia improved their RAN positions outside of China, initial estimates suggest Huawei’s global telecom equipment market share, including China, improved by two to three percentage points for the full year 2020.

Dell’Oro now estimates the following revenue shares for the top seven suppliers:

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Additional key takeaways from the 4Q2020 reporting period:

- Preliminary estimates suggest that the positive momentum that has characterized the overall telecom market since 1Q-2020 extended into the fourth quarter, underpinned by strong growth in multiple wireless segments, including RAN and Mobile Core Networks, and modest growth in Broadband Access and CES.

- Helping to drive this output acceleration for the full year 2020 is faster growth in Mobile Core Networks and RAN, both of which increased above expectations.

- Covid-19 related supply chain disruptions that impacted some of the telco segments in the early part of the year had for the most part been alleviated towards the end of the year.

- Not surprisingly, network traffic surges resulting from shifting usage patterns impacted the telecom equipment market differently, resulting in strong demand for capacity upgrades with some technologies/regions while the pandemic did not lead to significant incremental capacity in other cases.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained around 3 to 4 percentage points of revenue share between 2019 and 2020, together comprising more than 40% of the global telecom equipment market.

- Even with the higher baseline, the Dell’Oro analyst team remains optimistic about 2021 and projects the overall telecom equipment market to advance 3% to 5%.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Carrier Ethernet Switch.

…………………………………………………………………………………………….

Last week, Dell’Oro Group reported that the optical transport equipment revenue increased 1% in 2020 reaching $16 billion. In this period, all regions grew with the exception of North America and Latin America.

“Between concerns on starting new optical builds during the start of the pandemic and aggressive plans on 5G deployments that required a larger share of a service provider’s capital budget, the spending on optical transport dramatically slowed by the end of 2020,” said Jimmy Yu, Vice President at Dell’Oro Group.

“It was a really dramatic drop in optical equipment purchases in the fourth quarter. While we anticipated a slowdown near the end of the year due to concerns around COVID-19, we were surprised by a 29 percent year-over-year decline in WDM purchases in North America as well as a 12 percent decline in China. That said, there was good growth in the other parts of the world, especially Japan,” continued Yu.

| Optical Transport Equipment Market | |

| Regions | Growth Rate in 2020 |

| North America | -6% |

| Europe, Middle East and Africa | 2% |

| China | 1% |

| Asia Pacific excluding China | 13% |

| Caribbean and Latin America | -14% |

| Worldwide | 1% |

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please email [email protected].

References:

Apple is new smartphone king, but market declined 5% in 4Q 2020

Apple doesn’t report unit sales for its devices. However, the company said revenue from iPhones grew by 17% in the fourth quarter of calendar 2020 on a year-over-year basis to $65.6 billion. Apple’s business is seasonal, and the quarter ending in December is usually the company’s biggest in terms of sales.

“The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020,” said Anshul Gupta, senior research director at Gartner. “Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter.”

Table 1. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 4Q20 (Thousands of Units)

| Vendor | 4Q20

Sales |

4Q20 Market Share (%) | 4Q19

Sales |

4Q19 Market Share (%) | 4Q20-4Q19 Growth (%) |

| Apple | 79,942.7 | 20.8 | 69,550.6 | 17.1 | 14.9 |

| Samsung | 62,117.0 | 16.2 | 70,404.4 | 17.3 | -11.8 |

| Xiaomi | 43,430.3 | 11.3 | 32,446.9 | 8.0 | 33.9 |

| OPPO | 34,373.7 | 8.9 | 30,452.5 | 7.5 | 12.9 |

| Huawei | 34,315.7 | 8.9 | 58,301.6 | 14.3 | -41.1 |

| Others | 130,442.8 | 33.9 | 145,482.1 | 35.8 | -10.3 |

| Total | 384,622.3 | 100.0 | 406,638.1 | 100.0 | -5.4 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

Full Year 2020 Results:

Samsung experienced a year-on-year decline of 14.6% in 2020, but this did not prevent it from retaining its No. 1 global smartphone vendor position in full year results. It faced tough competition from regional smartphone vendors such as Xiaomi, OPPO and Vivo as these brands grew more aggressive in global markets. In 2020, Apple and Xiaomi were the only two smartphone vendors of the top five ranking to experience growth.

Huawei recorded the highest decline among the top five smartphone vendors which made it lose the No. 2 position to Apple in 2020 (see Table 2). The impact of the ban on use of Google applications on Huawei’s smartphones was detrimental to Huawei’s performance in the year and negatively affected sales.

Table 2. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 2020 (Thousands of Units)

| Vendor | 2020

Sales |

2020

Market Share (%) |

2019

Sales |

2019

Market Share (%) |

2020-2019

Growth (%) |

| Samsung | 253,025.0 | 18.8 | 296,194.0 | 19.2 | -14.6 |

| Apple | 199,847.3 | 14.8 | 193,475.1 | 12.6 | 3.3 |

| Huawei | 182,610.2 | 13.5 | 240,615.5 | 15.6 | -24.1 |

| Xiaomi | 145,802.7 | 10.8 | 126,049.2 | 8.2 | 15.7 |

| OPPO | 111,785.2 | 8.3 | 118,693.2 | 7.7 | -5.8 |

| Others | 454,799.4 | 33.7 | 565,630.0 | 36.7 | -19.6 |

| Total | 1,347,869.8 | 100.0 | 1,540,657.0 | 100.0 | -12.5 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

“In 2021, the availability of lower end 5G smartphones and innovative features will be deciding factors for end users to upgrade their existing smartphones,” said Mr. Gupta. “The rising demand for affordable 5G smartphones outside China will boost smartphone sales in 2021.”

Europe and U.S. to delay 5G deployments; China to accelerate 5G

Up until the COVID-19 pandemic hit the world hard in late February, 5G seemed a priority for most wireless network operators. Now, with across the board cutbacks everywhere, it will be much further down the must do list for 2020.

In the absence of any new 5G applications or completion of 3GPP 5G Phase 2 and ITU-R IMT 2020, 5G was not expected to ramp this year, despite ridiculous hype and false claims (especially ultra low latency which has not yet been specified let alone standardized yet).

Now the new technology faces an unprecedented slow down to launch and expand pilot deployments. Why? It’s because of the stay at home/shelter in place orders all over the world. Non essential business’ are closed and manufacturing plants have been idled. Also, why do you need a mobile network if you’re at home 95% of the time?

One reason to deploy 5G is to off load data (especially video) traffic on congested 4G-LTE networks. But just like the physical roads and highways, those 4G networks have experienced less traffic since the virus took hold. People confined to their homes need wired broadband and Wi-Fi, NOT 4G and 5G mobile access.

“5G deployment in Europe will certainly be delayed,” said Eric Xu, one of Huawei’s rotating CEOs, during a Huawei (private company) results presentation today. Xu also told reporters the delays could last until “the time when the pandemic is brought under control.”

Huawei’s Eric Xu said the current crisis would “certainly” delay 5G rollouts

………………………………………………………………………………………………………..

Answering questions about its annual report, published on Tuesday, Huawei vice-president Victor Zhang said there would “definitely” be an impact but it would likely be worse in Europe than in the UK.

A few data points from European telcos in the aftermath of COVID-19:

- On March 20, the UK’s BT reported a 5% drop in mobile data traffic, compared with normal levels.

- Today, Belgian incumbent Proximus said capital expenditure would go down this year to offset the impact of COVID-19 on profits.

- A growing number of European countries are delaying 5G spectrum auctions, as restrictions related to the Covid-19 pandemic make it difficult to maintain planning. The EU’s deadline of June for the release of the 700 MHz band for 5G will be missed by several countries, including Spain and Austria.

- In Portugal, MEO, NOS and Vodafone Portugal now face a further wait for frequency rights in the 700MHz, 900MHz, 1800MHz, 2.1GHz, 2.6GHz and 3.6GHz bands

- German company United Internet’s CEO, Ralph Dommermuth, said that the construction of subsidiary 1&1 Drillisch’s 5G network would experience delays due to current measures adopted in the country to prevent a further spread of the COVID-19 pandemic in Germany, local paper Handelsblatt reported.

- In Sweden, which has controversially avoided a total lockdown, telecom incumbent carrier Telia has now cut dividends as it prepares for a hit.

Huawei’s statements imply the U.S. will also face a delay in 5G rollouts. It has overtaken Italy as the country with the highest number of coronavirus infections, and its response to the outbreak has been lackluster and confusing at best, horrendous at worst.

As a mobile-only network equipment vendor, Ericsson looks the most exposed to a 5G slow down. More than 50% of its business is generated in Europe and the Americas, where the rate of COVID-19 infections is rising.

Although less reliant on the 5G wireless base station business than Ericsson, Nokia could also be in trouble due to the slowdown in 5G deployments. Approximately 30% of its sales came from North America last year, and another 28% from Europe.

…………………………………………………………………………………………….

“After the pandemic was brought under control, China has accelerated its 5G deployments,” according to Huawei’s Xu.

China has accelerated its own 5G deployment after the number of cases of Covid-19 subsided, according to Xu, but in other countries, it would depend “on several factors”, including whether telecoms companies had the budget and resources to “win back the time” lost.

Indeed, China Mobile this week awarded 5G contracts worth $5.2 billion with approximately 90% of the contracts going to Huawei and ZTE. Ericsson won contracts worth RMB4.2 billion ($593 million) and small local vendor CICT will net RMB965 million ($136 million). Nokia reportedly bid, but failed to win any of the contracts from China Mobile.

This centralized procurement involves 28 China provinces, autonomous regions and municipalities directly under the central government. According to C114, the total demand is 232,143 5G base stations. At the end of February, the number of 5G base stations owned China Mobile has exceeded 80,000.

References:

https://www.bbc.com/news/technology-52108172

https://www.lightreading.com/5g/covid-19-will-help-china-to-extend-its-5g-lead/d/d-id/758596?

https://www.lightreading.com/5g/5g-auctions-delayed-across-europe-due-to-covid-19/d/d-id/758606?

…………………………………………………………………………………………………

9 April 2020 Update:

5G is looking like a casualty of COVID-19

All 5G companies had accomplished was the design of a technology that provides faster connections and additional capacity on smartphone networks. A few have already been launched, and South Korea, the most advanced market, already has millions of subscribers. Yet local news reports suggest many have been underwhelmed by the 5G experience. For service providers, it has had minimal impact on sales while marketing and rollout costs have made a huge dent in profits.

This will discourage 5G investment in countries under COVID-19 lockdown. As customers downgrade to cheaper services and dump TV sports packages rerunning last year’s highlights, many operators will cut spending. Concerned about exposing field workers to unnecessary health risks, they will prioritize the maintenance of networks already used by the majority. Moreover, people confined to their broadband-equipped homes for most of the day have little use for mobile data networks. Any additional investment is likely to go into fiber-optic equipment.

5G launches will also be delayed in European markets that have postponed auctions of the spectrum needed to support services. Austria, the Czech Republic, France, Portugal and Spain are all now reported to have delayed auctions. Without spectrum, 5G will obviously not fly.

Fear mongering stories linking 5G to illness could also hinder rollout. Countries such as Belgium and Switzerland have imposed limits on the use of 5G antennas amid lingering concern that radiofrequency emissions are carcinogenic. The World Health Organization says mobile frequencies are too low to be dangerous, but activists are unconvinced.

In the UK, operators now have to contend with the ludicrous suggestion that 5G networks transmit COVID-19. After misinformed tweets by celebrities including Amanda Holden, a British actress and reality-TV regular, 5G masts were burnt in the cities of Belfast, Birmingham and Liverpool.

China, meanwhile, remains determined to erect more than half a million 5G base stations by the end of this year. Claiming to have beaten COVID-19, it has lifted restrictions on the movement of people and reopened its factories. For the equipment makers building those 5G networks, this investment program could be essential medicine. Just last month, China Mobile, the country’s largest operator, awarded 5G contracts worth $5.2 billion. Unfortunately, with almost 90% of the work going to domestic suppliers Huawei and ZTE, Western vendors will not be able to count on China for a boost.

https://www.lightreading.com/5g/5g-is-looking-like-a-casualty-of-covid-19/a/d-id/758804?

At long last: India Telecom Minister gives go ahead for 5G trials

India’s telecom minister has met with the major mobile network operators and invited them to start testing their 5G services. The government also confirmed that Chinese network infrastructure equipment vendors Huawei and ZTE would be allowed to participate in the trials.

The meeting was chaired by telecom secretary Anshu Prakash and was attended by senior representatives of Bharti Airtel, Vodafone Idea, Reliance Jio and all equipment vendors, including Huawei, reports Live Mint. Indian television channel CNBC-TV18 reported the news first, citing a senior official. The trials will be held in January, according to the official, the channel reported.

India’s department of telecom expects to allocate spectrum soon (we’ve heard that before?) for trials, which should begin in Q1-2020, ahead of plans for a spectrum auction no later than April 2020.

India Telecom Minister Ravi Shankar Prasad said earlier that 5G spectrum for trials would be available to all wireless network equipment (base station) vendors. In particular, he told reporters in India earlier this week:

“5G trials will be done with all vendors and operators. We have taken an in-principle decision to give 5G spectrum for trials.” On being asked specifically about Huawei, Prasad said that at this stage, all vendors are invited.

India Telecom Minister Ravi Shankar Prasad

………………………………………………………………………………………………………….

The Indian government believes the trials, which were originally supposed to be held in 2019, will help in the development of the country’s 5G ecosystem. The Indian telcos will be conducting 5G tests with different vendors: Bharti Airtel plans to conduct trials with Nokia, Huawei and Ericsson, while Vodafone Idea wants to partner with Ericsson and Huawei. Reliance Jio, which currently works primarily with Samsung, has applied to conduct 5G tests with the South Korean vendor.

A senior executive at one vendor said the trials should have begun a year ago and now that global testing is over, it does not make sense to start from scratch in India, especially with the auction of 5G airwaves slated for March-April.

…………………………………………………………………………………….

India’s telcos have been asking for clarity from the government regarding the participation of both Chinese vendors in 5G activities. Initially only a handful of vendors, including Cisco, Ericsson, NEC, Nokia and Samsung, received invitations to participate in the 5G trials.

The decision was welcomed by Huawei India in a statement, as well as comments from the Chinese ambassador in India on Twitter. Huawei is already active in the country, where it has deployed 4G networks for Bharti Airtel and Vodafone Idea.

The inclusion in India’s 5G trials is of particular significance for Huawei, which faces trading restrictions in several countries, including Australia, New Zealand and the US, because of security concerns. The US has been lobbying the Indian government to exclude Huawei from the 5G market but, equally, China has been lobbying for Huawei and ZTE to be given equal opportunities in India’s 5G market.

The efforts of the US authorities to restrict Huawei’s business had an impact on the vendor’s sales in 2019, though with expected full-year revenues of almost $122 billion it is still by far the largest supplier of telecoms infrastructure globally and the number two player in the smartphone market.

During the past few years, Chinese vendors have provided crucial support to India’s service providers as they attempted to manage their costs and keep tariffs under control. Chinese network equipment is cheaper than the equivalent offerings from Western rivals, enabling traditional telcos to offer services in a market with one of the lowest average revenue per user (ARPU) figures in the world.

The exclusion of Huawei and ZTE from forthcoming 5G deals would almost certainly result in an increase in capital expenditure by India’s telcos: Sunil Bharti Mittal, the chairman of Bharti Enterprises, the parent company of Airtel, spoke out in support of Huawei during a recent event organized by World Economic Forum, stating that Huawei’s equipment was superior to that of its main European rivals, Ericsson and Nokia.

“Glad to know all players got equal chance to participate in 5G trial in India. A welcome move conducive to initiatives like Digital India,” said Chinese Ambassador Sun Weidong in a social media message.

References:

SK Telecom top winner at Global Telecoms Awards in London, UK

South Korean network operator SK Telecom’s early success in 5G helped it win three awards at the Global Telecoms Awards (GLOTEL Awards), held on November 7 in London, UK. SK Telecom received awards in the categories of ‘5G Implementation Excellence,’ ‘Best Operator,’ and ‘BSS/OSS Transformation Excellence.’

SK Telecom was also highly commended in the consumer IoT and fixed network categories, bringing its awards total on the night to five. Other notable performers were Huawei, with two wins and a highly commended, and ZTE with one win and two highly commended.

With the aim to provide customers with the best 5G service quality, SK Telecom has deployed the fastest and widest 5G network in Korea, arming it with quantum cryptography technologies and an AI-based network management system named TANGO (T Advanced Next Generation OSS). Moreover, by combining its 5G with cutting-edge ICT, the company has introduced a wide range of powerful solutions including 5G-AI Machine Vision, 5G Live Golf Broadcast, AI Video Security and 5G-based Cooperative Intelligent Transportation System.

“I feel confident in saying that this was the strongest set of entries to the awards we’ve had yet,” said Telecoms.com Editor Scott Bicheno (pictured above with Chang-min Park of SK Telecom), who hosted the awards alongside comedian Miles Jupp and was also one of the judges. “Our judges had a really tough job choosing between so many great products, services and projects this year and for that I thank them. The fact that so many entries were highly commended shows how close the scoring was. My congratulations to the winners and thanks everyone who contributed to our best awards yet.”

…………………………………………………………………………………………………

Here’s the complete list of winners:

5G Implementation Excellence

Winner – SK Telecom: World’s First 5G Commercialization

Advancing Artificial Intelligence

Winner – Telefónica: Aura

Highly Commended – Nokia: AI as a Service for CMCC Hainan

Automation Initiative of the Year

Winner – Huawei: AUTIN

Best 5G Innovation

Winner – Vodafone Germany: Automotive Factory of the Future

Highly Commended – China Mobile, China Southern Power and Huawei: Smart Grid 5G Slice Operation and Monetization

Best Digital Transformation Project

Winner – Infosys and Vodafone UK: Digital Platform

Highly Commended – Singtel: Unboxed

Best Operator

Winner – SK Telecom

Highly Commended – Reliance Jio Infocomm

BSS/OSS Transformation Excellence

Winner – SK Telecom: OSS Evolution for E2E integration and 5G Business

Connecting the Unconnected

Winner – Ufinet: Rural connectivity case studies

Consumer IoT Initiative of the Year

Winner – O2 and Accenture: Making UK homes smarter energy users

Highly Commended – SK Telecom: V2X Service Enabler (VSE)

Digital Transformation Innovation

Winner – BT: The Digital Business Marketplace

Highly Commended – Netcracker: Digital Transformation Solution

Fixed Network Evolution

Winner – Turkcell: Customer Oriented Failure Prioritization and Complaint Management

Highly Commended – SK Telecom: Giga Premium 10G Residential Broadband Internet Service

Ground-breaking Virtualization Initiative

Winner – AT&T: Edge Solutions

Industrial IoT Initiative of the Year

Winner – Dialog Axiata: Affordable and Purpose-built IoT Solutions for Industries in Emerging Markets

Highly Commended – ZTE: ZTE NMVP Solution

Innovating in the Cloud

Winner – MYCOM OSI: The Assurance Cloud

Managed Services Innovation of the Year

Winner – Ericsson and Telenor: Common Delivery Center for innovative Managed Services model

Highly Commended – Saudi Telecom Company: STC Fixed Network Customer Operations Service transformation

Mobile Device Innovation

Winner – Reliance Jio Infocomm: JioPhone

Mobile Money Mastery

Winner – AsiaHawala and Comviva: AsiaHawala powered by mobiquity Money

Most Innovative Cloud Service

Winner – Tata Communications Transformation Services: Cloud Networking and Security as a Service

Highly Commended – Red Hat: Red Hat open hybrid cloud technologies

Project Delivery Perfection

Winner – ZTE: ZTE for China Mobile ‘He-Fetion’ Project

Highly Commended – X by Orange: X by Orange with Red Hat

Security Solution of the Year

Winner – Mobileum Signalling Firewall

Highly Commended – CUJO AI: AI-powered cybersecurity technology

Telecoms Transformation

Winner – Huawei: NFV-SDN based telco cloud technology initiative

Highly Commended – ZTE: 5G Slicing Wholesale Solution for New B2B2C Business Model

………………………………………………………………………………………..

About SK Telecom

SK Telecom is the largest mobile operator in Korea with nearly 50 percent of the market share. As the pioneer of all generations of mobile networks, the company has commercialized the fifth generation (5G) network on December 1, 2018 and announced the first 5G smartphone subscribers on April 3, 2019. With its world’s best 5G, SK Telecom is set to realize the Age of Hyper-Innovation by transforming the way customers work, live and play.

Building on its strength in mobile services, the company is also creating unprecedented value in diverse ICT-related markets including media, security and commerce.

For more information, please contact: [email protected] or [email protected]

…………………………………………………………………………………………

Conflicting reports: Huawei and China Mobile may buy Brazil carrier Oi

The O Globo website reported on Saturday that Huawei is joining forces with China Mobile to buy struggling Brazilian carrier Oi, in an attempt to boost their footprint in Latin America’s largest market. The two Chinese companies anticipate a significant growth in business once Brazil starts deploying its 5G network. Oi’s 360,000 kilometers of fiber infrastructure is seen as an attractive asset.

Oi declined to comment on the matter, while Huawei and China Mobile did not immediately respond to Reuters’ requests for comment.

However, on Sunday Huawei told Reuters it was not interested in acquiring struggling Oi or any other Brazilian carrier.

“Huawei has no plan or interest in acquiring Oi or any other Brazilian carrier. In Brazil for more than 20 years, the company is working with all major Brazilian carriers supplying the best products and solutions to support digital transformation in Brazil,” the company said in an emailed statement to Reuters.

It would be very strange for Huawei to invest in a telecom carrier which is traditionally its bread and butter customer!

Brazil’s largest fixed-line carrier has been struggling to turnaround its business since it filed for bankruptcy protection in June 2016 to restructure approximately 65 billion reais of debt. Oi is also negotiating its network with Spain’s Telefonica and Telecom Italia, AT&T and another (unnamed) Chinese company.

Speculation of the bid comes as Brazil’s Senate approved a bill to update the country’s obsolete framework for telecommunications, paving the way for Oi to implement a plan to sell up to $2 billion in non-core assets. Earlier this week, Suno Notícias reported that China Mobile has filed a request to operate in Brazil and eventually acquire Oi. The country’s telecom regulatory agency Anatel said Sept. 17th it didn’t have any official information regarding the request.

…………………………………………………………………………………………………….

Addendum: Huawei launches new ‘Vision TV’ with 4K quantum dot color, which comes in 55″/65″/75″ sizes. Media paying attention to the fact that Huawei is adopting QD technology, which until now has been a key technology for Samsung’s TV (QLED) strategy. (ZDNet)

http://www.zdnet.co.kr/view/?no=20190920082939

…………………………………………………………………………………………….

References: