Juniper Research

Juniper Research: Global 6G Connections to be 290M in 1st 2 years of service, but network interference problem looms large

A new study from Juniper Research, a leading telecommunications research firm, forecasts 290 million connections globally by 2030; the year after its initial expected launch in 2029 (this author doesn’t think standards for 6G will be completed by 2030). To achieve this early growth, the report cautions operators must solve various technological challenges, including the issue of network interference arising from the use of high-frequency spectrum.

This use of high-frequency spectrum in 6G will be the key enabling technology to provide throughput speeds 100 times greater than current 5G networks. However, as cellular technologies have never used spectrum bands in this range before, the most pressing concern for operators is minimizing this network interference, or risk creating an unreliable 6G network.

RIS Identified as Key Emerging 6G Technology:

To achieve this, the report urges operators to invest in RIS (Reconfigurable Intelligent Surfaces); a technology that will mitigate the impact of interference from large obstacles, including buildings, on network services. This is accomplished by purposefully reflecting and refracting 6G mobile signals to enable data packets to move around physical obstacles.

As 6G standards become clearer in 2025, RIS technology must become an immediate priority for development. However, the report warns that given the wide geographical areas of some 6G networks, operators must implement AI to monitor and adjust RIS configuration in real-time to maximize the technology’s benefits.

Research author Alex Webb remarked: “Initial 6G coverage will occur in the most densely populated geographical areas to serve as many users as possible. Therefore, RIS technology will be key to providing a valuable 6G service to both consumer and enterprise customers in the first few years of network operation.”

In 2030, when Juniper Research expects 6G to reach 290 million connections, GSMA Intelligence predicts in its 2023 mobile economy report that 5G will have surpassed 5 billion connections. We believe both of those forecasts are way off the mark. In fact, we forecast ZERO 6G subscribers in 2030, because the ITU-R IMT 2030 radio standards and 3GPP 6G specs won’t be completed by then.

About the Research Suite:

The new research suite offers the most comprehensive assessment of 6G development to date, including insightful market analysis, and in-depth forecasts for 60 countries. The dataset contains almost 21,000 market statistics over a nine-year period.

Juniper Research has, for two decades, provided market intelligence and advisory services to the global telecommunications sector, and is retained by many of the world’s leading network operators and communications platforms.

Find out more about the new report: Global 6G Development 2024-2032, or download a free sample.

References:

Global 6G Connections to Reach 290m in First Two Years of Service (juniperresearch.com)

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

SK Telecom, Intel develop low-latency technology for 6G core network

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

ETSI Integrated Sensing and Communications ISG targets 6G

Ericsson’s India 6G Research Program at its Chennai R&D Center

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

5G to Account for 80% of Operator Revenue by 2027:

Juniper Research has forecast that communications operators are likely to generate $625B from 5G services globally by 2027, a substantial rise from the $310bn predicted for the end of 2023. The new report, Operator revenue strategies: Business models, emerging technologies & market forecasts 2023-2027, forecasts that 80% of global operator-billed service revenue will be attributable to 5G by 2027; allowing operators to secure a return on investment into their 5G networks. However, the increasing implementation of eSIMs into new devices will drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G.

Juniper Research noted that the increasing implementation of embedded subscriber identity modules (eSIMs) into new devices would drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G. Previous Juniper studies have observed that after spending more than a decade offering a potential breakthrough in mobile communications, embedded eSIM technology has enjoyed noticeable growth in the past 12 months, making its way from smartphones to smart devices. The report also calculated that, driven by Apple’s innovation disrupting the smartphone sector, the value of the global eSIM market was expected increase from $4.7bn in 2023 to $16.3bn by 2027.

Juniper Research author Frederick Savage commented: “eSIM-capable devices will drive significant growth in cellular data, as consumers leverage cellular networks for use cases that have historically used fixed networks. Operators must ensure that networks, including 5G and upcoming 6G networks, are future‑proofed by implementing new technologies across the entirety of networks.”

6G Development Necessitates Innovative Technologies:

To prepare for this increasing demand in cellular data, the report predicts that 6G standards must adopt innovative technologies that are not currently used in 5G standards. It identified NTNs (Non‑terrestrial Networks) and sub-1THz frequency bands as key technologies that must be at the center of initial trials and tests of 6G networks, to provide increased data capabilities over existing 5G networks.

However, the research cautions that the increased cost generated by the use of satellites for NTNs and the acquisition costs of high-frequency spectrum will create longer timelines for securing return on 6G investment for operators. As a result, it urges the telecommunications industry to form partnerships with specialists in non-terrestrial connectivity; thus benefitting from lower investment costs into 6G networks.

………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.juniperresearch.com/pressreleases/operator-5g-revenue-to-reach-$625bn-by-2027

Juniper Research: CPaaS Gobal Market to Reach $29 Billion by 2025

Juniper Research: 5G connectivity opportunity for the connected car market

Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

Juniper Research: 5G connectivity opportunity for the connected car market

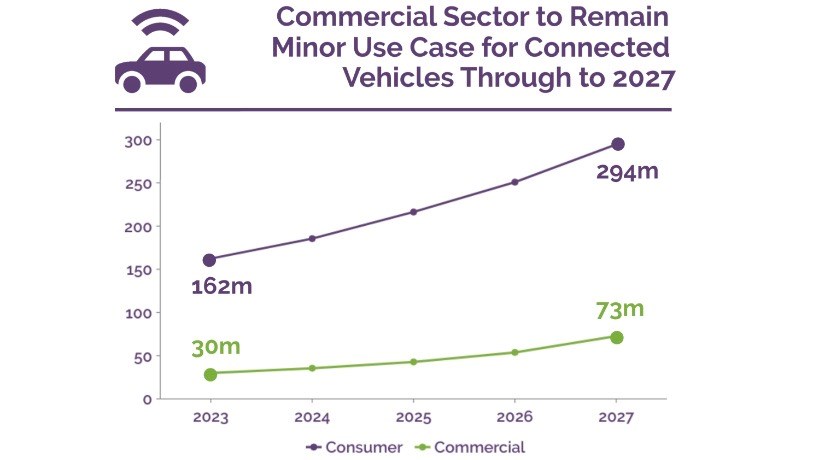

The number of connected vehicles globally is set to grow from 192 million this year to more than 367 million in 2027, with 5G connectivity set to play a key role in the development of the market, according to a new report from Juniper Research. The company’s new Connected Vehicles research report provides an independent analysis of the future evolution of this fast-paced market and advanced connectivity solutions within the automotive industry. It provides a comprehensive study of the increase in constant connectivity technology features in cars being adopted by automotive original equipment manufacturers, how the rise of 5G is impacting the connected cars market expansion, and the key role mobile network operators have in driving the market forward in order to offer advanced connectivity and an enhanced driving experience.

The analyst firm believes the growth will be driven by improvements in both advanced driver assistance systems (ADAS), the attraction of enhanced in-vehicle infotainment systems, and the transformative potential of 5G’s high-speed and low-latency capabilities. However, maximizing 5G’s potential impact will require “effective collaborations between automotive OEMs and [mobile network] operators,” according to the authors of the report, who believe the 5G connectivity opportunity presented to telcos by the connected vehicle sector will be worth US$3.6bn in 2027.

According to the co-author of the research, Nick Maynard, “5G can allow automotive OEMs [original equipment manufacturers] to upgrade the in-vehicle experience. In a vehicle market transitioning to electric vehicles, improving the user experience is key. Operators hold the critical role in enabling this in a reliable way, making them the partners of choice as their 5G networks rapidly expand.” Connected vehicles utilising 5G will be able to exchange information “between the various elements of the transport system and third-party services.”

| Key Market Statistics | |

| Market size in 2023: | 192 million vehicles in service |

| Market size in 2027: | 367 million vehicles in service |

| 2023 – 2027 Market Growth: | 91% |

The report is upbeat overall, but notes that commercial use cases are proving more difficult to find and justify than those for ordinary automobile drivers. According to the Juniper Research team, by 2027 commercial vehicles will account for no more than 20% of connected vehicles worldwide, only a slight increase from the 16% that commercial vehicles will account for this year.

The research shows that such slow uptake is because commercial vehicle design is not yet fully exploiting the potential of connectivity beyond simple emergency call features and basic connected infotainment systems. The report recommends that automotive OEMs prioritize integrations with common fleet tracking systems out of the factory to maximise the benefits of connectivity, and to enable commercial fleet owners to maximize efficiency in their processes.

All types of connected vehicle technologies are still ‘works in progress,’ according to Juniper Research.

Various types of connected vehicle technologies are being pursued and improved. Vehicle-to-infrastructure (V2I) connectivity is used mainly to ensure vehicle safety as the vehicle communicates with road infrastructure and shares and receives information, such as traffic flows, road and weather conditions, speed limits, accident reports, and so on. Meanwhile, vehicle-to-vehicle (V2V) connectivity primarily permits the real-time exchange of information between vehicles.

Vehicle-to-cloud (V2C) connectivity is enabled via 4G/LTE networks and is mainly used for downloading over-the-air (OTA) vehicle updates, remote vehicle diagnostics or to connect with internet of things (IoT) devices. Vehicle-to-pedestrian (V2P) connectivity is a newer safety technology that uses sensors to detect pedestrians and other ‘obstacles’ and provides collision warning and avoidance guidance. Lastly, vehicle-to-everything (V2X) connectivity is exactly what it says it is – the combination of all the above connectivity systems and methods.

Of course, connected vehicle technology is not solely concerned with conventional automobiles. Self-driving vehicles will also exploit connection technologies to communicate with the road infrastructure and cloud platforms, but as incidents of crashes, injuries and deaths proliferate, self-driving vehicles are getting some bad press and would-be user enthusiasm is waning. Again, much stock is again being placed on the ability of 5G to help make self-driving vehicles not only safer but much more intelligent and responsive – it is very much a work in progress.

References:

Connected Car Market Research: Size, Trends, 2023-27 (juniperresearch.com)

Telcos to play critical 5G role in connected vehicles sector – report | TelecomTV

Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

Global telco revenues from 5G Fixed Wireless Access (FWA) will rise from $515 million in 2022 to $2.5 billion next year, according to a new report from Juniper Research. FWA includes services that provide high-speed Internet connectivity through cellular‑enabled CPE (Customer Premises Equipment) for uses including broadband and IoT networks.

The research predicts that operators’ 5G FWA revenue will reach $24 billion globally by 2027. It identified the consumer market as the sector generating the highest revenue for network operators, representing 96% of global 5G FWA revenue. However, it warns that operators must provide a compelling user proposition for FWA solutions through the bundling of services such as video streaming, gaming and smart home security to enrich user experience and gain competitive advantage against incumbent high‑speed connectivity technologies, such as FTTP (Fibre‑to‑the‑Premises).

| Key Market Statistics | |

| Market size in 2022: | $515m |

| Market size in 2023: | $2.5bn |

| 2022 – 2027 Market Growth: | 480% |

Juniper Research author Elisha Sudlow-Poole remarked: “The benefits of FWA are now comparable with services using fibre-based networks. Operators have an immediate opportunity to generate revenue from broadband subscriptions directly to end users by providing last-mile solutions underpinned by their existing 5G infrastructure.”

Juniper Research notes that the increase in 5G subscribers will be driven mainly by “the accelerating migration of cellular subscriptions to 5G networks, owing to operator strategies that minimize or remove any premium over existing 4G subscription offerings,” and that 600 million additional 5G subscriptions are expected be created next year, “despite the anticipated economic downturn in 2023.”

The report predicts that the growth of 5G networks will continue, and over 80% of global operator‑billed revenue will be attributable to 5G connections by 2027. The telecommunications industry demonstrated its robustness against the impact of the COVID-19 pandemic, and the report forecasts that the growth of 5G will also be resilient against this economic downturn due to the vital importance of mobile Internet connectivity today.

Juniper Research co-author Olivia Williams noted: “Despite the growth of the Internet of Things, revenue from consumer connections will continue to be the cornerstone of 5G operator revenue increase. Over 95% of global 5G connections in 2027 will be connected personal devices such as smartphones, tablets and mobile broadband routers.”

Private 5G Networks Represent a Key Opportunity for Operators:

In addition, the report predicts that the ability of standalone 5G networks to offer ‘network slicing’ will act as the ideal platform for the growth of 5G private network revenue. 5G Standalone (SA) uses 5G core networks supporting network slicing technology, which can be used to take a ‘slice’ of public 5G infrastructure and provide it to private network users. In turn, this helps mitigate the cost of private 5G network hardware and increase its overall value proposition, all against a background of deteriorating macro-economic conditions.

The report recommends that operators use 5G FWA to facilitate the last mile-solution by treating the relationship between FWA and fibre networks as wholly collaborative to maximize network performance and return on investment.

References:

https://www.juniperresearch.com/whitepapers/how-operators-will-capitalise-on-5g-fixed-wireless

5G Service Revenue to Reach $315 Billion Globally in 2023 | TelecomTV

Juniper Research: Cellular IoT market expected to hit $61B by 2026

A new study from Juniper Research has found that the global value of the cellular IoT market will reach $61 billion by 2026; rising from $31 billion in 2022. It identified the growth of 5G and cellular LPWA (Low-power Wide Area) technologies as key to this 95% increase over the next four years.

The new study, Cellular IoT: Strategies, Opportunities & Market Forecasts 2022-2026, predicts that, LPWA solutions, such as NB-IoT and LTE-M, will be the fastest-growing cellular IoT technologies over the next four years. It anticipated that the low cost of both connectivity and hardware will drive adoption for remote monitoring in key verticals, such as agriculture, smart cities and manufacturing. In turn, LPWA connections are expected to grow 1,200% over the next four years.

The report urged operators to migrate IoT connections on legacy networks to networks that support LPWA technologies. It anticipated that demand from enterprises for low-cost monitoring technologies, enabled by LPWA networks, will increase as these legacy networks are shut off over the next four years.

Research co-author Charles Bowman commented: “Operators must educate users on the suitability of LPWA as a replacement technology for legacy networks. However, many IoT networks cannot solely rely on LPWA technologies. More comprehensive technologies, such as 5G, must underpin IoT network architectures and work in tandem with LPWA technologies to maximize the value of IoT services.”

5G to Generate $9 Billion for the IoT Market by 2026 (???):

The report predicted that 5G IoT services [1.] will generate $9 billion of revenue by 2026; rising from $800 million in 2021. This represents a growth of 1,000% over the next five years as 5G coverage expands and operators benefit from the increased number of 5G IoT connections. To capitalise on this growth, it recommended operators offer value-added services, such as network slicing and edge computing, to IoT users to maximise the value of 5G adoption.

Note 1. We believe that premium 5G-based IoT services must use the ultra-reliable low-latency communication (URLLC) 5G use case for which the 3GPP spec URLLC in the RAN has yet to be completed. Mission critical apps need ultra high reliability while real time control of IoT devices require ultra low latency. That won’t happen till the spec is complete, performance tested and implemented widely. URLLC will also required a 5G SA core network to prioritize URLLC traffic ahead of eMBB data flows.

Premium 5G URLLC services are expected to command a higher price and therefore generate proportionally more revenue per connection. However, they will likely still be in the early stages of deployment and uptake in 2026.

…………………………………………………………………………………………………………………………………

In contrast to Juniper’s bullish cellular IoT forecast, others have forecast non cellular LPWAs to be the big IoT connectivity winners.

- Ericsson predicted in a November 2020 Mobility Report that by 2026, cellular will account for 5.9 billion of the expected 26.9 billion IoT connections.

- Transforma Insights’ most recent forecast is for 19.9 billion IoT connections by 2026, with 3.2 billion of those being cellular connections. That implies the majority of LPWAs will not be cellular based, e.g. LoRA WAN, Sigfox, others.

We agree with Nick Wood’s of telecom.com who concluded, “Juniper’s forecast implies that 5G is not about to make a meaningful contribution to operators’ IoT revenues any time soon.”

References:

https://www.juniperresearch.com/press/cellular-iot-market-value-to-exceed-61b-globally

Juniper Research: Network Operators to Spend Billions on AI Solutions

A new study from Juniper Research has found that total network operator spending on AI solutions will exceed $15 billion by 2024; rising from $3 billion in 2020. The research identifies network optimisation and fraud mitigation solutions as the most highly sought-after AI based services over the next 4 years. AI-based solutions automate network functionalities including routing, traffic management and predictive maintenance solutions.

For more insights, download our free whitepaper, How AI Analytics will Boost Operators’ Revenue.

Network Optimisation & Fraud Prevention Driving Adoption in Developed Markets

The new research, AI Strategies for Network Operators: Key Use Cases & Monetisation Models 2020-2024, found that operators in developed regions, such as North America and Europe, would account for over 40% of AI spend by 2024, despite only accounting for less than 20% of global subscribers. It predicts that growing demand for operational efficiencies will drive operators in these regions to increase their overall investment into AI over the next 4 years.

The research urges operators to embrace a holistic approach to AI implementation across service operations, rather than applying separate AI strategies to individual use cases. It suggests network operators leverage AI to unify internal data resources and encourage cross-functional insight sharing into network efficiencies to maximise the benefits of collaboration across internal teams.

The research predicts that AI spend by Emerging Markets operators will exceed $5 billion by 2024, rising from only $900 million in 2020. It found that this growth will be driven largely by operators exploring early use cases of AI before expanding the presence of AI in their networks to include more comprehensive services.

The report forecasts that Indian Subcontinent and Africa & Middle East will experience the highest growth in spend on AI services, with operator spend in both regions forecast to grow over 550% over the next 4 years. It anticipates that operators in these regions will initially invest in AI-based CRM (Customer Relationship Management) solutions that yield immediate benefits.

Related post:

Juniper Research: Telco Operator Voice Revenue to Drop 45% by 2024, Under a Growing OTT Challenge

A new study from Juniper Research has found that mobile operator voice revenue will drop to $208 billion by 2024 from $381 billion in 2019, as users continue to prefer more flexible and free OTT (Over-the-Top) services.

The new research, Mobile Voice: Emerging Opportunities for Operators & Vendors 2019-2024, forecasts that third-party OTT voice services will continue to grow; nearing 4.5 billion users by 2024. The study found that while this trend will contribute to declining voice revenue for operators, 5G proliferation will propel a number of nascent mobile voice and video services; generating fresh revenue streams for service providers.

Operator Voice Revenue Falls, as OTT managed VoIP Users Continue to Grow

The research forecasts that operator voice revenue will decline by 45% by 2024, in the face of an increase of 88% in the total number of third-party OTT mVoIP users over the next five years. The study urges operators to invest in AI-enabled communications platforms that facilitate competitive voice service delivery.

However, the research anticipates that improved 4G coverage and a growing number of capable devices will boost the number of mobile video call users; partially offsetting voice revenue losses. The study forecasts that ViLTE (Video over LTE) operator revenue will exceed $33 billion by 2024.

RTI (Real-Time-Interaction) and Vo5G (Voice Over 5G)

The report anticipates that 5G proliferation will generate new revenue streams for operators by enabling innovative use cases for VoLTE and ViLTE. The study notes that high data throughput and low latency will propel emerging services such as RTI, remote control and Vo5G, which will find wide application across a range of industries.

Additionally, the research prompts operators to accelerate VoLTE launches, in order to benefit from emerging Vo5G services. The study notes that establishing a 5G-enabled IMS (IP Multimedia Subsystem) infrastructure for VoLTE will provide a pivotal foundation for future voice services rollouts, which operators can monetise in upcoming years.

For more insights on mobile voice, download the free whitepaper: How Will 5G Evolve Mobile Voice in an AI-driven World.

……………………………………………………………………………………………..

Juniper Research provides research and analytical services to the global hi-tech communications sector, providing consultancy, analyst reports and industry commentary.

For further details please contact:

Sam Smith, Press Relations

Telephone: +44(0)1256 830002

Email: [email protected]

Juniper Research: Japan & South Korea lead in 5G; NTT Docomo most promising 5G operator

Mobile carriers in Japan and South Korea are way ahead of wireless telcos in US and China in near future “5G deployments, according a new study from Juniper Research. In its new report, 5G Market Strategies: Consumer & Enterprise Opportunities & Forecasts 2018-2025, the research firm ranked NTT Docomo, SK Telecom, LG U+, KTand SoftBank as the world’s top five “most promising 5G network operators.”

Comment: What’s so interesting about Juniper’s ranking is that there is no standard for 5G radio access network/radio interface technologies and there won’t be till the end of 2020 when IMT 2020 will be completed.

Japan’s NTT Docomo topped the list as No. 1, overtaking the top spot from SKT, which was the leader in the same study last year. SKT slipped into second place in 2018.

Following the top 5 players are AT&T and China Mobile, which were in the top five spots last year.

The research firm said it assessed over 50 global operators for the study and evaluated them based on results of 5G testing and trials, the extent and range of partnerships in the ecosystem and the level of technology innovation.

Japan, South Korea will account for 43% of 5G connections in 2019:

Japan and South Korea have established themselves as clear leaders in the development of 5G, says Juniper Research. In a white paper, Operators Need to Secure 5G ROI ~ Here’s How, accompanying the study, the research firm predicts that 43% of global 5G connections in 2019 will be in Japan and South Korea.

Juniper Research also forecasts that first commercial 5G network launches are expected in 2019 and that the first networks with 5G services will be in the Far East, China and North America. These regions are expected to account for all of the predicted 1.05 million 5G active connections by the end of 2019.

However, the research cautioned that operators faced significant challenges both to deploy and most effectively configure 5G networks. It claimed that the need to deploy dense small cell networks, operators would need far greater access to sites to upgrade and share equipment. Furthermore, it urged operators to invest in virtualized networks to enable both more efficient traffic management and improve security in the network perimeter.

“Over the past 2 years, operators and network vendors have been actively trialing their 5G solutions, including antennas, core networks and beam forming. Since 3GPP standards have been finalized for 5G NRs (3GPP spec New Radios) many of these trials have focused on interoperability between devices and 5G networks,” the research firm said.

“As a result, leading operators are now aiming for a launch date in 2019. Indeed, many operators have begun rolling out antennas and backhaul infrastructure to provide a 5G service. Initial 5G coverage will be in urban areas.”

220M 5G broadband connections forecast by 2025:

The research firm also forecasts that 5G based fixed wireless broadband (there is no such thing as it’s not even a use case for IMT2020!) will be among the first services to launch over 5G (e.g. Verizon’s proprietary spec). Its suitability as a last mile solution will drive adoption to over 220 million connections by 2025. However, the challenge for operators will be to demonstrate tangible benefits, to enterprises and consumers, over existing fiber-based solutions, warns Juniper Research author Sam Baker.

“Operators must carefully consider pricing strategies for 5G broadband,” Baker said. “Pricing must address both the anticipated large traffic generated, whilst remaining price competitive against incumbent broadband suppliers.”

He also cautions that operators faced significant challenges both to deploy and most effectively configure 5G networks.

“With the need to deploy dense small cell networks, operators would need far greater access to sites to upgrade and share equipment. Furthermore, we would urge operators to invest in virtualized networks to enable both more efficient traffic management and improve security in the network perimeter.”

Current Market Status:

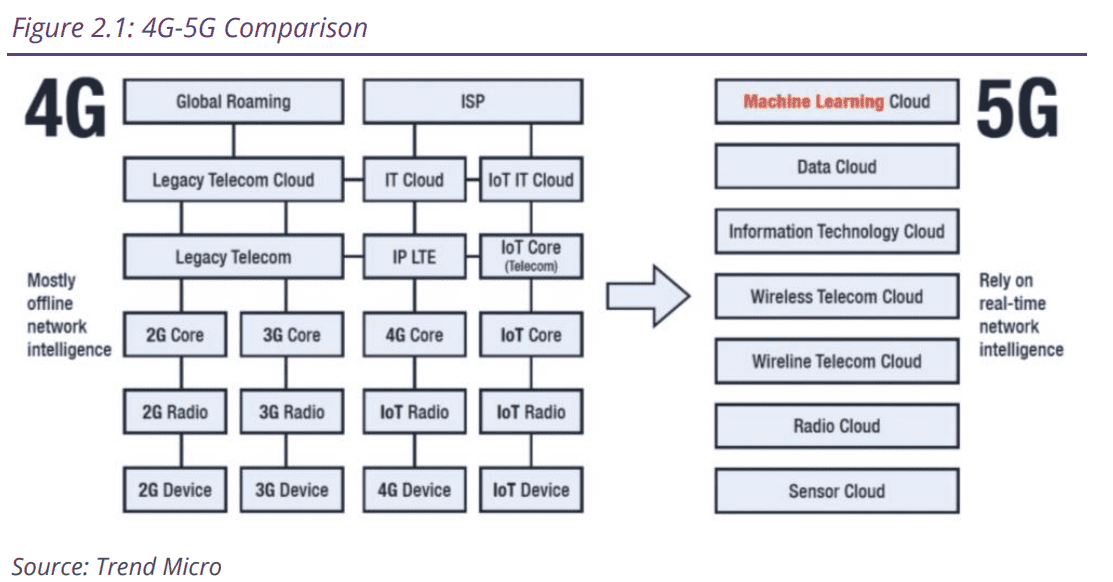

5G, the next iteration of wireless cellular technologies, is currently reaching its final stages of development and commercialization by MNOs and industry stakeholders. Previous iterations of technologies (3G and 4G) were developed with a consumer-oriented focus. However, 5G will have further-reaching impacts, enabling a large number of use cases in IoT (Internet of Things) sectors such as healthcare, automotive industries, smart cities and mobile broadband. 5G networks will deliver high-bandwidth and low latency that support services such as UHD (Ultra High Definition) video streaming.

Juniper Research anticipates that the first commercial network launches will occur in 2019; the first networks to provide 5G services will be located in Far East & China and North America. Meanwhile, network operators in Europe have mostly adopted a ‘wait-and-see’ approach, closely following the progress of operators in these 2 regions.

Over the past 2 years, operators and network vendors have been actively trialing their 5G solutions, including antennas, core networks and beam forming. Since 3GPP Release 15 specs have been finalized for 5G NRs (New Radios) many of these trials have focused on interoperability between devices and 5G networks.

As a result, leading operators are now aiming for a launch date in 2019. Indeed, many operators have begun rolling out antennas and backhaul infrastructure to provide a 5G service. Initial 5G coverage will be in urban areas.

Operator Monetization Strategies for 5G:

As noted in our previous edition, ARPU (Average Revenue per User) has been considered the benchmark metric for measuring operator success in terms of billed revenue. The new services discussed in the previous sections are expected to be heavily dependent on a favorable operator service model.

There is both a need and a desire to solve the ARPU problem that network operators are facing; carriers are considering different service scenarios that they could deploy to garner payback from their network licence investments. However, the challenge here is that as 5G expected to drive a number of connected devices, systems and sensor networks, is ARPU going to be the right factor for measuring 5G? For example, consider M2M verticals:

References:

https://www.juniperresearch.com/press/press-releases/5g-market-strategies-tbc