2019 IoT World: Market Research from Ovum & Heavy Reading; LPWAN Market to be >$65 billion by 2025

I. IoT World May 14, 2019 presentation by Alexandra Rehak, Practice Leader IoT, Ovum and Steve Bell, Sr. Analyst, Heavy Reading.

Edited by Alan J Weissberger

Ovum Forecasts:

- IoT devices will grow to 21.5bn by 2023, while revenue will nearly double to $860bn.

- Key trends driving IoT evolution in 2019: enabling technologies, new business models, (industry) verticalization, big data & analytics, new tools, e.g. AI/ML.

- Drivers for IoT deployment still focus on efficiency and customer

experience, but many enterprises are looking for new revenue. Top 4 IoT drivers are to improve: operation efficiency, customer engagement & experience, strategic decision making based on actionable insights, new revenue streams from value added products/services. - The biggest enterprise IoT challenge is data – how to secure it, how

to derive analytics value from it, how to integrate it. Top 3 barriers to enterprise IoT deployment: data security & privacy (has been top concern for last 10+ years), data analytics skills/data scientists, difficult to integrate with existing IT (and likely OT too), complexity of technical implementation (and systems integration).

Enabling Technologies:

1. LPWAN will be a key enabler for cheaper, massive scale IoT

connectivity – and 2019 will be the year it finally takes off (Alan has heard that for several years now! However, NB-IoT and LoRa are growing very quickly in 2019.)

• <$1 per month connectivity

• <$10 modules

• Low bandwidth, long battery life, extended coverage characteristics

• Use cases: smart cities, consumer IoT, asset monitoring, environmental monitoring

• NB-IoT, LTE-M, LoRa, Sigfox are the big four LP WANs

2. 5G enables enhanced IoT digital capabilities:

▪ High bandwidth services – eg UHD video

▪ Critical applications, which require low latency – e.g., autonomous driving, industrial applications (3GPP Release 16 and IMT 2020 approved standard)

▪ High bandwidth, low latency services – e.g., augmented reality

▪ Information intensive routines, which require low latency performance– eg smart advertising, True AI (is what we have today fake AI?)

▪ Services that can – but don’t readily – work over 4G, e.g., mobile video conferencing

3. Edge and the IoT opportunity:

Virtualized services (including gateways and vCPE), FOG nodes, life cycle management, linking silos (systems and data), many different applications, data analytics, AI/ML/DL, threat intelligence, device management services, security credential management.

4. Blockchain is still early-stage as an IoT enabler, but promising use

cases are emerging

- Authentication of devices joining IoT network

- Supply chain management and verification

- Smart grid microcontracts

- Autonomous vehicles

Blockchain will not suit all IoT security and contract requirements. That’s because it’s: Complex, heavy processing load, not yet fully commercialized, private blockchain space is fragmented, need for supporting regulatory/legal frameworks Autonomous vehicles.

………………………………………………………………………………………………………….

Industrial IoT (IIoT):

It’s becoming a core focus for the market – and an important testbed for 5G. Requires ultra reliable and very low latency.

IIoT is moving beyond efficiency gains:

• IIoT will grow in importance in 2019

• Drivers: efficiency and margins, competitive positioning, ‘job lots of one’

• Challenges: IT/OT integration, security, traditional business models

• Applications: simple asset tracking/monitoring to complex propositions (predictive maintenance, digital twin, robotics, autonomy)

• IoT, 5G, and AI form virtuous circle for industrial sector and factory

campuses

• Private LTE as another enabler (Steve Bell of Heavy Reading was very optimistic on this during the Thursday morning, May 17th round table discussion on 5G and LTE for IoT). So is this author!

……………………………………………………………………………………………………..

IoT value chain: evolution from ‘platform providers’ to ‘end-to-end

solution providers,’ simplifying the buying process. An end-to-end solution requires: sensors/devices/hardware, connectivity, platform (connectivity and device control/management), applications, analytics, integration.

Value chain evolution is also driving IoT business model innovation, for both enterprises and providers. For connectivity, this includes: flat rate IoT connectivity pricing (e.g. $5 per year), bundled IoT device connectivity, alternative IoT connectivity providers (e.g. Sigfox, Zigbee mesh, BT mesh, etc), private LTE (licensed frequencies so not contention for bandwidth as with WiFi).

…………………………………………………………………………………………………….

Summary and Recommendations:

- Enabling IoT technologies: 5G, LPWAN, edge, blockchain – developing

quickly – but shouldn’t be seen in isolation. - IoT data usage & security: Focus of customer concern – stronger support,

simpler tools needed to deliver value through analytics, eventually AI. - Vertical strategies: Industries face significant disruption – understand

how IoT will help your customer to transform and address these shifts. - New IoT business models: increasingly sophisticated – end customers

very interested, but need help to understand them, manage risk.

……………………………………………………………………………………………………………

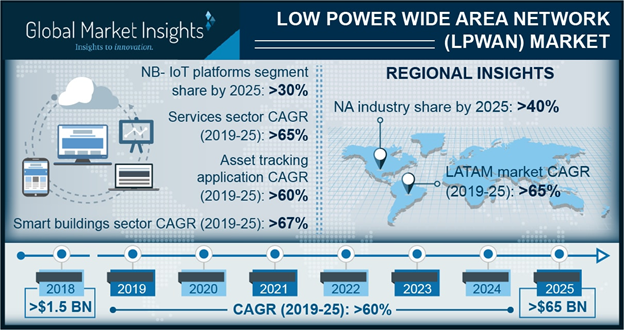

II. LPWAN Market Forecast from Global Market Insights, Inc.

The LPWAN market is set to grow from its current market value of more than $1.5 billion (€1.3 billion) to over $65 billion (€58.2 billion) by 2025, according to a new research report by Global Market Insights, Inc.

Low power wide area network market growth is driven by the growing deployment of LPWA technologies, including LoRa, NB-IoT, and LTE-M, offering a wide range of connectivity options to enterprises. These technologies provide broader network coverage and better battery life to connect various devices. LPWAN networks are becoming very popular among enterprises to support various IoT use cases for verticals including healthcare, manufacturing, agriculture, logistics, and utilities.

For instance, the rising penetration of Industrial IoT (IIoT) in the manufacturing industry has increased the demand for LPWA technologies, particularly NB-IoT and LTE-M, to enable reliable machine-to-machine communication. Industrial IoT connections are expected to increase nearly five times between 2016 and 2025, from 2.4 billion to around 14 billion connections.

By deploying LPWAN connections, manufacturing companies can increase their operational efficiencies to drive high productivity. Another factor fuelling the LPWAN market growth is increasing investments by companies in LPWAN technologies. For instance, in June 2017, Cisco contributed to a US$ 75 million Series D funding round for Actility, a LPWAN startup. Cisco’s investments in Actility enabled it to accelerate the development of IoT solutions.

The LPWAN platforms held a major market share of over 70% in 2018 owing to the deployment of various platforms, including NB-IoT, LoRaWAN, Sigfox, and LTE-M. Massive IoT deployments in various industry verticals, including utilities, manufacturing, transportation, and healthcare, has increased the demand for LPWAN platforms to support connected devices requiring low power consumption, long range, and low costs. Among all the platforms, LoRaWAN platforms held the highest market share of over 50% in 2018 as they use unlicensed spectrum and are best suited for applications that generate low traffic and require low-cost sensors.

In the services segment, the managed services segment is expected to hold low power wide area network market share of around over 30% in 2025. Managed services enable organisations to accelerate the deployment of LPWAN and reduce the time & expenses spent on training the IT staff. The on-premise deployment model is expected to grow at a CAGR of over 50% over the projected timeline. The demand for this deployment model will increase as it enables organisations to build & manage their own LPWAN for IoT-based applications.

References:

Ovum’s latest video on IoT with Alexandra Rehak: https://ovum.informa.com/products-and-services/research-services/internet-of-things

https://www.gminsights.com/industry-analysis/low-power-wide-area-network-lpwan-market

3 thoughts on “2019 IoT World: Market Research from Ovum & Heavy Reading; LPWAN Market to be >$65 billion by 2025”

Comments are closed.

Quite nformative with respect to IoT emerging in 2019. Lots of research here with credit given to 2019 IoT World speakers Alexandra Rehak and Steven Bell-both of whom seemed to be very optimistic on IoT and LPWANs this year.

Only thing that could have been changed a little is the blog post is very weighed down on the technology side. For a reader just getting into IoT (after many years of hype) it could be a little over the top

Important IoT Questions:

How many connected consumer IoT devices will be in the market by 2022, and which countries, regions, and applications will see the strongest growth? What about the and Industrial IoT market?

Which connectivity technologies will be most prevalent in the connected consumer electronics and Industrial IoT device markets?

How large will service revenues be for the connected consumer electronics and Industrial IoT markets, and how will this vary by country and by application type?

This is one of the best posts I have come across about the IoT market.

Thank you very much for sharing such priceless information with us.