Dell’Oro: LTE still dominates private wireless market; will transition to 5G NR (with many new players)

Dell’Oro Group just published an updated Private Wireless market report with a 5-year forecast. According to the report, private wireless RAN revenues for the full-year of 2021 are slightly weaker than initially projected.

“The markdown is more driven by the challenges of converting these initial trials to commercial deployments than a sign that demand is subsiding,” said Stefan Pongratz, Vice President at Dell’Oro Group. “In fact, a string of indicators suggest private wireless activity is firming up not just in China but also in other regions,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward just slightly to factor in the reduced 2021 baseline.

- Total private wireless RAN revenues, including macro and small cells, are still projected to more than double between 2021 and 2026.

- The technology mix has not changed much with LTE dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

- Risks are broadly balanced. On the upside, the 5G enterprise puzzle has still not been solved. The successful launch of private 5G services by suppliers with strong enterprise channels could accelerate the private 5G market at a faster pace than expected. On the downside, 5G awareness is improving but it will take some time for enterprises to fully understand the value of private LTE/5G.

Comment & Analysis:

This author notes a bevy of new activity in the 5G private network space. It’s almost approaching a frenzy!

Yesterday, Cisco announced a “private 5G service that simplifies both 5G and IoT operations for enterprise digital transformation.” The company promised to show off the new product at the upcoming MWC trade show in Barcelona, Spain. Cisco to sell its 5G private network under an “as-a-service” model, such that enterprise customers who purchase it will only pay for what network resources they actually use. The company said that it would partner with unnamed vendors for all the necessary components, adding that it will run over midband spectrum. The company did not provide any further details. It should be noted that Cisco has never had ANY 2G/3G/4G/5G RAN products, as their wireless network portfolio has always been focused on WiFi (now for enterprise customers).

In late November 2021, Amazon unveiled its new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind. Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this (AWS Private 5G) announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

In addition, Mobile network operators like Deutsche Telekom, AT&T and Verizon offer private 5G networks, as do other cloud computing companies, mobile network equipment vendors like Ericsson and Nokia, system integrators like Deloitte, as well as startups like Betacom and Celona. So it’s a crowded market with suppliers each expecting a chunk of a very big pie.

I posed the seemingly contradictory finding of a less than forecast 2021 private wireless market vs the new private 5G players to Dell’Oro’s Pomengratz. In his email reply, Stefan wrote:

“If I had to summarize all our various projections I will just say that the things we know (public 5G MBB/FWA) are generally accelerating at a faster pace than expected while the things that we don’t know (private 5G/critical IoT etc.) are developing at a slower pace than expected.

And for this particular update, slower-than-expected comment was more related to revenues than activity. I agree with you that activity both when it comes to private trials and entering this space remains high.

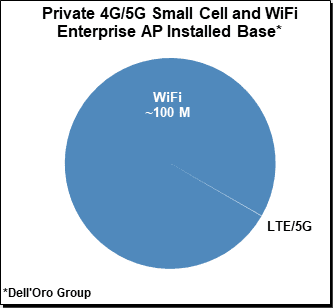

At the same time, we have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

References:

Private Wireless Weaker Than Expected in 2021, According to Dell’Oro Group

https://www.cisco.com/c/en/us/products/wireless/private-5g/index.html

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America

3 thoughts on “Dell’Oro: LTE still dominates private wireless market; will transition to 5G NR (with many new players)”

Comments are closed.

IEEE ComSoc and SCU will host a virtual panel session on Private 4G/5G and OpenRAN. We have confirmed participants from Nokia, Mavenir, Intel, and EdgeQ + analyst firm StrandConsult.

If you’re interested in attending this FREE event (to be scheduled in late Feb) please email me: [email protected] & I will put you on the email invitation list.

Another dark horse player in the private 4G/5G market is FreedomFi with its blockchain (Helium)-enabled small cell solution. At this point, the economics seem to work best for locations where coverage would be poor and the dwell time is relatively high (e.g. a sports bar, mall, hospital, cafe, etc.).

https://wirelessworkshop.tv/getting-started-with-helium5g-how-do-i-make-money/?s=09

According to this article, they have already sold 10,000 small cell bundles with half of those turned up. They expect 50,000 deployed by the end of the year. They just received Series A funding, which includes money from Samsung and Qualcomm. Like the Helium LoRA network, FreedomFi is effectively crowdsourcing the funding of its network.

https://decrypt.co/95153/samsung-qualcomm-back-freedomfi-heliums-5g-crypto-network-partner

Never heard of FreedomFi and they are not listed in Gartner’s 2022 5G Magic Quadrant as per:

https://techblog.comsoc.org/2022/03/15/gartners-magic-quadrant-for-5g-network-infrastructure-for-communications-service-providers/