Analysts: Increased Fiber internet services may force cablecos to alter pricing & deploy FTTP

Several analysts believe the increased availability of Giga bit/sec FTTP (fiber to the premise) service offerings (with flat rates) could force cablecos to rethink their pricing strategy. For example, Jonathan Chaplin of New Street Research stated in a note to clients that cable’s promotional pricing is generally competitive with fiber offers. The problem, however, is that cable service ends up costing consumers significantly more than fiber based broadband access once those introductory rates disappear. “We have hypothesized for a couple of years that 1) Cable’s pricing strategy contributes to high churn and low NPS scores and 2) that it is unsustainable. We don’t think Cable has to cut price to remain competitive; we suspect they do have to fix the pricing model.”

Recon Analytics founder Roger Entner agreed, telling Fierce Telecom his research has shown price is the number one reason people join or leave a service provider. While consumers find promotional pricing very attractive, they’re generally unhappy when their promotions end. “So, for the cable companies, it’s both a gross addition driver and a churn driver as well,” he explained. While cable’s pricing strategy worked well when there was no competition to offer similar broadband speeds or features, that is now changing as fiber is becoming more broadly available, Entner said.

Indeed, fiber based telcos are already seizing on the opportunity to lure customers in with the promise of more simplistic pricing. For instance, AT&T used its recent launch of multi-gig fiber broadband plans as an opportunity to introduce new “straightforward” pricing which promises a flat rate with equipment and other fees included.

Speaking on an episode of Entner’s podcast, AT&T’s EVP and GM of Broadband Rick Welday stated there is “significant” demand in the market for simple pricing. “It’s obvious that consumers are done with this intro pricing where you see a fun, attractive, low rate advertised on television, you go sign up with that ISP and then 12 months later your rate jacks up considerably. Frankly, this is the model that cable has chosen. It seems to align with their video business and annual increases in carriage fees,” he said. Welday argued AT&T’s new cost model is a “game changer in terms of an ISP really obsessing over how to be transparent and upfront with the market.”

Chaplin said a shift by cable to the flat pricing model fiber players use might “weigh on gross adds initially.” However, he predicted net additions would ultimately “land in a similar place” over the course of a couple years while reduced churn would yield “lower costs and higher margins.”

Despite the potential benefits, Entner said he doesn’t expect cable to change its approach right away. “The system is still working and so you have a lot of inertia in the system. Only when cable is actually losing customers will this change,” he concluded.

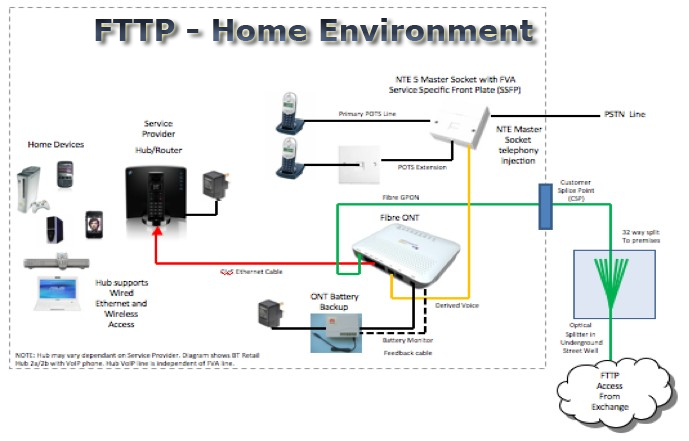

Source: https://kitz.co.uk/adsl/fttp.htm

In addition, cablecos are planning FTTP deployments in the near future. I’ve heard that directly from an anonymous Comcast executive who told me to look out for their upcoming 10G bit/sec service.

We previously reported that a Cable One joint venture (JV) with three private equity firms is seeking to speed its expansion of fiber based Internet access to underserved markets. Clearwave Fiber is a newly formed joint venture that holds Clearwave Communications and certain fiber assets of Hargray Communications. Cravath is representing Cable One in connection with the transaction. With the formation of the JV, Clearwave Fiber intends to invest heavily in bringing Fiber-to-the-Premise (“FTTP”) service to residential and business customers across its existing footprint and near-adjacent areas.

Meanwhile, CableLabs has developed technologies that fall under the platform’s key tenets including capacity, security and speed. Increasing the number of bits per second that are delivered to subscribers can improve download and upload speed, a primary objective for the 10G platform. As data demands increase, many operators are considering increasing capacity on the existing optical access network.

To help operators better meet that demand, CableLabs recently published its first set of specifications for a new device, called the Coherent Termination Device, that enables operators to take advantage of coherent optics technologies in fiber-limited access networks.

References:

https://www.fiercetelecom.com/broadband/analysts-fiber-could-force-cable-overhaul-its-pricing-model

https://www.fiercetelecom.com/operators/at-t-puts-cable-companies-notice-fiber-plan

https://kitz.co.uk/adsl/fttp.htm

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

10-Gbps last-mile internet could become a reality within the decade from Futurology

WideOpenWest picks Seminole County, FL as its 1st greenfield area for FTTP deployments

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Cable One joint venture to expand fiber based internet access via FTTP

3 thoughts on “Analysts: Increased Fiber internet services may force cablecos to alter pricing & deploy FTTP”

Comments are closed.

Jeff Heynen, Dell’Oro Group VP of Broadband Access and Home Networking, gave Fierce his take on what to expect in the coming year. First and foremost, he said, fiber isn’t going away.

“I don’t think that you can talk about cable without also talking about fiber,” he said. According to Heynen, there’s a growing mindset among certain cable players that “now would be a good time to go ahead and start to overbuild with fiber, particularly if some of the subscriber growth that has slowed down continues to impact the bottom line.” Indeed, the beginnings of this trend could already be seen in 2021, as companies like Blue Ridge Communications in the U.S. and Virgin Media O2 in the U.K. announced plans to rebuild their entire cable networks with fiber.

In North America, Heynen said Tier 2 and Tier 3 players are the ones jumping ship to fiber the fastest, in part because it’s less expensive for them to do so than it would be for a company like Comcast or Charter Communications. They’re also being driven by a need to stay competitive and the prospect of cost savings stemming from the removal of active electronics in the field.

RELATED: Blue Ridge plots fiber rebuild of its entire 8,000-mile cable network

For larger players like Comcast and Charter which are sticking with DOCSIS, Heynen tipped 2022 to bring more activity around distributed access architecture (DAA) and more work to prep their outside plant for the rollout of DOCSIS 4.0. Comcast is expected to press ahead with Remote PHY technology, driving an increase in Remote PHY device shipments. But those like Charter and Cox Communications who want to pursue Remote MAC-PHY technology will run into one key problem.

“The challenge is going to be the silicon,” Heynen said. “Unfortunately, the silicon issues and the supply chain issues are going to be the thing that holds Remote MAC-PHY back in 2022.”

In terms of technology, Heynen tipped automation to be another focus area for cable in the coming year. For broadband in general “speed is going to become less important because we’re starting to get to equivalencies with gigabit and all that,” he said. Instead, consumers will start focusing on factors like reliability and latency, among other things.

“Cable, they need to get to that point where they can customize the provisioning of services based on a customer profile,” he added.

“We think fiber and FWB adds will increase as the footprint across which each is offered expands. Unless the entire market accelerates, cable adds have to slow,” New Street Research analyst Jonathan Chaplin wrote in November.

Heynen concurred, stating “I do think it’s a threat.” While FWA providers are finding early success pulling unhappy DSL customers, he argued there’s going to be a point at which existing cable subscribers could be lured away by a FWA provider with stellar customer service.

“There’s a real potential challenge here coming from on one side fiber and on the other side fixed wireless,” Heynen concluded. “Discounting it is just the wrong approach.”

https://www.fiercetelecom.com/broadband/heres-how-fiber-fwa-factor-cables-future-2022

UTOPIA Fiber is putting the finishing touches on the second largest municipal broadband network in the U.S., wrapping up a multi-year fiber build to more than 140,000 locations across West Valley City, Utah.

During a press conference announcing the news, UTOPIA executive director Roger Timmerman noted West Valley’s new asset is also the largest open access network in the country. Residents there now have access to broadband speeds ranging from 250 Mbps to 10 Gbps from 16 different residential ISPs and about 30 different business providers riding on the new infrastructure, he said.

“This is a city where they did have cable and DSL options. They recognized those were insufficient for their community,” Timmerman stated.

According to Timmerman, West Valley was one of the original 11 cities in Utah which joined together to form UTOPIA Fiber in the early 2000s. Work there started in 2004, but was halted soon after as UTOPIA worked its way through financial struggles. Construction resumed in 2009 but was slow going. However, activity picked up in recent years as UTOPIA was able to access the necessary financing to finish its work.

“It may sound like it was a 20-year project. Really about 75% of that city was all done in last two years,” Timmerman said.

https://www.fiercetelecom.com/broadband/utopia-fiber-wraps-work-largest-open-access-broadband-network-us

I want to to thank you for this great read about FTTP! I definitely enjoyed every bit of it.

I’ve got you bookmarked to look at new IEEE Techblog articles you post!