Infonetics Predicts 4.9% CAGR (2013 to 2017) for Telecom/Datacom Market; Asia vs RoW?

Market research firm Infonetics Research released excerpts from its annual Telecom and Datacom Network Equipment and Software report, which provides a big picture of the health of the overall market.

TELECOM AND DATACOM MARKET HIGHLIGHTS:

. Following a recession-induced drop in 2009, the global telecom/datacom equipment and software market grew 19% in 2010, 7% in 2011, and held steady (no gain) in 2012 at $172 billion

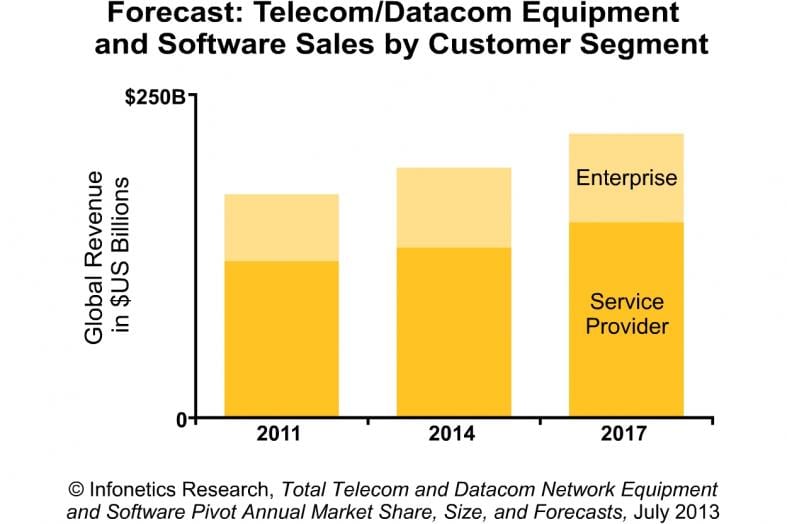

. Going forward, Infonetics projects the telecom and datacom equipment and software market to grow at a 4.9% CAGR from 2013 to 2017, when it is forecast to hit $218 billion worldwide

. During those 5 years, Infonetics expects service providers and enterprises to spend a cumulative $1 trillion on telecom and datacom equipment and software

. The top 4 telecom/datacom equipment vendors in order by overall worldwide revenue market share are Cisco, Ericsson, Huawei and Alcatel-Lucent

. Cisco maintains its commanding lead in the enterprise segment, while Ericsson is #1 in the larger service provider segment

“Even though there’s tremendous uncertainty about the health of the global economy and prospects for economic growth in the short term, the telecom and datacom equipment and software market is on track to grow annually through 2017, driven by major network transformations,” reports Jeff Wilson, principal analyst at Infonetics Research.

Michael Howard, co-founder of Infonetics and co-author of the report, adds, “Asia Pacific took the lead in telecom and datacom equipment spending in 2012, and we expect the region to continue leading at least for the next 5 years, contributing more than a third of global spending through 2017.”

Infonetics’ annual telecom and datacom equipment and software report compiles worldwide and regional market size, vendor market share, and forecasts through 2017 from its reports that track enterprise and service provider gear. It is a subset of all data networking and telecom equipment for service providers, cable companies, and small, medium, and large organizations, and therefore excludes consumer electronics.

The 11 major categories of equipment and software tracked include broadband aggregation; broadband CPE; pay TV; optical network hardware; carrier routing, switching, and Ethernet; service provider VoIP and IMS; service provider mobile/wireless infrastructure; service enablement and subscriber intelligence; security; enterprise and data center networks; and enterprise communications.

Companies tracked include Alcatel-Lucent, Avaya, Brocade, Ciena, Cisco, Ericsson, Fujitsu, HP, Huawei, Juniper, Motorola, NEC, Nokia Siemens Networks, Samsung, Siemens, ZTE and many others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Alan’s Opinion:

We think the telecom/datacom market is bi-furcated: Asia is doing well, but Rest of World (RoW) is struggling and not growing much. In particular, the European market is “sagging,” according to Bloomberg:

European Plan to Boost Sagging Telecom Market Set for September

Asian companies like Huawei, ZTE, and Samsung are gaining market share in the fiercely competitive telecom equipment market. Huawei and ZTE also dominate broadband CPE with Taiwanese companies like Netgear, D-Link, Ubee Interactive, ZyXEL, Actiontec, and many others doing quite well.

We think that RoW telecom/datacom vendors are struggling to make a profit. Moreover, VCs are not investing in such start-up companies, as they don’t see a viable market in the next five years. In fact, “network infrastructure” has become a dirty word to most VCs and angel investors.