Month: June 2019

SK Telecom and Samsung Bring South Korea Closer to 5G Standalone Commercialization

The two companies successfully completed interoperability test between 5G Standalone Core and Commercial Network Solutions (based on 3GPP Release 15 which is not 3GPP’s final submission to ITU-R for IMT 2020 RIT/SRITs.

SK Telecom and Samsung Electronics today announced the successful completion of South Korea’s first interoperability assessment between 5G Standalone (SA) Core and other commercial network systems over a pre-standard 5G network. This successful result brings the two companies one step closer to 5G SA commercialization.

The 5G SA Core, jointly developed by SK Telecom and Samsung Electronics, not only supports technologies including network slicing and function modularization based on 3GPP standards, but also offers additional functions that operators have been using since LTE, include billing, subscriber management and operational convenience system. The interoperability assessment is the final stage for verifying the validity of 5G SA data transmission, signifying that the SA system is ready to be launched for commercial service.

Both companies implemented several cutting-edge technologies in the 5G SA Core that has been used for the interoperability. The technologies include Data Parallel Processing technology that performs QoS and transmission control simultaneously; Data Acceleration technology that classifies and distributes similar traffic types; and Path Optimization technology that automatically delivers data traffic to Mobile Edge Computing (MEC) platform.

“Along with the initial phase of NSA rollout, SK Telecom has been continuously focusing on researching and developing the SA technology in order to provide customers a differentiated service quality with innovative products, which will be launched in the first half of next year,” said Park Jin-hyo, Chief Technology Officer and Head of ICT R&D Center at SK Telecom. “By strengthening bilateral collaboration with Samsung, SK Telecom will drive and lead highly innovative 5G technologies and solutions.”

“The fundamental structure of 5G SA is built on a completely new configuration, successfully delivering the most optimized 5G service to customers and enterprises across numerous industries,” said Jaeho Jeon, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Maintaining Korea’s leadership in network innovations through continuous investments in next-generation technologies is important to Samsung and SK Telecom, and the companies will continue to collaborate on developing and commercializing 5G SA.”

Once 5G SA is commercialized, data processing efficient will be improved by threefold, allowing efficient control for supporting massive data traffic. Moreover, 5G SA system is highly optimized for emerging next generation services such as Autonomous driving, Smart Factory, Smart Farm, and AR/VR.

For the past five years, the two companies have been collaborating on LTE and 5G development, which ultimately led to this successful 5G SA Core interoperability test. Some of other accomplishments include the commercialization of Virtualized LTE Core and Packet Optimization system; and they have completed the development of 3GPP Rel. 15 based SA Core in July last year, and successfully launched 5G NSA commercial service in April this year.

…………………………………………………………………………………………………….

About SK Telecom:

SK Telecom is the largest mobile operator in Korea with nearly 50 percent of the market share. As the pioneer of all generations of mobile networks, the company has commercialized the fifth generation (5G) network on December 1, 2018 and announced the first 5G smartphone subscribers on April 3, 2019. With its world’s best 5G, SK Telecom is set to realize the Age of Hyper-Innovation by transforming the way customers work, live and play.

Building on its strength in mobile services, the company is also creating unprecedented value in diverse ICT-related markets including media, security and commerce.

……………………………………………………………………………………………………

For more information, please contact:

[email protected] or [email protected].

Media Contact

Yong-jae Lee

SK Telecom Co. Ltd.

(822) 6100 3838

(8210) 3129 6880

Irene Kim

SK Telecom Co. Ltd.

(822) 6100 3867

(8210) 8936 0062

Ha-young Lee

BCW Korea

(822) 3782 6421

ITU-R Proposal: Report on IMT-2020 for remote sparsely populated areas providing high data rate coverage

Proposal to develop a draft new ITU-R WP 5D Report on IMT-2020 for remote sparsely populated areas providing high data rate coverage

ITU-R WP5D July 2019 meeting contribution by LM Ericsson

Abstract:

Ericsson proposes that ITU-R WP 5D develops a Report that addresses the specific needs for high data rate coverage for sparsely populated and under-served areas using suitable frequency spectrum bands.

[This author thoroughly agrees with Ericsson’s proposal!]

Introduction:

IMT-2020 networks have the capacity of satisfying the need for high data rate coverage for enhanced mobile broadband services in under-served and remote, sparsely populated areas. In this contribution we are suggesting that work be started on a Report giving details on prospects associated with the provisioning of enhanced mobile broadband services to remote, sparsely populated and underserved areas, proposing enhancements of user equipment (UE) as well as for networks in suitable frequency bands

- for user equipment, possible solutions based on affordable user deployed equipment combined with access to local spectrum at user premises could be considered and examined, and

- for network equipment, possible solutions based on high gain massive MIMO antennas could be reviewed.

A significant part of the global population is currently connected to existing cellular and mobile broadband sites. As a complement, users in remote sparsely populated and under-served areas could be connected to higher tower sites.

The proposed Report could, for example, consider an existing GSM cellular site grid designed for voice coverage, which could be estimated to reach high downlink data rates at a cell edge of IMT-2020 coverage ranges using conventional UE and network equipment. The Report would need, however, to focus on and consider the uplink performance characteristics which may be regarded as not being satisfactory without further elaborations on policy, spectrum and other aspects. For example, consider suggesting enhancements on UE and network equipment as well as consider using high tower installations that may provide coverage reach far beyond that is currently supported by typical GSM sites.

Background:

With regard to current perceptions, it is easy to get the impression that IMT-2020 is primarily targeting a shorter-range network build using millimeter wave (mmW) bands supporting extremely demanding requirements on latency, capacity, and very high peak data rates.

However, it is suggested that IMT-2020 is designed to operate in frequency bands ranging from low-bands to high-bands and can be configured to perform better or on-par with IMT-Advanced in every aspect, also in rural sparsely populated areas. IMT-2020 has evolved from IMT-Advanced, adding significant improvements to an already capable and proven design. IMT-2020 provides two fundamental benefits relevant for longer-range coverage

- Firstly, it is designed to fully utilize massive MIMO, and

- Secondly, it is based on a flexible and lean design reducing energy consumption.

To achieve longer-range, earlier cellular and mobile broadband systems have relied on low-bands. System operated in bands around the frequency range 450 MHz having excellent coverage, but with the limitation of available bandwidth. Pushing uses to higher and higher frequency bands is clearly resulting in increased capacity, but also in reduced coverage range.

For IMT-2020 massive MIMO configuration there is no longer a simple relation between low-band use and longer-range coverage. Using high-band frequencies the size of individual antenna element decreases, resulting in reduced efficiency of each antenna element. However, with massive MIMO this effect can be compensated for by adding antenna elements, effectively keeping the physical antenna size constant while moving to higher frequency bands.

Long-range cellular coverage is very much about using higher towers, higher power, and high gain antennas. In previous cellular systems, higher radio frequency (RF) power resulted in larger network energy consumption. IMT-2020 efficiently supports lean-design and massive MIMO as it provides the right tools to deploy longer-range systems supporting high peak data rates with lower average network energy consumption.

One offered solution to achieve both good coverage as well as high capacity is to use two or more frequency bands from low-band, mid-band and / or high-band, in an aggregated configuration. This approach has proven to be very effective in dense urban areas when deploying IMT-2020 in mmW bands in combination with a low-band or mid-band that can provide improved coverage.

When combined in an effective way, the high-band off-loads the traffic from the low-band and / or mid-band, resulting in significantly improved coverage as well as capacity. This could potentially also be a promising solution for bringing IMT-2020 to underserved rural sparsely populated areas. Combining IMT-2020 using a band in the range 3.5 GHz and IMT-Advanced in a band below the frequency 1 GHz on a GSM cellular grid can provide superior capacity compared to a standalone IMT-Advanced network deployment below 1 GHz. The reason being that in mid-bands in the range 3.5 GHz there is access to more bandwidth, and the low-band on a band below 1 GHz, provide coverage for cell edge users at the same time.

Considering the above, the proposed Report could review, discuss and assess the feasibility for potential enhancements for both network equipment and UE, it may consequently be viable to deploy IMT-2020 network in a band in the range 3.5 GHz providing high capacity and long-range coverage in underserved rural sparsely populated areas. This could be more feasible and economical than deploying new sites in these areas.

IMT-2020 could potentially provide high peak data rate and high capacity mobile broadband services in underserved rural sparsely populated areas by utilizing a band in the range 3.5 GHz, where typically 100 MHz bandwidth is available compared to 20 MHz that can be expected to be available in band in the range below 1 GHz. The Report could elaborate several possible enhancements using higher towers for extended range coverage. Further contribution based on studies, within the context of the proposed Report, would be required to find a technically as well as economically best practice solution resulting in sufficiently long-range, cell-edge throughput, and capacity. Such a solution could be to consider and review the use of both the existing grid of cellular towers and possibly the higher but also sparser television towers in combination, as well as reviewing a standalone 3.5 GHz configuration, or possible aggregation between the range 3.5 GHz for downlink and low-bands for uplink.

In addition, spectrum and policy aspects having a possible impact on a feasible network configuration may need to be addressed by a possible Report.

Proposals:

Ericsson proposes that WP 5D develops a draft new Report that addresses the specific needs for high data rate coverage for sparsely populated and under-served areas using suitable frequency spectrum.

Editor’s Note:

Attachments 1 and 2 of Ericcson’s proposal, with more detailed proposals and time schedules, are only available to ITU member organizations and individuals with a TIES account.

ZTE and China Mobile demo 5G 8K+VR ultra-wide bandwidth and 5G MU-MIMO at Mobile World Congress Shanghai 2019

by Margaret Ma, ZTE

1. 5G 8K+VR ultra-wide bandwidth:

ZTE Corporation a leading provider of telecommunications, enterprise and consumer technology solutions for the mobile internet, and China Telecom have today demonstrated 5G 8K+VR ultra-wide bandwidth experience at a 5G experience zone at Mobile World Congress (MWC) Shanghai 2019.

The 5G commercial network-based demonstration has not only showcased the excellent performance and business-enabled capabilities of China Telecom’s commercial network, but also reflected ZTE’s excellent 5G end-to-end commercial capabilities, providing a good model for 5G business cases.

ZTE will fully support the construction of China Telecom’s 5G commercial networks, exploring the application and business models of the 5G industry, helping establish China Telecom’s 5G brand leadership and achieve a win-win co-operation in the 5G era.

In addition, for visitors to MWC Shanghai 2019, China Telecom and ZTE have arranged a 5G Tour, travelling 5km with continuous coverage of the 5G network onboard a 5G experience bus. On this trip, visitors can enjoy diversified service experiences, including 5G-8K VR panoramic live streaming, 16-channel HD video live streaming, and 5G commercial smartphone video calls.

A screen on the bus shows the real-time 5G date rate that visitors can achieve, with a peak date rate of more than 1GBPS.

Empowered by the technologies of China Telecom and ZTE, the 5G-8K VR panorama live streaming combines 8K and the VR technology. The images and data captured by a 8K VR 360-degree camera are transmitted through a 5G network, allowing visitors to wear VR glasses and enjoy an immersive viewing experience.

With the capability of providing complete 5G end-to-end solutions, ZTE looks forward to working closely with industry partners to actively promote 5G business applications and practices, thereby facilitating the digital transformation of vertical industries.

……………………………………………………………………………………………………………………………………………………………………………..

2. 5G MU-MIMO:

In addition, ZTE and China Mobile demonstrated a 5G MU-MIMO (Multi-User, Multiple-Input Multiple-Output) multi-user performance test based on 5G commercial base stations and smart phones at Mobile World Congress Shanghai 2019. The demonstration showcases both companies’ leading positions in commercial performance.

The MU-MIMO makes full use of multi-antenna features to maximize the utilization of spectrum resources, creating much greater revenue for users. It is the core technology of 5G to realize ultra-wide bandwidth.

This MU-MIMO test was carried out in China Mobile’s Guangzhou 5G field, employing ZTE’s industry-leading 160M full-band 4/5G dual-mode commercial base station. The base station supports dynamic spectrum sharing, achieving dual-network integration at 2.6GHz, and 16 ZTE commercial mobile phone Axon10 Pro.

The test result showcased that a 5G single cell throughput is over 3.7Gbps, while a single EU downlink data rate is more than 200Mbps. The result is also a four-time increase in network system capacity than that of the SU-MIMO technology. The test footage and data were also transmitted back to China Mobile’s booth at MWC Shanghai in real time from Guangzhou.

ZTE and China Mobile have been strategic partners for years, working together on 5G technical innovation and industry development. The two parties have witnessed a series of milestones in the path to 5G commercialization. China Mobile and ZTE jointly developed the world’s leading 5G prototype base station, the world’s leading 5G site, the world’s leading 2.6GHz NR IoDT and the world’s leading end-to-end system.

With great capability of providing complete 5G end-to-end solutions, ZTE looks forward to working closely with industry partners to actively promote 5G business applications and practices, thereby facilitating the digital transformation of vertical industries.

…………………………………………………………………………………………………………………………………………………………………………………………………

About ZTE:

ZTE is a provider of advanced telecommunications systems, mobile devices, and enterprise technology solutions to consumers, carriers, companies and public sector customers. As part of ZTE’s M-ICT strategy, the company is committed to provide customers with integrated end-to-end innovations to deliver excellence and value as the telecommunications and information technology sectors converge. Listed in the stock exchanges of Hong Kong and Shenzhen (H share stock code: 0763.HK / A share stock code: 000063.SZ), ZTE’s products and services are sold to over 500 operators in more than 160 countries. ZTE commits 10 per cent of its annual revenue to research and development and has leadership roles in international standard-setting organizations. ZTE is committed to corporate social responsibility and is a member of the UN Global Compact. For more information, please visit www.zte.com.cn.

…………………………………………………………………………………………………………………………………………………………………………………………………

Media Contact:

Margaret Ma

ZTE Corporation

Tel: +86 755 26775189

Email: [email protected]

References:

Virgin Media Experimenting with 10 Gbps mmWave backhaul in UK fixed broadband FTTP trial

UK’s Virgin Media has been exploring possibilities of delivering backhaul traffic over the air (OTA) in a small village in the English countryside. Although this is something which Virgin Media has been doing for years, this time the company is experimenting with mmWave as opposed to microwave.

“As we invest to expand our ultra-fast network we’re always looking at new, innovative ways to make build more efficient and connect premises that might currently be out of reach,” said Jeanie York, Chief Technology and Information Officer at Virgin Media. “While presently this is a trial, it’s clear that this technology could help to provide more people and businesses with the better broadband they deserve.”

The challenge which seems to be addressed here is combining the complications of deploying infrastructure and the increasing data appetite of the consumer. As you can see below, the trial makes use of mmWave to connect two ‘trunk’ points over 3 km with a 10 Gbps signal. The signal is converted at the cabinet, before being sent through the last-mile on a fiber connection.

Although this trial only connected 12 homes in the village of Newbury, Virgin Media believes this process could support delivery of residential services to 500 homes. This assumption also factors in a 40% average annual growth in data consumption. With further upgrades, the radio link could theoretically support a 20 Gbps connection, taking the number of homes serviced to 2,000.

The advantage of this approach to delivering broadband is the ability to skip over tricky physical limitations. There are numerous villages which are experiencing poor connections because the vast spend which would have to be made to circumnavigate a valley, rivers or train lines. This approach not only speeds up the deployment, it simplifies it and makes it cheaper.

Looking at the distance between the two ‘trunks’, Virgin Media has said 3km is just about as far as it can go with mmWave. This range takes into account different weather conditions, the trial included some adverse conditions such as 80mph winds and 30mm rainfall, but radios chained together and used back-to-back could increased this coverage and scope of applications.

Virgin Media has unveiled the results of a new trial using wireless to deliver broadband to customers in remote locations.

………………………………………………………………………………………………………………………………………………………………………………………………………

With alt-nets becoming increasingly common throughout the UK, new ideas to make use of mmWave and alternative technologies will need to be explored. Traditional network operators will find revenues being gradually eroded if a new vision of connectivity is not acquired.

Of course, use of mmWave for fixed broadband internet is common in the U.S., but it is proprietary to the equipment vendor (no standards) and line of sight is required from the network operators equipment to an antenna mounted on the rooftop of the home being served.

………………………………………………………………………………………………………………………………………………………………………

Reference:

http://telecoms.com/498170/virgin-media-to-take-a-mmwave-approach-to-full-fibre/

AT&T FlexWare and Cybersecurity power Exide’s Digital Transformation

AT&T is powering Exide’s digital transformation with its FlexWare network virtualization solution. AT&T FlexWare is one of AT&T’s core software-centric services from the company’s “edge solutions portfolio.” AT&T says its near real-time service cuts long set up times and complex processes.

FlexWare enables businesses to launch virtual network functions (VNFs) to improve productivity and communication across its geographically dispersed physical sites. With FlexWare, AT&T can move the VNFs, such as firewall or security VNFs, to devices on a company’s network.

“Our technology will give Exide the support it needs to continue operating at high standards and to prepare for new opportunities in a 5G world,” said John Vladimir Slamecka, AT&T Region President for Europe, the Middle East and Africa. “We’re building a platform that is ready for new data hungry apps made possible with the arrival of 5G; such as AR and VR. That’s why we are moving compute resources closer to the network edge, opening the door to new experiences and opportunities.”

AT&T’s FlexWare, for virtualized network edge services, is now in place across Exide’s global locations, including throughout Europe, North America and Asia Pacific. FlexWare at the edge allows Exide to use both highly secure MPLS and internet access services for its network needs. Starting with network routing, Exide is able to access all wide area network components utilizing high bandwidth capabilities to help provide greater flexibility as the needs of each change over time. AT&T FlexWare also allows Exide to fulfill its centralized IT requests without needing local site support.

……………………………………………………………………………………………………….

Exide is a battery and energy storage company which was founded 130 years ago. It manufactures and recycles batteries for a broad range of industrial and transportation applications including cars, boats, forklifts and uninterrupted power units. The company has more than 10,000 employees located across 80 countries.

“Our global presence in today’s fast paced technology environment presents the unique challenge of blending reliable legacy platforms with emerging digital solutions. This requires a data transport infrastructure that supports a broad number of traditional and disruptive applications,” said Brian Woodworth, Exide Chief Information Officer. “AT&T is leading the way as a trusted and visionary provider of network edge solutions, so naturally we turned to AT&T to collaborate with us on our digital journey to become the preferred supplier to our customers across the globe,” he added.

Exide is also using managed network security services from AT&T Cybersecurity. From an AT&T report on this vital topic:

The security landscape is growing increasingly treacherous as hackers of every type continue to evolve their attack strategies to evade detection while maximizing profit from their time and effort. It doesn’t matter if it’s an organized criminal gang looking to make money from ransomware schemes, covert state-sponsored groups attempting to steal data and disrupt operations, or just malevolent individuals trying to impress others in the hacker community—every bad actor is smarter than they were last year, and better equipped to wreak havoc.

However, we wonder if AT&T takes cybersecurity seriously for its own customers, like this author who has experienced two AT&T account unexplained security breaches in the last few months?

…………………………………………………………………………………………………………………..

AT&T says it is “offering customers like Exide unrivaled visibility and security through people, process and technology allowing them to better protect their global business.” This author certainly hopes that happens!

…………………………………………………………………………………………………………

References:

https://about.att.com/story/2019/att_powers_exide_digital_transformation.html

For more information about AT&T FlexWare (nice video): https://www.business.att.com/solutions/Service/network-services/sdn-nfv/virtual-network-functions/

For more information about AT&T Cybersecurity: https://att.com/security

https://www.business.att.com/learn/cybersecurity-report-volume-8-5.html

T-Mobile mmWave 5G to be available in six cities on June 28th along with Samsung Galaxy S10 5G smartphone

T-Mobile US has announced it will use millimeter wave (mmWave) spectrum to offer up “pre-standard 5G” services in parts of six cities beginning on June 28th. Sales of the Samsung Galaxy S10 5G will commence that same day (see References below). The company published detailed coverage maps showing where subscribers in Atlanta, Cleveland, Dallas, Las Vegas, Los Angeles and New York can expect to access their 5G network.

T-Mobile has said its plan for nationwide coverage hinges on its vast portfolio of 600 MHz spectrum, but the “Un-carrier” also has its own stash of high-band frequencies. Sprint activated its mobile 5G offering using mid-band 2.5 GHz spectrum. The complementary aspects of Sprint’s and T-Mobile’s spectrum is a key piece of the pending $26.5 billion merger, which is awaiting regulatory approval which may be delayed due to several states filing opposition lawsuits.

T-Mobile US CEO John Legere, has been highly critical of AT&T’s and Verizon’s millimeter wave-based 5G deployments (particularly the lack of coverage maps). He wrote in a June 20th blog post that the “New T-Mobile” (merged with Sprint) could deliver the range of spectrum needed for 5G.

“Current 5G networks in the U.S. aren’t anything to write home about. That’s because they’re mostly focused on high-band millimeter wave (mmWave) spectrum, which doesn’t travel far from the cell site and is blocked by things like trees, windows and doors. It’s a massively important part of 5G, don’t get me wrong, but it’s just that – a PART. We’ve been clear all along… real, game-changing 5G will require a range of spectrum – low, mid and high – and only the New T-Mobile will be able to deliver it.”

Legere stated that the “New T-Mobile” (merged with Sprint) would be better able to deliver 5G because:

- We’ve got the high-band spectrum with mmWave, which delivers massive capacity over a very small footprint.

- Later this year, when compatible smartphones launch, we’ll launch broad 5G on our low-band 600 MHz spectrum, providing the wide area coverage necessary to reach across America.

- If regulators approve our merger with Sprint, we’ll have the crucial mid-band spectrum (2.5 GHz), which provides the balance of coverage and capacity that enables a seamless and meaningful 5G experience. Mid-band spectrum is key to providing an ideal mix of coverage and capacity for 5G networks, and the combination of Sprint’s mid-band and our low-band will allow New T-Mobile to use both spectrum more efficiently, increasing capacity even more.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………

T-Mobile said it will use “Multi-band Dual Connectivity” to aggregate “5G in the millimeter wave band and LTE.”

T-Mobile plans to launch a larger 5G network later this year using the low-band 600Mhz 5G spectrum, a technology not supported by the Galaxy S10 5G. 5G smart phones that support both mmWave and the low-band spectrum are expected later this year.

However, critical infrastructure for mmWave 5G will require many more small cells (due to limited range) that will need to be mounted on mainly local (public) government property with fiber backhaul. We wonder why that gating item is hardly ever discussed on line or in the telecom business press? It is probably why T-Mobile’s 5G mmWave coverage is extremely limited as you can see from their coverage maps.

References:

https://www.t-mobile.com/news/samsung-galaxy-s10-5g

https://www.tmonews.com/2019/06/t-mobile-galaxy-s10-5g-launch-network-six-cities/

GSA Silicon Summit: Focus on Edge Computing, AI/ML and Vehicle to Everything (V2X) Communications

Introduction:

Many “big picture” technology trends and future requirements were detailed at GSA’s Silicon Summit, held June 18, 2019 in Santa Clara, CA. The conference was a “high level” executive briefing for the entire semiconductor ecosystem- including software, middleware and hardware. Insights on trends, key issues, opportunities and technology challenges (especially related to IoT security) were described and debated in panel sessions. Partnerships and collaboration were deemed necessary, especially for start-ups and small companies, to advance the technology, products and services to be offered in this new age of AI, ML/DL, cloud, IoT, autonomous vehicles, (fake) 5G, etc. Companies involved in the development of next generation Mobility and Edge Intelligence systems architectures and solutions discussed what opportunities, advancements and challenges exist in those key areas.

With the rapid proliferation of smart edge computing devices and applications, the volume of data produced is growing exponentially. Connected, and “intelligent,” devices are predicted to grow to 200 billion by 2020, generating enormous amounts of data every single day. The business potential created by this data comes with huge expectations. Edge devices, edge intelligence, high bandwidth connectivity, high performance computing, machine learning and other technologies are essential to enabling opportunities in markets such as Mobility and Industrial IoT.

This article will focus on Edge Computing, AI moving closer to the endpoint device (at the network edge or actually embedded in the end point device/thing), and vehicle to vehicle/everything communications.

While there were many presentations and panels on security, that is beyond the scope of the IEEE ComSoc Techblog. However, we share Intel’s opinion, expressed during a lunch panel session, that standards for Over The Air (OTA) security software/firmware updates are necessary for almost all smart/intelligent devices that are part of the IoT.

Architectural Implications of Edge Computing, Yogesh Bhatt VP of Products- ML, DL and Cognitive Tech Ericsson – Silicon Valley:

Several emerging application (data flow) patterns are moving intelligence from the cloud to local/metro area to on premises and ultimately to the endpoint devices. These applications include: cloud native apps like content delivery; AI enabled apps like sensing, thinking and acting; immersive apps like media processing/augmentation/distribution.

AI enabled Industrial apps are increasing. They were defined as: The ability to collect and deliver the right data/video/images, at the right velocity and in the right quantities to wide set of well-orchestrated ML-models and provide insights at all levels in the operation. Connectivity and compute are being packaged together and offered as “a service.” One example given was 4K video over (pre-standard) “5G” wireless access at the 2018 U.S. Open. That was intended to be a case study of whether 5G could replace miles of fiber to broadcast live, high definition sports events.

Yogesh Bhatt VP of Products- ML, DL and Cognitive Tech Ericsson – Silicon Valley

Image courtesy of GSA Global

……………………………………………………………………………………………………………………………………………………….

Required Architecture for Emerging App Patterns: Application Cloud, Management & Monetization Network slices, Mobile Fixed Cloud infrastructure, Distributed Cloud and Transport. The flow of emerging apps requires computing capability to be distributed based on the application pattern and flow. That in turn mandates cross-domain orchestration and automation of services.

Key take-aways:

- Emerging Application patterns will require significant compute capabilities close to the data sources and sinks (end points)

- Current Device-to-Cloud Architecture need to expand to encompass hosting points that provides such processing capabilities

- The processing capabilities at these Edge locations would be anything but like the centralized Cloud Data Centers (DCs)

……………………………………………………………………………………………………………………………………………………….

Heterogeneous Integration for the Edge, Yin Chang Sr. VP, Sales & Marketing ASE Group:

ASE sees the “Empowered Edge” as a key 2019 strategic trend. Edge computing drivers include: latency/determinism, cost of bandwidth, better privacy and security, and higher reliability/availability (connections go down, limited autonomy).

- At the edge (undefined where that is -see my comment below) we might see the following: Collect/Process data, Imaging Device, Image processing, Biometric Sensor, Microphone, Sensors with embedded MCUs, Environmental Sensor.

- At the core (assumed to be somewhere in the cloud/Internet): Compute/Intelligent processing, AI & Machine Learning, Networks/Server Processors, High Bandwidth Memory (HBM), Neuro-engine (future), Quantum computing (future).

Compute capabilities are moving to the edge and endpoints:

- Edge Infrastructure and IoT/Endpoint Systems are growing in compute power per system.

- As the number of IoT/Endpoint systems outgrows other categories, TOTAL Compute will be at the Endpoint.

Challenges at the Edge will require a cost effective integration solution which will need to deal with:

- Cloud connectivity – latency and bandwidth limitations

- Mixed device functionality – sense, compute, connect, power

- Multiple communication protocols

- Form factor constraints

- Battery life

- Security

- Cost High density

ASE advocates Heterogeneous Integration at the Edge— by material, component type, circuit type (IP), node and bonding/ interconnect method. The company has partnered with Cadence to realize System in Package (SiP) intelligent design with “advanced functional integration.” That partnership addresses the design/verification challenges of complex layout of advanced packages, including ultra-complex SiP, Fan-Out and 2.5D packages.

One such SiP design for wireless communications is antenna integration:

- Antenna on/in Package for SiP module integration

- Selective EMI Shielding for non-limited module level FCC certification

- Selective EMI Shielding – partial metal coating process by sputter for FCC EMI certification

- Small Size Antenna Integration – Chip antenna, Printed circuit antenna (under development)

…………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Democratizing AI at the Endpoint, Brian Faith, CEO of QuickLogic:

QuickLogic was described as “a platform company that enables our customers to quickly and easily create intelligent ultra-low power endpoints to build a smarter, more connected world.” The company was founded in 1989, IPO in 1999, and now has a worldwide presence. Brian said they were focused on AI for growth markets including:

▪ Hearable/Wearable

▪ Consumer & Industrial IoT

▪ Smartphone/Tablet

▪ Consumer Electronics

AI and edge computing are coming together such that data analytics is moving from the cloud to the edge to the IoT endpoint (eventually). However, there are trade-offs for where computing should be located which are based on the application type. Some considerations include:

▪Applications latency & power consumption (battery life) requirements

▪Data security can be a factor

▪Local insights are trivial and non-actionable

▪Smart Sensors => rich data => actionable if real-time

▪Network sends insightful data (less bandwidth needed)

▪Cloud focuses on aggregate data insights and actions

AI Adoption Challenges:

1. Resource-Constrained Hardware:

▪ Can’t just run TensorFlow

▪ Limited SRAM, MIPS, FPU / GPU

▪ Mobile or wireless battery/power requirements

2. Resource-Constrained Development Teams:

▪ Embedded coding more complex & fragmented than cloud PaaS

▪ Scarcity of data scientists, DSP, FPGA and firmware engineers

▪ Limited bandwidth to explore new tools / methods

3. Lack of AI Automated Tools:

• Typical process: MATLAB modeling followed by hand coded C/C++

• Available AI tools focus on algorithms, not end-to-end workflows

• Per product algorithm cost: $500k, 6-9 months; often far greater

For Machine Learning (ML) good training is vital as is the data:

• Addresses anticipated sources of variance

• Leverages application domain expertise

• Includes all potentially relevant metadata

• Seeks optimal size for the problem at hand

ML Algorithms should fit within Embedded Computing Constraints:

Endpoint Inference Models:

• Starts with model appropriate to the problem

• Fits within available computing resources with headroom

• Utilizes least expensive features that deliver desired accuracy

SensiML Toolkit:

• Provides numerous different ML and AI algorithms and automates the selection process

• Leverages target hardware capabilities and builds models within its memory and computing limits

• Traverses library of over 80 features to optimize selection to best features to fit the problem

A Predictive Maintenance for a Motor Use Case was cited as an example of AI/ML:

Challenges:

▪Unique model doesn’t scale across similar motors (due to concrete, rubber, loading)

▪ Endpoint AI decreases system bandwidth, latency, power

Monitoring States:

▪ Bearing / shaft faults

▪ Pump cavitation / flow inefficiency

▪ Rotating machinery faults

▪ Seismic / structural health monitoring

▪ Factory predictive maintenance

QuickLogic aims to democratize AI-enabled SoC Design using SiFi templates and a cloud based SoC platform with a goal of a custom SoC in 12 weeks! In 2020 the company plans to have: an AI Software Platform, SoC Architecture, and eFPGA IP Cores. Very impressive indeed, if all that can be realized.

……………………………………………………………………………………………………………………………………………………………………………………………………………………

Empowering the Edge Panel Session:

Mike Noonen of Mixed-Com chaired a panel discussion on Empowering the Edge. Two key points made was the edge computing is MORE SECURE than cloud computing (smaller attack surface) and that as intelligence (AI/ML/data processing) moves to the edge, connections will be richer and richer. However, no speaker or panelist or moderator defined where the edge actually is located? Is it on premises, the first network element in the access network, the mobile packet core (for a cellular connection), LPWAN or ISP point of presence? Or any of the above?

Mike Noonen of Mixed-Com leads Panel Discussion

Photo courtesy of GSA Global

……………………………………………………………………………………………………………………………………………………………………………………………………………………

After the conference, Mike emailed this to me:

“One of the many aspects of the GSA Silicon Summit that I appreciate is the topic/theme (such as edge computing). The speakers and panelists addressing the chosen theme offer a 360 degree perspective ranging from technical, commercial and even social aspects of a technology. I always learn something and gain new insights when this broad perspective is presented.”

I couldn’t agree more with Mike!

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

V2X –Vehicle to Everything connectivity, Paul Sakamoto, COO of Savari:

V2X connectivity technology today is based on two competing standards: DSRC: Dedicated Short Range Communications (based on IEEE 802.11p WiFi) and C-V2X: Cellular Vehicle to Everything (based on LTE). Software can run on either, but the V2X connectivity hardware is based on one of the above standards.

DSRC: Dedicated Short Range Communications:

- Legacy Tech – 20 years of work, Low Latency Performance Range and reliability

- No carrier fees; minimize fixed cost

- Infrastructure needs; how to pay?

- EU Delegate Act win, but 5GAA is contesting

C-V2X: Cellular Vehicle to Everything:

- Developed from LTE-Big Money Backing

- Cellular communications history; good range and reliability

- Carrier fees required; subsidy for fixed costs

- Mix in with base stations to amortize costs

- China has chosen it as part of the government’s 5G plan

V2X Challenge: Navigate the Next 10 Years:

For mobile use, the main purpose is safety and awareness:

• Tight message security

• Low latency (<1ms)

• Needs client saturation

• Short range

For infrastructure, the main purpose is efficiency and planning:

• Tight message security

• Moderate latency (~100ms)

• Needed where needed

• Longer range

In closing, Paul said V2X is going to be a long raise with many twists and turns. Savari’s strategy is to be ”radio agnostic,” use scalable computing and scalable security elements, have a 7-10 year business plan with a 2-3 year product development cycle, and be ready to pounce at any inflection point (which may mean parallel developments).

May 20, 2020 Update:

ITU-R WP 5D will produce a draft new Report ITU-R M.[IMT.C-V2X] on “Application of the Terrestrial Component of IMT for Cellular-V2X.”

3GPP intends to contribute to the draft new Report and plans to submit relevant material at WP 5D meeting #36. 3GPP looks forward to the continuous collaboration with ITU-R WP 5D for the finalization of Report ITU-R M.[IMT.C-V2X].

…………………………………………………………………………………………………………………………………………..

OpenSignal reports on 5G Speeds and 4G LTE Experience in South Korea & Other Countries

Introduction:

South Korea wireless telcos have all deployed pre-standard versions of “5G,” based on 3GPP Release 15 NR NSA. That relies on a “LTE anchor” for signaling, mobile packet core, etc. Are those “5G” speeds significantly greater than 4G LTE Advanced Pro which AT&T claims is 5GE?

Opensignal has published what it says is the first “real analysis” of 5G download speeds as of June 20, 2019. Their latest report (June 2019) is on the performance of various 4G LTE wireless carriers and devices in South Korea.

5G Speeds in South Korea:

The market research firm reveals that the average 5G download speeds in South Korea (for the Samsung S10 5G and LG Electronics V50 ThinQ 5G) is 111.8 Mbps (see illustrations below), or 48% faster than comparable recent 4G smartphones, and 134% faster than other 4G LTE phones.

While those average 5G speeds outpace what 4G devices obtain, Opensignal’s results show that those averages track well behind the maximum capabilities supported by 5G in South Korea. The vast majority of South Korean 5G smartphone users currently have either the Samsung S10 5G or LG V50 smart phone. Therefore, we compared these 5G users with owners of 4G flagship smartphone from those two brands released in 2018 and 2019, this includes: Samsung S9, S9+, Note 9, S10e, S10, S10+ and LG G7 range, V40, and G8.

…………………………………………………………………………………………………………………………………………………………………………………………………….

Opensignal lists maximum 5G download speeds of 1.2 Gbit/s in the U.S. and 988 Mbit/s in South Korea.

“While 1.2 Gbps is the maximum (download) speed experienced by Opensignal users in real-world conditions, Opensignal has seen speeds as high as 1.5 Gbps in the U.S. using our software but in test conditions that do not reflect the real-world experience.”

Currently, 5G smartphone users connect to both a 4G spectrum band and a (3GPP Release 15) 5G New Radio (NR) band simultaneously in what is called Non-Standalone Access (NSA) mode. Effectively, the system is using 5G for raw download bandwidth, but uses 4G for other network functions. When operators launch services based on Standalone Access, 5G smartphones will be able to connect exclusively to a 5G NR signal and latencies should decrease significantly, improving the experience for consumer applications such as online multiplayer games like Fortnite or PUBG, as well as internet-based voice communication like FaceTime, Tango, WhatsApp, KakaoTalk, LINE, etc. Opensignal expects the experience of 5G users to change during the course of 2019 as 5G’s coverage improves and vendors resolve initial 5G problems.

While there is a significant increase in the average download speeds experienced by 5G smartphone users, both upload speeds and latency — a measure of the responsiveness of the network — are similar between 4G smartphone users and 5G smartphone users. This upload and latency finding is what Opensignal would expect at this early stage of the 5G era because initial 5G technology does not yet seek to improve either characteristic.

As vendors fix 5G teething issues and refine their solutions, peak and average 5G speeds will improve. And, while some 5G frequency bands are not available in particular countries yet – for example 3.5Ghz in the U.S., mmWave in Europe – they will be over the next few years and experience gained from other countries will help carriers improve these later 5G roll outs.

4G LTE Speeds in South Korea and other countries:

South Korea was the only country where smartphone users enjoyed average mobile Download Speeds over 50 Mbps, although Norway was close behind with 48.2 Mbps. Then there was a bit of a drop in speeds to the next two countries, Canada and the Netherlands, where OpenSignal measured Download Speed Experience at just over 42 Mbps. The remaining six of the top 10 markets scored in the 33-40 Mbps range. The global average score of the 87 countries analyzed was 17.6 Mbps — barely a third of the top score.

Canada’s impressive third place is little surprise. Users experienced over 35 Mbps in Download Speed Experience, while speeds of over 60 Mbps weren’t uncommon in the country’s biggest cities.

……………………………………………………………………………………………………………………………………………………………………………………………….

4G LTE Mobile Experience in South Korea:

OpenSignal said there was a wide variety of of their metrics in Download Speed Experience, with average speeds ranging from over 50 Mbps to less than 2 Mbps. There were 13 countries with Download Speed Experience scores over 30 Mbps, while 35 of the 87 markets measured fell into the 10-20 Mbps range, and 20 scored under 10 Mbps.

For 4G Availability, LG U+ achieved a near-perfect score. All three South Korean wireless operators were able to deliver a 4G signal to their users more than 95% of the time, putting them among the global elite in 4G reach. LG U+ went further. Its 4G Availability score of 99.5% means that there was practically no instance where our users couldn’t find a 4G connection during our data collection period.

South Korea rates highly in Video Experience. U+ and SK telecom both landed in the Very Good range (65-75 in our 100-point scale) in Video Experience, while KT was less than a point shy of achieving the same rating. That indicates that the consumer Video Experience in South Korea is commendable, exhibiting short load times and little stalling during playback. But South Korea’s operators didn’t score as highly in Video Experience as operators in many other countries, despite their superiority in most of our other metrics. Extremely fast speeds and ubiquitous 4G reach don’t always translate into an Excellent consumer Video Experience.

…………………………………………………………………………………………………………………………………………………………………………………..

Conclusions:

Opensignal believes that these early results will improve and change as 5G matures. The firm notes that early 5G networks, like those in South Korea, use the non-standalone 5G spec (3GPP Release 15 NR NSA), which relies on the 5G data plane for downloads, but utilizes 4G LTE for control plane functions.

Opensignal says that average speeds will improve as standalone 5G is deployed and more 5G frequency bands are used.

…………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.opensignal.com/reports/2019/06/southkorea/mobile-network-experience

Verizon CTO Upbeat on 5G Millimeter Wave vs Lack of mid band spectrum?

Millimeter wave spectrum “opens up so many possibilities,” said Verizon Executive Vice President and Chief Technology Officer Kyle Malady at an investor conference today. Malady made his comments at the Wells Fargo Telecom 5G Forum, which was webcast. “The cloud will go closer and closer and closer,” he said without providing any rationale or support for that statement.

The latest pre-standard 5G technology was designed to support speeds of a gigabit or more, along with lower-latency 9via 3GPP Release 16 not yet completed) and other attributes. However, getting the highest wirelessspeeds requires wide swaths of spectrum that are nearly impossible to come by in frequency bands traditionally used for cellular service. Wide swaths of spectrum are available in high-frequency millimeter wave bands – the downside is that range is not as great as with lower-frequency bands which will require many more small cells in a given geographical area.

5G pioneers AT&T and Verizon used millimeter wave for their initial deployments, but as Sprint and T-Mobile get into the game or make plans to do so, they have touted their ability to quickly cover broad areas by using lower-frequency spectrum, although that didn’t stop T-Mobile from spending more than $842 million to obtain millimeter wave spectrum in the recent auctions. Likewise, AT&T and Verizon have said they expect to deploy 5G in lower-frequency bands as well as in the millimeter wave band.

Verizon 5G Millimeter Wave

Nevertheless, Verizon executives get most fired up when they talk about the millimeter wave band.

Malady offered an interesting data point to support his millimeter wave enthusiasm. Before obtaining millimeter wave spectrum through the acquisition of Straight Path, Verizon had amassed licenses for an average of 160 MHz of spectrum in all bands nationwide. In comparison, the company used four segments, apparently each comprised of 100 MHz, for a total of 400 MHz of millimeter wave spectrum to support its initial mobile 5G launches in Chicago and Minneapolis. And according to Malady, “we’re working on bringing [that] to eight” segments.

Malady didn’t discuss the speeds Verizon is experiencing with mobile service, but he noted that some customers are obtaining gigabit speeds using fixed wireless 5G service in the millimeter wave band, which Verizon has launched in four markets.

AT&T has said it has seen speeds of 1.2 Gbps in mobile 5G trials using a 400 MHz channel over a distance of 150 meters. More on AT&T’s mmWave spectrum holdings here.

Millimeter wave distance limitations are driving a change in network topology, Malady noted. “As the network [becomes] flattened, the antennas [are] smaller and lower,” he explained. “Wireless becomes fiber with antennas hanging off of it.”

As Verizon builds out more fiber to support this model, the fiber also can be used by the company’s other business units, he added.

There may be one additional requirement before 5G can reach its full potential, and Malady discussed that as well. He pointed to the example of police using facial recognition to help find an abducted person by comparing a photo with numerous public cameras, then identifying the closest officer to the abductee’s location. Applications such as that will require processing power located closer to the network edge.

References:

Verizon CTO: 5G Millimeter Wave “Opens Up So Many Possibilities”

https://www.verizon.com/about/our-company/5g/what-millimeter-wave-technology

AT&T owns >630 MHz nationwide of mmWave spectrum + HPE partnership for Edge Networking & Computing

https://www.fiercewireless.com/wireless/verizon-ceo-mmwave-early-days-but-engineering-team-good-it

https://www.lightreading.com/mobile/5g/ve

rizon-mmwave-is-not-a-coverage-spectrum-for-5g/d/d-id/750980

…………………………………………………………………………………………………….

Meanwhile, carriers and analysts say that a lack of mid-band spectrum is delaying the deployment of wireless services. The Federal Communications Commission has recently proposed allowing carriers to share parts of the Educational Broadband Service spectrum in this range, a plan that a number of educational groups oppose.

The Wall Street Journal (tiered subscription model)

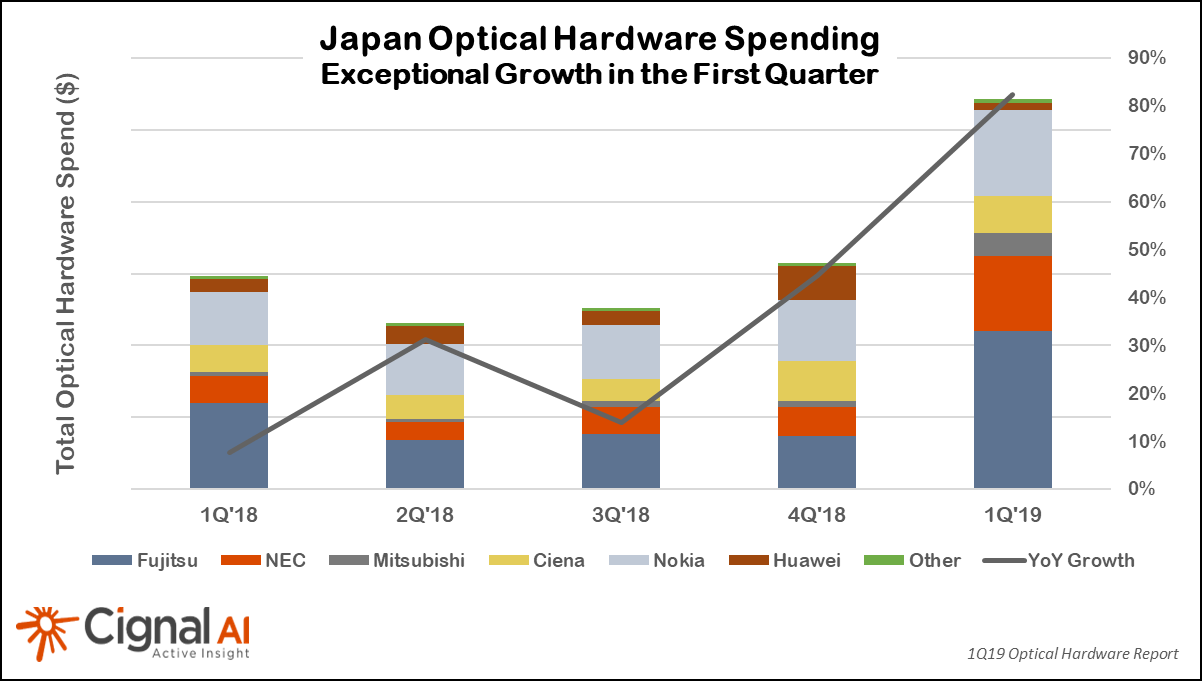

Cignal AI: Japan’s Optical Hardware Growth Soars in 1Q2019; North America Remains Weak

by Scott Wilkinson and Andrew Schmitt of Cignal AI (edited by Alan J Weissberger)

Metro Bandwidth Growth Outpaces Long Haul; North America Remains Weak

Japan continued its recent hot streak as 1Q2019 marked the fourth quarter in a row of growth with an extraordinary 82% increase, according to the most recent (1Q2019) Optical Hardware Report from research firm Cignal AI. Japan registered an extraordinary 82% year-over-year increase in optical networking hardware sales in the first quarter of 2019. Prime beneficiaries were domestic suppliers NEC, Mitsubishi and Fujitsu along with Ciena and Nokia, all of which posted significant gains during the quarter.

“The exceptional optical market growth in Japan is the story to watch for 2019,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Network operators have begun significant network rebuilds and expansions, and domestic as well as non-Japanese vendors continue to grow sales in the region at remarkable rates.”

North American growth continued to disappoint as slow optical hardware spending among traditional telco operators obscured growth in sales to cloud and colo operators (e.g. multi-tenant data centers).

Additional key findings in the 1Q19 Optical Hardware Report:

- Metro Bandwidth Outpaces Long Haul – While long haul spending grew at a higher rate than metro, analysis reveals that metro bandwidth is growing more rapidly.

- Growth in China Decelerates – Growth in China moderated into the single-digits during 1Q19, as 2018’s high spending by Chinese carriers could not continue indefinitely.

- EMEA Posted Solid Gains – Both metro and long haul spending grew during the quarter, with growth led by both traditional and cloud & colo operators.

- CALA Continues Lackluster Performance –Q1 showed no improvement for the region. Relief may be coming, as vendors believe major carriers in the region will return to spending later this year.

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. The analysis is based on financial results, independent research, and guidance from individual equipment companies. Forecasts are based on overall spending trends for equipment types within the regions.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Cignal AI’s interactive Optical Hardware Superdashboard is available to clients of the Optical Hardware Report and provides up-to-date market data for real-time visibility on individual vendors’ results. Users can manipulate data online and see information in a variety of useful ways.

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. In addition to the interactive tracker, the analysis includes an Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Active Insight, Cignal AI’s real-time news service on current market events.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Mitsubishi Electric, NEC, Nokia, Padtec, Tejas, Xtera, and ZTE.

Full report details, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Cignal AI: Record Spending on Cloud Operator Optical Networks Drives Growth in 2018