Month: June 2013

Infonetics Research: Data Center equipment takes hit in 1Q13! Cisco Insieme: "application-centric infrastructure"

“Following 2 strong years of investment, growth in the data center equipment market is starting to slow,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research. “While the near term outlook remains positive, ultimately we think the market is headed for a peak, as data center operators improve infrastructure utilization, and adoption of cloud services moves hardware consumption from enterprises to large-scale data center operators.”

Infonetics Research reported that Worldwide revenue for data center network equipment (data center Ethernet switches, ADCs and WAN optimization appliances) declined 11% sequentially in 1Q13, to $2.3B. http://www.infonetics.com/pr/2013/1Q13-Data-Center-Network-Equipment-Market-Highlights.asp

So all this hype about SDN, Network Virtualization, Disaggregated Network OS, bare metal/commodity switches, etc for the “new Data Center” will likely be a smaller total market than the new stakeholders thought! That means many start-ups will go belly-up, similar to what happened after the Dot Com/fiber optic boom went bust!

Insieme is Cisco’s response to the SDN competitive threat to it’s switch/router business. It’s reported to be a network-based system that will orchestrate security and network services out of the gate, as well as storage and compute down the road. Insieme Senior Vice President of Marketing Soni Jiandani said the company is building an “application-centric infrastructure” that will make the network reactive to applications. The technology will “orchestrate and integrate networks, security and network services that need to be delivered to applications,” she said.

This will be extended to accommodate storage and compute eventually. The technology will use a common policy operational model that is exposed via a unified API and supports standard interfaces like JavaScript Object Notation and XML, Jiandani explained.

Light Reading on Cisco’s Insieme:

Cisco’s Insieme Doesn’t Like Your SDN Model Neither fish nor fowl, Cisco’s Application-Centric Infrastructure seems built to address so-called shortcomings of two main software-defined networking (SDN) camps.

- The overlay model involves virtual networks being created and destroyed at will on top of the physical network. That’s what Nicira Networks Inc. (owned by VMware Inc.) and startup Plumgrid Inc. are doing.

- The controller model uses a centralized element or elements to make packet-forwarding decisions; this is how OpenFlow works, and it’s what Big Switch Networks and many of the incumbent equipment vendors have been pursuing.

Here is what FBR’s Scott Thompson wrote about Cisco’s new Data Center Strategy:

Cisco Live! provided a view into the next wave of network innovation, particularly in the datacenter. The overwhelming takeaway is that the company appears to be transitioning to new architectures that place applications and their performance as the primary driver of networking while simultaneously lowering TCO and ease of use. The company released another round of new products that continue to consolidate multiple product families into one platform, but the most significant announcements focused on the datacenter.

Two products that seemed to dominate the spotlight were Cisco’s new datacenter switch, the Nexus 7700, accompanied by the new F3 switching blade, as well as an introduction to application-centric infrastructure, which Insieme appears poised to deliver. Both products are expected to be available by 4Q13 and should help to provide a bridge as management works to transition to a more software-based business model.

■Dynamic Fabric Automation delivers virtual-less automated provisioning to the datacenter edge. Cisco announced a new datacenter fabric that delivers automated provisioning across a leaf and spine (two-tier) architecture. The

fabric also delivers Layer 2/3 hybrid functionality to the network’s edge. The technology stops short of the automation achieved from ALU’s Nuage and Juniper’s Contrail solution but also helps to automate network provisioning. These features are likely to further blur the lines between routing and switching but provide enough near-term differentiation to offset a portion of the pricing pressure in the datacenter and service provider sectors.

■ Insieme has potential; more details in coming months. Cisco dedicated a significant amount of time on June 26th to the introduction of Insieme. The new platform was positioned as a game-changing technology that will usher in the age of the Internet of Everything with very little help from SDN or traditional virtualization technologies. While short on details, Insemie (=Italian for together) laid out a plan to combine several different functions of today’s IT datacenter and networking platforms into one application-centric architecture.

In a nutshell, the product is moving the company toward service-oriented rackscale architectures. Cisco indicated it would release additional Insieme details in coming months and have product available end-of-year 2013.

■ Focus begins to shift from product to sales. For nearly two years, Cisco appears to have been focused on striking a balance between driving margin out of legacy platforms and launching new, more efficient products without affecting

margins. The focus now shifts to Cisco’s formidable sales and marketing machine to convert the product into additional revenue growth. We expect the product portfolio it has announced is nearly certain to ignite a significant

near-term upgrade cycle within the enterprise customer base, which accounts for approximately 45% of Cisco’s revenue. To us, it remains unclear as to what extent the hyperscale and service provider businesses, which represent the

largest source of revenue growth and more than 45% total revenue, may adopt Cisco’s new platforms.

Q: When will Asia based competition affect Cisco’s performance?

A: While Huawei Technologies Co., Ltd. has been unable to gain a foothold in North America (due to the impact of the attached stigma from the stance of the U.S. House Subcommittee on Cyber Security), without the EU taking a firm stand with the U.S., we expect Cisco has more revenue at risk in China than Huawei has in the US.

Q: Will new and unexpected entrants into the data networking space take share from Cisco?

A: There are significant technical and strategic shifts affecting the IT landscape. We expect Cisco to be threatened, and we expect these to become threats to an increasingly large number of IT players as technology shifts drive the industry toward consolidation. It will likely take 2 Years+ to have a significant impact on Cisco.

Infonetics Reports on Mobile Devices and Mobile Broadband Services

Infonetics Research released excerpts from its 1st quarter 2013 (1Q13) 3G and 4G Mobile Broadband Devices and Subscribers market share, size and forecasts report. The comprehensive report tracks over 50 mobile broadband market segments and sub-segments, including smartphones, operating systems (OS), routers, cards, USBs, embedded devices (such as tablets) and subscribers, all by the type of network they connect to, including Long Term Evolution (LTE), W-CDMA/HSPA and other networks.

1Q13 MOBILE BROADBAND MARKET HIGHLIGHTS:

. The global 3G/4G mobile broadband device market, including smartphones, embedded devices and routers, totaled $93 billion in 1Q13, dropping off 6% from 4Q12

. Tablets comprised 89% of embedded device units in 1Q13

. By 2017, Infonetics expects FDD-LTE mobile broadband tablets to edge out WiFi-only tablets in revenue share, with the higher selling price of connected tablets playing a key role

. Windows 8 is struggling to make a dent in the smartphone operating system (OS) segment, but did pass Blackberry in 1Q13 to take 3rd place behind big gorillas Andriod and iOS

. Tablets have dealt a death blow to the netbook: leading netbook manufacturers Acer and Asus announced

plans to cease production of netbooks

“The growing popularity of low-cost, WiFi-only tablets like Google’s Nexus 7 and Amazon’s Kindle Fire is having a direct and negative impact on embedded mobile broadband cards, as the vast majority of embedded device units come from connected tablets,” notes Richard Webb, Infonetics Research’s directing analyst for microwave and carrier WiFi.

Webb adds: “Both unit shipments and revenue for the embedded card segment sank by double digits in 1Q13 from the previous quarter and the year-ago quarter.”

REPORT SYNOPSIS:

Infonetics’ quarterly mobile broadband report provides worldwide and regional market size, vendor market share, forecasts through 2017, analysis and trends for smartphones, smartphone OS (Android, Blackberry, iPhone, Linux, Palm, Symbian, Windows Mobile, other), netbook OS (Linux, Mac, Windows, other), tablet OS (Android, iOS, Windows, other), USBs, cards, routers, embedded devices (PCs, netbooks, tablets, mobile internet devices) and subscribers. Companies tracked: Apple, Dell, HTC, Huawei, LG, Motorola, Nokia, Novatel Wireless, Qualcomm, RIM, Samsung, Sierra Wireless, Sony, ZTE and others.

To buy report, contact Infonetics: http://www.infonetics.com/contact.asp

2G, 3G, 4G Mobile Services and Subscribers: Voice, SMS/MMS, and Broadband (2013 Edition)

This report tracks mobile services revenue, mobile voice and data average revenue per user (ARPU), and mobile voice and broadband subscribers.

MOBILE SERVICES MARKET HIGHLIGHTS:

- For the full year 2012, global mobile service revenue – including voice, SMS/MMS and broadband – totaled $739 billion, up 2.5% from 2011

- Mobile data (text messaging, mobile broadband) service revenue rose in all major world regions in 2012, boosted by an increase in smartphone usage

- Though more subscribers are migrating from voice-only plans to data-centric packages, voice services are still expected to account for almost half of total mobile service revenue in 2017

- LTE broadband is growing the fastest of any mobile services category, with an Infonetics-projected compound annual growth rate of 55% for 2012–2017

- Infonetics forecasts global mobile LTE broadband subscribers to near 570 million by 2017, with most concentrated in North America and Asia Pacific

“Overall, the wireless industry remains resilient and continues to perform above expectations during a period of global economic malaise and increasing mobile saturation,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

“In fact, we found that local regulatory conditions and high mobile penetration rates are the key factors affecting mobile service revenue rather than economic conditions,” Téral continues, “Except in Europe, where unabated economic turmoil continues to take a toll as consumers set less and less money aside for mobile products and services, weighing on Europe’s BIG 5 – Vodafone, Telefónica, Deutsche Telekom, France Télécom and Telecom Italia.”

REPORT SYNOPSIS:

Infonetics’ biannual mobile services report provides worldwide and regional market size, forecasts through 2017, analysis and trends for mobile broadband, SMS/MMS and voice mobile service revenue, ARPU and subscribers by technology (GSM, W-CDMA, TD-SCDMA, cdmaOne, CDMA2000, FDD-LTE, TDD-LTE). The report features a Mobile Broadband Service Tracker following service provider deployments by country, technology and number of subscribers.

To buy report, contact Infonetics: http://www.infonetics.com/contact.asp

Infonetics: Mobile Infrastructure Market Declines, while Mobile M2M Spending was Up 25% year-over-year

Infonetics Research released excerpts from its 1st quarter 2013 (1Q13) 2G, 3G, 4G Mobile Infrastructure and Subscribers report, which tracks 2G, 3G, LTE, and WiMAX network equipment and subscribers.

MOBILE INFRASTRUCTURE MARKET HIGHLIGHTS:

. In 1Q13, the worldwide 2G/3G/4G mobile infrastructure market totaled $9.8 billion, down 9% sequentially, and down 2% year-over-year, despite another LTE ramp-up driven by North America and Europe

. LTE revenue was $2.7 billion in 1Q13, an increase of 21% quarter-over-quarter and 108% year-over-year, though Infonetics believes an appreciation of the U.S. dollar against the Japanese Yen erased at least 5% of revenue

. WiMAX continued its decline, dropping 42% in 1Q13 from the previous quarter

. After dragging down 4Q12, the BRIC countries (Brazil, Russia, India, China) are shaping up as a major engine for 2013; case in point: Brazil added to the 1Q13 revenue mix when its 4 mobile operators kicked off LTE rollouts

. Ericsson remains king of the RAN, with double the revenue market share of #2 Nokia Siemens Networks

. Infonetics expects 3G RAN to continue to be greater than GSM moving forward solely driven by W-CDMA

. Global mobile subscribers are forecast by Infonetics to reach 7 billion by 2017, with LTE subscribers making up just 8% of total subscribers

“We are clearly seeing the broad shift to LTE and its direct effect on 2G, 3G, and WiMAX,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. “Typically strong 2G and 3G

markets, China in particular, did not come to the rescue this time around. In fact, China and Russia had a busy 1Q13 selecting LTE vendors. Life without LTE would be hell!”

Richard Webb, directing analyst for microwave and carrier WiFi at Infonetics, adds: “LTE is the highlight of our long-term 2G/3G/4G infrastructure forecast, growing at a 16% CAGR over the 5 years from 2012 to 2017.”

AW Comment: Despite all the pundit predictions that wireless telco infrastructure spending would increase, due to more LTE and 3G+ deployments with small cells, it hasn’t. Not even close! The contracting wireless network equipment market has led vendors such as NSN and Alcatel-Lucent to restructure and revamp their business focuses. That means asset sales and more downsizing (will it ever end?).

Our previous post indicated that NSN was up for sale, as co-owner Siemens has reportedly approached private equity companies to discuss NSN’s possible sale. Nokia has been reported to be interested in buying the wireless gear company. https://techblog.comsoc.org/2013/06/17/siemens-searching-for-nsn-buyer-which-might-be-nokia

Just this past week, Alcatel-Lucent announced it’s cutting costs (yet again), is shifting its focus more toward LTE and small cells, and decreasing investments in legacy wireless technologies. The plan is aimed at producing cost savings of about $1.34 billion as well as another $1.34 billion gain from unspecified asset sale. The proposals are the biggest corporate overhaul of the group since the $13.4bn merger of France’s Alcatel and Lucent of the US in 2006, according to the Financial Times which wrote that it is likely to lead to more than 10,000 job cuts, from an employee base of more than 70,000, according to estimates by analysts. Alcatel-Lucent’s market capitalization, at €3.3bn, has slid 80% since the merger between the two telecom equipment titans in 2006. What does that tell you about the health of the industry?

http://www.ft.com/cms/s/0/f0f928d4-d824-11e2-b4a4-00144feab7de.html#axzz2WzUrTLvp

REPORT SYNOPSIS:

Infonetics’ quarterly 2G, 3G, 4G (LTE) report provides worldwide and regional market size, vendor market share, analysis, deployment trackers, and forecasts through 2017 for 2G, 3G, 4G (LTE), and WiMAX mobile network equipment and subscribers. The report tracks more than 50 subsegments of the market, including radio access networks (RAN), base transceiver stations (BTSs), mobile softswitching, packet core equipment, and E-UTRAN macrocells. Vendors tracked:

Airspan, Alcatel-Lucent, Alvarion, Cisco, Datang Mobile, Ericsson, Fujitsu, Genband, HP, Huawei, NEC, NewNet, Nokia Siemens Networks, Proxim, Redline Communications, Samsung, UTStarcom, ZTE, and others.

MOBILE M2M MARKET HIGHLIGHTS:

- The global mobile M2M module market scaled to a new level in 2012, reaching $1.5 billion – an increase of 25% from the previous year

- While 2G technologies make up the majority of mobile M2M units now, 3G M2M is on the rise, forecast by Infonetics to grow to 56% of all M2M modules shipped in 2017

- LTE is the fastest growing mobile M2M technology segment, driven by connected car initiatives such as GM’s OnStar, China Mobile’s massive LTE-TDD network buildout, and the Chinese government’s smart cities efforts

- Infonetics projects a cumulative $2.6 billion will be spent over the next 5 years on mobile M2M modules for the auto/transport/logistics vertical, the key anchor for the M2M market

- North America and Europe are currently the main centers of mobile M2M module growth, but Asia Pacific has the fastest anticipated rate of growth due to a highly diversified economic base that creates a stratified market for M2M solutions

- Infonetics expects the next 18 to 36 months to bring further vendor consolidation and vetting of business models to the mobile M2M module industry

Commenting on the growth in Mobile M2M (which impacts mobile infrastructure), Godfrey Chua, Infonetics’ directing analyst for M2M said: “To put things in perspective, the mobile M2M module is just one of many technology solutions available for M2M services, one that represents less than 15% of active M2M connections today. Mobile M2M modules compete against myriad other technology solutions that enable M2M services, including DSL and T1 lines as well as wireless technologies like WiFi, Zigbee and Bluetooth.”

Chua continues: “Mobile operators are deploying more M2M solutions and enterprises and consumers are increasingly adopting them across the globe, creating a robust outlook for the overall M2M services market, as well as the mobile M2M module market. Many mobile operators are putting a sharp focus on and real resources behind their M2M businesses, and it’s beginning to pay off. That one of the global leaders, AT&T, can speak of a billion-dollar business in this segment demonstrates the traction and growth that M2M services are experiencing.”

M2M REPORT SYNOPSIS:

Infonetics’ mobile M2M modules report provides worldwide and regional market size, forecasts through 2017, analysis, and trends for mobile M2M modules (units, revenue, ARPU) by technology and vertical (utilities/smart grid, automotive/transport/logistics, security/surveillance, retail/vending, healthcare, other).

The report includes a Customer Wins tracker with updates on activity by equipment manufacturers including Brightsky, Cinterion, Encore Networks, Gemalto, Huawei, Mesh Systems, Multi-tech Systems, Novatel Wireless, nPhase, Quake Global, Sierra Wireless/Sagemcom, Simcon Wireless, Skywave and Telit. Service providers and enterprises noted include Aeria, Ambient, AT&T, Digital Communications, du, EDMI, Geacom, Ground Lab, M2M Data Corporation, Motorola, Numerex, Orbcomm, Pomdevices, PositiveID, Redtail Telematics, Rogers Wireless, SK Telecom, Softbank, Sprint, Telstra, Verizon Wireless and others.

To buy these report, contact Infonetics:

Siemens Searching For NSN Buyer which might be Nokia!

Siemens has reportedly contacted private equity firms to gauge their interest in buying Nokia Siemens Networks or, as a less likely alternative, taking over the German telecom equipment-maker’s stake in the NSN venture, according to The Wall Street Journal. For its part, Finnish cellphone-maker Nokia reportedly has been exploring buying out Siemens’ 50% stake in the company. Some analysts have valued the company as a whole at nearly $9.4 billion.

The catalyst for the recent exploration of alternatives for NSN is a change in April in the shareholder agreement that frees each partner to explore options for its stake without the risk of a veto from the other party. Still, it is unclear how Nokia would view a possible sale of all or part of NSN to private-equity investors.

Siemens Chief Financial Officer Joe Kaeser earlier this year said NSN “is not a business that we have any aspirations to stay [in]…and I do believe that 2013 will be the time for Siemens to help NSN to move to a better place.”

People familiar with the matter told the WSJ that Nokia is exploring a possible buyout of its 50-50 German partner in NSN. Evidently, Nokia wants to keep NSN mobile network equipment and managed services business, which has propped up revenues and helped maintain cash levels during Nokia’s shift to Windows Phone. NSN had sold its optical network equipment business this past December to private investment firm Marlin Equity Partners.

Last quarter, NSN contributed €210m to Nokia’s net cash position with revenues of €2.8bn, putting it on a par with Nokia’s device and services sales of €2.88bn.

http://online.wsj.com/article/SB10001424127887323734304578544910076383572.html?KEYWORDS=siemens++NSN

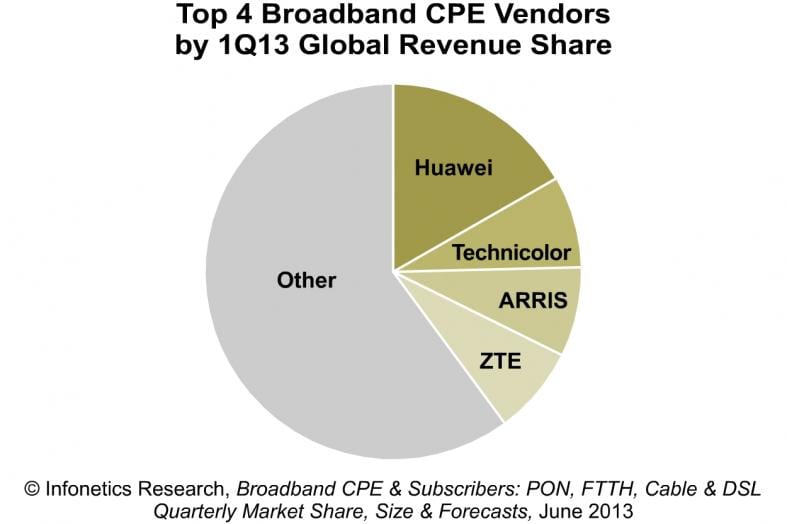

Huawei widens lead in broadband CPE market; VDSL Vectoring to the Rescue!

Infonetics Research released excerpts from its 1st quarter 2013 (1Q13) Broadband CPE and Subscribers: PON, FTTH, Cable, and DSL market share, size and forecasts report, which tracks digital subscriber line (DSL), cable and fiber to the home (FTTH) customer premises equipment (CPE), residential gateways and broadband subscribers.

1Q13 BROADBAND CPE MARKET HIGHLIGHTS:

- Owing to the continued strong growth of FTTH and cable CPE, the global broadband CPE market hit $2.2 billion in 1Q13, an increase of 6% sequentially and 17% from the year-ago quarter .

- Though the overall DSL CPE market is slowing on an annual basis, VDSL CPE continues to enjoy strong growth (+30% YoY), particularly in North America and EMEA (Europe, Middle East, Africa ).

- Broadband CPE share leader Huawei pulled farther away from the pack in 1Q13, thanks to a 26% spike in revenue coming mostly from China , Singapore and Malaysia, where it is the primary supplier of GPON ONTs and ADSL CPE.

- Former #2 ZTE slipped to 4th place, leapfrogged by Technicolor and Arris .

- Pace’s share of the broadband CPE market continues to grow, and Infonetics expects it to challenge for a place in the top 3 this year.

- Headless video gateways are forecast by Infonetics to grow at a 117% compound annual growth rate (CAGR) from 2012 to 2017

“Better than expected sales of higher-end cable CPE, including headed and headless video gateways being sold in North America and Europe, helped the broadband CPE market put up another strong quarter,” notes Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research. Heynen adds: “Operators across multiple verticals are in the middle of a long-term transition to higher-speed broadband technologies like FTTH, DOCSIS 3.0 and VDSL2 to keep up with subscriber demand for multiscreen video.”

REPORT SYNOPSIS:

Infonetics’ quarterly broadband CPE report provides worldwide and regional market size, vendor market share, forecasts through 2017, analysis and trends for ADSL and VDSL modems, gateways and IADs; standard and DOCSIS 3.0 cable modems, gateways and EMTAs; FTTH ONTs and gateways; residential gateways; PON and Ethernet FTTH ports; and broadband subscribers. Companies tracked: Alcatel-Lucent, Arris, AVM, Cisco (Linksys, Scientific Atlanta), Comtrend, D-Link, Dasan Networks, Fiberhome, Hitron, Huawei, Mitsubishi, Motorola, Netgear, OF Networks, Pace, Sagemcom, SMC Networks, Sumitomo, Telsey, Technicolor, TP-Link, Ubee Interactive, Zhone, ZTE, Zyxel and others.

To buy report, contact Infonetics at: http://www.infonetics.com/contact.asp

Reference: http://www.infonetics.com/newsletters/Broadband-Access-June-2013.html

Comments on VDSL:

After 10 years (1996-2006) of slow growth and unfilled potential, VDSL-based CPE grew 30 percent year-over-year in North America and EMEA. For network operators that have a large base of copper plant, VDSL2 has become a viable near-term option to deliver higher speed services and video.

Three major telcos, including AT&T, Deutsche Telekom and Telecom Italia, have outlined large-scale build out plans that will continue through the year 2016. AT&T’s Project VIP will extend U-Verse and IP DSLAM FTTN coverage by 8.5 million homes by 2015, while Deutsche Telekom will increase VDSL coverage to 65 percent by 2016. Telecom Italia will deploy fiber to the cabinet to 6.1 million homes in 100 cities by the end of 2014.

Unlike ADSL which uses ATM and AAL5 as a L2 framing, almost all VDSL/VDSL2 uses Ethernet MAC frames and Unnumbered Information (UI) Frames for Layer 2 (Data Link layer. Hence, we see an increase of more Ethernet compatible gear in the home, small office and telco central office (e.g. IP/Ethernet DSLAMs).

More importantly, VDSL got a new lease on life through the concept of “vectoring,” which was co-invented by IEEE ComSocSCV member George Ginis. Check out his excellent paper on that topic:

Vectored DSL to the Rescue

http://www.ospmag.com/issue/article/vectored-dsl-rescue

Congrats George!

Analyst Takeaways from June 6th AT&T Management Meeting + 3 AT&T Talks @June 12 ComSocSCV Meeting!

http://online.wsj.com/article/BT-CO-20130606-712991.html

http://www.att.com/gen/press-room?pid=24340&cdvn=news&newsarticleid=36572&mapcode=financial

“AT&T’s management reiterated top-line revenue guidance of above 2% for FY13, but we believe a key strategic challenge for AT&T (and other network operators) is how to drive wireless ARPU up from today’s levels (across the business and consumer segments), leveraging the high quality network in an environment where the market is mature, competition is intensifying, and further wireless consolidation is now unlikely in the near term, based on our latest regulatory checks.”

■ Zealous versus pragmatic DOJ stance is cause for concern. As approval approaches for SoftBank’s investment in Sprint, and following recent shareholder approval of T-Mobile and MetroPCS, we see a new zealous stance by the DOJ and now see less potential for a merger between Sprint and T-Mobile USA. The DOJ appears excited by the fact that wireless network operators have no choice but to invest, even if incremental returns are poor. This is coupled with the DOJ looking to limit access to spectrum in upcoming auctions.

■ Too soon for a change in capex intensity, but do not discount the potential for a “hard pivot” away from incumbent vendors. AT&T is deploying SDN (Software Defined Networking) outside the datacenter, including Central Offices, to best serve U Verse and LTE-based features and applications (such as cached video) at low latency. We see a laser-sharp focus on open and flexible white box switches, with Broadcom cited as a company in focus. The era of simply driving lower costs from incumbent vendors appears to be over.

3. Jefferies’ analysts Thomas Seitz, Kunal Madhukar and Ankit Sharma:

http://www.ewh.ieee.org/r6/scv/comsoc/index.php#current

Forbes Article at:

http://www.forbes.com/sites/connieguglielmo/2013/01/04/att-makes-foundry-a-verb-asks-employees-for-tips/

100G is real: Alibaba selects ZTE for 100G in China; Global 100G market growing; Ciena’s Perspective

Introduction

While there’s been a lot of buzz about 100G fiber optic deployments, it’s been the smaller network operators that to date have acutally built out such fiber optic networks. Those include: XO Communications, DukeNet Communications, ARSAT, Kansas City Fiber Network, ORION in Canada, Intercontinental Transmission Links for Research and Education Community (Internet2, NORDUnet, ESnet, SURFnet, CANARIE, and GÉANT) and others.

But many industry analysts and vendors believe the time for 100G is now here. That is, for telcos, cableco’s, governement agencies, and e-commerce companies to move to 100G OTN and/or 100G Optical Ethernet networks. Note that SONET/SDH topped out at 40G so is not an option for 100G PHY layer.

1. Alibaba Group has just announced a 100G network for China

ZTE’s ZXONE 8700 100G OTN series will be deployed to build Alibaba’s 100G transmission network. The first phase of the project will cover four MANs in Hangzhou, Tianjin and Beijing respectively. The ultra-large bandwidth, high capacity, and robust reliability of ZTE’s solutions, and the ability to provision a comprehensive range of services will serve the enormous networking needs of Alibaba, and support the continued high-speed growth of Alibaba’s operations. Alibaba is one of the world’s largest e-commerce companies, operating more than 10 platforms including Alibaba.com, Taobao Marketplace, Tmall.com, eTao, Alipay, Juhuasuan, Alibaba Cloud Computing and China Yahoo! When the construction of the broadband network is completed, it will carry most of Alibaba’s data traffic.

2. Market Research firms Ovum and Frost & Sullivan say 100G is growing rapidly

“Growth in 100G remains a bright spot in the optical networking industry, as annualized revenues exceeded $1bn for the first time ever. 100G port shipments in 1Q13 grew 41% and revenues grew 24% versus 4Q12, with annualized revenues surpassing $1bn for the first time. Twenty vendors shipped 100G for revenue in 1Q13 and more are slated to enter the market throughout the year. Even with the growth of 100G, 40G shipments were holding; however, 1Q13 was the first time the market declined versus the year-ago quarter and the rolling 4Q average declined 2%, indicating perhaps the 40G market is starting to slow.”

http://ovum.com/research/market-share-1q13-global-on/

Frost & Sullivan Estimates Global 100G Market to Continue to Grow, Reaching $4.8 Billion by 2016

Enterprises and data centers are fueling the global 100G optical network market, which is predicted to increase at a 52.2 percent compound annual growth rate (CAGR), reaching $4.8 billion by 2016, according to market research firm Frost & Sullivan. Since its inception in 2010, the market has growth by 210 percent in 2011 and 387 percent in 2012, according to the research firm.

Alcatel-Lucent, Huawei, Infinera, Ciena and ZTE are the top five 100G vendors, accounting for over 76.2 percent of the market share by unit shipments. The research firm expects these firms to continue to dominate the market because of high barriers to market entry.

3. Ciena – a leading vendor of 100G optical networking equipment (selected quotes related to 100G)

During Ciena’s June 6th earnings call, CEO Gary Smith said, “the 100G (network) scale and beyond (is needed) to handle the sheer volume of connections and software-defined networking to make those connections as flexible and as valuable as possible.”

In answer to questions on 100G market and the competition, Mr Smith replied:

“I describe the 100G as one of the essential components for this next-generation architecture, along with OTN, converged packets and very tightly aligned software architectures as well, so I think it’s one of the key components. We clearly have market leadership in that space in terms of revenues and Tier 1 (carrier) wins and overall capacity that we’re now deploying on a global basis. We’re seeing a strong uptick in 100G. We expect to see that continue and also spread into other areas of the architecture. We’ve got WaveLogic 3, which is our third-generation platform. Many of our competitors are struggling to get their (frankly) first generation fully operational in the marketplace. We’ve got a lot of features and functionality and in fact, software intelligence that is part of WaveLogic 3, so increasingly more smart photonics there that we’re able to leverage, so we feel very positive from a competitive position around 100G, particularly when you encompass it with the complete solutions you’re putting together around OTN, control plane, converged packets and then the software architecture approach that we have.”

“We’re now seeing finally the Ethernet business services, and it’s the fastest-growing part of the enterprise data services market. And we expect the percentage of revenue coming from this business, Ethernet services, to increase. Our position is pretty strong in the marketplace, certainly, with the — even with wireless backhaul. And I think we support about 50% of the fiber-fed U.S. towers for backhaul actually, which we’ve been able to deploy over the last couple of years.”

In response to a question on what constitutes the non-telco portion of Ciena’s customers: “It’s cable operators, government, research and education. Some very large research and education networks around the globe, clearly a big requirement to move very, very large amounts of capacity around the enterprise space. There’s a lot of very high-end enterprises who want carrier-class interconnectivity lodged in between their data centers. We’re increasingly seeing opportunities in that space and also the content delivery network folks as well. So all of that together is about 25%.”

Thomas Mock – Former Ciena Senior Vice President of Corporate Marketing & Communications- added, “We’re now seeing 100G across all domains in the (optical) networks. And one of the ways you can get to those other domains in the network is to have the bigger architectural components. So that’s really what’s let us move from the core into the metro and also into the ultra long haul and undersea markets.”

Long time Ciena Network Architecture Executive Joe Berthold (PhD-Physics) wrote this author, ” Many network operators are making the transition to 100G. Many of our customers were waiting for our WaveLogic3 cards, which went GA at the end of last year. These cards support longer distances for 100G, are denser and more power efficient, and have the new ASICs capable of supporting multiple modulation formats.”

4. Analyst Opinion on the 100G Upgrade Cycle and Ciena

FBR’s Scott Thompson wrote in an email, “Ciena management made clear that it believes that the company is in the early stages of what is likely to be much more than a 100G upgrade cycle. On the earnings call, management emphasized that it thinks the industry is in the beginning stages of a significant shift in network architectures that will propel Ciena’s business into a much larger opportunity. We believe that the industry analyst community has not fully realized the scope of this opportunity.”

“Ciena will likely prove more strategically positioned than most in the communications space for what is likely to be one of the most significant transitions in the networking sector in more than two decades.”

5. Another Analyst Opinion on Competition in 100G Network Gear

Note: Huawei, ZTE, Alcatel-Lucent, Ciena, Fujitsu, Cisco, Infinera, Xtera, NSN Optical (owned by Marlin Equity Partners), and other network equipment vendors are all competing in this space.

Raymond James Financial analyst Simon Leopold notes that Ciena is strong in the 100Gbit/s equipment and carrier Ethernet markets but he believes there is “evidence of 100G price competition and maybe discounts for larger Ethernet projects.”

Closing Comment:

According to Frost & Sullivan, the 100G market is mainly driven by the demand for high quality broadband network services, especially by the growing IP traffic and number of broadband subscription during recent years and in the future. Implementing a 100G optical network results in high network efficiency and reduced per byte transmission costs for data, the research firm noted.

Future 100G applications include: interconnection of cloud resident data centers, 4G LTE wireless backhaul, metro optical networks, submarine and ultra-long haul optical networks.

References:

Infonetics & IDC: Worldwide Carrier Ethernet Switch & Router Results and Market Forecasts

Infonetics: Carrier Ethernet S/Rs down in last Quarter, but expected to grow 8.8% CAGR through 2017

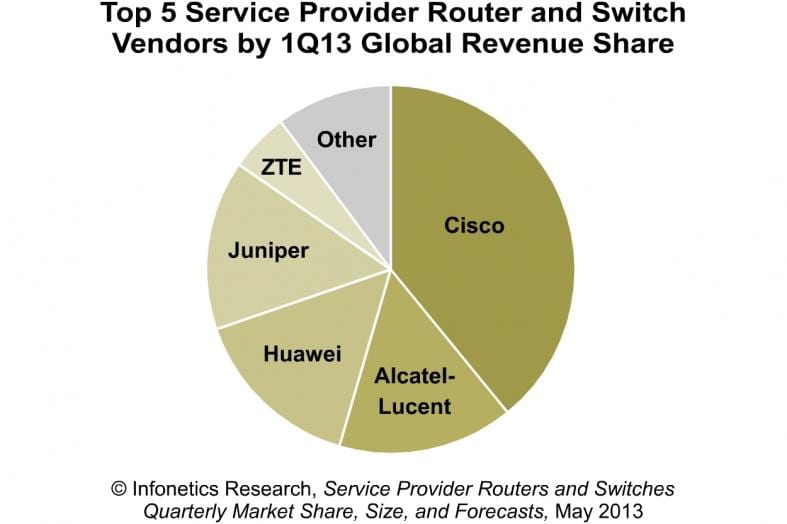

Market research firm Infonetics Research released excerpts from its 1st quarter 2013 (1Q13) Service Provider Routers and Switches market share and forecasts report, which tracks IP edge and core routers and carrier Ethernet switches (CES).

SERVICE PROVIDER ROUTER AND SWITCH MARKET HIGHLIGHTS:

Pushed lower by weakness in Europe, global service provider router and switch revenues declined 17% in 1Q13 from 4Q12, and is down 6% from the year-ago quarter (1Q12). North America was the only geographic region to buck the usually down Q1, posting a 7% sequential gain. EMEA (Europe, the Middle East, and Africa), Asia Pacific, and CALA (Caribbean and Latin America) all declined by double digits in 1Q13.

Cisco maintains its strong hold on the #1 spot in the overall carrier router and switch market with 39% revenue share in 1Q13. The competition for the next 3 positions in the carrier router and switch market remains tight, with less than 1 percentage point separating Alcatel-Lucent, Huawei, and Juniper Networks. Alcatel-Lucent edged ahead of Huawei for 2nd place in 1Q13. Private router company Compass-EOS recently announced NTT as a customer for its new core router that provides terabit-per-second connectivity to facilitate software-defined networking (SDN) and network function virtualization (NFV).

“The 1st quarter is normally down for routers and carrier Ethernet switches, so it’s better to look at the longer-term trends,” explains Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research. “The main growth drivers – the transition from TDM to packet and rising video traffic – are still in effect, the U.S. economy is slowly improving, and a number of large operators in the Euro zone intend to spend.” “Given these factors,” Howard adds, “We expect the router and Carrier Ethernet Switch market to grow at an 8.8% CAGR through 2017.”

REPORT SYNOPSIS:

Infonetics’ quarterly router and switch report provides worldwide, regional, China and Japan market share, market size, forecasts and trends for IP edge and core routers, carrier Ethernet switches and the IP edge market by application. Vendors: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Compass-EOS, Ericsson, Fujitsu, Hitachi Cable, Huawei, Juniper, NEC, Tellabs, ZTE, others.

Here’s a chart of the leading Carrier Ethernet switch/router vendors (Cisco, Alcatel-Lucent, Huawei, Juniper, ZTE):

To buy report, contact Infonetics at: http://www.infonetics.com/contact.asp

Meanwhile, IDC reported that the worldwide Ethernet switch/router market (Layer 2/3) grew 2.1% year over year in 1Q13, while the worldwide router market decreased 7.9% year over year.

From a geographic perspective, the first quarter results found the Ethernet switch market was particularly strong in China where it increased 10.6% year over year, followed by Central and Eastern Europe, which was up 10.3% year over year. As a region, Asia/Pacific (excluding Japan) came in with a 6.6% increase, while the United States also performed relatively well in 1Q13 with an increase of 3.5% year over year. Western Europe remained an area of weakness, declining 6.2% year over year. On a positive note for Western Europe, this was an improvement over the double-digit year-over-year declines experienced in 3Q12 and 4Q12.

“While 10GbE continues to drive the worldwide Ethernet switch market, it is interesting to note the increasing divergence in the performance of the overall market across the various regions, and in some cases, specific countries,” said Rohit Mehra, Vice President, Network Infrastructure at IDC. “While GbE is still expected to hold its own for the foreseeable future, we expect 10GbE and 40GbE to drive the wired infrastructure market forward in the coming years, both in the datacenter as well as campus core deployments. But as the market evolves, we should expect there will be pronounced market differences across the various theatres.”

10Gb Ethernet switch (Layer 2/3) revenue increased 12.9% year over year to $1.87 billion while 10Gb Ethernet switch port shipments grew 37.6% year over year to 3.9 million ports in 1Q13. 10GbE continues to be the primary driver of the overall Ethernet switch market.

The worldwide Layer 4-7 switching market lost some momentum in 1Q13 and decreased 4.3% year over year. This was the first annual decline in more than three years.

The worldwide enterprise and service provider Router market declined 7.9% year over year and 13.0% sequentially in 1Q13. As with the Ethernet switch market, IDC saw very uneven performance across major geographies and countries this quarter. Asia/Pacific (excluding Japan) actually grew 4.2% year over year in 1Q13 while North America and the Middle East and Africa (MEA) regions were down only low single digits on an annual basis. Elsewhere, Japan, Latin America, and Western Europe all declined by more than 20% year over year. Specifically, Japan fell by 24.8%, Latin America by 22.5%, and Western Europe by 20.5% year over year, each a significant market move by any standard.

From a vendor perspective, Cisco’s Ethernet switch (Layer 2/3) market share in 1Q13 came in at 62.7% reflecting a year-over-year decrease from 64.1% in 1Q12, but a solid increase from 61.4% Cisco held in the previous quarter. Cisco’s market share in the fast growing 10GbE market segment was 66.7% in 1Q13.

An interactive graphic showing the relative market shares of the top 5 vendors in the worldwide Layer 2/3 Ethernet switch market over the previous five quarters is available here. The chart is intended for public use in online news articles and social media. Instructions on how to embed this graphic can be found by viewing this press release on IDC.com.

“While enterprise mobility is no doubt an area of focus for IT and network managers, the underlying wired infrastructure is also continuing to get mindshare, both in the enterprise campus as well as the datacenter, especially as IT looks to improving the application experience for enterprise users,” said Petr Jirovský, Senior Research Analyst in IDC’s Networking Trackers Group. “That said, the need to support a growing and diverse set of wired and wireless devices at the network edge will continue to keep the enterprise networking market relevant over the longer term.”

The IDC’s Worldwide Quarterly Ethernet Switch and Router Tracker provides total market size and vendor shares for the Ethernet switch and router technologies in an easy-to-use Excel pivot table format. The geographic coverage for both the Ethernet switch market and the router market includes eight major regions (USA, Canada, Latin America, Asia/Pacific (excluding Japan), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 58 countries. The Ethernet switch market is further segmented by speed (100Mb, 1000Mb, 10Gb, 40Gb), form factor (fixed managed, fixed unmanaged, modular), and layer (L2, L3, L4-7). Measurement for the Ethernet switch market is provided in factory revenue, customer revenue, and port shipments. The router market is further split by product class (high-end, mid-range, low-end, SOHO) and deployment (service provider, enterprise) and the measurements are in factory revenue, customer revenue, and unit shipments.

http://www.idc.com/tracker/showproductinfo.jsp?prod_id=93

For more information about IDC’s Worldwide Quarterly Ethernet Switch and Router Tracker, please contact Kathy Nagamine ([email protected]).