Month: December 2014

Infonetics & GSMA reports on the Global Mobile Services & Subscriber Markets

Infonetics, now part of IHS Inc. (NYSE: IHS), released excerpts from its December 2014 2G, 3G, LTE Mobile Services and Subscribers market size and forecast report.

MOBILE SERVICES MARKET HIGHLIGHTS:

- Worldwide mobile service revenue barely budged in the first half of 2014 (1H14), up just 0.5% from the same period a year ago, to $385.5 billion

- Gains in the Caribbean and Latin America (CALA), Asia Pacific, and North America together offset a high double-digit decline in EMEA

- For the first time, voice usage slightly slowed, dragged by China where over-the-top (OTT) alternatives took their share, and mobile broadband overtook SMS as the largest revenue generator of mobile data

- Mobile broadband revenue rose 26% in 1H14 from 1H13 and continued to drive overall mobile services market growth

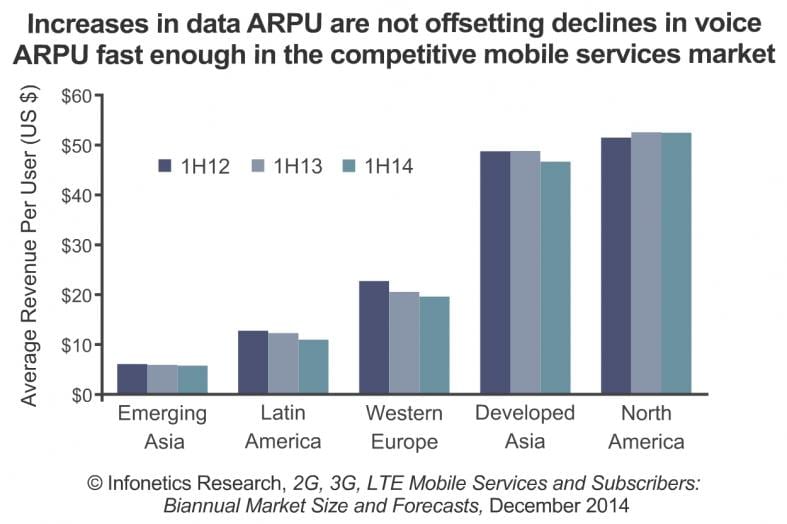

- Despite the rise of mobile data, blended ARPU continues to fall, but at a much slower pace in every region, including developing Asia Pacific

“Europe continues to be the main drag on global mobile services revenue, but Europe’s BIG 5-Deutsche Telekom, Orange, Telecom Italia, Telefónica, Vodafone-see some light at the end of the tunnel, with looming consolidation that should ease the pressure on mobile services revenue,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

MOBILE SERVICE REPORT SYNOPSIS:

Infonetics’ mobile services report provides worldwide and regional market size, forecasts through 2018, analysis, and trends for voice, SMS/MMS, and broadband mobile service revenue, ARPU, and subscribers by technology. The report features a Mobile Broadband Service Tracker following operator deployments by country, technology and subscribers.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

GSMA has produced a free report on the 2014 Mobile Economy. It’s available for download as a pdf at:

http://www.gsmamobileeconomy.com/GSMA_ME_Report_2014_R2_WEB.pdf

GSMA represents the interests of mobile operators worldwide. Spanning more than 220 countries, the GSMA unites nearly 800 of the world’s mobile operators with more than 230 companies in the broader mobile ecosystem, including handset makers, software companies, equipment providers and Internet companies, as well as organisations in industry sectors such as financial services, healthcare,media, transport and utilities. The GSMA also produces industry-leading events such as the Mobile World Congress (in Barcelona, Spain) and Mobile Asia Expo.

For more information, please visit the GSMA corporatewebsite at www.gsma.com

U.S.-Cuba Rapprochement: Telecom & Internet Infrastructure is a Top Priority for the Cuban Government!

NOTE: An update to this article is at:

Introduction:

Recognizing the urgent need to improve its infrastructure and bolster the private sector economy, Castro & company felt the need to engage the U.S. in dialog to get U.S. companies to invest in the island, especially in telecommunications and information infrastructure.

We were not surprised to read this section of President Obama’s new course for Cuba:

“Telecommunications providers will be allowed to establish the necessary mechanisms, including infrastructure, in Cuba to provide commercial telecommunications and Internet services, which will improve telecommunications between the United States and Cuba.”

Included in the list of products and services that the US will will now make available to Cuba are “certain consumer communications devices, related software, applications, hardware, and services, and items for the establishment and update of communications-related systems.”

Cuba is the largest island in the Caribbean and the closest to the U.S. The island nation’s telecom system, is just starting to be upgraded, after more than five decades of aging and breaking down. A revealing editorial in the December 15th Gramma (Cuba’s state owned and controlled newspaper) is titled The digitalization of society, a priority for Cuba:

“Steps have been taken at the administrative and enterprise levels to guarantee technological sustainability and sovereignty for the massive provision of Internet access services. The trial balloon has been the opening of 154 Public Navigation Centers, distributed throughout the nation, as a prelude to the generalized availability of data services, which will allow the country to commercially offer broadband access (with greater speed and options), work on which is currently underway.”

Continuing……”other initiatives are under development, or in the start-up process, to facilitate the distribution of data via mobile phones and the development of platforms for university and institutional networks, which could extend their services to all of society.”

“The strategy additionally projects the creation of new wireless access capacity; and the integration and orderly use of institutional data networks, such as those in sectors such as public health, education and culture, which are well known by Cuban users. These will be hosted by high performance servers, which will facilitate their potential use. Also planned is the development of video games and multimedia with educational and historical content, as well as the updating of the regulatory framework governing the use of information and telecommunications technology.”

However, one critic is skeptical. Martyn Warwick writes in a blog post:

“Even those privileged enough to have access to a computer and an Internet connection pay through the nose for a very patchy service. Connectivity is a lottery for much of the time and system often falls over and lays dead for indeterminate periods. Hourly connection, when available can cost as much as 20 per cent of the minimum monthly wage. Almost all digital files are exchanged offline via USB sticks that are sold on the dollar black market.”

“Cuba desperately needs good, modern, efficient and inexpensive comms and although the US economic embargo remains in place for the moment, the monolith is cracked. Mr. Obama is using his executive power as President to permit infrastructure projects that will “promote civil society” in Cuba – and that means telecoms.”

http://www.telecomtv.com/#articles/policy-and-regulation/us-telcos-now-allowed-to-do-business-with-cuba-borr-n-y-cuenta-neuva-a-clean-slate-and-a-new-start-12051/

Bottom line: Cuba seeks help from U.S. telecommunications carriers and equipment manufacturers to modernize it’s outdated telecom facilities in order to provide broadband access for the country’s industries, universities, and the public. The projects and strategies noted by Gramma can NOT be achieved without international assistance and investment to build out and overhaul/ upgrade Cuba’s telecommunications networks and information infrastructure.

Highlights of IEEE Globecom: Dec 8-12, 2014 in Austin, TX

Here are selected highlights of IEEE Globecom 2014:

1. 5G cellular: 5G is still in the development stage and not yet standardized by ITU-R. However, there was lots of discussion about what it is and when it might come on line. The consensus seems to favor millimeter wave bands (28, 38 and 72 GHz) using small cells and massive multi-user MIMO. But as they say, the devil is in the details. There is still lots to do in defining, developing and deploying 5G. A good guess is that we won’t see this until 2020 and beyond. Most carriers haven’t even started LTE Advanced which is the true ITU-R complaint 4G RAN.

2. Heterogeneous networks and small cells: The small cell movement has been around a while but few have been deployed. It is finally happening but there apparently are lots of options and some critical issues to solve. Self-organizing networks (SONs) are a part of that effort.

3. Internet of Things (IoT): This mega-trend is already gaining market traction in many forms- mostly industry verticals. Yet there is still some confusion over multiple standards. Many wireless technologies are used including Wi-Fi, Bluetooth, ZigBee, ISM band and others. The new Bluetooth 4.2 and ZigBee 3.0 standards will boost their use.

4. Software-Defined Networking (SDN) and Network Function Virtualization (NFV): Multiple sessions attempted to define each and show how they will impact all future networks. SDN/NFV seems to be one solution to the security problem as well as implementing 5G. The transformation is just beginning but this appears to be a major shift in networking. A fully programmable network is in our future. Some other topics with multiple sessions were cognitive radio, Wi-Fi, sensor networks and fiber optics.

5. Best Paper Award: A team of researchers from Texas A&M University at Qatar, Texas A&M University and the University of Waterloo received a best paper award for “Semi-distributed V2V Fast Charging Strategy Based on Price Control.”

http://www.qatar.tamu.edu/newsroom/2014/12/researchers-win-best-paper-aw…

There were few exhibits with only a few companies participating. National Instruments of Austin, TX made a significant announcement at the conference. NI introduced their LabVIEW Communications System Design Suite. Dr. Truchard, NI CEO briefed the audience on this amazing new development platform uses a combination of hardware and software for prototyping software-defined radios and other new wireless systems. It is already being used to test new modulation algorithms, 5G approaches and large MIMO systems. Look for it to expedite 5G in the future.

Reference:

IEEE GLOBECOM 2014 Industry Program Overview

http://globecom2014.ieee-globecom.org/indforum.html#.VJB-9NLF92E

Ethernet Switch Market: 40G growth; 2.5G and 25G Ethernet coming, but not IEEE 802.3 standards yet

Infonetics Research released excerpts from its 3rd quarter 2014 (3Q14) Ethernet Switches report, which tracks unmanaged, web-managed, and fully-managed fixed and chassis switches by port speed (100ME, 1GE, 10GE, 40GE, 100GE).

3Q14 ETHERNET SWITCH MARKET HIGHLIGHTS.

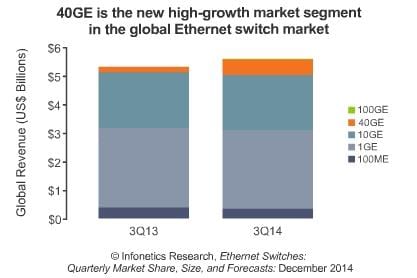

- Globally, Ethernet switch revenue grew 4% sequentially in 3Q14, to $5.6 billion;

- Year-over year growth stood at 5%, thanks to demand from the public and financial services sectors.

- Web-managed and fully-managed fixed switches notched double-digit year-over-year revenue growth in 3Q14; unmanaged and chassis switches declined .

- 10GE port shipments were up 26% year-over-year in 3Q14, falling short of expectations at this stage in the adoption cycle.

- 40GE is taking over from 10GE as the new high-growth market segment: 40GE port shipments more than doubled year-over-year in 3Q14, with growth especially strong in the white box market.

- 100GE took a breather after a strong 2Q, but its arrival on fixed switches and the introduction of lower-cost optics will drive growth in 2015

“Recent momentum in the Ethernet switch market carried through to the third quarter, and 2014 is on track for record revenue. Looking ahead, we expect growth to accelerate, thanks in part to the introduction of 2.5G and 25G Ethernet. These new Ethernet speeds will be a premium offering relative to 1GE and 10GE to address bandwidth constraints in data center and campus networks, and should provide an additional boost to revenue,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research.

Alan’s comment: Unknown to most is that 2.5G and 25G Ethernet is NOT being standardized by IEEE 802.3! It is being specified by the “MGBase-T Alliance.” The specification adopted by this Alliance leverages many of the fundamental technologies in Ethernet standards as defined in the IEEE 802.3 10GBASE-T, enabling faster time to market with minimal research and development efforts for ecosystem vendors. The specification is available royalty-free to all members.

The IEEE has formed a study group to understand the need for these new speeds that will meet the high demand for Ethernet between 1G and 10G, which are the only standard options available today for high-speed networking over UTP cables.

With advanced technologies in enterprise networks and increasing numbers of wireless computing devices connecting to next-generation cloud infrastructure, 1000BASE-T Ethernet is limited in bandwidth while 10GBASE-T Ethernet requires UTP Cat6a cabling, a costly upgrade to the install base of Cat5e and Cat 6 cables that constitutes the majority of the cabling installed base today. The addition of the 2.5G and 5G Ethernet link protocol speeds will enable the cost effective scaling of network bandwidth delivered to enterprise access points and provide IT professionals with more data rate options.

Top IEEE member discussion list contributor and former IEEE 802.3 chair Geoff Thompson wrote in an email:

The theory behind this standardization effort is twofold.

1) The implementation is relatively easy as a back off form earlier work and implementations of 10GBASE-T.

2) There is a major market driver in the links between closet switches and next generation WiFi access points.

(i.e. > 1G and 100 meter Cat 5e).

The driving target market is very specific to Wireless Access Points (WAPs), rather than data centers.

You can see the presentation on this standards effort at the Nov 2014 IEEE 802 meeting at:

http://www.ieee802.org/3/cfi/1114_1/CFI_01_1114.pdf

The call for interest (CFI) at the July 2014 IEEE 802 plenary session:

http://www.ieee802.org/3/cfi/0714_1/CFI_01_0714.pdf

The material from the teleconferences that have taken place since then can be found at:

More info at:

http://www.mgbasetalliance.org/

http://tinyurl.com/mhzx2bx

http://www.ethernetalliance.org/blog/2014/06/23/tef-2014-the-rate-debate/

What about White Box Switches (AKA Bare Metal Switches)?

“White box (or bare metal) switches account for <1% of all Ethernet switch ports, but if you look at 10/40GE (where white box switches are used), its 12% of 10/40GE ports last quarter (3Q14)," Matthias wrote in an email to this author.

ETHERNET SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly Ethernet switch report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for Ethernet switches, including: revenue and ports by port speed; unmanaged, web-managed, and fully-managed switches; fixed configuration and chassis switches; and PoE. Vendors tracked: Adtran, Alaxala, Alcatel-Lucent, Arista, Avaya, Brocade, Cisco, D-Link, Dell, Extreme, Hitachi Metals, HP, Huawei, IBM, Juniper, Netgear, Ruby Tech, TP-Link, ZTE, others.

To buy the report, contact Infonetics:

www.infonetics.com/contact.asp

RELATED REPORT EXCERPTS:

- Enterprise router market improves in 3Q; Cloud, economic expansion drive growth in 2015.

- Nearly a quarter of all WLAN access points are now 802.11ac.

- Infonetics study: Security is #1 concern for enterprise access networks.

- Tight battle for 2nd place after Cisco in Infonetics’ enterprise networking scorecard

Market Research Reports Assess the LTE & VoLTE Markets with Different Forecasts for 2015 and Beyond

Infonetics Research released excerpts from its 3rd quarter 2014 (3Q14) 2G, 3G, LTE Mobile Infrastructure and Subscribers report, which tracks more than 50 categories of equipment, software, and subscribers based on all existing generations of wireless network technology.

3Q14 MOBILE INFRASTRUCTURE MARKET HIGHLIGHTS:

. Operators are currently spending around $5.6 billion per quarter on LTE, and this has prompted Infonetics to raise its 2014 forecast for the global macrocell 2G, 3G, and 4G mobile infrastructure market to $45.4 billion, up from $43 billion the prior year

. Investments initially earmarked for 2015 have shifted to 2014, reinforcing Infonetics’ prediction that the LTE market will peak in 2015

. The worldwide macrocell 2G/3G/4G mobile infrastructure market totaled $11.2 billion in 3Q14, up 0.4% sequentially, and up 10% year-over-year

. Nokia Networks moved into the #1 spot for LTE revenue in 3Q14, propelled by strong performances in the U.S. and China

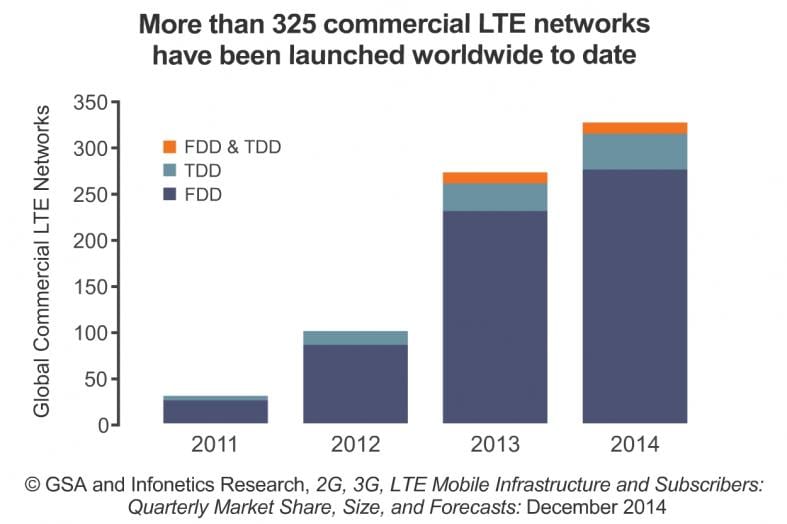

. China continues to push LTE through the roof, but the rest of the world is also moving fast to LTE, with 331 commercial networks launched as of September 2014, as per the GSA

“In the mobile infrastructure market, the third quarter of 2014 was almost a carbon copy of last quarter, and we are now reaching the peak of plain LTE rollouts, which are so brisk in China that they are overshadowing strong activity in Europe, the Middle East, and Russia,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

In an explanatory email to this author, Stephane wrote: “In our (Infonetics) reports, we explain why the LTE market revenues will peak next year: Simply it’s because we’re done with hardware deployments of eNodeB on this planet! I’ve been telling folks around the world for some time that they should enjoy the ride while they can because the market will start to go downhill in 2016.

One major factoid: China Mobile alone has deployed 570,000 eNodeBs this year. No one else (i.e. other network operator) – not even a single country on this planet can match that rollout! This is 10x the size of an AT&T or Verizon footprint!

Once you have those eNodeBs in place, you need the LTE core network such as EPC (Evolved Packet Core) to start with and then IMS (IP Multimedia System) to implement VoLTE. That’s why VoLTE will keep growing.

LTE-A is mainly a software upgrade, involving some level of hardware but no way near the magnitude of those plain LTE rollouts.

Bottom line: get on Virgin Galactic and go to another planet to roll out eNodeBs or move fast to software!

That’s the story.

Cheers, Stéphane

MOBILE REPORT SYNOPSIS:

Infonetics’ quarterly 2G, 3G, LTE mobile infrastructure report provides worldwide and regional market size, vendor market share, forecasts through 2018, deployment trackers, analysis, and trends for macrocell mobile network equipment, software, and subscribers. The report tracks more than 50 subsegments of the market, including radio access networks (RANs), base transceiver stations (BTSs), mobile softswitching, packet core equipment, and E-UTRAN macrocells. Vendors tracked: Alcatel-Lucent, Cisco, Datang Mobile, Ericsson, Fujitsu, Genband, HP, Huawei, NEC, Nokia Networks, Samsung, ZTE, others.

To buy the report, contact Infonetics:www.infonetics.com/contact.asp

VOLTE WEBINAR AND Free Report:

Join Infonetics analyst Stéphane Téral Dec. 9th at 11:00 A.M. ET for Improving the VoLTE Experience: Best Practices from Early Launches, a live event discussing the increasing importance of user experience measurement and analysis in live networks. Attendees receive an Infonetics companion report titled The State of VoLTE.

Attend live or access the replay:http://w.on24.com/r.htm?e=872675&s=1&k=64BD39225EC39496AAB3F16091F3FB04

Meanwhile, Research & Markets predicts a very bright future for VoLTE. In a new report titled ““Voice over LTE Market by Long-Term Evolution, by Technology, and by Geography – Analysis & Forecast to 2014 – 2020,” the market research firm states:

“The overall voice over LTE market is expected to increase at a CAGR of 64.40% from 2014 to 2020.”

Rich communication services, reduced latency, and increased revenue per user are the main reasons behind the increased adoption of the voice over long term evolution services.

The voice over LTE market report analyzes the ecosystem of the network technologies; and the key market, by technology, includes VoIMS, CSFB and dual radio/SVLTE; by LTE market includes LTE and voice over LTE subscriptions, network launches, LTE network modes and end user devices. The report also provides the geographic view for major regions such as the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (ROW). This report also discusses the burning issues, market dynamics, and winning imperatives for the voice over LTE market.

Voice over LTE is garnering more value due to its various features and technologies that are used in the voice over LTE market. The advantages provided by VoLTE such as High Definition (HD) voice, Rich Communication Services (RCS), faster call setup times, and true device interoperability, integration of voice over LTE with voice over Wi-Fi service, and improved battery life over other network technologies have attracted the new users towards it. The CFSB technology held the highest market share in 2013 but the VoIMS technology is estimated to experience a better growth in the near future.

The report provides a detailed view of the VoLTE and LTE market with regard to the subscriptions, LTE and VoLTE network launches, and LTE and VoLTE technologies market; and also presents detailed market segmentation, with qualitative and quantitative analysis of each and every aspect of the segmentation; done by technology, LTE end user devices, and on the basis of the LTE and VoLTE market, by geography. All the numbers in terms of the volume and revenue, at every level of report, are forecasted from 2014 to 2020.

For more information:

http://www.researchandmarkets.com/research/vzx2lx/voice_over_lte

Carrier Ethernet Market up Strongly in 3Q14; What’s it Used for & What Role will SDN Play?

Infonetics Research released vendor market share and analysis from its 3rd quarter 2014 (3Q14) Service Provider Routers and Switches report. Author & Infonetics co-founder Michael Howard writes that Carrier Ethernet Switches had a terrific quarter and year:

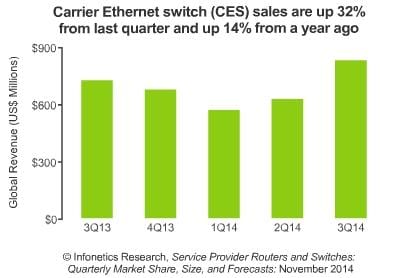

“…Carrier Ethernet switches (CES) had an unprecedented quarter, with global revenue up 32% from the previous quarter and up 14% from a year ago, driven by ZTE in China and Cisco in North America. Fundamental changes are on the horizon as the market transitions from hardware-driven to software-driven, but no doubt routers must be fitted with higher-capacity blades to accommodate growing traffic, and there is intensifying focus on content delivery networks (CDNs) and smart traffic management across routes to make routers and optical gear cooperate more closely.”

“The ‘SDN hesitation’ we first identified four quarters ago remains in effect, slowing router spending in the third quarter of 2014 as carriers remain cautious about investing in equipment and software that might need to be replaced in the future,” Howard added.

3Q14 CARRIER ROUTER AND SWITCH MARKET HIGHLIGHTS:

. Combined, service provider routers and switches-including IP edge and core routers and carrier Ethernet switches-totaled $3.7 billion worldwide in 3Q14, down 3% from the previous quarter

. All regions except CALA (Caribbean and Latin America) were down sequentially in 3Q14

. However, the market is up 3% from the year-ago 3rd quarter, reflecting the long-term slow growth trend Infonetics has been tracking

. Infonetics expects the global carrier router and switch market to slowly grow to $17 billion by 2018, a five year (2013-2018) compound annual growth rate of just over 3%

. Looking at rolling 4-quarter router market share, Huawei increased its share the most of any vendor (+4.6 points) from 3Q12 to 3Q14, as edge and core router revenue stayed

relatively flat

ROUTER/SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly service provider router and switch report provides worldwide, regional, China, and Japan market share, market size, forecasts through 2018, analysis, and trends for IP edge and core routers and carrier Ethernet switches. Vendors tracked: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Coriant, Ericsson, Fujitsu, Hitachi, Huawei, Juniper, NEC, UTStarcom, ZTE, others.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

What is Carrier Ethernet used for?

We’ve asked this question many times and the answer seems to be “something other than a Carrier Ethernet service.” For example, it’s the “last mile” or last few meters access to triple play service offerings that include IP TV. AT&T’s U-verse is a good example of that. It’s also used to access IP-MPLS VPNs which may terminate at a company’s or cloud service providers point of presence.

XO Communications Chief Operating Officer Don MacNeil said at MEF14 (see below) that networks increasingly will consist of Carrier Ethernet connections feeding into an MPLS core. That matches an observation from Bob O’Brien, vice president of network and OG&M solutions for the Americas for global network operator Orange, who noted that customers’ preferred method of accessing the company’s MPLS offerings is via Carrier Ethernet. That’s in contrast to Carrier Ethernet as a private line, virtual private line, or private LAN over WAN service.

Role for SDN?

Rob Tompkins believes that SDN will boost Carrier Ethernet Services. He wrote that SDN will change carrier Ethernet and its services in three significant ways:

- Cost: A key objective for both SDN and carrier Ethernet is to reduce overall costs. SDN has the potential to lower operational expenditures through increased network automation and network optimization. This will also reduce capital expenditures. Carrier Ethernet is proven to significantly reduce network costs and in many cases reduce solution complexity. Coupling SDN with carrier Ethernet to reduce costs just makes sense.

- Control: SDN leverages a logically centralized control model to enable deterministic, dynamic, on-demand services that comply with strong service-level agreements. Carrier Ethernet, when coupled with SDN, provides an agile and flexible network for network virtualization and dynamic bandwidth services.

- Ubiquity: Ethernet has become a ubiquitous networking technology. It dominates the marketplace as the interface for IP networking, whether in its wired forms or as Wi-Fi. It does not rely on Layer 1 or optical technologies to carry it over fiber, but can be used over any of today’s optical technologies to gain enhanced distance, even trans-Pacific submarine links. SDN’s tight coupling with Ethernet strongly positions carrier Ethernet coupled with SDN to be critical in next-generation service and content provider networks. Currently, the Optical Transport working group of the Open Networking Foundation (ONF) is working on standards that will allow SDN controllers to manage or direct optical networks.

At last week’s MEF14 conference in Washington, DC:

- Rob Rockell, vice president of regional engineering for Comcast Business, noted that software defined networking (SDN) is reversing the common wisdom often followed by network operators to “distribute what you can and centralize what you must.” That assumes the version of SDN implemented uses a centralized controller which computes paths (i.e. Control plane) for many packet/frame forwarding engines (Data planes).

- The U.S. Defense Information Systems Agency sees SDN as a way of simplifying its network which in turn is viewed as a means of making the network more secure by “reducing the attack surface,” commented Cindy Moran, director of the Network Services Directorate for the agency. Plans also include “collapsing” 1,000 peering points to a smaller number and establishing different procedures for exchanging traffic that is internal and external to the DoDI.

- Tata Communications Vice President of Managed Network Services James Walker sees customers increasingly seeking deterministic connectivity between data centers.

- Craig Drinkhall, CTO for Lumos Networks, said it a priority to co-locate in as many data centers as possible so that they will be well positioned to provide connectivity to cloud providers located in those data centers.

- Colt has made substantial progress in implementing a vision shared by many other network operators – givingcustomers the ability to turn up network bandwidth at the same time they turn up a cloud service or virtual machine. Colt calls that capability Dedicated Cloud Access, noted Matthias Hain, director of data services for Colt Technology

- Large companies that are customers of Lumos Networks also are seeking that capability – they want to use a “best of breed” approach to cloud services, which means they want that capability for multiple cloud providers. In order for that to happen, the customers are looking for Lumos to allow some back office functions to be triggered by other back office systems. The question then, he said, is whether to let business systems run network systems, which is “very scary to the network people” or whether to let the network systems run the business systems, which is “very scary” to the IT people.

- What Lumos’ Drinkhall described was a theme that came up repeatedly at GEN14: in order to meet the vision of a nimble network that so many companies seem to share, network operators will need to open their operations support and business support systems not only to other internal systems but also to customer and those of other network operators. It remains to be seen if that will actually happen. The NOC is the heart and soul of a network operator’s services and the info therein has never been made directly available to outsiders.