Month: July 2021

Canada’s 3.5 GHz spectrum auction raises record US $7.2B

Canada’s 3.5GHz auction ended this week with a total of $7.2 billion (C $8.9B with US $1 = 1.2444 Canadian dollars) in winning bids. Bell Canada (BCE), Rogers Communications and Telus captured roughly 80% of the spectrum offered for sale by Canada’s government.

Out of 1,504 available licenses, 1,495 were awarded to 15 Canadian companies, including 757 licenses to small and regional providers, Innovation Minister Francois-Philippe Champagne said in a statement on Thursday.

The results would boost competition, he added, a reference to Ottawa’s push to open up a market dominated by BCE Inc, Telus Corp, and Rogers Communications Inc, known as the big three.

Canadian consumers have complained of steep wireless bills, which are among the highest in the world, and Prime Minister Justin Trudeau’s Liberal government has asked operators to cut prices by a quarter by 2021.

Preliminary results showed that BCE Inc spent C$2.1 billion, Rogers C$3.3 billion and Telus Corp C$1.9 billion.

The 3500 MHz range frequencies are seen as important to provide 5G wireless services as they carry larger volumes of data over longer distances (than mmWave, for example). Mid-band spectrum also offers faster upload and download speeds and help power everything from smart cities to driverless cars.

Vidéotron, owned by Quebecor Inc, spent C$830 million to expand its geographic footprint in Canada, buying licenses not just in its native Quebec but also in Ontario, Manitoba, Alberta and British Columbia.

The move indicates that Quebecor plans to become a service provider in those areas, said Mark Goldberg, an industry analyst. He noted that the areas where the company did not bid – Saskatchewan and Atlantic Canada – both have preexisting strong fourth competitors to the big three.

“They’re prepared to be the fourth service provider… This is showing pretty close to a billion dollars in investment in spectrum,” Goldberg said.

Vidéotron said in a statement that the investment would help the company to “realize its ambition of boosting healthy competition in telecom beyond the borders of Québec.”

Bell, Rogers and Telus said their investments will help to provide reliable 5G services.

The auction, initially set to take place in June 2020 and delayed due to the COVID-19 pandemic, closed after eight days and 103 rounds of bidding, the government said.

………………………………………………………………………………………

Xona Partners analyst Frank Rayal noted the Canadian auction clocked in at an average of $1.83 per MHz-POP. The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors. Rayal said that’s a record price for mid-band spectrum and far higher than the $0.94 per MHz-POP that U.S. operators paid for similar C-band spectrum in the FCC auction earlier this year.

“Underscoring the Bell team’s goal to advance how Canadians connect with each other and the world, acquiring this significant additional 3500MHz spectrum will drive Bell’s ongoing leadership in 5G, a critical component in our multibillion-dollar program to accelerate investment in Canada’s next-generation network infrastructure and services,” Mirko Bibic, president and CEO of BCE and Bell Canada, said in a press release.

References:

Sparkle to Build Blue and Raman Submarine Cable Systems in Collaboration with Google Cloud

Each cable system will contain 16 fiber optic pairs while adhering to the innovative concepts of open cable, supporting multiple fiber tenants, and open landing station, enabling competitive access to the cable termination points, the two systems set a new reference in terms of diversification, scalability and latency throughout these geographies.

Blue will be deployed along a new northbound route in the Mediterranean, crossing the Strait of Messina, rather than following the traditional route through Sicily Channel.

As a result, Internet Service Providers, Carriers, Telecom Operators, Content Providers, Enterprises and Institutions will benefit from high-speed Internet and state-of-the-art capacity services with unparalleled diversity and performances.

Within the Blue System, BlueMed submarine cable is now Sparkle’s own private domain sharing its wet components with four additional fibre pairs and an initial design capacity of more than 25 Tbps per fibre pair, and is extended up to Jordan (Aqaba) with additional private branches into France (Corsica), Greece (Chania – Crete), Italy (Golfo Aranci – Sardinia and Rome), Algeria, Tunisia, Libya, Turkey, Cyprus and more in the future.

BlueMed flexible design allows both seamless express connections throughout the Mediterranean Basin, with unprecedented latency and spectral efficiency, and sophisticated regional subsystems, based on specific customer requirements.

In addition, Sparkle’s Genoa Open Landing Platform is set to become the alternative priority access for other upcoming submarine cables looking for a diversified entry to Europe, backhauled to the Milan’s rich digital marketplace, and thus a new reference gateway between Africa, the Middle East, Asia and Europe.

Blue and Raman are expected to be ready for service in 2024, with the Tyrrhenian part of BlueMed planned to be operational already in 2022.

“We are extremely proud to bring our collaboration with Google to the next level with this cutting-edge intercontinental infrastructure”, comments Elisabetta Romano, CEO of Sparkle. “With Blue and Raman Submarine Cable Systems, Sparkle boosts its capabilities in the strategic routes between Asia, Middle East and Europe and the enhanced BlueMed strengthens our presence in the greater Mediterranean area”

Comcast: cable business firing on all cylinders, wireless doing well, video revenue up

Comcast added another 354,000 total broadband subscribers (334,000 residential and 20,000 business) in the second quarter of 2021, beating the 323,000 it added in the year-ago period. The U.S.’s largest broadband wireline provider ended the quarter with 31.38 million residential and business broadband customers, by far the most in the U.S.

Comcast’s broadband subscriber growth rate is very impressive, at 6.7% YoY, which was unchanged versus last quarter. Comcast Business was also a bright spot, with a strong acceleration in growth. Business services revenues were up 9.9% YoY, a huge acceleration from the 6.1% YoY rise last quarter and a beat versus consensus growth of 8.8%.

The strong results are way better than Comcast’s two largest competitors – AT&T and Verizon – which both reported poor Business Wireline results.

New Street Research analysts noted Comcast’s broadband net additions were “well above estimates,” noting it had previously forecast gains of 253,000 and the market consensus estimate was 270,000. Cavanaugh said the operator is now expecting total broadband net additions for 2021 to be up in the “mid-teens” compared to the 1.4 million net adds it posted in 2019.

Other highlights:

- Cable Segment revenue growth of 10.9% was fully 200 bps ahead of Wall Street consensus for 8.9% YoY growth – but indeed for every sub-segment.

- Broadband revenues were up 14.3% YoY on a reported basis (versus 13.6% consensus); adjusted for RSN credits in Q2 2020, broadband revenues were up 12.6% YoY.

- Business Services revenues were up 9.9% YoY (versus 8.8% consensus).

- Wireless revenues were up 70.6% YoY (versus 63.4%).

- Comcast’s Xfinity Mobile service added 280,000 mobile lines, a quarterly record for the company, up from adds of 126,000 in the year-ago period. Comcast, which launched mobile (via its MVNO with Verizon) in 2017, ended Q2 2021 with 3.38 million mobile lines. Mobile revenues rose 70.4%, to $556 million.

Dave Watson, CEO of Comcast Cable, said mobile is now tied into every sales channel. And the launch of a new unlimited plans focused on multi-line customers has also led to a “nice shift in mix,” he said.

Cable Communications CAPEX of $1.7 billion was up 16.8% year-on-year in Q2, accounting for 10.6% of the division’s revenue compared to 10.1% of revenue in the year-ago period.

In addition to investments in scalable infrastructure to increase network capacity, Comcast CFO Michael Cavanaugh said on an earnings call the money was spent on broadband CPE and line extensions.

“We have decided to move a bit faster to the next phase of DOCSIS using very cost-effective technology,” he said.

CEO Brian Roberts noted the company has been trialing gigabit and multi-gigabit symmetrical speeds since October 2020 “to great success.” While upstream traffic comprises only 10% of broadband usage on its network and “we don’t really have a consumer use case” for symmetrical speeds yet, “the strategy for our network is to plan ahead,” he said.

“We’re investing in architecture that allows us to go beyond where consumers are, and we can do all of this in a way that won’t affect the capital intensity ratios we currently enjoy,” he added.

Video sub losses continue but less than expected:

Comcast lost another 399,000 total video subs (364,000 residential and 34,000 business) in the period, improved from a year-ago loss of 477,000 customers. Comcast ended Q2 2021 with 18.95 million total video subs.

Nevertheless, video revenues were up 2.6% YoY (versus 0.8% consensus). Adjusted for Regional Sports Networks (RSN) credits in Q2 2020, video revenues were up 0.5% YoY.

Comcast remains excited about Flex, a video streaming/smart home product it offers for no added cost to broadband-only subscribers. Watson said Comcast has deployed more than 3.8 million Flex boxes, up from the 3.5 million the company reported in May.

Summary:

Consolidated revenue of $28.5 billion grew 20.4% year-on-year, with net income attributable to Comcast up 25.1% to $3.7 billion. Sales for the Cable Communications business increased 10.9% year-on-year to $16 billion.

Broadband revenue was up 14.3% to $5.7 billion, video revenue increased 2.6% to nearly $5.6 billion, business services revenue increased 9.9% to $2.2 billion and wireless revenue jumped 70.4% to $556 million.

……………………………………………………………………………….

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-2nd-quarter-2021-results

https://www.cmcsa.com/static-files/c53499bd-4ff5-4e44-b793-74f8743a96dc

https://www.cmcsa.com/financials/earnings

https://www.fiercetelecom.com/financial/comcast-notches-record-q2-broadband-adds-354-000

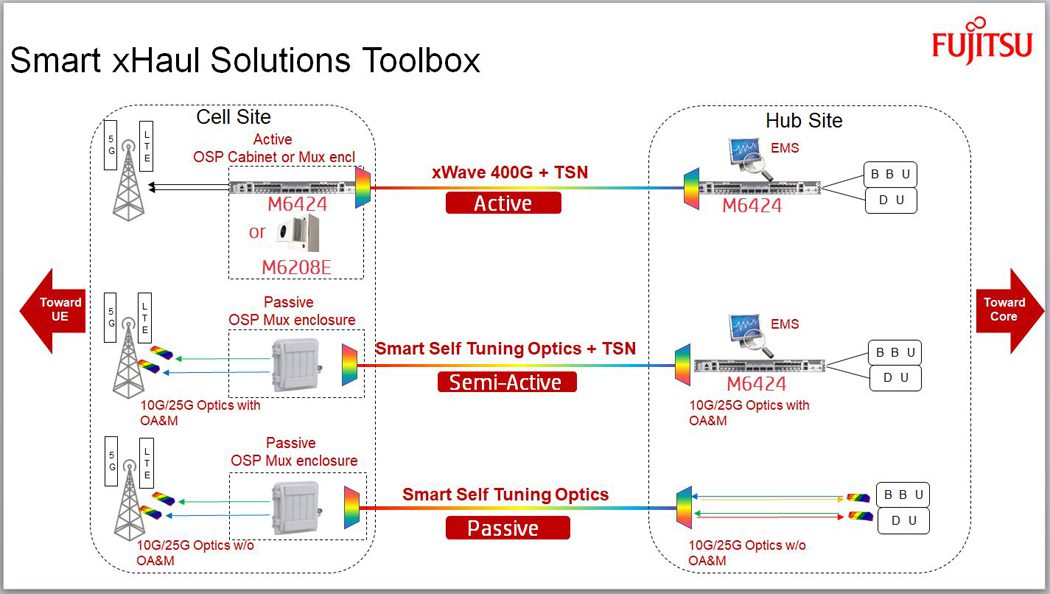

Fujitsu and HFR unveil Smart xHaul optical transport for 5G traffic

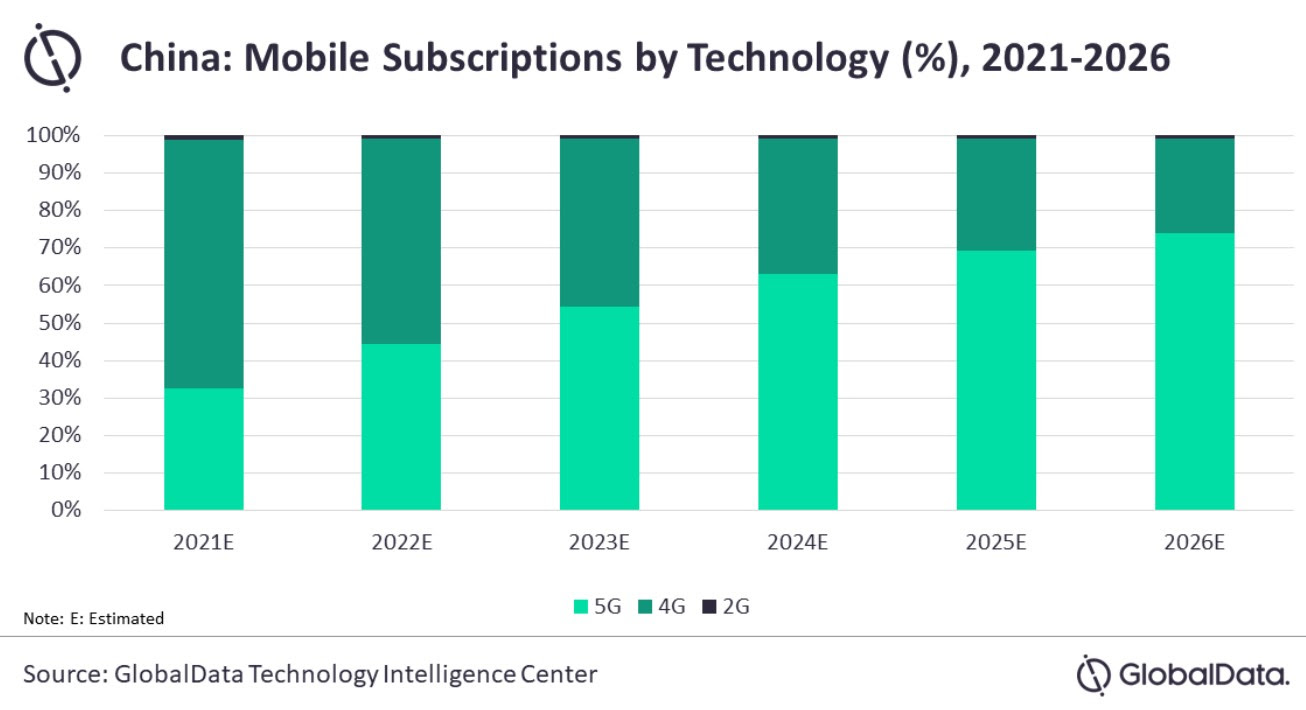

GlobalData: 5G to drive mobile services market in China through 2026

The total mobile service revenues in China are poised to grow at a compounded annual growth rate (CAGR) of 3.1% from US$131.3bn in 2021 to US$152.7bn in 2026, mainly supported by growing 5G subscriptions, according to GlobalData, a leading data and analytics company.

According to GlobalData’s China Mobile Broadband Forecast Pack, mobile voice revenues will decline at a CAGR of 5.2% between 2021 and 2026, due to falling voice average revenue per user (ARPU) levels. Mobile data revenues, on the other hand, will increase at a CAGR of 6.8%, driven by rising adoption of 5G services and the subsequent rise in data ARPU.

The three leading (state owned) network operators in China greatly increased their 5G CAPEX. China Mobile’s 2020 5G CAPEX totaled US$15.7bn (RMB 102.5bn), 57% of all CAPEX up from US$3.7bn (RMB 24.0bn) (14% of total CAPEX) in 2019.

Meanwhile, the combined 5G CAPEX of China Telecom and China Mobile, who are sharing 5G infrastructure, totaled US$11.3bn (RMB 73bn) in 2020, 48% of total combined CAPEX, up from US$2.7 (17.2 bn) in 2019 (13% of total combined CAPEX).

Harika Damidi, Telecoms Analyst at GlobalData, says: “5G subscriptions will surpass 4G subscriptions in 2023 and go on to account for 73.8% of the total mobile subscriptions share in 2026, driven by the ongoing 5G network expansion by operators and increase in the availability of 5G-enabled smartphones. Moreover, increasing penetration of IoT and M2M services are also expected to drive market growth during the forecast period.”

The average monthly mobile data usage is forecasted to increase from 9.9GB per month in 2021 to around 32.6GB per month in 2026, driven by the growing consumption of high-bandwidth online entertainment and social media content over smartphones.

Ms Damidi concludes: “China Mobile led the Chinese telecom market in terms of mobile subscriptions in 2020, followed by China Telecom. Moreover, China Mobile is the leading provider of 5G services which are poised to dominate the Chinese market in the future. In addition, the operator is making strategic investments in 5G base stations, data centers, industrial Internet, and IoT to ensure its leadership.”

…………………………………………………………………………………………….

According to GlobalData’s mobile broadband forecasts, by end of 2020 China and South Korea outpaced the world in adoption with 26% and 24% 5G subscription penetration of the population respectively compared to the Global penetration of 5% at the end of the same period. This rapid adoption is beginning to help operators in these markets grow revenue from mobile services and drive ARPU uplift in China and South Korea with overall 2021 mobile service ARPU expected to rise.

5G in China and South Korea are supporting both consumers and enterprise and even contributing to social welfare. On the consumer side new value and revenue streams for consumer 5G is being driven by next gen content like AR/VR experiences, the ability to stream 8K anywhere, providing multi-camera views for live events, offering dedicated gaming networks and new consumer IoT applications.

Enterprise networks are being deployed as an enabler for enterprise services alongside technologies like multi-access edge computing (MEC) and IoT platforms and industrial applications to support use cases like (industrial automation, AI video applications, drones, smart city). Often these enterprise solutions are supported by a combination of 5G, IoT and multi-access edge computing (MEC). China Mobile alone has entered contracts to construct dedicated 5G networks for private industry with 470 enterprise customers, in 2020. The company claims these projects support 15 different industry segments and represent over US$620m (RMB 4bn) in revenues.

Beyond typical consumer and enterprise services, 5G has supported the pandemic response in both countries, with hospitals in Wuhan being rapidly connected with 5G networks and telehealth for the elderly being delivered in South Korea.

References:

5G to drive mobile services market in China through 2026, forecasts GlobalData

Optimistic 5G Market forecasts by GlobalData and Research&Markets

Google Cloud revenues up 54% YoY; Cloud native security is a top priority

Google Cloud revenues increased 54% year over year to $4.62 billion during the second quarter of 2021, parent company Alphabet reported today. Google Cloud’s operating loss shrunk 59%, from $1.42 billion a year ago to $591 million last quarter.

Google Cloud includes both Google Cloud Platform (GCP) and its Workspace (formerly G Suite) cloud computing services and collaboration tools.

Like previous quarters, “GCPs revenue growth was, again, above cloud overall, reflecting significant growth in both infrastructure and platform services,” the company said in a statement.

“As for Google Cloud, we remain focused on revenue growth, and are pleased with the trends we’re seeing across cloud,” Google CFO Ruth Porat said on the company’s 2Q-2021 earnings call today. Porat added that growth in its Google Cloud Platform segment again surpassed overall cloud gains “reflecting significant growth in both infrastructure and platform services.”

“We will continue to invest aggressively, including expanding our go-to-market organization, our channel expansion, our product offerings, and our compute capacity,” she said.

Also on today’s earnings call, Google CEO Sundar Pichai cited security as a competitive differentiator and “our strongest product portfolio.” Google will continue to invest in security and continue its work to integrate its various security products such as Beyond Corp and Chronicle, he added.

“Cyber threats increasingly are on the mind of not just CIOs but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest…so a definite source of strength and you’ll see us continue to invest here,” he said.

“We are cloud native, we pioneered … zero trust and built the architecture out from a security-first perspective. Particularly, over the course of the last couple of years, with the recent attacks, [companies] really started thinking deeply about vulnerabilities, supply chain security has been a major source of consensus, cyber threats are increasingly on the mind of, not just CIOs, but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest.”

Google Cloud, along with its other business units, boosted Alphabet’s revenue 62% year over year, to $61.9 billion. As usual, Google ad revenue represented the biggest piece of the pie. It grew 69% to $50.44 billion. Retail was the biggest contributor to advertising growth.

Google Cloud holds around 7% market share in the cloud services segment, according to a Canalys report released in April 2021. It trails Amazon Web Services (AWS) and Microsoft Azure, which hold 32% and 19% market share, respectively.

Microsoft posted financial results Tuesday, its Intelligent Cloud revenue increased 30% to $17.4 billion. The company stated Azure revenue grew of 51%, but did not break out a dollar figure. Amazon is set to report earnings on Thursday.

Along with their hyper-scale cloud competitors Google Cloud is partnering with telecom companies all over the world to help them drive transformation and accelerate 5G adoption and monetization.

Here are a few of their telco partners:

………………………………………………………………….

References:

https://abc.xyz/investor/static/pdf/2021Q2_alphabet_earnings_release.pdf?cache=4db52a1

https://www.fiercetelecom.com/financial/google-cloud-revenue-climbs-54-q2

https://www.sdxcentral.com/articles/news/google-cloud-losses-shrink-59-revenue-hits-4-6b/2021/07/

Digital Realty & Zayo plan next gen fiber interconnection and security capabilities

Digital Realty, the largest global provider of carrier- and cloud-neutral data center, colocation and interconnection solutions, announced today a significant step in its plan to create next-generation interconnection and security capabilities and build the largest open fabric-of-fabrics interconnecting key centers of data exchange.

As part of this development strategy, Digital Realty is working with Zayo Group Holdings, Inc., a leading global provider of fiber-based communications solutions, to lay the physical and virtual foundations of a new open fabric.

This collaboration represents a significant milestone on the cross-industry roadmap outlined earlier this year in Digital Realty’s industry manifesto for open interconnection and next-generation colocation solutions. The collaborative approach aims to unlock trapped value and remove legacy barriers to digital transformation by more closely aligning with the hybrid IT and security considerations of multinational enterprises.

“As businesses continue to shift globally towards hybrid IT to enable new digital workplace models, create new lines of business, and control costs, Zayo and Digital Realty are in an excellent position to enable customers’ growth through a shared interest in globally secure, software-defined interconnection,” said Brian Lillie, Chief Product and Technology Officer at Zayo. “We look forward to working together to power next-generation interconnection and security capabilities that will unlock the true potential of digital transformation.”

This initiative builds upon new and existing innovative capabilities, including PlatformDIGITAL®, Digital Realty’s first of its kind global data center platform, which already brings together over 4,000 participants in connected data communities around the world, as well as Zayo’s extensive global fiber network. The new collaboration also follows Digital Realty’s recent announcement of its plan to build native SDN-enabled multi-platform orchestration and global fabric connectivity across its global platform.

“We’re excited to advance our roadmap for removing the legacy interconnection barriers that continue to impede enterprise digital transformation initiatives,” said Digital Realty Chief Technology Officer Chris Sharp. “Our platform capabilities and the steps we are taking in collaboration with Zayo will serve as a force-multiplier in building the industry’s largest open fabric-of-fabrics to effectively address the growing intensity of enterprise data creation and its gravitational impact on IT architectures.”

Digital Realty’s Data Gravity Index DGx™ projects that Forbes global 2000 enterprises will be adding storage at a combined rate of more than 620 terabytes per second for data aggregation and exchange across 53 metros by 2024. This rapid growth reflects a growing trend among global customers towards deploying and connecting large, private data infrastructure footprints across multiple global locations.

Gartner® predicts that by 2023, over 50%1 of the primary responsibility of data and analytics leaders will comprise data created, managed, and analyzed in edge environments. As a result, a new pervasive data center infrastructure is needed to enable digitized endpoints and mobile users to fully participate in globally distributed workflows. By removing legacy barriers across the interconnection industry, the consortium approach seeks to enable connected data communities and to support transformative outcomes for customers across all industries.

References:

Media & Industry Analyst Relations:

Marc Musgrove, Digital Realty, +1 (415) 508-2812

[email protected]

Highlights of CTIA’s 2021 Annual Wireless Industry Survey

The U.S. cellular industry invested $30 billion in 2020 to power America’s world-leading wireless networks, according to CTIA’s 2021 Annual Wireless Industry Survey. This represents a five-year high and the third straight year of increasing capital expenditures (CAPEX), pushing cumulative mobile telecom industry investment over $600 billion.

The U.S. accounted for 18% of global mobile telecom CAPEX last year, while being only 4% of the world’s population and 6% of all global mobile connections.

Important CTIA survey results:

- Mobile speeds increased 50% in the past year.

- 5G networks nationwide now cover over 300 million people.

- 5G for home broadband services—capable of over 100M b/sec downstream—are deployed in communities across the country.

- Increases in wireless data use, cell sites and data-only devices—indicators of the ongoing shift to the “5G Economy.”

Other highlights:

- Sustained Wireless Investment. Over the past five years, wireless providers have invested nearly $140 billion, and over the life of the wireless industry, total capital investment is over $601 billion. This investment is in addition to the almost $200 billion in payments to the government for the spectrum needed to power wireless networks.

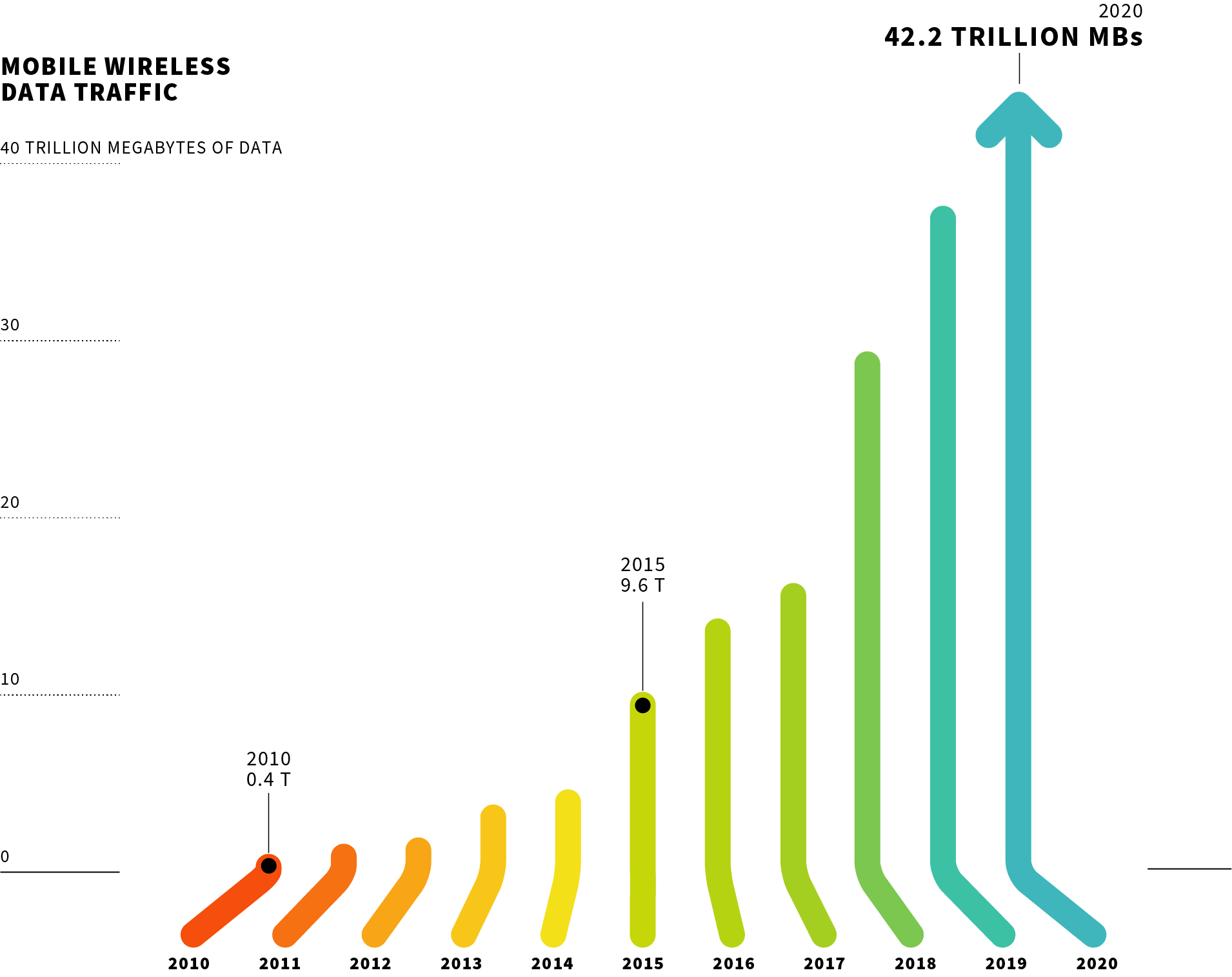

- America’s Demand for Wireless Data Continues to Grow. In 2020, mobile wireless data traffic topped 42 trillion megabytes, a 208% increase since 2016. Over the past decade, America’s wireless users drove a 108x increase in mobile data traffic—an amount equal to Gen Z’s 72 million members streaming TikToks for over 586 hours each.

- Wireless Providers Are Building the Infrastructure for Our Country’s Future. Over the past five years, operational cell sites have increased over 35%—and in just the two years since the implementation of historic federal siting reforms, more cell sites have been sited than the previous seven years combined. Now numbering over 417,000, these sites provide the physical platform for the U.S. 5G Economy.

- Providers’ Messaging Platforms See Continued Growth. Total carrier messaging traffic (SMS + MMS) reached 2.2 trillion, an increase of more than 119 billion over 2019, driven by a 28% jump in MMS messages as users send more GIFs, videos and other multimedia.

- Internet of Things More Than Two-Fifths of All Devices. Data-only devices—think smartwatches, hotspots, and medical sensors, for instance—now represent 41% of all estimated devices. Totaling over 190M, these data-only devices have grown 272% since 2013.

“These numbers show that while we were social distancing last year, U.S. wireless providers were busy both ensuring that wireless networks handled skyrocketing demand and constructing 5G networks, the foundation for our country’s post-pandemic recovery,” said Meredith Attwell Baker, CTIA’s President and CEO.

………………………………………………………………………………………..

U.S. Wireless Industry Continues to Lead the World in Capex:

The U.S. wireless industry’s investment in 2020 represents, once again, 18% of the world’s total mobile capex—even though the U.S. has just 4.3% of the world’s population and 5.9% of the world’s mobile connections. That means that for two years in a row, the U.S. accounted for nearly one-fifth of global wireless capex.

Building More Cell Sites to Support 5G Economy:

America’s cell sites provide the physical platform that enables technological innovation in the U.S. 5G Economy, driving broader coverage and capacity to meet increasing consumer demand. By the end of 2020, over 417,000 cell sites were built and operational, an increase of 35% since 2016—and in just the two years since the implementation of historic federal siting reforms, more cell sites have been built than the previous seven years combined.

Source: CTIA

…………………………………………………………………………………………

Licensed Spectrum Investment Continues to Grow:

U.S. wireless networks depend on licensed spectrum, which enables providers to deliver faster speeds and higher capacity to consumers. The wireless industry invested ~$85 billion in the two auctions the FCC launched in 2020—airwaves that will be the foundation for the U.S. 5G Economy for years to come, creating millions of jobs and sparking hundreds of billions of dollars in economic growth.

The $82 billion C-band auction revenue represents the largest investment in a spectrum auction to date and brings the total to more than $200 billion in payments to the government for the spectrum needed to power wireless networks and carry the increasing volumes of services used by consumers across the country.

5G Rollouts Continue:

Since 5G was launched in 2019, three nationwide networks—and regional provider networks across the U.S.—already cover 300 million Americans, up from 200 million last year and amounting to over 90% of the entire country. 5G networks are also being built out and expanding faster than 4G. The first 5G network achieved nationwide coverage 2x as fast as 4G, and all three major providers built nationwide networks 42% faster than 4G.

Large national operators and small local start-ups are also bringing 5G for home broadband (also known as 5G fixed wireless) services to millions of homes across the country, including in unserved and underserved communities.

Mobile Wireless Data Traffic Continues to Increase:

Mobile wireless data traffic had another record year, topping 42 trillion MBs—a 208% increase since 2016. Over the past decade, Americans have driven a 108x increase in mobile data traffic.

Source: CTIA

……………………………………………………………………………………

Continued Growth of Data-Only Devices:

5G is driving our nation’s transition to the Internet of Things, where medical sensors, smartwatches, hotspots, and other IoT devices usher us into the “connected-everything” era. Data-only devices rose to 190.4 million in 2020, now representing 41.3 percent of all estimated devices. Data-only devices have grown 272 percent since 2013. Overall wireless connections grew to 468.9 million.

References:

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

The Case for Private 5G:

Some organizations do not want telcos involved in 5G. Instead, they have bought their own spectrum licenses and plan to build and operate private 5G networks.

According to a research report by the Beyond by BearingPoint and Omdia, only 16% of enterprise projects are telco-led, while a fifth of businesses plan a do-it-yourself 5G private network approach.

Private 5G networks offer much more robust security as they need not be connected to the larger telecom network, and hence are attractive to companies which have very high security requirements, such as power plants and other critical infrastructure.

Private 5G networks are also highly customizable and can therefore be built to exact company specifications as opposed to having to select from telco offerings. Also, wireless data can be managed and analyzed internally.

Given that 5G SA/ Core network deployments will take years and will all be different, private networks can deliver robust connectivity now. Another important advantage is that many private 5G networks are being designed to operate indoors as well as outdoors.

Indeed, the survey found that 5G is clearly seen as primarily a B2B or B2B2X opportunity. 72.8% of telcos believe that most 5G revenues will be derived from B2B, B2B2C or Government/ smart cities opportunities. The challenge for telcos is to capture some of that market, less it all goes to private 5G network equipment suppliers, like Nokia, Cisco and NEC.

……………………………………………………………………………………………..

Telco Partnerships with Public Cloud Service Providers:

Most 5G network operators are teaming up with public cloud giants (AWS, Azure, and Google Cloud) for either multi-access edge computing (MEC) and/or implementation of (non-standardized) 5G SA core networks. That business partnership requires telcos to split revenues with those cloud giants and/or pay them a fee.

This growing list of CSA-Public Cloud partnerships continue to grow. We’ve summarized many of them in previous IEEE Techblog posts (see References below).

The biggest risk is that such partnerships diminish the telco’s role in 5G as all the intelligence and key functions are implemented by the cloud providers. That once again, relegates the CSPs to dumb pipe providers (of only the radio access network [RAN]), which only provide 2 way wireless transport.

Research conducted by Beyond by BearingPoint and Omdia (a sister company of Light Reading owned by Informa) revealed that hyper-scaler cloud service providers have “accelerated their push into network activities” during the pandemic, even as that has “exposed some limitations of communications service providers (CSPs) when it comes to capabilities to create new agreements at speed.”

Expect AWS, Azure and Google Cloud to accelerate their push to take over all the intelligence/smarts in a 5G network, including such highly touted functions as “network slicing,” service registration & discovery, network automation, authentication, security and many more which are ONLY possible with a 5G SA core network.

References:

https://www.lightreading.com/the-core/standalone-shaping-up-to-be-5gs-next-big-flop/a/d-id/771094

https://www.bearingpointbeyond.com/en/industries/5g/5g-insights/5g-enterprise/

German Telecom Regulator awards 5G private network licenses in the 3.7GHz to 3.8GHz band

Samsung introduces 5G mmWave small cell for indoor use with Verizon as 1st customer

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

Cloud Service Providers Increase Telecom Revenue; Telcos Move to Cloud Native

TIM with Google and Ericsson will launch first ‘5G Cloud Network’ in Italy

Spain’s Correos to be a MVNO & offer cloud + fiber services

According to reports from Spain news sites La Información and Expansión, the group’s Correos telecom division is preparing to launch a mobile virtual network operator (MVNO) and also intends to offer fiber services and a local cloud storage offering.

Correos, chaired by Juan Manuel Serrano, has been developing scenarios for three years to take advantage of its extensive network of offices to diversify the business. It has already closed agreements with banking, energy and telco entities.

……………………………………………………………………………………….

The Correos Telecom website certainly indicates that something important will happen. The reports say the new services could be launched as soon as this week.

The new mobile phone service and high-speed fiber connection will be announced this week and made available to the Group’s employees imminently, thus complying with the first phase of implementation of this new strategy championed by Correos Telecom.

Speculation about a potential Correos MVNO has been around since at least December 2020, when El Pais said the Spanish postal service intended to follow in the footsteps of its French and Italian counterparts by launching its own mobile and Internet services.

Few other details are available as yet, although the reports suggest that fixed and mobile services will initially be targeted at the post office’s own workers and eventually rolled out to anyone who wants them.

La Información said Correos Telecom will offer the group’s 53,000 employees a wide range of mobile phone options as well as two packages of fixed and mobile services, with TV to be added at a later stage.

It’s not clear which mobile network would host any Correos MVNO. A likely contender could be Spain’s fourth-largest operator Másmóvil, the aggressively expansionist group that recently launched a takeover bid for Basque operator Euskaltel.

Másmóvil is already playing host for Sweno, the new MVNO that is due to be launched in collaboration with El Corte Inglés any time soon. Unveiled in March, the Sweno MVNO is expected to offer mobile and fiber services on a converged basis, although there seems to have been some delay in getting the joint products off the ground.

Sweno is an existing El Corte Inglés brand that is being re-purposed for the telecoms offering.

Másmóvil will add to an already brimming pot of marques. As well as Másmóvil itself, the group provides services under the Yoigo, Pepephone, HitsMobile, Lebara, Lycamobile and Llamaya brands.

Másmóvil has become an increasingly a potential competitor of Orange Spain, Telefónica (Movistar) and Vodafone Spain. If the Euskaltel deal goes through, Másmóvil will gain a larger slice of the market. Traditionally a regional player, Euskaltel branched out nationally last year under the Virgin brand.

Spain has been a highly competitive market for years, driven by an early and aggressive move by Telefónica into converged offerings of fixed, mobile and TV services.

All four operators now provide services under their own low-cost brands, such as Telefónica’s Tuenti and O2 Spain; Vodafone’s Lowi; and Orange’s Amena and Simyo.

It certainly remains to be seen how new low-cost offerings from the likes of Correos and El Corte Inglés will be positioned, although the suggestion that Correos will initially target its own workforce would certainly provide it with a ready-made audience.

………………………………………………………………………………..

References:

https://www.expansion.com/empresas/distribucion/2021/07/23/60f9db08468aeb73428b4612.html