Month: October 2012

Infonetics: Femtocells being positioned as a a home network for voice & mobile BB ; Complementary to WiFi

The telecom industry has talked about Femtocells for years, but not much has happened outside of AT&T giving away femtocell equipment to folks buying iPhones in rural areas (like my cabin in Blue Lake Springs, CA where AT&T doesn’t provide cellular service of any kind). Here’s an article I wrote on this topic over 3 1/2 years ago:

WCA Panel Session: Femtocells and their consequences for Mobile Broadband Technologies

Yesterday, Infonetics Research completed interviews with more than 25% of the network operators in the world that have already launched or plan to launch femtocell services by 2013.

Excerpts follow from the resulting report, Residential Femtocell Service Strategies: Global Service Provider Survey, follow. The report assesses operator needs and analyzes trends in the femtocell market.

FEMTOCELL SURVEY HIGHLIGHTS:

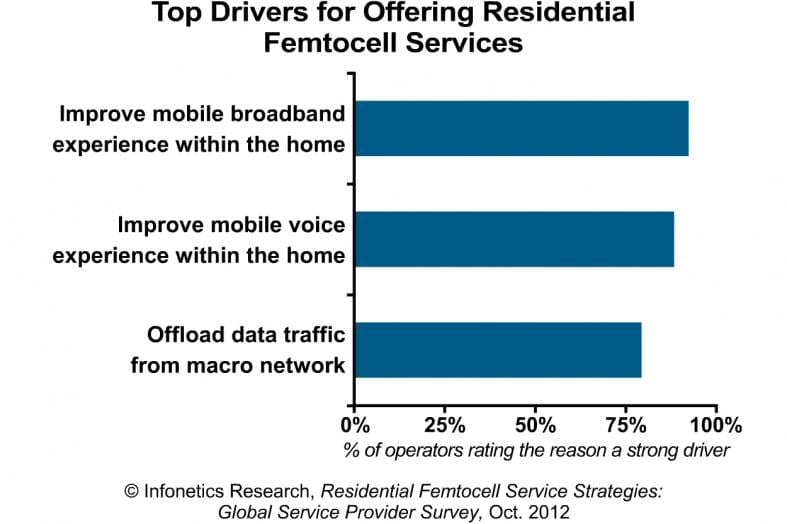

. The top drivers for offering residential femtocell services are improving mobile broadband and voice within the home, and offloading data traffic from macro cellular networks

. 29% of operators surveyed plan to offer FD-LTE femtocell services by 2013

. WiFi, long seen as a competitor to the growth of femtocells in the home, is increasingly being viewed as complimentary by carriers

(AJW comment: Competition from WiFi has been a real sticking point for residential femtocell deployments, especially with so many VoIP/OTP voice services that use WiFi for broadband Internet access)

. Service provider respondents project they will have, on average, 211,000 femtocell subscribers by 2013

(AJW comment: The other huge obstacle for residential femtocells is that the wireless traffic generated/received goes on the wired broadband network. That’s OK if that latter network is owned and operated by the cellular carrier (e.g. AT&T or VZ), but NOT OK otherwise. In the most classic example, AT&T gives a free residential femtocell to rural users that typically have Comcast/Xfinity for an ISP. All the iPhone and iPAD traffic that would otherwise go on AT&Ts 3G/4G network is offloaded to Comcast/Xfinity which doesn’t get a penny extra to carry it.)

FEMTOCELL SURVEY SYNOPSIS:

For its 27-page Residential Femtocell Service Strategies survey, Infonetics asked purchase-decision makers at service providers in North America, Europe/The Middle East/Africa, Asia Pacific, and Latin America about their plans for delivering femtocell services through 2013. Survey participants were asked about current and future femtocell service launches, adoption drivers and challenges, femtocell technologies, service features, add-on services, marketing, advertising, sales strategies, CPE features, form factors, expected service revenue, ARPU, and subscribers.

“Operators are still very much focused on using femtocells to deliver better voice coverage, but our 2012 residential femtocell survey identifies a shift toward a more strategic utilization of femtocells for enhancing the mobile broadband experience and as a means for delivering value-added services like virtual home phone numbers and media file sharing,” explains Richard Webb ([email protected]), directing analyst for microwave, mobile offload, and mobile broadband devices at Infonetics.

Mr. Webb adds, “The business model for more sophisticated femtocell services remains a big question mark. For the market to evolve, vendors need to help operators on pricing and service models so they can drive volumes and enable new service revenue. If it adds up, there’s a real opportunity to leverage the femtocell to put the mobile network at the heart of the home network-something that’s traditionally been beyond the reach of the mobile operator.”

To buy the survey, contact Infonetics: http://www.infonetics.com/contact.asp

From a report released last month, Infonetics 2nd quarter (2Q12) Femtocell Equipment market share and forecast report

FEMTOCELL EQUIPMENT MARKET HIGHLIGHTS:

- Global 2G and 3G femtocell revenue is up 12% in 2Q12 over 1Q12, and is up 43% from the year-ago second quarter

- Every segment of the femtocell market—consumer, enterprise, and public access—grew by double digits in 2Q12, with consumer femtocells accounting for more than 1/2 of 2Q12 revenue

- In 2Q12, Alcatel-Lucent holds on to the #1 spot it nabbed last quarter in the tight race for W-CDMA/HSPA femtocell revenue, with Cisco/ip.access a close 2nd

- W-CDMA/HSPA 3G femtocell revenue is growing at an 84% 5-year compound annual growth rate (2011 to 2016) and is expected to make up 95% of the 3G femtocell market by 2016

- Airvana continues to lead the higher-priced CDMA2000/EV-DO femtocell segment, with Samsung easily maintaining the #2 spot

Analyst Commentary:

“Double-digit revenue growth returned to the femtocell market in the 2nd quarter following a minor seasonal dip the previous quarter,” notes Richard Webb, directing analyst for microwave, mobile offload, and mobile broadband devices at Infonetics Research. “The combination of attractive product feature sets and price points, wider service availability, a growing customer base, and rising shipment volumes is proof positive that the femtocell market has long-term viability.”

Webb continues: “A slight dip in 3G femtocell revenue per unit held back overall revenue growth in the femtocell market in the first part of the year, but price erosion is an important factor that will drive long-term volume growth. Femtocell price erosion is due to a combination of factors, including new component suppliers entering the fray, manufacturing efficiencies, and the continuing scale-up of femtocell shipment volumes. Yet we remain cautiously optimistic that femtocells have sufficient market drivers and support among operators to sustain year-over-year growth through 2016.”

To purchase this or other Infonetics reports, contact Infonetics sales: http://www.infonetics.com/contact.asp

Addendum: Informa Telecoms & Media Small Cells Market Update Report

Julian Bright of Informa Telecoms & Media, recently presented his firm’s latest quarterly market update on small cells. The most important finding was that the number of small cells now exceeded the number of macrocells worldwide. This is helped by Sprint’s 1 million residential femtocell deployments– up from 250,000 in 2011.

Their report also highlights how new femtocell deployments from Telefónica O2, Orange UK, and Bouygues Telecom over the Summer mean that the UK and France have become the first countries globally where all major operators have deployed the technology. Telefónica O2 has made significant public-access progress with the world’s densest femtocell deployment in east London for the Olympics, as well as the launch of public Wi-Fi in central London which will be upgraded imminently to support licensed small cells. Informa predicts market growth to over 90 million small cells by 2016, based on linear growth, of which the vast majority (more than 90%) will be residential.

Cisco Predicts Explosive Traffic Growth for Cloud Services, while Outages Continue Unabated & Cloud Cost is Higher than Thought!

The Cisco Global Cloud Index, forecasts that all data center traffic growth is expected to quadruple between 2011 and 2016, from 1.8 zettabytes in 2011 to 6.6 zettabytes in 2016. Cloud traffic will be the fastest growing segment of this growth, burgeoning from 39 percent of data center traffic at 683 exabytes in 2011 to 64 percent of data center traffic at 4.3 exabytes in 2016. In 2011, 30 percent of server workloads were processed in the cloud, and 70 percent were handled in traditional data centers. By 2016, 62 percent of server workloads will be processed in the cloud.

http://newsroom.cisco.com/release/1091855

But will cloud traffic growth continue in the face of well publicized service outages? We first called attention to the lack of rapid cloud failure recovery in this piece:

http://viodi.com/2011/04/22/amazons-ec2-outage-proves-cloud-failure-recovery-is-a-myth/

More than 18 months later, cloud computing is still disturbingly vulnerable to outages that can close an online business to be out of service or down for several days, or cause it to lose precious data. ThinkStrategies Jeff Kaplan wrote, “There are inevitably going to be disruptions to service availability, and it’s key for service providers to minimize these occurrences and for cloud consumers to mitigate their risk by having a backup and recovery plan in place and by exploring ways to take advantage of offline service options.”

1. Microsoft Azure: On Feb. 28, a “leap-year bug” caused Microsoft Azure to suffer an extensive, worldwide cloud outage that wasn’t fixed for more than 24 hours.

2. Amazon Web Services: On June 15, an Amazon Web Services power outage cut services to customers for about six hours, affecting its Amazon Elastic Compute Cloud, Amazon Relational Database Service and AWS Elastic Beanstalk, which are run from Amazon’s data centers in Northern Virginia. The Northern Virginia data centers, the company’s oldest and most used, suffered a similar outage in 2011 and another in October, leading some to believe its infrastructure is wearing thin.

3. Microsoft Windows Azure: Azure customers in Western Europe were out of service for ~2.5 hours on July 26, when “a service interruption was triggered by a misconfigured network device that disrupted traffic to one cluster in our West Europe sub-region,” Microsoft said. The company said customers’ storage accounts were not impacted during the Azure outage.

4. Google Talk: Also on July 26, Google Talk chat service used by Google Gmail customers went down for almost five hours. Google apologized when the service was restored, saying in part: “Please rest assured that system reliability is a top priority at Google, and we are making continuous improvements to make our systems better.”

5. GoDaddy: On Sept. 11, web-hosting and email services company GoDaddy said a six-hour outage that disrupted its operations was caused by a networking issue and not by an attack from Anonymous, as the hacker group claimed.

6. Amazon Web Services: Amazon Web Services went down in its Northern Virginia market Oct. 22, causing website outages in an unknown number of companies, including Reddit, Pinterest and Airnb. The outages affected Elastic Beanstock services, followed by announcements of service interruptions with its Management Console for Elastic Beanstock Services, Relational Database Service, ElasticCache, Elastic Compute Cloud and CloudSearch.

Several days later, Amazon wrote a very comprehensive report that a memory leak and a failed monitoring system caused the AWS outage. https://aws.amazon.com/message/680342/

One effected company wrote their website was taken out of service by the AWS outage

https://getsatisfaction.com/offerpop/topics/oct_22nd_site_outage_due_to_aws

7. Google App Engine: Google’s platform for developing and hosting Web applications in Google-managed data centers, went down Oct. 26 for about four hours as it experienced slowness and errors. As a result, 50 percent of requests to the App Engine failed. The company said no application data was lost and application behavior was

restored. Google then said it is bolstering its network service to guard against traffic latency.

8. Tumblr: About the same time as the Google App Engine failure, the microblogging platform and social networking website Tumblr said service had been restored within a few hours and the company promised it would issue a full report.

9. Dropbox: The online storage company also experienced an outage on Oct. 26th. It displayed a message that stated, “Error: Something went wrong. Don’t worry, your files are still safe and the Dropboxers have been notified.”

The Cloud Connundrum:

How can users continue to use cloud computing services, especially for mission critical applications, when failures are occuring with increased frequency and failure recovery takes hours or days?

Read this for corroboration of this assertion: Analyst: AWS Could Lose Customers If Outages Continue

http://www.crn.com/news/cloud/240010601/analyst-aws-could-lose-customers-if-outages-continue.htm

Will cloud computing really be cheaper than using premises data centers? At least one company doesn’t think so. Martin Saunders, product director at Claranet said: “People understand that cloud isn’t cheaper. It is always going to be cheaper for a company to buy a server, stick it in server room and run it themselves. But I think if that’s all you’re focusing on then you’re very much missing the point of what this thing is all about, because it’s a service. It’s not just about buying infrastructure and hardware.”

Saunders said that people often compare the cost of running a server on premise to the cost of running a server in the cloud, and conclude that the cost of the on-premise server can be written off in three years, whereas the cloud

server will be an on-going expense. Meaning OPEX will be higher for cloud then on prem data center!

http://www.cio.com/article/718107/Cloud_Will_Never_be_Cheaper_Than_On_Premise_Claranet

So will Cisco’s forecast for explosive cloud data growth be realized? I’m certainly not betting on that!

Sprint’s Network Vision delayed but still on track for nationwide coverage by end of 2013!

Deployment of Sprint’s Network Vision has begun in the U.S. Network Vision is a wireless network infrastructure that allows Sprint to run multiple network technologies/protocols and host multiple spectrum bands at the same set of base stations/cell sites. As it’s deployed, Sprint is installing LTE-FDD as well as upgrading its 3G/CDMA wireless network, while phasing out the narrowband iDEN network originally developed by Nextel. Sprint had said it expected the Network Vision deployment to reach 12,000 cell sites this year.

On its 3rd Quarter 2012 earnings call last Thursday, Sprint blamed its equipment vendors for a delay of about three months for its network upgrade plans, but said that it would not affect overall spending on the $7 billion Network Vision project. The company said the delay related to logistics, execution and materials but did not single out a specific vendor from its three main suppliers: Ericsson, Alcatel Lucent SA and Samsung Electronics Co.

From Sprint’s Kristin Wallace:

“Sprint’s Network Vision initiative continues to gain momentum. The number of sites that are either ready for construction or already underway has more than doubled in the last three months to more than 13,500. Leasing and zoning have been completed on more than 20,000 sites. To date nearly 4,300 sites are on-air and meeting speed and coverage enhancement targets. Recent weekly construction starts are up over 250 percent from the second quarter. Sprint now expects to bring 12,000 sites on air approximately one quarter later than originally planned.

Additional information:

· On July 15, 2012, Sprint launched 4G LTE in 15 cities surrounding the Atlanta, Dallas, Houston, Kansas City, San Antonio and Waco markets.

· Sprint 4G LTE is available in 32 cities and expects to have largely completed the nationwide build-out by end of 2013.

· On Sept. 10, Sprint announced that 4G LTE will be available in the coming months in over 100 additional markets. These include: Boston; Charlotte, N.C.; Chicago; Indianapolis; Los Angeles; Memphis, Tenn.; Miami; Nashville, Tenn.; New Orleans; New York; Philadelphia; and Washington, D.C.

Sprint expects to have nationwide LTE coverage by the end of 2013.”

Author’s Note:

Unlike other wireless carriers, Sprint has to deal with four separate and disparate networks: the soon to be shut down Nextel IDEN push-to-talk, Sprint’s legacy CDMA/3G-EVDO, Network Vision (CDMA/3G-EVDO, LTE-FDD)+, and Cleawire’s Mobile WiMAX/ LTE-TDD). Looks like the last three of these networks will survive- at least for a couple of years. Sprint’s legacy network will certainly co-exist with Network Vision, until the latter covers all Sprint customers. Sprint will continue to resell Clearwire’s mobile WiMAX- at least till the end of 2013. But it remains to be seen whether Sprint will resell Clearwire’s LTE-TDD network, which is now being developed for global deployments by resellers.

Will these two versions of LTE (differing in only the duplexing method) inter-operate/ inter-work with each other to permit video calls and other types of real time (very low latency) communications between users of each LTE network? See Appendix below for more on this topic.

More information, comment and analysis on Sprint’s 2012 Open Solutions conference, including CEO Dan Hesse’s keynote speech is at:

Appendix: Conundrum for Sprint – Reselling Clearwire’s LTE-TDD

Clearwire Releases Research Reports from IDC and ABI Highlighting Spectrum Holdings and TDD-LTE Ecosystem

http://corporate.clearwire.com/releasedetail.cfm?ReleaseID=716442

Clearwire to start major TDD-LTE network construction in Q4 – FierceWireless

“Clearwire intends to deploy TDD-LTE at 5,000 cell sites by June 30, 2013, in areas of high network traffic and congestion, since Clearwire will charge Sprint usage-based pricing for access to its LTE network”

The number of CLRWR TDD-LTE cell sites deployed by mid 20013 was recently reduced to 2,000 as per this article:

http://www.fiercewireless.com/story/clearwire-slashes-lte-deployment-target-5000-sites-2000-sites/2012-10-25

There are 2 issues for Sprint if they resell CLRWR’s TDD-LTE:

2. Latency & jitter bounds (=max permitted values) when interworking real time calls between the 2 different LTE networks. Will be especially important for video conferencing and other real time applications.

Note also that voice can’t go on CDMA unless CLRWR is reselling Sprint’s CDMA network too.

Was Google’s acquisition of Motorola Mobility (& Hardware Biz) a good idea? Or is that a rhetorical question?

So far, it isn’t paying off at all! Google spent $12.5 billion for Motorola’s mobile phone handset business and Set Top Boxes (STBs), which are sold to Comcast and other MSOs. Motorola Mobility had a $505 million operating loss in the third quarter, compared to an operating loss of $41 million in the same quarter last year, when it was an independent company. Motorola Mobility had revenues of $2.58 billion, below analysts’ estimates of $3.3 billion.

According to the Wall Street Journal, Motorola’s sales of mobile devices dropped significantly. In the third quarter, the mobile unit’s sales were $1.78 billion, down about 26 percent from the year-ago quarter when Motorola was an independent company.

“It’s hard to see how results are going to improve dramatically in the fourth quarter as Apple pushes its new iPhone 5 aggressively around the world, and Samsung continues to drive sales of its popular Galaxy S III smartphone,” the Journal‘s Spencer Ante commented.

Not only is Motorola Mobility losing sizable chunks of cash, but sales are shrinking. Turning around the division will not be easy since, unlike much-larger rival Samsung, it can’t harness huge cost efficiencies. Revamping the business will also take time, making the Motorola unit a likely drag on profits for several quarters.

Breaking Views writes, “Getting advertisers to pay more for mobile would supercharge Google’s ad business. Unfortunately, Google executives have plenty of other messes to sort out, such as fixing the phone business – and finding snappier quotes from Chief Executive Larry Page.”

http://www.breakingviews.com/googles-hardware-ambitions-proving-costly/21047859.article

Here’s what Infonetics analyst Julien Blin wrote in an email about Moto Mobility’s drag on Google’s earnings:

“So the obvious question for Google is: “Where do we go from here? Do we stick to Motorola’s smartphone, tablet and set-top box business or sell all these units and keep the IP portfolio?” Although management mentioned that they were fairly pleased with the progress at Motorola as Google continues to streamline Motorola’s business, and the acquisition is still pretty recent, these are tough questions that Google execs will need to answer in the coming months.”

“Pressure is on Google execs to execute on the best-of-breed Android devices strategy. Over time, if Motorola

continues to be a drag on Google’s earnings, Google is likely to sell Motorola’s smartphone, tablet and STB business. When Google announced the Motorola acquisition, Google execs were quick to say that their intent was to build

best-in-class Android devices, but as a result of that many OEMs were worried about the relationship between them and Google, as Motorola, a competitor, was now part of the company.”

“The reality is that Google does not need to get into the hardware business, as it presents the risk of pressuring its overall margins. Google could just rely on its pro-Android OEMs (Samsung, LG, HTC, etc.) to do so, and these partners could

also help them win the mobile OS platform war against Apple. With that in mind, we believe that over time Google is likely to sell Motorola’s smartphone, tablet, and set-top-box business and keep Motorola’s IP portfolio, as it could be very valuable to address potential patent lawsuits.”

Financial impact was very negative: The mistaken early release of unexpectedly weak earnings knocked over $20 billion off Google’s market capitalization on Thursday October 18th with an 8% decline in share price. That decline continued on Friday, October 19th. At least seven brokerages cut their price targets on Google’s shares after the company missed Wall Street earnings expectations.

http://www.reuters.com/article/2012/10/19/us-google-research-idUSBRE89I0OA20121019

Do you think it’s a good idea to own individual stocks, especially high flyers like Google (and Apple)? 🙂

References— related articles by this author about Motorola Mobility and Google’s wireless aspirations:

http://www.viodi.tv/2007/07/30/google-2/

and this quote from Ken Pyle in August 2011; “Alan Weissberger may have said it best when he suggested that the Google purchase of Motorola Mobility is representative of what has become a sort of patent mania these days.”

Infonetics: Cisco leads in Session Border Controllers; $377 billion to be spent on VoIP and UC services over next 5 years!

Infonetics Research recently released two reports that highlight the growing market for enterprise VoIP and Unified Communications.

1. Enterprise Session Border Controllers market size and forecast report (bi-annual) provides worldwide and regional market size, market share, forecasts, analysis, and trends for enterprise SBC revenue and sessions by system and business size in North America, Asia Pacific, EMEA (Europe, Middle East, Africa), and Central and Latin America. Companies tracked include Acme Packet, Adtran, AudioCodes, Avaya, Cisco, Dialogic, Edgewater, GENBAND, Ingate, Innomedia, Media5, OneAccess, Sangoma, Siemens Enterprise, Sonus Networks, and others.

Note: A Session Border Controller (SBC) is a device regularly deployed in Voice over Internet Protocol (VoIP) networks to exert control over the signaling and usually also the media streams involved in setting up, conducting, and tearing down telephone calls or other interactive media communications. SBCs are inserted into the signaling and/or media paths between calling and called parties in a VoIP call, predominantly those using the Session Initiation Protocol (SIP), H.323, and MGCP call-signaling protocols.

2. VoIP and UC Services and Subscribers report features a Hosted PBX/UC Provider Tracker and provides worldwide and regional market share, market size, forecasts, analysis, and trends for VoIP services, including residential/SOHO, hosted VoIP and UC, IP connectivity, and managed IP PBX services. Companies tracked include AT&T, Cablevision, Charter, Comcast, Cox, Embratel, France Télécom, KDDI, LG Uplus, LibertyGlobal, NTT, ONO, Optus, Rogers, SFR, SK Broadband, SoftBank, Telecom Italia, Time Warner Cable, Verizon, Vonage, and others.

To buy these reports, contact Infonetics: http://www.infonetics.com/contact.asp

Enterprise Session Border Controllers (E-SBCs) are being used to facilitate complex Unified Communication (UC) feature interworking, simplify interconnection via SIP (Session Initiated Protocol) trunking and enhance services around local enterprise policies. There are several sales models for E-SBCs: customer owned and operated, hosted or managed by a service provider, reselling equipment and software as a packaged service.

ENTERPRISE SBC MARKET HIGHLIGHTS:

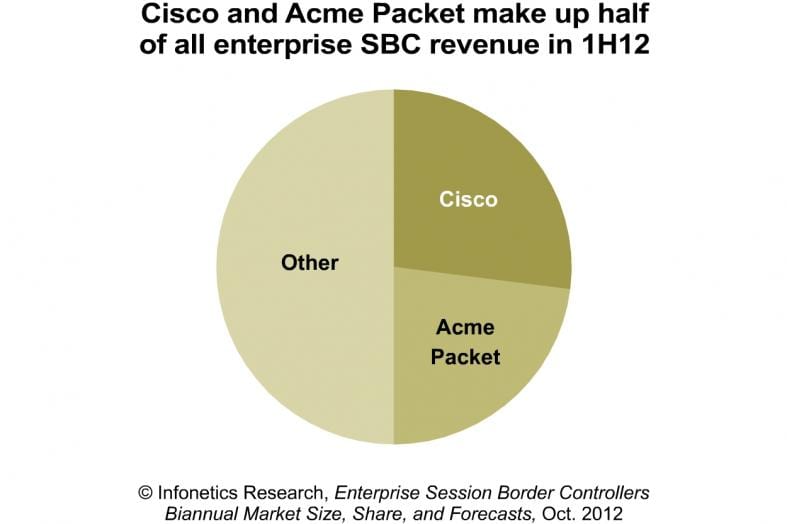

- Worldwide revenue for enterprise SBCs hit $82.5 million in the first half of 2012 (1H12)

- Systems with fewer than 800 sessions comprise the largest share of enterprise SBC sales

- Cisco and Acme Packet are the top enterprise SBC vendors by 1H12 global revenue share

- Competitive pressures during the first half of the year impacted average revenue per session downward

- Infonetics Research forecasts the enterprise SBC market to grow strongly, topping $430 million in 2016

“For the first time ever, Cisco captured the lead in the enterprise session border controller market, taking 26% revenue market share in the first half of 2012,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “Cisco’s been able to turn its market-leading position in IP PBXs into an advantage, selling its enterprise SBCs with new IP PBX and unified communications deployments.”

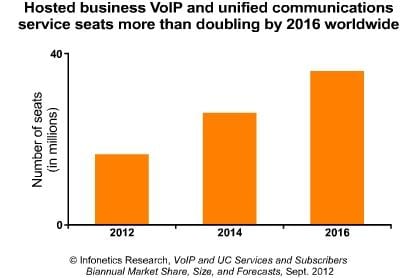

VOIP AND UC SERVICES MARKET HIGHLIGHTS:

- Infonetics predicts a cumulative $377 billion will be spent on business and residential/SOHO VoIP services over the 5 years from 2012 to 2016, driven primarily by SIP trunking and hosted VoIP/UC services

- NTT, the perennial leader of residential VoIP market, topped 14 million subscribers in 2Q12

- Roughly 15%–20% of all new IP PBX lines sold are part of a managed service or outsourced contract, making managed IP PBX the largest segment of business VoIP services

- SIP trunking revenue grew 23% in the first half of 2012 compared to the second half of 2011, led by strong activity in North America

“The SIP trunking and hosted UC segments were marked by strong growth and dynamic supplier landscapes in the first half of 2012,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “Cisco’s been able to turn its market-leading position in IP PBXs, VoIP gateways, and data networking equipment into an advantage, upselling its enterprise SBCs to this customer base as they transition to services such as SIP trunking.”

Contact: [email protected]

Infonetics also released excerpts from its UC Deployment Strategies and Vendor Leadership: North American Enterprise Survey, which explores enterprise plans for unified communications (UC) and their perceptions of UC vendors.

VOIP AND UC SERVICES MARKET HIGHLIGHTS:

- Infonetics predicts a cumulative $377 billion will be spent on business and residential/SOHO VoIP services over the 5 years from 2012 to 2016, driven primarily by SIP trunking and hosted VoIP/UC services

- NTT, the perennial leader of residential VoIP market, topped 14 million subscribers in 2Q12

- Roughly 15%–20% of all new IP PBX lines sold are part of a managed service or outsourced contract, making managed IP PBX the largest segment of business VoIP services

- SIP trunking revenue grew 23% in the first half of 2012 compared to the second half of 2011, led by strong activity in North America

“Our unified communications survey reveals a really important shift taking place as enterprises increasingly use mobile devices to access UC applications,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research. “Survey respondents indicate that smartphones and tablets will be the two most widely used devices for UC in 2013, passing traditional computers and deskphones.”

To buy this survey, contact Infonetics: http://www.infonetics.com/contact.asp

AT&T May Buildout U-Verse to Remote/Underserved Areas; 7M U-Verse subscribers to get OTT content & Second Screen Apps!

Contrary to a missive by DSL Reports last year (http://www.dslreports.com/shownews/ATTs-Stankey-Uverse-Build-Virtually-Over-114279), AT&T is not cutting back it’s U-Verse deployments. This summer, U-Verse was installed throughout Santa Clara, Fremont, CA and most of the SF Bay Area. Today, Jefferies & Company analyst George Notter came out with a report stating that AT&T is considering expanding its U-verse buildout by offering high-speed broadband to some of the 18 million copper access lines in the U.S. that don’t yet have high speed broadband yet. Mr. Notter points out that the remaining 18 million access lines are “scattered over 80 percent of AT&T’s geographic footprint.”

Notter writes that AT&T is discussing this internally and should make a decision within weeks. The venerable carrier has an analyst day scheduled for Nov. 7, so it’s possible the U-Verse expansion news will be announced during that event. It would probably take 12 to 18 months, equipment-vendor sources told Notter.

In this potential U-Verse builout, approximately 3 million to 5 million households would get FTTN (Fiber to the Node with short VDSL copper loops) in a U-verse expansion, Notter estimates. While the first 30 million-line U-Verse deployment concentrated on fairly densely populated metro and urban areas, a further buildout would be to more remote (unserved or underserved) geographical areas.

Alcatel-Lucent (ALU) provided the fiber-to-the-node gear for the original U-verse deployment and would be the likely choice for this rumored expansion, Notter writes. The FTTN business wouldn’t be huge for ALU — about $110 million to $190 million in DSLAM equipment, Notter estimates.

http://www.lightreading.com/document.asp?doc_id=226139&f_src=lrweeklynewsletter

In its latest earnings report (2Q-2012), AT&T said it had 6.8 million total U-verse® subscribers (TV and high speed Internet) in service. U-verse TV subscribers grew 22 percent year over year, according to the company.

“U-verse Revenues Up 38 Percent. Revenues from residential customers totaled $5.5 billion, an increase of 1.7 percent versus the second quarter a year ago — their strongest growth in more than four years. Continued strong growth in consumer IP data services in the second quarter more than offset lower revenues from voice and legacy products. The second quarter marked the eighth consecutive quarter of year-over-year growth in wireline consumer revenues. U-verse continues to drive a transformation in wireline consumer, reflected by the fact that consumer broadband, video and voice over IP revenues now represent 57 percent of wireline consumer revenues, up from 50 percent in the year-earlier quarter. Increased AT&T U-verse penetration and a significant number of subscribers on triple- or quad-play options drove 18.2 percent year-over-year growth in IP revenues from residential customers (broadband, U-verse TV and U-verse Voice) and 6.2 percent sequential growth. U-verse revenues grew 38.3 percent compared with the year-ago second quarter and were up 10.2 percent versus the first quarter of 2012.

U-verse Subscribers Near 7 Million Mark. Total AT&T U-verse subscribers (TV and high speed Internet) reached 6.8 million in the second quarter. AT&T U-verse TV added 155,000 subscribers to reach 4.1 million in service. AT&T U-verse High Speed Internet delivered a second-quarter net gain of 553,000 subscribers to reach a total of 6.5 million, helping offset losses from DSL. Overall, AT&T wireline broadband connections decreased 96,000, partly due to seasonality. More than 50 percent of U-verse broadband subscribers have a plan delivering speeds up to 12 Mbps or higher, up from 39 percent in the year-ago quarter. About 90 percent of new U-verse TV customers took AT&T U-verse High Speed Internet in the second quarter and about half of new subscribers took AT&T U-verse Voice. About three-fourths of AT&T U-verse TV subscribers have a triple- or quad-play option from AT&T. ARPU for U-verse triple-play customers was about $170, up slightly year over year. U-verse TV penetration of eligible living units continues to grow and was at 17.3 percent in the second quarter.”

http://www.att.com/gen/press-room?pid=23091&cdvn=news&newsarticleid=34898

In the last week, AT&T announced two new ways it is augmenting its U-Verse offerings via “TV Everywhere” (e.g. on mobile devices) and Second Screen apps (using the screen of a mobile device for various applications that enhance the TV viewing experience).

1. In its first “TV Everywhere” offering, AT&T has partnered with Viacom to add several Viacom channels to its U-verse TV online offerings on selected websites. With the AT&T U-verse ID, AT&T customers will now get to view the full-length episodes from BET, Comedy Central, MTV, Nickelodeon, Spike and VH1 on demand through Viacom’s network-based websites like www.mtv.tve. Also, customers will soon get the access to these services on their mobile devices including smartphones and tablets.

http://www.zacks.com/stock/news/84880/att-bolsters-u-verse-offerings

2. In a presentation at last Thursday’s TVNEXT Conference in Santa Clara, CA, AT&T’s Lee Culver said that AT&T is working with third parties and also developing its own “second screen” mobile apps for iOS compatible devices (Apple iPhones and iPADs). Article covering that topic is at:

Stay Tuned: We are synthesizing the results of a comprehensive market survey of AT&T U-Verse subscribers and will be summarizing those plus providing selected anonymous quotes in a forthcoming article!

Related article on Verizon’s FiOS streaming video plans is at:

More articles at: http://viodi.com/author/alanweissberger

ComSocSCV Oct meeting on Mobile Backhaul: Significance of LTE, Small Cells, Macro Cells and Market Forecasts!

PDH 32.80%

ATM over PDH 0.45%

SONET/SDH and WDM 1.29%

Ethernet copper 6.02%

Ethernet fiber 44.13%

DSL 0.84%

PON 0.52%

Coax cable 0.03%

WiMAX 0.02%

Satellite 0.03%

Microwave–TDM 3.05%

Microwave–Dual Ethernet/TDM Microwave Equipment

4.48%

Microwave–Ethernet only 6.35%

Grand Total 100.00%

PDH 8.52%

ATM over PDH 2.93%

SONET/SDH and WDM 11.99%

Ethernet copper 2.05%

Ethernet fiber 16.67%

DSL 0.81%

PON 1.54%

Microwave–TDM 21.53%

Microwave–Dual Ethernet/TDM Microwave Equipment

Microwave–Ethernet only 6.14%

Grand Total 100.00%

Medium CY12 CY16

Copper 11.76% 4.14%

Fiber 32.75% 41.75%

Air: MWV + Satellite (but mostly MWV)

Grand Total 100.00% 100.00%

Medium CY12 CY16

Air: MWV + Satellite (but mostly MWV)

Grand Total 100.00% 100.00%

areas, and provides analysis of equipment, connections, cell sites, and service charges.

ANALYST NOTES

“Steady, albeit slow, growth is in store for the macrocell mobile backhaul equipment market,” notes Michael Howard, principal analyst and co-founder of Infonetics Research. “While Verizon Wireless and AT&T are winding down their first big wave of LTE deployments and their spending is slowing, this is a large market and there’s still room for growth.

We’re expecting a cumulative $43.6 billion to be spent on macrocell mobile backhaul equipment over the 5 years from 2012 to 2016, as operators outside of North America buy up microwave gear to support rising capacity requirements.”

“Well over half of all spending in the mobile backhaul market is on microwave equipment,” adds Richard Webb, directing analyst for microwave and mobile offload at Infonetics.

MACROCELL MOBILE BACKHAUL MARKET HIGHLIGHTS

. Globally, the macrocell mobile backhaul equipment market is forecast by Infonetics to grow to $9.7 billion by 2016

. 94% of all macrocell mobile backhaul equipment spending is on IP/Ethernet gear, with 54% of this on packet-capable microwave .

backhaul subsides and the focus shifts to small cells.

Decline in ROADMs unit shipments & price reductions cause huge drop in component revenue, but growth seen in 2014

Introduction:

Market research firm Infonetics Research has just released excerpts from its latest ROADM Components report, which tracks the reconfigurable optical add/drop multiplexer (ROADM) network equipment market and the wavelength selective switch (WSS) components within it (the latter is measured by spacing technology and degree count).

The firm’s biannual ROADM Components report provides market size, ROADM vendor market share, forecasts, analysis, and trends for ROADM optical network hardware and ROADM WSS components (1×4 or less 50GHz/100GHz and 1×5 or larger 50GHz/100GHz). Companies tracked include ADVA, Alcatel-Lucent, Capella, CoAdna, Ciena (Nortel), Cisco, ECI Telecom, Ericsson, Finisar, Fujitsu, Huawei, Infinera, JDSU, NEC, Nistica, Nokia Siemens Networks, Oclaro/Xtellus, Tellabs, Transmode, and others.

To buy this or other Infonetics research reports, contact Infonetics sales: http://www.infonetics.com/contact.asp.

ROADM/ WSS COMPONENT MARKET HIGHLIGHTS:

- Unit shipment declines coupled with price reductions caused ROADM/WSS component revenue to fall 34% in the 1st half of 2012 (1H12) from the 1st half of 2011 (1H11)

- ROADM /WSS component revenue as a share of WDM ROADM equipment has fallen to a 5 year low of 6%

- No single vendor controls the WDM ROADM optical network equipment market

- Infonetics forecasts the ROADM WSS component market to grow at a 9.5% compound annual growth rate (CAGR) from 2011 to 2016

- Component growth will benefit from the rollout of new greenfield coherent 100G networks in 2014, particularly gridless ROADMs designed to support colorless, directionless, contentionless (CDC) architectures

“Growth in the overall WDM ROADM equipment market hasn’t been stellar, but it has far outstripped the declines seen in ROADM WSS units and revenue,” explains Andrew Schmitt, principal analyst for optical at Infonetics Research. “I think we have learned that the WSS market is more cyclical and tied to the ebb and flow of common equipment deployments.”

Infonetics had previously forecast a mixed market for optical network equipment, with OTN on the upswing and SONET/SDH declining sharply.

Optical network spending up 15% in 2Q12; road ahead diverges sharply by segment and region

http://www.infonetics.com/pr/2012/2Q12-Optical-Network-Hardware-Market-Highlights.asp

Also see this article: https://techblog.comsoc.org/2012/09/27/new-infonetics-survey-ranks-optical-network-vendors-alcatel-lucent-ciena-huawei-infinera-get-top-marks

IEEE ComSoc Dedicated Volunteer Yigang Cai wins Alcatel Lucent Distinguished Inventor Award

While greatly diminished from its days of glory, Bell Labs still exists but with no connection to AT&T. IEEE ComSoc NA Director and former Distinguished Lecture Tour Manager has distinguished himself through many inventive accomplishments and patent contributions throughout his career with Alcatel Lucent. He has been honored to have received the Bell Labs Inventors Award three times as we’ve previously reported:

https://techblog.comsoc.org/2012/08/08/profile-of-prolific-inventor-comsoc-na-director-yigang-cai

http://www.comsoc.org/blog/ieee-comsoc-member-yigang-cai-receives-2011-bell-labs-inventors-award

Mr. Cai is truly a patent generating machine. His latest patent is:

METHOD AND DEVICE FOR PROVIDING USER EQUIPMENT WITH VOICE MESSAGES

Inventors: Yigang Cai (Naperville, IL, US) Xiangyang Li (Shanghai China, CN)

IPC8 Class: AH04W412FI

USPC Class: 455413

Class name: Radiotelephone system message storage or retrieval voice mail

Publication date: 2012-10-04

Patent application number: 20120252417

Read more: http://www.faqs.org/patents/app/20120252417#ixzz28rWLJSWg

Yigang’s consistently outstanding performance, exemplary innovative potential and extraordinary contributions to a strong Alcatel Lucent patent portfolio warrant a different and higher level of recognition. And to that end, Yigang has been selected to receive the company’s first “Distinguished Inventor” Award. What an honor! Heary congrats Yigang!

Author’s Note: As a volunteer for IEEE for almost 40 years (and an IEEE member for 44 years), I’ve seldom seen such a hard working, dedicated volunteer like Yigang. He came to U.S. from China in the 1990’s and made a whole new life for himself. He is greatly admired by his IEEE and Alcatel-Lucent colleagues.

Analysis of Telco M&A talks: T-Mobile/Sprint with MetroPCS & Century Link with TW Telecom?

Overview:

Is carrier consolidation good for the telecom industry? Yes, if you are the acquiring telco because you gain new customers, a larger service area, potential entry into new markets, better equipment pricing due to higher volumes. and less competition. No, if you are a consumer or any other player in the telecom eco-system (with possible exception of the vendors of the acquiring company).

In the past week, T-Mobile made an offer for wireless pre-paid carrier MetroPCS, while Sprint’s Board was to meet to decide whether or not to do likewise. Meanwhile, Century Link was reported to be in buy-out talks with TW Telecom.

DealReporter (owned by the Financial Times/ Pearson Group) wrote that network operator Level 3 Communications also had interest in acquiring TW Telecom, but balked at the high price tag.

Analysis:

1. Metro PCS is being courted due to its very successful pre-paid business and it’s LTE network and smart phones. T-Mobile and MetroPCS have stated their commitment to a merger, but with the union far from finalized, Sprint is reconsidering whether to make another bid after it’s failed attempt to acquire T-Mobile earlier this year.

Bloomberg earlier this month reported that Sprint’s stock was trading at twice the value it was at in February, putting Sprint in a nice position for an acquisition. Piper Jaffray analyst Chris Larsen, telling Bloomberg Oct. 5 that a deal between MetroPCS and Sprint would “just make sense.” Data from Kantar Media suggests T-Mobile and MetroPCS could be a strong pairing—and a problem for Sprint—since T-Mobile has been successful at attracting away customers from Verizon and Sprint while MetroPS has been attracting away AT&T subscribers, There also seems to be very little potential overlap of the two carriers subscriber bases.

2. TW Telecom is one of the three largest providers of Business Ethernet (AKA Carrier Ethernet or Metro Ethernet) in the nation, with fiber to more commercial buildings than any other competitive carrier. TW Telecom operates a nationwide fiber-optic network and provides high-speed Internet connections for business.

“TW Telecom’s equity is more attractive than CenturyLink’s, and the rural telecom operator would likely have to pay a steep premium to acquire the fiber-optic network operator, the second industry source continued. A TW Telecom acquisition, however, would bolster CenturyLink’s enterprise and small business services and support its past acquisition of Savvis, the two industry sources said.”

http://www.ft.com/intl/cms/s/2/927a80c0-0bfe-11e2-8032-00144feabdc0.html

There are at least three reasons CenturyLink might be interested in acquiring TW Telecom:

1. A large installed base of business customers (mostly SMBs, but a few large accounts). The company has a broad market reach into 75 markets and

2. A huge nationwide fiber optic network with over 28,000 fiber route miles–75 percent of which are in metro areas. TW Telecom has 16,000 on-net buildings connected to its fiber network. That would enable CenturyLink to expand the reach of its own growing Business/Carrier Ethernet footprint and connect many more customers to cloud services offered by its Savvis unit. Savvis is one of the few cloud service providers that is actually leveraging its managed IP VPN to deliver cloud services. They presented at the 12 Oct 2011 IEEE ComSocSCV meeting with ppt presentation available for fee download at: http://www.ewh.ieee.org/r6/scv/comsoc/ComSoc_2011_Presentations.php (scroll down to Oct 2011 meeting and you will find Savvis as well as other presentations there).

3. Profitability–unlike a number of other CLECs, TW Telecom is actually profitable. Driven by sales of Business Ethernet and IP/VPN services, TW Telecom reported that total revenues in Q2 2012 grew 1.6 percent sequentially over Q1 2012 and 7.7 percent year over year. The company had $1.4 billion in revenue in 2011.

What do you think of these two potential telco M & Adeals and about carrier consolidation in general?

For more information about the two targeted companies, please contact this author.

Addendum: On October 6th, it was announced that:

tw telecom inc.has been awarded two contracts with the U.S. Department of Health and Human Services for secure Internet connectivity worth approximately $11.67 million over five years, the company announced.

Under the terms of the competitive awards, tw telecom will deliver Ethernet Internet Services and 10 Gig wavelength services for mission-critical and health-related data connectivity to the National Institutes of Health, Centers for Disease Control, Food and Drug Administration and Indian Health Services in Washington, D.C., Atlanta and Albuquerque.

Both contract awards require tw telecom to deliver private, secure and scalable network connectivity transmitting mission-critical medical data and communications traffic, the company said.