Month: October 2017

Australia’s ACMA Targets 3.6-GHz for “5G” Mobile Broadband

Australian telecoms regulator ACMA has announced plans to reallocate spectrum in the 3.6-GHz band for 5G purposes.

The five-year spectrum outlook released today by ACMA details how Australia’s telecom regulator will adjust spectrum usage of 50MHz of the 900MHz band for 4G mobile broadband, switching from the roughly 8MHz paired chunks of spectrum that worked best with 2G to sets of matched 5MHz pairs more efficient for 4G networks. This won’t happen until mid-2021 to give telcos enough time to roll out appropriate hardware, and also takes into account the as-yet-unallocated 850MHz ‘expansion’ band, where two 15MHz portions sit unused.

However, it’s 3.6GHz that’s most interesting, because that massive 125MHz portion of spectrum could be huge for 5G mobile connectivity or even fixed wireless broadband across Australia. 3.6GHz is “being looked at internationally as a pioneer band for 5G mobile broadband”, according to ACMA chair Nerida O’Loughlin, and ACMA wants Australia to be positioned well to take advantage of any early developments. Telstra sits on the 5G steering council, and both Vodafone and Optus have already done significant testing with network partners.

The Australia telecom regulator also plans to re-allocate the 2G spectrum being freed by the switch off of 2G services for more modern mobile services. In order to achieve these goals the regulator is following a new five-year spectrum roadmap, which was published last week.

The outlook includes details of planned spectrum allocations including possible auction scenarios, as well as a proposed approach to the development of annual spectrum work programs.

‘The 3.6 GHz band is being looked at internationally as a pioneer band for 5G mobile broadband. We want to make sure Australia is well placed to realize the benefits 5G has to offer,” ACMA chairwoman Nerida O’Loughlin said.

‘Now that 2G services have been or are being switched off, the ACMA is also keen to re-farm the 900 MHz GSM band and optimise its utility for newer generation mobile broadband services, such as 4G. We propose to do this over a number of years to avoid disruption of existing services. We also plan to make available additional spectrum already planned for reallocation to mobile broadband in the 850-MHz band.”

Verizon, Ericsson Team Up for Massive MIMO Deployment

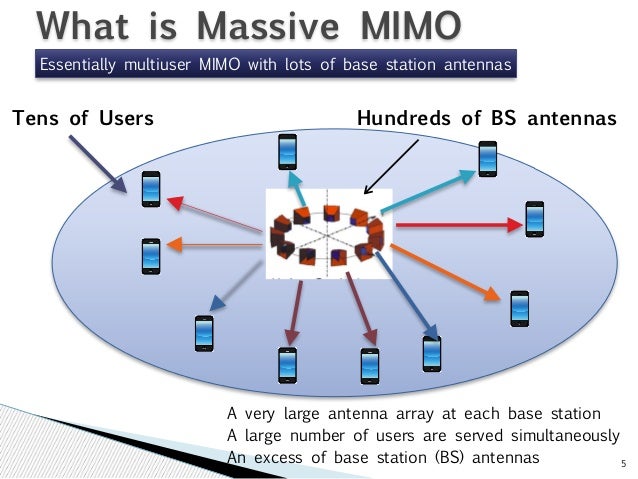

Verizon and Ericsson have deployed frequency division duplexing (FDD) Massive Multiple Input-Multiple Output (MIMO) technology on the Verizon’s wireless network in Irvine, Calif., a step forward in implementing “5G” wireless communications. Ericsson provided 16 transceiver radios and 96 antenna elements in an array for the deployment.

The two companies say the Massive MIMO deployment will improve spectral and energy efficiency, increasing network capacity for current devices in the market. Other network enhancements are expected to provide higher and more consistent speeds for using apps and uploading and downloading files, clearing the pathway for “5G” deployment.

The massive MIMO deployment is running on a 20 MHz block of AWS spectrum. Four-way transmit has been widely deployed throughout the Verizon network and has contributed to significant 4G LTE advancements, according to the announcement. The high number of transmitters from the Massive MIMO provides more possible signal paths. It also enables beamforming, which directs the beam from the cell site directly to where the customer is, dramatically cutting down on interference. Reduced interference results in higher and more consistent speeds for customers.

Note: Massive MIMO is a candidate feature for IMT 2020 (standardized 5G). Please see last references for authoritative status of IMT 2020.

……………………………………………………………………………………………………….

“While continuing to drive 5G development, the deployment of Massive MIMO offers very tangible benefits for our customers today. As we innovate, we learn and continue to lay the groundwork and set the standards for 5G technology,” said Nicola Palmer, Verizon Wireless chief network officer, in a prepared statement. “Our collaboration with Ericsson on this new deployment continues to drive industry-wide innovation and advancements.”

“We have a tremendous excitement around 5G, and today we made a great announcement to our commitment of driving the 5G ecosystem,” Verizon SVP Atish Gude said

Niklas Heuveldop, Ericsson head of market area North America said: “Massive MIMO is a key technology enabler for 5G, but already today, 4G LTE service providers and end users can benefit from the superior capacity and network performance this technology enables. The current trial is an important step in the collaboration we have with Verizon to prepare their network for 5G.”

Ericsson is active with massive MIMO deployments on other carrier networks, including Sprint, who announced a deployment last month.

References:

ABI Research: MIMO starting to realize its full potential in LTE Advanced networks

On the Path to 5G, Verizon, Ericsson Team Up for Massive MIMO Deployment

http://www.zdnet.com/article/verizon-and-ericsson-deploy-massive-mimo-on-irvine-lte-network/

IEEE ComSoc Webinar: 5G: Converging Towards IMT-2020 Submission

LoRaWAN and Sigfox lead LPWANs; Interoperability via Compression

Backgrounder:

The Low Power Wide Area Network (LPWAN) market is focused on IoT WAN connectivity for devices (endpoints) that consume low power, send/receive short messages at low speeds, and have low duty cycles. There are two categories of LPWANs:

1] Cellular (e.g. NB-IoT and LTE Category M1) WANs using licensed spectrum.

2] Wireless WANs operating in unlicensed frequency bands.

While cellular may be the ultimate winner, Sigfox and LoRAWAN currently have a lot more market traction and are growing very fast. Other non-cellular LPWANs (Ingenu, Weightless SIG, etc.) are also getting some attention, but if there are too many commercially available LPWANs the market will be segmented and fractured.

Overview of LoRaWAN and Sigfox network:

Let’s look at the two most popular unlicensed band LPWANs:

1. LoRaWAN:

- LoRaWAN is specified by the LoRa Alliance which includes 47 network operators.

- The LoRa Alliance states on its website: “LoRaWAN™ is the open global standard for secure, carrier-grade IoT LPWA connectivity. With a certification program to guarantee interoperability and the technical flexibility to address the multiple IoT applications be they static or mobile we believe that LoRaWAN can give all THINGS a global voice.”

- For the Physical layer (PHY), LoRa uses a modulation scheme called chirp spread spectrum (CSS) and a radio both developed and sold or licensed by Semtech Corporation.

- About two years ago, Semtech licensed its technology to Microchip and NXP (like ARM, Semtech now licenses to other semiconductor companies). As a result, the core LoRa hardware (PHY layer) is no longer provided by a single global chip manufacturer.

- LoRaWAN defines the media access control (MAC) sublayer of the Data Link layer, which is maintained by the LoRa Alliance. This distinction between LoRa and LoRaWAN is important because other companies (such as Link Labs) use a proprietary MAC sublayer on top of a LoRa chip to create a better performing, hybrid design (called Symphony Link by Link Labs).

- Many of the LoRa Alliance companies building products are focusing on software defined enhancement and use the LoRaWAN defined MAC.

- LoRaWAN will most likely be best used for “discrete” applications like smart buildings or campuses, where mobile network connectivity is not needed.

……………………………………………………………………………………………………………………….

2. Sigfox:

- Sigfox has designed its technology and network to meet the requirements of mass IoT applications; long device battery life-cycle, low device cost, low connectivity fee, high network capacity, and long range.

- Sigfox has the lowest cost radio modules(<$3, compared to ~$10 for LoRa, and $12 for NB-IoT).

- A recent announcement from Sigfox noted the addition of a new service called “Admiral Ivory,” that makes possible to connect devices with hardware components costing as little as $0.20.

- An overview of Sigfox’s network technology is described here. It consists of: Ultra Narrow Band radio modulation, a light weight protocol, small frame size/payload, and a star network architecture.

- The Sigfox network is currently deployed in 36 countries, 17 of which already have national coverage.

- In February, Sigfox reached an agreement with mobile network operator Telefonica to integrate Sigfox’s low-powered connectivity into the Telefonica’s managed connectivity platform. By complementing Telefónica’s cellular connectivity offerings, with Sigfox’s LPWAN connectivity solution, customers can choose the most appropriate type of connectivity or combine them, implementing use cases and creating new service opportunities that otherwise may not have been possible.

- Additionally, Telefónica´s managed connectivity platform will integrate Sigfox’s cloud, which gives the company the ability to develop its own end-to-end IoT solutions, based on Sigfox’s connectivity solution and including device integration, as well as data collection and management.

- While Sigfox is a proprietary IoT network architecture, the company has provided their intellectual property library free of charge and royalty-free to semiconductor companies which have implemented chipsets with dedicated Sigfox interfaces or multi-mode capabilities. The list of chipsets/modules supporting Sigfox (+ multimode) includes: Pycom (+ WiFi, BLE=BlueTooth Low Energy), Texas Instruments (+ BLE), STMicroelectronics (+ BLE), Microchip/Atmel, Analog Devices (+ BLE), NXP, OnSemiconductor (SiP), SiLabs, M2Com, GCT Semiconductor (+ BLE, CatM1, NB-IoT, EC-GSM, GPS), Innocom, and Wisol.

- The current Sigfox ecosystem is composed of several chipset vendors, device makers, platform providers and solution providers.

- Here’s a graphic from the Sigfox website on their expanding network footprint:

…………………………………………………………………………………………………….

Sigfox’s LPWAN Interoperability using Internet Compression Technology:

In a phone conversation with Sigfox standardization expert Juan Carlos Zuniga last week, I learned that Sigfox plans to achieve LPWAN interoperability at the Application layer, rather than building multi-mode base stations with different radio access networks. Here’s a glimpse on how that might happen:

At the IETF 98 Bits-n-Bites event, March 30th in Chicago, Sigfox demonstrated IoT interoperability with internet compression technology. which enables LPWAN applications to run transparently over different IoT radio access network (RAN) technologies.

To achieve this milestone and enable IP applications to communicate over its network, Sigfox and Acklio implemented Static Context Header Compression (SCHC) -a compression scheme being standardized by the IETF IPv6 over LPWAN working group*, which Juan Carlos participates in. SCHC allows reducing IPv6/UDP/CoAP headers to just a few bytes, which can then be transported over LPWAN network small frame size for low-power, low-cost IoT applications.

…………………………………………………………………………………………………….

* The focus of the IPv6 over LPWAN working group is on enabling IPv6 connectivity over four different Low-Power Wide-Area (LPWA) technologies: Sigfox, LoRa WAN, WI-SUN and NB-IOT (from 3GPP).

…………………………………………………………………………………………………….

The demonstration platform was based on an Acklio compression protocol stack running on Sigfox-enabled devices and cloud-based applications over the live Sigfox network in Chicago. Two scenarios were demonstrated: 1] CoAP requests to legacy IP LPWAN devices, and 2] CoAP interoperability over the live Sigfox and cellular networks in Chicago with IP enabled endpoint devices.

“We are thrilled with this latest milestone in our quest to support and promote interoperability in the IoT,” said Juan-Carlos Zúñiga, senior standardization expert at Sigfox and co-chair of the IETF IntArea working group. “It is critical that the industry rallies together to adopt open internet standards to unlock the true potential of the IoT.”

Compression based technology for LPWAN application interoperability builds on Sigfox’s commitment to supporting the development of IoT interoperability as an active member of standards development organizations including the IETF, ETSI and IEEE 802. And the number of chip companies providing Sigfox network interfaces (see above list) is equally impressive.

References:

https://www.iotforall.com/a-primer-for-loralorawan/

………………………………………………………………………………………………………..

Juan Carlos will be following up with a blog post on LPWAN application layer interoperability as well as a more detailed description of the IETF work on LPWANs.

Wi-Fi hotspots in Cuba Create Strong Demand for Internet Access

by Alexandre Meneghini, Sarah Marsh of Reuters

The introduction of Wi-Fi hotspots in Cuban public spaces two years ago has transformed the Communist-run island that had been mostly offline. Nearly half the population of 11 million connected at least once last year.

That has whet Cubans’ appetite for better and cheaper access to the internet.

“A lot has changed,” said Maribel Sosa, 54, after standing for an hour with her daughter at the corner of a park in Havana, video chatting with her family in the United States, laughing and gesticulating at her phone’s screen.

She recalled how she used to queue all night to use a public telephone to speak with her brother for a few minutes after he emigrated to Florida in the 1980s.

Given the relative expense of connecting to the internet, Cubans use it mostly to stay in touch with relatives and friends. Although prices have dropped, the $1.50 hourly tariff represents 5 percent of the average monthly state salary of $30.

“A lot more could change still,” said Sosa. “Why shouldn’t we be able to have internet at home?”

A tiny share of homes has had broadband access until now, subject to government permission granted to some professionals such as academics and journalists.

The state telecoms monopoly has vowed to hook up the whole island and connected several hundred Havana homes late last year as a pilot project. In September, it said it would roll that service out nationwide by the end of 2017.

Cubans say previous promises for such access have not been fulfilled, so their expectations are not high. They also say the cost is prohibitive, with the cheapest monthly subscription priced at $15.

Cubans use their mobile devices to connect to the Internet via WiFi Hotspot near their street.

…………………………………………………………………………………………………..

Havana says it has been slow to develop network infrastructure because of high costs, attributed partly to the U.S. trade embargo. Critics say the government fears losing control.

Cubans who can afford it flock to Internet cafes and 432 outdoor hotspots where they brave ants, mosquitoes and the elements.

Here they laugh, cry, shout, and whisper. Black market vendors weave in and out among them, trying to hawk pre-paid scratchcards allowing Wi-Fi access. The ping of incoming messages and ring of calls fill the air.

“There’s absolutely no privacy here,” said Daniel Hernandez, 26, a tourist guide, after video chatting with his girlfriend in Britain.

“When I have sensitive things to talk about, I try shutting myself into my car and talking quietly.”

The quality of connections is often good only at specific spots, he said, and when fewer users are connected. Otherwise, the screen tends to freeze mid-chat.

Hernandez said he also uses the internet to search for news. In Cuba, the state has the monopoly on print and broadcast media.

A few meters further on, Rene Almeida, 62, sat in his taxi checking email. He said he felt lucky that his two children had moved to the United States where communications are better than ever. It was only in 2008 that the government first allowed Cubans to own cell phones.

He, too, complained of the lack of privacy and the expense.

“It’s better than nothing,” he said. “But it should improve. It will.”

…………………………………………………………………………………………………

References:

https://techblog.comsoc.org/2017/08/18/whats-the-real-status-of-internet-access-in-cuba/

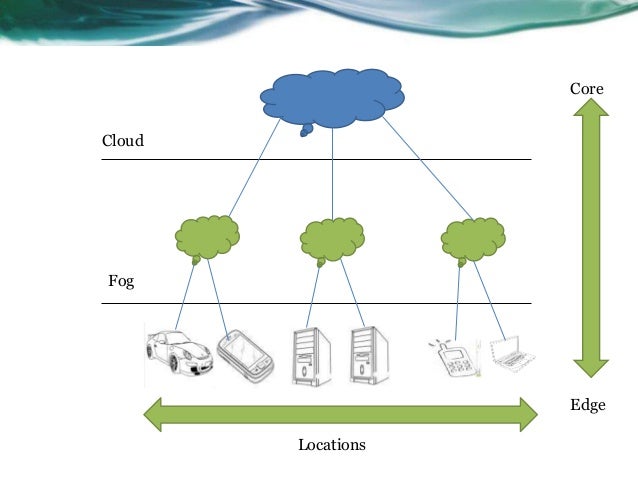

Preview of Fog World Congress: October 30th to November 1st, Santa Clara, CA

The Fog World Congress (FWC), to be held October 30th to November 1st in Santa Clara, CA, provides an innovative forum for industry and academia in the field of fog computing and networking to define terms, discuss critical issues, formulate strategies and organize collaborative efforts to address the challenges. Also, to share and showcase research results and industry developments.

FWC is co-sponsored by IEEE ComSoc and the OpenFog Consortium. It is is the first conference that brings industry and research together to explore the technologies, challenges, industry deployments and opportunities in fog computing and networking.

Don’t miss the fog tutorial sessions which aim to clarify misconceptions and bring the communities up to speed on the latest research, technical developments and industry implementations of fog. FWC Research sessions will cover a comprehensive range of topics. There will also be sessions designed to debate controversial issues such as why and where fog will be necessary, what will happen in a future world without fog, how could fog disrupt the industry.

Here are a few features sessions:

- Fog Computing & Networking: The Multi-Billion Dollar opportunity before us

- Driving through the Fog: Transforming Transportation through Autonomous vehicles

- From vision to practice: Implementing Fog in Real World environments

- Fog & Edge: A panel discussion

- Fog over Denver: Building fog-centricity in a Smart City from the ground up

- Fog Tank: Venture Capitalists take on the Fog startups

- 50 Fog Design & Implementation Tips in 50 Minutes

- Fog at Sea: Marine Use Cases For Fog Technology

- NFV and 5G in a Fog computing environment

- Security Issues, Approaches and Practices in the IoT-Fog Computing Era: A panel discussion

View the 5 track conference program here.

Finally, register here.

For general information about the conference, including registration, please email: [email protected]

About the Open Fog Consortium:

The OpenFog Consortium bridges the continuum between Cloud and Things in order to solve the bandwidth, latency and communications challenges associated with IoT, 5G and artificial intelligence. Its work is centered around creating an open fog computing architecture for efficient and reliable networks and intelligent endpoints combined with identifiable, secure, and privacy-friendly information flows between clouds, endpoints, and services based on open standard technologies. While not a standards organization, OpenFog drives requirements for fog computing and networking to IEEE. The global nonprofit was founded in November 2015 and today represents the leading researchers and innovators in fog computing.

For more information, visit www.openfogconsortium.org; Twitter @openfog; and LinkedIn /company/openfog-consortium.

Reference:

https://techblog.comsoc.org/2017/07/20/att-latency-sensitive-next-gen-apps-need-edge-computing/

Gartner’s Advice to use Multi-Vendor Network Architectures Contradicts Industry Trends, e.g. SD-WANs, NFV

Editor’s Note: Why Single Vendor Solutions Dominate New Networking Technologies

There are no accredited standards for exposed interfaces or APIs* in SD-WANs, NFV “virtual appliances,” Virtual Network Functions (VNFs), and access to various cloud networking platforms (each cloud service provider has their own connectivity options and APIs). Those so called “open networking” technologies are in reality closed, single vendor solutions. How could there be anything else if there are no standards for multi-vendor interoperability within a given network?

In other words, “open” is the new paradigm for “closed” with vendor lock-in a given.

* The exception is Open Flow API between Control and Data planes-from ONF.

Yet Gartner Group argues in a new white paper (available free to clients or to non clients for $195), that IT end users should always adopt multi-vendor network architectures. This author strongly agrees, but that’s not the trend in today’s networking industry, especially for the red hot “SD-WANs” where over two dozen vendors are proposing their unique solution in light of no standards for interoperability or really anything else for that matter within a single SD-WAN.

Yes, we know Metro Ethernet Forum (MEF) has started working on SD-WAN policy and security orchestration across multiple provider SD WAN implementations. They’ve also written a white paper “Understanding SD-WAN Managed Services,” which defines SD-WAN fundamental characteristics and service components. However, neither MEF or any other fora/standards body we know of is specifying functionality, interfaces for interoperability within a single SD-WAN.

…………………………………………………………………………………………………….

Here are a few excerpts from the Gartner white paper is titled:

Divide Your Network and Conquer the Best Price and Functionality

“IT leaders should never rely on a single vendor for the architecture and products of their network, as it can lead to vendor lock-in, higher acquisition costs and technical constraints that limit agility. They should segment their network into logical blocks and evaluate multiple vendors for each.”

Key Challenges:

-

Vendors tend to promote end-to-end network architectures that lock clients with their solutions because they are focused on their business goals, rather than enterprise requirements.

-

Enterprises that make strategic network investments by embracing vendors’ architectures without first mapping their requirements often end up with solutions that are overhyped, over-engineered and more expensive.

-

Enterprises that do not create and actively maintain a competitive environment can overpay by as much as 50% for the same equipment from the same vendor. Savings can be even greater when comparing to other vendors with a functionally equivalent solution.

Recommendations:

IT and Operations leaders focused on network planning should:

- Divide the network into foundational building blocks, defining how they interwork with each other, to enable multiple vendor options for each block.

- Remove proprietary components from the network, replacing them with industry standard elements as they are available, to facilitate new vendors to make competitive proposals.

- Get a technical solution that meets needs at the lowest market purchase price by competitively bidding on each building block.

- Ensure that operations can deal with multiple vendors by planning for network management solutions and processes that can cope with a multivendor environment.

Introduction

Network technologies have matured in the last 20 years and are a routine component of every IT infrastructure. No vendor can claim a unique “core competency” nor “best-of-breed” capabilities in every area of the network, so there is no reason to treat the network as a monolithic infrastructure entrusted to a single supplier. However, we regularly speak to clients that still give credit to the myth of the single-vendor network. They believe that having only one networking vendor provides the following advantages:

- There is no need to spend time designing a solution, as you simply get what leading vendors recommend.

-

Products from the same vendor are designed to work seamlessly together, with limited or no integration challenges.

-

The procurement process is simplified with only one vendor, and there’s no need to deal with time-consuming, vendor-neutral RFPs.

-

A higher volume of purchases with one vendor would result in a better discount.

-

You only have a single vendor to hold accountable in case you run into problems, and one that will respond quickly given the loyalty and volume of purchases.

However, these perceived advantages are largely a myth, as much as open networking and complete vendor freedom is a myth. The harsh reality that we frequently hear from clients that followed this single-vendor strategy includes:

- Holistic designs recommended by vendors are not necessarily the best. They are often over-engineered, include products that are not aligned with enterprise needs and are ultimately more expensive to buy and maintain.

- Diverse product lines from the same vendor share the brand, but they are rarely designed to work together from the start, since they often come from independent BUs or acquisitions, making them difficult to integrate.

- A higher volume of purchases does not automatically translate into better discounts. For most vendors, their best discounts are reserved for competitive situations and will generally offer savings of 15% to 50% when compared with the best-negotiated sole-source deals.

- Having to deal with just one vendor for technical issues is simpler, but does not necessarily translate in shorter time to repair and better overall network availability, which is the real goal.

Clients that pursue a multivendor strategy report that time spent on RFPs and evaluation of different vendors is not a waste, because it increases teams’ skills, motivates them to stay abreast of market innovations, prevents suboptimal decisions and pays off — technically and financially.

Divide the Network Into Foundational Building Blocks to Enable Multiple Vendor Options for Each Block

Network planners and architects must break the network infrastructure into smaller, manageable blocks to plan, design and deploy a “fit-for-purpose” infrastructure that addresses the defined usage scenarios and control costs (Figure 1 shows typical building blocks).

*Security is not addressed in this document. Note: There is no hierarchy associated with block positioning in this picture.

*Security is not addressed in this document. Note: There is no hierarchy associated with block positioning in this picture.

Source: Gartner (October 2017)

……………………………………………………………………………………….

The key objectives of this activity are to:

- Identify network blocks that have logical and well-defined boundaries.

- Document and standardize as much as possible the interfaces between the various building blocks, to allow choice and enable use of multiple vendors.

This building block approach is useful because not all network segments have the same properties. In some segments little differentiation exists among suppliers, and there is a high degree of substitution within a building block, so enterprises can seek operational and cost advantages. For example, wired LAN switching solutions for branch offices are largely commoditized, and the difference between vendors is hard to discern in the most common use cases.

In other cases, such as in the data center networking market, there is more differentiation among vendors, and the segmentation approach ensures that enterprise architectural decisions align with IT infrastructure strategies and business requirements.

There are no hard-and-fast industry rules on where the boundaries between blocks must be drawn. Each enterprise has to split network infrastructure in a way that makes sense for them. The most common approach is segmentation around functional areas, such as data center leaf and spine switches, WAN edge, WAN connectivity, LAN core and LAN access. Each segment could further be split. For example, LAN access includes wired and wireless, while WAN edge might include WAN optimization and network security services. Another complementary segmentation boundary can be the geographical place, as a large organization with subsidiaries in multiple locations could select different vendors on a regional or country basis for some blocks. Disaggregation is creating another possible segmentation, since hardware and software can be awarded to different vendors for some solutions like white-box Ethernet switching.

Defining building blocks also protects organizations from the “vendor creep” trap. As vendors acquire small companies and startups in adjacent markets, they often encourage enterprises to add these new products or capabilities to the “standardized” solution. If the enterprise defines its foundational requirements, it can easily determine whether the new functionality truly solves a business need, and whether any additional cost is warranted.

Remove Proprietary Components From the Network to Facilitate New Vendors to Make Competitive Proposals

Employment of proprietary protocols and features inside the network limits the ability to segment the network into discrete blocks and makes this activity more difficult.

Within building blocks, it is acceptable to use proprietary technologies, as long as enterprises compare vendors against their business requirements (to avoid over-engineering) and the solution provides a real and indispensable functional advantage. It is important to express the business functionality as a requirement and not to tie requirements to specific proprietary technologies.

Between building blocks, it is critical to avoid proprietary features and use standards, since proprietary protocols favor using certain vendors and disfavor others, leading to loss of purchasing power. Sometimes it’s necessary to employ a proprietary protocol, for example:

-

To obtain functionality that uniquely meets a critical business need. If so, then it’s critical that these protocols be reviewed regularly and are not automatically propagated into new buying criteria over the long term.

-

In the early stages of market development, before standards have caught up to innovation. However, once standards exist, or the technology has started to move down the commodity curve, it is imperative that network architects and planners migrate to standards-based solutions (as long as business requirements aren’t compromised). Examples of industry standards that replace previous proprietary solutions are Power over Ethernet Plus (PoE+) and Virtual Router Redundancy Protocol (VRRP) (see Note 1).

In these cases it is essential to document and motivate the exception, so that it can be periodically reviewed. Proprietary technologies should always be avoided in the interface between the network and other components of IT infrastructure (for example, proprietary trunking to connect servers to the data center network).

Get a Technical Solution That Meets Needs at the Lowest Market Purchase Price by Competitively Bidding on Each Building Block

Dividing the network provides a clear definition of what is really needed within each building block, which in turns enables a fit-for-purpose approach and a competitive bidding process.

–>The goal is not to bid on the best technical solution for each block, but on one that is good enough to meet requirements.

This enables real competition across vendors and provides maximum price leverage, since all value-adds to the common denominator can be evaluated separately and matched with the cost difference.

By introducing competition in this thoughtful manner, Gartner has seen clients typically achieve sustained savings of between 10% and 30% and of as much as 300% on specific components like optical transceivers.

Discern the Relationships Between Networking Vendors and Network Management Vendors

You may also find that networking vendors have some level of leverage with certain other vendors specialized in network management. Therefore, it is valuable to understand the arrangement of any partner agreement and whether this can be leveraged to your organization’s benefit.

………………………………………………………………

Editor’s Closing Comment:

The advice provided above by Gartner Group seems very reasonable and mitigates risk of using only a single vendor for a network or sub-network. If so, how can any network operator or enterprise networking customer justify the single vendor SD-WAN solutions that are proliferating today?

Readers are invited to comment in the box below the article (can be anonymous) or contact the author directly ([email protected]).

……………………………………………………………………………..

References:

https://www.firemon.com/resources/collateral/avoid-these-bottom-ten-networking-worst-practices/

https://www.gartner.com/doc/3783150/market-trends-csps-approach-sdwan

Ericsson Survey: Network Operators Focus on New Markets for 5G Revenue

Survey Highlights:

Most network operators say they’re ready for “5G” even if they don’t know what it will actually deliver (the RAN and other key functions haven’t even been discussed by ITU-R WP5D for IMT 2020, let alone agreed upon), Ericsson found in a survey of wireless network operators around the world (see References and hyper-links below). Many expect the enterprise market and Internet of Things (IoT) applications to drive revenue growth from 5G technology.

More than three-quarters of the respondents said they were in the midst of 5G trials. That corresponds with research from the Global Mobile Suppliers Association research which found 81 5G trials underway in 42 countries.

23% of survey respondents plan to migrate 4G subscribers to 5G with enhanced services and revenues (but when?). Yet nearly two thirds (64%) of operators said they can’t pay for 5G by simply raising rates on consumers, because consumers are “tapped out.” Eighteen percent of respondents said they expect to monetize 5G by “expanding to new markets—enterprise/ industry segments.”

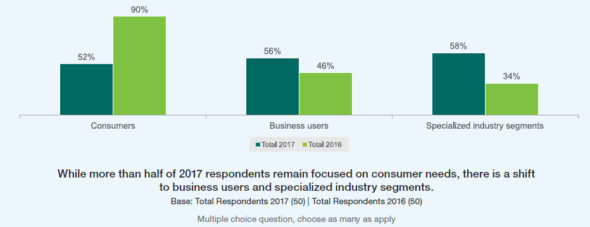

“In 2016, 90% pointed to consumers as the central segment in their planning and only 34% focused on specialized industries,” the Ericsson researchers wrote in this year’s report. An increased emphasis on the enterprise market is a key shift since a previous Ericsson 5G operator survey was conducted in 2016.

“This year, operators are seeing that the consumer market is saturated, so planning for 5G is more evenly split across specialized industry segments (58%), business users (56%) and consumers (52%),” the Ericsson researchers added.

Specific industry segments on which operators expect to focus 5G monetization efforts include media/entertainment (cited by 69% of respondents), automotive (59%), public transport (31%), healthcare (29%) and energy/ utilities (29%).

Providing industry-specific services to these industry segments will be important in 5G monetization, according to 68% of respondents. The single most important use case in the media/entertainment segment is high-quality streaming, respondents said. Other top use cases by segment included:

- Automotive: autonomous vehicle control

- Public transport: Smart GPS

- Healthcare: Remote robotic surgery

- Energy & utilities: Control of edge-of-grid generation

More than three quarters (77%) of respondents said third-party collaboration is an essential element in 5G monetization and 68% said they need to find new revenue-sharing models.

Chart courtesy of Ericsson’s 5G Readiness Survey

……………………………………………………………………………………………..

Survey Questions and Methodology:

Some of the questions asked in the survey:

-Exactly how have preparations for 5G evolved over the past year?

-Where do telcos stand now in their 5G activities and developments?

-What actions are service providers taking now in anticipation of 5G?

-What priorities drive their initiative?

-How ready are they to take leadership positions in the 5G future?

The survey’s objective was to obtain a snapshot of the state of the industry in relation to next-generation mobile technology. Last year, we struggled to find 50 executives globally who were far enough along in 5G to answer the survey questions.

This year, Ericsson says they “easily identified 50 executives, both business and technical leaders, from 37 operators around the world. As leaders of their organizations’ 5G efforts, they are at the center of the 5G evolution. That increase clearly signifies the growing recognition among industry leaders of 5G’s importance.”s

References:

https://www.ericsson.com/assets/local/narratives/networks/documents/5g-readiness-survey-2017.pdf

5G Monetization Survey: Operators Look to IoT for Revenue Growth

Verizon’s O’Byrne: NG-PON2 offers multiservice support, 40 Gbps speeds

Two years ago, we reported that “Verizon has completed a field trial of NG-PON2 fiber-to-the-premises technology that could provide the infrastructure for download speeds up to 10 Gbps for residential and business customers.”

This past January, Verizon completed its first interoperability trial of NG-PON2 technology at its Verizon Labs location in Waltham, MA. During the trial, Verizon demonstrated that equipment from different vendors on each end of a single fiber—one on the service provider’s endpoint and that the customer premises—can deliver service without any end-user impact.

In an October 16th press release in advance of the Broadband Forum’s Access Summit, Verizon said NG-PON2 represent a paradigm shift in the access space and a more certain path towards long-term success.

“Technologies such as NG-PON2 present exciting new opportunities for vendors, such as delivering residential and business services on multiple wavelengths over the same fiber,” said Vincent O’Byrne, Director of Technology at Verizon.

“Not only does NG-PON2 parse business and residential customer traffic to isolate and resolve potential problems in the network, it can also scale to achieve speeds of 40 Gbps and above,” O’Byrne added.

“Technologies such as NG-PON2 present exciting new opportunities for vendors, such as delivering residential and business services on multiple wavelengths over the same fiber,” said O’Byrne. “Not only does NG-PON2 parse business and residential customer traffic to isolate and resolve potential problems in the network, it can also scale to achieve speeds of 40 Gbps and above.”

At the Broadband Forum’s Access Summit, The Verizon executive will address how the fiber access space is constantly evolving, with emerging PON technology providing solutions to some of the issues around cost and reliability during the Broadband World Forum, at the Messe Berlin on Tuesday, Oct. 24th.

Verizon has been an active participant in driving awareness about how NG-PON2 can work in a real-world carrier environment. The company completed NG-PON2 interoperability with five vendors for its OpenOMCI (ONT Management and Control Interface) spec, bringing it one step closer toward achieving interoperable NG PON systems.

The mega telco plans to offer it’s own OpenOMCI specification [1], which define the optical line terminal (OLT)-to-optical network terminal (ONT) interface, to the larger telecom industry.

Note 1. OpenOMCI specification was developed and is owned by Verizon, rathr than a formal standards/spec writing body like the ITU-T or Optical Internetworking Forum (OIF). Is this the new way of producing specs (like “5G” used in trials)?

……………………………………………………………………………………

Bernd Hesse, Chair of the Broadband Access Summit and Senior Director Technology Development at Calix, said:

“We will be exploring NG-PON2 in depth and the use cases that underpin the decisions to deploy them. I look forward to the debate, hearing from the experts in the industry and welcoming the community to these new Forum events.”

Frost & Sullivan: 5G Connectivity to Disrupt Global Industries, Economies & Markets

Editor’s Note:

There’s certainly no shortage of 5G reports predicting some combination of utopia and nirvana. The Frost & Sullivan report described here is one of them.

Perhaps the reader should reflect on all the pie in the sky predictions for all optical networks in the 1998-2001 time frame which to this day have not been even remotely realized. With that caveat in mind, enjoy this Frost & Sullivan press release for their new 5G report!

………………………………………………………………………………………………

5G: The Foundation for a Hyper-Connected World

by Frost & Sullivan and and Principal Financial Group

The expected transition to 5G, the next generation in mobile communications, will bring new startups, new competitive intensity, and the development of new platforms and business models, according to a report released today by Frost & Sullivan and Principal Financial Group.

The collaborative whitepaper titled, 5G: The Foundation for a Hyper-Connected World, predicts that 5G will result in a period of industry disruption and vertical realignment in a massive portion of the global economy, which is likely to impact investors’ portfolios. The paper is the first in a series on 5G, which takes a multifaceted look at how this technology will prompt the next wave of technological innovation and shape investment opportunities in the coming years.

To download the full whitepaper, please visit: http://frost.ly/1vs

Here’s an excerpt:

5G will be a world in which more and more objects are connected online, making our homes, cities, farms, and factories more efficient. Where adopted, 5G will be a critical enabler of innovation, bringing new products and services to market that will help people live better while also increasing productivity in sectors such as manufacturing and healthcare. Within this world, investment opportunities and threats will inevitably emerge, prompting critical questions around timing, location, and which industries stand to benefit the most.

“Disruption brings with it the potential to find strong growth prospects. However, with 5G, as with any new technology, investors must remain realistic. Although 5G will improve people’s lives and strengthen productivity, rollout will take time,” said Richard Sear, partner and senior vice president of Frost & Sullivan’s Visionary Innovation Group. “It will likely be a decade or more until the widespread economic impact of 5G can be fully measured. Finding opportunities will rely on ongoing, active monitoring of regional, government, and industry landscapes.”

It is expected that 5G connectivity will affect every industry as more data will be transmitted at faster rates. This will allow for innovative and advanced applications—many of which have yet to be conceived. Successful long-term investment strategies will place a premium on those industries, companies, and countries that establish clear use cases for 5G early on and that position this technology as a strategic complement to additional pursuits such as artificial intelligence, big data, and machine learning.

“The effect that 5G will have on the speed of technological implementation is hard to quantify today. What we do know is that this technology will further enable developing economies to close the gap with developed markets,” said Jim McCaughan, chief executive officer for Principal Global Investors, the asset management arm of Principal. “5G, coupled with strong middle class expansion in these emerging markets, will create interesting opportunities for investors, while also leading to the development of new, tailored financial solutions.”

…………………………………………………….

A related Frost & Sullivan report on 5G network testing can be read here.

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today’s market participants. For more than 50 years, we have been developing growth strategies for the global 1000, emerging businesses, the public sector and the investment community. Is your organization prepared for the next profound wave of industry convergence, disruptive technologies, increasing competitive intensity, Mega Trends, breakthrough best practices, changing customer dynamics and emerging economies? Contact us: Start the discussion

ABI Research: MIMO starting to realize its full potential in LTE Advanced networks

As LTE progresses to more advanced versions such as 3GPP standard LTE-Advanced, LTE-Advanced Pro and the recently marketed Gigabit LTE, ABI Research expects that MIMO [1] will become an increasingly important part of mobile network operators’ options in their evolution to 5G (officially known as IMT 2020).

While MIMO has not delivered on its promises so far, no doubt exists that the technology will become a foundational building block for mobile networks in the evolution to 4G/5G, and advanced antenna systems will receive increasing attention and research and development (R&D) by both vendors and MNOs.

Advanced antenna systems, including complex passive antennas and large-scale active antennas, will become part of the roadmap to advanced LTE and 5G, according to ABI Research.

Note 1. Long term evolution (LTE) is based on Multiple Input Multiple Output (MIMO)-Orthogonal frequency-division multiplexing (OFDM) and continues to be developed by the 3rd Generation Partnership Project (3GPP).

OFDM is a frequency-division multiplexing (FDM) scheme used as a digital multi-carrier modulation method. A large number of closely spaced orthogonal sub-carrier signals are used to carry data on several parallel data streams or channels.

……………………………………………………………………………………….

LTE Advanced (true 4G before the term was hijacked by marketing heads) adds support for picocells, femtocells, and multi-carrier channels up to 100 MHz wide. LTE has been embraced by both GSM/UMTS and CDMA operators.

………………………………………………………………………………………

ABI Research thinks that Massive MIMO will be a key feature of 5G and deploying advanced MIMO for 4G-LTE is a long-term investment which will prepare the ground for the deployment of the next generation of networks.

“While MIMO has not delivered on its promises so far, we are left with no doubt that the technology will become a foundational building block for mobile networks in the evolution of 4G and 5G and advanced antenna systems will receive increasing attention and R&D by both vendors and MNOs,” says Nick Marshall, Research Director at ABI Research. “We expect increasing acquisition activities in the antenna market, particularly involving MIMO technology.”

Overall the installed base of MIMO-enabled LTE antennas will grow by more than double worldwide from 2017 to 2021 to reach almost 9 million, with the Asia Pacific region outpacing this with a growth rate of three times. The Asia Pacific region will grow to represent most of the market by 2021. Although the MIMO-enabled LTE platform retains the largest installed base through 2021, growing by a factor of almost two times, it is the MIMO-Enabled LTE-Advanced platform growing at a faster rate and MIMO-enabled LTE-Advanced Pro at almost six times which rise rapidly to match the scale of the earlier MIMO-enabled LTE platform. The cellular antenna market forms a very dynamic and innovative ecosystem with many vendors including Amphenol, Comba, CommScope, Huawei, Kathrein and RFS all competing to include these advanced multi-antenna features,

“Advanced antenna systems including complex passive antennas and large scale massive MIMO active antennas will become part of the roadmap to advanced LTE and 5G,” concludes Marshall. “The need for active antennas when MIMO becomes more advanced will also change the market map, which has largely depended on passive antennas for previous generations.”

These findings are from ABI Research’s “Evolution of MIMO in LTE Networks“ report. This report is part of the company’s Mobile Networks Service research service, which includes research, data, and analyst insights.

For more info,including an Executive Summary:

https://www.abiresearch.com/market-research/product/1026964-evolution-of-mimo-in-lte-networks/#

About ABI Research:

ABI Research stands at the forefront of technology market intelligence, providing business leaders with comprehensive research and consulting services to help them implement informed, transformative technology decisions. Founded more than 25 years ago, the company’s global team of senior and long-tenured analysts delivers deep market data forecasts, analyses, and teardown services. ABI Research is an industry pioneer, proactively uncovering ground-breaking business cycles and publishing research 18 to 36 months in advance of other organizations. For more information, visit www.abiresearch.com.

Backgrounder:

COMPLIMENTARY TUTORIAL ON MMWAVE AND MASSIVE MIMO

http://www.comsoc.org/blog/complimentary-tutorial-mmwave-and-massive-mimo