Month: March 2013

Sprint in Deal with U.S. Law Enforcement to Restrict China Gear, especially from Huawei

Seeking to address national security concerns, Sprint Nextel and SoftBank, its Japanese suitor, are expected to enter an agreement with American law enforcement officials that will restrict the combined company’s ability to pick suppliers for its telecommunications equipment and systems, government officials said on Thursday.

The agreement would allow national security officials to monitor changes to the company’s system of routers, servers and switches, among other equipment and processes, the officials said. It would also let them keep a close watch on the extent to which Sprint and SoftBank use equipment from Chinese manufacturers, particularly Huawei Technologies. The government officials spoke about the possible agreement on the condition of anonymity because negotiations are continuing. SoftBank, one of Japan’s biggest cellphone companies, is offering to buy majority control of Sprint for $20.1 billion.

While common to most technology investments in the United States by foreign companies, such agreements have come into sharper focus recently because of accusations by United States government officials of espionage by foreign countries.

SoftBank and Sprint have already assured members of Congress that they will not integrate equipment made by Huawei into Sprint’s United States systems and will replace Huawei equipment in Clearwire’s network. Clearwire is a discount cellphone firm Sprint is seeking to buy.

Masayoshi Son, the Chairman and CEO of SoftBank; Daniel Hesse, CEO of Sprint; and Erik Prusch, CEO of Clearwire, jointly sought to reassure United States officials that the merged company would take the steps necessary to ensure that its networks would not endanger United States communications networks.

Representative Mike Rogers, Republican of Michigan and chairman of the House Permanent Select Committee on Intelligence, said on Thursday that he also met this month with the company executives, who promised him that they would not use equipment from Huawei.

“I expect them to make the same assurances before any approval of the deal” by national security officials, Mr. Rogers said. “I am pleased with their mitigation plans but will continue to look for opportunities to improve the government’s existing authorities to thoroughly review all the national security aspects of proposed transactions.”

A recent report by the intelligence committee identified Huawei and the ZTE Corporation, another Chinese equipment provider, as possible security risks. The report cited the companies’ potential ties to Chinese intelligence or military services.

References:

http://arstechnica.com/security/2013/03/sprint-softbank-to-shun-chinese-networking-equipment/

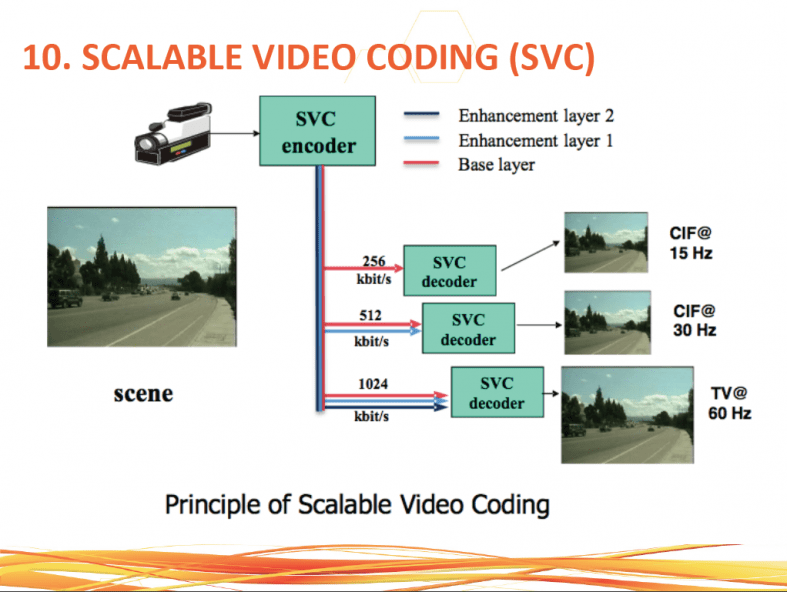

Technologies that will offer higher quality viewing experience & enable new OTT services

Oracle Acquires Tekelec to Pursue Telco Market: Manage, Control & Analyze IP Traffic

Less than two months after buying Acme Packet, Oracle has announced that it has agreed to acquire Tekelec, a leading provider of network signaling, policy control, and subscriber data management solutions for communications networks. The company has also been an innovator in IP traffic shaping.

Tekelec specializes in critical elements of the modern IP carrier network where the networking and IT software operations converge. This is the area where Oracle sees its opportunity to expand in the telco market – by bringing its data center and IT systems to telecos and taking on incumbent telco vendors like Ericsson.

Financial terms of the deal were not disclosed. Tekelec has been considered a potential acquisition target since it went private in November 2011. It was then acquired by a group led by private equity firm Siris Capital for $761m, a deal which many believed undervalued the company. Tekelec made a name for itself in the 1980s and 1990s by specializing in test equipment and then converting to a VoIP software company.

Last month, Oracle paid $1.7bn for Acme Packet, which specializes in VoIP and IP traffic equipment, notably session border controllers. We analyzed that transaction in this article: https://techblog.comsoc.org/2013/02/04/oracle-buys-acme-packet-for-2-1-billion-to-provide-converged-systems-solution

It appears that Oracle is building a group of software technologies which help network operators control and manage IP traffic and analyze it in detail, in order to impose policies such as offload or premium charging – increasing the ability to monetize the exploding traffic. In particular, it is now a major force in signalling, taking players like F5, which acquired Diameter specialist Traffix over a year ago. With the Tekelec and Acme Packet acquisitions, Oracle will be in a better position to compete with Cisco Systems, which has recently bought policy management firm BroadHop.

“In an increasingly mobile and social world, customer experience is about optimizing network performance and personalizing services based on what engages, moves, and inspires people,” said Ron de Lange, president and CEO, Tekelec, in a statement. “Together with Oracle, we expect to accelerate the pace of service innovation by helping service providers transform the way they manage and monetize the explosive growth in signaling and data traffic on their networks.”

“Oracle has in the past partnered to provide these capabilities, but by bringing them in house it will have more opportunity

to shape the roadmap and combine the capabilities in a more tightly-coupled solution,” wrote Ovum principal analyst Dana Cooperson in a research note. “Expect Oracle’s telecom focused competitors (Alcatel-Lucent, Huawei, Ericsson) and its IT-focused competitors (HP, SAP, SAS Institute) to do more strategic soul searching and, as their financial situation allows, to pursue acquisitions of their own.”

“As connected devices and applications become ubiquitous, intelligent network and service control technologies are required to enable service providers to efficiently deploy all-IP networks, and deliver and monetize innovative communication services,” said Bhaskar Gorti, general manager of Oracle Communications, in a statement.

In addition to its software products, Tekelec owns hundreds of patents and applications in the communications space. This is an area that Oracle has not hesitated to explore in the courtroom, and given the billion-dollar-plus sums involved in some patent battles, this could have bumped up the pricetag for Tekelec somewhat higher.

References:

http://www.oracle.com/us/corporate/acquisitions/tekelec/index.html

http://www.rethink-wireless.com/2013/03/26/oracle-bolsters-telco-assault-tekelec-buy.htm

FBR: SDN’s impact on the networks deployed by service providers and large enterprises

FBR’s research leads them to believe that the next generation of network and datacenter hardware will blur the boundaries between routing, switching, and computing, providing a single hardware platform on which network and computing functions will be delivered through software applications.

• Drive power efficiencies from a total platform perspective.

• Lower the overall datacenter footprint.

• Seek to eliminate redundant or nonessential hardware and components.

• Commoditize hardware, thus driving value into “select” software and semiconductors. This new hardware attempts to eliminate the need for custom, purpose-built hardware (example: routers, switches), instead replacing this with a common but versatile computing/switching platform.

• Drive the commoditization of hardware through the scaled use of non-branded component based hardware solutions in distributed datacenter architectures (i.e., white box servers, switches provided by reference designs from the Open Compute Project [OCP]).

• Attempt to replace ASICs with “open” merchant silicon and/or drive advanced functionality into general purpose CPUs (i.e., OpenFlow enables the transfer of the control plane into the CPU).

• Seek to utilize and optimize “open source” software and hardware alternatives (OpenFlow, OpenStack, OpenCompute hardware reference designs).

• Increase infrastructure flexibility through a software approach (example: network function virtualization).

Source: BIG “switches:” little SERVERS–FBR’s Holistic View of the Coming Datacenter, written by FBR Technology, Media & Telecom research group

Subject: SDN: New Approach to Networking

Subject: The Open Networking Foundation

http://www.ewh.ieee.org/r6/scv/comsoc/ComSoc_2012_Presentations.php

Wireless Infrastructure Market and Carrier WiFi integration with cellular networks

The wireless network infrastructure market is currently in a phase of transition as mobile network operators seek to address increasing mobile traffic demands amidst global economic uncertainties. This paradigm shift is bringing new challenges and opportunities to wireless infrastructure vendors.

In 2011, global 2G , 3G and 4G wireless infrastructure revenues were $45.9 billion. Signals and Systems Telecom (http://www.snstelecom.com/) estimates that these revenues increased 8 percent year on year (YOY) reaching $49.7 billion by end of 2012, primarily driven by LTE investments. However, between 2012 and 2017, the market is expected to shrink to $48.6 billion. That’s because of the decline in operator spending on 2G and 3G network infrastructure, network management and related software.

Although, the new wave of 4G-LTE macrocell Radio Access Network (RAN) and core network investments will not be able to compensate the overall declines in 2G and 3G equipment sales, operators are expected to significantly increase their spending in the evolving small cell and carrier WiFi equipment market. Small cell and WiFi offload equipment will represent a market of $5.4 billion in 2017. Consequently the small cell and WiFi offload market segment is attracting considerable attention from both established vendors as well as startups which solely focus on the small cell market.

However, carrier WiFi will NOT be supported by all operators. For example, Sprint and Verizon Wireless have no definitive plans to operate carrier WIFi networks. Market research firm Informa #1 Trend for 2013 was that Wi-Fi will become a victim of its own success

“There will be a shift in operator sentiment away from public Wi-Fi as it becomes evident that the growing availability of free-to-end-user Wi-Fi devalues the mobile-broadband business model. Mobile operators will respond by articulating the value of their cellular networks better, but others not affected by this trend will double down on their public Wi-Fi investments to continue to propel the deployment and monetization of Wi-Fi.”

Based on it’s WiFi/cellular integration demo at the 2013 Mobile World Congress, Telefonica d’Espagne seems to be 100% committed to Carrier WiFi. And so is ATT&T based on their Wayport acquisition in 2008. AT&T might be in the best position to provide access to a worldwide Wi-Fi network. In that scenario, customers would pay a set amount (maybe $5 or $10 a month) for that capability. The fact that no one has a fixed monopoly on Wi-Fi makes this a difficult trend for mobile operators to control.

Republic Wireless, a mobile virtual network operator, has created a service that primarily relies on Wi-Fi for connectivity and defaults back to the cell network. Republic sells its service for $19 a month, far less than what people pay carriers. Thus, if carriers seek to monetize their Wi-Fi offerings they are going to have to figure out how to create a service that’s better than what most users cobble together on their own.

IEEE ComSocSCV had a great technical meeting debating the pros and cons of Carrier WiFi along with the new features and functions of IEEE 802.11ac. Presentos will be posted at the archive section of the Chapter’s web site: http://comsocscv.org

Bell Labs (ALU) narrows its R&D focus to be more product-oriented & realize "near term gains"

What’s left of Bell Laboratories is focusing on software product development on behalf of its parent company, Alcatel-Lucent. “We want to still be the innovation arm of Alcatel-Lucent (ALU) that continues to amaze and surprise people. But I think in order to do that we do have to change somewhat,” said Bell Labs’ Gee Rittenhouse. He added, “As the industry moves toward dynamic networks, distributed systems, Bell Labs also has to move toward those directions.”

Last month, ALU appointed Rittenhouse as the new leader of the nearly 90-year-old Bell Labs, known for inventing the first transistor, along with a whole host of other technological innovations and discoveries. During his tenure, Rittenhouse plans to steer Bell Labs more toward software products related to networking and cloud computing.

Increasingly, Bell Labs is collaborating with outside partners to solve major technological problems facing the IT industry. One such effort is the GreenTouch Consortium, which is focused on dramatically reducing the power needs of today’s telecommunication networks. Bell Labs and Alctatel-Lucent’s rivals like Huawei and ZTE, among others, are members of the group.

To bring more products to the market, Rittenhouse said Bell Labs will choose long-term projects that can result in near-term gains for the market. Although he declined to reveal specific projects at Bell Labs, he pointed to “immersive communication” as one area the research division has heavily invested time in. This involves examining what makes face-to-face conversations genuine, and how that experience can be replicated over long-distance communication.

“So research in applications, multimedia is just as important as research in physics,” Rittenhouse said. “Because if you are only in math, physics, optical, you are missing this big sea change,” he added.

http://www.cio.com/article/730268/Bell_Labs_Aims_At_Getting_More_Products_to_Market_Faster

http://www.computerworld.com/s/article/9237625/Bell_Labs_hopes_to_get_more_products_to_market_faster

AW Comment: The days of pure research are long gone. Today, companies have a very short time horizon and must get product to market quickly to maintain a competitive edge. This is especially true in the telecom equipment business, where low cost Chinese vendors Huawei and ZTE, have taken considerable market share from the previous incumbents and forced some (e.g. Nortel) out of business.

Here are a few articles on Bell Labs as the standard for innovation (may no longer be true):

http://www.physicstoday.org/daily_edition/science_and_the_media/is_legendary_bell_labs_the_us_s_gold_standard_for_innovation

http://viodi.com/2012/04/06/computer-history-museum-event-summary-the-idea-factory-bell-labs-and-the-great-age-of-american-innovation/

http://www3.alcatel-lucent.com/wps/portal/!ut/p/kcxml/04_Sj9SPykssy0xPLMnMz0vM0Y_QjzKLd4w3MXMBSYGYRq6m-pEoYgbxjggRX4_83FT9IH1v_QD9gtzQiHJHR0UAaOmbyQ!!/delta/base64xml/L3dJdyEvd0ZNQUFzQUMvNElVRS82X0FfNDZL

http://www.lgsinnovations.com/about-us/bell-labs

http://www.nytimes.com/2012/02/26/opinion/sunday/innovation-and-the-bell-labs-miracle.html?pagewanted=all&_r=0

France Telecom & Vodafone team up to challenge Telefonica in Spain’s FTTH/High Speed Broadband Access market

France Telecom (FT)/Orange and Vodafone will invest up to up to 1 billion euros (=$1.3 billion) in the joint development of a fiber optic network in Spain, Vodafone-Spain’s Antonio Coimbra told Reuters on March 13th. The Financial Times reports that Vodafone and FT/Orange plan to offer their own high speed broadband services to customers, in addition to bundled services with mobile, fixed line and TV that are becoming increasingly important in gaining and keeping customers. The fiber-to-the-home network will reach 800,000 households and workplaces by March 2014, 3m by September 2015, and 6m by 2017.

The new network will challenge Telefónica d’Espagna in the high-speed broadband access market. But the deal will still need permission to use Telefónica’s network to reach individual homes. The planned jointly built fiber optic network is intended to reach 6m premises across 50 major cities by September 2017. Vodafone and FT/Orange will each deploy fiber optics in separate but complementary areas to share the network scale. The fiber optic lines will be owned independently but will work as a single network. The combined capital expenditure needed to reach 6m homes and workplaces is expected to reach €1bn, according to the companies.

Vodafone, which has traditionally been viewed as a purely mobile operator, has slowly established a pan-European fiber optic network through either partnering existing fixed line owners, building its own network as in Portugal or buying companies with fibre or cable assets. Vodafone and FT/Orange said that the agreement would increase the efficiency of fiber optic deployment and maximize returns on investment for both operators. The agreement is also open to third parties willing to co-invest.

Paolo Bertoluzzo, chief executive of Vodafone’s Southern Europe region, said: “This agreement demonstrates Vodafone’s commitment to provide high-speed unified communications services to our customers coupled with our willingness to invest when there are positive returns.”

http://www.ft.com/intl/cms/s/0/fbd182cc-8bf0-11e2-b001-00144feabdc0.html

KC FTTH network was described at the Feb 13th ComSocSCV meeting. Ken Pyle of

Viodi View wrote: “A step function improvement in capability,” is how Milo Medlin described Google’s Kansas City fiber project at the February 13th IEEE ComSoc meeting in Santa Clara. That huge improvement in customer experience is in contrast to the incremental gains of MSO [Multiple System Operator] and telco broadband networks which have much lower access speeds. Medlin, who is VP of Access for Google, described a Gigabit/second fiber network that eliminates the bottleneck between the home and the cloud, unleashing new applications and devices both in the home and by implication, throughout a city. Google’s biggest innovation may not be in technology, but it in its ability to improve the provisioning process, create a simplified offering and use grass-roots marketing to promote its high speed fiber access

offering. The story of Google Fiber is pretty well-known by now. Google issued an RFI a couple of years ago to which 1,100 cities responded he test bed for Google’s fiber to the home project. What isn’t so well-known is that the motivation for this was the middling price/bandwidth performance of the U.S. as compared to other countries.

Mobile World Congress (MWC) 2013 Report: OTT Services & LTE Networks

Source: Wireless Intelligence

Mobile Network Operators face up to regulatory and OTT challenges

Many of the operator CEOs speaking at the 2013 MWC in Barcelona commented on the phenomenal pace the industry is currently moving. But what was also apparent was how those same network operators have been much slower than over-the-top (OTT) players, OS developers and in some cases device manufacturers in taking advantage of the opportunities that these changes have brought about.

Taking advantage of rapidly increasing smartphone penetration, OTT messaging services such as Viber, WhatsApp and KakaoTalk have grown exponentially during the past year. Operators have been unable to respond quickly to the challenge of these IP-based players and are feeling the effect in their SMS (texting) ARPUs. Network operator CEOs object that OTT players benefit directly from operator investment in networks without incurring any of their own costs. According to CEO Talmon Marco, Viber, whose users have increased to more than 170 million from 90 million in July 2012, costs just $200,000 per month to run.

As well as the OTT threat, operators voiced concern that excessive regulation and inefficient spectrum allocation were hampering their efforts to develop the infrastructure required to satisfy the everincreasing demand for data.

Key Data Points:

• Network Operators stressed that the regulatory environment needs to be in sync with network investment cycles in the

industry

• Network Operator revenues are stagnating in developed markets, but increasing capex is required to build out 4G LTE infrastructure

• OTT players are eating into operator revenues, and they benefit from operator investment at no cost to themselves

• Current regulation seeks to increase competition but operators say there is too much competition in many countries already, especially in Europe

Spectrum was also high on the agenda for operators, with GSMA chairman Franco Bernabè calling for more efficient allocation as well as greater harmonisation of spectrum for LTE. These are crucial issues, notably in Europe where LTE technology currently accounts for less than 1% of mobile connections in the region – compared to more than 10% in North America, Japan and South Korea.

Operators require a portfolio of frequency bands to ensure that economically viable infrastructure solutions can be deployed nationwide. At present, pieces of the puzzle are missing, with digital dividend frequencies yet to be assigned in several European countries. Availability of spectrum in the 800 MHz band in the region is critical to ensure that LTE coverage is sufficient to meet escalating demand for data services.

There were a number of announcements from European operators focused on network expansion to accomodate greater demand for mobile data services.

Key Data Points:

• O2 UK announced a partnership with Ericsson to deploy LTE this year

• In the UK, EE announced that around a quarter of its customers living within range of its 4G LTE network have upgraded to one of its 4G plans

• O2 Germany is launching an LTE network in Munich and Berlin on 31 March 2013, followed by four other large cities in Q2 2013

• Unlike its competitors that started by covering ‘white spot areas’ (rural zones underserved with broadband connectivity) under licence obligations, O2 Germany says it will focus on large cities

• Vodafone Germany already reports 60% LTE coverage by area and said that 20 million households now have access to its highspeed network

• Telstra claimed that demand for LTE is exploding as one in five Australian smartphone owners plan to buy a 4G handset in the next 12 months. There are 19 LTE devices available on the market

• Telstra has sold 1.5 million 4G LTE devices since September 2011 and aims at increasing coverage to two thirds of the population by June 2013

• China Mobile claimed that its TD-LTE network will be launched in Q3 2013

LTE pricing models vary between operators and regions. Most operators in North America focus on consumption-based tariffs while operators in Europe tend to include a speed-based element to their data plans. In the latter region, competition is intensifying around LTE tariffs, notably with operators such as 3 (Hutchison) promising no LTE premium to consumers in the UK.

O2 Germany claimed that “the German consumer is comfortable with paying for quality of service and different speeds

with data”. The operator unveiled four new O2 Blue tariffs aimed at smartphone users that will better prepare it for an LTE future. The two premium plans support download speeds of rates up to 50 Mb/s and data allowances of up to 5 GB, as well extra SIM cards to enable data to be shared between a smartphone and tablet or laptop. The entry-level plan starts at €19.99 per month, while unlimited voice and SMS is included in all new plans. Bolt-on options are also provided to

enable subscribers to add extra data at LTE speeds.

Wi-Fi hotspots occupy an increasingly important place in the data-centric world that mobile operators are creating, to help manage mobile data traffic, network capacity and high-speed data network coverage. Telefónica demonstrated during Congress a technology that enables smartphone and tablet users to move between Wi-Fi and mobile networks without losing coverage, and said this service could be available in the next year.

http://www.telefonica.com/en/descargas/mwc/np_20130226_4G-WiFi.pdf

Sunil Bharti Mittal, Chairman of Bharti Airtel (India), challenged network infrastructure vendors to offer integrated networks with support for both TD-LTE and FDD LTE technologies – alongside support for various frequency bands – in order to control its infrastructure cost. Bharti has over 20,000 TD-LTE customers in India, and is looking to deploy the technology in the 1800 MHz band using the FDD LTE variant in the near future.

For the complete report, visit:

https://wirelessintelligence.com/files/analysis/?file=130307-mwc-wrap-up.pdf

On 11 March 2013, Yankee Group presented their Mobile World Congress Wrap-Up webinar. You can replay that Yankee Group webinar at:

http://blogs.yankeegroup.com/2013/03/11/webinar-mobile-world-congress-wrap-up/

There are other webinars shown on the top of that website which may be of interest to our readers.

Google’s white space spectrum database makes its debut

Google is launching its U.S. White Space spectrum database today in a 45-day public readiness trial, becoming the third player to do so, after Telcordia and Spectrum Bridge completed their trials. The data base provides data on TV broadcast frequencies not in use that are available for short-range device access.

In addtion to Spectrum Bridge and Telcordia, there are another 10 companies approved to run databases – including Microsoft – but Google is interesting because it’s one of the biggest brands involved and has previously suggested that, unlike the competition, it won’t charge for access to its data.

For more info, go to:

http://www.theregister.co.uk/2013/03/04/google_white_spaces/

References:

http://viodi.com/2012/11/13/google-advocates-unlicensed-spectrum-sharing-via-tv-white-spaces-for-wireless-broadband-access/

https://techblog.comsoc.org/2012/11/14/summary-of-nov-2nd-wireless-symposium-sponsored-by-joint-venture-silicon-valley