Month: August 2023

Ericsson: Global 5G subscriptions close to 1.3 billion in Q2-2023

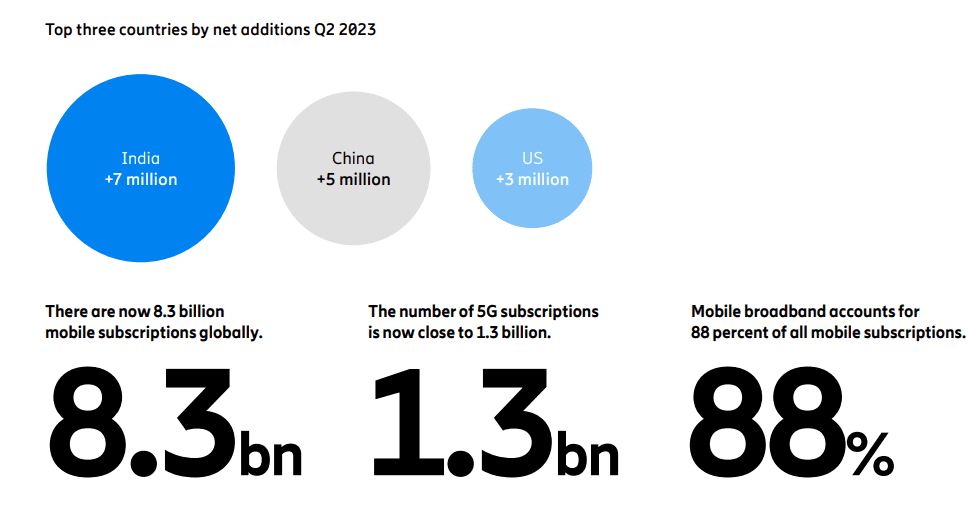

According to Ericsson’s Mobility Report update, approximately 260 communications service providers (CSPs) have launched commercial 5G services. About 35 CSPs have launched 5G standalone (SA) networks. The Q2-2023 additions bring the global number of 5G subscriptions close to 1.3 billion.

India continues to lead the world in 5G subscription growth rate with more than seven million of the 175 million global subscriptions added between April and June (the second financial quarter – Q2) 2023 accounted for in the country.

China had the second highest country growth rate with more than five million 5G additions during Q2.

The United States was in third place with more than three million 5G subscription additions.

The four-page August 31 update is an addendum to the full edition of the Ericsson Mobility Report, published in June 2023. It focuses on recent updates to the quarterly subscription and traffic data sections.

Other information in the Q2-2023 update includes:

- In Q2 2023, the number of mobile subscriptions totalled 8.3 billion, with a net addition of 40 million subscriptions during the quarter. The number of unique mobile subscribers is 6.1 billion.

- Global mobile subscription penetration was 105 percent.

- The number of mobile broadband subscriptions grew by about 100 million in the quarter, totalling 7.4 billion, a year-on-year increase of five percent. Mobile broadband now accounts for 88 percent of all mobile subscriptions.

- Mobile data traffic grew by 33 percent between Q2 2022 and Q2 2023.

- 4G subscriptions increased by 11 million, totalling about 5.2 billion and representing 62 percent of all mobile subscriptions.

- WCDMA/HSPA subscriptions declined by 85 million and GSM/EDGE-only subscriptions dropped by 59 million during the quarter. Other technologies fell by about two million.

References:

https://www.ericsson.com/en/news/2023/8/emr-q2-2023-update

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/june-2023

Ericsson Mobility Report: 5G monetization depends on network performance

Ericsson Mobility Report: 5G subscriptions in Q2 2022 are 690 million (vs. 8.3 billion total mobile users)

June 2022 Ericsson Mobility Report: 5G subscriptions increased by 70 million in Q1-2022 to reach 620 million

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

5G network slicing [1.] use cases are still few and far between, mainly because so few 5G telcos have deployed the 5G SA core network which is mandatory for ALL 3GPP defined 5G features and functions, such as network slicing and 5G security.

ABI’s 5G network slicing and cloud packet core market data report found that growing ecosystem complexity and ongoing challenges with cloud-native tooling adoption have placed increased pressure on new service innovation, like 5G network slicing. ABI expects the 5G network slicing market to be worth US$19.5bn in value by 2028. Considering existing market activities, a growing force behind 5G slicing uptake is enhanced mobile broadband (eMBB) and fixed wireless access (FWA). To that end, there is growing market activity and commercial engagements from network equipment vendors (NEVs) Ericsson, Huawei, Nokia, and ZTE, among other vendors. ABI regards these market engagements as representing a good foundation for the industry to match 5G slicing technology to high-value use cases, such as enhanced machine-type communication and ultra-reliable low-latency communications.

Note 1. A network slice provides specified network capabilities and characteristics – or multiple, isolated virtual networks – to fit a user’s needs. Although multiple network slices run on a single physical network, network slice users are sometimes (depending upon the access level of the individual) authenticated for only one network level, enabling data and security isolation and a much higher degree of security. Individuals can be sanctioned for more than network level. Each slice spans multiple connected components that form a network, components that include physical computing, storage and networking infrastructure. These are virtualized, and protocols are set in place to create a specific network slice for each user or application. This means that varying types of 5G traffic, such as video streaming, industrial automation and mission-critical applications, all can be accommodated on the same network, yet each has its own dedicated resources and performance guarantees.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

“5G Slicing continues to promise new value creation in the industry. However, as reflected in multiple ABI Research’s market intelligence reports, a solid software and cloud-native foundation must be in place for that promise to materialize. That, in turn, is a prerequisite for a wider diffusion of 5G core adoption, an architecture that provides native support for 5G slicing,” explains Don Alusha, Senior Analyst at ABI Research.

Image Credit: Viavi Solutions

From a network architecture perspective, ABI said two modalities are emerging to deploy 5G slicing. The first one is to share the whole infrastructure spanning radio access network (RAN), core, physical devices and physical servers. This, said the analyst, constitutes a unified resource pool, the basis of which can be used to instantiate multiple logical connectivity transmissions.

A second approach is to provide hardware-based logical slices by slicing the physical equipment. The analyst cautions that this is a time-consuming, resource-intensive endeavor, but said it may be the best option for mission-critical services. It requires slicing the physical transmission network and oftentimes a dedicated user plane.

“Horizontal integration for cross-domain interoperability is critical going forward. Equally important is vertical integration for 5G slicing lifecycle management of multi-vendor deployments. There is ongoing market activity for the 5G core network penetration and maturity of 5G slice management functions. To that end, enterprises will seek to create and reserve slices statically and on-demand. They also want to efficiently integrate with cloud providers through open and programmable Application Program Interfaces (APIs) to enable hybrid cloud/cellular slice adoption. NEVs and other suppliers (e.g., Amdocs, Netcracker, etc.) offer solutions enabling CSPs to create fully automated and programmatic slicing capability over access, transport, and core network domains,” Alusha concludes.

These findings are from ABI Research’s 5G Network Slicing and Cloud Packet Core market data report. This report is part of the company’s 5G Core & Edge Networks research service, which includes research, data, and analyst insights. Market Data spreadsheets comprise deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight into where opportunities lie.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

T-Mobile US, the only U.S. carrier that has deployed 5G SA core network, has recently shared details of what it claims is “first use of 5G network slicing for remote video production on a commercial network,” which took place during Red Bull’s cliff diving event in Boston, MA. This customized slice gave the broadcast team supercharged wireless uplink speeds so they could easily and quickly transfer high-resolution content from cameras and a video drone circling the event to the Red Bull production team in near real-time over T-Mobile 5G. The uplink speed was up to 276 Mbps!

T-Mobile says they can also use network slicing for specific application types for enterprise customers across the U.S. Earlier this month they launched a first-of-its-kind network slicing beta for developers who are working to supercharge their video calling applications with the power of 5G SA. With a customized network slice, developers can sign up to test video calling applications that require consistent uplink and downlink speeds along with increased reliability. In the weeks since, we’ve seen tremendous interest from the developer community with dozens of companies large and small signing up to join the likes of Dialpad, Google, Webex by Cisco, Zoom and more.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Vodafone recently worked with Ericsson to provision network slices optimized for cloud gaming. In January, Samsung and KDDI announced the successful demonstration of Service Level Agreements (SLA) assurance network slicing in a field trial conducted in Tokyo, Japan. Yet there’s hardly a flood of real-world use cases (see References below).

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.abiresearch.com/market-research/product/market-data/MD-SLIC/

https://www.computerweekly.com/news/366550353/5G-network-slicing-value-hits-19bn-but-growth-stalls

https://www.t-mobile.com/news/network/its-time-to-unleash-network-slicing

https://www.viavisolutions.com/en-us/5g-network-slicing

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

GSA 5G SA Core Network Update Report

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Japan network operator KDDI announced today that it has signed an agreement with SpaceX to introduce satellite-to-cellular service in Japan. Leveraging SpaceX’s Starlink low earth orbit (LEO) satellites and KDDI’s extensive national wireless spectrum, this partnership aims to enhance cellular connectivity in areas, including remote islands and mountains that have been traditionally hard to reach using conventional 4G and 5G networks.

The partnership is slated to introduce SMS text services as the initial step, starting as early as 2024. At a later date, voice and data services will follow suit. The company also announced the service will work with almost all existing smartphones on the KDDI network.

The service is planned to be provided based on the establishment of radio-related laws and regulations in Japan.

Source: SpaceX

…………………………………………………………………………………………………………………………………

SpaceX first announced plans to provide cellular connectivity with T-Mobile in the US last year. At the time Elon Musk invited other companies to join them, and while there were no immediate takers, KDDI is now the third company to sign a deal.

Earlier this year New Zealand’s telecommunications company, One NZ (formerly known as Vodafone), announced it has signed an agreement with SpaceX to offer mobile coverage across the country, eliminating cellular dead zones.

KDDI and SpaceX also invite carries worldwide to join the ecosystem of mobile network operators bringing next generation satellite enabled connectivity to their customers.

■About KDDI:

KDDI’s au network enables our customer’s daily lives and helps them share unforgettable moments. We are proud of providing 99.9% “population coverage” to the people of Japan. Unfortunately, only a small portion of the Japanese land mass is habitable and often it is difficult to use traditional technologies to provide coverage from coast to coast. Our extensive network continues to grow in coverage as we deploy more fiber and satellite backhauled base stations. In addition to our continued efforts, we will provide “connecting the unconnected” experience, by enabling smartphones to connect to satellites.

■About Starlink by SpaceX:

Starlink delivers high-speed, low-latency internet to users all over the world. As the world’s first and largest satellite constellation using a low Earth orbit, Starlink delivers broadband internet capable of supporting streaming, online gaming, video calls and more. Starlink is engineered and operated by SpaceX. As the world’s leading provider of launch services, SpaceX is leveraging its deep experience with both spacecraft and on-orbit operations to deploy the world’s most advanced broadband internet system, as well as a Direct to Cell constellation of satellites to provide connectivity directly to unmodified LTE cell phones.

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2023/08/30/6937.html

KDDI teams up with SpaceX to bring Starlink-powered cellular service to Japan

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

Global spending on public cloud services is projected to reach $1.35 trillion in 2027, according to IT market research firm IDC. Although annual cloud spending growth is expected to slow slightly over the 2023-2027 forecast period, the market is forecast to achieve a five-year compound annual growth rate (CAGR) of 19.9%.

IDC forecasts that the U.S. will be the largest geographic public cloud market and will reach $697 billion in 2027. Western Europe is predicted to be in second place with $273 billion, followed by China at $117 billion in 2027.

Eileen Smith, program VP for data & analytics at IDC, said cloud is dominating spending in the tech sector across infrastructure, platforms and applications. She wrote:

“Cloud now dominates tech spending across infrastructure, platforms, and applications. Most organizations have adopted the public cloud as a cost-effective platform for hosting enterprise applications and for developing and deploying customer-facing solutions. Looking forward, the cloud model remains incredibly well positioned to serve customer needs for innovation in application development and deployment, including as data, artificial intelligence/machine learning (AI/ML), and edge needs continue to define the forefront of innovation.”

Of the 28 industries* covered in the IDC Spending Guide, the three largest in 2027 – Banking, Software and Information Services, and Telecommunications – will together represent $326 billion in public cloud services spending.

IDC forecasts that software-as-a-service (SaaS) applications to be the largest cloud computing category, garnering about 40% of all public cloud spending. Next largest is infrastructure as a service (IaaS) with a CAGR of 23.5%, followed by platform as a service (PaaS) with a five-year CAGR of 27.2%. SaaS – system infrastructure software (SIS) is forecast to be the smallest category of cloud spending, cornering about 15% of the market.

…………………………………………………………………………………………………………………….

References:

https://www.idc.com/getdoc.jsp?containerId=prUS51179523

https://www.idc.com/getdoc.jsp?containerId=IDC_P33214

IDC: Public Cloud software at 2/3 of all enterprise applications revenue in 2026; SaaS is essential!

https://techblog.comsoc.org/2022/02/09/gartner-accelerated-move-to-public-cloud-to-overtake-traditional-it-spending-in-2025/

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?

Google Cloud infrastructure enhancements: AI accelerator, cross-cloud network and distributed cloud

Google is selling broad access to its most powerful artificial-intelligence technology for the first time as it races to make up ground in the lucrative cloud-software market. The cloud giant now has a global network of 38 cloud regions, with a goal to operate entirely on carbon-free energy 24/7 by 2030.

At the Google Cloud Next conference today, Google Cloud announced several key infrastructure enhancements for customers, including:

- Cloud TPU v5e: Google’s most cost-efficient, versatile, and scalable purpose-built AI accelerator to date. Now, customers can use a single Cloud TPU platform to run both large-scale AI training and inference. Cloud TPU v5e scales to tens of thousands of chips and is optimized for efficiency. Compared to Cloud TPU v4, it provides up to a 2x improvement in training performance per dollar and up to a 2.5x improvement in inference performance per dollar.

- A3 VMs with NVIDIA H100 GPU: A3 VMs powered by NVIDIA’s H100 GPU will be generally available next month. It is purpose-built with high-performance networking and other advances to enable today’s most demanding gen AI and large language model (LLM) innovations. This allows organizations to achieve three times better training performance over the prior-generation A2.

- GKE Enterprise: This enables multi-cluster horizontal scaling ;-required for the most demanding, mission-critical AI/ML workloads. Customers are already seeing productivity gains of 45%, while decreasing software deployment times by more than 70%. Starting today, the benefits that come with GKE, including autoscaling, workload orchestration, and automatic upgrades, are now available with Cloud TPU v5e.

- Cross-Cloud Network: A global networking platform that helps customers connect and secure applications across clouds. It is open, workload-optimized, and offers ML-powered security to deliver zero trust. Designed to enable customers to gain access to Google services more easily from any cloud, Cross-Cloud Network reduces network latency by up to 35%.

- Google Distributed Cloud: Designed to meet the unique demands of organizations that want to run workloads at the edge or in their data center. In addition to next-generation hardware and new security capabilities, the company is also enhancing the GDC portfolio to bring AI to the edge, with Vertex AI integrations and a new managed offering of AlloyDB Omni on GDC Hosted.

Google’s launch on Tuesday puts it ahead of Microsoft in making AI-powered office software easily available for all customers,” wrote WSJ’s Miles Kruppa. Google will also open up availability to its large PaLM 2 model, which supports generative AI features, plus AI technology by Meta Platforms and startup Anthropic, reported Kruppa.

The efforts are Google’s latest attempt to spark growth in the cloud business, an important part of CEO Sundar Pichai’s attempts to reduce dependence on its cash-cow search engine. Recent advances in AI, and the computing resources they require, have added extra urgency to turn the technology into profitable products.

Google’s infrastructure and software offerings produce $32 billion in annual sales, about 10% of total revenue at parent company. Its cloud unit turned a quarterly operating profit for the first time this year. That still leaves Google firmly in third place in the cloud behind AWS and Microsoft Azure. However, Google Cloud revenue is growing faster – at 31% – than its two bigger cloud rivals.

Google will make widely available its current large PaLM 2 model, which powers many of the company’s generative-AI features. It was previously only available for handpicked customers. The company also will make available AI technology developed by Meta Platforms and the startup Anthropic, in which it is an investor.

Google Cloud CEO Thomas Kurian who gave the keynote speech at Google Cloud Next 2023 conference. Image Credit: Alphabet (parent company of Google)

……………………………………………………………………………………………………………………………

Google Cloud’s comprehensive AI platform — Vertex AI — enables customers to build, deploy and scale machine learning (ML) models. They have seen tremendous usage, with the number of gen AI customer projects growing more than 150 times from April-July this year. Customers have access to more than 100 foundation models, including third-party and popular open-source versions, in their Model Garden. They are all optimized for different tasks and different sizes, including text, chat, images, speech, software code, and more.

Google also offer industry specific models like Sec-PaLM 2 for cybersecurity, to empower global security providers like Broadcom and Tenable; and Med-PaLM 2 to assist leading healthcare and life sciences companies including Bayer Pharmaceuticals, HCA Healthcare, and Meditech.

Partners are also using Vertex AI to build their own features for customers – including Box, Canva, Salesforce, UKG, and many others. Today at Next ‘23, we’re announcing:

- DocuSign is working with Google to pilot how Vertex AI could be used to help generate smart contract assistants that can summarize, explain and answer what’s in complex contracts and other documents.

- SAP is working with us to build new solutions utilizing SAP data and Vertex AI that will help enterprises apply gen AI to important business use cases, like streamlining automotive manufacturing or improving sustainability.

- Workday’s applications for Finance and HR are now live on Google Cloud and they are working with us to develop new gen AI capabilities within the flow of Workday, as part of their multi-cloud strategy. This includes the ability to generate high-quality job descriptions and to bring Google Cloud gen AI to app developers via the skills API in Workday Extend, while helping to ensure the highest levels of data security and governance for customers’ most sensitive information.

In addition, many of the world’s largest consulting firms, including Accenture, Capgemini, Deloitte, and Wipro, have collectively planned to train more than 150,000 experts to help customers implement Google Cloud GenAI.

………………………………………………………………………………………………………………………

“The computing capabilities are improving a lot, but the applications are improving even more,” said Character Technologies CEO Noam Shazeer, who pushed for Google to release a chatbot to the public before leaving the company in 2021. “There will be trillions of dollars worth of value and product chasing tens of billions of dollars worth of hardware.”

………………………………………………………………………………………………………………

References:

https://cloud.google.com/blog/topics/google-cloud-next/welcome-to-google-cloud-next-23

https://www.wsj.com/tech/ai/google-chases-microsoft-amazon-cloud-market-share-with-ai-tools-a7ffc449

https://cloud.withgoogle.com/next

Huawei launches new network products at HNS 2023 in Mexico

At the Huawei Network Summit (HNS) 2023, held in Cancun, Mexico August 25th, Huawei Data Communication (Huawei Datacom) announced its high-quality IP network solutions with three distinctive traits — versatile, premium, and cost-effective — for diverse industries like public service, education, healthcare, hospitality, and retail.

With the theme of “Innovation Never Stops,” HNS 2023 attracted over 500 customers and partners from more than 10 countries, including Mexico, Brazil, Colombia, Argentina, Peru, and Chile. At the event, attendees from diverse industries — such as public service, finance, energy, Internet Service Provider (ISP), education, and healthcare — delved into data communication technology innovations and explored new ways to accelerate enterprise digital transformation and create new value together in Latin America.

Image Credit: Huawei

Saul Arjona Bueno, CTO of Huawei’s Latin America Enterprise Network Solutions, unveiled future-proof network solutions for five scenarios in the Latin America commercial markets. Subsequently, Francisco Jose Fuster Montiel, CTO of Huawei’s Mexico Enterprise Business Department, delved deep into these network solutions together with attending customers and partners.

Huawei Datacom Highlights:

- High-quality government office network solution: Integral to this solution, one AP ensures a smooth 1080p video conference of 30 to 50 channels, without any lags.

- High-quality primary and secondary school network solution: With its simplified network architecture, this solution enables fiber-to-the-room and facilitates network evolution over the next 5 to 10 years. It just takes 3 days to deploy the network for one school building.

- High-quality hotel network solution: A core part of this solution, Huawei APs draw on smart antenna technology to ensure more focused Wi-Fi signals and deliver 30% greater coverage range than omnidirectional antennas. More importantly, Huawei’s lossless roaming technology ensures zero roaming disconnections and zero network complaints from guests.

- High-quality small and midsize hospital network solution: As part of this solution, Huawei’s IoT-capable APs enable Wi-Fi and IoT converged deployment. Specifically, one AP provides both Wi-Fi coverage and IoT connectivity, making it easy to expand healthcare IoT use cases while improving the quality of hospital services.

- High-quality retail network solution: A unique component of this solution is Huawei’s 6-in-1 gateway — NetEngine AR5710 router — which helps to lower network investments by 30% for retail stores.

At the event, Luis E. Juarez, Director of Security One at Mainbit and Héctor Cabrera, Executive Director at NGN also shared their successful practices of cooperating with Huawei in commercial markets. By leveraging Huawei’s high-quality IP network offerings, MainBit and NGN help their customers quickly address network pain points and enjoy the ultimate network experience.

Huawei’s high-quality IP network offerings have been proven valuable in numerous customers across diverse industries — such as public service, education, healthcare, hospitality, and retail — in more than 100 countries and regions. As a trusted partner for digital transformation, Huawei Datacom is committed to becoming a key contributor to the ICT infrastructures of small- and medium-sized enterprises (SMEs). Huawei Datacom keeps integrating technologies into specific enterprise scenarios and helping global SMEs to lay a solid digital foundation for their digital transformation journey.

Huawei builds CloudCampus, CloudFabric, and CloudWAN solution capabilities, and launched many groundbreaking innovations, including the first-of-its-kind zero-roaming distributed Wi-Fi, high-quality experience assurance card (used on flagship campus switches), CloudEngine 16800-X (a 400GE data center network switch), NetEngine 8000 F8 (a converged transport router), and iMaster NCE-based network digital map.

All of these offerings empower networks with innovations and unleash digital productivity at an accelerated pace.

Intelligent Cloud-Network Solution with enhanced user experience, AI, and convergence includes:

- CloudCampus 3.0 + Experience: Huawei’s high-quality 10 Gbps CloudCampus solution focuses on user experience and stands out with four unique features: ultra-high-speed access, simplified architecture, ultimate experience, and simplified O&M. This solution is a great fit for public service, finance, energy, education, healthcare, and other industries, where it can help to build a non-blocking office network. The resulting benefits include smooth video conferencing, 50% lower network construction costs, and fast fault recovery in minutes.

- CloudFabric 3.0 + Intelligence: Huawei’s CloudFabric data center network solution becomes more intelligent than ever, and takes on three distinctive features: ultra-powerful performance, ultra-fast deployment, and ultra-intelligent O&M. In diverse industries like finance, public service, education, and ISP, this solution can improve AI training efficiency by 20%, provision services across clouds and data centers in minutes, locate network root causes for application exceptions with one click, and demarcate faults in minutes.

- CloudWAN 3.0 + Convergence: Huawei’s converged CloudWAN solution creates new value for customers through converged networks, converged devices, and converged management. Leveraging Huawei’s solution, customers in industries such as public service, ISP, energy, and transportation can reduce the total cost of ownership (TCO) by 30% and capital expenditure (CAPEX) by 30% while increasing O&M efficiency by 60%.

Huawei says the company will continue to innovate and overcome technical bottlenecks through more R&D investments. Also, Huawei will keep aligning best-in-class products and solutions with customers’ future business development. Doing so will help a wide range of industry customers to bridge technical divides and stay ahead of the competition. Huawei’s extensive training and communication platforms help customers gain fresh insight into leading products and solutions, and explore unique ways to unleash digital productivity.

References:

Research on quantum communications using a chain of synchronously moving satellites without repeaters

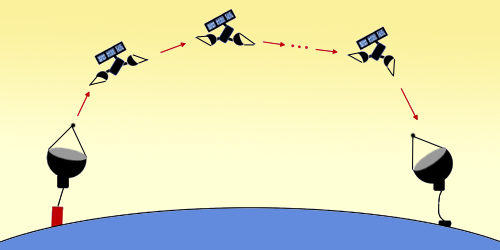

Academic and industry researchers are increasingly eyeing the prospect of global communications networks that would take advantage of quantum technology. Long-distance quantum communication can be achieved by directly sending light through space using a train of orbiting satellites that function as optical lenses without using repeaters.

Some research groups are looking at satellite-based quantum communications, in which quantum information would ride on laser beams between spacecraft in low Earth orbit (LEO). However, the loss of photons in diffracting laser beams, as well as the curvature of the Earth itself, would likely limit realistic distances of high-efficiency quantum links between LEO satellites to less than 2000 km.

Image Credit: S. Goswami/University of Calgary

Recently, researchers Sumit Goswami of the University of Calgary, Canada, and Sayandip Dhara of the University of Central Florida, US, have laid out a proposal showing how those pitfalls could be overcome (Phys. Rev. Appl., doi: 10.1103/PhysRevApplied.20.024048). Their proposal involves relaying delicate quantum signals across a chain of relatively closely spaced, synchronously moving satellites. Those satellites, the pair suggests, could effectively act “like a set of lenses on an optical table,” focusing and bending beams along Earth’s curvature and preventing photon loss across distances as great as 20,000 km—without the need for quantum repeaters. Goswami said that a chain of around 160 satellites would be needed to cover the full 20,000-km distance modeled in the paper. Such a single, geostationary chain, he noted, would cover most of the globe every three days as the Earth rotated beneath the satellite array—so, Goswami said, “even just one chain can be used for connecting many places at different times.” But a larger, 2D network, to enable uninterrupted worldwide quantum communications, would require tens of thousands of new satellites.

While Goswami and Dhara metaphorically refer to the nodes in their proposed all-satellite quantum network (ASQN) as satellite lenses, in reality the optical magic happens with mirrors, to keep absorption-related photon losses to an absolute minimum. In simplified terms, a given satellite in the chain sends a beam of light to the next one, perhaps 120 km away. That next satellite captures and refocuses the beam with a receiving mirror and bounces it off of two smaller mirrors to a final transmitting mirror, which relays the signal on to the next satellite in the chain.

In their modeling, Goswami and Dhara considered a chain of satellites, each separated from the next by 120 km; given expected beam divergence in Earth orbit, that implies a telescope diameter of 60 cm for each satellite. The team’s modeling suggests that such a relay setup, using vortex beams to pass the quantum signal from satellite to satellite, would virtually eliminate diffraction loss across distances of 20,000 km.

With diffraction loss taken care of, Goswami and Dhara methodically looked at other potential sources of loss in the satellite-lens system. One obvious one is reflection loss of some photons at the mirrors themselves, which the pair thinks could be kept manageable through a configuration combining large metal mirrors and small, ultrahigh-reflectivity Bragg mirrors. Another source of loss lies in tracking and positioning errors for the satellites in the chain; such hiccups would need to be held to a minimum to keep the satellites in sync with one another.

A final source of loss has nothing to do with the satellites. Depending on the quantum communication architecture, quantum information needs to be transmitted from and to stations on Earth’s surface. For free-space optical signals, that opens the prospect of data losses due to atmospheric turbulence, which can dramatically increase the beam size and spread. Turbulence turns out to be a much bigger problem for data in the uplink (ground to satellite) than in the downlink (satellite to ground). That’s because in the uplink, the turbulence is doing its dirty work at the beginning of the communication chain rather than at its end; thus the turbulence-induced beam divergence and fragmentation is magnified across the large propagation distance of the satellite network as a whole.

Outperforming fiber—without repeaters:

Image Credit: S. Goswami and S. Dhara, Phys. Rev. Appl. 20, 024048 (2023), doi: 10.1103/PhysRevApplied.20.024048; copyright 2023 by the American Physical Society [Enlarge image]

For their proposed all-satellite quantum network (ASQN), Goswami and Dhara modeled two different quantum communication schemes. In one, qubit transmission (top), photons are transmitted from a ground-based source to a first satellite, relayed through space along a chain of reflector satellites, and beamed to another ground station, with beam diffraction controlled by focusing. In the other, entanglement distribution, an entanglement source is located either in a satellite (S1) or on the ground (S2), and entangled photons are distributed to widely separated ground stations, where they’re tested for quantum-secure communication.

Taking all of these sources of loss (and a few others) into account, Goswami and Dhara numerically simulated how such a chain of relay satellite lenses might work in transmitting quantum information under two scenarios. One is so-called entanglement distribution, the protocol demonstrated by researchers in China on the Micius satellite, in which photons are entangled in space and sent in different directions via the satellite lenses, ultimately to be transmitted down to widely separated stations on Earth and tested for quantum security.

The other is a simpler “qubit transmission” protocol, in which quantum bits (qubits) are simply sent from a ground station to the first satellite, transmitted across the chain and finally beamed down to a second, distant ground station. Such a system would require a different kind of optical design, to counteract the impact of turbulence on the satellite uplink. Goswami and Dhara think this approach may have certain advantages, however, as it keeps both the qubit source and detection in more controllable, better-outfitted ground stations.

Under both scenarios, the team found that the total signal loss across 20,000 km would come in at around 30 dB. That’s comparable to the loss experienced across only 200 km of a direct optical-fiber link (assuming a loss rate of 0.15 dB/km in the fiber). “Such a low-loss satellite-based optical-relay protocol,” Goswami and Dhara write, “would enable robust, multimode global quantum communication and would not require either quantum memories or repeater protocol.”

“What this proposal basically does,” Goswami observed in an email to OPN, “is that it shifts the task of creating quantum network from physics to engineering.” He added, however, that some of the engineering likely wouldn’t be trivial, particularly with respect to designing and developing the satellites in the fleet. Still, he and Dhara stress in the paper that recent developments in space technology—embodied in reusable launch vehicles from organizations such as SpaceX and the vast constellations of classical-communications satellites being lofted into LEO by a number of private companies—make a system such as their ASQN considerably more feasible than it would have been in the past. Goswami and Dhara stress that recent developments in space technology make a system such as their ASQN considerably more feasible than it would have been in the past.

Goswami and Dhara believe that, by dispensing with the need for quantum repeaters or memory, the scheme they’ve proposed and modeled could open a range of possibilities implicit in a quantum network. Such prospects include secure communication via quantum key distribution, the linking of quantum computers, and precision long-distance quantum sensing.

The researchers admit, however, that a more complex network—that is, the long-term vision of a “quantum internet” now being fleshed out in a variety of research labs—would still require some sort of quantum memory to ensure completely lossless transmission.

This research could pave the way for the development of globally secure quantum communications networks, as the use of satellites would provide a high level of security against hacking and eavesdropping. The proposed system still needs further development and testing, but it presents a promising solution for enabling long-distance quantum communication without the need for repeaters.

References:

https://physics.aps.org/articles/v16/s103

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Derek Kelly, Lumos’ VP of market development, went as far as to say that “fiber is always the answer,” and suggested cable alternatives will not stand the test of time. Kelly claimed that as $42.5 billion is set to roll out through the Broadband, Equity, Access, and Deployment (BEAD) program, relying on investments in fiber will provide stability over the next 15 years.

“I think we’ve all seen DSL and fixed wireless projects get funded over the last couple of years. And then what happens? Those areas ultimately become blocked from future funding until the definitions change. And then they become available for another grant. And we see public dollars going on top of previous public dollars.” Kelly said. He noted Lumos defines “unserved being no cable, underserved means they’re stuck with cable. And then there’s everyone else that has life-changing fiber. So we don’t care about speeds at this point.”

While acknowledging the need for funding in areas without even cable access, he noted another large-scale program after the BEAD initiative is unlikely. “Cable modems aren’t going to keep up with these definitions forever. Their lobbyists aren’t going to be able to convince people forever just make sure that they just barely can meet the definition of unserved,” he said. “We have communities that don’t have access to fiber. The FCC and NTIA may consider them as served today. And I agree the funding should go to areas that don’t even have cable yet, but the time is coming, where cable is going to be what’s unserved or underserved.”

Fiber execs mostly targeted cable’s “Achilles heel,” which is its lacking symmetric speed capabilities (upstream and downstream).

AT&T Fiber’s EVP Chris Sambar told a large keynote audience, “Don’t ask cable about symmetrical speeds, they don’t even know what that means.” In an earlier blog post, he wrote, “Fiber is superior technology for things like uploading large files and increased bandwidth. It delivers an amazing experience, with multi-gig speeds and equally fast up- and downlinks. It’s also critical for powering technologies like 5G (backhaul) and edge computing (fiber access for ultra low latency). And with a far superior upgradeable capacity to handle soaring demand for high-quality bandwidth well into the future.”

However, Jay Lee, CTO of ATX Networks said that cable operators are “right in the throes” of upgrading their networks to get to full DOCSIS 3.1, and that high-split type of architecture will allow them to achieve competitive speeds in the upstream. “Their downstream is probably two gigabits per second now and there’s a line of sight to be more than that,” he said. “Is it 10 Gig PON? No. But it’s still in that gig threshold that I think is as important from a consumer standpoint,” he added.

The next plan phase for cable is to move up to DOCSIS 4.0, which starts to get toward multi-gigabit upstream and five-plus in the downstream, sometimes upwards of 10 in the downstream. Lee noted that plenty of cable companies are doing “lots” of their own fiber buildouts. “Some of the statements made on cable were like ‘they can’t do anything about it’ and certainly they can. DOCSIS 3.1 high-split is just the start.”

Jeff Heynen, VP at Dell’Oro Group echoed Lee’s comments, noting that current DOCSIS 3.1 mid-split can deliver 2 Gbps downstream and up to 200 Mbps upstream, which is what Comcast is offering today. Charter and Cox’s high-split offerings can go even further, delivering 2 Gbps downstream and up to 1 Gbps upstream.

A recent interoperability test conducted by Cable Labs showed that DOCSIS 4.0 modems paired with CCAP and vCMTS platforms in high-split configurations could deliver up to 8.6 Gbps downstream and 1.5 Gbps upstream. Cable operators have claimed DOCSIS 4.0 modems should become available later this year, with volumes in 2024. Those downstream speeds would give cable “very comparable service tiers to most fiber providers,” Heynen said. “And this is before the outside plant is upgraded to DOCSIS 4.0, which will be capable of delivering up to 10 Gbps down and 6 Gbps up.” However, other analysts have hinted that DOCSIS 4.0 rollouts will take longer than cable companies are saying.

References:

https://www.fiercetelecom.com/broadband/cable-fiber-rivalry-separating-fact-fiction

https://www.business.att.com/learn/articles/docsis-vs-fiber-why-knowing-the-difference-matters.html

https://about.att.com/innovationblog/2022/sambar-fiber-expansion.html

Huawei and Ericsson renew global patent cross-licensing agreement

The top two global RAN equipment makers, Huawei and Ericsson, have announced the renewal of a multi-year global patent cross-licensing agreement, which enables each to use the other’s standardized (3GPP, ITU, IEEE, and IETF standards for 3G, 4G, and 5G cellular technologies) and patented technologies. The patent sharing agreement includes network infrastructure, as well as endpoint devices.

“We are delighted to reach a long-term global cross-licensing agreement with Ericsson,” said Alan Fan, Head of Huawei’s Intellectual Property Department. “As major contributors of standard essential patents (SEPs) for mobile communication, the companies recognize the value of each other’s intellectual property, and this agreement creates a stronger patent environment. It demonstrates the commitment both parties have forged that intellectual property should be properly respected and protected.”

“Both companies are major contributors to mobile communication standards and recognize the value of each other’s intellectual property. This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly, driving healthy, sustainable industry development for the benefit of consumers and enterprises everywhere.”

Over the past 20 years, Huawei has been a major contributor to mainstream ICT standards, including those for cellular, Wi-Fi, and multimedia codecs. In 2022, Huawei topped the European Patent Office’s applicant ranking for number of patent applications filed, with 4,505 applications.

“Our commitment to sharing leading technological innovations will drive healthy, sustainable industry development and provide consumers with more robust products and services,” added Fan.

Huawei is both a holder and implementer of SEPs and seeks to take a balanced approach to licensing. Through the signing of this agreement, it is both giving and receiving access to key technologies. Fan said, “This agreement is the result of intensive discussions that ensured the interests of both patent holders and implementers are served fairly.”

Christina Petersson, Ericsson’s chief IP officer said, “This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly.”

The last time the two companies extended a cross-licensing agreement was in 2016. Over the past few years, both companies have actively contributed to developing key mobile standards.

Earlier this year, the European Patent Office published the EPO Patent Index 2022: with 4,505 patents filed, Huawei was the top contributor, while Ericsson came in fifth with 1,827. Currently, according to the Financial Times, Huawei owns 20% of global patents which makes it the world’s largest 5G patent owner. Ericsson says they’ve been granted 60,000 patents.

Both Huawei and Ericsson are part of the Avanci patent pool, although the Chinese company is a recent addition following Avanci’s launch of a 5G vehicular programme earlier this month, which it says will “simplify the licensing of the cellular technologies used in next generation connected vehicles.”

Other Avanci patent licencees include Samsung, Philips, Panasonic and ZTE.

However, while Huawei and Ericsson have not engaged in active patent litigation, towards the end of last year Huawei demonstrated an intention to be more litigious over its patent portfolio. This included filing lawsuits against car manufacturer Stellantis over mobile phone patents, as well as launching a series of lawsuits over Wi-Fi 6 patents against Amazon, Netgear and AVM.

Around the same time, in the midst of a US FRAND trial, Ericsson and Apple signed a global patent licence agreement. This ended one of the largest disputes over implementation patents and SEPs in recent years, which spanned the US, Germany, the Netherlands, Belgium, the UK, Colombia and Brazil.

References:

Nikkei Asia: Huawei demands royalties from Japanese companies

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

LightCounting: Wireless infrastructure market down in 2Q-23 (no surprise)

| Historical data accounts for sales of the following vendors: | |||

| Vendor | Segments | Source of Information | |

| Altran | vRAN | Estimates | |

| Amdocs | 5GC | Estimates | |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates | |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates | |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates | |

| Corning | vRAN | Estimates | |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Enea | 5GC | Estimates | |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates | |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Fujitsu | RAN | Survey data and estimates | |

| HPE | 2G/3G core, 5GC | Estimates | |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| JMA Wireless | vRAN | Estimates | |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates | |

| Microsoft (acquired Metaswitch and Affirmed Networks, 2020) | 5GC, vEPC and 2G/3G core | Estimates | |

| Movandi | RAN/vRAN (RU/repeater) | Estimates | |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Node-H | vRAN (small cells) | Estimates | |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| NEC (including Blue Danube Systems, January 2022) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates | |

| Oracle | 5GC | Estimates | |

| Parallel Wireless | vRAN (CU, DU) | Estimates | |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates | |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Qucell | RAN, vRAN | Estimates | |

| Rakuten Symphony (acquired Altiostar, August 2021) | vRAN (CU, DU) | Estimates | |

| Ribbon Communications | 2G/3G core | Survey data and estimates | |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates | |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors | |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates | |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |