Month: April 2021

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

On its Q1-2021 earnings call, Dish Network Chairman and Co-founder Charlie Ergen did not provide any specifics regarding Dish’s deal with Amazon/AWS or its overall plan to build a nationwide 5G Open RAN, “cloud native” core network. Are you a bit tired of cliché’s like this:

“We’re building a Netflix in a Blockbuster world.” All Netflix did was put video on the cloud. Instead of going to a physical store, you put it in the cloud. Right. All the business plans in the world, all the numbers, all the thought if they just did something simple they put it in the cloud and the technology was they were a little ahead of the technology but the technology got there. All we’re doing is taking all those towers that you see as you drive down the highway, we basically put them in the cloud. And so instead of driving to physical store and rent a movie, you’re going to get all your data and information and automation everything from the cloud. And so it’s a dramatic paradigm shift in the way network is built and it should and it’s an advantage over legacy carriers who have 30-year-old architecture.” Of course, that’s incorrect as almost all 5G carriers plan to build a 5G cloud native core network.

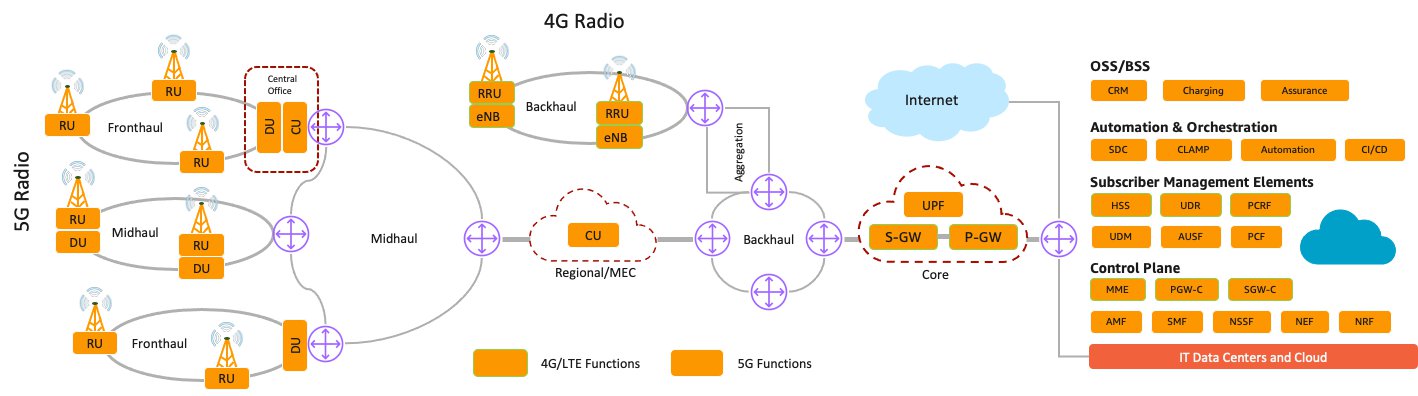

Dish is planning to build the world’s first standalone, cloud-based 5G Open Radio Access Network (O-RAN), starting with the launch of a 5G wireless network for enterprise customers in Las Vegas, NV later this year.

Dish says it will leverage AWS’s architecture and services to deploy a cloud-native 5G network that includes O-RAN—the antennas and base stations that link phones and other wireless devices to the network. Also existing in the cloud will be the 5G core, which includes all the computer and software that manages the network traffic. AWS will also power Dish’s operation and business support systems.

“Amazon has made massive investments over the years in compute storage transport and edge, [and] we’ll be sitting on top of that and as we tightly integrate telco into their infra, then we can expose APIs to their development community, which we think makes and enables third-party products and services to have network connectivity, as well as enterprise applications,” said Tom Cullen, executive VP of corporate development for Dish, explaining some of the technical details of the arrangement during Thursday’s earnings call.

Ergen reiterated Dish’s plan to spend up to $10 billion on its overall 5G network and provided milestone date for completion of the first phase of the 5G build-out.

“All of that $10 billion isn’t spent by June of 2023, which is our major milestone,” Ergen said, pointing to the company’s agreement with the U.S. government to cover at least 70% of the population with 5G no later than June 14, 2023. However, Ergen has an escape hatch:

“The agreement we have [with the FCC] recognizes that [there could be] supply chain issues outside of our control, and that the timelines could be adjusted. But we don’t look at it that way internally. There is always unforeseen circumstances, and this one might be particularly acute. But we’re not going to let anything stop us. We’re focused on meeting our timelines, and regardless of what the challenges are. And we’ll have to reevaluate that from time to time, but we’re focused right now on Las Vegas and we’re focused on the 20% build-out by June of next year.”

“We’re not going to let anything stop us, he added. The $10 billion “does take us through the complete (5G) buildout.”

On the 5G cloud native aspect, Ergen said:

“Yes, we anticipated a cloud native network from the beginning, he said. “So the $10 billion total build-out cost that we announced a couple of years ago–I think people are probably still skeptical … But you can see where we’re headed. Most of your models will probably take a lot of capex off the board when you understand the architecture, and we’re not going to go through all the architecture in this call, but it’s certainly has a material impact on capex.”

Dish said last week it plans to run all of its network computing functions inside the public AWS cloud – a plan that represents a dramatic break from the way most 5G networks around the world run today. Many analysts think that’s a huge cyber-security risk as the attack surface is much greater in a virtual, cloud based network.

Marc Rouanne — Executive Vice President and Chief Network Officer:

“Yeah, the way to think of our cloud native network is a network of networks, that’s the way it’s architected. So when a customer comes to us, it’s easy for us to offer one sub network, which we can call it private network and there are techniques behind that like slicing, like automation, like software defined, so I’m not going to go into the techniques, but natively the way to think of it is really this network of networks. Right. And then, as Stephen, you’ve seen that you plan this to the postpaid customers and telling you how they would shake lose sub networks.”

“Absolutely, yeah. No, I think we’ve talked to a number of customers across multiple verticals in different industry segments and is an increasing appetite in demand for the kind of network that we’re building, which is really to enable them to have more security, more control and also more visibility into the data that’s coming off the devices, so that they can control their business more effectively. So we’re seeing a terrific demand. And the network architecture, we’re putting in place actually enables and unlocks that opportunity for those enterprise customers and it’s again not restricted to any specific vertical.

We’re touching a lot of different companies and a lot of different vertical segments across the country and the other aspect of the opportunity that we see for ourselves is that while we build out a nationwide network, we are in the process of working with customers and prospective customers on private networks that are not limited by the geography of our national footprint. So we can deploy those within their environments to support their business operations as well. So the demand we’re seeing is terrific and we’re already engaged with a number of customers today.”

Ergen chimed in again:

“The cloud infrastructure as it existed a couple of years ago, really didn’t handle telco very well, there has been a lot of R&D and investment that they’ve had to make to transform their network into something that where a telco can operate in the cloud, because it’s a little bit different than their traditional IT infrastructure. And then today they are, they were best in class room for what we needed and whether it be their APIs and the documentation and discipline and vendor at the — community that supports them and their — the developers and then of course obviously reach into the enterprise business. So it was — so that’s the first and foremost.

And then the second thing I think is, is the company committed? I’m not going to put words in Amazon’s mouth, I’ll let them talk to their commitment, but they’ve done a lot of work for us to help us without knowing where they have the deal or not and very appreciative that it. I think it’s helpful that Andy will become the CEO because he’s owned this project from the start and he can — he will be able to move all the pieces within Amazon to focus on this. And so I think at the end of the day, I think we’re going to be their largest customer in cloud and I think they’re going to — they may be the largest customer in our network. I mean, but we have to build a network and prove it, and they have to build and prove it. I think that all other carriers around the world will, including the United States will look at Amazon as a real leader here because we’re just doing something different.”

Stephen Bye — Executive Vice President, Chief Commercial Officer

“Yeah. So just in terms of what the Las Vegas build looks like. I think there are several attributes that are really important to what we’re doing to build on Charlie’s comment. One is we are building a cloud native infrastructure. We are using an Open Radio Access architecture. But it’s also a 5G native network. We’re not trying to put 5G on top of 2G, 3G and 4G, the infrastructure that we’re deploying is optimized for 5G and the way we’ve designed the network from an RF perspective and a deployment perspective is to take advantage of the 5G architecture as well as the 5G platform. And so, what does that look like?

It’s basically a new network, it’s new infrastructure, it’s designed using all of the spectrum bands that we have and the RF is optimized to take advantage of that. So we’re on a path to launching that in the third quarter, but it’s one of a number of markets we have coming on. We just have announced those markets through the end of the year, but it’s the first, obviously a number that we have in flight today and we’ve got activity going on across the country to actually build out this network. So it will be the first one that people can touch and feel and get the experience, but it is really a 5G native network and we’ve proven that O-RAN from a technology perspective can work compared to that at the end of last year. Now we are in the execution phase, now we’re in the deployment phase and so you know Vegas will have to be the first one that it will be a fully deployed market that people will be able to touch and feel and experience.”

Bye added that the 5G build-out will be done in phases but the network is designed to support all customers across all segments.

5G Network End-to-End Architecture. Image courtesy of AWS.

……………………………………………………………………………………………………………………………

In a note to clients, analyst Craig Moffett said that Dish was purchasing services from AWS rather than Amazon investing in Dish’s 5G network:

“It was a purchase agreement, albeit one freighted with lots of rather fuzzy jargon, and nothing more. Notably, Verizon already has its own relationship with AWS, and theirs does call for AWS to co-market Verizon services to AWS’s enterprise customers. By contrast, the Dish agreement calls only for Dish to market AWS services to Dish’s customers, not the other way around. Objectively, it is Verizon, not Dish, that has the more strategic relationship.

Amazon isn’t likely to market a service to its customers unless they are highly confident that its quality is first rate and that its staying power is assured. Perhaps Dish will get there. But it won’t be clear that they have arrived at that point until their network is successfully serving customers… without the safety net of the T-Mobile MVNO agreement. That’s not until 2027. That feels to us like a long time to wait.”

Regarding Dish Network’s new business model, Craig said “It is now fair to say that Dish’s core business is wireless rather than satellite TV. Not by revenues, of course; the wireless business is today but the modest reseller stub of what once was Boost (Mobile). But certainly by valuation….What does matter, however, is the extent to which the satellite TV business can serve as a source of funds for financing the wireless business.”

………………………………………………………………………………………………………………………………………

References:

https://d1.awsstatic.com/whitepapers/5g-network-evolution-with-aws.pdf

https://docs.aws.amazon.com/whitepapers/latest/cicd_for_5g_networks_on_aws/5g-networks-on-aws.html

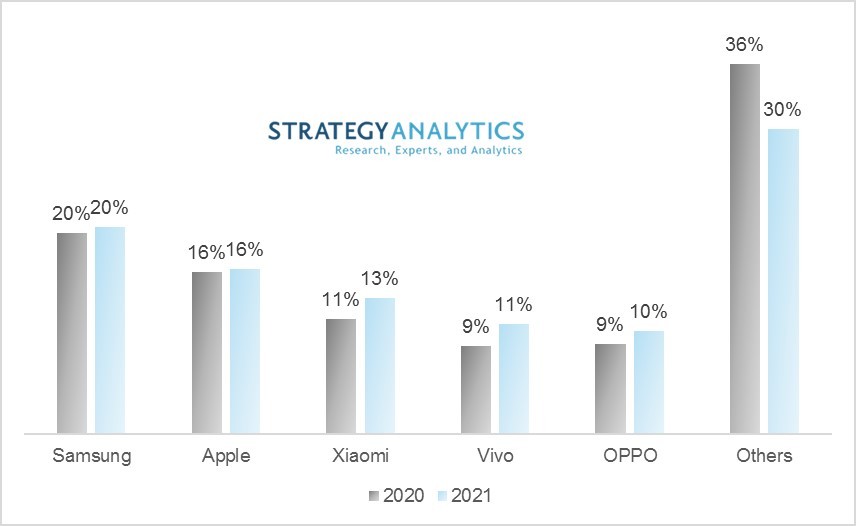

Omdia and IDC: Samsung regains lead in global smartphone market

The global smartphone market climbed 28.1% year on year to reach total shipments of 351.1 million units in the first quarter of 2021, according to preliminary data from Informa owned Omdia. That gain consolidates the smartphone market’s recent recovery after it posted its first annual growth since Q3 2019 in the final quarter of 2020. However, Omdia said 2021 is set to be a year of transition with Huawei’s role continuing to change, LG exiting the market and a severe semiconductor shortage affecting sales.

Samsung took over the top spot from Apple in the first 3 months of 2021, shipping 76.1 million units, up 29.2 percent year on year, to reach 22 percent of the market. The company was able to increase shipments by 22.8 percent from Q4 2020 thanks in part to an early update to the Galaxy S line as well as the launch of its latest range of devices in the A series.

Apple followed its blockbuster Q4 2020 with another significant year on year growth of 46.5% to reach 56.4 million units shipped in the quarter, equivalent to 16% of the market, followed in third place by Xiaomi with 14% after shipping 49.5 million units, up 78.3% year on year.

Two more Chinese smartphone brands – Oppo and Vivo – continue to battle for fourth and fifth place in the global rankings and remain tied on 11 percent of the market. Vivo shipped 38.2 million units, just above the 37.8 million units Oppo shipped in Q1.

Year on year, Vivo grew shipments by 95.9 percent and Oppo by 85.3 percent, as they overtook Huawei, which slipped out of the top 5 global smartphone OEM ranking after shipping 14.7 million units, some 70 percent less than in Q1 2020, not including the 3.6 million units shipped by its sub-brand Honor, which is now an independent entity.

Top 10 Shipments per manufacturer

| Rank | OEM | 1Q21 | 4Q20 | 1Q20 | QoQ | YoY | |||

| Shipment (m) | M/S | Shipment (m) | M/S | Shipment (m) | M/S | ||||

| 1 | Samsung | 76.1 | 22% | 62.0 | 16% | 58.9 | 21% | 22.8% | 29.2% |

| 2 | Apple | 56.4 | 16% | 84.5 | 22% | 38.5 | 14% | -33.3% | 46.5% |

| 3 | Xiaomi | 49.5 | 14% | 47.2 | 12% | 27.8 | 10% | 4.9% | 78.3% |

| 4 | vivo | 38.2 | 11% | 34.5 | 9% | 19.5 | 7% | 10.7% | 95.9% |

| 5 | Oppo | 37.8 | 11% | 34.0 | 9% | 20.4 | 7% | 11.1% | 85.3% |

| 6 | Huawei | 14.7 | 4% | 33.0 | 9% | 49.0 | 18% | -55.5% | -70.0% |

| 7 | Motorola | 12.6 | 4% | 9.8 | 3% | 5.5 | 2% | 28.6% | 128.1% |

| 8 | Realme | 11.4 | 3% | 14.3 | 4% | 6.1 | 2% | -20.3% | 86.9% |

| 9 | Tecno | 8.2 | 2% | 7.7 | 2% | 3.5 | 1% | 6.5% | 133.4% |

| 10 | LG | 6.8 | 2% | 8.4 | 2% | 5.4 | 2% | -18.9% | 26.2% |

| Others | 41.3 | 12% | 46.4 | 12% | 41.1 | 15% | -11.0% | 0.6% | |

| Total | 353.0 | 100% | 381.8 | 100% | 275.7 | 100% | -7.5% | 28.1% | |

Gerrit Schneemann, principal analyst at Omdia commented: “The smartphone market continues to show resiliency in the face of multiple challenges. The global component supply shortage is looming large over the market. On the other hand, two well-known smartphone brands will disappear from the global smartphone market this year, in Huawei and LG, opening the door for other brands to reach new markets and buyers.”

……………………………………………………………………………………………………………………………………..

Separately, International Data Corporation (IDC) said that the smartphone market accelerated in the first quarter of 2021 (1Q-2021) with 25.5% year-over-year shipment growth.

According to preliminary data from the (IDC) Worldwide Quarterly Mobile Phone Tracker, smartphone vendors shipped nearly 346 million devices during the quarter. The strong growth came from all regions with the greatest gains coming from China and Asia/Pacific (excluding Japan and China). As the two largest regions globally, accounting for half of all global shipments, these regions experienced 30% and 28% year-over-year growth, respectively.

“The recovery is proceeding faster than we expected, clearly demonstrating a healthy appetite for smartphones globally. But amidst this phenomenal growth, we must remember that we are comparing against one of the worst quarters in smartphone history,1Q20, the start of the pandemic when the bulk of the supply chain was at a halt and China was in full lockdown,” said Nabila Popal, research director with IDC’s Worldwide Mobile Device Trackers. “However, the growth is still very real; when compared to two years ago (1Q19), shipments are 11% higher. The growth is coming from years of repressed refresh cycles with a boost from 5G. But above all, it is a clear illustration of how smartphones are becoming an increasingly important element of our everyday life – a trend that is expected to continue as we head into a post-pandemic world with many consumers carrying forward the new smartphone use cases which emerged from the pandemic.”

As the smartphone market is recovering, a major shift is happening in the competitive landscape. Huawei is finally out of the Top 5 for the first time in many years, after suffering heavy declines under the increased weight of U.S. sanctions. Taking advantage of this are the Chinese vendors Xiaomi, OPPO, and vivo, which all grew share over last quarter landing them in 3rd, 4th, and 5th places globally during the quarter with 14.1%, 10.8%, and 10.1% share, respectively. All three vendors are increasing their focus in international markets where Huawei had grown its share in recent years. In the low- to mid-priced segment, it is these vendors that are gaining the most from Huawei’s decline, while most of the high-end share is going to Apple and Samsung. Samsung regained the top spot in 1Q21 with impressive shipments of 75.3 million and 21.8% share. The new S21 series did well for Samsung, mainly thanks to a successful pricing strategy shaving off $200 from last year’s flagship launch. Apple, with continued success of its iPhone 12 series, lost some share from their very strong holiday quarter but still shipped an impressive 55.2 million iPhones grabbing 16.0% share.

“While Huawei continues its decline in the smartphone market, we’ve also learned that LG is exiting the market altogether,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “Most of LG’s volume was in the Americas with North America accounting for over 50% of its volume and Latin America another 30%. Despite the vendor losing ground in recent years, they still had 9% of the North America market and 6% of Latin America. Their exit creates some immediate opportunity for other brands. With competition being more cutthroat than ever, especially at the low-end, it is safe to assume that 6-10 brands are eyeing this share opportunity.”

| Top 5 Smartphone Companies, Worldwide Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (shipments in millions of units) | |||||

| Company | 1Q21 Shipment Volumes | 1Q21 Market Share | 1Q20 Shipment Volumes | 1Q20 Market Share | Year-Over-Year Change |

| 1. Samsung | 75.3 | 21.8% | 58.4 | 21.2% | 28.8% |

| 2. Apple | 55.2 | 16.0% | 36.7 | 13.3% | 50.4% |

| 3. Xiaomi | 48.6 | 14.1% | 29.5 | 10.7% | 64.8% |

| 4. OPPO | 37.5 | 10.8% | 22.8 | 8.3% | 64.5% |

| 5. vivo | 34.9 | 10.1% | 24.8 | 9.0% | 40.7% |

| Others | 94.1 | 27.2% | 103.0 | 37.4% | -8.7% |

| Total | 345.5 | 100.0% | 275.2 | 100.0% | 25.5% |

| Source: IDC Quarterly Mobile Phone Tracker, April 28, 2021 | |||||

Notes:

- Data are preliminary and subject to change.

- Company shipments are branded device shipments and exclude OEM sales for all vendors.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

- Figures represent new shipments only and exclude refurbished units.

……………………………………………………………………………………………………………………………………………

Closing Comment:

“Globally, the top five vendors combined took a 76% market share in Q1 2021, up from 71% a year ago. Chip shortages and supply side constraints did not have a significant impact in Q1 among the top 5 brands,” said Linda Sui, senior director, Strategy Analytics. Samsung’s newly launched A series 4G and 5G phones, and the earlier launched Galaxy S21 series combined drove solid performance in the quarter. Xiaomi maintained strong momentum in both India and China, and the expansion in Europe, Latin America and Africa region also started to bear fruit.

Note: Strategy Analytics said the global smartphone shipments were 340 million units in Q1 2021, up over 24% (year-on-year) representing the highest growth since 2015. The smartphone market rebound was driven by the healthy demand of consumers with aging devices and a phenomenal 5G push from Chinese smartphone vendors.

References:

https://omdia.tech.informa.com/pr/2021-apr/global-smartphone-market-grows-28

https://www.idc.com/getdoc.jsp?containerId=prUS47646721

https://www.idc.com/tracker/showproductinfo.jsp?containerId=IDC_P8397

Verizon Explores Sale of Media Assets; Wake up Call for AT&T?

According to the Wall Street Journal, Verizon Communications is exploring a sale of its media assets including Yahoo and AOL, as the telecommunications giant looks to exit an expensive and unsuccessful bet on digital media. The sales process, which includes private-equity firm Apollo Global Management Inc. (which owns Cox Media Group) could lead to a deal worth $4 billion to $5 billion, according to people familiar with the matter—assuming there is one.

Verizon splashed out billions of dollars assembling a portfolio of once-dominant websites, including AOL and Yahoo. Verizon bought AOL in 2015, and Yahoo in 2017. It then merged them into a new venture called Oath, paying more than $9 billion in total to acquire the pair. So the rumored sale would be a huge loss for Verizon, based on what it paid for those two media outlets.

The digital-media business ultimately failed to reach its target of $10 billion in annual revenue by 2020, and Verizon in 2018 wrote down about $4.5 billion of its value. Verizon has cut jobs in the unit, and in November agreed to sell its HuffPost news division to BuzzFeed Inc. That followed a 2019 agreement to sell the Tumblr blogging platform for a nominal sum to the owner of WordPress.

Verizon’s media business, which also includes Yahoo Finance and Yahoo Mail (used by AT&T-Yahoo Internet subscribers) as well as news sites TechCrunch and Engadget, generated $7 billion of revenue in 2020, down 5.6% from the previous year due to a sharp advertising pullback during the early months of the coronavirus pandemic. Business picked up in the second half and the unit has logged two consecutive quarters of double-digit growth, including a boost of 10%, to $1.9 billion, in the first quarter.

…………………………………………………………………………………………………………………………………………

SIDEBAR — Message to AT&T:

If the Verizon media sales go through, it should send a clear message to AT&T, which went heavily into debt when it purchased Time Warner (and to a lesser extent DirecTV). AT&T has already spun off off its TV assets. AT&T agreed to create a new company for its U.S. video business unit together with private equity firm TPG Capital. The company will be called New DirecTV and include: today’s Direct TV, U-verse TV and AT&T TV (AT&T’s OTT video service). Closing the TV units “sale” will reduce their observed rate of decline. In the most recent quarter, video revenue shrank by 9.2%. That hemorrhage will stop once the video sale is complete. Next stop is for AT&T to sell or spin off Time Warner to reduce it’s debt load.

It’s incomprehensible to this author, that AT&T’s wireline Internet subscribers (actually AT&T-Yahoo Internet) are dependent on Yahoo support for email and any other content issues, including log-in. When you click on https://att.net you are redirected to https://currently.att.yahoo.com/. Since the 2017 Verizon acquisition of Yahoo, there is no tech support from AT&T on any email or content issues you might have with your AT&T-Yahoo internet account. AT&T will only troubleshoot wireline connectivity issues- NOT email or internet content problems its subscribers might experience.

……………………………………………………………………………………………………………………………………………..

By selling now, Verizon could raise needed cash at a time when valuations of similar assets are enjoying an upswing. The company this year committed about $53 billion to secure spectrum licenses that will support its ultrafast fifth-generation wireless network.

Indeed, Verizon was by far the biggest spender in January’s record-breaking FCC C-Band spectrum auction. The carrier bid nearly $45.5B, well ahead of still-heavy spending AT&T which paid $23.4B for that spectrum. Of course, there are huge additional build-out costs to actually deploy 5G over C-Band spectrum!

Verizon executives recently told investors that capital spending (CAPEX) this year on network equipment, fiber optic cables and the like could reach up to $21.5 billion.

Verizon has focused much of its recent attention lately on partnerships with streaming-video services like Disney+ and Hulu that can be bundled with its wireless and home-Internet plans.

Analyst Craig Moffett recently wrote in a note to clients:

“Verizon has, until now, taken a “wait-it-out” stance, perhaps out of confidence that AT&T’s (cellular network) promotional stance had to be transitory. Verizon’s short term results have suffered during this wait-it-out period; subscriber results have been weak.

Faced with AT&T’s ongoing retention marketing promotion, Verizon faces a lose-lose choice: either continue to lose subscribers (and face something still worse, when 5G comes around), or respond and their subscriber growth will recover, but their profitability will decline. There are no good options.

With longer term concerns about competitive positioning in 5G looming ever closer, we are

downgrading Verizon to Neutral.”

References:

https://www.wsj.com/articles/verizon-explores-sale-of-media-assets-11619642003

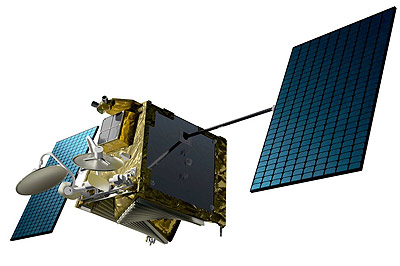

OneWeb receives investment from Eutelsat Communications; LEO satellite constellation for global internet service

OneWeb, the satellite communications network provider [1.], announced today that it has secured $550 million in funding from Eutelsat Communications (one of the world’s leading satellite operators). That brings OneWeb’s total funding to $1.9 billion in fresh equity since it emerged from bankruptcy.

Note 1. OneWeb is a global communications network powered by a constellation of 650 Low Earth Orbit (LEO) satellites. Headquartered in London, OneWeb is enabling high-speed, low latency connectivity for governments, businesses, and communities everywhere around the world. OneWeb’s satellites, together with a network of global gateway stations and a range of User Terminals, will provide an affordable, fast, high bandwidth, low-latency communications service connected to the IoT future, and a pathway to 5G for everyone, everywhere.

This investment is a vote of confidence in OneWeb and underscores the arrival of Low Earth Orbit (LEO) satellites into mainstream long-term growth planning for major operators.

………………………………………………………………………………………………………………………………………

OneWeb’s 648 LEO satellite fleet will deliver high-speed, low-latency global connectivity. It’s partnership with Eutelsat, a global geostationary satellite operator, will enhance both companies’ commercial potential, leveraging Eutelsat’s established commercial reach to governments and enterprise customers in addition to its strong institutional relationships, recognized technical expertise and global fleet.

OneWeb’s ability to address multiple applications requiring low latency and ubiquity will also allow both companies to explore GEO/LEO configurations for future service integrations and packages.

OneWeb’s mission is to deliver broadband connectivity worldwide to its customers, to bridge the global digital divide by offering data connectivity, facilitating linkage to the Internet of Things (IoT) future and a pathway to 5G. OneWeb’s LEO satellite system includes a network of global gateway stations and a range of user terminals for different customer markets capable of delivering affordable, fast, high-bandwidth and low-latency communications services.

Yesterday, OneWeb successfully launched another 36 satellites into its constellation bringing the system to 182 satellites. The company has only two more launches left in its ‘Five to 50’ programme that will cement the company’s ability to start connectivity services to the United Kingdom, Alaska, Northern Europe, Greenland, Iceland, the Artic Seas and Canada, with global service available next year.

After OneWeb completes the full deployment of the constellation, the company anticipates annual revenues of approximately $1 billion in year three or soon thereafter, thanks to its partnership driven, wholesale business plan.

OneWeb Mini-satellite Constellation for Global Internet Service

……………………………………………………………………………………………………………………………………

Sunil Bharti Mittal, Founder and Chairman of Bharti Enterprises said: “We are delighted to welcome Eutelsat into the OneWeb family.

“As an open multi-national business, we are committed to serving the global needs of governments, businesses and communities across the world. Together we are stronger, benefitting from the entrepreneurial energy of Bharti, the extensive global outreach of the UK Government and the expertise in the satellite industry at Eutelsat. OneWeb, with its innovative and disruptive approach, is poised to take a leading position in LEO broadband connectivity.”

Business Secretary Kwasi Kwarteng said: “Today’s investment is another giant leap forward for OneWeb in realising their ambition to provide global broadband connectivity around the globe.

“Eutelsat brings over forty years of experience in the global satellite industry and this exciting new partnership puts OneWeb on a strong commercial footing, and the UK at the forefront of the latest developments in low Earth orbit technology.

“This comes alongside yesterday’s exciting news that a further 36 satellites were launched into space and demonstrates the momentum behind OneWeb and the promising efforts to provide connectivity to some of the world’s most remote places.”

Neil Masterson, Chief Executive Officer of OneWeb, said: “We are delighted with the investment from Eutelsat, which validates our strategy, technology and commercial approach. We now have 80% of the necessary financing for the Gen 1 fleet, of which nearly 30% is already in space. Eutelsat’s global distribution network advances the market entry opportunities for OneWeb and we look forward to working together to capitalise on the growth opportunity and accelerate the pace of execution.”

Commenting on the agreement, Rodolphe Belmer, Eutelsat’s Chief Executive Officer, said: “We are excited to become a shareholder and partner in OneWeb in the run up to its commercial launch later in the year and to participate in the substantial opportunity represented by the LEO segment within our industry. We are confident in OneWeb’s right-to-win thanks to its earliness to market, priority spectrum rights and evolving, scalable technology. With over 40 years’ expertise in the global satellite industry, we look forward to working alongside the UK Government, Bharti and the other shareholders to open new opportunities and market access to ensure OneWeb maximizes its potential.”

Editor’s Notes:

- OneWeb, based in the UK, filed for Chapter 11 bankruptcy at the end of March 2020 after failing to secure $2 billion financing from lead shareholder SoftBank.

- In January, Japan’s SoftBank Group and Hughes Network Systems LLC had invested $400 million in OneWeb.

- The UK government and Bharti Global invested $500 million each to acquire OneWeb under a bankruptcy resolution process.

- OneWeb plans to start high-speed internet services in India by mid-2022.

- In November, Mittal told Mint that OneWeb will boost rural broadband connectivity in India and other developing countries, including those in Africa.

- For 5G wireless service, satellite network could play an important role as it will reach areas where fiber and radio airwaves cannot penetrate. However, there are no standards for satellite based 5G networks (IMT 2020 and 3GPP specs are for terrestrial wireless operation).

- Also, the cost of using a satellite network is the highest among the three mediums, and thus, fiber and terrestrial wireless spectrum will be the preferred modes of transmission of data wherever they will be available, he added.

References:

Telecom Italia to be first Open RAN network operator in Italy

Telecom Italia (TIM) is among the first operators in Europe and the only one in Italy to launch the Open RAN deployment program to innovate 4G and 5G radio access networks.

The initiative is covered by the signing of a Memorandum of Understanding (MoU) last February with the main European operators to promote Open RAN technology with the aim of speeding up the implementation of new generation mobile networks, in particular 5G, Cloud and Edge Computing.

TIM said it signed up to the MoU to commit to the development of innovative mobile network systems that use open virtualized architecture to facilitate increasingly agile, flexible, secure and functional 5G services.

The first city in Italy to adopt this open network model is Faenza. Through collaboration with JMA Wireless – a leader in mobile coverage and the development of Open RAN software – TIM will use a solution that decouples or disaggregates the components (hardware and software) of the radio access network.

The radio node on the 4G network has been built by combining JMA’s software baseband with the radio units provided by Microelectronics Technology (MTI). Going forward, this venture will also extend to 5G solutions.

The deployment of Open RAN solutions in an open environment, in line with the objectives of TIM’s 2021-2023 ‘Beyond Connectivity’ plan, will unite the potential of the cloud and Artificial Intelligence with the evolution of the mobile network. Moreover, it will enable operators to further strengthen security standards, improve network performances and optimize costs in order to provide ever more advanced digital services such as those linked to the new solutions for Industry 4.0, the smart city and autonomous driving.

TIM is a member of the European Open RAN alliance launched earlier this year by Deutsche Telekom, Orange, Telefonica and Vodafone to work together on developing and implementing open RANs for mobile. TIM said that the initiative will provide strong impetus to the introduction of the broadband mobile network’s new functionalities, in particular the 5G ones, promoting an increasingly widespread deployment and improving its management.

That consortium may be in competition with the 5G Open RAN Ecosystem, which includes the following companies: Dell Technologies Japan, Fujitsu, Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm Technologies, Red Hat, VMware, Wind River and Xilinx.

Of course there is also the O-RAN Alliance and the TIP Open RAN project group. Yet no standards body (like ITU, ETSI, IEEE, etc) is involved and neither is 3GPP which is the main spec writing body for cellular networks.

…………………………………………………………………………………….

References:

https://www.gruppotim.it/en/press-archive/corporate/2021/CS-TIM-ORAN-Faenza-26-aprile2021-EN.html

Analysis: Telefonica, Vodafone, Orange, DT commit to Open RAN

Another Open RAN Consortium: 5G Open RAN Ecosystem led by NTT Docomo

https://www.gruppotim.it/en/press-archive/corporate/2021/PR-TIM-ORAN-en.html

Ericsson claims to be 5G market leader with strong revenues coming in 2022

On Ericsson’s 1st quarter 2021 earnings call this past week, CEO Börje Ekholm said that while Ericsson is focused on growing its core business of networks and digital and managed services, it’s also putting energy into building an enterprise business. The Swedish based company is “seeing a very strong development, strong demand for 5G and enterprise applications.”

The CEO believes that the 5G market cycle will be both longer and bigger due to entering a complete new application area with enterprise applications. What’s encouraging is the progress Ericsson is making on their product portfolio. In Q1-2021, the company announced the ultra-lightweight, high-performance Massive MIMO radio portfolio.

“We have continued to consolidate our position as market leader in 5G with 136 commercial contracts and 85 live networks in 42 countries. What’s also encouraging is that organically, FX-adjusted, we saw sales grew 10% during the first quarter. And if we actually add — or adjust for the IPR revenues, organic growth was 14% in our business. So that is really driven by a strong growth in networks that, again, if you would adjust for IPR, actually grew 19% in the quarter, which is fairly significant growth.

If we look at the market areas, we saw good growth in four out of five market areas. Northeast Asia, we grew by 80%, which is really driven by the non-Chinese markets, primarily. If we look at — the next one is Southeast Asia, Oceania, and India, where we saw good growth, driven by 5G in Australia, as well as 4G rollout in India, of a little touch more than 20%. Moving on to Europe, where we had good growth, 15% in Europe.But that was partly offset by more flattish development in Latin America. And, of course, Latin America suffers from the pandemic and the macroeconomic effects following the tough situation with the COVID-19. If we then look – MANA had a strong development based on continued rollout of 5G. And there, we see, actually, good progress also on our cloud-native portfolio in digital services.So we had a growth of 10% — more than 10% organically. And we’ve been able to also strengthen our market position, which is, long term, going to be very attractive for us. We also saw the completion of the C-band auction, so we expect that to result in deployments during the second half of the year. And if we look then at our last market area, Middle East and Africa, we saw sales falling by 16%.That is really an effect of the pandemic in Africa impacting the macroeconomic and the spend environment, but we’re also seeing a slowdown in Middle East following the large investments last year. So one of the cornerstones of our strategy has been to grow gross margin, and it’s a fundamental indicator of success or progress on the focus strategy. So it is encouraging that we continue to see our gross margin strengthen in the business, and we are able to see that strengthening despite lower IPR revenue. As a matter of fact, we fully compensate for the lower IPR revenue in the gross margin development.”

In the enterprise market, Ericsson is starting to see good progress on its 5G IoT offering, but we’re also seeing that Cradlepoint becomes integrated into our business and seeing the growth opportunities now materializing in the numbers from Cradlepoint.

Ekholm said that the expects to see the U.S. C Band auction result in deployments during the second half of this year. Verizon, in particular, has indicated that it wants to have 7,000 to 8,000 C Band sites ready to go when the spectrum is cleared in late 2021.

Ekholm also briefly addressed Ericsson’s supply chain. AT&T CEO John Stankey raised the potential for C Band equipment supply chain issues this week during AT&T’s quarterly call with investors. Asked about the carrier’s plans for C Band deployment, Stankey said that global supply chains are “stretched” and as a result, he is “a little skittish,” adding that the company is “seeing dynamics that are occurring in the global supply chain where unexpected things are popping up, and it is possible that we could see certain element shortages that start to crop up as everybody’s racing to put stuff up on towers.”

The CEO categorized 2021 as an investment year for Ericsson, particularly in its Digital Services segment, and that the company is incurring costs ahead of revenues — some of which might come as soon as the fourth quarter, but “we’re really going to see revenues coming in 2022,” he said.

References:

Ericsson: Enterprise focus will mean a ‘bigger and longer’ 5G cycle

Telstra wins most lots in Australia’s 5G mmWave auction

Five companies have won spectrum in the Australian Communications and Media Authority’s (ACMA) latest spectrum auction in the 26 GHz band. The 26 GHz band has been identified as optimal for the delivery of 5G wireless broadband services.

Of the 360 lots available in the auction, 358 were sold, realizing a total revenue of Australian $647,642,100, equivalent to almost $0.0127/MHz/POP. The new licensees will have rights to the spectrum for 15 years, starting from later in 2021 through 2036.

Dense Air Australia Pty Ltd won 2 lots for $28,689,900, Mobile JV Pty Limited won 86 lots for $108,186,700, Optus Mobile Pty Ltd won 116 lots for $226,203,100, Pentanet Limited won 4 lots for $7,986,200, and Telstra Corporation Limited won 150 lots for $276,576,200.

Further apparatus licenses in the 26GHz band will be issued next month by ACMA.

“This outcome represents another significant milestone for 5G in Australia. The successful allocation of this spectrum will support high-speed communications services in metropolitan cities and major regional centers throughout Australia,” said ACMA Chair Nerida O’Loughlin.

“This auction is one among a suite of licensing approaches that the ACMA has introduced in the 26 GHz and 28 GHz bands to encourage a wide range of innovative communications uses,” said Ms O’Loughlin.

Optus said it had secured “the most highly valued position at the top of the spectrum band” and foreshadowed new services such as AR/VR video, next-generation cloud gaming and massive simultaneous usage, as well as enterprise use cases such as automation and private networking.

In a blog post, Telstra CEO Andy Penn expressed similar expectations. Penn said the new spectrum capacity was more than ten-times Telstra’s existing 5G spectrum holdings and would be deployed to increase capacity in high-traffic locations such as shopping centers, inner-city train stations and sporting stadiums. Telstra’s mobile networks was increasing by an average of 40% annually.

Telstra is leading in 5G Australia deployments with its 3.6GHz spectrum network expected to reach 75% of the population by the end of June.

References:

https://www.acma.gov.au/articles/2021-04/outcome-millimetre-wave-spectrum-auction

https://www.lightreading.com/asia/australian-operators-pay-a$648m-for-mmwave-spectrum/d/d-id/768991?

AT&T reports strong wireless growth in 1Q 2021; C Band ? Fiber footprint increases

AT&T reported strong wireless subscriber growth today. The company recorded $19.0 billion in mobility revenue, up 9.4% from a year earlier. While service revenue grew just 0.6%, with subscriber gains largely offset by continued pressure on international roaming amid the pandemic, AT&T’s equipment revenue rose 45.2% as AT&T benefited from a greater mix of higher priced smartphones. The latest results also benefitted from comparisons to those from a year-ago period that saw temporary store closures due to the beginning of the COVID-19 crisis.

The telecom/media recorded to 595,000 postpaid phone net additions for the quarter and a postpaid phone churn rate of 0.76%, which was down from 0.86% a year prior. Of the major wireless companies in the U.S., AT&T has been the most focused since the latest iPhone launch on offering promotions meant to drive upgrades from existing customers, rather than mostly targeting customers who would be switching from another carrier.

Impressively, AT&T added 235,000 AT&T Fiber customers in the 1st quarter of 2021, up from 209,000 in the year-ago period. Fiber penetration rose to 35% from 30% in Q1 2020.

During an earnings call, AT&T CEO John Stankey said the company added a total of more than 1 million fiber subscribers over the last four quarters, and was on track to build out fiber to 3 million consumer and business customer locations in 2021. He previously said AT&T was aiming to roll out fiber to 2 million new residential customers this year.

Reflecting on its progress thus far, Stankey said, “I like what I see in terms of our market position. If you look at things like lives, churn, customer satisfaction and net promoter scores and the actual performance of the product, they’re all great…I’ve not seen share movement on typical products like this as rapidly as we’re able to get share movement once we deploy an area.”

“We continued to excel in growing customer relationships in our market focus areas of mobility, fiber, and HBO Max,” said CEO John Stankey. “We had another strong quarter of postpaid phone net adds, higher gross adds, lower churn, and good growth in Mobility EBITDA.” AT&T posted 2.7 million total domestic HBO Max and HBO subscriber net adds, bringing total domestic subscribers to 44.2 million.

AT&T said it expects to spend $6 to $8 billion between 2022 and 2024 to deliver 5G services over its own midband C-band spectrum licenses. The company expects to cover up to 100 million people in “early” 2023, but that target generally trails the buildout plans of Verizon and T-Mobile.

“Global supply chains are stressed right now across the board. You ask the question, can you do the work? And people will give you comfortable answers,” Stankey said in response to questions about plans for C-band, timing and increased capex on AT&T’s first quarter earnings call.

“But I’m a little skittish,” Stankey acknowledged. “We’re seeing dynamics that are occurring in the global supply chain where unexpected things are popping up. And is it possible we could see certain element shortages that start to crop up as everybody’s racing to put stuff up on towers? It may.”

Stankey said that’s part of why he’s cautious about increasing guidance or making changes to C-band plans until there is a little momentum happening.

Likely as a result, Stankey expressed interest in purchasing additional midband spectrum licenses later this year during the FCC’s 3.45-3.55GHz spectrum auction. “I believe there could be an opportunity there,” he said.

Business Wireline, which accounts for 14% of AT&T’s consolidated revenues, saw weak results. This has historically been a highly cyclical business. Total Business Wireline revenue was $6.0B, down 3.5% YoY, a bit better than last quarter’s 4.1% decline. That result was considerably weaker than the expectation of a 3.5% decline.

As with peers, AT&T’s Business Wireline business has held up better than we would have expected during the COVID recession. Verizon noted last quarter that their own Business Wireline segment has been boosted by explosive growth in Public Sector revenues, driven in large measure by schools adjusting to the demands of remote learning, and they indicated that they expected some mean reversion. Perhaps, the CARES Act, which provides a huge amount of subsidy for schools and local governments, will soften (or even reverse) that blow.

AT&T Communications CEO Jeff McElfresh said that AT&T is “supportive” of President Joe Biden proposed infrastructure plan, which sets out to bring high-speed broadband to rural America, and that the company is “encouraging the government to do this in a smart way.” He argued that efforts to expand broadband access are “generally more impressive when you have scale backing the implementation” and that private-public partnerships, as well as collaboration within the telecommunications industry, can help drive success.

……………………………………………………………………………………………………………………………………….

Analyst Comments:

“AT&T appears to be ceding the field in wireless with a network plan that doesn’t even attempt to close the gap with T-Mobile and Verizon,” wrote the financial analysts at New Street Research in a note to clients released shortly after AT&T disclosed its first quarter financial results. “As with results today, for a little longer AT&T may be able to stem the tide of losses through continued aggressive promotions and retention offers, but this can only go so long given other costly priorities (a massive investment in HBO, a doubling of the fiber footprint) amidst generally constrained resources. Moreover, if they allow the network gap to widen too far, they may not be able to keep subs at any price (as was the case with Sprint in later years).”

“AT&T is investing in mobile and HBO Max, as it promised, and at great cost,” wrote the financial analysts at Sanford C. Bernstein & Co. in a note to investors. “The problem is, there are not enough investment dollars to go around. We believe the share price fairly reflects the highly uncertain outlook, and we are watching … as the competitive environment evolves.”

Craig Moffett of MoffetNatanson wrote: “The broadband business requires big capital investments up front for gradual and steady returns later… but the payback period even for good investments is as much as ten years…. The C-Band auction was just the beginning. Verizon has already committed to an additional $10B of capex over the next three years, and Verizon was, by all accounts, far ahead of AT&T already in small cell densification. And what of their costly handset giveaways? Can they be sustained?”

“The problem, as ever, is s AT&T’s debt load. To maintain any pretense that they will be able to pay down debt and service their $15B per year dividend, they need to sustain free cash flow at current levels, or grow it even. But service revenue is still declining, and, despite solid cost controls in Q1, EBITDA is still declining as well (down 4.7% YoY).”

…………………………………………………………………………………………………………………………………..

References:

China Mobile reports 9.5% increase in sales; depreciation and electricity expenses will increase at relatively high rates

China Mobile is the world’s largest wireless network operator by customers, serving 940 million total subscribers in the Q1 2021. The #1 China carrier had 189 million 5G customers a March, an increase of 24 million since December. Its 4G-LTE use base also grew during Q1 2021, up 36 million year-on-year to 788 million.

China Mobile reported a 9.5% year-on-year increase in sales, to 198.4 billion Chinese yuan ($30.6 billion), for its first quarter of 2021. China Mobile’s net profit increased by 2.3% to about RMB24.1 billion ($3.7 billion).

The company states that continued to devote concerted efforts to promoting digitalized and intelligent transformation and achieving high-quality development. Placing a special focus on its “4×3” strategic core and fully implementing the “5G+” plan, it managed to maintain stable growth in key business performance indicators and delivered sound development momentum, taking solid steps towards becoming a world-class enterprise by building a dynamic “Powerhouse.”

China Mobile Chairman Yang Jie said following its large-scale 5G network deployment, it expects corresponding depreciation and electricity expenses to increase at relatively high rates.

Following the large scale operation of 5G, the China Mobile Group expects the corresponding depreciation and electricity expenses will increase at relatively high rates. As the Group scales up the development of DICT and other information services, the demand for resources to address the need for business transformation and upgrade will remain robust.

Facing these challenges and pressure, the Group will continue to explore new sources to increase revenue, and at the same time take measures to lower costs and enhance efficiency. It will also precisely allocate resources by adhering to the principle of ensuring a sufficient budget for areas essential to promote growth, while reducing and controlling expenses on certain selected areas.

While fostering business transformation, promoting innovation and nurturing new areas of growth, the Group will strive to achieve stable and healthy growth in telecommunications services revenue and net profit, maintain good profitability and continuously create value for investors.

China Mobile said it was under pressure to make other cutbacks to cope with the increase in electricity fees and depreciation charges in 2020.

China Mobile’s The revenue growth was mainly due to a 67 per cent increase in handset sales to CNY20.8 billion, which the operator credited to a wider range of 5G models at more affordable prices. Telecoms service turnover increased 5.2 per cent to CNY177.7 billion.

Total subscribers fell by 6 million to 940 million. ARPU edged up 1.1 per cent to CNY47.40, while average monthly data usage increased 34.9 per cent to 11.2GB. The volume of total voice minutes increased 8.3 per cent and SMS usage dropped 12.6 per cent.

China Mobile also faces a huge capital expenditure bill this year as it extends 5G services outside the big cities and into less densely populated communities. It plans to spend RMB183.6 billion ($28.3 billion) in total, up from RMB180.6 billion ($27.8 billion) last year. In its last annual report, it said that approximately RMB110 billion ($17 billion) would go toward 5G rollouts.

…………………………………………………………………………………………………………………………………..

References:

https://www.chinamobileltd.com/en/file/view.php?id=246145

https://www.lightreading.com/5g/china-mobile-warns-of-mounting-5g-costs/d/d-id/768941?

Telenor trial of multi-vendor 5G Standalone (SA) core network on vendor neutral platform

Telenor Group [1.] today said it has established a 5G standalone core network environment using a vendor-neutral platform, with network functions from Oracle, Casa Systems, Enea and Kaloom, all running on Red Hat Openshift. It has deployed Palo Alto Networks Prisma Cloud Compute protection and a 5G New Radio (NR) cellular transmission system from Huawei. Telenor said its 5G standalone (SA) trial using commercially available components proves that a multi-vendor environment is possible.

Note 1. Telenor Group is a Norwegian majority state-owned multinational telecommunications company headquartered at Fornebu in Bærum, close to Oslo, Norway.

The Palo Alto Networks Next Generation Firewall is being used to securing internet connectivity for mobile devices, said Telenor. Red Hat’s Ansible Platform is being used as a scalable automation system, and Emblasoft is providing automated network testing capabilities. The Norwegian Armed Forces have tested Security as a Service enabled by the multi-vendor set-up, it added.

Patrick Waldemar, vice president and head of technology at Telenor Research, said:

“The main component of 5G-SA is the 5G mobile core, the ‘brain’ of the 5G system. Unfortunately, most 5G core deployments are still single vendor dependent, with strong dependencies on that vendor’s underlying proprietary architecture. This single-vendor dependency can be a killer for innovation. It restricts open collaboration from the broader 5G ecosystem of companies developing new technology, use cases, and services that the market expects.”

“To protect the 5G infrastructure from cyber threats, we deployed Palo Alto Networks Prisma Cloud Compute, and their Next Generation Firewall is also securing Internet connectivity for mobile devices. Red Hat Ansible Automation Platform is being used as a scalable automation system, while Emblasoft is providing automated network testing capabilities. The 5G New Radio (NR) is from Huawei,” says Waldemar.

Telenor’s 5G-SA trial, with commercially available components, demonstrates that a truly multi-vendor environment is possible. However, this author has doubts that a multi-vendor 5G SA core network will go into production anytime soon.

“We believes that such a multi-vendor environment will stimulate innovation, reduce cost of the infrastructure, increase competition and accelerate the development of an open 5G-ecosystem which in turn will enable a range of new services for Telenor’s consumers, industry and government customers,” says Waldemar.

……………………………………………………………………………………………………………………………………..

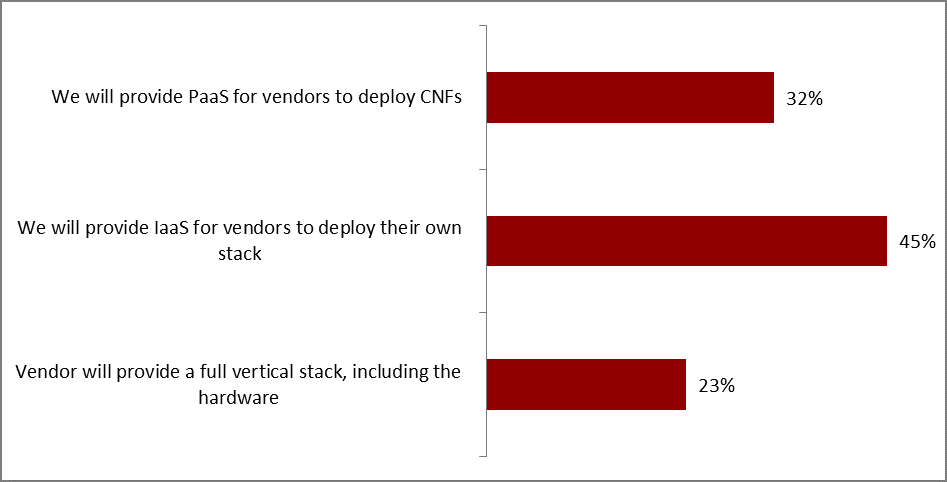

Heavy Reading Survey:

One of the key choices for a 5G cloud native core network is between infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS).

A Heavy Reading “Cloud-Native 5G Core Operator Survey” published in March 2021 identifies a preference for an IaaS model (45%) over PaaS (32%) and vendor-integrated full stack (23%). Larger operators, however, prefer PaaS.

Respondents working for operators with revenue of more than $5 billion annually are somewhat more likely to select PaaS, with a score of 44% versus 41% for IaaS and 16% for the vendor full stack. Conversely, respondents working for operators with revenue of less than $5 billion reported a score 23% for PaaS, 49% for IaaS and 28% for the vendor full stack. This difference reflects corporate cloud technology strategies and, to some extent, the internal capabilities of the operator’s technology team.

Source: Heavy Reading

The overall picture, according to the survey, is that both PaaS and IaaS models are likely to be used over the near and medium terms. This accords with Heavy Reading’s understanding that both models are already in use, in production, for 5G core. Nevertheless, Heavy Reading expect the PaaS model and the container as a service (CaaS) variant to prevail over the longer term, especially as 5G core workloads move closer to the edge.

For more information contact:

Stian Kristoffer Sande, Communication Manager, Telenor Group [email protected]

References:

https://www.telecompaper.com/news/telenor-runs-5g-sa-trial-of-multi-vendor-core-on-red-hat–1380126

https://www.lightreading.com/5g/cloud-infrastructure-for-5g-core/a/d-id/768873?