Month: March 2014

Regulatory Barriers to >95 GHz Wireless Technology

While ITU has spectrum allocations as high as 275 GHz and claims jurisdiction to 3000 GHz, FCC – and probably all nation spectrum regulators (“administrations” in ITU jargon) – have no specific rules, licensed or unlicensed, for frequencies greater than 95 GHz – with the minor exception of provisions for radio amateurs and ISM (e.g. microwave ovens) in a few small segments. This lack of rules and quick market access probably inhibits capital formation for innovative wireless products because it raises unusual and unquantifiable “regulatory risks”

The commentators of Fox News repeatedly comment on the “war on coal” and the “war on religion”. Well, the “war on millimeter (mmW) wave technology” at FCC is just as real and easier to document, although it is no doubt unintentional. There are 3 proceedings at FCC that document FCC’s present disinterest/apathy towards commercial use of cutting edge microwave technology, even as other national competitors advance in this area due to better collaboration between indusrial policy and spectrum policy.

The current situation of US regulation >95 GHz needs the urgent attention of communications technologists, especially researchers and firms dealing with millimeter wave technology. The lack of “service rules” beyond 95 GHz makes regular commercial licensed or unlicensed mmW use impossible. This in turn greatly complicates capital formation for such technology because VCs can easily find other technology to invest in that does not involve making a prominent communications lawyer member a member of your family for several years and paying his children’s college tuition while at the same time the entrepreneur has no access to market and bleeds red ink.

Sadly, with the exception of the IEEE 802 LAN/MAN Standards Committee (the techies behind Wi-Fi standards), Boeing, and the more obscure (at least in FCC circles) Battelle Memorial Institute and the rather obscure Radio Physics Solutions, Inc., no commercial interests have filed comments with FCC on 3 key issues blocking capital formation for technology above 95 GHz and by extension hindering US competitiveness in advanced radio technology.

The 3 dockets involved are:

- Docket 10-236 which as was supposed to encourage experimentation had the apparently unintended effect of complicating millimeter waver research by forbidding, for the first time and without an explanation, all experimental licenses in bands with only passive allocations – independent of whether there was any adverse impact on passive systems. Many mmW bands have only passive allocations and it is difficult a and expensive to avoid them in initial experiments with new technology and it is not important if there is no passive use near the experiment than could get interference. Since the text of the Report and Order contradicts itself on this issue, the simplest explanation is that a sentence was put in the wrong section. Your blogger filed a timely reconsideration petition when he noticed this 2 days before the deadline and that had been supported by Battelle and Boeing and has been opposed by none. But FCC doesn’t necessarily react in a timely way, specially when incentive auctions are very distracting and staffing is low, unless there are multiple expressions of concerns, preferably from corporate America.

- Docket 13-259 deals with the IEEE-USA petition seeking timely treatment of new technology proposals for this green field spectrum >95 GHz under the terms of 47 USC 157, although any clear statement from FCC on how to get timely decisions on such spectrum would be useful.

- Docket 13-84 has proposed updating the Commission’s RF safety rules. The rules currently only have numeric limits up to 100 GHz – the upper limit of the standard they were based on when they were last updated almost 2 decade ago – but the new proposals are silent on numeric limits above 100 GHz even though the standard that is now the base of the regulations now goes to 300 GHz! This lack of a specific safety standard above 100 GHz adds even more to the regulatory uncertainty of those interested in mmW technology. With today’s mmW technology, the specific numeric standard doesn’t really matter much because exposures will be low. But this proposal to leave ambiguity for mmW systems can be very damaging. Battelle has proposed one way to deal with a specific standard. Others interested in mmW technology should either support it or propose an alternative.

- RM-11713 A specific proposal from Battelle for rules to allow a licensed point-to-point service at 102-109.5 GHz (between 2 bands allocated for only passive use).

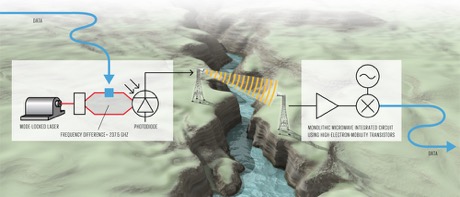

Technology above 95 GHz may not be available at retailers like Walmart and Radio Shack today, but it is not “blue sky” either. (Wi-Fi was not a household word – even even yet named – when FCC created the rules for it in 1985.) The pictures below shows a 120 GHz systems used 6 years ago and a recent German 237 GHz experiment.

Spectrum policy need not be a “spectator sport”. Wireless innovators should realize that access to capital for R&D depends on real business plans and that includes timely spectrum access in the case of wireless technologies. Listed above are 4 FCC proceedings that deal with technologies >95 GHz. The technical community has been oddly silent on all 4. You may not agree with all of them or even some of them, but the proper way to deal with that is make your voice known and tell FCC and/or you national spectrum regulator what you think about policies at the upper end of the spectrum.

vox populi, vox dei

Japanese 120 GHz system used at 2008 Beijing Olympics

German 237 GHz System exceeding 100 Gbits/s

( An experiment probably not permitted in USA under the terms of FCC’s recently revised experimental license rules)

Winners of the NetEvents Cloud Innovation Awards 2014: Martin Casado is Cloud Industry Idol

Winners of the NetEvents Cloud Innovation Awards 2014 were announced March 27th at the NetEvents Cloud Innovation Summit celebration dinner in Los Gatos, CA, USA. These annual Industry Innovation Awards celebrate organizations and individuals that lead the world by innovation and performance in the networking and telecommunications sector.

The top prize was the “Cloud Industry Idol” award, won by Martin Casado, CTO Networking, VMware (and founder of Nicira, which was acquired by VMware in 2012 for $1.26 billion). Mr Casado, PhD Stanford, is quite a humble gentleman. He is an ultra marathon runner who actively competed in multiple races per year before his arduous business air travel shut him down. He wrote in an email to this author: “Thanks Alan, it was a pleasure to meet you. Flying 320K miles last year was brutal. I’m on track for the same this year….”

Mr Casado maintains a personal ultra running web page at: http://yuba.stanford.edu/~casado/ultrarunning.html

At the awards ceremony, NetEvents CEO Mark Fox said: “Martin’s vision and innovations have helped ignite a vibrant SDN research community with potential to bring about one of the most radical transformations the networking industry has witnessed in the past 20+ years.”

That’s likely because Martin is credited as the inventor of OpenFlow API/protocol (between the separate Control and Data Plane equipment) while a PhD student in 2007. “SDN and OpenFlow came out of work we were doing at Stanford,” Casado said. The term SDN was coined in 2009, but has become quite vague now. Neither Nicera or VMWare use OpenFlow in their implementations of Network Virtualization. The latter is effectively an overlay networking model, rather than the pure SDN model which requires all new -SDN complaint- networking equipment.

Other Cloud Innovation 2014 award winners were:

Cloud Security Solution – for the most innovative, practical and effective contribution to cloud security – was won by HyTrust DataControl™ encryption and key management for its ability to give the data owner control of the keys to their cloud based data encryption solution. The other finalists were Juniper Networks & Wedge Networks (joint solution submission) and F-Secure.

SDN Solution for the Enterprise – for SDN solutions that offer easy migration, that deliver early ROI, and generally encourage businesses to take the first steps to tomorrow’s networking. The result was a shared win for Nuage Networks’ Virtualized Services Platform (VSP) and HP’s Network Optimizer SDN application.

Hottest Cloud Company – this award was open to wide interpretation and was a difficult choice between AirWatch, NetSuite and one year old Nuage Networks. “NetSuite’s one integrated offering allows companies of any size to move seamlessly move through most business operations” according to the judges, who awarded it also on the strength of its easy set-up and operation.

NFV Solution for Carriers – from a finalist line-up of Cyan, Gigamon and a joint submission from Juniper Networks & Wedge Networks, the judges picked out Cyan Blue Planet, notably for its support of an open cloud environment “whether Cyan hardware products are involved or not.”

Cloud/Datacenter Solution – for the most innovative Cloud/Datacenter solution, providing major business benefits – was won by Citrix’s CloudPlatform unified cloud management. The other finalists were CoreSite and RedHat

Cloud Mobility Solution – for cloud mobility solutions that offer useful and seamless service, but without compounding IT headaches. The judges decided that AirWatch’s superb security solution, and the choice of ways to implement their solutions added up to a winning formula – over fellow finalists Aerohive and AdaptiveMobile

Cloud Services for the Enterprise – won by Comcast over finalists Basho and RedHat, notably on the strength of its superb friendly service to smaller business customers, including the Cloud Desk “concierge service” for hosted applications and the simplified customer support and billing.

Summing up Mark Fox, said: “These awards offer a rare opportunity to raise a company’s profile in front of the world’s leading media gatekeepers – reaching a massive global audience of high-level decision makers. What’s more, these awards have also raised over $100K for charities to-date.”

For information about the NetEvents program of events plese visit:

http://www.netevents.org/events/events-overview

NetEvents PR contact:

Helen Whitworth

NetEvents International

[email protected]

+44 (0) 870 760 6464

Cloud Innovation Summit Snapshot:

A key theme of this conference was that new approaches to cloud security are urgently needed. Martin Casado said he and VMware will be working on that. “Security will never be the same,” he said pointing to increased threats and requirements for malware and network protection along with vulnerability assessment/management.

Martin’s Stanford PhD Thesis (published in December 2007): ARCHITECTURAL SUPPORT FOR SECURITY MANAGEMENTIN ENTERPRISE NETWORKS presents a principled approach to network redesign that creates moresecure and manageable networks. It proposes a new network architecture in whicha global security policy defines all connectivity. The policy is declared at a logically centralized Controller and then enforced directly at each switch.

One panelist suggested that security functionality should be included in the application program and executed in the cloud. Others advocated building security into the lowest layer and implementing it in silicon (as Intel has done after their purchase of McAfee).

We will be covering Mr Casado’s keynote presentation as it relates to Cloud Security as well as selected others in forthcoming articles. We will also consider writing up some of the 1 on 1 industry chat sessions that took place Thursday and Friday afternoons.

Stay tuned….

Internet of Things (IoT) Key Messages- Part 2: IDC DIrections 2014 + Market Survey Abstracts

Introduction:

I attended three of four IoT sessions at IDC Directions 2014 plus sat in on a lunchtime roundtable discussion of IoT devices and semiconductors led by Mario Morales. All of the above were excellent. This article provides highlights of two presentations and abstracts of various IoT market studies.

On the Cusp of a Demand-Driven Internet of Things (IoT) Market, by Carrie MacGillivray

- 30B Connected Things Predicted by 2020!

- 2012 -2020 CAGR = 6% from 19B connected devices in 2012

- IoT Revenue Almost 2x by 2020 to $8.9T from $4.8T in 2012

- IoT has been a supply driven market with vendors looking for new opportunities and revenue sources.

- IoT has potential to complement product and service portfoliosOngoing development of connected Smart Cities/Cars/Houses/Things Regulatory environment

- Age of “Big Data” will be used to analyze information collected from Internet connected devices

- Connected Culture -High affinity for full-time connectivity

-Device & semiconductor manufacturers

• Market transformation means change from top to bottom at your organization

• Markets are being redefined

• The next big markets are all ready here

• Intelligent systems unlock opportunity

• Appetite for data drives sustainable growth

• From the cloud to client

• Technology alone does not guarantee success

• Moving away from shipping hardware to system level value and solutions

• Focus must be on execution and solutions that address a diverging set of customers and vertical markets

• Ecosystem is fragmented, vertical market focused

Key technologies enabling IoT business transformation:

• Heterogeneous SoCs

• Low power connectivity and SoCs, energy harvesting/reduction

• Security in silicon

• Large solid state capacity to support appetite for data and eventually analytics

• Natural User Interfaces (NUIs)

• Intelligent sensor fusion

• Audio and visual search, real time system learning

Proliferation of sensors are tied to their User Interface (UI):

• Providing systems with contextual awareness

• Connecting with our environment

• 40 year effort to replicate human senses

• Market still looking for viable usage scenarios, applications, and business models

IoT Transformation Drives the Monetization of Data

Today: Function & data, Connected, Limited Security

Tomorrow: Data drives function, Interoperable, Scalable, Security is fundamental to IoT solution

IoT Markets with potential:

During his closing keynote, UT Professor of Innovation (and Ethernet inventor) Bob Metcalfe, PhD, said that “software defined networking (SDN) hasn’t really found it’s niche yet. Perhaps, it will in managing the Internet of Things.” Even though SDN was never intended to be used to provision, control and manage the IoTs/connected devices, we suggest that it could do so along with managing internal network equipment from source to destination route.

IDC’s Worldwide Internet of Things Spending by Vertical Market 2014–2017 Forecast – Feb 2014

This IDC study analyzes the worldwide vertical market opportunity for the burgeoning Internet of Things (IoT) market. It provides a market outlook for 2012–2017 and sets the forecast within the context of the IoT ecosystem, including intelligent systems, connectivity services, platforms, analytics, and vertical applications in addition to security and professional services required to build out a complete picture. This study discusses the key vertical market trends contributing to the growth of the IoT on a worldwide basis. A worldwide vertical market revenue forecast is included.

“The Internet of Things market must be understood in terms of vertical markets because the value of IoT is based on individual use cases across all markets,” said Scott Tiazkun, senior research analyst, IDC’s Global Technology and Industry Research Organization. “Successful sales and marketing efforts by vendors will be based on understanding the most lucrative verticals that offer current growth and future potential and then creating solutions for specific use cases that address industry-specific business processes.”

https://www.idc.com/getdoc.jsp?containerId=246384

Addendum: IoT Market Research Studies

Mckinsey Global Institute’s Disruptive Technologies report calls out the Internet of Things (IoT) as a top disruptive technology trend that will have an impact of as much as $6 Trillion on the world economy by 2025 with 50 billion connected devices. The Internet of Things is the next huge wave of growth of the Internet. Big growth numbers and expectations are dramatically expanding for the Internet of Things in Silicon Valley and globally. Valuations for IoT startups have also increased dramatically and caught Wall Street and the venture capital community by storm, including Google’s acquisition of Nest for $3.2 billion dollars and Jawbone’s pre-IPO valuation at $1.5 billion.

Gartner Group: IoT to transform data center market

The Internet of Things (IoT) has a potential transformational effect on the data center market, its customers, technology providers, technologies, and sales and marketing models, according to Gartner, The IoT is expected to reach 26 billion units installed by 2020, and by that time, IoT product and service suppliers will generate incremental revenue exceeding USD 300 billion, mostly in services.

The report has also identified potential challenges, covering security, enterprise, consumer privacy, data, storage management, server technologies, and data centre network.

The increasing digitization and automation of the multitudes of devices deployed across different areas of modern urban environments are expected to create new security challenges to many industries. Significant security challenges will remain as the big data created as a result of the deployment of myriad devices will drastically increase security complexity. This, in turn, will have an impact on availability requirements, which are also expected to increase, putting real-time business processes and, potentially, personal safety at risk.

As is already the case with smart metering equipment and increasingly digitized automobiles, there will be a large amount of data providing information on users’ personal use of devices that, if not secured, can give rise to breaches of privacy. This is particularly challenging as the information generated by IoT is a key to bringing better services and the management of such devices.

The impact of the IoT on storage is two-pronged in types of data to be stored: personal data (consumer-driven) and big data (enterprise-driven). As consumers utilize apps and devices continue to learn about the user, significant data will be generated.

The impact of the IoT on storage infrastructure is another factor contributing to the increasing demand for more storage capacity, and one that will have to be addressed as this data becomes more prevalent. The focus today must be on storage capacity, as well as whether or not the business can harvest and use IoT data in a cost-effective manner. The impact of IoT on the server market is forecast to be largely focused on increased investment in key vertical industries and organizations related to those industries where IoT can be profitable or add significant value. Existing data center WAN links are sized for the moderate-bandwidth requirements generated by human interactions with applications. IoT is expected to dramatically change these patterns by transferring massive amounts of small message sensor data to the data center for processing, dramatically increasing inbound data center bandwidth requirements.

The magnitude of network connections and data associated with the IoT are expected to accelerate a distributed data center management approach that calls for providers to offer efficient system management platforms. This new architecture will present operations staffs with significant challenges, as they will need to manage the entire environment as a homogeneous entity while being able to monitor and control individual locations. Furthermore, backing up this volume of data will present potentially insoluble governance issues, such as network bandwidth and remote storage bandwidth, and capacity to back up all raw data is likely to be unaffordable. Consequently, organizations will have to automate selective backup of the data that they believe will be valuable/required. This sifting and sorting will generate additional big data processing loads that will consume additional processing, storage and network resources that will have to be managed.

http://www.telecompaper.com/news/iot-to-transform-data-center-market-stu…

Semiconductor Wireless Sensor Networks IoT Market to Hit $12 bil by 2020 Forecasts a Research Report

Worldwide markets are poised to achieve significant growth as the Semiconductor Wireless Sensor Network is used to implement the Internet of things and to monitor pipelines, oil wells, and health care patients to illustrate the variety of projects supported by these networks.

Semiconductor wireless sensor networks (http://www.reportsnreports.com/reports/275026-semiconductor-wireless-sensor-internet-of-things-iot-market-shares-strategies-and-forecasts-worldwide-2014-to-2020.html) are used for bridge monitoring, implementing the smart grid, implementing the Internet of things, and monitoring for security implementation. The systems are used to implement energy savings in homes and commercial buildings, almost anything can be monitored with sensors and tracked on a smart phone. Projects are ongoing.

With 9 billion devices connected to the Internet in 2014, phenomenal growth is likely to occur when that number rises to 100 billion by 2020. Businesses control devices with sensors and wireless sensor networks (WSNs).

The sensors connected to the Internet promise to bring a big data explosion. Much of the data will be discarded, as users get simply overwhelmed by vast volumes. Analytics will become popular inside the wireless sensor networks so that alerts are generated at the point of collection of data.

The issue is how to embed analytics into the wireless sensor network control units so that only the alert data needed is transmitted. Users of information need to be able to find, control, manage, and secure the information coming from sensors onto the network. Users need to analyze and exploit the information coming from sensors.

Advanced technologies for wireless sensor networks are associated with emerging ways of interconnecting devices that have never been connected before. Networking is based on leveraging the feasibility of making sensors work independently in groups to accomplish insight not otherwise available. Advanced storage devices are emerging simultaneously with the energy harvesting devices that are economical, making sensor networks feasible. Storage devices can leverage the power captured by energy harvesting when sensors and devices are interconnected as a network.

Data storage technologies connected to the sensors are permitting far better control of the world around us, implementing vastly improved energy efficiency as lights and hearting are turned on and off just as needed. Wireless sensor networks implement cost-effective systems.

Wireless sensor networks are developing a market presence. They are set to power wireless sensor network proliferation. Independent sensor devices located almost anywhere have attained workable levels of efficiency.

The proliferation of apps on smart phones will drive growth of semiconductor wireless sensor networks markets because the sensors work directly as they are installed without excess labor and wiring that has been necessary previously, making the systems more convenient to install and run.

Healthy lifestyle choices can increase the length of DNA sequences found at the end of a person’s chromosomes and reverse aging. This discovery is likely to increase interest in monitoring and testing DNA sequences and looking at the ends of the chromosomes. This discovery is likely to increase a shift toward wellness initiatives. It has stimulated the need for better communication between clinicians and patients. New sensor technology creates the opportunity for monitoring and testing. Wireless sensor network devices can be used to send alerts to at risk people who are exercising.

Wireless sensor networking is set to grow as sensors are freed from the grid and networks implement connectivity that is mesh architecture based. Converting ambient energy to useable electrical energy harvesting (EH) systems creates the opportunity to implement wireless sensor networks. These networks interconnect an inexpensive and compact group of devices and sensors. The networks use wireless capability to power portable electrical devices.

According to the semiconductor wireless sensor network market research study, “Semiconductor wireless sensor network markets are evolving as smart phone devices and technology find more uses throughout the landscape of the Internet of Things. Sensors can provide monitoring that has not previously been available. Differential diagnostic tools support provide differential information that helps manage our daily lives from traffic patterns to crime detections, to medical treatment.”

“The decision process take into account clinical findings from the home monitoring devices and from symptoms verbally communicated in a clinical services setting. Improved economics of healthcare delivery implementation is facilitated by wireless sensor networks. This is true across the spectrum of things that can be monitored by sensors”

Semiconductor Wireless Sensor Networks Markets at $2.7 billion in 2013 are forecast to reach $12 billion Worldwide by 2020. Wild growth, frequently measured as penetration rates is a result of the change out of wired sensor networks for wireless ones. In addition, the wireless networks have a broader reach than the wired ones did, spurring market extensions in a variety of applications, some not even thought of so far.

Market growth is dependent on emerging technology. As the wireless technology, the solid state battery, the sensor technology, smart phone technology and the energy harvesting technology all become commercialized, these devices will be used to implement wireless sensor networks. The semiconductor wireless sensor networks markets will be driven by the adoption of 9 billion smart phones by 2020, creating demand for apps that depend on sensor networks.

Inquire for Discount at: http://www.reportsnreports.com/contacts/discount.aspx?name=275026

IoT Key Messages from TiE-SV, IDC Directions 2014 and Yankee Group- Part I TiE-SV IoT event & TiECon 2014

Part I: TiE-SV Panel and IoT Track at TiECon 2014

Introduction:

In the past two weeks, we’ve attended Internet of Things (IoT) presentations at TiE-Silicon Valley (SV), IDC Directions 2014 and (via webinar) from Yankee Group. This three-part article summarizes the key take-aways from each of those events.

Backgrounder:

The confluence of efficient wireless protocols, improved sensors, cheaper processors, and a bevy of startups and established companies developing the necessary management and application software has finally made the concept of the Internet of Things (IoT) mainstream.

by 2020, Internet-connected devices are expected to number between 26 billion and 50 billion (depending on which forecast you believe). For every Internet-connected PC or handset there will be 5-10 other types of devices sold with native Internet connectivity. These will include all manner of consumer electronics, machine tools, industrial equipment, cars, appliances, and a number of devices likely not yet invented. In our view, the concept of the IoT will disrupt consumer and industrial product markets generating hundreds of billions of dollars in annual revenues, serve as a meaningful growth driver for semiconductor, networking equipment, and service provider end markets globally, and will create new application and product end markets that could generate billions of dollars annually

The IoT will result in profound changes in the way enterprises operate and the products they produce and consume. Although machine-to-machine (M2M) applications have existed for quite a while, these applications were closed, highly specialized and expensive. IoT opens up inexpensive connectivity to any device and couples this with the power of the cloud and big data analytics to enable enterprises to reduce costs, optimize resources, create new products, and explore new business models.

McKinsey Global Institute’s Disruptive Technologies report calls out the Internet of Things (IoT) as a top disruptive technology trend that will have an impact of as much as $6 Trillion on the world economy by 2025 with 50 billion connected devices! The economic impact of IoT has been variously estimated as between $14.4 and $19 trillion, and inevitably this will create unprecedented opportunity for entrepreneurs, be they in software, hardware or services. Valuations for IoT startups have also increased dramatically and caught Wall Street and the venture capital community by storm, including Google’s acquisition of Nest for $3.2 billion dollars and Jawbone’s pre-IPO valuation at $1.5 billion.

TiE Silicon Valley IoT March 12, 2014 – Overview presentation and panel session discussion:

The IoT overview was presented by Bill Bien, a partner at Waterstone Management Group LLC. “If software will eat the world, then the IoT will be the teeth that will do the eating,” according to Mr. Bien.

Opinion: That’s a heck of a statement, considering how much software goes into cloud c& mobile computing/ mobile apps, e-commerce, gaming, virtual reality and big data/analytics.

“Embedded intelligence is now growing at 11% per annum, but will grow to In this session, we 40% by 2017,” said Bien (see Note below). “There will be 50B connected devices by 2020,” he added. Vertical market segments such as transportation, retail, agriculture, health care, government and others will all embrace IoT. Investor interest is building up as evidenced by Google’s recent acquisition of smart thermostat maker NEST, according to Bill.

The drivers for IoT include: increased processing power in devices (courtesy of Moore’s Law) and sensors, wireless ubiquity (95% cell phone penetration rate in the U.S.), cloud computing and big data deployments.

IoT will change industries, according to Bill. A few examples: wearable electronics and connected self, connected home and car, industrial Internet, connected health.A Credit Suisse (investment bank) study said there was “significant upside” for the connected home, but which direction it takes isn’t clear. Will everything in the home be connected or will there be separate connected appliance solution depending on use or application, e.g. security, lighting and energy control, etc.

“The connected car will be a $54B opportunity,” according to Bill. That includes both mobile connectivity and services as well as telematics for remote management of the car.Industrial IoT was said to be a $3T to $6T market (by when?). That huge market includes: e-health, manufacturing, smart cities, power grid/smart grid, building controls, process automation.

An astonishing “$45B of the enterprise IoT market will be addressable by start-ups,” Bien predicted. That includes: data analytics, enterprise software and analysis, applications and services.

The Economist magazine stated that enterprise IoT is still in the planning phase with manufacturing in the lead. It has to cross a “chasm” before it can be a commercial success. While there’s great excitement and a lot of interest in enterprise IoT, the industry needs to change how software and services are sold to the customer. Mr. Bien concluded: “Drivers are in place for rapid growth of IoT. A diverse set of apps will soon be developed, but we’re still in the early days of IoT.”

Note: Mr. Bien stated many forecasts for market size, growth rate and number of connected devices, but generally did NOT provide the source for any of those. Part II of this series includes even more market size forecasts, which are all from IDC.

Panel Session Discussion:

Moderator: Brett Galloway, Founder and CEO, Xova Labs

Panelists:

-Thomas A. Joseph, PhD, Senior Vice President, SAP’s Office of the CTO

-Bill Bien, Partner, Waterstone Management Group LLC

-Jasper zu Putlitz, Founder and Managing Director, ansacloud LLC (formerly with Bosch)

-Sanjay Manney, Director of Product Management, Echelon Corporation

-Pradip Madan, Advisor, Board Member, and Investor

-Patrick Eggen, Investment Director, Qualcomm Ventures

The panel first addressed the question of whether or not IoT is a real market, rather than just another way of talking about industrial networking technology. The management and control of high value assets is one way IoT is different and distinct. It’s a platform where discrete data can be used to manage high valued assets, suc h as in health care. It’s a system where many devices talk to each other, e.g. Internet connected health care appliances/monitors.

Sanjay Manney of Echelon thinks the IoT foundation starts with Internet protocols. Then others are added to provide a “reliable form factor for the appropriate applications. There’s a real value in putting sensor data in a software context,” he said.

Patrick Eggen of Qualcomm ventures said that WiFi was probably the most likely wireless network to be used for the IoT. He said that cellular (3G, 4G) might be used in the future, but the economics of 3G don’t work today for many low cost applications. (Note that Sprint is using 2G for many of it’s IoT/M2M configurations). He identified smart cities, sensor based parking as applications while noting that many municipalities have their own proprietary wireless networks with cellular being too expensive to replace them.

Jasper zu Putlitz of ansacloud said the wireless carriers would be big beneficiaries of the IoT. Of course, that assumes that their cellular services (2G, 3G, and 4G) are used. Seven or eight wireless carriers control most global wireless access. 6% growth in service provider CAPEX is primarilly driven by wireless spending.

How IoT will change transportation (cars, trains, buses, etc) was the next panel discussion point. Connected transportation systems will include sensors with built in radios. Telematics will be used to ensure smoother traffic flows. This will be part of many smart city initiatives.The challenge will be integrating many diverse technologies, especially different sensor types. Much of the systems integration will need to be done in software.

One version of the connected home will be for optimized energy management, which will minimize wasted energy usage. Such a system will control heating, lighting and react to the ambient environment, e.g. smoke alarms. But standards for this are missing but needed to o beyond “hobbyist” endeavors. A connected home/IoT system has to work flawlessly and be intuitive to sense (and possibly act) on ambient conditions.The panel continued to debate many interesting aspects of the IoT.

While time and space don’t permit me to cover that, readers are invited to watch this TiE-SV event video at:

http://player.vimeo.com/video/89187936?title=0&byline=0

IoT Track at TiECon 2014:

Many, including this author, believe that the Internet of Things is the next huge wave of growth of the Internet, and TiEcon 2014 will explore this fast expanding field of entrepreneurial opportunities. Big growth numbers and expectations are dramatically expanding for the IoT in Silicon Valley and globally.

TiEcon 2014 (May 16, 2014) will explore all the major IoT trends and the disruptive opportunities they will create for startup innovation, consumer value and enjoyment, societal benefit, and wealth creation. If you are an entrepreneur and interested in surfing the next wave of the Internet, come join us at TiEcon 2014. We will be wrapping up the day with a panel of leading VCs talking about where they plan to invest!More info at: http://tiecon.org/internet-of-things

From TiECON: Why the ‘Internet of Things’ is relevant:

‣ $6 Trillion impact on world economy by 2025‣ 50 Billion connected devices by 2025

‣ Evolution of smart cars, buildings, factories & cities

‣ Proliferation of intelligent wearable technologies & smart devices

‣ Quantum leaps in innovations around healthcare, manufacturing & infotainment

What you will learn at TiECon 2014 IoT Track:

‣ Top market trends and projections in IoT

‣ Technology visions of the whose-who in IoT

‣ Shifts and transformations in value chains

‣ Demonstration of healthcare management through remote applications and sensors

‣ Innovative Ideas and breakthrough opportunities for entrepreneurs

TiECON 2014 Overview:

Infonetics: Data Center Network Market May Become Disaggregated; Caused by Bare Metal Switches

Market research firm Infonetics Research released excerpts from its full 4th quarter 2013 (4Q13) and year end Data Center Network Equipment and SAN and Converged Data Center Network Equipment reports, which now include forecasts for bundled solutions and ports-in-use for storage.

DATA CENTER NETWORK EQUIPMENT MARKET HIGHLIGHTS

. Data center Ethernet switch ports sold as part of a bundled solution made up 27% of all data center ports shipped in 2013, growing to 45% in 2018

. The bare metal switch market has the potential to transform a significant portion of the Ethernet switching market into a disaggregated model, similar to the server market

SAN AND CONVERGED DATA CENTER NETWORK MARKET HIGHLIGHTS

. Nearly half of all converged data center network ports shipped in 4Q13 will carry

storage traffic

. Infonetics forecasts Ethernet switch ports-in-use for storage to reach 55% of all data center purpose-built switch ports shipped in 2018

. Switch ports-in-use for Fibre Channel over Ethernet (FCoE) are expected to account for 22% of all data center purpose-built ports shipped in 2018

ANALYST NOTE

“There’s still room for best-of-breed in the Ethernet switch market, but as the industry moves beyond early adopters and the early market for data center fabrics, the next wave of adoption has to be made simpler for the ‘main street’ buyer,” notes Cliff Grossner, Ph.D., directing analyst for data center and cloud at Infonetics Research. “This will keep the market for best-of-breed solutions healthy even as a portion of the data center Ethernet switch market turns to bundled solutions.”

Grossner adds: “The shift to cloud-architected data centers with automated deployment of virtual workloads will require storage networking to be more agile, driving the need for a converged network with storage and application traffic on Ethernet.”

REPORT SYNOPSES

Infonetics’ quarterly data center network equipment report tracks data center Ethernet switches, application delivery controllers (ADCs), WAN optimization appliances, and Ethernet switches sold in bundles (companies tracked: A10, Alcatel-Lucent, Arista, Array Networks, Barracuda, Blue Coat, Brocade, Cisco, Citrix, Dell, F5, HP, Huawei, IBM (BNT), Juniper, Kemp, Radware, Riverbed, others). Infonetics’ quarterly SAN and converged data center network equipment report tracks chassis and fixed Fibre Channel switches; Fibre Channel HBAs; converged data center switch ports-in-use for storage (iSCSI, FCoE, FC-to-FCoE); and converged data center network adapters (iSCSI, CNAs, universal) (companies tracked: Alcatel-Lucent, Arista, ATTO, Brocade, Broadcom, Cisco, Dell, Emulex, HP, IBM (BNT), Intel, Juniper, QLogic, others).

To buy the reports, contact Infonetics: http://www.infonetics.com/contact.asp

IDC Data Network Prioritites Survey Results:

Reference:

A New Open Data Center Network: Disaggregating the Network Operating System from Switch/Router Gear

http://viodi.com/2013/06/25/a-new-open-data-center-network-disaggregatin…

FREE SDN REPORT AND WEBINAR:

Everyone who registers for analyst Cliff Grossner’s Virtualizing Networks with SDN NVOs and Bare Metal Switches webinar will receive a special Infonetics report, 2014: The Year SDN NVOs and Bare Metal Networking Get Serious. Join the live event March 25 at noon EDT or watch the replay. The webinar explores how network virtualization overlays (NVOs) and bare metal networking make data center network virtualization faster, easier, and more affordable:

http://w.on24.com/r.htm?e=746584&s=1&k=F8942DEE951A3E32B8495DE59289A1E3

IDC Directions 2014: 3rd Platform is Transforming and Disrupting IT; IoT Offers Tremendous Potential!

Introduction:

For the last three years, the IDC Directions annual conference has emphasized the 3rd Platform for IT, which consists of some combination of big data/ analytics, social collaboration for business, mobile and cloud computing/storage. But this year, the market research firm produced numbers that imply the 3rd Platform is really taking hold. It is disrupting entire industries, which in turn puts more pressure on IT professionals to adapt or die. Surprisingly, much of that adaptation is being done at the departmental level, rather than the organization’s centralized IT department.

Frank Gens, IDC senior vice president and chief analyst, opening keynote set the stage for the presentations to follow. According to IDC, 25% of all IT spending in 2013 went toward the third platform, a percentage that will only grow in coming years. “Virtually 100% of all the marginal spending growth in IT is now coming from 3rd platform,” Gens said. “Now that every vendor in the industry has their full attention on that marketplace, this year is going to be all about pitched battles in every single corner of the third platform to establish new leadership in this market.” Gens added that the 3rd platform is reinventing many industries, with six of the top 20 IT market leaders being disrupted by competitors.

Probably the main driver of the 3rd platform has been the (core IT infrastructure) shift from premises data centers and networking to cloud computing and storage with almost everything now being offered “as a service.” Cloud’s adoption has been driven by three major factors: scale, complexity and speed, The cloud offers scale that regular businesses do not have, which allows them to deliver more complex services faster.

Focusing on the changing demands of the 3rd platform, Gens outlined the five key battlegrounds that will determine the winners and losers in 2014’s business IT transformation.

1. Core Infrastructure (Data Centers)

IDC predicts that the number of global cloud delivery centers will double in the next two years, with more vendors moving cloud capacity to developing marketplaces. This will lead to industry consolidation within the next four years, with the dozens of cloud infrastructure providers that are active today shrinking to between six and eight large companies. Who they might be was not named (our guess is that Amazon, Google, Microsoft, Rackspace, IBM, and others will succeed in either private or public cloud, but not both).

2. Internet of Things (IoT)

Gens talked about Internet-connected things (IoT) — beyond smartphones and tablets — as the next battleground and indeed this was a major theme of 2014 IDC Directions with many talks on that topic. Manufacturers are introducing connectivity in some surprising products: jewelry, sports equipment, dog tags and even toothbrushes, Gens said. The growth in connective devices ties directly into the IoT, which IDC predicts will also see a boom in coming years. Here’s the press release for their IoT market forecast: http://www.idc.com/getdoc.jsp?containerId=prUS24671614

The coming IoT revolution is hyper-extending (using IDC’s words) the edge of the network and will fuel a major explosion in killer apps impacting every industry worldwide.

3. Platform as a Service (PaaS)

Developers of cloud applications will rely on PaaS to deploy and support their software, which is quite a significant development as Infrastructure as a Service (IaaS) and Software as a Service (SaaS) were the previous big cloud platforms offered.

IDC market research forecasts that 80% of new cloud applications in development will be hosted on the top six PaaS providers. Developers will only want to create apps for the most popular platforms. “It’s like musical chairs,” Gens said. “When the music stops, there are only so many seats left.”

Industry-specific cloud platforms are becoming more popular, especially since previous cloud platforms were industry neutral. IDC predicts that by 2016, more than 100 platforms targeting individual industries will be on the market.. Most significantly, big players in those industries — GE, Disney and John Deere, etc — are leading the way forward and are often welcoming competitors in as collaborators.

4. Cloud Applications

With the mass migration from premises data centers to cloud computing, IDC predicts a tenfold growth in SaaS/AaaS over the next four years, worth about $20B by 2017. About two-thirds of them will be process or role-based business solutions and 75-80% of new cloud apps will be big data intensive. These apps are being created by close to 18 million professional and hobbyist developers. They should not be underestimated, Gens added.

5. Infrastructure as a Service (IaaS).

Over the next two years, IDC expects to see a large increase in the number of specialized infrastructure services. “The last five years, anyone who’s looked at the software industry have seen a huge flip,” Gens explained. The enterprise was once the traditional beginning point for new software, but that has now moved to the cloud. Gens commented: “Software developers have said, ‘If I have a new product, I can get it to market and scale is much more quickly if I introduce it first through a cloud service.'”

Other Data Points from IDC Direcitons 2014:

- Cloud computing was an estimated $47.4 billion industry in 2013 and is expected to more than double to $107 billion by 2017.

- Clloud computing’s 23.5% compound annual growth rate is five times faster than that of the broader technology market.

- An IDC’s survey revealed that 41% of its 143 IT executive respondents said application modernization was important, followed by 38% who named big data/business analytics and 35% who noted security/risk management as the key areas their organizations will focus on this year.

- 80% of new cloud apps will be “big data intensive”

- Convenience will trump everything, including security and reliability!

- “For every mobile device that’s launched, there has to be a large data center behind it to enable it,” Rick Villars said. This led to a wave of “mega data centers” being built by the likes of Google, Verizon and others.

- As IoT gets built out along with wearable technologies, there will be a need to locate (satellite) cloud data centers closer to the premises, according to Villars.

- There are still no solid standards for IoT, especially provisioning, activation/de-activation, monitoring and management. The data standards and protocols are likely to be industry specific, e.g. health care, retail stores, finance, etc.

Closing Comment:

This year’s IDC Directions has no sessions on Software Defined Networking (SDN) or Network Virtualization. That was in sharp contrast to last year’s conference program. Perhaps, the conference organizers have recognized that the SDN/NFV industry is spinning (or drowning in hype)

In response to an audience question after his closing keynote, UT Professor of Innovation Bob Metcalfe, PhD, said that “software defined networking hasn’t really found it’s niche yet. Perhaps, it will be in managing the Internet of Things.” We couldn’t agree with him more.

Addendum: Internet of Things (IoT)

McKinsey Global Institute’s Disruptive Technologies report calls out the Internet of Things (IoT) as a top disruptive technology trend that will have an impact of as much as $6 Trillion on the world economy by 2025 with 50 billion connected devices. The Internet of Things is the next huge wave of growth of the Internet. Big growth numbers and expectations are dramatically expanding for the Internet of Things in Silicon Valley and globally. Valuations for IoT startups have also increased dramatically and caught Wall Street and the venture capital community by storm, including Google’s acquisition of Nest for $3.2 billion dollars and Jawbone’s pre-IPO valuation at $1.5 billion.

The author is available (under contract) to do a thorough report of IDC’s IoT presentations as well as IoT findings from TiECon 2014 on May 16.

AT&T’s John Donovan talks BIG GAME but doesn’t reveal Game Plan at ONS 2014

John Donovan wants to revamp AT&T’s network using SDN, but also its internal policies, methods and procedures. AT&T’s senior executive vice president of technology and network operations was strong on conviction, but short on details during his March 4th keynote speech at the Open Network Summit (ONS) in Santa Clara, CA.

You can watch that keynote, along with opening remarks from ONS Chairman Guru Parulkar, PhD at:

https://www.youtube.com/watch?v=tLshR-BkIas

AT&T is committed to shifting to a more agile networking strategy, which it’s calling User-Defined Network Cloud or Domain 2.0. According to Donovan, there are four key principles that will guide AT&T’s network transformation:

1. Open- APIs are the perfect tool

2. Simple- a more common network infrastructure

3. Scale- evolve network to support high traffic growth

4. Secure- protect the Control Plane

“We intend to provide elastic network services, just like cloud provides elastic computing and storage services today,” Donovan said. “Customers will be able to self-provision networking services on the fly, as needed, just as they now do with compute services and storage from cloud service providers,” he added.

Donovan shook up the audience (especially this author) when he said:

“We’re changing everything at AT&T:

- How the network is built (presumably with much more software control)

- The actual equipment and the software – leveraging open source principles and software

- How AT&T will be partnering and purchasing from both startups and larger companies

- AT&T’s operations and culture – changing their OSS model while pursuing network agility”

To that latter point, Donovan said that AT&T plans to retire more than 1,000 of its current OSS applications. In their place, the carrier hopes to handle operations such as billing and provisioning through parallel processes “as opposed to the inhibiting process that defines everything that we do,” Donovan said. It was quite refreshing to hear an AT&T executive admit that the company is plagued by “inhibiting processes,” which often is the cause for botched service orders and delayed service deployments.

Orchestration of many distributed controllers will be one of the most difficult steps in the SDN migration. During the Q & A session, Donovan was asked whether any vendors have orchestration offerings that AT&T’s goals and objectives. “We’ve had a lot of very interesting dialogue, but we have nothing ready to deploy,” he said. “That is a massive software project. It will be a highly complex, multi-participant approach. We’re going to have to even write some of it ourselves,” he added.

“Our backbone today, we manage over 4 million routes, and that’s larger than you can get from any control plane, so we wrote our own. So, we’re not brand new to this game.”

“Our strategy is more than just a network design change,” Donovan added. “It’s a change in how we do business with suppliers and with how we manage platforms, systems and software. It changes our people. We have to take advantage of cultural change at our company.” Wow, that was quite an impressive statement from an AT&T executive!

In answer to a question from a skeptical Light Reading analyst, Donovan replied that AT&T is making real progress in its evolution to SDN. He said that the company has succeeded in abstracting the control plane from the backbone network – one of the first steps to realize the separation of the control plane from data plane. “What I’m talking about is radically reshaping the WAN,” Donavan noted.

And what about this year’s roadmap for SDN? “What we’re looking for in 2014 are beachhead projects that can move us from an old Domain 1 architecture to a Domain 2 architecture. We’re calling it D1.5,” Donovan said. The idea is to fit controllers onto AT&T’s current platforms, extending the lives of those platforms.

The beachhead projects are meant to happen quickly. AT&T has already identified “a half dozen” of them, Donovan said. Moving into 2015, AT&T hopes to start introducing applications that were born in the cloud, a buildup that should lead to a “crescendo effect,” Donovan said.

Comment & Analysis:

We wonder what version of SDN AT&T will implement? No details on the specific network infrastructure were announced at ONS 2014, nor in any AT&T press releases. Donovan did not mention OpenFlow in his speech and the carrier is NOT a member of the Open Network Foundation (ONF) that is standardizing that southbound API/protocol between the Control and Data planes.

At previous year ONS events, Chair Guru Parulkar, PhD, emphatically stated there was only one version of SDN, which clearly separated Control and Data planes via OpenFlow southbound API. Anything else was “SDN washing,” he said. That statement was not repeated at ONS 2014. In fact most speakers said that OpenFlow was one of many protocols that would be used for SDN. Some clearly stated that they would not use OpenFlow at all, as it didn’t solve the open networking problems adequately.

In a March 14 conversation with Soren Telfer of AT&T’s Palo Alto Foundry, we learned that OpenFlow is under investigation along with many other protocols that might be used in “distributed systems.” More about that phone interview in a forthcoming article.

In conclusion, we think AT&T has a very long way to go to transition its network to SDN and NFV. One of the key issues will certainly be vendor interoperability when there are no universally accepted open interfaces/protocols that have been standardized. Ericcson- one of AT&T’s Domain 2.0 vendors and host for their Palo Alto Foundry, said (at both at ONS 2014 and 2013) that they are not using OpenFlow in their SDN implementations, So the SDN eco-system really can’t count on OpenFlow as a core standard and there are many more needed. Ultimately, the actual standards will have to be published by ITU-T as “carrier grade” SDN and NFV recommendations.

Meanwhile, we call your attention to NTT Communications, who has deployed SDN/OpenFlow for almost two years now and is planning to launch NFV this summer.

NTT Com Leads all Network Providers in Deployment of SDN/OpenFlow; NFV Coming Soon

http://viodi.com/2014/03/15/ntt-com-leads-all-network-providers-in-deplo…

Infonetics: Wireline Broadband Experiencing Solid Growth; Tier 3 Operators Upgrading their Broadband Networks

Infonetics Research launched a new research service this year – Broadband Subscriber Database by Provider, led by analyst Jeff Heynen. The latest report, released this week, contains demographic and subscriber data of more than 130 global wireline broadband providers.

SELECT BROADBAND SUBSCRIBER DATABASE HIGHLIGHTS:

. The top 6 wireline broadband providers by subscriber are, in rank order, China Telecom, China Unicom, Comcast, NTT Group, Deutsche Telekom, and AT&T

. Fixed broadband subscribers in China totaled 183 million in the third quarter of 2013, up 37% in two years

. In the Middle East, wireline broadband subscribers grew more than threefold in the same period

. China Telecom, NTT Group, and Verizon are the leading providers of FTTH services

. Comcast and Time Warner Cable are the 2 largest cable broadband operators by subscribers in the world, and the merged companies will tout over 31 million subscribers

FTTH subscribers are growing rapidly in Europe, while Asia Pacific region is growing faster.

ANALYST NOTE:

“We’re seeing phenomenal growth in fixed broadband subscribers in Asia Pacific, particularly China, where China Telecom and China Unicom continue to add both DSL and FTTH subscribers at a phenomenal pace. Meanwhile, Latin America continues to see moderate growth in both cable and DSL subscribers,” reports Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Heynen continues: “FTTH subscribers in Europe are now showing signs of solid growth, with Swisscom, Free, and Telefonica among a handful of operators moving forward with FTTH.”

ABOUT THE SUBSCRIBER DATABASE:

Infonetics’ quarterly broadband subscriber database tracks fixed broadband subscribers (DSL, cable broadband, FTTB and LAN, FTTH) in North America, EMEA (Europe, Middle East, Africa), Asia Pacific, and CALA (Caribbean and Latin America). The database, which includes searchable and sortable pivot tables, data, and charts, provides subscriber data by region, technology, individual service provider, and service provider type (cable operator, competitive, incumbent, independent wireless, satellite). It also includes service provider demographics and a Customer Premise Equipment (CPE) Tracker that lists manufacturer, model, and type of CPE by service provider.

To buy the database, contact Infonetics: http://www.infonetics.com/contact.asp

In a related report on Set Top Boxes, Heynen wrote: “The overall set-top box (STB) market declined in 2013, but cable and satellite video gateways had a very strong year, with shipments growing 333% and 98%, respectively,” says Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

“Video gateways collapse the STB and broadband CPE into a single device, and it’s for this reason we expect to see a long-term shift to these devices, at least in North America, to reduce capex in multiple TV set homes,” he added. Infonetics expects global IP video gateway revenue to grow at a 79% compound annual growth rate (CAGR) from 2013 to 2018.

Evidently Heynen is on a roll. In yet another Infonetics report issued last week titled: Tier 3 Broadband Strategies and Vendor Leadership: North American Service Provider Survey, he wrote:

“Tier 3 operators in the U.S. are already heavily invested in FTTH networks and will continue to expand their fiber availability until they reach their entire subscriber base. But like other operators around the world outside of China,” Heynen continues, “The long-term transition to fiber will happen incrementally, with fiber-to-the-node and fiber-to-the-curb deployments using VDSL2 as a critical, strategic tool in the effort to keep up with subscriber and network bandwidth demands.”

TIER 3 BROADBAND SURVEY HIGHLIGHTS:

. Only 5% of operators participating in Infonetics’ survey are providing average downstream speeds of 100+ Mbps today, increasing to 45% by 2016

. Survey respondents expect capital expenditures earmarked for fixed broadband networks to remain flat

. After 2014, 55%-75% of respondents plan to upgrade and expand their networks with 2.5G GPON and Ethernet FTTH

. Meanwhile, the percentage of respondents upgrading their networks with system-level vectored VDSL2 goes from 0 in 2013 to 30% in 2014

. A majority of those surveyed named Calix, Adtran, and Alcatel-Lucent as the top 3 fixed broadband access equipment suppliers

TO BUY INFONETICS REPORTS, CONTACT:

N. America (West), Asia Pacific: Larry Howard, [email protected], +1 408-583-3335

N. America (East, Midwest), L. America: Scott Coyne, [email protected], +1 408-583-3395

EMEA, India, Singapore: George Stojsavljevic, [email protected], +44 755-488-1623

Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

Infonetics: OTN switching is booming; Windsteam’s 100G Express Network

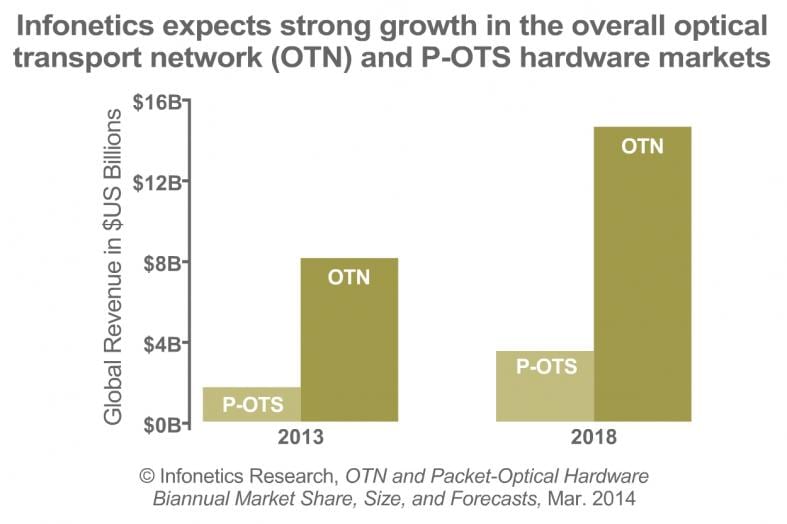

In a just released report, Infonetics Research summarizes the 2013 optical network hardware (OTN and SONET/SDH) and Packet Optical Transport System (P-OTS) markets, provides their 2014 outlook, as well as which vendors are benefiting the most.

OTN AND P-OTS MARKET HIGHLIGHTS:

. Worldwide overall OTN revenue totaled $8 billion in 2013, or 66% of all optical network hardware spending

. The OTN switching segment of the market grew 37% in 2013

. The market for P-OTS equipment came to $1.7 billion in 2013, split fairly evenly between metro edge and metro regional P-OTS gear

. P-OTS revenue grew 32% between the second half of 2012 and the second half of 2013

. Infonetics projects the OTN switching segment to grow at about a 20% compound annual growth rate (CAGR) from 2013 to 2018

Infonetics previously reported that service providers are choosing OTN switching as the technology best suited to filling 100G pipes, because it enables efficient aggregation of diverse services and protocols over a single link.

ANALYST NOTE:

“OTN switching had a major year of growth in 2013 as service providers prioritized installation of integrated WDM+OTN switching and 100G coherent technology in the core. Alcatel-Lucent, Ciena, and Infinera are the key beneficiaries here,” notes Andrew Schmitt, principal analyst for optical at Infonetics Research. “Meanwhile, Chinese carriers continue to expand large deployments of OTN switching, with Huawei as the sole beneficiary.”

Schmitt adds: “Over in the P-OTS space, incumbent vendors Cisco, Fujitsu, Tellabs, Ciena, and Alcatel-Lucent are the market leaders, but new players BTI, Cyan, Transmode, and Ericsson are challenging with pure-play P-OTS platforms.”

On Feb 18, 2013, Schmitt wrote: “Optical spending flattened in the fourth quarter of 2013, though it wasn’t distributed evenly around the world or by vendor. Weakness was concentrated in North America, but a year-end capex surge in EMEA evened things up. All indications are that an all-clear from Verizon and AT&T is forthcoming and the Q4 drop was a pause rather than a reversal — and this is in line with our forecasts.”

REPORT SYNOPSIS:

Infonetics’ biannual OTN and packet optical report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for OTN transport and switching hardware, including metro edge and metro regional port revenue forecasts by type and speed. Companies tracked: Adtran, Adva, Alcatel Lucent, BTI, Ciena, Cisco, Cyan, ECI, Ericsson, Fujitsu, Huawei, Infinera, NEC, NSN, Tellabs, Transmode, ZTE, and others.

To buy the report, contact Infonetics:

http://www.infonetics.com/contact.asp

|

Andrew Schmitt, Principal Optical Analyst at Infonetics is speaking at four OFC/NFOEC sessions this week in San Francisco: |

|

|

Low Cost 100G Interfaces for Metro Access: Standardized or Proprietary? |

Mar. 10, 9:00 am |

|

Market Watch: Panel 1: State of the Industry |

Mar. 11, 12:00 pm |

|

Flexible Rate OTU for Beyond 100G |

Mar. 12, 8:00 am |

|

The Buzz – A Real-time Look at the News and Trends Happening at OFC |

Mar. 12, 3:30 pm |

In related optical transport news, Windstream today announced it’s deploying the Infinera DTN-X platform, featuring 500 Gigabit per second (Gb/s) super-channels across Windstream’s long-haul express network. The Infinera Intelligent Transport Network enables Windstream to differentiate their services, protect their investment and lower operational expense as they scale their network.

Windstream operates a nationwide fiber and IP network, covering 118,000 miles of fiber and 27 data center locations across the nation. As a cloud solutions provider, Windstream serves businesses with a wide range of cloud communication needs, in addition to offering an advanced data, voice and video network that provides customers low latency and reliable 100 Gigabit Ethernet services.

“By deploying the Infinera Intelligent Transport Network, Windstream will significantly increase the capacity of our network infrastructure to meet the needs of our customers,” said Randy Nicklas, executive vice president of engineering and chief technology officer for Windstream. “The DTN-X platform enables us to offer services that result in lower latency for mission critical applications while providing a network that is even more reliable and enables rapid provisioning of services.”

Read more at:

http://www.infinera.com/pdfs/news/2014/pr20140310-Windstream_Deploys_Inf…