Month: February 2021

Deutsche Telekom & Ericsson CEOs: Europe’s Dysfunctional Telecom Industry Must Consolidate

Europe’s telecommunications industry needs to consolidate, Deutsche Telekom Chief Executive Tim Hoettges said on Friday, as the region’s 100 operators invest more in 5G networks at a time when revenue and profits are under pressure.

“The industry is in a dilemma that it can only escape through cost synergies,” Hoettges told a news conference, repeating earlier calls for consolidation. “I believe deeply that European consolidation is necessary.” Yet the Germany-based telecom provider, that owns a majority stake in T-Mobile US, is not in active merger talks.

Earlier this month, Borje Ekholm, chief executive of Sweden based equipment maker Ericsson told the Financial Times that Europe has a “non-functioning” telecoms market. Ekholm suggested it was rational for Europe’s telecoms operators not to invest in 5G networks, because many of them failed to earn their cost of capital. “The problem is that the guys that are supposed to build out that infrastructure (wireless telcos) don’t make any money. There is a very big cost to waiting,” he added.

Ericsson is worried that Europe is falling far behind China and the U.S. in the rollout of 5G, which it argues will be crucial for the digitalization of businesses. The company has forecast that 5G could boost the continent’s gross domestic product by 2 percentage points a year.

“Without [5G], general industry will be less efficient and less competitive. Without the infrastructure, it’s hard to develop the digital industry, and that impacts huge value potential and potentially millions of future jobs,” said Ekholm.

The European 5G network equipment makers — Ericsson and Finland’s Nokia — also have a big strategic and security role, as Europe grapples with how much market access to give to their Chinese rival Huawei.

Europe has dozens of telecom operators, but attempts to consolidate in some countries have been blocked by the European Commission because of competition worries. That led some operators to complain their profitability lags far behind bigger U.S. rivals.

Several countries, including Germany and the UK, are pushing for the creation of additional telecom equipment makers, as well as the opening up of networks to other companies. Ekholm expressed surprise that Europe would do anything to undermine Ericsson and Nokia, as telecoms was one of the few technology sectors where the continent had “strategic autonomy,” he said.

“It is interesting to see that now there is a discussion about giving EU subsidies to develop competing companies, mostly they are based in the US and Asia.”

He added that it was vital for Ericsson “to be in markets at the forefront of tech development: China and the U.S.”

“For us to have a presence in both China and the U.S. allows us to be a global tech leader. It is high risk to be only in one ecosystem and not the other. It could ultimately lead to the Chinese ecosystem developing faster thanks to its scale.”

Ericsson’s CEO previously spoke out about Sweden’s ban of Chinese telecoms vendors, e.g. Huawei and ZTE. Ekholm insists that there are currently too many disincentives to invest in European telecom infrastructure. He’s probably right.

……………………………………………………………………………………………………

References:

https://www.ft.com/content/32b38192-8c77-412a-ab20-36f75d6f4995

https://services.eiu.com/wave-of-consolidation-in-the-eu-telecoms-market/

Analysis: AT&T spins off Pay TV business; C-Band $23.4B spend weakens balance sheet

AT&T has agreed to create a new company for its U.S. video business unit together with private equity firm TPG Capital. The company will be called New DirecTV and include: today’s Direct TV, U-verse TV and AT&T TV (AT&T’s OTT video service) which AT&T said was “the future of TV” only 11 months ago. That was, indeed, a very short lived future!

The new company will have an estimated enterprise value of $16.25 billion. It will be headed by DirecTV CEO Bill Morrow and have its headquarters in El Segundo (California) and Denver (Colorado).

AT&T will own 70 percent of the new company, while TPG will hold 30 percent and will pay AT&T $1.8 billion in cash.

AT&T CEO John Stankey said the agreement is in line with the operator’s strategy to focus on core assets such as 5G, fiber optic network build-outs and HBO Max. The New DirecTV will provide “dedicated management focus” for the pay-TV operations while reducing AT&T’s huge debt burden.

AT&T bought DirecTV in 2015 for $48.5 billion but the actual value was closer to $66 billion including debt. AT&T recently struck $15.5 billion off the value of the DirecTV, reflecting the service’s dimmer prospects. AT&T said it would get about $7.8 billion in cash from the transaction to help pay down debts. Those proceeds include $5.8 billion that the new company will borrow from banks and pay back to AT&T.

“The disruption in pay TV did exceed our original expectations,” AT&T finance chief John Stephens said in an interview, adding that the satellite-TV business had helped generate cash for the company even as its customer base declined. Mr. Stephens said the new ownership structure is “a very attractive transaction, getting TPG’s expertise and that upfront cash payment.”

The new company will not include the WarnerMedia HBO Max streaming platform, AT&T’s Latin American video operations Vrio, AT&T’s regional sports networks, U-verse network assets and AT&T’s Sky Mexico investment.

At completion, all existing AT&T video subscribers will become New DirecTV customers and all existing content deals, including NFL Sunday Ticket on DirecTV, will become of the new company. New DirecTV will have a commercial agreement with AT&T and continue to provide bundled pay-TV services for mobile and internet customers.

New DirecTV video subscribers will also continue to receive HBO Max (which currently costs $15 per month) plus any associated discounts. AT&T and New DirecTV will also continue to serve customers through multiple distribution channels, including retail, online, call centers and indirect sellers; and share revenues for ad inventory management and ad sales.

The new company’s board will have two representatives from both AT&T and TPG, with Morrow holding the fifth seat. Most AT&T video services employees will move to New DirecTV. The new company plans to recognize its unionized labor force and will assume and honor all existing collective bargaining agreements.

The deal is expected to close in second half of this year. Under the terms of the agreement, AT&T will receive $7.8 billion from New DirecTV, including $7.6 billion in cash and the assumption from AT&T of $200 million worth of existing DirecTV debt. AT&T will use the proceeds to reduce its debt. TPG will contribute $1.8 billion in cash to New DirecTV in exchange for preferred units and its 30 percent stake in the new company.

“This agreement aligns with our investment and operational focus on connectivity and content, and the strategic businesses that are key to growing our customer relationships across 5G wireless, fiber and HBO Max. And it supports our deliberate capital allocation commitment to invest in growth areas, sustain the dividend at current levels, focus on debt reduction and restructure or monetize non-core assets,” said AT&T CEO John Stankey.

“As the pay-TV industry continues to evolve, forming a new entity with TPG to operate the U.S. video business separately provides the flexibility and dedicated management focus needed to continue meeting the needs of a high-quality customer base and managing the business for profitability. TPG is the right partner for this transaction and creating a new entity is the right way to structure and manage the video business for optimum value creation.”

“We look forward to working with AT&T, Bill and the entire talented team at the new DIRECTV to create a seamless customer experience through the separation of the company,” John Flynn, Principal at TPG said. “We are particularly excited by the opportunity to grow new DIRECTV’s streaming video service, leveraging the company’s leading pay-TV platform, talented labor force and large subscriber base to transition it into a leading next-generation video provider with best-in-class content and customer experience.”

AT&T lost 7 million domestic pay-TV subscribers over the last two years. Comcast lost about 2 million such customers over the same period. Dish Network Corp. , DirecTV’s satellite-TV rival, shed roughly 1 million subscribers.

Financing the Deal:

New DirecTV has secured $6.2 billion in committed financing from its bank group, $5.8 billion of which will be used to pay AT&T and assume the $200 million of agreed debt.

AT&T also agreed to cover up to $2.5 billion in losses tied to DirecTV’s NFL Sunday Ticket package.

AT&T financial impact:

AT&T’s net debt load, which was listed above $180 billion after the Time Warner transaction, recently stood around $148 billion.

In 2021, AT&T expects to apply the cash proceeds from the transaction toward debt reduction and does not expect a material impact to its 2021 financial guidance for:

• Consolidated revenue growth in the 1% range

• Adjusted EPS to be stable with 2020

• Gross capital investment in the $21 billion range with capital expenditures in the $18 billion range

Following close of the transaction, AT&T expects to deconsolidate the U.S. video operations from its consolidated results. The company will continue to look at ways of “monetizing non-core assets.”

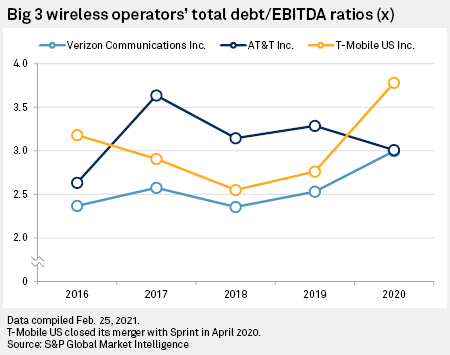

Opinion – AT&T’s C-Band Spend Adds to Debt and Weakens its Balance Sheet:

The company added that it has proactively managed its debt portfolio, reducing near-term debt maturities by about $33 billion in 2020 and lowering the overall portfolio average rate to 4.1 percent at the end of 2020, down 20 basis points from first-quarter 2020 levels.

However, AT&T has not said how it would pay for the $23.4B they spent to acquire spectrum at the recently completed C-Band auction, other than the $14.7B it raised raised in a loan-credit agreement with Bank of America earlier this year.

Moody’s Investors Service on Wednesday told clients that AT&T’s C-Band spectrum splurge could pressure AT&T’s credit rating, which sits two notches above junk territory. In a brief note Thursday, Moody’s called the DirecTV deal “moderately credit positive” because it would produce cash to help cover the spectrum costs.

Oppenheimer analysts believe that spectrum build-out in new 5G deployments will take at least a year and the resulting revenue won’t show up for a few years. We believe that AT&T will be very hard pressed to fund the spectrum buildout within the next two or three years due to delays in installing hundreds of thousands of small cells and fiber to them for backhaul.

Analyst Craig Moffett had this to say: “At $23.4B, AT&T spent more than would have been expected a month ago, but expectations for their spend had been rising (notwithstanding the fact that they have onlyfinanced half of what they bought, and even that with only short-term debt), so the surprise may not be large there, either. But again, it’s a shock to see the number.”

“AT&T emerges from the auction with leverage of 4.1x EBITDA (assuming all debt financing)……AT&T, in particular, will face enormous pressure to withdraw its hyper-aggressive promotional stance in order to produce enough free cash flow to sustain their dividend – but that is cold comfort for an industry whose ROI will inarguably be even worse than it has been in the past.”

Craig noted that C-Band spectrum will require many more small cells which require permits, time and effort to install. That will delay AT&T’s 5G network expansion using the newly acquired spectrum:

“3.5 GHz spectrum (again, as a rough proxy for C-Band) requires sixteen times as many cell sites as would 2.0 GHz spectrum for the same free space coverage. And because C-Band will have very limited ability to penetrate obstructions (trees, walls and windows, intervening buildings, etc.), real world propagation limitations will likely be even greater than what a free space model would suggest.”

References:

https://www.wsj.com/articles/at-t-to-spin-off-directv-unit-in-deal-with-tpg-11614288845 (paywall)

https://otp.tools.investis.com/clients/us/atnt2/sec/sec-show.aspx?FilingId=14659869&Cik=0000732717&Type=PDF&hasPdf=1 (SEC 8K report on $14.7B loan with BoA)

Equinix and Vodafone to Build Digital Subsea Cable Hub in Genoa, Italy

Equinix and Vodafone have announced plans to build a new subsea cable hub in the northern Italian port of Genoa, to be called GN1.

Under the deal, Vodafone will land the 2Africa cable system at Genoa and use Equinix’s GN1 facility as a strategic interconnection point for the subsea cable system, with a connection on to Milan and the rest of Europe.

The partners said the EUR 1 billion 2Africa cable will be ready for service in 2023, a 37,000 km system circumnavigating the continent of Africa and directly connecting 16 countries in Africa to Europe and the Middle East, with a design capacity of up to 180 Tbps on key segments. To facilitate interconnection, GN1 will have a direct fiber connection to ML5, the soon-to-be opened Equinix flagship data center in Milan.

The newly-announced GN1 hub will be Genoa’s first carrier-neutral data center, offering customers secure colocation and interconnection services, as well as the ability to directly tap into Equinix’s digital ecosystems and colocation facilities in Milan. It will provide a capacity of 150 cabinet equivalents, and colocation space of around 560 square meters.

The combination of 2Africa’s landing in the new Genoa site and the direct connection to Milan means GN1 will offer a new, complementary and diverse alternative option for the Mediterranean region. As Genoa’s first carrier-neutral data center, GN1 will offer customers secure, resilient colocation and interconnection services, as well as the ability to directly leverage Equinix’s digital ecosystems and colocation facilities in Milan. It will provide a capacity of 150 cabinet equivalents, and colocation space of approximately 6,000 square feet (560 square meters).

2Africa is expected to deliver more than the total combined capacity of all subsea cables serving Africa today, with a design capacity of up to 180 Tbps on key segments of the system. This will be vital to help build a digital society ready for services that require a large amount of data transfer, such as cloud computing or video.

The need for robust digital infrastructures can be seen across the world, and Africa is no exception. The continent is experiencing a critical period of digital transformation and development of its digital economy. In the next few years, digital technologies are expected to be a factor in improving African people’s quality of life and driving economic development in the region.

The GSMA predicts that the number of mobile internet users in Africa will continue to grow rapidly, primarily due to the popularization of smartphones and lack of fixed-line infrastructure, which has led to a boom of new services such as mobile payment, instant messaging, online streaming media and short video.

Highlights/Key Facts:

- The 2Africa project includes partners from China Mobile International, Facebook, MTN GlobalConnect, Orange, stc, Telecom Egypt, Vodafone and WIOCC. The cable system will underpin digitization across the African continent by bringing greater capacity, quality and availability of internet connectivity between Africa and the rest of the world.

- Responsibility for landing the 2Africa cable is split between the 2Africa parties depending on location. Vodafone is leading all European landings, along with selected other sites.

- As the home of the interconnected cloud®, Equinix is a natural destination for subsea cable systems and a gateway to new opportunities for system operators and their customers. Equinix hosts over 2,950 cloud and IT service providers on its global platform and can support subsea cable systems in 40 subsea-enabled metros around the world. When subsea cable systems are linked to cloud and content ecosystems on Platform Equinix®, users can access a variety of scalable cloud services almost anywhere they need to be. And because Equinix is carrier-neutral, subsea system operators can offer excess network capacity to customers who otherwise couldn’t as quickly or efficiently reach the markets being served by new subsea architectures.

- GN1 is being built in line with global environmental standards and will contribute to a portfolio of some of the most energy-efficient data centers in the world. Indeed, GN1 is expected to utilize 100% renewable energy. As the world’s digital infrastructure company, Equinix is working to protect, connect and power a more sustainable digital world by proactively addressing its ESG impacts. Equinix recently scored the highest rating on its first response to the DPP’s Committed to Sustainability survey, and joined European cloud infrastructure and data center providers and European trade associations to form the Climate Neutral Data Centre Operator Pact and Self-Regulatory Initiative.

- ML5 will be a new flagship International Business Exchange™ (IBX®) data center in Milan that offers state-of-the-art colocation, as well as a host of advanced interconnection services—including Equinix Fabric™ and Equinix Internet Exchange®—enabling virtual interconnections to some of the largest cloud providers in the world, such as Amazon Web Services, Microsoft Azure, Oracle Cloud Infrastructure and Google Cloud. When opened, ML5 will provide capacity of 500 cabinet equivalents and colocation space of approximately 15,000 square feet (1,400 square meters).

- The Global Interconnection Index (GXI) Volume 4, a market study recently published by Equinix, forecasts that overall interconnection bandwidth—the measure of private connectivity for the transfer of data between organizations—will achieve a 45% compound annual growth rate (CAGR) from 2019 to 2023, globally. The expected growth is driven by digital transformation, and specifically by greater demands from enterprises extending their digital infrastructure from centralized locations to distributed edge locations.

Quotes:

- Nick Gliddon, Director, Vodafone Carrier Services:

“The 2Africa project is vitally important to improving connectivity between Europe, Africa and the Middle East, and will also improve intra-European connectivity. By linking Spain and Portugal directly to Genoa and Milan, the system will avoid fiber bottlenecks that naturally occur between France and Spain, further strengthening Vodafone’s Gigabit networks.” - Emmanuel Becker, Managing Director, Italy, Equinix:

“Italy is an important growth market for Equinix in EMEA, as it’s a strategic interconnection point for the region and beyond. We are working to give our customers improved access to the expanding global subsea cable network, so they have increased opportunities to expand internationally. Thanks also to the opening of our new data center in Milan, ML5, we are creating an interconnected metro area where customers can connect with strategic business partners in Italy and across the world.” - Eugene Bergen Henegouwen, President, EMEA, Equinix:

“I am thrilled we are adding a new metro to our EMEA portfolio. Equinix’s Genoa site provides a great landing hub for subsea cable operators, whilst at the same time boosting the digital ecosystems at our recently announced Milan flagship, ML5. Equinix continues to focus on expanding its position as a global connectivity service provider. Our commitment is always to support the increasing demands we’re seeing from companies globally to accelerate their digital transformation. We’re helping businesses connect to everything they need to succeed, and will continue to do so.” - Marco Bucci, Mayor of Genoa City:

“We are very excited to be the host city for the new subsea hub GN1, that will serve as a landing point for the 2Africa cable in the north of Italy. Genoa is known for the central role it has played in maritime trade for many centuries. Thanks to GN1, the city will become one of the main digital harbors of Europe, and play a key role in global data transfer.”

References:

https://www.telecompaper.com/news/equinix-and-vodafone-announce-genoa-hub-for-subsea-cables–1373724

https://blog.equinix.com/blog/2021/01/15/equinix-submarine-cable-momentum-is-accelerating/

Vodafone-Espana trial: 5G connected drone (UAS) enables Guardia Civil to improve surveillance in rural areas

Vodafone Spain has completed a trial with the Guardia Civil military police force to evaluate the viability of using 5G networks to improve surveillance using remote-controlled drones.

The pilot test consisted of using the 5G network to improve communication of the UAS (unmanned aerial vehicle systems) drone for surveillance tasks in rural areas or areas with difficult access. The drone was remotely-controlled by the Guardia Civil.

The Tarsis fixed-wing unmanned aerial vehicle system of local provider Aertec Solutions coupled with a 5G smartphone for both high-definition and 4k camera communications, as well as flight command management.

Vodafone said its 5G network provided the maximum bandwidth and minimum latency required for the transmission of high-quality images and control signals in real time, allowing specialist pilots to operate the drone remotely from a control center.

In order to carry out teleoperation safely, it was necessary to broadcast high quality images from cameras installed in the UAS and to send remote control actions or reference coordinates by the pilot.

The pilot trial was the latest test in the Andalucia 5G initiative which has been promoted by Spain’s ICT development agency Red.es, which is being developed by Vodafone and Huawei.

This is one of the two projects that Spain’s Government has promoted through the first public call for aid to 5G pilots, resolved in the spring of 2019.

Presented in November 2019 in Seville, it includes 35 use cases that will apply the benefits of 5G technology in the sectors of energy, industry, smart cities, tourism, agriculture, health and dependency, security, emergencies and defense, society and digital economy.

Vodafone said the project’s budget is EUR 25.4 million, including EUR 6.3 million from Red.es. It will cover the provinces of Seville, Jaen, Malaga, Cadiz and Huelva.

References:

https://www.saladeprensa.vodafone.es/c/notas-prensa/np_piloto_5G_dron_Guardia_Civil/

https://www.bbc.com/news/technology-54797917

Google Cloud and Intel partner for 5G Cloud Native Core & Edge Networking

Google Cloud and Intel plan to collaborate to develop cloud-native 5G core, 5G services and edge networking for network operators, enterprises, and the growing pool of vendors involved in mobile networks.

The partnership spans three main areas focused on:

- Accelerating the ability of communications service providers to deploy their virtualized radio access network (RAN) and open RAN solutions with next-generation infrastructure and hardware.

- Launching new lab environments to help communications service providers innovate for cloud native-based 5G networks.

- Making it easier for communications service providers to deliver business applications to the network edge.

“The next wave of network transformation is fueled by 5G and is driving a rapid transition to cloud native technologies,” said Dan Rodriguez, Intel corporate vice president and general manager of the Network Platforms Group, in a press release. “As communications service providers build out their cloud infrastructure, our efforts with Google Cloud and the broader ecosystem will help them deliver agile, scalable solutions for emerging 5G and edge use cases.”

The partnership’s cloud native 5G objectives will be “across the telecommunications stack, with application providers, carriers and communications service providers, hardware providers, and global telecoms,” according to the press release, to decrease the cost and time-to-market needed for the telecommunications industry.

……………………………………………………………………………………………..

Last March, Google Cloud announced a telecommunications industry strategy that focused on cloud capabilities with 5G connectivity and this builds upon that plan.

Google Cloud recently announced an initiative to deliver 200+ partner applications to the edge via Google Cloud’s network and 5G.

Opinion:

Partnerships like this one will be increasingly necessary to build 5G cloud native core networks and services (like network slicing), because there are no implementation specific standards (more below).

Ericsson wrote in a blog post:

“Of course, the implementation of a fully cloud native network will take considerable time and the new and legacy infrastructure will have to co-exist in a hybrid mode to begin with. Nevertheless, depending on your market requirements, it is important to start the journey towards a cloud native 5G Core now and focus future investments in accordance with the new target architecture. This is also the reason why we have re-designed our EPC software to also be cloud native and created a solution we call the Ericsson dual-mode 5G Core.”

“The new 5GC will live together with EPC for a considerable time and it’s important to define an evolution path that is smooth and cost efficient, while still supporting your business strategy and ambitions. We have developed a solution we call dual-mode 5G Core, where 5GC and EPC live together under one common O&M system for efficient TCO. This enables a smooth migration at your own pace and in accordance with your business needs.”

Images Courtesy of Ericsson

…………………………………………………………………………………………………

3GPP High Level Specs on 5G Network Architecture/5G Core:

The high level 3GPP technical specs for 5G Core (5GC) call for a service based architecture (SBA), which is designed for cloud native deployment.

These three 3GPP Technical Specs (TS’s) are the basis for 5G core networks, but they do not specify implementation details:

- 23.501 System architecture for the 5G System (5GS)

- 23.502 Procedures for the 5G System (5GS)

- 23.503 Policy and charging control framework for the 5G System (5GS); Stage 2

The ETSI standard is a transliteration of 3GPP TS 23.501: https://www.etsi.org/deliver/etsi_ts/123500_123599/123501/15.03.00_60/ts_123501v150300p.pdf

From section 4.2.1:

“The 5G architecture is defined as service-based and the interaction between network functions is represented in two ways.

– A service-based representation, where network functions (e.g. AMF) within the Control Plane enables other authorized network functions to access their services. This representation also includes point-to-point reference points where necessary.

– A reference point representation, shows the interaction exist between the NF services in the network functions described by point-to-point reference point (e.g. N11) between any two network functions (e.g. AMF and SMF).

Service-based interfaces are listed in clause 4.2.6.

Reference points are listed in clause 4.2.7.

Network functions within the 5GC Control Plane shall only use service-based interfaces for their interactions.”

………………………………………………………………………………………………..

References:

More information on use cases and the full news release can be found on Google’s website.

More Context: 5G & Wireless Communications at Intel

Intel Partner Stories: Intel Customer Spotlight on Intel.com | Partner Stories on Intel Newsroom

https://www.ericsson.com/en/blog/2020/10/building-a-cloud-native-5g-core-the-guide-series

Intel, Google Cloud Aim to Advance 5G Networks, Edge Innovations

Apple is new smartphone king, but market declined 5% in 4Q 2020

Apple doesn’t report unit sales for its devices. However, the company said revenue from iPhones grew by 17% in the fourth quarter of calendar 2020 on a year-over-year basis to $65.6 billion. Apple’s business is seasonal, and the quarter ending in December is usually the company’s biggest in terms of sales.

“The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020,” said Anshul Gupta, senior research director at Gartner. “Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter.”

Table 1. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 4Q20 (Thousands of Units)

| Vendor | 4Q20

Sales |

4Q20 Market Share (%) | 4Q19

Sales |

4Q19 Market Share (%) | 4Q20-4Q19 Growth (%) |

| Apple | 79,942.7 | 20.8 | 69,550.6 | 17.1 | 14.9 |

| Samsung | 62,117.0 | 16.2 | 70,404.4 | 17.3 | -11.8 |

| Xiaomi | 43,430.3 | 11.3 | 32,446.9 | 8.0 | 33.9 |

| OPPO | 34,373.7 | 8.9 | 30,452.5 | 7.5 | 12.9 |

| Huawei | 34,315.7 | 8.9 | 58,301.6 | 14.3 | -41.1 |

| Others | 130,442.8 | 33.9 | 145,482.1 | 35.8 | -10.3 |

| Total | 384,622.3 | 100.0 | 406,638.1 | 100.0 | -5.4 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

Full Year 2020 Results:

Samsung experienced a year-on-year decline of 14.6% in 2020, but this did not prevent it from retaining its No. 1 global smartphone vendor position in full year results. It faced tough competition from regional smartphone vendors such as Xiaomi, OPPO and Vivo as these brands grew more aggressive in global markets. In 2020, Apple and Xiaomi were the only two smartphone vendors of the top five ranking to experience growth.

Huawei recorded the highest decline among the top five smartphone vendors which made it lose the No. 2 position to Apple in 2020 (see Table 2). The impact of the ban on use of Google applications on Huawei’s smartphones was detrimental to Huawei’s performance in the year and negatively affected sales.

Table 2. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 2020 (Thousands of Units)

| Vendor | 2020

Sales |

2020

Market Share (%) |

2019

Sales |

2019

Market Share (%) |

2020-2019

Growth (%) |

| Samsung | 253,025.0 | 18.8 | 296,194.0 | 19.2 | -14.6 |

| Apple | 199,847.3 | 14.8 | 193,475.1 | 12.6 | 3.3 |

| Huawei | 182,610.2 | 13.5 | 240,615.5 | 15.6 | -24.1 |

| Xiaomi | 145,802.7 | 10.8 | 126,049.2 | 8.2 | 15.7 |

| OPPO | 111,785.2 | 8.3 | 118,693.2 | 7.7 | -5.8 |

| Others | 454,799.4 | 33.7 | 565,630.0 | 36.7 | -19.6 |

| Total | 1,347,869.8 | 100.0 | 1,540,657.0 | 100.0 | -12.5 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

“In 2021, the availability of lower end 5G smartphones and innovative features will be deciding factors for end users to upgrade their existing smartphones,” said Mr. Gupta. “The rising demand for affordable 5G smartphones outside China will boost smartphone sales in 2021.”

Deutsche Telekom tests 5G SA network via “Telekom cloud infrastructure”

Deutsche Telekom has started testing the “standalone” (SA) version of 5G, setting up its first 5G SA antenna site in the town of Garching, near Munich. The site will be the first in Germany with 5G core network technology, which has yet to be standardized.

The antenna site will soon be connected to a 5G Standalone core network. The core network will be implemented via a Telekom cloud infrastructure. The hallmark of 5G Standalone is that the infrastructure in the core network will also be fully upgraded to a new, cloud-based 5G architecture. This is the next evolution of 5G and also a prerequisite for new deployment options.

Deutsche Telekom has already achieved 68% coverage of the German population with non-standalone (NSA) version of 5G, which uses the existing 4G-LTE network as an anchor for all non radio aspects.

“It is important for us to be at the forefront of the further innovation steps of 5G,” says Claudia Nemat, Board Member for Technology and Innovation at Telekom. “To ensure that our customers can take advantage of technologies such as network slicing or edge computing in the future, we continue to actively drive the development of 5G and its features.”

With 5G Standalone, the network structure and architecture is changing. The 5G technology currently deployed in Germany is based on the 5G Non-Standalone (5G NSA) network architecture. This means that today’s 5G offerings are still technically dependent on a simultaneously available 4G network (LTE) and virtually “piggyback” on this network, i.e., they do not yet function completely independently.

“5G standalone is one of the goals for us with 5G,” said Walter Goldenits, head of technology at Telekom Deutschland. “The network innovation in Garching is initially the first step for us into the 5G SA live network. It helps us to gain necessary and important experience with 5G SA. A rollout in the area will then also depend on the requirements of our customers. Technology and the market will play a joint role in further development.”

There are currently no terminals for customers that support 5G standalone. Telekom is therefore conducting the first tests with special development software on commercially available devices. The goal is to test various connections and applications that function completely standalone and without the support of 4G in the coming weeks.

“The further roll-out of 5G is the preparation of our network for the next steps in 5G development. We will use every opportunity to make 5G even faster and develop it further,” says Walter Goldenits.

Image courtesy of Samsung

…………………………………………………………………………

Last month, Samsung and Deutsche Telekom conducted their first 5G SA trial in Pilsen, the Czech Republic, verifying performance of 5G SA multi-user, multiple-input, multiple-output (MU-MIMO) technologies.

The trial used Samsung’s latest end-to-end 5G SA solutions. In the SA trial, the two companies achieved outstanding results with the MU-MIMO technology using Samsung’s 3.5GHz Massive MIMO radio. The spectrum efficiency was tripled in comparison to that of LTE under realistic conditions and the throughput was increased by about 2.5 times of SU-MIMO (Single-User MIMO).

“We are pleased to collaborate with Samsung to verify the performance of its 5G SA solution,” said Alex Choi, SVP Strategy & Technology Innovation, Deutsche Telekom. “Together with strong partners we are consistently introducing advanced technical capabilities into our network, and we are very excited about the potential of 5G SA networks to further accelerate the 5G evolution.”

Samsung also said: “5G SA architecture enables mobile operators to have more efficient and simple network operations, while empowering 5G networks to deliver immersive user experiences and new business models for enterprises.”

References:

https://www.telekom.com/en/media/media-information/archive/telekom-tests-5g-standalone-619118

https://www.samsung.com/global/business/networks/products/core/cloud-core/

https://en.yna.co.kr/view/AEN20210128009500320

Dell’Oro Group: RAN market revenues at new record high

According to a recently published report from Dell’Oro Group, preliminary estimates suggest that the 2G-5G radio access network (RAN) market ended the year 2020 on a high note, with the full year 2020 revenues marking a new record since we started tracking the program in the year 2000.

“While we correctly identified the overall trajectory of the market going into the year and maintained the positive outlook even as the pandemic intensified and economists adjusted their GDP projections sharply downward,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “We also need to recognize that we completely underestimated the magnitude and the breadth of the ascent in the fourth quarter and for the full year 2020, reflecting stronger than expected results in multiple regions,” Pongratz added.

Additional highlights from the 4Q 2020 RAN report:

- Initial estimates suggest that vendor rankings remained stable between 2019 and 2020, while revenue shares were impacted to some degree by the state of the 5G rollouts in China and North America.

- Ericsson and Nokia maintained their No. 1 and No. 2 RAN revenues rankings excluding China. Both suppliers improved their RAN revenue shares outside of China, accounting for 35 percent to 40 percent and 25 percent to 30 percent of the overall RAN market, respectively.

- Huawei maintained its No. 1 ranking for the global RAN market, reflecting share gains in China.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceivers or RF carrier shipments, macro cell and small cell BTS shipments for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, and LTE. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

In December 2020, Dell’Oro forecast the overall RAN market to advance for a fourth consecutive year in 2021. In North America, low-band activity is expected to remain elevated while mid-band activity is projected to improve. However, the timing of the C-band availability remains uncertain (especially since there was no FCC requirement for C-band spectrum bidders to actually build and deploy cellular networks).

5G core capex should grow at a faster pace than 5G NR (RAN/RIT) revenues. Dell’Oro believes that the 5G Core/5G RAN revenue ratio will trend below historical core/RAN averages in the initial 5G wave and then gradually improve as operators start embracing 5G SA.

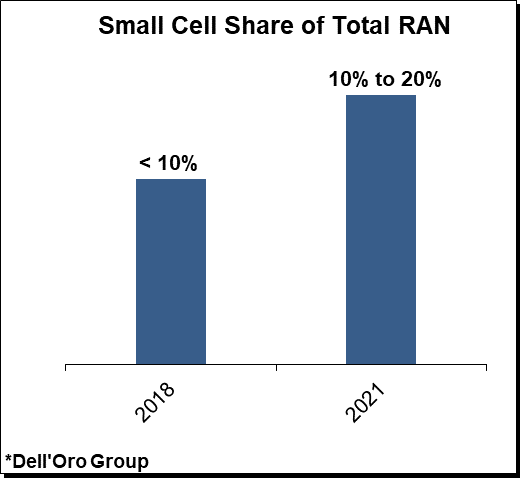

Small Cells to Account for 10% to 20% of Total RAN

The global growth outlook for small cells – including sub 6 GHz and mmWave – remains favorable, underpinning projections the technology will play an increasingly important role supporting the overall RAN network as operators and enterprises navigate new technologies, spectrum bands, and use cases.

Small cell RAN revenues are projected to approach 10% to 20% of the overall RAN market in 2021. Within the small cell mix, Sub 6 GHz capex is expected to characterize the lion share of the investments, driven partly by the reduced gap between macro and small cell radios associated with upper mid-band deployments.

Open RAN to Account for 1% to 2% of Total RAN Market in 2021

Open RAN and Virtual RAN continues to gain momentum, bolstered by Ericsson now formalizing its support with its Cloud-RAN announcement. The uptake remains mixed between the various Open RAN segments, as noted with Dell’Oro’s 3Q20 Open RAN update. These trends are expected to extend into 2021, with adoption accelerating in some RAN settings while the uptake remains weak in other RAN segments.

Huawei: 5G Technology Illuminates the Future + Huawei analysis

On the eve of MWC Shanghai 2021, Ryan Ding, CEO and President of Huawei’s Carrier Business Group, talked about “5G technology lights up the future.”

“2020 has been a difficult year. During that period, Huawei worked closely with our customers,” said Ding.

In 2020, Huawei supported the stable operations of more than 300 networks in more than 170 countries and helped operators offer online services and minimize the impact of the pandemic on their businesses. In collaboration with Huawei, the operators attracted 22 million new residential wireless broadband users around the world. Thanks to this, people can easily access telemedicine services and work from home.

“5G developed faster than we expected.” More than 140 commercial 5G networks have been implemented in 59 countries.

According to Ding, more than 50% of these networks were built by Huawei. The ecosystem is also developing. In China , more than 68% of the smartphones distributed in 2020 were 5G phones. More than 200 industrial 5G modules and devices are currently available, supporting 5G applications in a wide range of industries.

Huawei’s Ryan Deng talking up 5G

According to reports prepared in 2020 by market research firms such as IHS, P3, OpenSignal and Meqyas, the best 5G networks in Seoul, Amsterdam, Madrid, Zurich, Hong Kong and Riyadh were the ones that Huawei built.

Ding highlighted that a good experience on the web is the foundation of commercial success and that these six cities are only the tip of the iceberg of its purpose of collaborative innovation with the operators.

For example, by implementing Huawei’s AAU 64T64R and market-leading multi-antenna algorithms, LG u + achieved greater spectrum efficiency and a network experience more than 25% better than other carriers. With Huawei’s Blade AAU, which can operate in the Sub3G and C bands, Sunrise reduced site acquisition time from 24 months to just 6 months and was the only operator with 5 consecutive outstanding ratings in Switzerland.

5G is becoming part of the core production processes of industries. Looking ahead, Ding was optimistic about the prospect of a large-scale deployment of 5G industrial applications in 2021.

5G applications have been incorporated in more than 20 industries including manufacturing, healthcare, education and logistics. The manager pointed to examples of sectors in China where industrial 5G applications are already proving their value, such as in coal mining and steel fabrication and production, where the adoption of 5G technology has made production safer, smarter and more efficient. He also stressed: “5G is no longer exclusive to pioneer users, but aims to improve our daily lives. 2021 will be the 1st year with large-scale industrial 5G applications.

Operators will need new capabilities in planning areas network operations, implementation, maintenance, optimization and operations to achieve zero-to-one progress and replicate one-to-many success.

At the next MWC Shanghai, Huawei will hold in-depth exhibitions and discussions on these topics with stakeholders. of the sector, both online and through means that do not require connection. We will continue to innovate to help our customers develop the best 5G networks and achieve greater business success.”

SOURCE: Huawei

………………………………………………………………………………………………….

Analysis by Iain Morris of Light Reading:

Of today’s 140 “live” 5G networks, Huawei built more than half, said Ryan Ding, the head of Huawei’s networks division, during the company’s traditional briefing before the annual MWC Shanghai show (normally scheduled for June, it switched places with the bigger Barcelona show this year due to coronavirus).

Huawei can rely on a domestic market that has awarded almost 90% of all mobile infrastructure business to Chinese vendors. When the number of 5G base stations in a country hits 700,000, as it did last year in China, any pain elsewhere becomes tolerable. Several hundred thousand more are planned in 2021. Contrast that with Europe, where the entire region in 2019 hosted fewer than half a million mobile sites, according to Ernst & Young.

Even in Europe, Huawei’s networks business has not suffered as badly as it might have done. Several big countries have resisted political pressure to copy the UK and exclude Huawei from the future 5G market. They include Germany, where Huawei last year accounted for more than half the country’s mobile infrastructure. Its government undoubtedly fears the ramifications of a ban for exports of cars and machine tools to China.

Huawei’s massive fixed-line business has also been allowed to chug on outside the UK, which is now weighing a final decision. Smaller than the radio access networks business, broadband products still generated more than $8.4 billion in global revenues last year, according to Omdia, a sister company to Light Reading. Some 43% of that went to Huawei. In France, where authorities have indicated they will not renew licenses for Huawei’s mobile equipment, Orange counts Huawei as one of its two main broadband vendors (the other being Nokia).

…………………………………………………………………………………………….

Several European operators, including Deutsche Telekom, Orange and Spain’s Telefónica, have previously bought Huawei equipment for the cloud services they offer to their business customers. “Huawei provides standards servers (with the so-called x86 architecture) for the Open Telekom Cloud,” said a Deutsche Telekom spokesperson, in an email to Light Reading, when asked if that equipment remained in use.

Reference:

https://www.lightreading.com/5g/huawei-is-proving-as-hard-to-stop-as-movie-supervillain

ITU-R Future Report: high altitude platform stations as IMT base stations (HIBS)

Introduction:

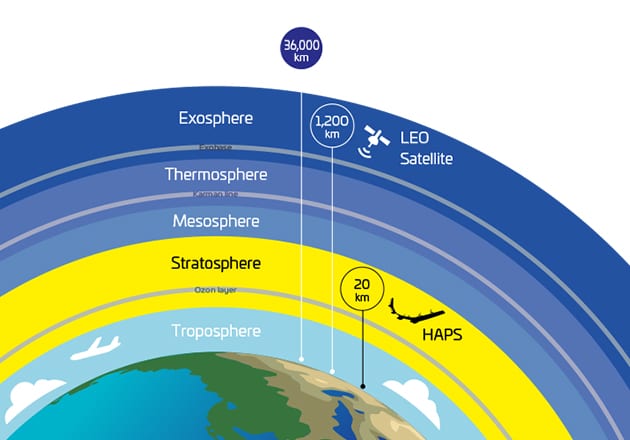

A High Altitude Platform Station (HAPS) is a wireless network node that operates in the stratosphere at an of altitude around 20 km and is instrumental for providing communication services. Precipitated by technological innovations in the areas of autonomous avionics, array antennas, solar panel efficiency levels, and battery energy densities, and fueled by flourishing industry ecosystems, the HAPS has emerged as an indispensable component of next-generations of wireless networks.

High-altitude platform station (HAPS) systems can potentially be used to provide both fixed broadband connectivity for end users and transmission links between the mobile and core networks for backhauling traffic. Both types of HAPS applications would enable wireless broadband deployment in remote areas, including in mountainous, coastal and desert areas.

In some situations, HAPS may be rapidly deployed for disaster recovery communications, particularly because the use of inter-HAPS links allows the provision of services with minimal ground network infrastructure.

ITU Radio Regulations (RR) define HAPS as radio stations located on an object at an altitude of 20-50 kilometres and at a specified, nominal, fixed point relative to the Earth.

………………………………………………………………………………………….

An ITU-R “work in progress” report will describe spectrum needs, usage and deployment scenarios, and technical and operational characteristics for the use of high altitude platform stations as IMT base stations (HIBS) for mobile service in certain frequency bands below 2.7 GHz already identified for IMT (International Mobile Telecommunications). In particular, the report will explain the technical and operational characteristics of HIBS in the bands 694‑960 MHz, 1710-1885 MHz, 1885-1980 MHz, 2010-2025 MHz, 2110-2170 MHz and 2500-2690 MHz to be used in sharing and compatibility studies under WRC-23 agenda item 1.4.

HAPSMobile’s Sunglider can cover 200 km at a distance of 20 km above the Earth in the stratosphere.

Image courtesy of HAPSMobile

……………………………………………………………………………………………………

IMT systems have evolved significantly in terms of spectrum identification, network deployment, and radio access technology, with the standardization of IMT-Advanced (4G) and IMT-2020 (5G).

At the same time, recent advances in battery and solar-panel technologies could enable HIBS to provide low latency mobile broadband connectivity to underserved communities, and in rural and remote areas, over a large geographic footprint.

These technological advances could enable HIBS, using the same frequency bands as ground-based IMT base stations, to be used as a part of, and complement terrestrial IMT networks. Existing user equipment (UE), which already supports a variety of frequency bands identified for IMT, could be served by both HIBS and ground-based IMT base stations. HIBS will therefore require new identifications to use certain frequency bands below 2.7 GHz already identified for IMT, considering potential HIBS deployment scenarios and its technical and operational characteristics, while taking into account sharing and compatibility with existing applications and services under WRC-23 Agenda 1.4.

Recognizing this, WRC-19 adopted Resolution 247 to consider “the use of HIBS in the mobile service in certain frequency bands below 2.7 GHz already identified for IMT, on a global or regional level.”

Basic concepts of HIBS applications:

HIBS (high altitude platform station as IMT base station) is defined in No. 1.66A as a “A station located on an object at an altitude of 20 to 50 km and at a specified, nominal, fixed point relative to the Earth.”

It’s important to recognize that HIBS can provide low latency mobile connectivity to unserved areas, including rural and remote areas, over a large footprint ( around 31,500 km2).

HIBS can enhance terrestrial IMT networks with so-called “super macro cells” that complement the existing ground-based deployment methods (e.g. macro cell, micro cell).

HIBS are intended to be used as a part of, and complement to, terrestrial IMT networks, using the same frequency bands as ground-based IMT base stations. In this sense, the UE to be served, whether by HIBS or ground-based IMT base stations, are the same. HIBS applications could provide flexibility and broaden the use of the existing IMT bands to complement coverage and support different use cases, while taking into account sharing and compatibility with existing applications and services.

Such use of spectrum by HIBS would require new identifications for HAPS as IMT base stations are required similar to those in RR no. 5.388A established at WRC-2000. Modifications to the IMT identification under RR No. 5.286AA, 5.317A, 5.341A, 5.341B, 5.341C, 5.346, 5.346A, 5.384A and 5.388 are outside the scope of WRC-23 Agenda Item 1.4.

The amount of spectrum needed in a given deployment scenario would depend on a number of factors and in the following section, examples of spectrum needs for HIBS applications is provided under specific system characteristics and deployment scenarios.

Usage and deployment scenarios:

The aim of HIBS is to provide internet access and services to the UE in remote area cases with quick deployment and less transmission loss.

Some HIBS applications communication usages foreseen are:

– Natural disaster relief missions, where communication for coordination and situation awareness across help and humanitarian aid organizations is needed.

– Fire detection, monitoring and firefighting missions to ensure communication between actors.

– Exploration missions with communication needs between exploration teams and regional home base.

Possible deployment scenarios:

HIBS would be deployed to provide connectivity to areas unserved and/or underserved by ground-based IMT base stations, such as:

– Areas where it is difficult to provide mobile connectivity using ground-based IMT base stations due to economic challenges (e.g. very small population covered, lack of backhaul connectivity and power supply, etc.).

– Areas covered by ground-based IMT base stations, but disruption to power supply and/or backhaul have resulted in a temporary lack of mobile connectivity.

– Unpopulated areas not covered by ground-based IMT base stations.

Mobile connectivity is becoming widespread, connecting objects (IoT: Internet of things, IoE: Internet of everything), as well as people.

Sensor networks which combine different types of sensors and IoT technology based on IMT systems (eMTC: enhanced Machine-Type Communication, NB-IoT: Narrowband IoT) are likely to be widely used in both populated and unpopulated areas. These areas are currently unserved and/or underserved.

Safety and security:

HIBS can help provide ubiquitous mobile coverage in unpopulated areas, thereby allowing users to get mobile connectivity regardless of time, place or circumstances. Thus, users will be able to make an emergency call wherever they are, in the case of a sudden car breakdown, getting lost or another problem.

In the aftermath of a natural disaster, communication networks can be restored quickly by using HIBS to cover these areas.

As they can connect to ordinary mobile phones that people carry all the time, HIBS are well suited for safety and security applications.

Internet of Things:

ICT is now widely used to help maintain and manage public infrastructure, such as roads, pavements, bridges and dams. Using a combination of IMT-based IoT technology and HIBS connectivity, infrastructure in both urban areas and rural/unpopulated areas can be managed on the same sensor network. The same approach can also be used to monitor natural processes, which are difficult for people to get close to, such as an active volcano.

Connected sensor networks can also support large-scale agriculture and livestock farming. The data they collect can be used for automation and the streamlining of processes, and can lead to innovation in this sector.

In this way, HIBS will be able to expand the reach of IoT services to support efficient management and maintenance of both public infrastructure and natural objects, while contributing to the development of the farming industry.

Event services:

HIBS can also be deployed above a venue, such as a stadium, a theme park, a resort, a tourist spot or exhibition place to provide more capacity to accommodate a temporary increase in demand. The rapid deployment of HIBS can augment the terrestrial network infrastructure to satisfy unusually high capacity requirements over short periods of time.

Frequency Bands:

HIBS will need additional and separate identification to use certain frequency bands below 2.7 GHz already identified for IMT taking into account sharing and compatibility with existing applications and services. Modifications to the identifications to IMT (5.286AA, 5.317A, 5.341A, 5.341B, 5.341C, 5.346, 5.346A, 5.384A and 5.388) in the Radio Regulations are outside the scope of WRC-23 Agenda Item 1.4. It may be possible for HIBS to employ the same band plans (see ITU-R Recommendation M.1036) as used by ground based IMT networks.

References:

https://www.itu.int/en/mediacentre/backgrounders/Pages/High-altitude-platform-systems.aspx

https://arxiv.org/pdf/2007.15088.pdf

https://eepower.com/news/hapsmobile-and-apb-collaborate-to-develop-high-energy-density-batteries/#

https://www.engineering.com/story/haps-alliance-is-putting-5g-in-the-stratosphere