Month: July 2013

Sprint to include Clearwire spectrum in new LTE roll-outs + Analysts turns cautious on Sprint

Sprint will incorporate spectrum from Clearwire’s network in its Long-Term Evolution service across the country next year, the carrier disclosed Tuesday, adding that it expects all of its new smartphones to support 4G speeds. Sprint executives declined to say whether those models will include the iPhone.

While Clearwire’s frequencies occupy a different band than Sprint’s other spectrum, the 2.5 GHz LTE base stations are designed to add capacity and boost service in dense, urban areas.

With the Clearwire acquisition, Sprint got access to an emerging Clearwire LTE network that it plans to use for extra mobile data capacity in densely populated areas. Though it uses a slightly different form of LTE than Sprint’s and operates in a relatively short-range spectrum band, around 2.5GHz, the former Clearwire network could give the carrier a large amount of capacity to bolster services in cities.

The network had been intended for Sprint’s use through the longstanding partnership between the two companies, but Sprint’s takeover of Clearwire gave that plan a more solid foundation.

There were already about 2,000 Clearwire LTE sites completed when the buyout was completed earlier this month, said Steve Elfman, president of network operations and wholesale, on the conference call. He expects several thousand 2.5GHz LTE base stations on the air this year, with sites across the country next year, though not the full deployment of sites that will use the spectrum. The 2.5GHz radios don’t have as long a range as Sprint’s other gear, so they’ll be deployed in a larger number of sites, he said.

Sprint plans eventually to operate LTE in three spectrum bands: Its own 1.9GHz band, the 800MHz frequencies from its defunct Nextel network, and the 2.5GHz spectrum. Earlier this month it introduced the first mobile device that will be able to use all those bands.

Analyst Opinion on Sprint: Waiting for Network Differentiation amid Heightened Competition, by David Dixon, FBR Capital Markets

Sprint reported mixed 2Q13 results, with better-than-expected revenue, offset by weaker-than-expected postpaid net adds and churn. Consolidated revenues of $8.9B and wireless revenue of $8.1B were ahead of consensus.

Operating Income Before Depreciation And Amortization (OIBDA) of $1.42B was slightly above the Street; postpaid net losses of 1,045,000 fell short of the consensus estimate of 914,000 net losses. Postpaid churn of 2.63% was up 83 bps annually and above the Street.

Sprint will continue to face customer churn pressures as it rolls out Network Vision. We believe Sprint is facing increasing

competitive pressure in the postpaid market, with Verizon and AT&T encroaching from the high end and a resurgent T-Mobile US encroaching from below.

We expect T-Mobile to pressure both AT&T and Sprint in the prepaid and postpaid markets as the company completes its 4G network upgrade (which shows better performance, versus T and VZ, according to our vendor checks), launches its LTE network, and markets its new “no contract” plans with a reinvigorated device lineup.

We believe Sprint will also face higher-than-expected cost pressures; this drives our below-consensus OIBTDA forecasts ahead of competitive differentiation in FY15.

* LTE buildout progressing well, but still behind rivals. Sprint announced the launch of LTE in an additional 41 markets, bringing the total number of markets to 151. The company remains well behind both Verizon and AT&T, with T-Mobile quickly catching up to Sprint. T-Mobile also announced that it would offer LTE on wider channels in 90% of the top 25 markets by the end of 2013, versus the current 2×5 MHz deployment that both Sprint and T-Mobile are currently using.

* Competitive intensity beginning to heat up. Both Sprint and T-Mobile have closed deals that provided capital and spectrum, creating a path forward for the two smaller players to better compete. However, we expect that Sprint may take until mid 2014 to approach competitive parity (especially for voice), and FY15 to differentiate on data; but T-Mobile should see churn improvement in FY13, which will affect Sprint, AT&T, and Verizon, in that order. Competitive intensity will affect both margins and capex costs as the four major operators compete on price and network quality.

* Hard-line, versus pragmatic, DOJ stance remains cause for concern. The DOJ’s hard-line stance regarding the need for four nationwide wireless players suggests less potential for a Sprint/T-Mobile US merger. The DOJ appears excited by the fact that wireless network operators have no choice but to invest, even if incremental returns are poor.

* We are downgrading Sprint to Market Perform from Outperform. Our downgrade is based on expectations for a weak network position to persist amid increased competition from T-Mobile (in prepaid) and Verizon and AT&T (in postpaid). Our OIBDA forecasts are significantly below consensus.

Other Analyst Ratings:

Analysts at Deutsche Bank reiterated a “buy” rating on shares of Sprint Nextel Corp. in a research note to investors on Monday. Analysts at BMO Capital Markets cut their price target on shares of Sprint Nextel Corp. from $9.00 to $7.00 in a research note to investors on Monday, but they still have an “outperform” rating on the stock.

Two research analysts have a sell rating on Sprint, twenty-one have given a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the stock. The company presently has an average rating of “Hold” and an average price target of $7.13.

Disclaimer: The author of this blog post does not hold stock in Sprint or any other telecom company! We do not recommend buying individual stocks of any company.

FBR Research: Analysis of AT&T’s latest earnings report + much greater wireless competition ahead!

From FBR Research Analyst David Dixon:

AT&T reported mixed 2Q13 results as the company responded to increased competitive intensity. Wireless churn deteriorated sequentially, offset by impressive postpaid net adds, largely driven by tablet growth. Management remains focused on prioritizing LTE network parity with Verizon to lower postpaid churn and expand wireless margins.

Smartphone adoption continued to increase nicely as AT&T sold 6.8 million smartphones, the highest level for the company in the second quarter, and also had the best-ever Android sales. At 88% of sales and 73% of the base, continued momentum is expected.

However, we believe AT&T (and Verizon) will experience increased competition in both the lower-end prepaid market (T-Mobile in FY13 and Sprint in FY14) and the higher-end postpaid market (Verizon). This may result in more-than-expected cost pressure.

More importantly, if Sprint can differentiate through Clearwire (something we will not see until mid FY14 at the earliest), AT&T may need to reconsider the acquisition of DISH Networks to improve its LTE spectrum position.

Note: Earlier this month, Clearwire shareholders approved Sprint buying the ~50% of Clearwire that it didn’t already own. Clearwire offers a nationwide wireless broadband network using spectrum in the 2.5GHz band. Sprint, which had previously owned about 50 percent of the company, is the only customer that Clearwire has for its wholesale network business. The company also has a retail business that offers wireless broadband service to consumers. http://news.cnet.com/8301-1035_3-57592700-94/clearwire-shareholders-approve-sprint-takeover/

Selected data points:

LTE buildout progressing well toward completion; what’s next for AT&T?

Management expects to “substantially complete” its initial LTE buildout by next summer. In comparsion, Verizon’s LTE network now covers 500 markets, and more than 99% of the company’s 3G coverage, with additional LTE capacity to be added in key markets.

AT&T benefits from a highly invested and high-performance 3G HSPA+ network, but 3G traffic will not slow as rapidly, limiting refarming potential.

Competitive intensity beginning to ratchet up. Both Sprint and T-Mobile have closed deals that provided capital and spectrum, creating a path forward for the two smaller players to better compete. We expect that Sprint may take until early 2014 to reposition, but T-Mobile should see churn improvement in FY13, which will affect Sprint, AT&T, and Verizon, in that order.

Competitive intensity will affect both margins and capex costs as the four major operators compete on price and network quality, not on device exclusivity. Higher data usage will keep pricing rational, but if Sprint differentiates with Clearwire, AT&T may need to acquire DISH Networks.

The proposed Leap Wireless acquisition will help AT&T’s spectrum position and may crimp T-Mobile in key LTE markets. Given public DOJ comments supporting a four-player wireless market and plans to restrict AT&T or Verizon in the incentive auctions, AT&T was wise to seek spectrum to improve its PCS spectrum position, increase leverage on Sprint to sell WCS spectrum in Texas, and potentially crimp T-Mobile US in key markets. Recall that Leap’s spectrum holdings cover the PCS and AWS bands covering 137M points of presence (POPs).

Note: Mr. Dixon didn’t discuss AT&T’s Project Velocity IP (VIP), which has 3 components: fiber to over 1K commercial buildings, U-Verse high speed Internet/TV service and IP-DSLAM high speed Internet but no TV.

At the June 12, 2013 IEEE ComSocSCV meeting, AT&T’s Shiyama Clunie presented the highlights and progress of AT&Ts Project Velocity IP. It’s a major effort to expand AT&T’s wireless and wireline broadband network. Under this initiative, which is underway now, AT&T expects to bring fiber to 1 million additional business customer locations, and its wireline IP network is expected to cover 57 million customer locations, by year-end 2015. These locations will have either U-Verse (video, Internet and voice) or U-Verse IP-DSLAM (high speed Internet and voice). AT&T also expects that its 4G LTE wireless network will cover 300 million people nationally by the end of 2014, and 99 percent of customer locations in AT&T’s wireline service area are expected to have high-speed Internet access through either IP wireline and/or 4G LTE wireless by year-end 2015.

During its earnings call, AT&T reported on U-Verse progress:

“Total U-verse subs reached 9.4 million, while video subs topped 5 million customers for the first time. Total U-verse revenues grew better than 30%, and U-verse now represents more than 50% of consumer revenues. And even with little help from the economy, business wireline showed sequential revenue improvement and strategic business services grew by more than 15%. All this resulted in improved revenue growth, continued EPS gains and strong free cash flow even while investing more in our customers and in our Project VIP.”

References:

1. AT&T Perspective on its most recent earnings report: http://www.att.com/gen/investor-relations?pid=282

2. Transcript of AT&T Management Discussing most recent earnings:

Is ITU Trying to Control/Manage the Internet as some pundits claim?

Disclaimer: This article was stimulated by IEEE member Pat McClung on the IEEE member discussion group maintained by ComSocSCV.

In an editorial “The Internet at Risk,” published in the March-April 2013 issue of Internet Computing, Google’s Vint Cerf states: “In some ways, the most pernicious proposals to limit the Internet’s openness to users and applications comes from some of the members of the [ITU] …”

http://www.computer.org/csdl/mags/ic/2013/02/mic2013020003.html

Pat McClung: “Mr. Cerf goes on to describe the attempts of the ITU to put forward revised International Telecommunications Regulations treaty language (ITRs), that would have the effect of restricting or governing content or applications on the Internet.”

Here’s a Nov 27, 2012 Reuters post with add on commentary from Mr. Cerf:

“Google’s Vint Cerf, the ordinarily diplomatic co-author of the basic protocol for Internet data, denounced the

proposed new rules as hopeless efforts by some governments and state-controlled telecom authorities to assert their power.

figured out that they are dead yet, because the signal hasn’t traveled up their long necks,” Cerf told Reuters.”

On the right upper side of that web page I clicked on Chairman’s report http://www.itu.int/md/S13-WTPF13-C-0016/en

and extracted the following:

Dr Touré underlined the need to work together. ITU will continue its bridge-building role and can leverage its unique position as a neutral convenor, where Member States, Sector Members and other stakeholders can come together. The timing of this year’s WTPF, with its focus on International Internet-related public policy matters, was particularly appropriate – as we stand at a ‘tipping point’ between the Internet as a vital enabler of social and economic progress in the industrialized world, and the Internet as a valuable global resource and a basic commodity of human life everywhere. The WTPF can create a shared vision that can be transformed into effective action to bring connectivity to the two-thirds of the world’s people who are still offline. He reminded delegates that WTPF is a forum for free-thinking debate and discussion on new and emerging issues.

Significant progress on key issues of Internet Governance

http://www.itu.int/net/pressoffice/press_releases/2013/24.aspx#.UfRhtavn9jo

It’s a tutorial leading up to the fifth ITU World Telecommunication Policy Forum, which is an ongoing series of CONFERENCES and not a standards meeting. In particular:

“The run-up to the WTPF included three preparatory meetings of the Informal Experts Group – a cross-sectoral, multistakeholder group, comprising some 180 experts, which advised the Forum and supported the drafting of the Secretary-General’s Report which was the main input document to the conference.”

http://www.itu.int/en/wtpf-13/Pages/report-sg.aspx

The ITU World Telecommunication Policy Forum is not a standards body, but rather a series of conferences and forums.

A key point is that ITU is serving as a “neutral convener” where various members and stakeholders can come together for dialog and discussion. ITU is not going to produce any rules or regulatory documents over how the Internet is to be controlled, governed, managed! So in no way is it trying to exert control or govern the Internet.

The "new Sprint" has a lot of things going for it!

Disclaimer: this post is from the IEEE Member Discussion email group open to all current IEEE members. Instructions to join are at http://comsocscv.org/ (Click on SUBSCRIBE)

From KC Star newspaper (Sprint HDQ is Overland Park, KS- near Kansas City):

July began with SoftBank Corp. in Tokyo buying 78 percent of America’s No. 3 wireless carrier.

SoftBank has pumped $5 billion into Sprint’s checkbook and installed its own founder, Masayoshi Son, as chairman. Sprint used some of that money to buyout its longtime wireless network partner Clearwire Corp.

After years of repairs to its reputation and struggles to overcome an ill conceived merger with Nextel, Sprint finally has the resources it needs to do battle. “I have great hopes for Sprint,” said analyst Roger Entner at Recon Analytics. “We’re out of excuses.”

Investors are hoping for some details Tuesday on how the new partners will challenge Verizon, AT&T and T-Mobile.

What vision does SoftBank’s Son have for Sprint’s future? Mr. Son has said he won’t take part in the traditional quarterly chat session with Wall Street analysts, though some were looking forward to hearing from him.

Is a price war in Sprint chief executive Dan Hesse’s plans to lure customers away from AT&T and Verizon?

How quickly can Sprint overcome its laggard’s start in the industry-wide race to deliver faster Internet connections for smartphones with LTE technology? Short for Long Term Evolution, LTE makes videos run smoothly on smartphones, downloads apps quickly and posts photos online in a snap.

Read more here: http://www.kansascity.com/2013/07/26/4369472/sprint-to-deliver-quarterly-numbers.html#storylink=cpy

From Mike Finegan, Sprint’s Manager M2M Solutions Engineering and good friend of IEEE ComSoc SCV chapter:

A few highlights regarding the Sprint/Softbank combination:

-The new, combined Sprint and SoftBank company is already among the top three communications companies in the world in terms of size of our customer base and revenue. Our buying power commands a position among the most powerful names in all of global business and places right up top in terms of all of our manufacturing partners’ biggest customers, globally.

-Sprint now has a whopping 185 MHz of spectrum. ATT has 106 MHz; VZ has 107 mhz. Sprint greater access to frequency ranges may give our customers the advance of a network that can handle higher levels of bandwidth.

-Motley Fool/Alexander Cho writes on July 3: “ Sell ATT and VZ: Sprint has an Overwhelming Advantage”

-$16B in capital will be invested in 2013 and 2014 as we build the world’s best network – a huge increase from our previous plans.

-A new innovation center will be built in the Silicon Valley to drive innovation and new technology with as many as 1000 employees.

-Guaranteed Unlimited is launched as an industry first!

-Headlines like: “Sprint/SoftBank Shake Up Wireless” and “Sprint: Buy for Awesome Spectrum Position” light up the news.

-Deutsche Bank issues a buy rating and an $8 price target for Sprint. Calls Sprint “the new king of spectrum with more bandwidth available for LTE than all its national competitors combined”

-We are now among the largest and strongest companies on Earth. We are investing more than ever in our network. We are committed to be innovators in the industry and in the world of technology.

SDN work gains momentum in ITU-T SG 11 and 13; Workshop to Progress SDN standardization

Standardization work on software-defined networking (SDN), a key priority for ITU-T in 2013, is progressing well in ITU-T’s Study Group 11 (SG11) with a number of important specifications nearing maturity following a meeting of two specialized groups in June.SG11 is tasked with developing the signalling requirements and protocols on SDN. The work will align with the functional requirements and architectures developed by ITU-T’s Study Group 13. In addition a Joint Coordination Activity on SDN was recently established to coordinate the work.

Matt Lopez, NEC Corporation and Rapporteur on Question 4/11 Signalling requirements and protocols for Bearer and Resource control in emerging telecommunication environments: “ITU-T’s consensus-based standards process provides an opportunity for the industry to agree common objectives for the emerging SDN environment, and resulting standards will do much to unify industry players in their work to introduce SDN on a large scale.”

Draft Recommendations in progress include a document specifying the scenarios and signalling requirements using SDN technologies in Broadband Access Network (BAN). A software-defined BAN (SBAN) simplifies network configuration, making deployment of new services easier and improving broadband service provision. Working document is only available hto ITU-T members.

Another document provides a gap analysis of SDN work going on across ITU and other standardization bodies as well as a framework, requirements and architecture for signalling in SDN. Working document is available here (members only).In addition SG 11 experts are working on a Recommendation that describes the scenarios and signalling requirements for a unified intelligent programmable interface for IPv6 service deployment. This working document is only available to ITU-T members.

The next physical meetings of the groups focusing on SDN will take place November 2013 in Uganda. For updated information see ITU-T Study Group 11 homepage.

http://www.itu.int/en/ITU-T/studygroups/2013-2016/11/Pages/default.aspx

ITU’s standardization work on SDN started in ITU-T Study Group 13 – Future networks including cloud computing, mobile and next-generation networks. SG 13 standardizes SDN’s functional requirements and architectures, and SG 11 thus works closely with SG 13 as it builds on this work by developing SDN’s signaling requirements and protocols.

SG 11’s recent meeting in Geneva received contributions calling for new SDN work items, including:

- Scenarios and signaling requirements for software-defined BAN (SBAN)

- Framework of signalling for SDN

- Scenarios and signalling requirements of unified intelligent programmable interface for IPv6

Workshop to Progress Software-Defined Networking Standardization

An ITU workshop on software-defined networking (SDN) will gather a global selection of standardization experts to progress SDN standards-development with one aim to establish efficient coordination of future work.

SDN is a promising route towards the introduction and realization of network virtualization, a major shift in networking technology which will give network operators the ability to establish and manage new virtualized resources and networks without deploying new hardware technologies. ICT market players see SDN and network virtualization as critical to countering the increases in network complexity, management and operational costs traditionally associated with the introduction of new services or technologies.

SDN proposes to decouple the control and data planes by way of a centralized, programmable control-plane and data-plane abstraction. This abstraction will usher in greater speed and flexibility in routing instructions and the security and energy management of network equipment such as routers and switches.

The upcoming workshop responds to Resolution 77 – Standardization work in ITU-T for software defined networking agreed by the World Telecommunication Standardization Assembly (WTSA-12) in Dubai, UAE, 20-29 November 2012. SDN was emphasized as a strategic priority for ITU-T by the meeting of the Chief Technology Officer (CTO) Group, 18 November 2012 (The 2012 CTO Meeting Communiqué can be found here). The Global Standards Symposium (GSS-12) held the day preceding WTSA-12, 19 November 2012, acted on the recommendations of the CTO Group by taking SDN as one of its points of focus and feeding the conclusions of its SDN discussion into WTSA-12.

The workshop will take place at ITU Headquarters in Geneva, Switzerland, 4 June 2013, within the annual meeting of the ITU Telecommunication Standardization Advisory Group (TSAG), 4-7 June 2013. It will be co-chaired by Wei Feng, Huawei, China, Chairman of ITU-T Study Group 11 (Signalling requirements, protocols and test specifications); and Chae-Sub Lee, Kaist, Republic of Korea, Chairman of ITU-T Study Group 13 (Future networks including cloud computing, mobile and NGN). Confirmed speakers include representatives of ITU-T Study Groups 11 and 13; the University of Tokyo, Japan; MIIT/CATR, China; Cisco Systems; the ETSI Industry Specification Group on Network Function Virtualization (ISG NFV); and the Open Networking Foundation (ONF).

SDN Workshop Details at:

http://www.itu.int/en/ITU-T/Workshops-and-Seminars/sdn/201306/Pages/default.aspx

Infonetics Predicts 4.9% CAGR (2013 to 2017) for Telecom/Datacom Market; Asia vs RoW?

Market research firm Infonetics Research released excerpts from its annual Telecom and Datacom Network Equipment and Software report, which provides a big picture of the health of the overall market.

TELECOM AND DATACOM MARKET HIGHLIGHTS:

. Following a recession-induced drop in 2009, the global telecom/datacom equipment and software market grew 19% in 2010, 7% in 2011, and held steady (no gain) in 2012 at $172 billion

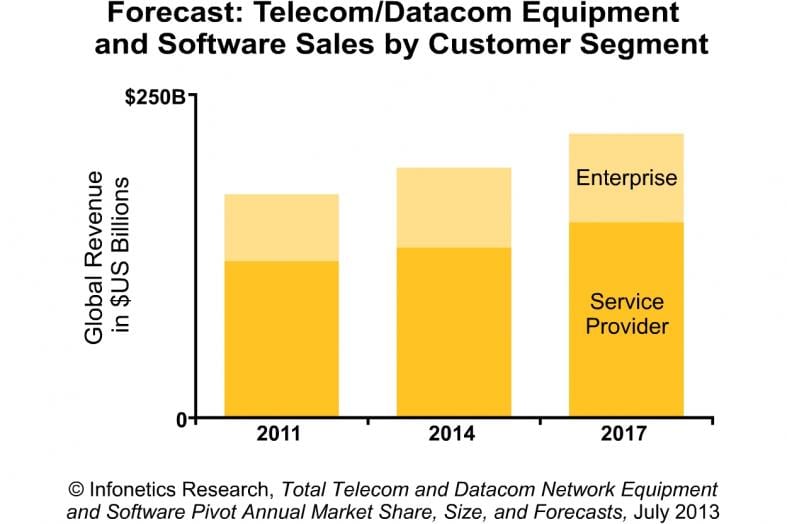

. Going forward, Infonetics projects the telecom and datacom equipment and software market to grow at a 4.9% CAGR from 2013 to 2017, when it is forecast to hit $218 billion worldwide

. During those 5 years, Infonetics expects service providers and enterprises to spend a cumulative $1 trillion on telecom and datacom equipment and software

. The top 4 telecom/datacom equipment vendors in order by overall worldwide revenue market share are Cisco, Ericsson, Huawei and Alcatel-Lucent

. Cisco maintains its commanding lead in the enterprise segment, while Ericsson is #1 in the larger service provider segment

“Even though there’s tremendous uncertainty about the health of the global economy and prospects for economic growth in the short term, the telecom and datacom equipment and software market is on track to grow annually through 2017, driven by major network transformations,” reports Jeff Wilson, principal analyst at Infonetics Research.

Michael Howard, co-founder of Infonetics and co-author of the report, adds, “Asia Pacific took the lead in telecom and datacom equipment spending in 2012, and we expect the region to continue leading at least for the next 5 years, contributing more than a third of global spending through 2017.”

Infonetics’ annual telecom and datacom equipment and software report compiles worldwide and regional market size, vendor market share, and forecasts through 2017 from its reports that track enterprise and service provider gear. It is a subset of all data networking and telecom equipment for service providers, cable companies, and small, medium, and large organizations, and therefore excludes consumer electronics.

The 11 major categories of equipment and software tracked include broadband aggregation; broadband CPE; pay TV; optical network hardware; carrier routing, switching, and Ethernet; service provider VoIP and IMS; service provider mobile/wireless infrastructure; service enablement and subscriber intelligence; security; enterprise and data center networks; and enterprise communications.

Companies tracked include Alcatel-Lucent, Avaya, Brocade, Ciena, Cisco, Ericsson, Fujitsu, HP, Huawei, Juniper, Motorola, NEC, Nokia Siemens Networks, Samsung, Siemens, ZTE and many others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Alan’s Opinion:

We think the telecom/datacom market is bi-furcated: Asia is doing well, but Rest of World (RoW) is struggling and not growing much. In particular, the European market is “sagging,” according to Bloomberg:

European Plan to Boost Sagging Telecom Market Set for September

Asian companies like Huawei, ZTE, and Samsung are gaining market share in the fiercely competitive telecom equipment market. Huawei and ZTE also dominate broadband CPE with Taiwanese companies like Netgear, D-Link, Ubee Interactive, ZyXEL, Actiontec, and many others doing quite well.

We think that RoW telecom/datacom vendors are struggling to make a profit. Moreover, VCs are not investing in such start-up companies, as they don’t see a viable market in the next five years. In fact, “network infrastructure” has become a dirty word to most VCs and angel investors.

Analysis of AT&T’s Bid to Acquire Leap Wireless

Proposed Deal:

After the close of business on July 12th, AT&T announced the planned acquisition of Leap Wireless for $1.19B, or $15 per share in cash. Leap sells pre-paid wireless service under the Cricket brand name. The press release is at: http://www.att.com/gen/press-room?pid=24533&cdvn=news&newsarticleid=36744&mapcode=corporate|financial

Our Opinion:

This deal seems to be all about acquiring additional spectrum at a fairly high price. AT&T isn’t just paying $1.2 billion for Leap – a premium nearly double Leap’s closing price Friday – it’s taking on $2.8 billion in Leap debt. That’s $4 billion to acquire regional spectrum, much of which isn’t in areas where AT&T needs the capacity.

Excluding adjustments, the total deal size is $4.0B (including $2.8B in net debt as of April 15, 2013). AT&T is also providing shareholders with a “contingent value right” (CVR)for net proceeds of the sale of Leap’s 700 MHz A block spectrum covering Chicago, IL.

AT&T holds at least 26 MHz of spectrum, and in densely populated cities that number grows to more than 70 MHz and in many cases over 100 MHz. Since the 700MHz spectrum auction failed over 5 years ago (http://viodi.com/2008/03/03/has-the-700-mhz-auction-been-a-failure/), this author has claimed that AT&T and VZW have a duopoly in the U.S. That’s because of the vast amounts of spectrum they own or control. With more spectrum as a result of this deal, AT&T would have more capacity to build bigger mobile data pipes and thereby gain a potential competitive advantage over its remaining rivals, e.g. VZW, Sprint and T-Mobile.

“Immediately after approval of the transaction, AT&T plans to put Leap’s unutilized spectrum–which covers 41 million people–to use in furthering its 4G LTE deployment and providing additional capacity and enhanced network performance for customers’ growing mobile Internet usage,” the carrier said in its press release.

AT&T seems to have concluded that the spectrum market is now so tight that airwaves — so long as they’re in the right band — are worth any price. It’s the same calculation that T-Mobile made when it merged with MetroPCS, paying Metro shareholders $1.5 billion and giving them a quarter of the combined company.

“The combined company will have the financial resources, scale and spectrum to better compete with other major national providers for customers interested in low-cost prepaid service,” the AT&T press release stated. ” Cricket’s employees, operations and distribution will jump start AT&T’s expansion into the highly competitive prepaid segment.”

But there’s no real gain in AT&T’s LTE footprint. Leap Wireless is just getting starting on its LTE rollout, but the map is still telling. Except for a few towns on the U.S.-Mexico border and a few fingers of coverage outside Tuscon, Ariz., and Houston, there’s nowhere Leap has an LTE network where AT&T doesn’t already have one.

Other Opinions

1. GigaOM: “AT&T is paying a ridiculous price but it probably feels it has no choice.” Continuing, “Today, mobile carriers are buying up their competitors for a single asset only, spectrum. The big four are becoming chop shops, buying up smaller players and stripping them to get at their airwaves.”

2. FBR’s David Dixon wrote in an email:

Key unknowns are the likely spectrum buyer and at what valuation.

Recall that this spectrum is:

(1) subject to interference issues in the short run and

(2) primarily owned by Verizon in major urban markets. Verizon built its initial LTE network using 700 MHz C block spectrum (and a band plan that does not allow for roaming) augmented by 1,700 MHz AWS spectrum using the latest technology to provide similar coverage plus capacity.

AT&T is acquiring all stock and wireless assets, which consist of the Cricket brand, spectrum, wireless network, 5,000 retail stores, and 5M prepaid subscribers.

AT&T has a voting agreement with shareholders that own 29.8% of outstanding LEAP shares. The FCC and the DOJ will both review the deal, which AT&T expects to close in six to nine months. Other key points about this deal:

* Spectrum alignment and strengthening T-Mobile USA asset drove the deal. Given public DOJ comments supporting a four-player wireless market and plans to restrict AT&T or Verizon in the incentive auctions, AT&T was wise to seek spectrum to increase leverage on Sprint and potentially crimp T-Mobile US in key markets. Recall that Leap’s spectrum holdings cover the PCS and AWS bands covering 137M POPs.

* Deal will face intense scrutiny from regulators. In recent transaction reviews, the DOJ has forced spectrum divestitures to improve T-Mobile US’ 4G LTE competitive position. We anticipate that, despite AT&T’s planned use, regulators may force divestitures in certain markets (possibly Washington, D.C., Philadelphia, and Detroit).

* Despite low termination fee, do not expect a counter-bidder to emerge. We do not believe that T-Mobile (arguably the most interested in Leap) can afford to counterbid a $15 per share all-cash bid. Sprint is a potential candidate after having closed Clearwire, while Verizon appears focused on 1.7 GHz LTE.

* CVR may be worth less than expected. No obvious near-term bidder exists for the spectrum up for sale in Chicago. Verizon holds the vast majority of 700 MHz A block spectrum in major markets. Sprint recently purchased U.S. Cellular’s Chicago operations, while T-Mobile is using AWS spectrum for LTE. Interference concerns persist. We think a spectrum sale above Verizon’s implied purchase price is less likely; we are valuing the CVR at $1 per share.

3. Fierce IPTV: AT&T’s $1.19B acquisition of Leap Wireless will boost U-verse

The deal “will be a major cog in Project Velocity IP (Project VIP), the carrier’s multibillion-dollar wireless/wireline expansion of U-verse.”

http://www.fierceiptv.com/story/att-acquires-leap-wireless-119b/2013-07-15

4. WSJ: AT&T Leaps in T-Mobile’s Way

But a closer look at Leap’s spectrum suggests the deal may be more of a jab at T-Mobile than a boost to AT&T. More than 60% of Leap’s spectrum resides in a band where T-Mobile has a major presence and AT&T, only a smattering of licenses, according to Moffett Research. Buying Leap thus keeps its highly complementary spectrum out of T-Mobile’s hands.

And AT&T may have a growing reason to do so. T-Mobile Chief Executive John Legere said last week that his company’s “porting ratio” against AT&T—customers switching to T-Mobile from AT&T over those doing the reverse—had shot up to 1.75 from 0.59 in the first quarter as a result of new contract-free service plans announced in March.

A desire to lock up Leap could explain why AT&T is paying more than eight times 2013 earnings before interest, tax, depreciation and amortization. Leap’s Ebitda is forecast to fall 7% in 2014 as its subscriber base shrinks. By comparison, AT&T trades at 6.3 times 2013 Ebitda. And while the price tag may be small relative to AT&T’s size, it could strain further its already stretched ability to fund dividend growth out of operating cash flow, according to BTIG Research.

In AT&T taking this leap, hobbling T-Mobile seems the primary goal.

http://online.wsj.com/article/SB10001424127887323664204578608141434541134.html

CANARIE upgrades 100G research and education network with Montreal-New York route

Overview:

Canadian research and education network CANARIE has deployed the 6500 packet-optical platform from Ciena to support the 100G upgrade and network expansion of a route connecting Montreal and New York, according to the optical transport equipment vendor. The new fiber-optic network link will sustain the “big data” streams used in today’s advanced academic and scientific research.

Last year, CANARIE experienced 83% percent growth in data traffic, going from 46,149 terabytes to 84,630 terabytes. Much of this data comes from “big data” projects like the Large Hadron Collider (LHC) at CERN in Europe. Canada’s TRIUMF facility in Vancouver is a Tier 1 data site for the LHC computing grid and uses the CANARIE network to transfer data to and from other sites.

Spanning Canada from Victoria, BC, to St John’s, NL, CANARIE’s network also connects more than 89 universities, 101 colleges, 47 public colleges, 127 provincial and federal government labs and research parks, 62 hospitals and health networks, 24 cultural institutions, thousands of K-12 schools, 12 provincial and territorial optical network partners, and more than 100 international peer networks in 80 countries.

The upgraded Montreal to New York link will provide high-performance optical transport to enable the delivery of big data streams and foster greater scientific collaboration – both in-region and internationally – for key Canadian research and education centers that are working on projects including everything from particle physics to genomics and neuroscience.

“With Ciena’s 100G technology, we are able to expand and upgrade the Montreal to New York route of our vast R&E network, while at the same time significantly reducing our operating costs and increasing performance over this busy link,” says Jim Roche, president and CEO of CANARIE. “This is a first step in doing the same at other segments of our network.”

“The TRIUMF Tier 1 LHC site is a leader in the field by being consistently at the top in terms of availability, reliability, and efficiency when compared to other sites in the world. There are several factors that are reflected in our success and the network infrastructure provided by CANARIE through providers like Ciena is certainly one of them,” added Dr. Reda Tafirout, a research scientist at TRIUMF.

Ciena has been both a research and technology partner to CANARIE for more than two decades. The upgrade of the Montreal to New York route represents the initial step in a wider upgrade of the network to 100G.

Ciena and CANARIE have also been showcasing emerging technologies and advanced applications for science, research, and education over high-speed, high capacity research networks at several recent events, including at the TERENA Networking Conference (TNC2013), and at the Vectors customer event at Ciena’s research and development lab in Ottawa, Canada.

At the TNC2013 demonstration, participants were able to control a robot arm with haptic feedback while simultaneously controlling an identical remote robot arm located miles away at another global location. To provide participants with the needed three-dimensional visual depth feedback on their movements at the remote location, the demonstration delivered ultra high-definition video streams at extremely low latency to the event venues. Multiple 3G-SDI uncompressed video streams were transmitted and kept in sync with Ciena’s Native Video Transport technology.

In its Ottawa R&D lab, Ciena showcased its software defined networking capabilities in a demonstration that showed 4K video delivery at 5 Gbps over the CANARIE network using Ciena packet networking technology featuring SDN ONF OpenFlow 1.3 protocol. As part of the demonstration, a video was sent from the StarLight R&E hub in Chicago across a Ciena connected link over the CANARIE network to Ciena’s lab in Ottawa.

Executive Comments:

- “With Ciena’s 100G technology, we are able to expand and upgrade the Montreal to New York route of our vast R&E network, while at the same time significantly reducing our operating costs and increasing performance over this busy link. This is a first step in doing the same at other segments of our network. Ciena has been a critical research and technology partner to CANARIE for more than two decades. CANARIE’s fibre optic networks and Ciena’s optical technologies are invisible to end users, but this infrastructure is absolutely critical to enabling academics, scientists and researchers to leverage global big data resources to create new knowledge and new opportunities for innovation.”

– Jim Roche, president and CEO of CANARIE

- “The research and education community relies on cutting-edge communications technology for global collaboration to achieve scientific advancements, which our OPn architecture supports by enabling the economical and exponential scale required to support high-bandwidth and collaborative research projects. Ciena is proud to work with CANARIE on the evolution of its network, helping it to deliver innovative new services and advanced research projects that

support tomorrow’s discoveries.” Rod Wilson, senior director of external research at Ciena

- “The TRIUMF Tier-1 LHC site is a leader in the field by being consistently at the top in terms of availability, reliability, and efficiency when compared to other sites in the world. There are several factors that are reflected in our success and the network infrastructure provided by CANARIE through providers like Ciena is certainly one of them.”

– Dr. Reda Tafirout, research scientist at TRIUMF

Recent Joint Demonstrations:

- Ciena and CANARIE have been showcasing emerging technologies and advanced applications for science, research and education over high-speed, high capacity research networks at several recent events, including at the TERENA Networking Conference (TNC2013), and this week at an exclusive customer event at Ciena’s research and development lab in Ottawa, Canada.

- At the TNC2013 demonstration, participants were able to control a robot arm with haptic feedback while simultaneously controlling an identical remote robot arm located miles away at another global location. To provide participants with the needed three-dimensional visual depth feedback on their movements at the remote location, the demonstration delivered ultra high-definition video streams at extremely low latency to the event venues. Multiple 3G-SDI uncompressed video streams were transmitted and kept in sync with Ciena’s Native Video Transport technology.

- In its Ottawa R&D lab, Ciena showcased its software defined networking capabilities in a demonstration that showed 4K video delivery at 5 Gb/s over the CANARIE network using Ciena packet networking technology featuring OpenFlow 1.3. As part of the demonstration, a video was sent from a StarLight-Ciena connected network in Chicago over the CANARIE network to Ciena’s lab in Ottawa.

References:

Nokia Buys out Siemens interest in NSN (as predicted); Company’s future raises many ?s

About 2 weeks ago we wrote a blog on this site titled:

Siemens Searching For NSN Buyer which might be Nokia!

https://techblog.comsoc.org/2013/06/17/siemens-searching-for-nsn-buyer-which-might-be-nokia

We speculated that Nokia might buy NSN, rather than a private equity firm or network equipment company. Today, that happened as Nokia bought Siemens interest in NSN for just €1.7 billion (US$2.22 billion). That seems like a low price for a half share of a vendor that generated revenues of €13.78 billion ($18 billion) and an operating margin (after one-time costs) of 5.6 percent for the full year 2012. The deal is set to close before the end of September, after which NSN will drop ‘Siemens’ from its name: Nokia says it will unveil the infrastructure vendor’s new name once the deal is completed.

Stephen Elop, President and CEO of Nokia, commented: “With its clear strategic focus and strong leadership team, Nokia Siemens Networks has structurally improved its operational and financial performance. Furthermore, Nokia Siemens Networks has established a clear leadership position in LTE, which provides an attractive growth opportunity. Nokia is pleased with these developments and looks forward to continue supporting these efforts to create more shareholder value for the Nokia group.”

Joe Kaeser, Siemens CFO, commented: “With this transaction, we continue our efforts to strengthen our focus on Siemens’ Core areas of Energy management, Industry and Infrastructure as well as Healthcare. The full acquisition of Nokia Siemens Networks by Nokia offers an attractive opportunity to actively shape the telecom equipment market for the future and create sustainable value.”

Nokia Siemens Networks was established on April 1, 2007, as a joint venture combining Nokia’s Networks Business Group and Siemens’ carrier-related operations for fixed and mobile networks. Nokia Siemens Networks has since become a leading global provider of telecommunications infrastructure, deploying networks that help people stay connected in more than 150 countries around the world. The company’s focus is in offering innovative mobile broadband technology and services.

Nokia will continue to consolidate Nokia Siemens Networks for financial reporting purposes as well as continue to strengthen the company as a more independent entity. Nokia plans to retain the existing management and governance structure at Nokia Siemens Networks, with Rajeev Suri continuing as CEO and Jesper Ovesen continuing as Executive Chairman of the Nokia Siemens Networks Board of Directors, which will adjust to the changing ownership structure.

http://press.nokia.com/2013/07/01/nokia-to-fully-acquire-siemens-stake-in-nokia-siemens-networks/

Note that NSN had previously sold its optical networking business unit to private investment firm Marlin Equity Partners, a Los Angeles-based private investment firm. So NSN was reduced to a pure wireless infrastructure play.

Light Reading: Six years of struggle

NSN was formed on April 1, 2007, when the joint venture partners combined their telecoms infrastructure subsidiaries (Nokia Networks and Siemens Communications) to form a European powerhouse. (See Nokia Siemens Opens on a Downer.)

But little has gone right for the venture since its inception as it battled merger pains and intense competition from Ericsson AB and Huawei Technologies Co. Ltd.: Its parents were forced to inject fresh funds into the company in 2011 and implement a massive restructuring program to keep it afloat. (See NSN Gets $1.36B & New Leader and NSN Could Lose More Than 17,000 Staff.)

But that painful restructuring process, which has involved significant job cuts and the sale of non-core parts of the company, has helped NSN improve its margins, while the focus on mobile networks, professional services and customer experience management (CEM) offerings has given the vendor a decent foothold in the global 4G networks market. Now Nokia will need to show it hasn’t made a big mistake in using up precious cash reserves on a networks operation, while the NSN team will need to prove it has market momentum and continue to improve its financial health.

What this move doesn’t do, though, is answer all the questions about NSN’s future. Nokia notes that it will “continue to strengthen the company as a more independent entity,” a statement that leaves the door open for a separate listing of NSN in the future.

Closing Comment/Questions:

- Will the 100% Nokia owned company be able to compete with Ericsson, Huawei and Alcatel-Lucent in the global wireless network equipment market that continues to shrink?

- What synergies can Nokia gain from combining wireless devices/smart phones with network equipment?

- Will the company have an opportunity to enter new markets such as M2M communications, wireless eHealth, connected cars, etc?

- Jury is out on all of those (and other) questions about the company’s future.

Did the U.S. Get it Right or Wrong on Broadband Communications? VZ says YES, this author says NO!!!

A NY Times op-ed by Verizon Chairman Lowell C. McAdam titled “How the U.S. Got Broadband Right” is yet another specious argument in favor of the existing loosely regulated monopoly system of Internet service.

http://www.nytimes.com/2013/06/21/opinion/how-the-us-got-broadband-right.html

The editorial states: “More than 80 percent of American households live in areas that offer access to broadband networks capable of delivering data with speeds in excess of 100 megabits per second. Almost everyone in the country has several competitive choices for high-speed broadband service (with wireline, satellite and wireless options). Verizon offers 14.7 million consumers, in parts of 12 states and the District of Columbia, speeds up to 300 megabits per second via our FiOS network, which is poised to provide even greater speeds in the future. Companies like AT&T, Comcast and Time Warner Cable are also investing in their infrastructure.”

That’s an outright lie! In Santa Clara, CA- the heart of Silicon Valley- I have only 2 choices for broadband- AT&T and Comcast Xfinity. I chose AT&T U-Verse which gets me 12M b/sec downstream. Comcast Xfinity offers ~50M b/sec here. In rural CA areas there is often no wireless broadband at all and only one provider- Comcast Xfinity!

Where does the U.S. rank on the list of the top 10 countries or regions with the fastest internet? Nowhere!

Here are the top 10 countries with fastest broadband access:

- Hong Kong

- South Korea

- Japan

- Latvia

- Romania

- Belgium

- Switzerland

- Bulgaria

- Israel

- Singapore

http://www.top10fastest.com/the-fastest-internet/

Also see: http://www.broadbandmap.gov/blog/

From a letter to the editor in Sat June 29th NY TImes:

“In fact, according to the Organization for Economic Cooperation and Development and the International Telecommunication Union (ITU), America trails most developed nations in providing broadband, despite Lowell C. McAdam’s assertion that Europe’s regulatory regime “limits investment and innovation.”

When will we wake up and recognize that a new economy dependent on broadband infrastructure is key to our success, indeed survival, in the world? Broadband is a public service that every individual and organization should have, and the United States needs to regulate this service as a public utility, not leave it to the so-called free marketplace.”

JOHN M. EGER

San Diego, June 21, 2013

The writer, a professor of communications and public policy at San Diego State University, is a former legal assistant to the Federal Communications Commission chairman (1970-73) and director of the White House Office of Telecommunications Policy (1974-76).

Addendum: Broadband penetration higher in countries with national rollout strategy

Partnerships between government and industry are driving progress, says ITU:

Countries with a coordinated national strategy for rolling out broadband are making significantly faster progress than those taking a more laissez-faire approach to broadband development, according to a new report.

The research, conducted by the International Telecommunication Union (ITU), together with the Broadband Commission for Digital Development and Cisco, indicates that countries with a national broadband plan have fixed broadband penetration some 8.7 percent higher on average than countries without plans.

Once the potential impact of factors like higher average income per capita, market concentration and urbanisation are discounted, countries with plans benefit from fixed broadband penetration on average 2.5 percent higher than countries without plans, according to the report.

In mobile, the impact is almost as significant. Countries with national broadband plans have mobile broadband penetration some 7.4 percent higher on average than countries without plans. The report also acknowledges the role of market competition in boosting uptake. Broadband penetration in competitive markets is 1.4 percent higher on average for fixed broadband and up to 26.5 percent higher on average for mobile broadband.

“The Broadband Commission’s message about the power of broadband to transform each and every economic sector is now gaining global traction,” said ITU Secretary-General, Dr Hamadoun I. Toure.