Month: December 2012

The End of the Public Switched Telephone Network (PSTN)

More and more businesses and households are trading their traditional switched telephone service for voice over Internet Protocol, or VoIP, services. That’s led to a paradoxical situation, where a huge number of phone calls start out as Internet packets and end up as Internet packets, but have to be switched to, and then from, a voice circuit on the old-school public switched telephone network. Universal Internet Protocol would allow telecom companies to meet the same demand with much less equipment. Seeing the possible financial benefits—including turning suddenly redundant real estate into cash—AT&T, the largest phone service provider in the world, called on the U.S. government to set a final date for the last plain old telephone call.

“Techwise Conversations” host Steven Cherry talks with Daniel Berninger, founder of the Voice Communication Exchange Committee. This Washington, D.C.–based telecom advisory group has chosen the date for the completion of the transition to the Internet Protocol.

To read the transcript of the podcast, visit: http://spectrum.ieee.org/podcast/telecom/internet/the-end-of-the-public-phone-network/?utm_source=techalert&utm_medium=email&utm_campaign=122712

Another source states, “At some point, there will be so few customers left on the older networks that they cannot be supported any longer, especially when all legacy services can be delivered using the new IP networks. Fixed voice still represents 25 percent of total service provider revenue in the 17 countries, Ofcom reports. But only a quarter of total revenues. And those revenues steadily are declining.”

Read more at:

Infonetics & Insight Research Corp paint different pictures & forecasts for Global Telecom CAPEX

Overview:

Market research firms Infonetics Research and the Insight Research Corp have huge differences in their global telecom capex forecasts. Infonetics is quite postive stating 2012 global capex increased almost 4% year over year in 2012. Meanwhile, Insight Research Corp says that capex spending among fixed-line operators continues to decline, with the only capex growth coming from the mobile operators in developing countries

1. Infonetics Research: Fundamental Telecom and Datacom Market Drivers

Infonetics released excerpts from its December 2012 Fundamental Telecom and Datacom Market Drivers report, which analyzes global and regional market trends and conditions affecting service providers, enterprises, subscribers, and the global economy. The firm estimates that global CAPEX was up approximately 4% (Year-over-Year) in 2012, outpacing global GDP growth of about 3.4%.

FUNDAMENTAL TELECOM AND DATACOM MARKET DRIVERS:

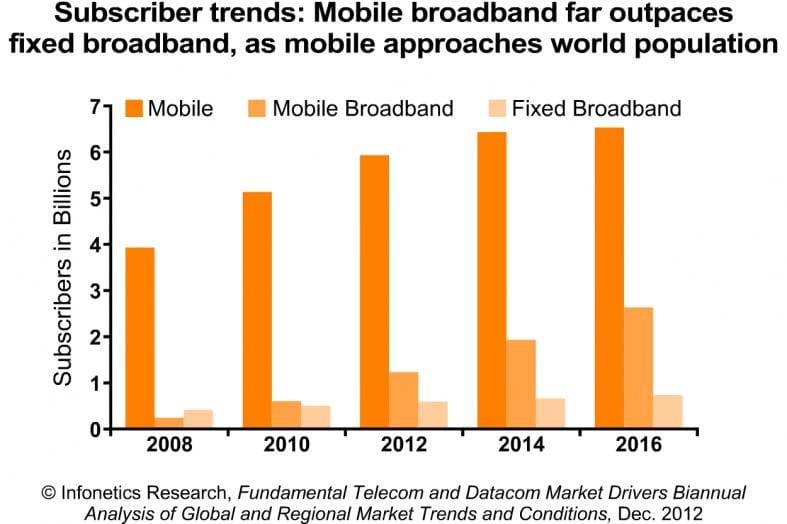

. Globally, mobile service revenue is the main growth engine in the overall telecom/datacom market, up 4.3% year-over-year in the first half of 2012.

. User mobility, specifically BYOD anywhere, is putting pressure on carriers to move to a single network for fixed and mobile access, internet traffic, and private/premium services.

. Data traffic growth is outstripping transport equipment costs: traffic is climbing 29% annually while equipment costs are falling 10%.

. Software-defined networks (SDNs) are here to stay, but not today: SDNs are on service providers’ minds, but it is a longer-term challenge to find implementations of hybrid SDN and non-SDN in live networks.

. The phase out of stimulus monies and pressure on government budgets is decreasing public sector spending and taking a bite out of overall enterprise growth.

. With security top of mind due to unprecedented threats and the growing BYOD trend, businesses everywhere are looking to integrate security into everything from smartphones to routers and switches, and are evaluating data center security appliances, cloud security services, and security for virtualized environments and public and private clouds.

ANALYST NOTE:

“As we’re ending 2012, Europe’s crisis remains uncontained and is now spreading to Germany. The potential of shaking business confidence everywhere in the world has risen to new heights, and the IMF lowered its growth forecast and is warning of recession risks due to downward revision of global GDP, which now stands at 3.3%. Economic readings are worrisome everywhere but the U.S., but so far the impact on global telecom and enterprise remains tame, and we’re forecasting capex to grow nearly 4% in 2012 over 2011,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Téral adds: “With the announcement of AT&T’s and Deutsche Telekom’s multi-billion dollar investment plans, next year’s capex outlay looks brighter.”

REPORT SYNOPSIS:

Infonetics’ market drivers report is published twice annually to provide analysis of global and regional market trends and conditions affecting service providers, enterprises, subscribers, and the global economy. The report assess the state of the telecom industry, telling the story of what’s going on now and what is expected in the near and long term, including spending trends; subscriber forecasts; macroeconomic drivers; and key economic statistics (e.g., unemployment, OECD indicators, GDP growth). The 40-page report is illustrated with charts, graphs, tables, and written analysis.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

2. The Insight Corp: Global Telecom CAPEX Hampered by Funding Problems

Capital expenditures (Capex) by telecommunications service providers globally will be very uneven, with North America, Europe and the Latin American-Caribbean regions showing little or no growth and only Asia-Pacific and Africa continuing to make investments in telecommunications hardware and software to keep up with burgeoning customer demand for new services, says a new market analysis report from The Insight Research Corporation.

“Customers in every region are pinching pennies and the demand for advanced applications is uncertain. The confluence of these trends means a further erosion of operator margins, which in turn will affect investments into infrastructures and new technologies since funding is now more difficult to obtain,” says Insight Research President Robert Rosenberg.

“The difficulty in finding funding now faced by many operators will certainly slow down, if not derail, the rolling out of investments in NGNs, WiMAX, LTE, or converged services,” Rosenberg concluded.

Insight’s report, “Telecommunications and Capital Investments: Impacts of the Financial Crisis on Worldwide Telecommunications, 2012-2017,” states that Capex is expected to increase at a compounded rate of 1.5 percent, from $207 billion in 2012 to $223.3 billion in 2017. The report notes that capex spending among fixed-line operators continues to decline, and the only growth in capex spending comes from the mobile operators in developing countries that continue increase their capital outlays to meet the pent up demand for service.

“Although demand for telecommunications services may be income inelastic and may actually grow, services will nonetheless come under pricing pressure as operators fight for more cost-focused customers and new device purchases are delayed. On the other hand, demand for advanced applications is more uncertain. This will result in further erosions of operator margins, which in turn will affect investments into infrastructures and new technologies since funding will be more difficult to obtain. It will prompt operators to search for further improvements in internal efficiencies, including infrastructure sharing and workforce reductions. Will the credit crunch derail investments in NGNs and converged services? How will OEMs fare during the economic maelstrom, where are the opportunities for operators, what are the risks, and which operators are best equipped to weather the crisis? “

AW Comment: Doesn’t sound too upbeat to me :–((

For more information on this report, please see:

http://www.insight-corp.com/reports/invest12.asp

http://www.insight-corp.com/ExecSummaries/invest12ExecSum.pdf

http://bbpmag.com/wordpress2/2012/12/global-telecom-capex-hampered-by-funding-problems/

Comment from Infonetics on the apparent differences in the 2 forecasts (apples & oranges?):

noticed that the excerpts from Insight’s forecast are about the future, whereas the excerpts from ours focus on our expectations for 2012 (final figures are not in yet so 2012 figures are still forecasts at this point).

So comparing the numbers is a little like comparing apples to oranges.

Our 5-year CAGR for capex for 2011–2016 is 2.7%. Insight’s is 1.5% for 2012–2017 (different set of years). Also, they could be counting slightly different things in their definition of capex. That’s why we can’t comment on their forecast.

If you want to use the specific growth figure we expect for 2012 over 2011, it’s 3.6% (we rounded it to “nearly 4%” in the press release). That is still slightly ahead of 2012 GDP forecasts (also just a forecast at this point until final figures are in).

When Stéphane says 2013 looks brighter, he means capex spending should be slightly better next year than this year on a worldwide basis, though he stresses in his report that things still look bleak in a lot of places, especially Europe , on a macroeconomic level. That’s why it was such big news that Deutsche Telekom committed to spending so much over the next 3 years – they’re spending despite the (difficult) economic environment.

Kimberly Peinado

Director of Marketing, Infonetics Research

Editor’s Note: This author is very appreciative of Kim’s efforts to share breaking news about Infonetics very high quality market research reports. She also sends me graphs, like the one that appears in this article Thanks a lot Kim!

References:

http://viodi.com/2012/12/25/global-telco-capex-may-surprise-on-the-upside-in-2013/

TW Telecom launches nationwide availability of 10GE "One to Many" Ethernet access

TW Telecom has announced the commercial availability of its new business 10G Ethernet service, which is being rolled out nationally through a partnership with Columbus Networks. The company says E-Access (one to many) — based on the Metro Ethernet Forum (MEF) 33 standard — will reach thousands of enterprise customers from a single hub in Miami. tw telecom says it is the first to offer national E-Access Ethernet connectivity based on new MEF 33 standards.

Through a single network connection in one location, tw telecom says its Business Ethernet service is delivered to virtually any building or data center in the United States across its 75 market national footprint. The E-Access solution provides ready-made infrastructure for carriers to quickly and easily reach their end user locations across a secure, scalable and trusted network, the company added.

“Our initial experience with tw telecom has enabled us to successfully connect to many U.S. customer locations from one network access point,” said Peter Collins, executive vice president and chief technical officer, Columbus Networks. “The uniqueness of E-Access provides us with additional seamless and scalable connectivity to extend our regional managed business solutions to customers with offices here in the USA.”

“E-Access with an external network to network interface (ENNI) provides carrier, application, and data center service providers with a single point of access into tw telecom’s vast national Ethernet footprint,” said Tom Marx, president of tw telecom’s wholesale services. “These providers are recognizing the need for a secure and scalable network as they roll out business critical applications to their customers. Many of these carriers typically do not have their own network to connect everywhere they need to go. They look to tw telecom to deliver secure, scalable and predictable network connections and solutions that help them deliver applications to their customers.”

References:

Contact:

For more information on TW Telecom’s portfolio of Ethernet services, please contact: TW Telecom Account Executive

Michael Weiss at [email protected] or call him at 408 603-2316

Spectrum Crunch or not? Do Wireless Network Operators really need More Spectrum?

AT&T Chief Randall Stephenson has been warning about a spectrum crunch for some time and used that argument as the main reason AT&T needed to acquire T- Mobile.

- http://forwardthinking.pcmag.com/none/300447-at-t-ahead-of-the-capacity-crunch-but-spectrum-problems-loom

But then just last month, the new Ma Bell (which is really SBC + the old AT&T) said they’d build out LTE to 99% of the US, including rural areas it previously said could only be built out if the company acquired T-Mobile’s spectrum and cell towers. A complete reversal!

http://viodi.com/2012/11/08/at-bring-fiber-to-commercial-buildings-cover-99-of-us-with-lte/

Stephane Teral of Infonetics clearly says no more spectrum is needed- operators should use what they have more efficiently to meet the surge in mobile data traffic. See his comments both within this article and in the comment box below it: http://viodi.com/2012/12/05/infonetics-mobile-infrastructure-market-down-in-quarter-small-cells-not-so-hot/

In particular, ” It’s interesting to see that so many people believe there is a spectrum crunch! And therefore, mobile infrastructure spending should increase! Who’s paying for the new infrastructure at a time ARPUs are falling everywhere except in Australia , Canada , the US , and Japan? I’m currently crunching mobile services revenue numbers and there are not pretty: consumers don’t want to pay for mobile communications. At this point of the 21st century, mobile infrastructure on this planet is essentially built out and the bulk of the market consists of migrating/upgrading 2G network to 3G with LTE-ready gears.”

In a SJ Merc editorial today, Joint Venture SV’s Chris DiGiorgio and Leon Beauchman say yes, more spectrum is needed to encourage more mobile apps & mobile computing.

Greater wireless spectrum can power Silicon Valley and U.S. economy, by Chris DiGiorgio and Leon Beauchman

http://www.mercurynews.com/opinion/ci_22148409/chris-digiorgio-and-leon-beauchman-greater-wireless-spectrum

Leon refers to the recent JVSV Wireless Symposium and Congresswomen Anna Eschoo said “we (U.S. Congress) must make freeing up more spectrum a top priority” Summary of her remarks & the entire symposium is at:

https://techblog.comsoc.org/2012/11/14/summary-of-nov-2nd-wireless-symposium-sponsored-by-joint-venture-silicon-valley

Here’s more to whet your appetite:

-WirelessOperators can’t afford to raise mobile data plan prices as a means to constrain mobile data traffic, as that would discourage users.

-And they apparently don’t want to spend much money to rebuild their cellular networks to make them more efficient, e.g. small cells, self organizing networks, mobile data traffic management, improved backhaul, etc.

-Operators seem to be using a combination of femtocells and WiFi hot spots to offload mobile data traffic to broadband wireline networks. Is that the ultimate solution, or would they really make use of more spectrum if they got it?

Yankee Group Assessment of 2012 Mobile Market & 2013 Predictions

From today’s Yankee Group webinar, which I attended.

2012 in Review: It’s Been a Busy Year!

- The mobile economy went mainstream

- 4G/LTE deployments gained momentum

- Innovations achieved in mobile data pricing

- Emerging markets jumped on the smartphone bandwagon

- Power shifted in the mobile OS war

- HTML5’s fortunes fluctuated wildly

- Cloud‐based mobile wallets emerged

- Mobile POS initiatives spread in U.S. and launched in EU

- Professionals became primary drivers of enterprise mobility

- Companies’apps initiatives shifted from experimental to strategic

Mobility in 2013 – A Make or Break Year:

The volatility marking the mobile industry is finally beginning to ease, and as the dust begins to settle, mobility’s true winners—and losers—will slowly emerge across the entire ecosystem, from devices, to applications, networks and more. This will be the year when smart players place their bets and position themselves for long‐term success in: Mobile money, Mobile apps & cloud, Mobile broadband, Mobile devices.

Highlights:

- With voice and messaging revenue on the decline, the only bright spot for operators is demand for mobile data services.

- Globally, data revenue will increase from U.S.$319 billion in 2011 to U.S.$550 billion by 2016, and total mobile service revenue will increase from U.S.$1 trillion in 2011 to U.S.$1.15 trillion by 2016.

- Consumers want—and demand—anytime, anywhere connectivity. Sixty-three percent of respondents to Yankee Group’s 2012 US Consumer Survey, September state that mobile data speeds are important to them and the same number (63 percent) want to be connected all the time.

- Mobile payments are due for a security setback. A perfect storm of ubiquitous smartphone usage, 24/7 connected devices and consumer naiveté are destined to culminate in at least one of the major cloud-based mobile payment schemes falling prey to a successful hack.

- Enterprises are experiencing their own mobile app gold rush. • The proportion of companies increasing their budgets for mobile applications has almost doubled in the past year, from 28 percent to 51 percent of all companies spending more, with many looking at different use cases, both internal and customer-facing.

- The iPhone continues to thrive. Today, iPhones are owned by almost 30 percent of U.S. consumers surveyed, and 42 percent of U.S. consumers who intend to buy a smartphone intend to buy an iPhone.

- M2M’s potential is starting to be realized. Yankee Group forecasts the number of M2M cellular connections to grow by over 22 percent between 2012 and 2013, spurred by falling M2M device costs, ubiquitous and affordable wireless connectivity, increasing enterprise awareness and business case viability and government mandates driving areas such as smart metering and e-Call services.

Top 10 Mobile Predictions for 2013 (those in bold font are most interesting to this author):

1. Operators Will Lose US$1 Billion per Month in Voice/Messaging Revenue in 2013

The Upshot: Changes in customer behavior and the mobile industry in general will culminate in a precipitous drop in voice/messaging revenue; fortunately, the loss will be offset by a boost in data.

2. By Year End, All Mobile Operators Will Be Either Digital Lifestyle Providers or Value Bit Providers

The Upshot: Both strategies are valid but ruled by different dynamics; thus both will feature winners and losers.

3. Small Cells Will Stumble

The Upshot: Tariffs influencing end‐users to avoid mobile broadband for video will strip much of the economic rationale for extensive small cell deployment in the near term, calling into question expectations for rapid market uptake.

4. At Least One Operator Will Launch Turbo‐ Boosting Service in 2013

The Upshot: As more operators look to real‐time analytics tied to network data to speed the creation, delivery and monetization of unique product and service bundles, they will begin to learn from customer expectations and be able to track, monitor and respond to any change. As a result, they will embark on new services—such as turbo‐boosting— enabled by this new insight.

5. By Year End, Google Will Start Subsidizing Mobile Payments Credit/Debit Transaction Fees

The Upshot: Google needs to entice merchants to accept its mobile wallet solution. Paying merchant transaction fees could prove very persuasive.

6. A Cloud‐Based Mobile Payment System Will See a Significant Data Breach in 2013

The Upshot: Fraudsters are not naive to the opportunities presented via mobile and thus far attacks have been muted only due to the lack of scale. But in 2013, we will see the perfect storm of ubiquitous smartphone usage, 24/7 connected devices and consumer naiveté culminate in at least one of the major mobile payment schemes falling prey to a successful hack. All things equal, we expect the victim will be a cloud player, since it presents criminals with the most lucrative risk/reward ratio.

7. More Than 50 Percent of Companies Look to the Cloud for Their Mobile App Deployments

The Upshot: Demand‐side pressures and supply‐side innovations are accelerating enterprise deployments of mobile applications in the cloud. Next year, the majority of enterprises will be deploying their applications using software‐as‐a‐service (SaaS), as opposed to on‐premises software.

8. Microsoft’s Windows Store Will Abandon 70‐30 Split and Registration Fees in 2013

The Upshot: In 2013, competition between app storefronts will turn red hot. Microsoft will entice developers to its store by breaking with standard app store‐to‐developer business terms.

9. 2013 Will Mark the First Year That Android Smartphone Market Share Will Decline in the US

The Upshot: Stronger competition from Apple, Microsoft and even RIM will put further pressure on already inexpensive Android smartphones and their makers, forcing them to differentiate and add more value.

10. In 2013, M2M MVNOs Will Feel the Squeeze as Operators Get Serious About M2M

The Upshot: As Tier 1 operators ratchet up their attention on machine‐to‐machine (M2M) networks to help drive new revenue, specialist MVNOs will feel the heat as they evolve from friend into foe.

http://web.yankeegroup.com/Report2013PredictionsRegistration.html

Infonetics: Global femtocell market experiencing double digit growth with sales of 3G Femtocells up 50% in 3Q 2012

One of the key factors contributing to this market growth is the increasing need for better network coverage, especially indoors and in areas with no 3G/4G service. The global femtocell equipment market has also benefited from the long promised emergence of fixed – mobile convergence services. However, interference with 3G/4G cellular macrocell networks could pose a challenge to the growth of this market.

Market research firm Infonetics Research just released excerpts from its 3rd quarter (3Q12) Femtocell Equipment market share and forecast report, which tracks femtocells by market segment, technology, and form factor.

FEMTOCELL EQUIPMENT MARKET HIGHLIGHTS:

. The global femtocell market, including 2G, 3G, and 4G femtocells, grew 13.5% sequentially in 3Q12, to $132.7 million

. Sales of 3G femtocells were up 50% in 3Q12

. Samsung grew revenue 45% in 3Q12 from 2Q12, seizing the femtocell market share lead for the 1st time since 4Q11; Samsung also led in units shipped

. Meanwhile, following a double-digit sequential decline in revenue, Airvana slid into the #2 spot in the 3rd quarter

. Integrated femtocells made up just 2% of units shipped in 3Q12, but Infonetics expects they will account for around 1/3 of total units by 2016

“After a minor dip earlier in the year, healthy revenue growth has returned to the femtocell market, where we saw a second consecutive quarter of increases,” notes Richard Webb, directing analyst for microwave, mobile offload, and mobile broadband devices at Infonetics Research. “All segments-consumer, enterprise, and public access-saw both units and revenue go up, and we remain optimistic that femtocells have sufficient market drivers and support among operators to sustain continuous annual growth through 2016.”

Webb adds: “Many new product types have launched recently, including the data-only femto from Ubiquisys, in-flight femtos from ip.access, the dual-mode 3G/LTE consumer femto from Fujitsu, and the 3G/4G/WiFi enterprise femto from SpiderCloud, and this innovation is driving new models and market opportunities.”

Femtocell Report Synopsys:

Infonetics’ quarterly femtocell equipment report provides worldwide and regional market size, vendor market share, forecasts, analysis, and trends for 2G femtocells (CDMA and GSM/GPRS), 3G femtocells (W-CDMA/HSPA, CDMA2000/EV-DO, and TD SCDMA), and 4G femtocells (WiMAX and LTE). Femtocells are tracked by form factor (standalone and integrated) and market segment (consumer, enterprise, and public access). Companies tracked

include Airvana, Alcatel-Lucent, Argela, Cisco/ip.access (3G femtocells), Contela, Huawei, ip.access, NEC/ Ubiquisys, Ubee Interactive, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

RELATED RESEARCH from Infonetics:

. Latest Infonetics Small Cells and Mobile Backhaul research brief: http://bit.ly/1232L4t

. Outdoor small cell backhaul a 5-year $5-billion opportunity, says new Infonetics report

. Small cell is the buzz but DAS is the biz, say operators in latest Infonetics survey

. Femtocells offer opportunity to put the mobile network at the heart of the home network

. Small cell market not big enough for all who want to play in it

. Femtocell market ignited by tight vendor battles, price erosion, shift to the enterprise

Another Opinion:

TechNavio’s analysts forecast the Global Femtocell Equipment market to grow at a CAGR of 74.76 % over the period 2011-2015. TechNavio’s report, the Global Femtocell Equipment Market 2011-2015, has been prepared based on an in-depth market analysis with inputs from industry experts. The report covers the Americas, and the EMEA and APAC regions; it also covers the Global Femtocell Equipment market landscape and its growth prospects in the coming years. The report also includes a discussion of the key vendors operating in this market.

The key vendors dominating this market space are Samsung Electronics Co. Ltd., Airvana Corp., Alcatel-Lucent, and Cisco Systems. Other vendors mentioned in the report are NEC Corp., Ubiquisys Ltd., Huawei Technologies Co. Ltd., Argela Technologies, Contela Inc., ip.access Ltd., and UbeeAirWalk Inc.

http://www.researchandmarkets.com/research/2ch5wh/global_femtocell

AT&T Talks Up U-Verse TV at 1st Consumer Analyst Conference; SJ Mercury picks U-Verse over Comcast for triple play bundle

2012 Consumer Analyst Conference:

AT&T has succesfully disrupted an existing service model – pay TV – with its U-Verse TV (and high speed Internet)service bundle. SBC Communications, which acquired AT&T, began building U-Verse as part of its Project Lightspeed broadband access network in 2004 and initiated commercial U-Verse service in a controlled release in San Antonio, TX in December 2005. That network consists of fiber to the node with VDSL based copper drops to homes. Compression is used to enable up to 4 separate TV streams over VDSL, including HD as well as SD.

With 4.34 million video subscribers and still growing rapidly, AT&T is now the seventh largest pay TV provider in the United States. U-Verse reached that position in less than seven years (Verizon has reached #6, with 4.59 million; in about the same length of time). Before U-Verse and in areas its not available now, AT&T resells Dish satellite TV service as part of a double or triple or quad play service bundle.

Many new and planned AT&T U-Verse TV features and second screen apps were described during the company’s 2012 Consumer Industry Analyst Conference in Atlanta,GA- the first such event for AT&T. AT&T representatives said that the interactive apps for U-Verse have significantly reduced churn – or subscriber loss rate. The AT&T U-Verse App enables users to view the program guide, select programming, control the DVR remotely, and view AT&T’s VOD library. The U-Verse App also allows users to know or select what’s being watched on each TV in the home. According to AT&T, about 80% of the available programming consists of full episodes, while the remaining video content are trailers and other short-form content. It’s that 80% of video content that’s accessible via the U-Verse App.

An excellent report on AT&Ts Consumer Industry Analyst conference is at:

http://www.telecompetitor.com/atts-2012-consumer-industry-analyst-conference-a-uverse-tv-update/

For a summary of second screen app presentations at the 2012 TVNext Conference, including AT&T U-Verse initiatives, please see: http://viodi.com/2012/10/16/second-screen-apps-enhance-viewing-experience-offer-additional-capabilities-tvnext-2012-conference-highlights/

U-Verse over Comcast for triple play bundle:

San Jose Mercury reporter Troy Wolverton wrote a stunning article explaining why he thinks AT&T U-Verse provides a much better value than Comcast Xfinity for a double or triple play service bundle. He compares prices and features side by side with AT&T clearly the winner. I agree completely, especially with the authors comment that Comcast makes no effort to retain customers, even journalists like myself and the author of this article:

Personally, I have been very satisfied with switching from Comcast Xfinity to U-Verse in July 2012.

Here are a few of the reasons why I like U-Verse better than Xfinity:

- Much better price for what you pay for both TV and high speed Internet (I don’t need 30M b/sec or higher speed than that and most consumers don’t either)

- Higher resolution picture quality/ reception- both SD and HD

- Many more TV channels (especially like CNN International) available at reasonable package price

- ZERO outages or hiccups in service in 5 months I”ve had U-Verse Internet and TV service

- No extra charge for DVR or wireless receiver (I use the DVR don’t have the receiver)

- AT&T Executives that truly make an effort to improve U Verse customer service and overall customer experience (rather than be ignored/ neglected)

- Many new advances coming, like anywhere remotes, on screen trouble diagnosis, 2nd screen apps, etc. The Telecompetitor article referenced above is a great example of this trend.

AT&T U-Verse vs Comcast Xfinity double/triple play user survey:

I have been surveying IEEE members on the ComSocSCV discussion list (any IEEE Member can join free by following instructions at www.comsocscv.org) about their experiences with U-Verse and/or Comcast Xfinity. All readers of this post are invited to email me their inputs which will be published anonymously in the survey results.

U-Verse Related articles by this author:

http://viodi.com/2012/11/08/at-bring-fiber-to-commercial-buildings-cover-99-of-us-with-lte/

http://viodi.com/2012/10/25/wireless-u-verse-managed-services-drive-att-revenues-earnings-in-3q2012/

http://viodi.com/2011/03/13/increased-video-traffic-necessitates-att-to-cap-dsl-internet-u-verse/

AT&T Expects to sell 26M smart phones in 2012 while Nokia will sell "flagship smarphone" through China Mobile

The Financial Times reports that AT&T raised its forecast for smartphone sales this year by 1m to 26m units. The company cited strong sales of Apple’s iPhone 5 and Android-based handsets in the current quarter. Ralph de la Vega, chief executive of AT&T Mobility, the second-largest US mobile operator by subscriber numbers, said the company sold 6.4m smartphones in the first two months of the quarter compared to 9.4m in the whole of the fourth quarter last year.

“Traffic in stores has been strong,” said Mr de la Vega who was speaking at a UBS conference in New York. Mr de la Vega said sales of the iPhone 5 and Google Android-based smartphones such as the LG Optimus G and HTC One X had been particularly strong but added that he is also “really excited” about sales results for the Windows Phones that AT&T is selling, including the Nokia Lumia 920 and HTC 8X.

The sales figures confirm a bounce back in the US smartphone market, which showed some signs of slowing earlier this year because of factors including higher upgrade costs set by US mobile network operators and delayed purchases by consumers waiting for September’s iPhone 5 launch. But while the rebound is good news longer term for US carriers that have spent heavily upgrading their networks to handle the larger data requirements of smartphones, the heavy subsidies paid to Apple and other handset makers could put additional pressure on margins and profits in the fourth quarter. The fourth quarter is typically the strongest for smartphone sales and analysts have predicted that holiday sales this year will set new records globally.

Earlier this week, IDG predicted that 224.5m smartphones will be sold in the current holiday season, a 39.5 per cent increase over the fourth quarter of 2011. IDC, another market research firm, has predicted that global smartphone shipments for 2012 will grow 45 per cent to 717m.

Mr de la Vega said AT&T signed up 5m customers to its shared data plan, called Mobile Share, since it was introduced five months ago, and that a quarter of them had opted for plans providing 10GB or more of data service per month.

Like Mr McAdam, Mr de la Vega also confirmed that his company is exploring the possibility of ‘toll free’ data plans for customers where application providers would pay the cost of data service.

Mr de la Vega and Lowell McAdam, Verizon’s chief executive, both said consumers had reacted positively to the introduction earlier this year by US mobile operators of shared data plans, rather than plans based on ‘buckets’ of voice calls.

Nokia has seen a rapid fall in sales of its devices in China, which was once one of the strongest parts of a dominant global franchise. This has been largely due to the introduction of cheap Chinese handsets as well as the allure of more expensive Western rivals such as the iPhone.

In an attempt to remedy this situation, the Finnish hand set makerhas agreed to sell its latest flagship smartphone through China Mobile, the world’s largest telecom operator and the only one in China without a contract to sellApple’s iPhone. China Mobile is the biggest operator in the world with more than 700m subscribers. It will sell a Lumia 920T, a variant of the device sold in other markets that uses Microsoft’s Windows Phone 8 platform. The phone will be customised for the TD-SCDMA network developed in the People’s Republic of China, which allows 3G phone services.

Lumia 920T users will be able to access Mobile Market, China Mobile’s application store, and Nokia has agreed with Air China to install wireless chargers in Beijing Airport VIP lounges.

http://www.ft.com/cms/s/0/4954fb54-3eef-11e2-87bc-00144feabdc0.html#ixzz2EHwZOZTs

Infonetics: Self Organizing Networks & Performance Optimization Strategies

Overview:

Market research firm Infonetics Research released excerpts from its new Self-Organizing Network (SON) and Optimization Strategies: Global Service Provider Survey, for which Infonetics interviewed wireless, incumbent, and competitive operators around the world about their network optimization strategies and SON deployment plans.

ANALYST NOTE:

“While SON is up and running in a few LTE networks around the world, we were surprised to find that some of the large

incumbents we surveyed for our SON and optimization study have deployed SON as the key optimization tool in their 3G networks as well,” reports Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. “Since SON was originally developed for LTE, this finding is fascinating and draws to a close the debate over whether SON could be used in legacy networks.”

SON AND OPTIMIZATION SURVEY HIGHLIGHTS:

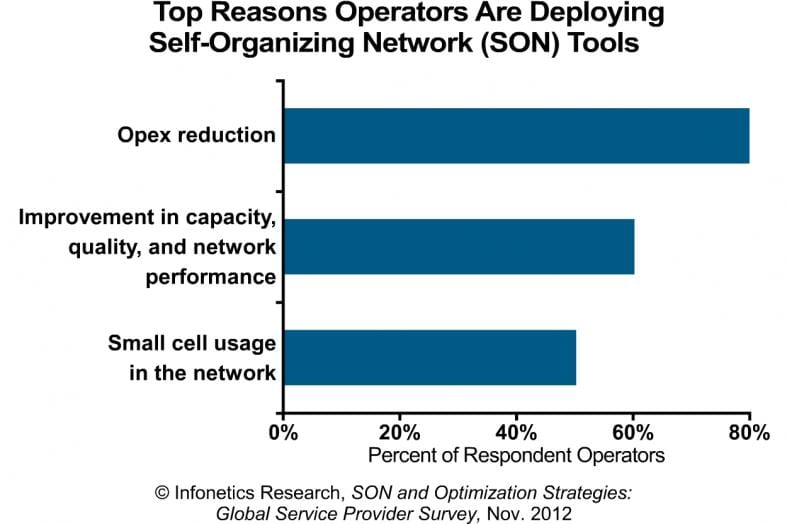

. The chief drivers for deploying SON are opex reduction; improvement in capacity, quality, and network performance; and small cell usage in the network.

. Automatic neighbor relations (ANR) is the most deployed SON feature among respondent operators

. 80% of operators interviewed rate complexity as the #1 barrier to deploying SON

. Survey respondents view Ericsson, Huawei, and Nokia Siemens Networks as the top SON vendors

. A majority of respondents consider SON an unproven and immature technology

In an email exchange with this author, Stephane Teral wrote: “Infonetics Research doesn’t cover Distributed Antenna Systems (DAS) in our Mobile Infrastructure report, but we know it’s a $1B/year market – tiny compared to $45 to $50B/year for mobile infrastructure which was in that report which was cited in your viodi.com article. Small cells will be part of a whole strategy along with carrier aggregation, Self Organizing Networks (SON), etc… to address capacity issues in specific areas.”

SURVEY SYNOPSIS:

For its new 24-page SON and optimization survey, Infonetics interviewed independent wireless, incumbent, and competitive operators in Europe, North America, and Asia about their network optimization strategies and SON deployment plans. The study provides insights into SON features, drivers, implementation barriers, technical challenges, and vendors. Operators surveyed together represent 1/3 of the world’s telecom capex and carrier revenue and 16% of all mobile subscribers.

To buy the survey, contact Infonetics: http://www.infonetics.com/contact.asp

RELATED INFONETICS RESEARCH:

. Latest Infonetics Mobile, Wireless, and Small Cells research brief: http://bit.ly/SL16eJ

. LTE jumps 30% in Q3, NSN doubles LTE revenue; mobile gear set for growth in 2013

. Japan’s mobile market grows 3-fold on the wings of LTE, China puts 3G first

. 3G and 4G self-organizing network (SON) software market set to double in 2013

. Telecom outsourcing, managed services a $76 billion opportunity by 2016

. Small cell is the buzz but DAS (Distributed Antenna System) is the biz, say operators in latest Infonetics survey

. Femtocells offer opportunity to put the mobile network at the heart of the home network

. Femtocell market spikes 12% in Q2; Alcatel-Lucent nabs W-CDMA femto lead

. A first: Increased ARPU now a top driver for LTE upgrades

. Mobile broadband will push mobile services to $976 billion by 2016; SMS, voice persevere

. Voice over LTE gaining momentum (at long last)

Related Article (published today, with comments from Stephane Teral):

http://viodi.com/2012/12/05/infonetics-mobile-infrastructure-market-down-in-quarter-small-cells-not-so-hot/

What about Small Cells for spectrum re-use as a mobile access performance optimization strategy?

Some believe that Small Cells will solve the mobile data capacity crunch. Alcatel-Lucent: “Small cells could solve the mobile broadband capacity crunch. A number of reports have identified the metro market as one of the driving factors in femtocell growth as operators use femtocells to provide fill-in coverage for congested metro areas..” http://tinyurl.com/asfzuk4

Infonetics’ Stephane Teral wrote in an email, “Small cells will be part of a whole strategy along with carrier aggregation, Self Organizing Networks (SON), etc… to address capacity issues in specific areas.”

Dell’Oro Group: Moderate Growth for Access Network Equipment with PONs leading the pack

In it’s new Quarterly Access report, Dell’ Oro Group says sales of access network equipment (i.e. for PON, DSL, and cable hybrid fiber/coax (HFC) ) grew by a “moderate” 6% year-on-year in the third quarter of 2012. PON systems were the leading segment, advancing 21% over the same quarter of 2011. Cable access networks (MSOs) grew 5% annually.

Overall DSL equipment sales declined versus the year-ago quarter, because a decrease in ADSL revenues offset 30% growth in VDSL revenues. In the growing VDSL segment, Alcatel-Lucent and Huawei again held the top two slots, with ADTRAN at number three.

“We saw strong growth from three segments in the third quarter. PON revenue surged to a record level, largely driven by strong GPON shipments to China, continuing the trend of the last several years,” said Steve Nozik, principal analyst of access research at Dell’Oro Group. “Cable revenue growth was driven by strong DOCSIS 3.0 CPE sales that more than offset sharply lower CMTS sales.

“For DSL, high-speed VDSL port shipments grew more than 50% over the year ago period driven by Western Europe, where a number of operators have chosen a fiber-to-the-node (FTTN) upgrade strategy utilizing VDSL,” Nozik said.

Alcatel-Lucent, Huawei, and ZTE won the quarter in the GPON space; excluding sales in China, however, Calix is moving into the third position, the report states.

in the first quarter, Cisco (e.g Scientific Atlanta), with near record shipments, was the lead vendor in terms of Cable CPE unit shipments. Arris was next with its strongest shipment quarter in over a year followed by Netgear which saw its Cable CPE shipments reach a record level.

The Dell’Oro Group Quarterly Access Report provides tables that cover manufacturers’ revenue, average selling prices, and port/unit shipments for cable, DSL, and PON equipment.

References:

http://www.delloro.com/news/2012/Acc120412.htm