Month: October 2019

China to launch 5G mobile networks on Friday with a huge government backed push

China’s three major wireless carriers— China Mobile, China Unicom , and China Telecom —will begin selling 5G services to consumers on Friday, November 1st in 50 major cities, including Beijing and Shanghai, said Chen Zhaoxiong, vice minister of the Ministry of Industry and Information Technology on Thursday October 31st at a Beijing conference. That will allow those with the few available 5G-China compatible smartphones to buy a subscription to access the network. The Chinese telcos will charge by speed rather than data used. See the section on 5G Subscriber Pricing below.

A woman using her cellphone walks past a vehicle covered in a China Unicom 5G advertisement in Beijing on Sept. 17. Chinese phone carriers will begin offering 5G service Friday. (China Stringer Network/Reuters)

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

The Chinese government has made building 5G a national priority, clearing red tape and reducing costs so the three wireless providers introduce the new technology as swiftly as possible. “They’ve made this a national priority. It’s part of the [Communist] Party‘s ability to show that it’s delivering the goods,” said Paul Triolo, head of geo-technology at the Eurasia Group consultancy. “And in the middle of the trade dispute and the actions against Huawei, it’s even more important for China to show that they are continuing to move forward despite all these challenges,” he added.

“This 5G technology is part of an overall, far-reaching revolution, and it will bring brand-new changes to the economic society,” China Telecom President Ke Ruiwen said at the launch Thursday.

China is forecast to spend between $130 billion and $217 billion on 5G between 2020 and 2025, according to a study by the state-run China Academy of Information and Communications Technology.

“The commercialization of 5G technology is a great measure of [President] Xi Jinping’s strategic aim of turning China into a cyber power, as well as an important milestone in China’s information communication industry development,” said Wang Xiaochu, president of China Unicom.

China President Xi has described the world as on the cusp of a fourth industrial revolution, one characterized by advances in information technology and artificial intelligence, analysts at Trivium China, a consultancy, wrote in a research note this week. “Xi wants to make sure that China is at the forefront of this new revolution — getting 5G up and running is a way to get a leg up in that race,” they said.

China’s central government wants 5G coverage extended to cover all of Beijing, Shanghai, Hangzhou and Guangzhou by the end of the year. The country’s largest carrier, China Mobile, which has 900 million cellphone subscribers, says it will be able to offer 5G services in more than 50 cities this year. Chinese technology companies have been touting the industrial applications of 5G, such as managing cement production, typhoon monitoring and surgeries performed by robots.

But there are challenges ahead. For one, relatively few people have 5G-enabled phones or other 5G end points. Huawei has released phones that can support 5G, as have China’s Oppo and South Korea’s Samsung. Apple, which comprises only 6 percent of the Chinese market, is not expected to release a 5G-capable iPhone until next year.

“It’s going to be really hard for Huawei to overcome the supply chain problems,” said Triolo of Eurasia Group. “Basically, the United States has Swiss-cheesed their supply chain, and there are big question marks hanging over Huawei’s ability to plug the holes.”

The technology is at the heart of a bitter dispute between China and the United States. Washington has expressed concern that 5G hardware made by Chinese manufacturers might contain hidden “back doors” that could enable spying.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

5G Base Stations:

Approximately 13,000 5G base stations have been installed in Beijing, the communications administration said this week. About 10,000 are already operating. China already has a total of more than 80,000 5G macro base stations, typically cellular towers with antennas and other hardware that beam wireless signals over wide areas, government officials said. They said China will end the year with about 130,000, while Bernstein Research estimates South Korea will be in second place with 75,000, followed by the U.S. with 10,000. Piper Jaffray estimated that of the 600,000 5G base stations expected to be rolled out worldwide next year, half will be in China.

Indeed, Chinese operators are launching 5G across fully 80,000 macro base stations this week, a figure that will grow to 130,000 by the end of this year, according to Wall Street research firm Bernstein Research. In comparison, the firm expects South Korea to end the year in second place with 75,000 base stations, followed by the US with just 10,000.

This is why most analyst firms expect China to command the largest number of 5G customers in the years to come.

Telecom-industry executives say Chinese wireless carriers now (and in the future will) buy the most of their cellular transmission equipment from Huawei. Analysts say U.S. measures that limit American businesses from selling components to Huawei could make it more difficult for the Chinese company to make telecom equipment. Huawei says it has taken steps to minimize the impact of such restrictions.

China’s 5G Standard-Approved by ITU-R for IMT 2020 RIT:

It should be noted that China has their own 5G standard, which has been presented to and progressed by ITU-R WP5D which is standardizing the radio aspects of IMT 2020. Here’s an excerpt of an IEEE Techblog comment:

On July 17, 2019, the ITU-R WP5D#32 meeting ended in Buzios, Brazil. At this meeting, China completed the complete submission of the IMT-2020 (5G) candidate technical solution, and obtained the official acceptance confirmation letter from the ITU regarding the 5G candidate technology solution.

China’s 5G wireless air interface technology (RIT) solution is based on 3GPP new air interface (NR) and narrowband Internet of Things (NB-IoT) technology. Among them, NR focuses on the technical requirements of enhanced mobile broadband (eMBB), low latency and high reliability (URLLC) scenarios, and NB-IoT meets the technical requirements of large-scale machine connection (mMTC) scenarios. China’s 5G technology program expresses China’s understanding of 5G technology, considers the integrity and advancement of 5G technology, and maintains the global unified standard with 3GPP as the core, reflecting China’s industrial interests.

According to the requirements of the ITU, the complete 5G technology submission materials include technical solution descriptive templates, link budget templates, performance indicator satisfaction templates, and self-assessment reports. China’s 5G technology solutions and technical support materials come from many research results of domestic equipment manufacturers, operators and research units, reflecting the collective efforts and collective wisdom in the domestic communications field. China’s self-assessment research results show that the NR+NB-IoT wireless air interface technology solution can fully meet the technical vision requirements of IMT-2020 and the IMT-2020 technical indicators.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

5G Subscriber Pricing:

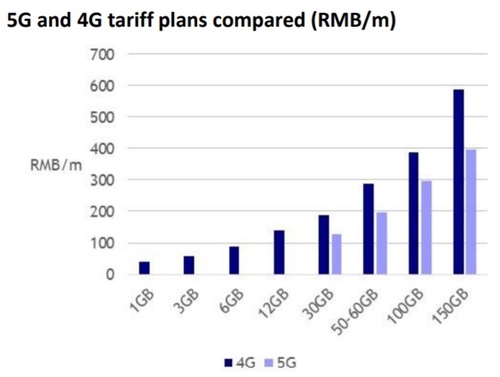

Chinese officials said the cheapest 5G subscription would cost 128 yuan (about $18) for 30 gigabytes of data a month. To enjoy the peak speed of 1 Gbps, Unicom customers will pay about $45 a month.

According to the Wall Street research analysts at New Street Research, China Mobile is offering 5G services at a 30% discount to 4G. “A 30GB 4G customer who migrated to 5G on the same plan would see their bill reduced from RMB 188 to RMB 128. Even a 12GB 4G customer migrating to the 30GB 5G plan would save money,” the analysts wrote in a report to investors.

10 million people in China have already registered their intention to purchase 5G subscriptions as we wrote in this IEEE Techblog post.

Mike Dano of Light Reading had this assessment:

A big part of the “race to 5G” discussion centers on spectrum allocation. Operators in China and South Korea are mainly using midband spectrum like 3.5GHz for their 5G buildouts, while operators in the US are using bands ranging from 600MHz to 28GHz because there isn’t much available midband spectrum for 5G in the US. This could change in the months to come as the FCC moves to release midband C-Band spectrum for 5G in the US. Midband spectrum is useful for 5G because it toes the line between providing high-speed connections and covering large geographic areas.

However, in recent months some US policymakers have been working to move the goalposts in the “race to 5G” a bit by pointing out that China’s 5G buildout is mandated by the country’s ruling party while 5G buildouts in the US and elsewhere are driven by the economics of competition and capitalism. As FCC Commissioner Brendan Carr explained earlier this month, that means 5G networks in the US will be more directly aligned with consumer demands than 5G networks in China.

Regardless, China’s official 5G rollout is starting this week — in a country with about four times more potential customers than the US — and it’s undoubtedly going to dwarf the 5G efforts in other countries in terms of most industry metrics.

Huawei vs Apple 5G smartphones in China:

Huawei Technologies has increased its smartphone market share in China to a record 42% in the September quarter, growing shipments by 66% year over year, while Apple’s share fell by two percentage points to 5%, with its shipments falling 28% year over year, according to Canalys.

Huawei has already released 5G-enabled phones—and they’re cheaper than Apple’s high-end non-5G iPhones. More models from other Chinese competitors will likely come out in the next few quarters. Industry analysts don’t expect a 5G-enabled iPhone until late 2020.

Rosenblatt Securities analyst Jun Zhang predicts many low- to mid-end iPhone users in China could switch to a cheaper 5G Android phone in 2020. “We believe Apple still has yet to face its biggest challenge in China, which is the upcoming launch of 5G service in November as well as the coverage for 5G service expanding to 100 cities by the middle of 2020,” Zhang wrote in a Thursday research note. “We continue to expect Apple’s smartphone market share will decline once 5G service starts in more cities,” he wrote in a note to clients.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

Zayo’s largest capacity wavelengths deal likely for cloud data center interconnection (DCI)

Zayo Group Holdings announced it has signed a deal for the largest amount of capacity sold on any fiber route in the company’s history. The deal with the unnamed customer will provide approximately 5 terabits of capacity that can be used to connect mega scale data centers. While Zayo didn’t disclose the customer, large hyperscale cloud providers, such as Amazon Web Services, Microsoft Azure and Google Cloud Project, and webscale companies such as Facebook, seem to be likely candidates.

Zayo provides a 133,000-mile fiber network in the U.S., Canada and Europe. Earlier this year it agreed to be acquired by affiliates of Digital Colony Partners and the EQT Infrastructure IV fund. That deal is slated to close in the first half of next year.

“Our customers [1] are no longer talking gigabits — they’re talking terabits on multiple diverse routes,” said Julia Robin, senior vice president of Transport at Zayo. “Zayo’s owned infrastructure, scalable capacity on unique routes and ability to turn up services quickly positions us to be the provider of choice for high-capacity infrastructure.”

Note 1. Zayo’s primary customer segments include data centers, wireless carriers, national carriers, ISPs, enterprises and government agencies.

Zayo to extend fiber-optic network in central Florida: The new fiber network infrastructure, comprising more than 2300 route miles, will open Tampa and Orlando as new markets for the fiber-optic network services company.

…………………………………………………………………………………………………………………………………………………………………………………………….

Zayo’s extensive wavelength network provides dedicated bandwidth to major data centers, carrier hotels, cable landing stations and enterprise locations across our long-haul and metro networks. Zayo continues to invest in the network, adding new routes and optronics to eliminate local stops, reduce the distance between essential markets and minimize regeneration points. Options include express, ultra-low and low-latency routes and private dedicated networks.

Zayo says it “leverages its deep, dense fiber assets in almost all North American and Western European metro markets to deliver a premier metro wavelength offering. Increasingly, enterprises across multiple sectors including finance, retail, pharma and others, are leveraging this network for dedicated connectivity as they seek ways to have more control over their growing bandwidth needs.”

According to a report by market research firm IDC, data created, captured and replicated worldwide will be 175 zettabytes by 2025 and 30% of it will be in real time. A large chunk of that amount will be driven by webscale, content and cloud providers that require diverse, high capacity connections between their data centers. In order to provision high bandwidth amounts, service providers and webscale companies are turning to dedicated wavelength solutions.

Zayo’s wavelength network provides dedicated bandwidth to major data centers, carrier hotels, cable landing stations and enterprise locations across its long-haul and metro networks. Its communications infrastructure offerings include dark fiber, private data networks, wavelengths, Ethernet, dedicated internet access and data center co-location services. Zayo also owns and operates a Tier 1 IP backbone and 51 carrier-neutral data centers.

References:

For more information on Zayo, please visit zayo.com

https://www.fiercetelecom.com/telecom/zayo-lands-largest-wavelengths-deal-its-history-at-5-terabits

AT&T $3B+ Earnings Miss; Truce with Elliott Management; HBO Max Announcement

Overview:

AT&T earned $3.7 billion on $44.6 billion in revenue for the July-September 2019 (3Q19) period, when Wall Street had expected about $6.8 billion in adjusted profit, $5.3 billion in net earnings and $45 billion in sales. The company added 255,000 wireless customers and now has more than 79 million total phone customers. AT&T suffered a steep drop at its DirecTV business, losing more than 1.1 million customers, which cut into profits.

In recent years, AT&T has transformed itself from a telecom/network operator into a major media player, selling satellite TV service to millions of people (via its DirecTV acquisition) and owning a large chunk of Hollywood (via its Time Warner acquisition). That business strategy hasn’t gone over well with investors as AT&T shares have declined over the past several years, despite this year’s gains in a bull market where the S&P 500 is up 21% year to date.

In September 2019, hedge fund Elliott Management asked the company to stop striking new acquisitions, to increase dividends and share buybacks and to improve its efficiency by cutting workers and selling off under-performing divisions like DirecTV. The fund also said it was seeking seats on AT&T’s board. The two sides have been in talks over the last few weeks to broker an agreement.

Yesterday, a truce was reached as AT&T announced changes to its corporate governance and pledged to increase revenue and profit each year for the next three years.

AT&T CEO Randall Stephenson on the earnings call:

We expect total company revenues over the 3-year period to grow by 1% to 2% per year. This will be driven by strength in Mobility, increased fiber penetration and WarnerMedia.

As mentioned earlier, our wireless business is now enjoying operating leverage from investments made over the last 5 years. Our WarnerMedia cost synergies are on target and EBITDA at AT&T Mexico is ramping, and we’re identifying significant opportunities for margin improvement through ongoing cost evaluation and operational review.

Improving margins 200 basis points will give us an EBITDA margin of 35% in 2022. And applying a 35% margin to a revenue base that’s growing 1% to 2% per year produces an EBITDA lift in the neighborhood of $6 billion in 2022, and that includes our investment in HBO Max.

AT&T’s strategy to bolster profits also includes potential job cuts, which was strongly opposed by a union that represents over 100,000 AT&T workers. The company also said it expected to pay off the debt associated with last year’s $80 billion purchase of Time Warner. It will review its sprawling set of businesses to see what could be sold or split off into a partnership with other companies.

“We commend AT&T for the positive steps announced today, which will create substantial and enduring shareholder value at one of America’s greatest companies,” Elliott Management said in a statement.

Analysis:

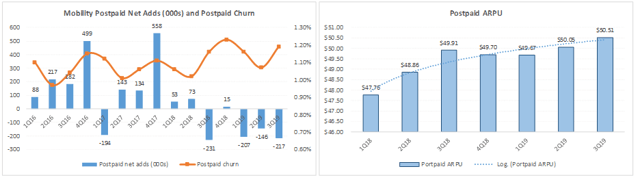

The graph below, on the left, clearly shows how postpaid net adds have been struggling for the past five quarters, while churn has risen to new levels.

Although the telecom carrier space is known for being highly competitive, peers Verizon and certainly T-Mobile US have done a much better job than AT&T at growing their mobility user base and keeping churn under control. Postpaid ARPU (a measure of per-unit revenue, see the chart on the right above) continues to improve YOY, which helps to explain better margins, but at a decelerating pace that reached a mere 1% in 3Q19 vs. 4% in 1Q19.

………………………………………………………………………………………

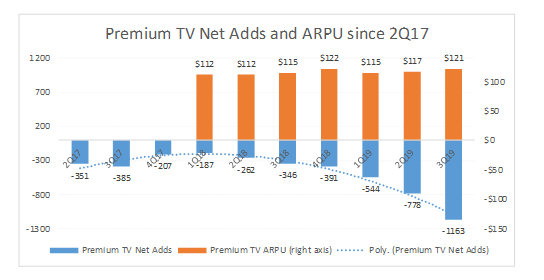

Premium TV net user loss reached an astonishing 1.2 million in the quarter, representing roughly 5% of total video connections being dropped in only three months. Over-the-top, once considered a glimmer of hope in user base growth, lost nearly 200,000 subscribers. Cord-cutting and increased competition in streaming probably best explain the deterioration.

Analysts say it is hard to be overly excited or optimistic about AT&T’s mobility and entertainment businesses (representing about two-thirds of its revenues). The company seems to be falling behind its peers, losing market share to competitors in both wireless (T-Mobile US and Verizon) and premium TV (cable TV/MSO companies).

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Update on HBO Max:

AT&T’s WarnerMedia said on Tuesday that its HBO Max streaming service will launch in the U.S. in May of 2020, and cost $14.99 a month. At a company event in Burbank, California, WarnerMedia CEO John Stankey said that content, technology platform and marketing and distribution are the “three pillars” for a successful streaming service. He said AT&T is best positioned for all three. The company said it will spend $4 billion over the next three years building HBO Max. It expects annual incremental revenue, from subscriptions, content and ads, to hit $5 billion by 2025, which is the year it should start to positively impact earnings.

HBO Max will start with about 10,000 hours of content, including movies, original content and classic TV shows. That’s “less than some of our competitors,” said Bob Greenblatt, chairman of WarnerMedia Entertainment, at the event. HBO will launch an advertisement-based HBO Max offering in 2021, less than a year after the ad-free version hits the market. The goal is to reach 75 to 90 million subscribers by 2025, Stankey said.

AT&T said the service would be free for existing HBO customers and the company said it expects to convert the majority of them to HBO Max subscribers over time.

WarnerMedia executives announced that the new streaming service will use “human-powered discovery” in addition to smart analytics to help curate a more ideal user experience for subscribers. One of the most interesting ways HBO Max is going to differentiate itself from its competitors is by what they’re calling “co-viewing.” Basically, each member of a subscriber’s family will be able to set up their own individual profile, but when they want to watch content together, they can log in simultaneously to a new, separate profile that won’t affect the recommendations for the individual profiles. They can also create shared watch lists.

John Stankey, CEO of WarnerMedia, speaks Tuesday in Burbank, CA during Warner Media Day

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

HBO Max is one of the newest additions to an extremely crowded streaming market that will soon include Disney+ and Comcast’s Peacock. They’re all taking aim at Netflix, Amazon, Hulu and Apple, which have a variety of subscription and ad-based offerings. AT&T has said HBO Max will become the “workhorse” for its video business as cord-cutting of traditional TV expands.

Drew FitzGerald of the Wall Street Journal had this assessment (excerpts):

HBO Max will have to overcome several hurdles from the start. Netflix is already in 60 million homes in the U.S. and an additional 97.7 million abroad. Also, Apple Inc. and Walt Disney Co. will both launch their video services in November, giving them a head start over AT&T. What’s more, those services will cost less than HBO Max.

There is little room for error for AT&T. The company is already the country’s biggest pay-TV company with more than 21 million DirecTV and fiber-optic subscribers watching its channel bundles. But cord-cutting has ravaged that industry as viewers seek cheaper and more user-friendly entertainment. AT&T has taken the brunt of the damage, with nearly three million customers lost so far this year.

HBO Max is an expensive rescue effort. The company expects to spend $2 billion next year to launch the service and stock it with new entertainment. It will spend $1 billion for each of the following two years until costs begin to subside. That comes on top of more than $1 billion already spent on reruns like “Friends” and “The Big Bang Theory.” The five-year deal for “South Park” streaming rights, which were sought by incumbent rights holder Hulu and Comcast Corp. ’s Peacock, was around $600 million, a person familiar with the matter said.

HBO Max’s debut was delayed by an antitrust fight over AT&T’s takeover of Time Warner. The $80 billion-plus acquisition was AT&T’s biggest-ever deal, making the Dallas company the world’s second-biggest media company practically overnight. But it had to fight a federal lawsuit launched in 2017, delaying its plans by more than a year.

HBO Max won’t replace HBO Now, which will remain a stand-alone service for the foreseeable future. The company isn’t able to do away with traditional HBO packaged with cable subscriptions, either. Adding to the confusion are AT&T TV, AT&T TV Now and AT&T Watch TV, three brands the telephone company uses to market its live channel packages.

“Our future video product set will focus on two platforms: HBO Max, our subscription video on-demand service…and AT&T TV, our live-TV offering,” Mr. Stephens said Monday. He didn’t mention DirecTV, the name most AT&T customers still use today. “We’ll convert as many as we can as quickly as we can,” Mr. Stephens said, and with all the new content being added, “why wouldn’t they?”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

As an illustration of how competitive streaming TVservices have become, Sony today announced it plans to shut down its PlayStation Vue streaming service early next year due to intensifying competition, as technology and media companies inundate consumers with video options.

The service, which launched in 2015 and lets users stream and record live programming through PlayStation 4 consoles and devices from Roku Inc., Apple Inc. and others, will be discontinued in late January, the company said Tuesday. Going forward, Sony said it would focus on its core gaming business.

“Unfortunately, the highly competitive Pay TV industry, with expensive content and network deals, has been slower to change than we expected,” the company said in a statement.

When PlayStation Vue made its debut, Sony faced minimal competition in providing consumers an opportunity to view live television and cable channels without having a subscription to a cable or satellite TV provider. Sling TV, now part of Dish Network Corp., in January 2015 became the first streaming service with major live networks.

But today there are more than a dozen television-streaming services on the market such as Hulu, YouTube TV, FuboTV and others. More streaming services are also slated to run out in the months to come from the likes of Apple, Walt Disney Co. and AT&T Inc. ’s WarnerMedia. Not all offer live television, but the wider array of services has meant that consumers are faced with more options for online video entertainment than ever before.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://seekingalpha.com/article/4299727-t-delivers-investors-want

https://www.nytimes.com/2019/10/28/business/dealbook/att-earnings-elliott-management.html

https://www.cnbc.com/2019/10/29/warnermedias-hbo-max-will-launch-in-the-us-in-may-of-2020.html

https://www.wsj.com/articles/at-t-steps-into-streaming-wars-with-hbo-max-11572368721 (on line subscription required)

https://www.wsj.com/articles/sony-to-shut-down-playstation-vue-streaming-tv-service-11572377619

Newsweek: We’re Surrounded by Billions of Internet-connected (IoT) Devices. Can We Trust Them?

by Adam Piore

In 2009, just as consumers had begun to buy wifi-enabled thermostats and front-door cams and other early devices that now make up the “Internet of Things,” computer scientist Ang Cui had gotten the idea to scan the Web for “trivially vulnerable” embedded devices.

By trivial, he meant those devices that still carried the usernames and pass codes programmed into them at the factory—obvious usernames like “name” and passcodes like “1234.” Many of these codes were published in manuals available freely on the internet and easily scanned automatically with computer programs, so there was no need even to guess.

When he did his scan, Cui found more than one million vulnerable, publicly accessible devices in 144 countries. From this sample, he estimated that about 13 percent of all devices connected to the internet were essentially unlocked doors, waiting for a hacker to walk through. Even more alarming, four months later 96 percent of those devices had the same security holes.

Cui’s warning was no less terrifying for its deadpan delivery: “Widely deployed and often mis-configured, embedded network devices constitute highly attractive targets for exploitation.”

In the decade since, the number of vulnerable devices connected to the internet has increased sevenfold. The explosion comes from growing demand, fueled by hype, for smart devices. Manufacturers are now tripping over themselves to embed just about every ordinary object, it seems, with tiny computers that happily communicate wirelessly with the world around them. In this “smart” revolution, virtually any device with an on/off switch or up/down button can be controlled remotely with a cellphone or voice sensor. Do you want to turn up the heat, dim the lights and run the dryer without getting up off the sofa—simply by uttering your desire to an Amazon Echo? Do you want your toaster to send a message to the television when the bagel has popped? Do you want your oven to inform you that the casserole has cooked for the prescribed 20 minutes at 350 degrees and is now cooling in the kitchen at 200? The Internet of Things can make all such things happen.

There’s a dark side to this wireless-driven revolution in convenience. The danger goes beyond hacking. Unlike the traditional “Internet of Computers,” which is confined to a circumscribed digital “virtual” world, the Internet of Things has a direct connection to the physical one. That opens up a disturbing set of questions: What might happen if the computers inside our new-fangled toaster ovens, security cameras or smart cities were turned against us? Can we really trust the Internet of Things? Most cybersecurity experts are unequivocal in their answer to that last question. “No,” says Ben Levine, senior director, product management, cryptography at Rambus, a Sunnyvale, CA-based technology company, specializing in the performance and protection of data. “My short answer, right now, is ‘no’.”

Unlike the “Internet of Computers,” which has been created largely by technicians with a background in information technology or computer science, many manufacturers making the devices now lack the expertise necessary to build airtight systems. Some don’t realize the importance of doing so. As a result, the possibilities for mischief seem endless—a fact Cui and other cybersecurity mavens have demonstrated on multiple occasions.

Is your vibrator cheating on you?

Some of the more creative of these exploits in recent months come from the lab of Alvaro Cardenas, who challenged his students at the University of Texas at Dallas last year to crack a wide array of IoT devices. Among other things, they managed to turn on and hijack a drone and demonstrate they could use it to attack an innocent victim, Kamikaze-style, or to stream video and audio of a neighbor. They hacked into a popular children’s toy—a small, talking dinosaur networked to the internet so it could receive updates. Then they demonstrated they could take over the toy and use it to insult the child, instigate inappropriate conversations (using the trusted voice of the toy) or tell the child what to do. They showed they could take control of internet-connected cameras to spy on households. They even identified the existence of “sensitive devices”—vibrators—sometimes used by overseas military personnel to have remote virtual relations with their partners. Not only were they able to obtain private usage information, they warned it was possible to impersonate a “trusted partner” and “commit remote sexual assault.”

Cardenas reported their findings to device manufacturers and the CERT Coordination Center, a federally funded non-profit R & D group that works with business and government to improve the security of the internet. Then he submitted a paper to IEEE, a professional association for electronic engineering and electrical engineering, which published their findings in a special issue this fall.

“These attacks show how IoT technologies are challenging our cultural assumptions about security and privacy and will hopefully motivate more emphasis on the security and privacy practices of IoT developers and designers,” they wrote. (After the paper was published, all the manufacturers responded and attempted to fix the vulnerabilities, except for the drone companies).

Force multiplier

By the end of 2018, more than 23 billion IoT devices had been installed globally. Many consumers buying these smart devices currently don’t bother to hook them up to their WiFi, which means they’re essentially offline and out of reach of hackers. But that may change as manufacturers continue to tout the benefits of connectivity. And the number of devices is expected to more than triple, to 75 billion, by 2025.

The sheer number of vulnerable devices gives hackers powerful leverage. The Mirai attack of 2016, which may have been inspired by Cui’s original paper, illustrates how dangerous the threat has grown. Paras Jha, a quiet, socially awkward college dropout from New Jersey, ran a lucrative business renting space on his own private computer server to fellow aficionados of the video-game Minecraft, so they could play privately with their friends. It sounds pleasant, but the business is cutthroat. A common tactic of Jha and his rivals was to hack into the home computers of unsuspecting people, hijack them with malware and instruct them to send torrents of unwanted messages and data to the machines of their rivals, overwhelming them and hopefully shutting them down—known as a Distributed Denial of Service Attack (DDoS). Unsuspecting customers, frustrated by the “unreliable” service, were then easy targets for poaching.

In 2016, Jha and two Minecraft friends he’d met online decided to do his rivals one better. They hacked not only desktop computers but also the myriad security cameras, wireless routers, digital video recorders, household appliances and other IoT devices. Like Cui before him, Jha and his friends wrote a program that scanned the internet to locate vulnerable devices. But unlike Cui, they actually planted malware on the machine and took control of them. Leveraged by the proliferation of smart devices, Jha’s zombie bot army grew faster than he could have imagined–by the end of the first day, he had appropriated 65,000 devices; by some estimates his zombie army reached 600,000.

The attack, nicknamed “Mirai” (“the future”) after a Japanese television series, was so powerful that Jha wasn’t content with taking down his small-fry Minecraft rivals. He also trained the new weapon on the huge French telecom provider OVH, which hosted a popular tool that his rivals relied on to defend themselves against his attacks. Eventually, the cops took notice. Jha was fined $8.6 million and 2,500 hours of community service working for the FBI.

Cui, now the 36-year-old founder and CEO of Red Balloon Security, often gives talks at hacker conferences wearing a tee-shirt, a bead necklace, and a man bun and makes a good living advising companies how to protect themselves in a hostile cyber-world. He continues to marvel at how little has been done to patch not just the vulnerability his paper identified but also many others that he believes could arguably cause even more damage. While the security firms serving large well-financed companies like those targeted in the Mirai attacks have come up with new ways to defend client servers against DDoS attacks, many manufacturers of IoT devices are doing little if anything to protect the rest of us from cyber mischief—not just zombie device conscription, but also spying, sabotage and exploits that security experts argue should raise profound privacy and safety concerns.

What accounts for the neglect, Cui believes, is a gold-rush mentality to grab market share in the burgeoning IoT device business. Over the last five years, the hype over IoT has become so hot that many VC-funded startups in the consumer-device field—and even some major manufacturers—are adding internet connectivity, rushing their products to market, and resolving to fix any security flaws later. Some haven’t even thought about security at all. “You have to put in the time and resources to care about security,” says Cui. “But there’s a lot of VC money, and they want to very quickly roll out a thing that has an IoT feature that they think the market might like.”

The money is primarily spent to develop new devices. “The problem at the moment is that there’s really no incentive for security,” Cardenas told Newsweek. “Security usually gets in the back burner of these products.” Most consumers aren’t aware of the dangers and aren’t demanding protection. And the device manufacturers are under no obligation to provide it.

In a lab at the Georgia Institute of Technology, Manos Antonakakis, an associate professor in the school of electrical and computer engineering, and research scientist Omar Alrawi, have also been probing the gaping security vulnerabilities of the emerging IoT. Antonakakis notes that while there’s a class of well-known vendors that “at least try to get the security right in some cases,” even large manufacturers are under pressure to rush new IoT products onto the current market. “It takes a lot of quality assurance and testing, and penetration analysis and vulnerability analysis to get it right,” he says. But the rush to market “comes into violent disagreements with proven security practices.”

Many of the largest tech companies have invested heavily in tapping into the market for “smart home” devices, one of the fastest growing areas for IoT devices. Amazon is among those dominating the market for smart hubs, along with Google, which purchased the digital thermostat maker Nest in 2014 for $3.2 billion. Google has since expanded it to become a digital hub that also includes smoke detectors and security systems like smart doorbells and locks. Samsung has the SmartThings hub, which it acquired in 2014 for $200 million, and now connects to air conditioners, washers and TVs. Apple has a home kit which can control any number of devices through voice commands delivered in range of its HomePod.

Gaping vulnerabilities

Once these systems are installed, devices from a growing number of companies can be added to the home network, including those made by well-known home appliance manufacturers like GE, Bosch and Honeywell. Belkin makes a line of connected appliances that includes a Crock-Pot WeMo Smart Slow Cooker, smart Mr. Coffee maker and a smart home humidifier. There’s a lot of money to be made. All told by the end of 2019, more than $490 billion in profits will have been earned on the nearly 2 billion consumer devices sold over the previous 12 months, according to the property management consulting firm iProperty Management.

To try to draw attention to the dangers—and the things consumers should be asking questions about when buying new IoT products—Antonakakis and Alrawi, in collaboration with researchers at the University of North Carolina at Chapel Hill, have developed a rating system and begun evaluating the security of a wide array of IoT devices. And surprisingly they found gaping vulnerabilities in devices and systems produced by even some of the most tech-savvy companies.

The vulnerability of IoT devices goes well beyond holes in password protection, the vulnerability exposed by the Mirai attack, they argue. IoT devices can also be accessed and taken over directly through the home network they are connected to, and that home network is only as strong as its weakest link. That means that even if each device comes with a unique password and username, it’s not necessarily secure. Once hackers find a way onto the home network through one vulnerable device, the path is often wide open to the rest of the network.

To secure an IoT device, they argue, manufacturers need to patch vulnerabilities in four different areas : direct access to the device itself, the mobile app used to run it, the way it communicates with its home network and, in many cases, the cloud-based server that manufacturers use to push out updates, collect user data, or provide new services.

Getting all that right is not easy. For a vendor to secure all four parts, Alrawi notes, it needs a good mobile-app developing team “that knows secure development,” a “system team that does very good embedded system development and secure development” and cloud experts who can design a secure cloud “backend” that allows the device to be managed without exposing it to additional risk. Finally, the device manufacturers need somebody who has network knowledge on how to build efficient and secure internet protocols and what protocols to avoid.

“They have to balance all this with usability,” he says “So you can see that this is already getting really hard to manage just mentally. When a startup team that comes up with this great idea wants to push a product to market, they’re usually a small team that doesn’t have all this expertise. But even with big vendors, some of these problems are really hard to pin down and manage.”

Indeed, while Antonakakis, Alrawi and their team give relatively high marks for device security to the mainstream products like the Amazon Echo and the Belkin Netcam, they gave them Cs, Ds, and Fs for network security—a measure of how protected these devices are from intruders who manage to access the home wireless network through other vulnerable devices. And while a number of devices associated with Google‘s Nest smart home products (like thermostats, smoke detectors, smart locks and doorbells) receive As and Bs for device and network security, they got Cs and Ds for mobile and cloud protections—meaning a resourceful hacker intent on say, unlocking the front door, could still access a home.

The cloud category is the most worrisome. Since many of these services are cloud based and connected to central company servers, if a determined, well-financed hacker—say, China, North Korea or Russia—were to use the same kind of sophisticated exploits they have used to bypass security on the traditional internet of computers, there’s no telling what they might do.

“You’re talking about getting access to potentially millions of people’s homes, and when that happens, think about all of the microphones and cameras and actuators that you have around your house, and multiply that out by all the people who use these things,” Cui says.

“Many consumers don’t fully understand the risks associated with installing some of these devices in their homes,” adds Alrawi.

Until they do, the situation is unlikely to change. Many experts wonder how big a price we will have to pay before that happens. “It’s a mess,” says David Kennedy, a cybersecurity expert who designs security for a wide array of manufacturers and has testified before Congress on the IoT. “An absolute mess. We’re going into this very blind, without a lot of security discussions around what the impacts are going to be to our lives and to our safety.”

Kennedy, whose current title is CEO of the company TrustedSec, has hacked into his share of devices over the years to make a point, including smart TVs, thermostats, smart fridges, robotic house cleaners and controllers that are connected to the energy grid. But Kennedy’s biggest concern at the moment is in the area of automotive safety.

There have already been some cautionary tales. In 2015, Fiat Chrysler had to issue a safety recall affecting 1.4 million vehicles in the United States so it could patch software vulnerabilities, after two security researchers hacked into the internet-connected entertainment system of a Jeep Cherokee carrying a magazine reporter, took control of the vehicle, blasted the radio and AC, then brought traffic to a standstill in the middle of a freeway.

The problem, says Kennedy, is that most cars have scores of different pieces of technology in them, many of which are connected directly to the internet to allow them to transmit data needed for preventive maintenance. But the manufacture of these different IoT devices is often subcontracted out to scores of different contractors, which makes it logistically difficult to provide security updates and patches when new security vulnerabilities are discovered. (He pointed to Tesla as the major exception because, he argues, it is “a software manufacturer first and car manufacturer second,” and thus knows how to build secure systems.)

The idea of regularly pushing out preventive security updates to patch newly discovered vulnerabilities in IoT-networked cars—a standard practice for products like Microsoft windows and the Apple iPhone—is new and has not yet been incorporated into the automotive industry. “I can’t talk about which car manufacturers I’ve done assessment work for, but I can tell you that I’ve worked for a number of them, and security practices need a lot of work,” he says. “They’re not pushing patches out to the cars, which makes them extremely vulnerable to specific attacks—everything from eavesdropping in your car to driving them off the road.”

The nightmare scenario is a mass fleet takeover, where a bad actor hacks different cars across the world to cause mass mayhem. “That’s definitely something that’s possible now with these interconnected cars, no question about it,” Kennedy says. “Someone will lose their life and then eventually they’ll kind of knee jerk into fixing the whole industry. I think that’s what it will take to change the mentality of car manufacturers.”

Lawmakers in some jurisdictions are beginning to wade into the murky waters of IoT regulation. In January, California will become the first state to implement an IoT security law. The bill, passed in 2018 with a January 2020 deadline, will require companies that make connected devices to equip them with “reasonable security features,” explicitly requiring that each device come with either a unique passcode or require the user to generate one before using the IoT device for the first time—taking aim at patching the vulnerability exploited so successfully in the Mirai exploit and the copycat attacks that have followed. Beyond that, however, the law seems to have been written to be purposely vague, allowing room for further state guidance in the future.

Cybersecurity experts have called on the Federal government in the U.S. to step in to regulate the industry. The U.S. House of Representatives last March introduced a bill, for the third session in a row, that would require the National Institute of Standards and Technology (NIST) in the U.S. Department of Commerce to develop recommended standards for IoT devices, and would assign the Office of Management and Budget (OMB ) the task of issuing guidance to agencies that aligns with NIST‘s requirements. The law would also require NIST to offer guidance on vulnerability disclosure and report on IoT cybersecurity threats.

Two and half years ago, NIST started a program to look at the issue and this past summer solicited public comment on a voluntary set of minimum “baseline” security functions that any internet capable device should offer, whether it is intended for consumers, businesses or federal agencies, says Katerina “Kat” Megas NIST program manager, Cybersecurity for Internet of Things.

Among them, every single device must have a unique number or identifier associated with it that shows up on the network, which would make it easy to locate quickly and unplug the source of any problems that arise—a feature that many IoT devices currently do not offer. Other features would manage access to each device through secure methods of user authentication; protect data by encrypting it; and provide secure updates and log cyber-events so investigators can track how problems develop.

Few experts have illusions these measures will solve the problem soon. The standards would be voluntary. And even if Congress were to enact laws mandating security standards, a profound security vulnerability would remain: users themselves.

“No matter how strong your system is, it’s only as strong as your weakest link—and the weakest link is always the human,” says Jason Glassberg, cofounder of Casaba Security, a leading cybersecurity firm. “The largest breaches, the largest attacks for the most part have not been because of some super significantly technical attack. It’s been because someone’s been fooled into giving up their credentials. They’ve been fooled into clicking on a link which installed malware or asked them to provide their password. And it certainly doesn’t change in the Internet of Things world.

Original article is at:

https://www.newsweek.com/2019/11/01/trust-internet-things-hacks-vulnerabilities-1467540.html

Verizon: strong wireless growth, 5G ultra wideband, relaunch of “5G Home” service, much more

Verizon reported Q3 net income of $5.3 billion, compared to $5.6 billion in the year-ago period. Total consolidated revenue came in at $32.89 billion versus $32.61 million a year ago.

The company, which is the #1 U.S. wireless telco (in subscribers) reported strong wireless growth in the third quarter. It added 615,000 postpaid (monthly contract) smartphones in Q3; and signed on 444,000 pay-as-you-go prepaid customers. Wireless revenue for the quarter was $23.6 billion.

CEO Hans Vestberg said on the earnings call:

And as you can see in our operation performance, we had a really good quarter when it comes to wireless additions here, one of the best quarter — third quarter we had in several years.

The company has deployed its 5G Ultra Wideband (its 5G mobile service) in 15 markets and is committed to deploy it in 30 markets by year-end.

Verizon has relaunched its fixed wireless “5G Home” fixed wireless broadband service in Chicago, using the 3GPP 5G New Radio release 15 spec, rather than the Verizon proprietary fixed 5G specification used for the initial launch in October 2018. Verizon said that maximum download speeds via 5G Home remains at 1 Gbit/s, with 300 Mbit/s as the promised minimum speed.

“It’s a new business model,” Verizon CEO Hans Vestberg said on Friday’s call. “Now we have it on the global standard [1], and now we have it on the self-install.”

Note 1. Once again, Vestberg is confused. 3GPP Release 15 (and any other 3GPP spec) is NOT a standard.

…………………………………………………………………………………………..

Vestberg on the earnings call:

We’re also doing a lot of things in One Fiber, continue to have a very high pace in that. And that One Fiber is so important for our overall Intelligent Edge Network that we are deploying in the company in order to realize the market-purpose network to gain all the efficiencies and serve our customers even better over time. So in short, a lot of progress in the network.

We continue to deploy also 5G Ultra Wideband in stadiums especially now with NFL, 13 stadiums when the season kicks off having 5G coverage. This is important for us because it’s part of the dense urban areas where you have a lot of viewers at the same time when really our 5G is coming to excel. Because of the 5G build that we’re doing with our assets is — we’re making a real big difference here.

We’re going to launch the first 5G mobile edge compute center in the fourth quarter. (Verizon is) engaging much more with large enterprises because with the 5G platform and 8 currencies, we are now a lot of interactions. We announced in this quarter, for example, collaboration with SAP, Corning. All of them are use cases for the 5G mobile edge compute. So we’re excited all that opportunity we’re creating with the 5G mobile edge compute with the largest companies in the market.

CFO Matt Ellis on Verizon FioS and Business/Enterprise segments:

Fios Internet net additions of 30,000 were relatively flat sequentially and down year-over-year. Fios Video results continued to be impacted by the ongoing shift away from linear video offerings with losses of 67,000. Our customers see value in our high-quality broadband offering paired with multiple choices for video through linear TV bundles or over-the-top options, such as YouTube TV and the recently announced Disney+.

Business wireless volumes remain strong with a 12% increase in gross adds for the quarter primarily within small and medium business and public sector. Postpaid net adds were 408,000 compared to 364,000 in the prior year. This includes 205,000 phones, 112,000 tablets and 91,000 other connected devices. Our continued strong customer loyalty across the Business segment led to phone churn of 0.98%, which is relatively flat sequentially and up slightly over the prior year. Total postpaid churn of 1.22% was up 5 basis points compared to the prior year. Total postpaid device activations were up 5.7% while our retail postpaid upgrade rate was 4.5% versus 4.8% in the prior year.

From a customer group perspective, global enterprise revenues declined 2.4%, driven by legacy pricing pressure and technology shifts. Wholesale revenues declined by 13.7% driven by price compression and volume declines, which we expect to continue in a highly competitive marketplace. Small and medium business revenue increased 6.2% driven by wireless service and Fios growth, partially offset by ongoing declines in traditional data and voice services. Public sector and other revenue increased 1.2% as a result of growth in wireless and wireline products and services.

Vestberg, answering a question from Timothy Horan:

Hans, can you give us maybe some more thoughts what you think people are going to do with gigabit speeds instead of megabits? When we rolled out 4G, we had a lot of new innovative kind of applications. Just any thoughts on that as you’re talking to the Fortune 500 companies. And are there ways for you maybe to participate in some of the revenue from some of these new applications with lower — also maybe lower latency? Just any more thoughts what you’re seeing on use cases.

Vestberg’s reply:

5G Home is a totally new way how we use the technology, which we have never been able to do before because a stand-alone fixed wireless access can never be sustainable financially. In this case, it is.

Then of course when you think about the 8 currencies coming out from 5G, I think that our conversation with the large enterprises today is a lot about the latency and the mobile edge compute. Because suddenly, you can transform your factory with robotics by having a low latency. You don’t need a wired factory, so the future digital factory will have 5G. We see also much bigger 5G private networks, where you get security much higher because it’s going to be your network. You define your network, you have a compute and storage for your enterprise. This is a new way of charging and actually interacting with our customer. And sometimes, there’s going to be a software in between that come from a software company, so we need to work with them as well.

And as I said earlier, I mean this quarter, we’re going to launch our first 5G mobile edge compute center. So we are on the path of doing this, which actually will add more opportunity. Then on the Consumer side, which usually question starts with, which are now end with because I see so many other opportunities, is of course AR/VR. We see now quite a lot of money coming into the ventures side when it comes to 5G innovation. And I think that as we move into 2020, we’re going to see much more. We have our 5G challenge, which we announced at CES where we had a lot of companies participate what they’re going to do with 5G. It ranged from everything what they can do with 5G.

I think we’re at the moment of 4G, but way bigger. When 4G came, I didn’t know what type of application and new service companies would show up. I think this is far bigger that we’re standing in front of right now, and we have much more insights to it as well.

We close with a Verizon assessment from Phillip Leasure:

Verizon has continued to engage in conservative and well thought out initiates compared to the excitement and drama of its competitors. It has not recently engaged in any historic mergers, it has not made any large corporate purchases to try to move into new sectors and it has fended of lower-priced competitors and continued to add subscribers. It has made smaller investments and purchases designed to strategically enhance the future of the business. It is clearly the market dominator in its sector and for the most part, has continued to focus on its core business and engage in competitive deals with other content creation companies to provide services rather than try to buy out content creators to provide services to their customers. So far this has helped them avoid taking on excessive levels of debt and held margins steady. We’ll see if this continues to be a winning strategy going forward for the top dog of telecommunications.

…………………………………………………………………………………………..

Nokia: 5G Costs Hit Q1 Outlook as Shares Crash and Dividend Suspended

We’ve strongly warned for some time that making money in 5G will be extremely difficult until the core IMT 2020 standards (radio and non radio aspects) are complete and widely implemented. Today we heard proof of that from Nokia:

“Some of the risks that we flagged previously related to the initial phase of 5G are now materializing,” Nokia CEO Rajeev Suri said, noting that its third-quarter gross margin was impacted by the “high cost level associated with our first generation 5G products.”

“Competitive intensity has increased in some accounts as some competitors seek to take share in the early stage of 5G,” Nokia said in a statement. Yet the company said it has 48 commercial 5G deals and has launched 15 live (pre-standard) 5G networks. It’s telco customers include Sprint, Verizon, AT&T, and T-Mobile in the U.S.

China has been a disappointment for Nokia, too. Greater China made up 8% of Nokia’s net sales in the third quarter, the company said Thursday. But revenue from the region fell by 21% from the year-earlier period.

Nokia shares had one of their worst days ever on Thursday after the Finnish telecom equipment maker reduced its profit outlook to reflect the costs of developing 5G products. The stock fell by -24% to $3.87 — the largest drop since 1991 — as Nokia also disclosed in its third-quarter earnings release that it would not be paying a dividend for that quarter and the fourth quarter in part to “guarantee Nokia’s ability to increase 5G investments.”

The elimination of Nokia’s dividend contradicted what the company said about dividends on its website to attract investors:

The dividend is the principal method of distributing earnings to shareholders. Over the long term, Nokia targets to deliver an earnings-based growing dividend by distributing approximately 40% to 70% of non-IFRS diluted EPS, taking into account Nokia’s cash position and expected cash flow generation.

Instead of paying a dividend, the company wants to use its cash to increase its 5G investments, strengthen its cash position, and invest in strategic areas such as software. The company expects to start paying dividends again after it reaches a cash balance of 2 billion euros.

Nokia reduced its earnings forecast this year from an operating margin of 9-12 per cent to one of 8.5 per cent, plus or minus one percentage point. For next year, it slashed its estimate of a 12-16 per cent operating margin to 9.5 per cent, plus or minus one percentage point.

……………………………………………………………………………………………………………………………………………………………………………………………………..

It will take much longer than most pundits believe to realize to monetize the potential and make a decent profit from 5G!

AJW Comment: We are at the start of the 5G transition and Nokia appears to be having the usual problems of refining and finding cost efficiencies in its technology in its first iterations. Gross margins were hit by “a high cost level associated with our first generation 5G products” combined with “pricing pressure in early 5G deals” as it has been limited in what it can charge for the next-generation equipment by competition for those key first customer wins. There are also “profitability challenges in China,” where there has been patriotic domestic buying and support of Huawei 5G equipment by the three state owned telcos. Also, the proposed (but not consummated) merger of Sprint and T-Mobile in the U.S. is causing uncertainty on future demand in one of Nokia’s main early markets for 5G where the company largely competes only with Ericsson (as Huawei has been shout out of the U.S. telecom equipment market, except for earlier sales to rural wireless carriers).

Nokia is the world’s second-largest telecom gear maker by market share, but way behind #1 Huawei. Ericsson is #3 (see Positive Note below).

………………………………………………………………………………………………………………………………………………………………………………………

From Nokia’s 3rdQ-2019 earnings statement:

The overall decrease in Nokia gross profit in the first nine months of 2019 was primarily due to lower gross margin in Networks. We experienced relatively high 5G product costs in Networks, as well as elevated levels of deployment services, consistent with being in the initial phase of 5G. This was partially offset by lower costs related to network equipment swaps, net sales growth in both Networks and Nokia Software, as well as higher gross margin in Nokia Software. In the first nine months of 2019, Nokia gross profit benefited from lower incentive accruals.

………………………………………………………………………………………………………………………………………………………..

From the company’s 3rdQ-2019 slide presentation:

Key drivers of Nokia’s outlook-

Net sales and operating margin for Networks and Nokia Software are expected to be influenced by factors including:

• Our expectation that we will perform approximately in-line with our primary addressable market in full year 2019 and full year 2020, as we further prioritize profitability and cash, while continuing to drive growth in our Nokia Software and Nokia Enterprise businesses. (This is an update to earlier commentary to outperform our primary addressable market in full year 2019 and over the longer-term.) On a constant currency basis, we expect our primary addressable market to grow slightly in full year 2019, and for growth to continue in full year 2020;

• Competitive intensity has increased in some accounts as some competitors seek to take share in the early stage of 5G, which is particularly impacting Mobile Access. (This is an update to earlier commentary that competitive intensity could increase);

• Additional 5G investments focused on accelerating our product road maps and cost competitiveness. Investment areas include System on Chip based 5G hardware, including diversifying and strengthening the related supplier base (new commentary);

• Additional digitalization investments focused on driving automation and productivity, including further simplification of IT tools and operational processes (new commentary);

• Temporary capital expenditure constraints in North America related to customer merger activity, as well as other potential mergers or acquisitions by our customers (This is an update to earlier commentary for potential mergers or acquisitions by our customers);

• The timing of completions and acceptances of certain projects, particularly related to 5G. Based on the evolving readiness of the 5G ecosystem and the staggered nature of 5G rollouts in lead countries, we expect full year 2019 will have seasonality characterized by a particularly weak first quarter, a strong second quarter, a solid third quarter and an expected strong fourth quarter (This is an update to earlier commentary for an expected soft third quarter and an expected particularly strong fourth quarter);

• Some customers are reassessing their vendors in light of security concerns, creating near-term pressure to invest in order to secure long-term benefits;

• Our expectation that we will improve our R&D productivity and reduce support function costs through the successful execution of our cost savings program;

• Our product and regional mix, including the impact of the high cost level associated with our first generation 5G products (This is an update to our earlier commentary, providing additional details); and

• Macroeconomic, industry and competitive dynamics.

On a positive note: “As I look to the future, it is clear to me that Nokia has some unique advantages,” Suri said, citing “a powerful, end-to-end portfolio that allows us to benefit from 5G investments across all network domains.”

Nokia’s dismal earnings report contrasts with that of rival Ericsson which last week beat quarterly earnings expectations and lifted its market forecast for this year and its sales target for 2020. The Swedish firm said demand for (pre-standard) 5G networks was robust: “5G is taking off faster than earlier anticipated,” CEO Börje Ekholm said in an earnings statement. The Swedish telecom equipment company said it had signed 27 commercial 5G contracts.

Other Voices:

Some analysts had thought that Nokia would benefit from the pressure on Huawei. But the disappointing results published Thursday were driven primarily by weakness in the division responsible for rolling out 5G.

“The report was a major disappointment … outlook was cut across the board reflecting the company’s continuing stumbles as the new cycle of network market is starting to take off,” Inderes analyst Mikael Rautanen said in a note to clients.

“This is all very disappointing,” said Lee Simpson, an analyst at Jefferies. “There is something almost embarrassingly irrelevant about the Nokia story now.”

“He has been in the position now for over five years and is still struggling to put in place a sustainable, comprehensive set of results and targets,” sad Neil Campling of Mirabaud Securities.

References:

https://www.nokia.com/system/files/2019-10/nokia_results_2019_q3.pdf

https://www.nokia.com/system/files/2019-10/nokia_slides_2019_q3.pdf

T-Mobile US to cover 200M in U.S. using 600MHz spectrum; OnePlus 7T Pro 5G McLaren smartphone exclusive deal

T-Mobile US plans to cover 200 million people with its 5G network by the end of this year, using 600 MHz spectrum. The “Un-carrier” said it has been working towards the launch of 5G using 600 MHz for the past two years, and will be deploying 5G-ready equipment for both indoors and outdoors.

To date, T-Mobile US has thousands of 5G-ready towers and cell sites capable of lighting up 5G on 600 MHz spectrum, and no other 5G signal will be as strong or as reliable for broad coverage. That means T-Mobile’s nationwide 5G network will be able to cover more people in more places and work indoors and out, unlike the competitors current 5G networks which can be blocked by things like walls, glass and leaves.

T-Mobile says their 5G network operating on 600 MHz spectrum is just the start of the journey to 5G and provides a critical low-band foundation. Together with Sprint, the New T-Mobile will have the ability to add critical depth with mid-band spectrum for broad coverage and performance as well as mmWave spectrum for hotspot-like coverage in dense urban areas. Only this combination will deliver a 5G network with both breadth and depth, something the carriers simply cannot do as quickly. The stakes are high for the U.S., as billions in economic growth and jobs are expected to come from 5G and the innovations it will unleash.

Observation: By deploying 5G on low band spectrum this year, T-Mobile US will be well ahead of AT&T, which has recently promised to launch 5G on its unspecified low band spectrum (probably 700MHz) by the middle of 2020.

T-Mobile CTO Neville Ray said in April that the Un-carrier would provide speeds of 60 Mbit/s to 70 Mbit/s using 5G in the 600MHz band. He said that would be roughly double the speeds the operator currently provides on its 600MHz spectrum with its 4G LTE network.

Mike Dano of Light Reading had this to say about T-Mo’s 5G on 600 MHz announcement:

T-Mobile’s lowband 5G network won’t provide speeds anywhere near the 1 Gbit/s peak speeds that Verizon is providing with its 5G network over millimeter-wave (mmWave) spectrum. Nor are those speeds nearly as fast as the roughly 500 Mbit/s peak speeds that T-Mobile is already providing on a mmWave 5G network the operator launched this summer in parts of six cities.

However, the key element of T-Mobile’s launch of 5G in its 600MHz spectrum is that it will reach across major portions of the US population. That’s because transmissions in 600MHz spectrum can cover large geographic distances, while transmissions in mmWave spectrum can’t go more than a few thousand feet. The tradeoff, though, is capacity and speeds: mmWave 5G can handle enormous amounts of data, while lowband 5G can’t.

Once again, we warn readers that none of the spectrum that’s being used for pre-standard (IMT 2020) commercial services have been approved by the ITU-R for 5G. That will only happen after WRC 19 has concluded as per this recent WRC 19 Preview article. Also note that mmW 5G will require line of sight transmission and many more small cells due to limited reach so will be restricted to dense urban areas.

………………………………………………………………………………………………………………………………………………………………………..

In the same T-Mobile US press release, OnePlus announced its OnePlus 7T Pro 5G McLaren smartphone, which it will be providing exclusively in the United States with T-Mobile US. The limited edition McLaren phone will have a 6.67 inch Fluid Display, a 90 Hz refresh rate, three cameras including a 48 MP main one, 3X optical zoom and a 117 degree Ultra-Wide-Angle lens. The 4085 mAh battery will come with Warp Charge 30T, for a full charge in one hour. Finally, the phone case will be made of Alcantara, a composite fabric material made to be soft, durable and very gripable. Pricing will be provided later this year, as will availability dates.

“At OnePlus we believe that 5G is the future,” said Pete Lau, CEO and Founder of OnePlus. “T-Mobile has always been a great partner, and T-Mobile’s expansive 5G network on the 600 MHz spectrum makes it the perfect opportunity for us to exclusively launch the OnePlus 7T Pro 5G McLaren in the United States,” he added.

The OnePlus 7T Pro 5G McLaren will launch exclusively at T-Mobile and take advantage of the Un-carrier’s 5G network

…………………………………………………………………………………………………………………………………………………………………………

Separately, T-Mobile US has launched a new campaign against Verizon, highlighting how the rival operator charges more for 5G but has limited coverage. The ‘VerHIDEzon’ campaign points out how Verizon does not provide customers with maps of its 5G coverage.

The campaign will run online and outdoors, including on T-Mobile’s Times Square display in New York city. It also promotes T-Mobile’s pledge to bring 5G to all of the US if its merger with Sprint goes ahead.

References:

https://www.t-mobile.com/news/oneplus-7t-pro-5g

To learn more about the new OnePlus 7T Pro 5G McLaren at T-Mobile, please visit https://www.t-mobile.com/devices/5g-phones. For more about T-Mobile’s 5G network, visit www.t-mobile.com/coverage, and to learn more about the proposed T-Mobile/Sprint merger, visit www.NewTMobile.com.

Spain has almost 10M FTTH lines installed; Global FTTH market to grow to $16.8 billion at 15% CAGR

Spain is likely to have 10 million FTTH lines by the end of the year. A total of 112,000 fiber to the home (FTTH) lines were added in Spain in August to increase the number of active connections in the country to 9.6 million, according to the latest monthly update from regulator CNMC. Fiber lines rose by 1.8 million year on year, offsetting a 1.2 million decline in DSL lines, said the watchdog. HFC lines totalled 2.3 million, down around 147,000 year on year, bringing the fixed broadband total to 15.03 million, up from 14.56 million a year earlier.

Nearly 4 in 10 (39.88%) of fixed broadband lines correspond to Telefonica, which gained around 1,700 in August. The Masmovil group once again topped the monthly net fixed broadband ranking, adding 30,400 lines in August to reach 39.88% percent of the market, while Orange (26.2%) returned to growth with a 2,400 monthly gain. Vodafone (20.9%) shed a net total of 8,300 lines, with all the other operators attracting 2,900 more lines to reach 4.4 percent of the market.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

According to a new ResearchAndMarkets.com’s report -“Fiber-to-the-Home/Building (FTTH/B) – Market Analysis, Trends, and Forecasts,” the Fiber-to-the-Home/Building (FTTH/B) market worldwide is projected to grow by US$16.8 Billion, driven by a compounded growth of 15%.

50 to 100 Mbps, one of the segments analyzed and sized in this study, displays the potential to grow at over 15.8%. The shifting dynamics supporting this growth makes it critical for businesses in this space to keep abreast of the changing pulse of the market. Poised to reach over US$15.6 Billion by the year 2025, 50 to 100 Mbps will bring in healthy gains adding significant momentum to global growth.

The United States will maintain a 13.3% growth momentum. Within Europe, which continues to remain an important element in the world economy, Germany will add over US$651.3 Million to the region’s size and clout in the next 5 to 6 years. Over US$543 Million worth of projected demand in the region will come from Rest of Europe markets. In Japan, 50 to 100 Mbps will reach a market size of US$781.6 Million by the close of the analysis period. China exhibits the potential to grow at 19.2% over the next couple of years and add approximately US$4.1 Billion in terms of addressable opportunity for the picking by aspiring businesses and their astute leaders.

Top Key Players: China Telecom., China Mobile Ltd., Verizon Communications Inc., AT&T Inc., Vodafone Group plc, Nippon Telegraph & Telephone Corporation, Softbank Group Corp., Deutsche Telekom AG, Telefonica S.A., America Movil

For more information about this report visit https://www.researchandmarkets.com/r/o3hlvj

A similar, if not identical report is available from: https://www.theresearchcorporation.com/enquiry-before-buying.php?id=39505

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.telecompaper.com/news/spain-hits-96-million-active-ftth-lines-in-august–1312974

Preview of WRC‑19: Enabling Global Radiocommunications via Radio Frequency Spectrum and Satellite Orbit Resources

By Mario Maniewicz, Director of the ITU Radiocommunication Bureau

The ITU’s upcoming World Radiocommunication Conference 2019 (WRC‑19) will play a key role in shaping the technical and regulatory framework for the provision of radiocommunication services in all countries, in space, air, at sea and on land. It will help accelerate progress towards meeting the Sustainable Development Goals (SDGs). It will provide a solid foundation to support a variety of emerging technologies that are set to revolutionize the digital economy, including the use of artificial intelligence, big data, the Internet of Things (IoT) and cloud services.

“The World Radiocommunication Conference, which opened today (October 28th), will address some of the leading-edge technological innovations set to play a pivotal role in tomorrow’s digital economy and the future development of services, systems and technologies,” said ITU Secretary-General Houlin Zhao, noting that digital inclusion provides the chance to improve the lives of millions across the world. “A transformative revolution in connectivity is in the making with immense implications for the trillion-dollar telecommunication and ICT industry and in advancing many of the United Nations SDGs.”

Every three to four years the conference revises the Radio Regulations (RR), the only international treaty governing the use of the radio-frequency spectrum and satellite orbit resources. The treaty’s provisions regulate the use of telecommunication services and, where necessary, also regulate new applications of radiocommunication technologies.

The aim of the regulation is to facilitate equitable access and rational use of the limited natural resources of the radio-frequency spectrum and the satellite orbits, and to enable the efficient and effective operation of all radio communication services.

WRC‑19 will be held in Sharm El-Sheikh, Egypt, from 28 October to 22 November 2019 and its agenda covers a wide range of radio- communication services (see examples at the end of this article).

The preparations for the conference include studies and discussions that take place in the ITU–R Study Groups, the Conference Preparatory Meeting, the ITU inter-regional workshops, and also within the regional groups. The very nature of the process and study cycle helps build consensus and facilitates the work of the conference, where final decisions are made. See the infographic for more information on the preparatory process.

Each World Radiocommunication Conference affects the future development of information and communication technologies (ICTs) in many ways, including:

-

- Introducing and expanding access to the radio spectrum for new radiocommunication systems and applications;

- Protecting the operation of existing radiocommunication services and providing the stable and predictable regulatory

environment needed for future investments; - Avoiding the potential for harmful interference between radio services;

- Allowing the provision of high-quality radiocommunications while protecting vital uses of the radio spectrum, particularly for distress and safety communications; and

- Facilitating international roaming and increasing economies of scale, thereby making it possible for network and user

devices to be more affordable.

2nd ITU Inter-regional Workshop on WRC-19 Preparation

……………………………………………………………………………………………………………

Currently, billions of people, businesses, and devices are connected to the Internet. ICTs are transforming each and every aspect of our lives, from the way people interact and communicate to the way companies do business.

People expect instantaneous high-quality connectivity, whether stationary or on-the-move, in their homes or outside in a crowd.

Companies search for new ways to increase their business and operational efficiency, whether by monitoring the condition of equipment and conducting predictive maintenance, or by monitoring customer data to offer personalized solutions. The increasing need for a new underlying ecosystem will be made possible by utilizing a variety of complementary terrestrial and satellite technologies/services.

The fifth generation of mobile technology, International Mobile Telecommunications (IMT) 2020 (5G) promises to enhance the connectivity infrastructure that delivers high-speed networks to end users, carries the flow of information from billions of users and IoT devices, and enables a whole array of services to different industry verticals. Spectrum for 5G services will be one of the main topics of WRC‑19. More specifically, new allocations will be considered for the mobile service and identification for IMT of frequencies in the mm Wave bands (above 24 GHz).

In addition, satellite services aim at increasing connectivity, whether by providing access to broadband communications to unserved rural communities, or to passengers on aircrafts, on ships and on land, or by expanding backhaul of terrestrial networks.

WRC‑19 will address fixed and mobile satellite services, earth stations in motion, and will revise the assignment procedures pertaining to satellite networks.