Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon Consumer:

Verizon reported better-than-expected wireless customer results for the Q1-2024, but still lost subscribers. The U.S. #2 telco consumer revenue the quarter was $25.1 billion, an increase of 0.8% YoY as gains in service revenue were partially offset by declines in wireless equipment revenue.

While Verizon lost 158,000 wireless retail postpaid phone customers in the first quarter, that was an improvement over the 263,000 losses the company reported in the same quarter a year ago. Verizon had been expected to lose around 201,000 postpaid phone customers in its consumer division in the first quarter. Thus, the difference between expectations and what Verizon reported is likely due to the estimated 35,000 customers who signed up for a $10 per month second line of wireless service and not necessarily new customers paying full price for a standard wireless subscription.

“It gives customers flexibility,” explained Verizon CFO Tony Skiadas this week during Verizon’s first quarter earnings call, according to Seeking Alpha. “They can add and remove it as desired. The adoption so far has been good.”

“Despite Verizon Consumer Group postpaid phone net adds beating consensus, Verizon stated that ‘a very low single-digit percentage of phone gross adds’ came from Verizon ‘second number,’ which was announced in early March,” wrote the financial analysts with KeyBanc Capital Markets in a note to investors following the release of Verizon’s earnings. “Implied by this is ~35,000 net adds from ‘second number’ without which investors could say Verizon Consumer Group postpaid phone net adds were in line.”

AT&T and T-Mobile offer similar second line wireless plans. T-Mobile has been offering its $10 per month Digits service for years, allowing customers to move their numbers around to various devices, including having two numbers on one phone. AT&T charges users $30 a month to add a line.

………………………………………………………………………………………………

Verizon FWA & Wireline:

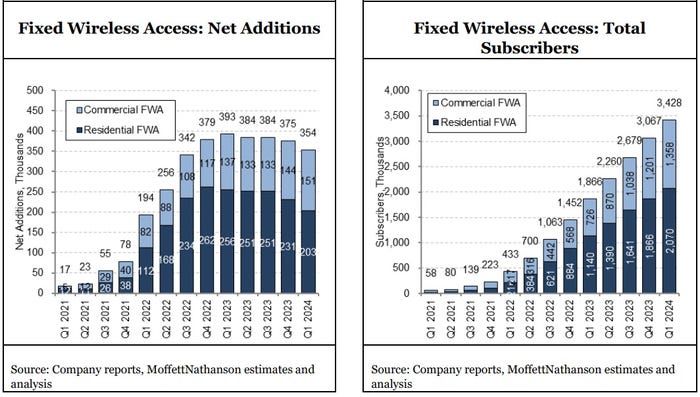

Verizon added 354,000 fixed wireless access (FWA) customers in Q1 2024, ending the period with 3.42 million. Record additions of business FWA subs were offset by a slowdown in the residential category.

Verizon’s overall FWA results “remain a puzzle,” MoffettNathanson analyst Craig Moffett explained in a research note (registration required).

“Growth [in FWA] is still relatively strong, but their quarterly results continue to decelerate, something we wouldn’t have expected given the early stage of their Band 76 C-Band footprint,” he noted.

Still, Verizon’s FWA offering continues to provide a solid alternative to cable broadband in the residential segment, despite some “muted activity,” CFO Tony Skiadas said on Monday’s earnings call. “We continue to be comfortable with this pace of [subscriber] growth.”

With respect to wireline, Verizon added 49,000 residential FiOS Internet customers, down from a gain of 63,000 a year earlier. Verizon ended the quarter with 7.02 million residential Fios Internet subs. With DSL losses included, Verizon added 36,000 wireline broadband customers in the period, extending its total to 7.22 million.

Verizon Business:

- Total Verizon Business revenue was $7.4 billion in first-quarter 2024, a decrease of 1.6% year over year, as increases in wireless service revenue were more than offset by decreases in wireline revenue and wireless equipment revenue.

- Business wireless service revenue in first-quarter 2024 was $3.4 billion, an increase of 2.7% year over year. This was driven by continued strong net additions in the quarter for both mobility and fixed wireless, as well as benefits from pricing actions implemented in recent quarters.

- Business reported 178,000 wireless retail postpaid net additions in first-quarter 2024, including 90,000 postpaid phone net additions.

- Business wireless retail postpaid churn was 1.51 percent in first-quarter 2024, and wireless retail postpaid phone churn was 1.13 percent.

- Business reported 151,000 fixed wireless net additions in first-quarter 2024, representing a 10.2 percent increase from first-quarter 2023. This marked their best quarterly result to date.

- In first-quarter 2024, Verizon Business operating income was $399 million, a decrease of 27.6 percent year over year, and segment operating income margin was 5.4 percent, a decrease from 7.4 percent in first-quarter 2023. Segment EBITDA in first-quarter 2024 was $1.5 billion, a decrease of 7.2 percent year over year, driven by wireline revenue declines. Segment EBITDA margin in first-quarter 2024 was 20.7 percent, a decrease from 22.0 percent in first-quarter 2023.

References:

https://www.lightreading.com/fixed-wireless-access/verizon-s-fwa-business-loses-some-steam-in-q1

Verizon’s 2023 broadband net additions led by FWA at 375K

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

One thought on “Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results”

Comments are closed.

ABI Research expects 5G fixed wireless access (FWA) CPE shipments to increase from 10.7 million in 2023 to 36.8 million by 2029 with a CAGR of 22.9 per cent, due in part to increased uptake by businesses.

Larbi Belkhi, an industry analyst at ABI Research, highlighted the US market as a success story for 5G FWA with Verizon, AT&T and T-Mobile US on track to hit their targets for connections.

He stated those connections are “achieved by serving customers with a multi-vendor portfolio of CPEs for their varying requirements.”

https://www.mobileworldlive.com/5g/abi-forecasts-surge-in-5g-fwa-cpe-shipments/

The company also noted enterprise FWA announcements have gained traction in 2024, especially in the US market where operators are diversifying their offerings.

ABI cited AT&T adding Askey and Cisco 5G FWA gear to its enterprise offerings as proof of the uptake this year while T-Mobile picked a Cradlepoint 5G router for its business customers.

Belkhi stated the business sector, particularly small-to-medium sized business (SMBs), “is a fast-growing opportunity for FWA, especially in the US”.

“The faster deployment and scalability it offers makes it particularly attractive for SMBs, but they have more nuanced requirements than simply just performance and price, so CPE vendors diversifying offerings to serve this market is key to success,” he explained.

Globally, ABI Research forecast 5G FWA subscriptions to hit 118 million by 2029, around 45 per cent of total users at that point.

https://www.mobileworldlive.com/5g/abi-forecasts-surge-in-5g-fwa-cpe-shipments/