Month: September 2014

Open Networking NOT truly OPEN without industry accepted Standards & APIs; Role of OpenStack Foundation?

There are so many flavors of “SDN” you can’t keep track of them. The term “SDN” has come to ONLY mean “software control of a network.” That could be anything and is a far cry from the original definition which included strict separation of the Control and Data planes, a “centralized controller” that computes paths for many packet forwarding engines (Data plane implementations) and a standardized API (Open Flow v1.3) as the “southbound API” between the Control and Data Planes.

What Guru Parulker of Stanford University called “SDN Washing” (non pure forms of SDN) have come to dominate the industry. There are network overlay models with multiple instances of Control planes, network virtualization (overlay of a logical network over a physical network) using VMware technology or VxLAN tags, and extensions of proprietary, closed network equipment to accomodate some degree of user control over the network configuration and paths.

I don’t think AT&Ts SDN WAN uses Open Flow or even a centralized SDN controller to compute paths/routes for multiple data forwarding “engines.” Instead, they use a proprietary, dynamic routing protocol as described in this article: http://viodi.com/2014/09/18/atts-sdn-wan-as-the-network-to-access-deliver-cloud-services/

What Standards are Required for SDN:

IMHO, Open networking imples multi-vendor interoperability, which requires standards for functionality, protocols, APIs, and interfaces that are in the public domain. I believe the following standards are needed for SDN:

1. API/protocol between the Control Plane entity and the Data Plane entity (Open Flow v1.3????)

2. API/protocol between the Control Plane entity and the Management/Orchestration/Automation entity. It’s sometimes referred to as the “Northbound API” or “Management plane API”

There’s also OpenStack Networking API v2.0 (neutron) Reference

Summary of Light Reading’s NFV and the Data Center Conference- 16 Sept 2014

Note: This is a condensed summary of two previously published articles on this excellent conference.

http://viodi.com/category/weissberger/

Introduction:

The telco data center [1] (DC) is likely to be the first place network operators deploy Network Virtualization/Network Functions Virtualization (NFV). That was the opening statement at the Light Reading conference on NFV and the Data Center, held Sept 16, 2014 in Santa Clara, CA. A network virtualized data center was defined by the conference host as a “cloudified DC which integrates virtualized telecom network functions utilizing Virtual Network Functions (VNF) or Distributed VNFs.”

Note 1. Larger network operators (e.g. AT&T, Verizon) already operate “telco DCs” for web hosting, storage, cloud computing, managed services, and back end network management/OSS/BSS. It will be easier for them (compared to those operators with no DC) to implement a NFV based telco DC. See Heavy Reading Survey results below for more details on this topic.

Concepts and reference architectures from the ETSI NFV specifications group were predicted to alter the data center from a siloed IT-centric model (separate compute /storage/ networking equipment) to a harmonized network and IT domain model, in which virtualized telecom functions, e.g. policy control and application orchestration, are added to the growing list of computing demands on servers. According to Light Reading, NFV will drive an entirely new set of storage, automation, management, and performance requirements, which are only now starting to be defined.

[One must assume that these VNF’s will be implemented as software in the DC compute servers, perhaps with some hardware assist functionality. Realizing that vision will eliminate a lot of network equipment (hardware) in a telco’s DC and provide much more software control of network functions and services.]

Key industry trends discussed at this excellent 1 day conference included:

•The need for service providers to shorten their service delivery cycles and adopt agile approaches to delivering new services.

•The key role that automation of network processes will play in helping operators deliver more user control and network programmability.

•Taming network complexity remains a significant challenge.

•Services in the era of virtualization must still maintain security and reliability for which telecom has been known.

Key findings from Heavy Reading’s January 2014, multi-client study are presented. Next, we summarize network operator keynotes from Century Link. Part 2. will review the Orange, and NTT Communications keynotes as well as our summary and conclusions.

Panel Discussion:

NFV requires operators to find new ways of looking at basic network attributes like performance, reliability and security. For example, performance metrics may change in migrating to NFV – from raw/aggregate performance to performance per cubic meter, or performance per watt. Virtualization will transform many ways of configuring and managing network resources.

However, a business case must be established for an operator to move towards network virtualization/NFV/NVFs. The cost and ROI must be justified. Heavy Reading analyst Roz Roseboro opined that projects which get funded are those that will affect the top line, meaning increased revenues from new and existing services. In that sense, NFV is more likely to get funding than SDN, because it will greatly help an operator increase service velocity/time to market and thereby realize more money. SDN is more about OPEX reductions and efficiency she said.

Century Link Keynote: James Fege, VP of Network Strategy & Development

CenturyLink is counting on its Savvis acquisition to make them hugely successful in cloud computing and to build a “cloudified” telco DC for traditional network services. Acquired in 2011, Savvis is a separate vertical entity within CenturyLink (which includes the former Embarq, U.S. West, Qwest and other companies. CenturyLink has successfully integrated the cloud orchestration and software development of Tier 3, and the platform-as-a-service capabilities of AppFog in their cloud computing capabilitites).

According to Feger, “Cloud is not ‘rust resistant.’ It must be: programable, self-service, and offer on-demand services.”

The CenturyLink Cloud process and operations involve the following attributes:

- Agile methodology

- 21- to 30-day release cycles

- DevOps team2

- Minimum viable product (not explained)

- Building block architecture which is API based

- Constant feedback to improve operations and services

Note 2: While network operations is traditionally a stand-alone function with dedicated staff, the DevOps model eliminates the hand-off from development to operations, keeps the developers in the feedback loop, and incentivizes developers to resolve problems or complications on their own instead of passing them to the Operations department.

The realization of the above cloud attributes is via open applications programming interfaces to software that exists above the physical network. Open source software will allow developers to offer their apps or services regardless of the underlying infrastructure, Feger said. He was firm in his view that “agility combined with our network platform is CenturyLink’s differentiator.”

Feger was quite honest during his talk. He confessed that the service cycles on the network side are still measured in months, not weeks or days. By incorporating the agile technology approaches of the CenturyLink Cloud and the use of a DevOps model, CenturyLink hopes to improve on that. But not this year or next.

“It will be a multi-year project to migrate our network to a cloud like set of capabilities, while minimizing (existing) customer disruptions.”

The take away here is that CenturyLink is attempting to leverage their highly regarded cloud capabilities to offer “cloud-like” L1 to L3 network services, e.g. IP MPLS VPN, Ethernet services, private line (e.g. T1/T3/OC3), broadband Internet access, video, and other wire-line services. Service delivery times must become a lot shorter, while programmability, orchestration, and automation are necessary components to make this happen.

Orange Keynote: Christos Kolias, Sr. Research Scientist, Orange – Silicon Valley

Christos first described the the NFV Concept and Vision from his perspective as a founding member of the ETSI NFV specifications group. It’s a quantum shift from dedicated network equipment to” virtual appliances.”

In the NFV model, various types of dedicated network appliance boxes (e.g. message router, CDN equipment, Session Border Controller, WAN acceleration, Deep Packet Inspection (DPI), Firewall, Carrier grade IP Network Address Translation (NAT), Radio/Fixed Access Network Nodes, QoS monitor/tester, etc.) become “virtual appliances,” which are software entities that run on a high performance compute server.

In other words, higher layer network functions become software based virtual appliances, with multiple roles over the same commodity hardware and with remote operation possible. “It’s a very dynamic environment, where (software based) network functions can move around a lot. It’s extremely easy to scale,” according to Christos.

[One assumes that each such virtual appliance would have an open or proprietary API for orchestration, automation, and management of the particular function(s) performed.]

A few examples were cited for a network virtualized telco DC:

• Security functions: Firewalls, virus scanners, intrusion detection systems, spam protection

•Tunnelling gateway elements: IP-SEC/SSL VPN gateways

•Application-level optimization: Content Delivery Networks (CDNs), Cache Servers, Load Balancers, Application Accelerators, Application Delivery Controllers (ADCs)

•Traffic analysis/forensics: DPI, QoE measurement

•Traffic Monitoring: Service Assurance, SLA monitoring, Test and Diagnostics

Note: This author DESPISES TLAs=three letter acronyms. In many cases, the TLA used in a presentation/talk is much more recognizable in another industry, e.g. ADC =Analog to Digital Converter, rather than Application Delivery Controller. Hence, I’ve tried to spell out most acronyms in this and the preceeding article on the NFV conference. It takes a lot of effort as I’m not familiar with most of the TLAs used glibly by speakers.

Kolias said that the migration from network hardware to software based virtual appliances won’t be easy. Decoupling NVFs from underlying hardware presents management challenges: services to NFV mapping, instantiating VNFs, allocating and scaling resources to VNFs, monitoring VNFs, support of physical/software resources.

NFV components in a virtualized telco DC might include: server virtualization, management and orchestration of functions & services, service composition, automation, and scaling (up and/or down according to network load). There are lots of servers, storage elements, and L2/L3 switches in such a DC. There’s also: security hardware (firewalls, IDS/IPS), load balancers, IP NAT, ADC, monitoring, etc.

NFV in the Data Center will be more energy efficient, according to Kolias. “It’s the greenest choice for an operator,” Christos said. With many fewer hardware boxes, NFV can bring the most energy efficiency to a data center (less energy consumed and lower cooling requirements). That’s a top consideration for those massively power-hungry DC facilities. “You have to dispose of telecom hardware, but when we move things into software, it becomes more eco-friendly,” Kolias said. “So yes, there is absolutely a fit for NFV in the Data Center,” he concluded.

Christos thinks it’s probably easier and faster to implement NFV in a telco DC, because there’s less compliance/ regulation and it’s a less complex environment – both technically and operationally.

Service chaining was referred to as “service composition and insertion,” with policies determining the chain order. Customized service chains are possible with NFV, Kolias added. Ad-hoc, on-demand, secure virtual tenant networks are also possible. For example, tunnels/overlays using the VxLAN protocol (spec from Arista, VMWare and Juniper).

Kolias also cited other benefits of “cloudification” — a term he admittedly hates. “For example, consolidating multiple physical network infrastructures in a cloud-based EPC (LTE Evolved Packet Core) can lead to less complexity in the network and produce better scalability and flexibility for service providers in support of new business models,” he noted.

Several other important points Christos made about NFV in the telco DC:

1. Virtual switches can be key functional blocks for management of multiple virtual switches and for programmable service chains.

2. The Control plane could become part of management and orchestration in a unified, policy-based management platform, e.g. OpenStack.

[That’s radically different than the pure SDN model (Open Network Foundation), where the Control plane resides in a separate enitity, which communicates with the Management/ Orchestration platform (e.g. OpenStack) via a “Northbound” API.]

3. Hardware acceleration can play a role in Network Interface Cards (NICs) and specialized servers. However, they should be programmable.

4. Challenges include: Performance (e.g. increased VM-VM traffic requirements), Security Hybrid environment, and Scaling.

APIs will be important for plug-n-play, especially for open platforms like Google, Facebook, Microsoft, eg. WebRTC. They can enable a plethora of innovative (e.g. ad-hoc/customized) services and lead to new business models for the telcos. That would translate into monetization opportunities (e.g. for new residential and business/ enterprise customers, virtual network operators (VNOs), and others) for service providers.

Christos predicts that many service providers will move from function/service based networks to app-based models. They will deploy resources, including Virtual Network Functions (VNFs) on-demand, as an application when the user needs them. He predicted that smart mobile devices and the Internet of Things (IoT) will precipitate the adoption of APIs for telco apps.

Kolias summed up: “NFV can propel the move to the telco cloud. When this happens we will have succeeded as an NFV community! NFV removes the boundaries and constraints in your infrastructure. It breaks the barriers and opens up unlimited opportunities.”

NTT Com Keynote: Chris Eldredge, Executive VP of Data Center Services for NTT America (NA subsidiary of NTT Com)

Background: NTT Com is one of the largest global network providers in the world, in third place behind Verizon and AT&T. They provide global cloud services, managed services, and connectivity to the world’s biggest enterprises. NTT Com has a physical presence in 79 countries, $112B in revenues, and 242K employees. It’s network covers 196 countries and regions. The company spent $2.5B in R&D last year, with a North American R&D center in Palo Alto, CA. Finally, they claim to be the #1 global data center and IP backbone network provider in the world. [Chris said Equinix has more total square footage in their data centers than NTT, but they don’t have the IP backbone network.]

NTT Com’s enterprise customers mostly use cloud for development and test applications. “It’s bursty in nature. They turn it up and turn it down,” Eldredge said. It’s also used for OTT broadcasts of sporting events and concerts. On January 1, 2014, NTT spun up 200,000 virtual machines (VMs) to meet demand for Europeans watching soccer matches on their mobile devices. After the soccer match was over, those VMs were de-activated.

With the Virtela acquisition, NTT Com has recently deployed their version of NFV capabilities in both their DCs and global network along with SDN based provisioning.

“SDN/NFV is a more scalable network technology that NTT Com is now using to provide cloud and managed services to a broad range of clients,” Eldredge said. “It allows us to specialize and provide custom solutions for our customers,” he added.

The NFV (higher layer) services NTT Com is now offering include: virtual firewall, network hosted applications accelerator, Secure Sockets Layer (SSL) VPN, IP-SEC gateway, automated customer portal (for full control of services, self deployment, self management, and full visibility), on premises harware based managed services which provide a fully integrated managed solution for NTT Com customers.

The above NFV enabled services can be easily applied, monitored and rapidly changed. NTT Com can customize applications performance and service levels for specific users and profiles. In conclusion, Chris said that “NFV has become the next phase of the virtualized DC, extending the enterprise DC into the cloud. [Such an extension, by definition, would be a hybrid cloud]

In answer to this author’s question on when and if NTT Com would use NFV to deliver pure (L1-L3) network connectivity services, Chris confessed that it wasn’t on their roadmap at this time.

Summary and Conclusions:

Operators are planning for NFV and some – like NTT Com – already have implemented several NFV enabled services. Examples of NFV capabilities were clearly stated by Kolias of Orange Silicon Valley and Eldredge of NTT Com. It starts with higher layer (L5-L7) network functions/capabilities, cloud and managed services. However, it will take considerable time before the entire network is virtualized. “NFV everywhere by 2020” is too aggressive, according to some. And don’t expect mainstream connectivity functions (including Carrier Ethernet services, private lines, circuit switching, etc) to be virtualized anytime soon.

Early NFV adopters will be challenged as they work through internal issues like breaking down their organizational silos and adapting their business models to a quicker, more agile manner of provisioning and controlling network resources and services.

What happens to the network IT guy when the majority of network equipment disappears and is transformed into virtual appliances? Who maintains a compute server that’s also implementing many higher layer networking functions? What trouble shooting tools will be available for NFV entities?

Automation and self service are crucial for the network operator to deploy services quicker and hence realize more revenues. CenturyLink’s Feger said it best: “If you’re on a nine-month release strategy, your network isn’t really programmable.”

“Agility is an asset. You can only tame complexity,” noted Heavy Reading analyst and event host Jim Hodges, who quoted Brocade’s Kelly Herrell from an earlier presentation. “As an industry, we realize complexity is an inherent part of what we’re doing, but it’s something we have to address.”

Infonetics: Data center and enterprise SDN market soars 192% year-over-year; Largest SDN in China

Infonetics Research released excerpts from its 2014 Data Center and Enterprise SDN Hardware and Software report, which defines and sizes the market for software-defined networks (SDN).

SDN MARKET HIGHLIGHTS:

. Vendors are seeding the market with SDN-capable Ethernet switches in the data center and enterprise LAN

. The leaders in the SDN market will be solidified during the next 2 years, as 2014 lab trials give way to live production deployments

. Bare metal switches are the top in-use for SDN-capable switch use case in the data center and are anticipated to account for 31% of total SDN-capable switch revenue by 2018

. Infonetics forecasts the “real” market for SDN-that is, in-use for SDN Ethernet switches and controllers-to reach $9.5 billion in 2018

. The adoption of SDN network virtualization overlays (NVOs) is expected to go mainstream by 2018

ANALYST NOTE:

“There is no longer any question about software-defined networking (SDN) playing a role in data center and enterprise networks. Data center and enterprise SDN revenue, including SDN capable Ethernet switches and SDN controllers, was up 192% year-over-year (2013 over 2012),” reports Cliff Grossner, Ph.D., directing analyst for data center, cloud, and SDN at Infonetics Research. “The early SDN explorers-NEC in Japan and pure-play SDN startups in North America-were joined in 2013 by the majority of traditional switch vendors and server virtualization vendors offering a wide selection of SDN products.”

“Even more eye opening,” continues Grossner, “In-use for SDN Ethernet switch revenue, including branded Ethernet switches, virtual switches, and bare metal switches, grew more than 10-fold in 2013 from the prior year, driven by significant increases in white box bare metal switch deployments by very large cloud service providers such as Google and Amazon.”

ENTERPRISE SDN AND DATA CENTER REPORT SYNOPSIS:

Infonetics’ annual data center and enterprise SDN report provides worldwide and regional market size, forecasts through 2018, analysis, and trends for SDN controllers and Ethernet switches in use for SDN. Notably, the report tracks and forecasts SDN controllers and Ethernet switches in-use for SDN separately from SDN-capable Ethernet switches. The report also includes significant SDN vendor announcements. Vendors tracked: Alcatel-Lucent, Big Switch, Brocade, Cisco, Cumulus, Dell, Extreme, HP, Huawei, IBM, Juniper, Midokura, NEC, Pica8, Plexxi, PLUMgrid, Vello Systems, VMware, others.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

RELATED ARTICLE:

Huawei and 21Vianet Collaborate to Launch China’s Largest Commercial SDN Network

RELATED REPORT:

87% of medium and large N. American enterprises surveyed by Infonetics intend to have SDN live in the data center by 2016 http://www.infonetics.com/pr/2014/SDN-Strategies-Survey-Highlights.asp

“Software-defined networking (SDN) spells opportunity for existing and new vendors, and the time to act is now. The leaders in the SDN market serving the enterprise will be solidified during the next two years as lab trials give way to live production deployments in 2015 and significant growth by 2016. The timelines for businesses moving from lab trials to live production for the data center and LAN are almost identical,” notes Cliff Grossner, Ph.D., directing analyst for data center, cloud, and SDN at Infonetics Research.

“There’s still some work to do on the part of SDN vendors. Expectations for SDN are clear, but there are still serious concerns about the maturity of the technology and the business case. Vendors need to work with their lead enterprise customers to complete lab trials and provide public demonstrations of success.”

SDN SURVEY HIGHLIGHTS (July 2014):

- Infonetics’ enterprise respondents are expanding the number of data center sites and LAN sites they operate over the next 2 years and are investing significant capital on servers and LAN Ethernet switching equipment

- A majority of survey respondents are currently conducting data center SDN lab trials or will do so this year; 45% are planning to have SDN in live production in the data center in 2015, growing to 87% in 2016

- Respondents’ plans for LAN SDN are nearly identical to their data center plans

- Among respondents, the top drivers for deploying SDN are improving management capabilities andimproving application performance, while potential network interruptions and interoperability with existing network equipment are the leading barriers

- Meanwhile, enabling hybrid cloud is dead last on the list of drivers, a sign that SDN vendors have some work to do in educating enterprises that SDN can be an important enabler of hybrid cloud architectures

- On average, 17% of respondents’ data center Ethernet switch ports are on bare metal switches, and only 21% of those are in-use for SDN

- Nearly ¼ of businesses surveyed are ready to consider non-traditional network vendors for their SDN applications and orchestration software

RELATED RESEARCH:

- 87% of medium/large N.A. enterprises say they intend to have SDN in data center by 2016 (see above summary)

- $1 trillion to be spent on telecom and datacom equipment and software over next 5 years

- SDN and NFV to bring about shift in data center security investments

Summary of Michael Howard’s NFV migration talk at 2014 Hot Interconnects:

http://viodi.com/2014/09/05/2014-hot-interconnects-hardware-for-software-defined-networks-nfv-part-ii/

INFONETICS WEBINARS:

Visit www.infonetics.com/infonetics-events to register for upcoming webinars, view recent webinars on-demand, or learn about sponsoring a webinar.

. Making Your Network Run Hotter With SDN (View on-demand)

. NFV: An Easier Initial Target Than SDN? (View on-demand)

. SDN and NFV Roundup of Trials and Deployments (Oct. 23: Learn More)

. SDN: vSwitch or ToR, Where is the Network Intelligence, and Why? (Oct. 30: Sponsor)

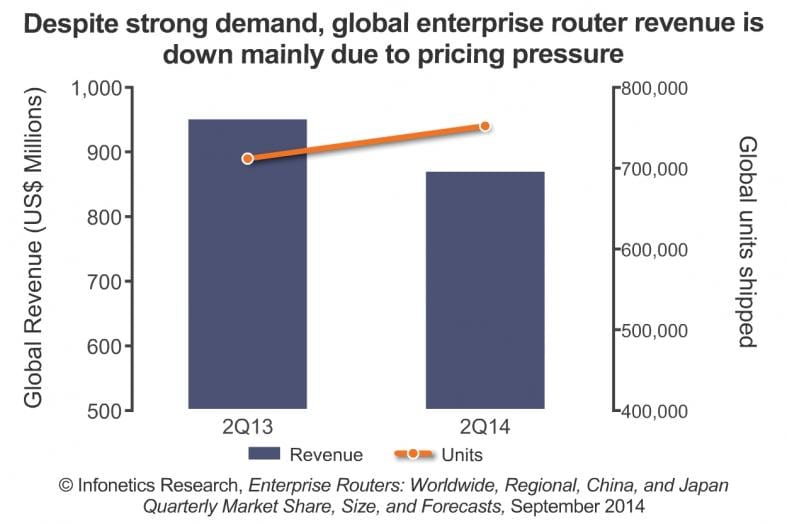

Enterprise Router Market Declines 9% while Service Provider Edge Router Market gains 4% Y-o-Y

Infonetics Research released excerpts from its 2nd quarter 2014 (2Q14) Enterprise Routers report, which tracks high end, mid-range, branch office, and low-end/SOHO router revenue and ports. There was no seasonal rebound in enterprise router sales in 2Q14, as the market was down 9% from one year ago.

2Q14 ENTERPRISE ROUTER MARKET HIGHLIGHTS:

. Worldwide enterprise router revenue totaled $867 million in 2Q14, just a 1% sequential gain in a quarter that typically sees a strong seasonal pickup; Unit shipments are still growing, up 6% year-over-year

. Meanwhile, enterprise router sales dipped 9% in 2Q14 from the year-ago quarter (2Q13)

. The good news in 2Q14: demand for higher-performance routers was strong; High-end and mid range router unit shipments were up by double digits year-over-year, while branch office and low-end routers posted more muted growth

. Asia Pacific is once again the top-performing region for enterprise routers in 2Q14; North American sales tumbled 19% year-over-year, and EMEA sales fell 11%

. U.S. vendor performance for enterprise routers was mostly down on a year-over-year basis in 2Q14, while Chinese vendors gained as preferences in China shift to local vendors Huawei and ZTE as well as the H3C division of HP

ANALYST NOTE:

“For the second quarter in a row, enterprise router sales disappointed, and revenue is now trending downward. Demand for routers is still strong, as indicated by rising unit shipments, but discount pressure, preferences for local and lower-cost vendors in China, and lower public sector sales drove down revenue,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research.

ENTERPRISE ROUTER REPORT SYNOPSIS:

Infonetics’ quarterly enterprise router report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for high-end, mid-range, branch office, and low-end/SOHO router revenue and ports. Vendors tracked: Adtran, Alcatel-Lucent, Brocade, Cisco, HP, Huawei, Juniper, NEC, OneAccess, Yamaha, ZTE, others.

To buy report, contact Infonetics:

www.infonetics.com/contact.asp.

RELATED REPORT EXCERPTS:

. Cloud is our number-one networking initiative, say enterprises in Infonetics’ latest survey

. Tight battle for 2nd after Cisco in Infonetics’ enterprise networking infrastructure scorecard

. $1 trillion to be spent on telecom and datacom equipment and software over next 5 years

. Infonetics releases Global Telecom and Datacom Market Trends and Drivers report

. Enterprise router market off to a rough start, plunges 14% sequentially

In sharp contrast to the enterprise router market, Dell’Oro Group,reports that the Service Provider Edge Router market grew to its highest level ever, gaining four percent in the second quarter of 2014 versus the year-ago period, contributing to a record quarter for the Service Provider Router market overall.

“Demand drivers varied by country as all regions grew versus last year,” said Alam Tamboli, Senior Analyst at Dell’Oro Group. “In the United States, demand for routers in the backhaul for LTE networks has been one of the primary motives for investment in recent years, however this quarter service providers in the region also invested heavily into fixed networks. In much of the world, routers used for LTE mobile backhaul networks continued to drive investment in the edge,” Tamboli added. –

The top Four SP Router Vendors Combined Accounted for Over 93% of the Market

:#1 Cisco Systems: Remained the first-ranked vendor with increased revenue into EMEA and Asia.

#2 Alcatel-Lucent: Achieved record Service Provider Edge Router sales, increasing revenue in every major region.

#3 Juniper Networks: Delivered a record quarter in Edge Router revenues driven primarily by sales into North America.

#4 Huawei Technologies: Saw a shift in demand as Service Providers in its domestic market, China, focused on mobile backhaul and cut back on routers for fiber deployments.

More info at: http://www.delloro.com/news/service-provider-edge-router-market-reaches-record-levels