Month: December 2013

FBR’s Scott Thompson expects strong Optical Networking Market in 2014

Traditional communications equipment companies may struggle through a challenging environment in lower-growth markets over the course of the upcoming year. However, we expect the optical space to experience stronger performance in 2014 versus 2013 as several catalysts combine to drive what will likely be one of the strongest optical cycles the industry has seen in more than two decades.

Additionally, we are in the early stages of a larger shift in the way large-scale data networks are built, in which the new architecture enables more intelligence and flexibility at the optical layer and creates savings at the switching and routing layers. The optical sector is likely to benefit significantly from the shift, potentially beyond what industry analysts are currently forecasting. We believe the optical network business cycle is still several quarters from a peak.

Packet networking, architecture shift, SONET to OTN transition, and hyperscale builds combine to deliver a more balanced, profitable, and prolonged upgrade cycle. Previous upgrade cycles have often been driven by large long-haul backbone upgrades and a mix of optical switching during a relatively short four- to -six-quarter cycle. We expect this cycle to be different, as it is driven by more diversified sources of demand, driving a more profitable mix of optical and electrical switching targeted at creating “large pools of intelligent optical bandwidth,” according to management.

As a result, we expect that growth rates across the sector may prove to be conservative, driving revenue growth well above the current consensus estimates for the sector.

Related networking forecasts from Ovum:

• Telcos will gain confidence to expand software-defined networking (SDN), network virtualization, and network functions virtualization (NFV) trials and early deployments. In 2014, new and revised standards and specifications related to software-defined networking (SDN), network virtualization, and network functions virtualization (NFV) will bring the industry closer to consensus.

• Lower-cost coherent optical metro solutions will hit the market in 2014. Network value will increasingly be driven by software-tunable capabilities, allowing new possibilities for transport network optimization and monetization.

http://ovum.com/press_releases/ovum-predicts-revenue-growth-and-resource…

Related market research from Infonetics:

Global Optical Network Hardware Sales Down, but Up in North America

https://techblog.comsoc.org/2013/11/21/global-optical-network…

Infonetics: 87% of Mobile Operators have Deployed Self Organizing Networks

Infonetics Research released excerpts from its 2013 SON and Optimization Strategies: Global Service Provider Survey, for which Infonetics interviewed wireless, incumbent, and competitive operators around the world about their network optimization strategies and self-organizing network (SON) deployment plans.

SON AND OPTIMIZATION SURVEY HIGHLIGHTS:

. 87% of operators participating in Infonetics’ survey have deployed SON in their networks, up 27% from a year ago

. SON is building momentum in 3.5G network optimization: A few large incumbents have already deployed SON as the key optimization tool for their 3.5G networks, and this trend appears unstoppable

. A large majority of operator respondents view “overall implementation” as the #1 technical challenge when implementing SON

. Two-thirds of respondents are evaluating centralized SON (C-SON) vendors Celcite and InfoVista to manage their distributed SON (D SON) LTE networks

. By 2015, 100% of those surveyed plan to use network- and handset/subscriber-based tools for mobile network optimization, reflecting the growing influence of SON on network self-learning

ANALYST NOTE:

“Mobile operators know they need to keep network operating expenses under control, and they’re placing a big bet on SON while acknowledging the complexity of and their unease with automation that minimizes human intervention and maximizes computerization,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

“Nonetheless, the ultimate goal is to use cell planning and field testing for zero-touch, self-healing networks,” Téral continues, “But it’ll take some time to get there. SON’s just started, after all.”

SON SURVEY SYNOPSIS:

For its 28-page SON and optimization survey, Infonetics interviewed independent wireless, incumbent, and competitive operators in EMEA, North America, Asia, and Latin America about their network optimization strategies and SON deployment plans. The study provides insights into SON features, drivers, implementation barriers, technical challenges, and vendors. Operators surveyed together represent 1/3 of the world’s telecom capex and carrier revenue and 25% of all mobile subscribers.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

A related Infonetcs report – 2013 Self-Organizing Networks (SON) and Optimization Software – tracks SON software by generation (3G, 4G) and by architecture (centralized, distributed) as well as 2G and 3G optimization software for the mobile network optimization market.

SON AND OPTIMIZATION SOFTWARE MARKET HIGHLIGHTS

. Following 17% growth in 2012 driven by major deployments at AT&T and KDDI and many smaller deals, the global mobile network optimization and self-organizing network (SON) market is on track to grow 13% in 2013

. In a large majority of cases, 3G network optimization, rather than LTE alone, is a key driver for using SON mobile network optimization and self-organizing network (SON) market is on track to grow 13% in 2013

. Over 80% of mobile operators worldwide are using SON for 3G/HSPA/HSPA+ optimization mobile network optimization and self-organizing network (SON) market is on track to grow 13% in 2013

. Centralized SON (C-SON) is predominant in optimization schemes

. The burgeoning SON segment of the market tripled in 2012

. Infonetics forecasts optimization and SON software to grow to nearly $5 billion by 2017

ANALYST NOTE:

“Self-organizing networks (SON) remain baked in LTE, but as an evolutionary 3GGP technology, SON will continue to evolve, offering more and more advanced features. So deploying SON for 3G optimization – with the zero-touch network as the long-term goal – is something that’s natural and logical for many operators,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Téral adds: “There is at least one cumbersome task, however, that can’t be easily automated and will require human intervention for quite a long time: drive testing. Our discussions with large mobile operators confirm there’s no way to replace today’s rudimentary technique of having a crew cruising a neighborhood in a truck to measure what’s going on.”

SON AND OPTIMIZATION SOFTWARE REPORT SYNOPSIS:

Infonetics’ annual SON and optimization software report provides worldwide and regional market size, forecasts through 2017, analysis, and trends for the mobile network optimization market, including 2G and 3G optimization software and self-organizing network software by generation (3G, 4G) and by architecture (centralized, distributed). The report includes a mobile subscriber forecast (2G/3G/4G subscribers), a specialist vendor snapshot, and SON use cases from the Next Generation Mobile Networks (NGMN) Alliance.

The report tracks Tier 1 mobile infrastructure vendors with mobile network optimization tools, including Alcatel-Lucent, Ericsson, Huawei, NSN, Samsung, and ZTE, as well as specialist vendors: Actix/Amdocs, Aircom International, Airhop Communications, Aricent, Ascom, Astellia, Axis Technologies, Celcite, Cellwize, Celtro, Centri, Cisco (Intucell, Ubiquisys), Commsquare, Eden Rock Communications, Forsk, Infovista, InterDigital, JDSU/Arieso, Newfield Wireless, Optulink, P.I.Works, Plano Engineering, Reverb Networks, Schema, Teoco/Schema, Theta Networks, TTG International, Tulinx, Vector, and Xceed Technologies.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Carrier WiFi: Market Research firms draw different conclusions..

Infonetics Research released excerpts from its latest Carrier WiFi Equipment report, which tracks WiFi equipment deployed by operators in public spaces for wireless internet access.

CARRIER WIFI EQUIPMENT MARKET HIGHLIGHTS:

. Globally, revenue for carrier WiFi equipment, including carrier WiFi access points and WiFi hotspot controllers, totaled $338 million in the first half of 2013 (1H13)

. Carrier WiFi revenue has already surpassed 2/3 of total revenue for the prior year

. The majority of carrier WiFi access points are WiFi hotspots

. North America has consistently dominated carrier WiFi revenue share since 2007, though by 2017 regional share shifts to Asia Pacific and EMEA

. As the carrier WiFi market evolves and more operators launch carrier WiFi services, Infonetics expects fluctuations in market share, with the top 5 positions-currently held by Cisco, Ericsson, Huawei, Ruckus, and Alcatel-Lucent-potentially shuffled

ANALYST NOTE:

“Over the 5 years from 2013 to 2017, operators will spend a cumulative $8.5 billion on carrier WiFi equipment, led by mobile operators using carrier WiFi for data offload,” said Richard Webb, directing analyst for microwave and carrier WiFi at Infonetics Research. “This strong growth will gain additional impetus from the proliferation of small cells with integrated WiFi over the coming years.”

REPORT SYNOPSIS:

Infonetics’ carrier WiFi report provides worldwide and regional market size, market share, forecasts through 2017, analysis, and trends for WiFi hotspot controllers and WiFi-only and dual-mode cellular/WiFi access points. The report includes carrier WiFi vendor announcements and customer wins and a Mobile Operator WiFi Offload Strategies Tracker. Vendors tracked: Airspan, Alcatel-Lucent, Cisco, Aruba Networks, Edgewater Wireless, Ericsson (BelAir Networks), Huawei, Motorola Solutions, NSN, Ruckus Wireless, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

The “Wireless Network Infrastructure Bible: 2014 – 2020 – Macrocell RAN, Small Cells, RRH, DAS, Cloud RAN, Carrier WiFi, Mobile Core & Backhaul” report presents an in-depth assessment of 9 individual submarkets of the wireless network infrastructure opportunity. Besides analyzing the key market drivers, challenges, operator revenue potential, regional CapEx commitments, expert interviews and vendor strategies, the report also presents revenue and unit shipment forecasts for the market from 2014 to 2020 at a regional as well as a global scale. Historical figures are also provided for 2010, 2011 and 2013.

Key Findings:

The report has the following key findings:

- Between 2014 and 2020, the 2G, 3G & 4G wireless network infrastructure market is expected to grow at a CAGR of nearly 5%

- Vendors are increasing their focus on profit margins. Many are already cutting staff, embracing operational excellence, evolving their new business models, acquiring niche businesses and expanding their managed services offerings

- New CapEx commitment avenues such as HetNet infrastructure and virtualization will usher industry restructuring. The wireless network infrastructure market will consolidate so as to eliminate one of the current global players by 2020

- As wireless carriers look to offload traffic from their overburdened macrocell infrastructure, HetNet infrastructure will represent a market worth $43 Billion in 2020

- Operators will ramp up on backhaul, aggregation, transport, routing based on IP and Ethernet technologies for offering mobile broadband services

- Developing market growth will be a significant factor during the forecast period, with China and India seeing some of the highest levels of growth, both in terms of shipments and in the size of their installed base. After 2014, developing countries and their requirements will begin to shape future infrastructure technologies and architectures

- Due to the investments in a single RAN technology, future LTE investments will cost much less than early investments of the technology

- Supplemented with a drive towards virtualization, a limited amount of hardware installation will be needed when wireless carriers upgrade to LTE in the future

- From 2016 onwards wireless carriers and vendors will spend at least $1 Billion per annum in R&D spending to drive standardization and commercialization of 5G technology

- Voice over LTE (VoLTE) subscriptions will surpass 700 Million by 2020

In Nov 2013, Research & Markets released a similar report titled: Small cells & Carrier Wifi

The need for Wi-Fi offloading is assessed and the future for carrier Wi-Fi analyzed. The report also presents the firm’s mobile traffic forecasts and identifies the share of mobile traffic offloaded to Wi-Fi. There is also a synopsis in ppt format. The companies evaluated are:

– Airvana

– Alcatel-Lucent

– Broadcom

– Cisco

– Ericsson

– Huawei Technologies

– ip.access

– NEC Corporation

– NETGEAR

– Nokia Siemens Networks

– QUALCOMM

– Samsung Electronics

– UbeeAirWalk

– Ubiquisys

– ZTE

More info at: http://www.researchandmarkets.com/

Infonetics: SDN to play big role in Data Centers/Enterprise Networking; IEEE ComSocSCV Jan 8, 2014 Meeting: "Open Networking"

Introduction:

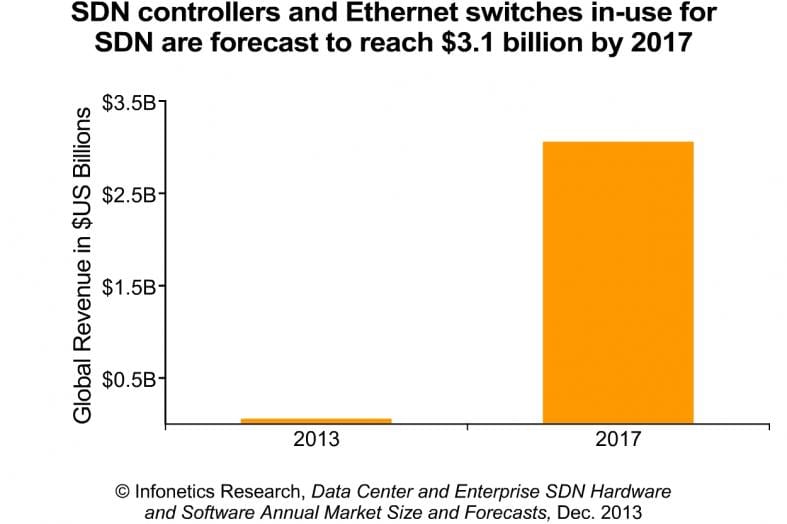

Infonetics Research released market size and forecasts from its new Data Center and Enterprise SDN Hardware and Software report, which defines and sizes the market for software-defined networks (SDN). The report provides data for important SDN market characteristics including product categories, definitions, and worldwide and regional market size. Notably, the report tracks and forecasts SDN controllers and Ethernet switches in-use for SDN – the ‘real’ market for SDN – separately from SDN-capable Ethernet switches.

The report also includes SDN market analysis, trends, vendor announcements, and a tracker of SDN products currently shipping.

ANALYST NOTE:

“The important question that everyone wants answered is, ‘What’s the real market for SDN?’,” says Cliff Grossner, Ph.D., directing analyst for data center and cloud at Infonetics Research. “It’s still early days, but our research over the last two years confirms that SDN controllers and Ethernet switches in-use for SDN will play a role in enterprise and data center networks, growing to a $3.1 billion market by 2017.”

“Wide scale in-use SDN deployments will occur first in the data center with large enterprises and cloud service providers, followed closely by the enterprise LAN,” continues Grossner. “We’re already seeing significant use cases for SDN in the enterprise LAN providing security and unification of wired and wireless networks, and enabling BYOD (bring your own device).”

DATA CENTER AND ENTERPRISE SDN MARKET HIGHLIGHTS:

- SDN is going through a classic market adoption cycle, with many new entrants looking to gain a toe-hold, and the majority of enterprises still kicking the tires.

- Vendors shipping SDN products in 2013 include Alcatel-Lucent, Big Switch, Brocade, Cisco, Cumulus, Dell, Extreme, HP, Huawei, IBM, Juniper, Midokura, NEC, Pica8, Plexxi, Plumgrid, VMware and others.

- The few early deployments for SDN-Google, NTT, AT&T, Verizon, DT, BT, and China Mobile-are in large data centers of cloud service providers and large enterprises.

- 10% of Ethernet switches will be in-use for SDN by 2017.

- North America is where SDN got its start, and the region will claim nearly 50% SDN revenue market share through 2017

To learn more or buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Jan 8, 2014 ComSoc SCV meeting on Open Networking will address SDN and other approaches to “Open Networking”….

Session Abstract:

“Open Networking” is a very popular industry initiative that aims to make networking equipment programmable and efficient while also lowering costs, especially OPEX.

In this new paradigm, network operators may choose the software to control their networks- independent of their choice of networking hardware. There have been several architectures proposed to realize “Open Networking,” including: Software Defined Networking (SDN)- with strict separation of data and control planes, Overlay models, Network Virtualization (& ETSI NFV), Linux based Network OS’s -with embedded control plane software- running on bare metal switches, and many vendor proprietary solutions.

In this highly informative session, executives from three “Open Networking” vendors (all private companies with no installed base to protect) will address the topic from different perspectives.

-Big Switch Networks CEO will present an overview of recent developments in SDN, describe architectures and use cases and give examples of recent production SDN deployment models;

–Arista Networks CTO will higlight the benefits of a Linux based network OS, including “closed Linux”, “Bare linux”, and “Open Linux”

-Plexxi Co-founder will describe an open policy control and state implementation facilitating true open networking (more than just “programming” network equipment).

The three presentations will be followed by a lively panel session where both pre-submitted and live audience questions/issues will be addressed.

Session Chair: Saurabh Sureka, ComSocSCV Vice Chair

Session Organizer: Alan J Weissberger, ComSoc Community Content Manager

For meeting details and RSVP instructions, please visit: http://comsocscv.org/

Please submit any questions or panel discussion topics to session chair Saurabh Sureka : [email protected]

More Broadband Deployments Needed for Economic Growth

The U.S. labor force is projected to grow slower than in the past, putting negative pressure on the overall rate of economic growth. Broadband-enabled innovations are among the most important drivers of productivity growth, which can help to counterbalance the effect of slower work force growth. Faster, smarter, and more secure broadband networks are critical enablers, providing a mechanism to gather, process, and disseminate valuable information, services, and products.

A primary objective of communications policy should be to encourage the rapid and efficient deployment of more and better broadband capability across the economy, enabling the wide adoption of productivity-enhancing innovations. The U.S. can accomplish this by removing barriers to investment by broadband providers, eliminating legacy burdens, and encouraging the migration to Internet Protocol networks.

AJW Comment: We feel the phase out of the PSTN and replacement with IP Telephony/fax will take much more time than people expect. We’ll provide the reasons why in a forthcoming blog post.

NSA snooping underscores need for multi-layered security in the data center: Google & Yahoo hit; Microsoft fights back!

“The most recent revelation that the NSA has been secretly siphoning data from Google and Yahoo! data centers worldwide has put a laser focus on the need for security at all levels of the data center, from layer 1 transport all the way up to individual applications and data. The world’s never been more tuned into privacy and security,” notes Jeff Wilson, principal analyst for security at Infonetics Research.

Infonetics just released excerpts from its latest Data Center Security Products report, which tracks data center security appliances and virtual security appliances.

DATA CENTER SECURITY MARKET HIGHLIGHTS

. While software-defined networks (SDN) and network functions virtualization (NFV) are forcing networking vendors to offer new form factors or to re-architect solutions, working with OpenFlow and other SDN technologies is an evolutionary change for security vendors, who have been adapting products for virtualized environments for over 5 years

. Global revenue for the ported virtual security appliances segment of the larger data center security appliance market grew 4% between the first and second quarters of 2013, to $107 million

. Purpose-built virtual security appliances are forecast by Infonetics to grow at a strong compound annual growth rate (CAGR) of 25% from 2012 to 2017

. The virtual appliance vendor landscape is crowded with a mix of established security players, virtualization platform vendors, and specialist vendors

DATA CENTER SECURITY REPORT SYNOPSIS

Infonetics’ biannual data center security report provides worldwide and regional market size, market share, forecasts through 2017, analysis, and trends for purpose-built virtual security appliances and multiple segments of ported virtual security appliances and data center security appliances. Vendors tracked: Arbor Networks, Blue Coat, Check Point, Cisco, Fortinet, GenieNRM, HP, ISS, Juniper, McAfee, Narus, SonicWall, Sourcefire, Stonesoft, Symantec, Trend Micro, WatchGuard, Websense, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

DATA CENTER SECURITY WEBINAR

Join Infonetics Dec. 10 for Data Center Firewalls: The New Performance Requirements, a live event that examines new high-speed, high-capacity data center security solutions: http://w.on24.com/r.htm?e=708420&s=1&k=93D3BBD5218FE00E14D1BCEDFE6834F7

Related articles:

19 Ways to Build Physical Security into a Data Center

http://www.csoonline.com/article/220665/19-ways-to-build-physical-security-into-a-data-center

Security Drives Major Transition in the Network and Data Center

http://blogs.cisco.com/security/security-drives-major-transition-in-the-network-and-data-center/

NSA infiltrates links to Yahoo, Google data centers worldwide

Internet Firms Step Up Efforts to Stop Spying

Microsoft fights back against NSA ‘snooping’

http://www.cnn.com/2013/12/05/tech/web/microsoft-nsa-snooping/

Microsoft’s General Counsel: N.S.A. Hacks Were an ‘Earthquake’ for Tech

Dell ‘Oro Group: Double-Digit Growth for Core Router Market Expected in 2014

According to a newly published report by Dell’Oro Group, the trusted source for market information about the networking and telecommunications industries, the Service Provider Core Router market grew by seven percent in the third quarter of 2013 versus the year-ago period. After almost two years of year-over-year declines, this second consecutive quarter of year-over-year growth reflected the increased emphasis service providers have placed on the backbone of their networks.

“All major core routing vendors have recently introduced, or will soon introduce new core routing platforms with significantly increased capacity,” said Alam Tamboli, Business Analyst at Dell’Oro Group. “We expect the confluence of these new products to drive the core router market to double-digit growth for the full-year 2014 as service providers qualify these new products for their networks,” added Tamboli.

Service Provider Core Router Market 3Q13—Top Four Vendors Comprise 98% Share

- #1 Cisco: remained the number-one ranked vendor and has introduced two new core routing platforms during the past six months.

- #2 Juniper: new product offerings gave the company a more complete core router product portfolio and spurred year-over-year growth in the third quarter.

- #3 Huawei: contract wins to provide its new higher capacity router to both domestic Chinese and international service providers drove year-over-year growth.

- #4 Alcatel-Lucent: held fourth place with sales of its first core routing product.

To purchase this report, please call Julie Learmond-Criqui at +1.650.622.9400 x244 or email [email protected]

Related Infonetics report: Carrier router/switch market roars back in 2Q13

http://www.infonetics.com/pr/2013/2Q13-Service-Provider-Routers-Switches-Market-Highlights.asp

Another reference for Router/Switch market: http://www.acgresearch.net/domain-expertise/routingswitching.aspx

FBR’s Scott Thompson thoughts: “Clearly, we are in the beginning stages of a shift in network architecture. The new architecture assists carriers by driving more intelligence and flexibility at the optical layer, which creates substantial savings at the switching and routing layers. As this shift progresses, the optical sector is likely to benefit significantly.”

Thompson predicts a continued decline in SP switch/routing revenues due to this perceived new network architecture.

ITU-T SG16 (Multimedia) Update: New standard for e-Health devices & the close of H.264 development cycle

In a move signifying an important milestone for global e-health standardization, ITU members have reached first-stage approval (‘consent’) on the transposition of Continua Health Alliance’s Design Guidelines into Recommendation ITU-T H.810 “Interoperability design guidelines for personal health systems”.

Consent has also been reached on the final extensions to ITU’s Primetime Emmy award winning video codec, Recommendation ITU-T H.264, concluding 10 years of ongoing work since the standard was first approved in 2003.

These achievements come as part of the output of a meeting of ITU-T Study Group 16 (Multimedia) in Geneva, 28 October to 8 November 2013, at which 18 texts found consent and 5 were approved.

Continua Health Alliance is an international non-profit industry organization enabling end-to-end, plug-and-play connectivity of devices and services for personal health management and healthcare delivery. The Continua Design Guidelines (CDG) embodied by ITU-T H.810 have garnered strong industry support and their formalization as an ITU-T Recommendation will stimulate their global adoption, improving device interoperability and paving the way for complementary e-health standards.

Recommendation ITU-T H.810 contains specifications to ensure the interoperability of devices used for applications monitoring personal health. The guidelines focus on the following interfaces:

· TAN-IF: Interface between touch area network (TAN) health devices and application hosting devices (AHDs)

· PAN-IF: Interface between personal area network (PAN) health devices and AHDs

· LAN-IF: Interface between local area network (LAN) health devices and AHDs

· WAN-IF: Interface between AHDs and wide area network (WAN) health devices

· HRN-IF: Interface between WAN health devices and Health Record Network health devices

SG16 also reached consent on what are the final updates to Recommendation ITU-T H.264, marking the first occasion in 15 years that no active work items remain open on planned extensions to the standard.

Read more: http://newslog.itu.int/archives/216

Video: Prof. Thomas Wiegand, one of the co-authors of the award-winning video codec ITU-T H.264, on tactile Internet—a way to better connect moving objects (cars, robots, humans, smart grid, etc):

https://www.youtube.com/watch?v=KpuVVR_pI9c&list=PLpoIPNlF8P2PacVXmmIdJDVhJjk4ptutO