Month: September 2019

Keysight Technologies, Qualcomm extend 5G Collaboration to Dynamic Spectrum Sharing (DSS) Technology

Keysight Technologies has extended its collaboration with Qualcomm to accelerate commercialization of Dynamic Spectrum Sharing (DSS) technology, which will enable mobile operators to quickly and cost-effectively roll out (3GPP Release 15) 5G new radio (NR) data services (independent of 4G LTE or 5G IMT 2020 signaling/ control plane or mobile packet core).

DSS enables a mobile operator to flexibly allocate existing spectrum across low-, mid- and high- frequency bands, by dynamically switching between 4G LTE and 5G NR coverage based on traffic demand. Mobile operators can leverage DSS to deliver the best possible performance and coverage for a mix of 4G and 5G devices. Mobile operators are expected to start deploying DSS on the prevailing 4G LTE base stations by 2020, thereby accelerating 5G services worldwide. As such, DSS will greatly expand the capability of 3GPP Release 15 – 5G New Radio (NR) devices, according to Keysight.

Keysight’s 5G network emulation solutions was said to accelerate the development of Qualcomm Snapdragon 5G Modem-RF System to support DSS. This collaboration bodes well for Qualcomm’s Snapdragon technology as the latest 5G network emulation solutions is enabled to support speed, latency, reliability and the emerging 5G infrastructure.

“Our continued collaboration with Keysight on 5G technology, which was initiated in 2015, has enabled Qualcomm Technologies to accelerate the implementation of DSS, a critical feature that will help mobile operators quickly transition to 5G,” said Jon Detra, vice president, engineering, Qualcomm Technologies, Inc, in a statement.

“Keysight helps us develop and validate our Snapdragon 5G Modem-RF System designs at a pace that will help accelerate 5G commercialization.”

“Our extended collaboration with Qualcomm Technologies on 5G technology enables device makers and mobile operators to cost-effectively build out 5G coverage”, said Kailash Narayanan, vice president and general manager of Keysight’s wireless test group.

Earlier this year, Keysight announced that the company’s 5G collaboration with Qualcomm resulted in several industry breakthroughs: the industry’s first Global Certification Forum (GCF) validation of 5G NR conformance test cases for radio frequency (RF) demodulation and radio resource management (RRM); and the industry’s first announced 5G NR data call in the Frequency Division Duplexing (FDD) mode.

Many Other Companies Working on DSS:

Ericsson has also collaborated with Qualcomm by making the world’s first 5G data call using DSS as we reported in this IEEE Techblog post. Also, Verizon is said to be working with chip makers and equipment vendors to advance DSS, which its CEO Hans Vestberg envisions applying across its full spectrum holdings. The carrier identified DSS as a key feature for their broader 5G deployment.

Paul Challoner, vice president of network solutions for Ericsson North America, said that he expects “multiple large customers” to use DSS around the second half of the year. While he noted that Swisscom mentioned using DSS in its recent announcement about its 5G deployment, he said the operator isn’t necessarily going to be the first to use it. DSS will only work with 5G-ready equipment, so operators that haven’t upgraded their network gear in the past couple of years won’t be able to use DSS. Challoner said that most of the large operators have upgraded their networks with 5G-ready equipment, but he noted that smaller operators may need to look at DSS as an extra incentive to upgrade their networks quickly. “This is a capex friendly way to get to 5G,” he said.

Qualcomm is already developing chips for consumer devices that will enable them to make use of DSS-enabled spectrum. Dean Brenner, senior vice-president of Spectrum Strategy and Technology at Qualcomm, has called DSS a game-changer. Phones that use DSS will need chips that support the different cellular standards. It’s not completely clear when the chips needed for the flexible phones will be commercially available.

Steve Scarlett, head of technology for Verizon customer business at Nokia, said that the timing of DSS deployment really depends upon the availability of 5G handsets that have the spectrum sharing capability because existing LTE handsets won’t be able to take advantage of the network upgrade, and operators need to be careful so DSS doesn’t impact existing LTE customers. Scarlett also said that he believes DSS will eventually be critical for 5G roaming because the spectrum bands where LTE is deployed are already being used globally for LTE roaming. Once 5G becomes more pervasive, operators will need to figure out a way for users to roam and still get the same 5G services. “There are timing signals in LTE that can’t be messed with,” Scarlett added.

Ed Gubbins, senior analyst with GlobalData, said that the value of DSS really depends upon the operator’s spectrum assets and their 5G rollout plans. Some operators aren’t planning to use overlapping spectrum for 4G and 5G, so they won’t need DSS. He also noted that DSS is really intended to be used by each vendor’s existing 4G customers. In other words, Ericsson customers will likely use Ericsson’s DSS product and Nokia’s customers will use Nokia’s product. The same will occur with Huawei and Samsung, which also offer spectrum sharing solutions.

……………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://about.keysight.com/en/newsroom/pr/2019/26sep-nr19123.shtml

https://www.fierceelectronics.com/iot-wireless/keysight-qualcomm-seek-to-speed-ramp-up-dss-for-5g

https://www.networkcomputing.com/wireless-infrastructure/dynamic-spectrum-sharing-promises-bridge-5g

Ericsson 5G data call using dynamic spectrum sharing with Qualcomm 5G Modem-RF System

UBS: 5G capex at $30 billion for India telcos; 5G spectrum auction by January 2020?

UBS analysts say that India’s top three telecom operators will have to spend a little over $30 billion on 5G base stations and fiber infrastructure. According to UBS, the need for a dense site footprint and fiber backhaul for 5G access networks will likely shift the balance of power towards larger and integrated operators with strong balance sheets.

Bharti Airtel and Vodafone Idea would need $10 billion capex each over the next five years.

“Bharti has solidly defended its market share and has narrowed the gap with Jio on 4G network reach, with improving 4G net adds. The company recently revamped its digital offering and launched converged digital proposition ‘Airtel Xstream’ offering digital content across TV, PC and mobile devices along with IoT solutions for connected homes. Further, Jio’s recently announced fixed broadband plans starting at Rs 699 are not as aggressive as we (and the market) feared and, therefore, do not pose significant pricing pressure on Bharti’s broadband average revenue per user,” UBS said in a research note to clients.

Reliance Jio’s incremental 5G capex is estimated somewhat lower at around $8 billion. That’s because Jio already has more 5G-ready fiberised towers than the incumbents, having already spent around $2 billion on tower fiberization.

Analysts were skeptical about Vodafone Idea’s ability to sustain such big-ticket capex spends given its continuing market share losses and weak financials, which they said could limit its 5G deployment ambitions.

They also said the need for a dense site footprint and fibre backhaul in 5G would shift the balance of power towards larger and integrated operators with strong balance sheets like Jio and Airtel, while those with high gearing levels are at risk given the sustained high capex needs.

“Airtel and Vodafone Idea will each need to spend $2 billion annually on 5G radio and fiber capex spread across 5 years,” UBS said in a report, implying 65% and 85% of Airtel’s and Vodafone Idea’s current annual India capex run rates respectively.

By contrast, Jio’s 5G capex, “would be lower due to its larger tower footprint and higher proportion of towers on fibre backhaul compared with Airtel and Vodafone Idea.” The brokerage firm also expects Jio to transition to 5G in a “time-efficient manner,” given its in-house data centres and investments in a content distribution network (CDN).

“Vodafone Idea’s stretched balance sheet will limit its participation in the 5G opportunity, and the company will require a significant improvement in network quality to arrest market share loss and revert to revenue growth,” UBS said.

Credit Suisse backed the view, saying, “Vodafone Idea will lose the most market share, and will need additional equity capital by FY2021, given our expectation of no price increase”.

UBS estimates that Airtel’s India mobile revenue will grow 5-6% in this financial year and the next even if interconnect usage charges – a source of revenue for incumbents – get scrapped from January 2020.

According to analysts, the India telecom sector can reduce overall estimated $30.5 billion 5G capex spends by 15-20% if Airtel, Vodafone Idea and Jio share towers and fiber resources. However, there is currently no progress on that front.

“We estimate the sector can reduce overall capex by 15-20 per cent if the three Indian telcos share towers and fiber (either commercially or driven by the regulator) – third-party tenancy poses upside risks to our estimates,” UBS said in its report.

……………………………………………………………………………………………………………

India’s Department of Telecommunications wants to hold a 5G spectrum sale by January 2020 at the latest, according to referenced sources.

Credit Suisse doesn’t expect that 5G spectrum sale to attract much interest. That’s due to a mix of “high reserve prices, telcos’ focus on monetising 4G investments, stretched balance sheets, a nascent 5G ecosystem and lack of significant 5G use cases for mass consumption.”

Rajiv Sharma, co-head of research at SBICap Securities, said that Vodafone Idea is unlikely to bid for 5G spectrum at current base prices “as the telco doesn’t have an existing pan-India 4G network that is essential for any telco planning to spend top dollars on 5G,” according to the report.

Analysts believe that Reliance Jio will probably take part in the process, as it is the only profit-making telco in the Indian market.

The Department of Telecommunications (DoT) had recently asked the Trai to lower the starting prices, which the regulator refused. “There was a chance for the Trai to reduce 5G prices. Let’s see what the DoT does now. But at current rates, Airtel won’t buy,” Airtel’s executive reportedly said.

Vodafone Idea CEO Balesh Sharma has previously said that the prices recommended by the regulator were ‘exorbitant.’ The telco said it will participate in the next auction but did not confirm if it would buy 5G spectrum.

Hemant Joshi, partner at Deloitte India, said it would be “prudent to defer the 5G auction till 2020 at least since at Trai’s recommended base prices, the industry response may be very lukewarm.” He also said that the reserve prices need to be lowered, taking into account the experiences in countries where 5G spectrum was recently auctioned.

……………………………………………………………………………………………

Analysts said there are three things that India’s Centre for Telecom Excellence (within the DoT) must do immediately to hasten the adoption of 5G:

First, lay down a clear roadmap of spectrum availability and specify frequency bands aligned with global standards (IMT 2020 from ITU-R). Given that 5G services will be supporting massive data applications, operators will need adequate spectrum.

Editor’s Note: India’s TSDSI has proposed a candidate IMT 2020 RIT based on Low Mobility Large Cell (LMLC), but it hasn’t yet been accepted by ITU-R WP 5D. TSDSI posted a revised and more comprehensive proposal on 10 September 2019, which will be evaluated at the next ITU-R WP 5D meeting in December.

………………………………………………………………………………………………….

Second, there is a need to move away from the existing mechanism of pricing spectrum on a per MHz basis. 5G services require at least 80-100 Mhz of contiguous spectrum per operator. If the Centre were to fix the floor price based on the per Mhz price realised in the last auction then no operator would be able to afford buying 5G spectrum. The pricing, therefore, will have to be worked out anew, keeping in mind the financial stress in the telecom sector and affordability of services.

Finally, the Centre must rapidly complete the national fiber optic network rollout as 5G high speed services will require huge back-haul support for which existing microwave platforms will not be sufficient.

Orange-Spain not rushing to join the “5G” deployment scramble and reveals why not

At the 5G Core Summit 2019 in Madrid, Orange España’s Head of Product Engineering-Tomas Alonso said his company was taking its time to deploy “5G,” despite pressure from other telcos, like Vodafone-Spain and Telefónica Móviles. During his conference session titled Orange Spain on the Road to 5G, Alonso said that 5G technology is still not mature enough to make any real difference to customers and Spanish authorities are not helping operators deploy it.

Obviously that’s true, because all pre-standard 5G deployments use LTE signaling/control plane and mobile packet core (5G NSA). Also there is no ultra low latency in 3GPP Rel 15 5G NR. More on this 5G core topic below.

“I would summarize our work in two words; testing and learning. We do not launch the technology because of the technology. We launch the technology to offer a better customer experience,” said Alfonso.

Orange Spain is currently trialing 5G at various locations throughout the country, though there are no plans to speed up the commercial launch, which is currently set for some point in 2020.

Spanish wireless network operators also lack sufficient spectrum they need to provide a high-quality 5G service. Spain held its 5G auction way back in July 2018, when Orange collected 60 MHz of spectrum in the 3.6GHz-3.8GHz band. The trouble, it seems, is that telcos’ band plans look like a piano with missing keys.

“In almost all cases, the spectrum is allocated in different packets,” said Alonso. “We need to do some shuffling to have contiguous bands so that we can provide the best experience in 5G.”

“The earliest date [for an auction] is the first half of next year,” Alonso added. That spectrum will be needed for “effective and efficient” mobile rollouts, he said.

Equally important, Alonso believes the 5G network equipment currently available remains “too heavy” and too power-hungry. “To be efficient, we need to wait a bit more and then have a better ROI [return on investment] when we deploy the network,” he said. There will be a stronger business case for 5G deployment when the equipment has been improved.

Also, Orange Spain’s wireless backhaul infrastructure must be upgraded, with more fiber optics urgently needed. Orange is leveraging its investments in fiber-to-the-home networks — which today reaches more than 14 million Spanish households — and extending fiber optics links to mobile sites. But the job is not yet nearly completed.

As for the scarcity of “5G” devices: “They are all very high end today and [each] costs more than €1,000 [$1,100],” said Alonso. None is yet available that supports the “standalone” (SA) version of 5G, which uses a new 5G core network in conjunction with the 5G NR technology.

As the IMT 2020 standard is over one year away from completion, there is no European operator that can deploy a 5G mobile packet core. In the meantime, operators are deploying services based on the “non-standalone” (NSA) system, which hitches the 5G New Radio to an existing 4G core. Alonso does not sound overly impressed. “So far, we have completely defined the enhanced mobile broadband [eMBB] functionality and in the second and third steps there will be newer standards for latency and mobile IoT [the Internet of Things],” he said. “Standalone will be mature in a matter of months … The real technology that will provide all the promises of 5G is not here.”

Orange Espagne S.A.U., more commonly known by its trade name of Orange España, is a mobile network operator in Spain. It was previously known as Amena, a brand of Retevisión, (Amena means pleasant in an amusing way in Spanish) until 2005, when it was bought by France Télécom (now Orange S.A.)

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

According to Alonso, the biggest challenge is to change how the company works. “The way we deliver value to customers will be completely different from the way we deliver value to customers with current technology and so we are spending a lot of time on that,” he said. That overhaul appears to involve setting up dedicated 5G teams within the company and breaking down some of the silos that currently separate technical and commercial departments.

A further requirement is for some type of certifications process for security of 5G technology.(from device to access network to mobile packet core to edge network to ISP/content provider point of presence) That’s endeavor is made much more difficult with no de facto or de jure 5G security standard (the work in ITU-T on IMT 2020 security is in its infancy). “Security is something we talk about a lot, but we need the sector to complete the analysis to have certifications,” said Alonso. “That is something we need in the short term.”

–>As Vodafone and other telcos race to deploy pre-standard 5G, the lack of any security system is a huge weakness, in this author’s opinion.

Network sharing is another important issue which the Orange Spain team will have to consider. This will probably not prevent the telco from launching 5G services, though it will impact the rollout strategy. Reports have emerged suggesting the team is in conversation with Telefonica and MásMóvil over sharing non-critical 5G sites. The idea of network sharing is becoming increasingly popular with telcos around the world, and it is easy to see why. During her own presentation, Lucy Lombardi of Telecom Italia quoting research from McKinsey, suggesting network sharing agreements could save as much as 40% of deployments costs for a telco. 5G is going to be a very expensive business, and any opportunity to reduce the financial burden will be strongly considered.

Some might disagree with the position of Orange Spain, but being first doesn’t necessarily mean best. Orange has shown itself to be one of the more considered, long term focused and successful telcos in Europe in recent years, so it would be quite reasonable to have confidence in the team.

References:

http://telecoms.com/499911/orange-spain-not-going-to-be-rushed-into-5g-fracas/

5G’s positive impact on Telemedicine + “not in my backyard” (NIMBY) problem of small cells

The IEEE Techblog post below is an excerpt of a November 1, 2019 article titled 5G Is the Future, by Eric Boehm- a reporter at Reason magazine. Reason magazine- Volume 51; Issue 6; ISSN:00486906. Edits and additional comments by Alan J Weissberger. You can read the entire article by subscribing to Reason here.

5G Impact on Telemedicine:

The ability to move more data more quickly between devices will open the door to new medical technologies, giving doctors volumes of information about patients even without being in the same room. That means telemedicine could finally be ready to go mainstream.

Market Research Future, a firm that predicts business trends, expects the American telemedicine market to grow by more than 16 percent annually from 2017 to 2023, in large part because faster connection speeds and lower latency will let doctors talk to and diagnose patients via high-definition video streamed from a phone. That could be a huge development for access to medical care-one that would be a boon for residents of rural areas, for the poor, and for the elderly. And everyone will benefit from spending less time sitting in a waiting room. If 4G gives you the ability to play Angry Birds until the doctor is ready to see you, 5G may let you skip the in-person visit altogether.

Some telemedicine will be fully automated, with wearable sensors providing real-time information about vital signs, falls, or physical activity, giving doctors a better understanding of a patient’s health with fewer invasive procedures. A Stanford University study estimates that, in 2020, Americans will produce 2,314 exabytes of medical data (an exabyte is equal to a billion gigabytes), up from a mere 153 exabytes in 2013.

“Those troves of information become the foundation for biomedical research,” the Stanford researchers conclude. “We are beginning to reconstruct the relationship between genes and life and health in ways that are likely to be transformative.”

……………………………………………………………………………………………………………………………………………………………….

5G’S NIMBY Problem:

Some of the U.S. government policies that will dictate 5G’s future are being made right now at the State Department, the Commerce Department, and the FCC. But equally important is what happens in places like Washington, D.C. office of Mayor Muriel Bowser and the city council. During an October 2018 hearing there, Advisory Neighborhood Commissioner Ann Mladinov voiced concern about the “visual clutter” that could result from having “so many additional poles holding small cell boxes over sidewalks and in other public space.” At the same hearing, another attendee told the council it should protect D.C. neighborhoods’ aesthetic qualities from being “put at risk for more corporate gain.” Like tall buildings and other forms ofvisible urban development, 5G has a “not in my backyard” (NIMBY) problem. For sure, it will be exacerbated with 5G mmWave spectrum which requires many more small cells due to limited range.

Those complaints, and many more like them lodged with city councils across the country, have to do with the physical hardware that will be necessary for widespread 5G adoption. Mobile providers are ditching the traditional cell tower, the backbone of cellular networks since they first emerged, in favor of so-called “small cell” antennas. These devices-some no bigger than a backpack, others as large as a refrigerator-will be affixed to telephone poles and buildings. Because each one has a considerably smaller range than a tower, covering a whole city requires a small cell to be placed every few blocks, a potential point of friction for residents who dislike change. But the benefits for users will be large.

Not only will the physical components be capable of making faster connections, but the physical proximity to users and greater bandwidth will allow more devices to be connected at once. A 4G network can handle about 4,000 devices per square kilometer. Verizon CEO Hans Vestberg has claimed that 5G networks will be able to handle up to 1 million devices within the same space.

“It’s going to introduce more competition, that’s for sure,” says Ian Adams, a 5G policy expert with TechFreedom, a nonprofit advocacy group. Because 5G mobile networks will offer speeds similar to wired connections, cable companies and traditional internet service providers will have more rivals. This may force them to innovate or lower prices, and the likely result will be better, cheaper online access for all. But if the tradeoff is greater “visual clutter” on and above city streets, some people won’t be on the side of innovation.

In letters to the FCC, telecom companies have complained about a wide range of local regulations that have slowed the deployment of 5G infrastructure-often a result of trying to apply rules written for large cell towers to the small cell antennas. For example, one Pennsylvania town requires that an eight-foot fence be erected around any structure containing a small cell antenna. That’s common sense for older, larger towers, but it’s nonsensical for a device that can be attached to a telephone pole.

Similarly, AT&T complained that it has had to pause or decrease small cell deployments in parts of California, Maryland, and Massachusetts due to high fees, and that some municipalities in Washington and New York have used restrictive zoning to limit the placement of small cell antennas. Timing is also an issue. The Wireless Infrastructure Association (WIA), an industry group, claims that about a third of all wireless antenna approvals exceed the 90-day limit for review that the FCC established in 2009. In one extreme case, the town of Paramus, New Jersey, spent five years considering a Sprint application for a new cell site before denying the request. In Greenburgh, New York, a small cell contractor faced a review process for a single antenna that “took approximately two years and nearly twenty meetings, with constantly shifting demands,” the WIA says. When a telecom company wanted to attach 23 small cells to the sides of Houston’s NRG Stadium, it first had to spend $180,000 in mandatory historic review fees. The stadium was built in 2002.

In taking action to curb the worst abuses, the FCC is attempting to strike a balance between innovation and local control. The agency estimates that streamlining the approval process will save telecoms $2 billion that can be put toward further expansion of their 5G networks.

But federal pre-emption is always going to be an imperfect solution. Ideally, telecom companies would negotiate with individual property owners to obtain the right to place small cell antennas on the sides of buildings or atop privately owned poles. But local governments generally control where such devices can be installed and how much companies are required to pay for the privilege.

It’s fine for residents to voice their opinions, of course, but “a local government shouldn’t get to impede the development of a national infrastructure,” says Adams. “Putting guardrails on particularly egregious local actions,” as the FCC has tried to do, is “important if we want to have uniformity of infrastructure.”

The local interference can indeed be egregious. In 2015, San Jose, California, started charging telecom companies $3,500 for each small cell antenna installed-far more than what similarly sized cities like Phoenix ($100) and Indianapolis ($50) charge for the right to install the same equipment. By 2018, it was apparent that the costs were causing San Jose to fall behind in the early stages of 5G deployment. So the city reconfigured the per-antenna fee into a $1 million one-time payment coupled with ongoing tax obligations. San Jose Mayor Sam Liccardo promised to use the revenue for a “Digital Inclusion Fund” that would spend $24 million bringing high-speed internet to 50,000 low-income households within the next 10 years.

The FCC’s new rules put an end to that shakedown. By capping the fees that localities can charge for installing 5G small cell antennas, it ensured that companies like T-Mobile and Verizon don’t have to pay off cities like San Jose for the right to bring residents high-speed mobile internet.

Shireen Santosham, the chief innovation officer within the San Jose mayor’s office, has called the FCC’s rules “a $2 billion taxpayer-funded subsidy to corporate interests.” But that’s hardly accurate. The new policy doesn’t require that taxpayers underwrite the 5G rollout. It only prevents cities from extorting telecom companies for the right to deploy small antennas. Keeping those dollars out of city tax coffers means the companies will be able to invest in infrastructure where they know it’s needed rather than where bureaucrats decide it should go.

Governments should strive to make “an honest assessment of where the market is,” says Pai, “recognizing that government can’t predict and shouldn’t micromanage the future, and getting rid of the red tape that stifles innovation and progress.”

FCC vs Dept of Commerce on 5G mmWave at 24 GHz:

In May, NASA and the National Oceanic and Atmospheric Administration (NOAA), which are jointly responsible for America’s fleet of weather-tracking satellites, complained to Congress that 5G cellphone signals in the 24 GHz band could interfere with satellites that read water vapor signals coming off the ocean. Among other things, those satellites are critical for forecasting the paths of tropical storms. In 2012, for example, they correctly predicted that Hurricane Sandy would make an unusual westward turn toward the New York City metro area. Without that tip, the disaster could have been far worse.

NOAA relies on a signal band that runs between 23.6 GHz and 24 GHz, so there won’t be direct overlap with the 24 GHz space that the mobile companies bought, which is currently unused. The federal weathermen say things could get cloudy along the very edges, where the bands run up against one another. Pai’s agency predicts sunny skies ahead because there’s already a buffer zone between the two bandwidths-and because independent testing commissioned by the FCC has concluded that there’s no need to worry.

“The assumptions that undergird [NOAA’s 5G interference claims] are fundamentally flawed,” Pai told the Senate Commerce Committee in June. Among other things, the NOAA study did not take into account the fact that 5G signals will be more focused (“beam-forming signals,” in industry lingo) than the signals sent by traditional cellphone towers, which broadcast in all directions.

In the two years since NOAA initially objected, the agency has not completed a follow-up study to confirm its worries about interference. FCC Chairman Pai told lawmakers he was frustrated by the holdups. “The Department of Commerce [which oversees NOAA] has been blocking our efforts at every single turn,” he said.

If the possibility of interference with weather satellites “is truly a technical problem,” says Joel Thayer, policy counsel for The App Association, which represents more than 5,000 app makers and mobile device companies, “then these agencies can solve it with technical solutions instead of performing political theater.”

Conclusions:

Realistically, 5G technology is going to make everyone better off, even if we can’t predict exactly how. When the first 4G smartphones went on the market in 2009, they were expected to usher in an explosion of new apps and other software. But few could have predicted the specifics, from Uber to Fortnite.

The same will be true for the 5G era. Brent Skorup, a senior research fellow at the Mercatus Center at George Mason University, predicts we’ll get “warehouse-floor robots that self-organize shipments, remotely operated electric air taxis that carry passengers high above rush-hour traffic, or smart glasses that connect blind people with professional guides who use audiovideo feeds to help wearers get around.”

Fast mobile connectivity is the foundation for whatever future innovations may develop. It promises more jobs, better communication, more enjoyable leisure time, and medical advances that let us live longer. “The speed of our connections is the speed of commerce,” says Adams, who favors the mostly hands-off approach the FCC has been taking with the 5G rollout. Whether for work or for play, he says, “the availability of virtually unlimited data is only going to improve the quality of life.”

The ability to move more data more quickly will open the door to new medical technologies, giving doctors volumes of information about patients even without being in the same room.

KT has >1M “5G” subscribers; 5G roaming agreements announced with 3 European telcos

KT, South Korea’s second largest operator (SK Telecom is #1), has announced its (pre-standard) 5G subscriber base has gone past the one million mark just five months after its 5G service was launched.

More importantly, KT also said it has entered into 5G roaming agreements with operators in Italy, Switzerland, and Finland. Specifically, KT has partnered with Telecom Italia Mobile in Italy, which is the largest telco in the country with over 31.7 million subscribers. The Italian telco is currently providing 5G services in Rome, Napoli, and Turin. In Switzerland, KT has partnered with the local telco Sunrise. Sunrise currently provides 5G connectivity to 262 cities, including Geneva and Zurich. In Finland, it has paired with Elisa which provides in 5G services in five cities, including Helsinki. That means that KT’s 5G subscribers will be able to use the 5G networks provided by those three operators in the three European countries.

KT has standing agreements with operators in 185 countries for 3G and 4G-LTE roaming. The operator aims to extend those agreements to 5G when 5G services go live in those countries. Prior to the agreements with the three European countries, KT had already set up a similar agreement with China Mobile, despite the fact it hasn’t launched services yet.

According to KT’s price proposals at the time of its 5G launch, customers on the starting package (paying KRW 55,000, or $46 per month) will have 8 GB roaming data while overseas, with the speed capped at 1 Mbps. Those on higher tiers (paying KRW 80,000 ($67) or KRW 100,000 ($84) per month) will have unlimited roaming data, but the speed will be capped at 100 Kbps. Customers on the premium tier of the 5G service (KRW 130,000, or $109, per month) will have the speed limited lifted to 3 Mbps.

KT’s “5G” Buses, which are equipped with transparent displays that give the South Korean passengers a taste of the 5G service, Giga-live TV.

………………………………………………………………………………………………………………………………………………………………………………………………………….

KT is not the first South Korean operator to tie 5G roaming partnerships. We reported in July that SK Telecom 5G subscribers will be able to connect to Swisscom while travelling in Switzerland, while those on LG U+ will be able to connect to China Unicom’s 5G when travelling to its neighboring country, after the latter’s 5G service goes live.

A concern for KT 5G users intending to visit Europe is that the roaming can only be done on Samsung Galaxy S10 5G, the vendor’s first 5G smartphone, though KT said the service will be extended to other devices soon. Earlier this month, at IFA in Berlin, Samsung announced that it had already sold 2 million 5G smartphones and expected to double the volume to 4 million by the end of the year.

Korean telcos have also started performing tests on 5G standalone networks using mmWave spectrum. The standalone networks are expected to be deployed sometime next year.

References:

http://telecoms.com/499860/kts-one-million-5g-subs-may-now-roam-in-europe-and-stay-on-5g/

https://www.zdnet.com/article/kt-rolls-out-5g-roaming-services-in-europe/

https://techblog.comsoc.org/2019/07/15/sk-telecom-with-swisscom-worlds-first-5g-roaming-service/

Conflicting reports: Huawei and China Mobile may buy Brazil carrier Oi

The O Globo website reported on Saturday that Huawei is joining forces with China Mobile to buy struggling Brazilian carrier Oi, in an attempt to boost their footprint in Latin America’s largest market. The two Chinese companies anticipate a significant growth in business once Brazil starts deploying its 5G network. Oi’s 360,000 kilometers of fiber infrastructure is seen as an attractive asset.

Oi declined to comment on the matter, while Huawei and China Mobile did not immediately respond to Reuters’ requests for comment.

However, on Sunday Huawei told Reuters it was not interested in acquiring struggling Oi or any other Brazilian carrier.

“Huawei has no plan or interest in acquiring Oi or any other Brazilian carrier. In Brazil for more than 20 years, the company is working with all major Brazilian carriers supplying the best products and solutions to support digital transformation in Brazil,” the company said in an emailed statement to Reuters.

It would be very strange for Huawei to invest in a telecom carrier which is traditionally its bread and butter customer!

Brazil’s largest fixed-line carrier has been struggling to turnaround its business since it filed for bankruptcy protection in June 2016 to restructure approximately 65 billion reais of debt. Oi is also negotiating its network with Spain’s Telefonica and Telecom Italia, AT&T and another (unnamed) Chinese company.

Speculation of the bid comes as Brazil’s Senate approved a bill to update the country’s obsolete framework for telecommunications, paving the way for Oi to implement a plan to sell up to $2 billion in non-core assets. Earlier this week, Suno Notícias reported that China Mobile has filed a request to operate in Brazil and eventually acquire Oi. The country’s telecom regulatory agency Anatel said Sept. 17th it didn’t have any official information regarding the request.

…………………………………………………………………………………………………….

Addendum: Huawei launches new ‘Vision TV’ with 4K quantum dot color, which comes in 55″/65″/75″ sizes. Media paying attention to the fact that Huawei is adopting QD technology, which until now has been a key technology for Samsung’s TV (QLED) strategy. (ZDNet)

http://www.zdnet.co.kr/view/?no=20190920082939

…………………………………………………………………………………………….

References:

Verizon CEO: 5G will require fiber optic expansion, mobile edge computing and continue to use mmWave spectrum

Verizon 5G Overview:

Verizon’s 5G network strategy is centered on three deliverables with fiber optics for backhaul playing a huge role in all of them:

- 5G mobile for businesses and consumers,

- 5G home broadband (see Note 1. below) —delivering home internet over the air—and

- Mobile edge computing, which is essentially miniature data centers distributed throughout the network so they’re closer to the 5G endpoints.

The company’s CEO Hans Vestberg said that a total of 30 5G mobile cities will be launched by Verizon this year. He also plans to restart Verizon’s fixed wireless 5G Home service [1] later this year. 5G Home currently is in four U.S. markets.

Note 1. There is no standard for 5G fixed wireless and none is even being worked on. It is not an IMT 2020 use case within ITU.

………………………………………………………………………………………………………………………………………………………………………..

Fiber and Mobile Edge Computing:

The U.S.’s #1 wireless carrier by subscribers will continue to install fiber at a rate of 1,400 miles per month in support of its 5G network builds for between two and three years. Verizon will begin to provide mobile edge computing [aka Multi-access edge computing (MEC)] during the upcoming quarter, Vestberg said at a Goldman Sachs Communacopia investor conference on Thursday, September 19th. Verizon fiber deployments are critical to supporting a mixture of services, Vestberg said.

As part of its Fiber One project, two years ago Verizon signed a $1.1 billion, three-year fiber and hardware purchase agreement with Corning to build a next-generation fiber platform to support 4G LTE, 5G, and gigabit backhaul for 5G networks and fiber-to-the premise deployments to residential and business customers. Also in 2017, Verizon also announced a $300 million fiber deal with Prsymian Group to provide additional fiber for its wireline and wireless services.

“The whole Intelligent Edge Network was basically all of the way from the data center to the access point we have one unique network for redundancy. And then, of course, in between fiber to the access point and then you decide if its 5G, 4G, or fiber to the home or fiber to curb, or fiber to the enterprise,” Vestberg said. “In that, the fiber deployment for us was extremely important.”

“One part of the whole intelligent edge network was that . . . all the way from the data center to the access point you have one unique network with a lot of redundancy and, in between, a lot of fiber to the access point and then you decide if it’s 3G, 5G, 4G or fiber to the home or fiber to the curb or fiber to the enterprise,” he explained.

Vestberg said: “You have one unique network with a lot of redundancy and, in between, a lot of fiber to the access point,” he said of edge computing, which has become a priority for many wireless and wireline network operators.

………………………………………………………………………………………………………………………………………………………….

mmWave for 5G:

Verizon will continue to deploy millimeter wave (mmWave) for its 5G network for the foreseeable future, Vestberg told the investor conference audience. High frequency band mmWave has great download speeds but its range is very limited, which requires many more small cells.

“Maybe you have 50 to 70 megabits per second on a 4G network today, when you get 1 gig [on 5G] it’s a totally different experience and what you can do with it,” Vestberg said. “What we saw in the 4G era was enormous innovation coming with that [greater] coverage and that speed [over 3G]. It’s going to be the same with 5G for sure,” he added.

“Now we have 2 gigs [gigabits per second] on the phones,” Vestberg said. The range, however, can veer from 2,000 feet to 500 feet and the network can’t deliver flashy streaming videos — or, in fact, any kind of service — indoors. Verizon is the only US carrier solely dedicated to the highband (28GHz) approach to 5G for now. AT&T and T-Mobile plan to launch low and mid band 5G networks next year, along with limited mmWave deployments. Sprint has mid band 5G launched so far.

“We can launch nationwide with millimeter wave,” the Verizon CEO insisted. “Any spectrum will have 5G in the future,” Vestberg noted. Verizon will also offer dynamic spectrum sharing (DSS) in the future. DSS will allow operators to share spectrum instantaneously and simultaneously between 4G and 5G networks. But not for mmWave, since that doesn’t share spectrum with any 4G networks.

Vestberg said Verizon has all the spectrum it needs now to do a nationwide network on mmWave, and that adding more antennas in a given area or making software adjustments are also options for increasing capacity on existing spectrum bands.

Vestberg insisted that the mmWave-based service will be “self-install.” This would be more economical than the “white glove” — a.k.a. professional — installation model that 5G Home started with in October 2018.

……………………………………………………………………………………………………………………………………………………………………………………

Verizon’s mobile network:

A growing percentage of Verizon’s mobile subscribers are on unlimited data plans, with about half today. “This is a way for us to continue to see that our customers have a great journey from metered plan to Unlimited (data) plans and then they can move up…to 5G,” Vestberg said.

“We think that we are best equipped to leverage the best network and continue to partner with [media companies] rather than us managing it. Others might have better qualities for doing that but we don’t, Vestberg said.

………………………………………………………………………………………………………………………………………………………………………………….

References:

Verizon to speak at Goldman Sachs Communacopia Conference September 19

https://www.verizon.com/about/investors/goldman-sachs-28th-annual-communacopia-conference

https://event.webcasts.com/starthere.jsp?ei=1260712&tp_key=eae790b458

https://www.barrons.com/articles/verizon-ceo-hans-vestberg-stock-5g-wireless-competition-51568906382

https://www.lightreading.com/mobile/5g/verizons-vestberg-sticks-with-mmwave-for-5g-/d/d-id/754248

https://www.telecompetitor.com/verizon-ceo-ongoing-fiber-investments-paying-dividends-including-mec/

NTT DoCoMo achieves multi-vendor 4G/5G RAN using O-RAN specifications

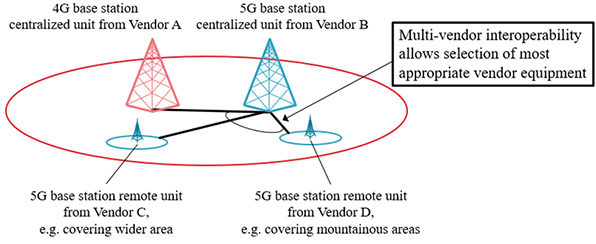

NTT DoCoMo has announced that it has achieved multi-vendor interoperability across a variety of 4G and pre-standard 5G base station equipment from Fujitsu, NEC and Nokia. Equipment from those vendors supports the Open Radio Access Network (O-RAN) Alliance specifications, which are NOT standards as claimed in DoCoMo’s press release. This is believed to be the world’s first realization of this level of multi-vendor interoperability in 4G and 5G base station equipment conforming to O-RAN specifications.

Up until now, cellular telcos (cellcos) have been locked into single cellular base station vendor contracts when deploying their radio access networks (RANs). Despite ITU-R standardization and 3GPP specifications, operators have not been able to use one vendor’s baseband gear with another’s radio equipment. Working across different 4G and 5G vendor systems has been similarly problematic if not impossible. Critics say this interoperability dilemma has led to “vendor lock-in” and strengthened a small number of giant RAN vendors, namely Ericsson, Huawei and Nokia.

The Open Radio Access Network (O-RAN) Alliance wants to change that. It is an operator led industry group working to create more open and intelligent next generation radio access networks, including 5G networks. The O-RAN specifications include RAN fronthaul and X2 profiles. There are 21 network operator members shown on the O-RAN Alliance member list, which includes NTT DoCoMo, AT&T, Verizon, Deutsche Telekom, Orange, China Mobile, China Telecom and other tier 1 operators.

RAN fronthaul describes the connectivity between remote base stations and centralized cell units, enabling multiple remote units to be serviced by a single central baseband unit using open hardware specs. Ultimately, radio heads and baseband units may be mixed and matched to create a fully multi-vendor RAN.

The ability to deploy and interconnect base station equipment from different vendors will make it possible to select the equipment most suitable for deployment in any given environment, such as base stations offering broad coverage in rural areas or small base stations that can be deployed in urban areas where space is limited. This will in turn allow more rapid and flexible expansion of 5G coverage.

DoCoMo will deploy the equipment in the pre-commercial 5G service it plans to launch on September 20, 2019 in Japan. Concurrent with the pre-commercial launch of its 5G services, DoCoMo will expand 5G coverage by combining 5G networks with existing 4G networks using equipment from diverse vendors. The signal transmission specifications that will enable this follows lengthy discussions within the O-RAN Alliance, which DoCoMo is chairing.

4G and 5G multi-vendor interoperability:

O-RAN fronthaul interface specifications provide a foundation for interoperability between centralized units and remote units of 5G remote-installed base stations manufactured by diverse partners. With remote-installed base stations, centralization of the baseband processing will bring the following benefits:

- Improved communication quality through coordination of multiple remote units

- Pooling of resources through the aggregation of hardware

- Minimization of equipment footprint, leading to a reduction in space and costs.

In addition, through the provision of only radio processing, the remote unit can be further downsized, making it possible to install in a variety of locations that would previously have not been viable, such as small buildings or mountainous areas.

The O-RAN X2 profile specifications provide a foundation for interoperability between 4G base stations and 5G base stations manufactured by diverse partners in 5G non-standalone (5G NSA) networks by taking 3GPP X2 interface specifications and specifying details for their usage. 3GPP Release 15 based 5G NR-NSA networks connect devices using both 4G and 5G technologies. The connection of 4G and 5G base stations makes it possible to combine the high-speed, low-latency data communications delivered by 5G technology with the comprehensive coverage of 4G networks.

Going forward, DoCoMo will continue to refine and develop its cutting-edge base station communication technology, aiming to expand the provision of stable 5G coverage.

………………………………………………………………………………………………………………………………………………………………………………………….

Open Test and Integration Center (OTIC):

O-RAN has announced the Open Test and Integration Center (OTIC) – an initiative led by China Mobile and Reliance Jio along with participation from China Telecom, China Unicom, Intel, Radisys, Airspan, Baicells, CertusNet, Mavenir, Lenovo, Ruijie Network, Inspur, Samsung Electronics, Sylincom, WindRiver, ArrayComm, and Chengdu NTS.

The above named companies are collaborating on multi-vendor interoperability and validation activities for O-RAN compliant 5G access infrastructure. The initial focus is to ensure RAN components from multiple vendors support standard and open interfaces and can interoperate in accordance with O-RAN test specifications.

“China Mobile will initiate an OTIC in Beijing, China, which should provide the common platform for solutions to be operationally ready to enable end-to-end interoperability and deployment in scale; as well as to be hardened for reliability, performance, scalability, and security that operator networks require,” said Dr. Li Zhengmao, EVP of China Mobile.

“Jio is creating an OTIC to accelerate the telecom industry transformation by driving ready-for-commercialisation products and solutions,” said Mathew Oommen, President, Reliance Jio.

………………………………………………………………………………………………………………………………………………………………………………………….

Heavy Reading Comments:

“It is pretty significant for O-RAN because DoCoMo is a genuinely leading operator, a rainmaker in these things,” says Gabriel Brown, a principal analyst with Heavy Reading. “They have said this will conform with O-RAN specifications in what looks like the production 4G and 5G network.”

“One of the criticisms of the 5G RAN was about using the same 4G vendor, but the implication here is that you could do multivendor,” said Brown, pointing to NTT DoCoMo’s statements about the O-RAN Alliance’s X2 specifications. “What they don’t appear to be saying is that they have different baseband vendors for 4G and 5G, but they are saying they can do it. There is no question at all this is a big statement about O-RAN.”

NTT DoCoMo’s update is not a complete surprise, he says, because the operator had already been in trials with Fujitsu, NEC and Nokia. Today’s move aligns that model with the O-RAN specifications at an important moment. “Whatever they are doing has to be rock solid because the Rugby World Cup is coming in a couple of weeks,” says Brown. “That is a warm-up for the 2020 Olympics in terms of international attention on Japanese networks and all operators will be launching a limited 5G service.”

……………………………………………………………………………………………………………………………………………………………………………………

Telco Testimonials and Deployment Plans for O-RAN:

“ The O-RAN Alliance was created to accelerate the delivery of products that support a common, open architecture and standardized interfaces that we, as operators, view as the foundation of our next-generation wireless infrastructure, while ensuring a broad community of suppliers driven by innovation and open market competition. ” — Alex Jinsung Choi, SVP Research and Technology Innovation, Deutsche Telekom “ Our industry is approaching an inflection point, where increasing infrastructure virtualization will combine with embedded intelligence to deliver more agile services and advanced capabilities to our customers. The O-RAN Alliance is at the forefront of defining the next generation RAN architecture for this transformation. ” — Andre Fuetsch, CTO and President AT&T Labs.

AT&T is a key proponent of O-RAN adoption. An AT&T employee, who presented on O-RAN at ONF Connect 2019, said the company is seriously evaluating adopting the Alliance’s specifications for 5G deployments sometime in 2020. AT&T has said that it foresees that it can bring the “whitebox” environment to the RAN by adopting open hardware specifications.

……………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.nttdocomo.co.jp/english/info/media_center/pr/2019/0918_00.html

https://www.o-ran.org/membership

https://www.o-ran.org/specifications

http://the-mobile-network.com/2019/03/taking-the-open-ran-commercial/

AT&T CEO Stephenson: AT&T has fastest wireless network, will have 5G nationwide footprint by mid-year 2020

Speaking at the Goldman Sachs Communacopia conference in New York, AT&T CEO Randall Stephenson said that the company has increased the capacity of its wireless network by 50% such that it is now the fastest and highest quality (presumably in the U.S.)

“Over the course of about 3 years, we are increasing (or have increased?) the entire nationwide capacity of the AT&T wireless network by 50%……What’s the by-product of that? AT&T, end of last year and first half of this year, has just surpassed the competition in terms of wireless network performance. It is unequivocally the fastest wireless network, best quality network. We’ve exceeded the competition and the gap is widening. It’s not getting closer. That’s a beautiful place to be for a company like ours, having a high-quality network claim. And it’s really important when you’re entering a world of distributing premium video to our consumers over wireless networks.”

Stephenson credits AT&T’s FirstNet build for helping with much of the company’s work on 5G:

“You have to go out and you have to climb every cell tower where you’re deploying this (FirstNet) network nationwide. Why is that such a big deal? We have also, over my tenure as CEO, invested well over $40 billion in aggregating a big portfolio of wireless spectrum. And this is really important because we believe when the world of video came, and you’re distributing video over wireless networks, you’re going to need an amazing amount of capacity. So we’ve been accumulating this wireless spectrum, $40 billion plus worth of this. To put that spectrum to work, what do you have to do? You have to go climb every cell tower and put it to work. This is expensive stuff to do across an entire country.”

And “what do you have to do to deploy 5G? You have to go climb every cell tower in the country and put up 5G antennas and the hardware associated with it.” he said. More specifically, Stephenson stated:

“We will, as a result of all this work that I just talked about, we will have a nationwide 5G footprint by midyear next year, nationwide 5G by midyear next year in the really premium spectrum areas of our network. And so we’re feeling really good about wireless.”

AT&T presently has 21 pre-standard 5G markets up in the U.S. using high band millimeter wave (mmWave) spectrum. Stephenson said that T-Mobile, AT&T and Verizon are all going “aggressively” for 5G markets in the U.S. In fact he considers the US the global leader in 5G.

This author strongly disagrees and believes that almost all of the currently deployed pre-standard 5G networks will have to be replaced in 2021-2023 after IMT 2020 is standardized by the ITU (not 3GPP!).

Stephenson said, “In China, I’m not aware of any 5G systems up and running…In Europe I’m not aware of an RFP [request for proposal] out.” While it’s true that China is currently in the build-out phase of 5G, it’s a top priority of China’s government to be the world leader as per this recent IEEE Techblog post.

Stephenson also talked up the benefits of 5G (as if there wasn’t enough hype already?). For instance, he says that 5G can handle “millions” of devices on a cell and locate objects to within “centimeters” rather than meters. The networks, he added, will also be “real time” and help with the “virtualization” of functions — an initiative that AT&T has already been pursuing aggressively through various open source projects in the OCP, ONF and Linux Foundation.

“You have to have powerful compute capability for 5G. All of a sudden, when you have networks this fast, you can begin to push a lot of these requirements, storage into the edge of the network. And so you’re getting cloud distributed (computing) down to the edge of the network. This brings a whole different level of speed, but it also brings a whole different level of imagination in terms of what do form factors start to look like? Millions of devices per square mile literally being located within centimeters of each other with a whole different form factor in terms of power, storage and compute requirements. I mean, truly, the Google vision of a few years ago that everybody laughed about, that this becomes the screen, that’s feasible. That is truly feasible. Sensors that are microscopic because the power requirements are so much lower. And where this allows you to go as a society? I mean traffic management capability because of sensors that are this cheap and broadly distributed, millions per square mile, pipeline management, utility — I can go on and on, autonomous cars.” Ughhhhh!

Continuing with his 5G cheer leading, Stephenson added:

“When you go to 5G, millions of simultaneous connections are now feasible within a given square mile area on this technology (unlike 4G-LTE). That’s a different business proposition for everybody who sits in this room and all the companies you invest in. So the connectivity goes to a different level. The security, this is the part we love, goes to a different level as well,” he added.

Note — AT&T’s mmWave Spectrum holdings:

AT&T currently uses mmWave spectrum for its 5G+ service. The company’s 5G spectrum holdings in the millimeter wave band are now more than 630 MHz (as of July 2019 as per this press release). All of the licenses won in FCC Auction 102 were in the more valuable upper 500 MHz portion of the 24 GHz band, AT&T said. “We’re leading the nation in mobile 5G deployment and the large, contiguous block of spectrum we won in Auction 102 will be critical to maintaining that leadership,” said Scott Mair, president of AT&T Operations. For more information, please see this IEEE Techblog post.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

Regarding virtualization of 75% of AT&Ts network (a claim we think is highly exaggerated as per this comment), the AT&T CEO said:

“This virtualization, which we now have 75% of our network virtualized, cloud-based types of architecture, we are now 17 — roughly 17 quarters where the cost of this has been going down year-over-year 7% to 8%, year-over-year for about 17 straight quarters. That’s a stunning development. For a company like ours, to get yourself in a cost position like that to address pricing pressure, competition from the Chinese and so forth, it’s a really powerful thing.”

As for AT&T’s wireless network operator competition, Stephenson said:

“Everybody is in an aggressive build cycle for 5G, so a lot of capital being deployed as well. But do have a new player in the market in the form of DISH with a prepaid business and a lot of fallow spectrum? Does that come into the market? And the AGs have a successful lawsuit and block it? I honestly don’t know how predict it. I do think the next 2 or 3 years doesn’t get radically different. If the Sprint/T-Mobile deal gets done, everybody’s — Sprint, T-Mobile, we know what that play looks like to run integrations of large-scale networks. They have a lot of great opportunity. They’ll have a lot of spectrum to put to work, but it’s a 2- or 3-year integration exercise. DISH will have a rather significant period of time to build out networks. So next 2 or 3 years may be as predicable as they’ve been. As soon as you say that, something will change, but it’s kind of my assessment of it right now.”

“You have T-Mobile, AT&T and Verizon all going aggressively, accumulating the spectrum required to deploy this, getting the spectrum cleared and the right bands to deploy this and working the standards of the technology. And so we have been aggressive. AT&T was hyper-aggressive at working the global standards for 5G so that our network equipment providers can manufacture equipment and get us in the market.”

Question to Ponder?

In conclusion, we ask readers to think if Stephenson’s remarks are truly accurate, especially his claims (echoed by many AT&T executives) that the company has virtualized 75% of its network functions. That would mean replacing that percentage of network equipment (hardware with embedded proprietary software/firmware) with open source virtualization software and orchestration running in commodity compute servers with white box switches and transport network elements. Is that true or is it “lies and more lies?”

References:

https://www.lightreading.com/mobile/5g/atandt-ceo-us-ahead-in-5g/d/d-id/754180?

China’s telecom carriers to play a pioneering role in 5G; China Telecom and China Unicom may be barred from U.S.

by Ma Si <[email protected]> of China Daily Multimedia Co. Ltd.

Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association, and a keen observer of the telecom sector for nearly two decades, said: “Chinese telecom companies have made big strides in their innovation capabilities, through their consistent and heavy input into research and development. They have strong willingness to pioneer cutting-edge applications.”

Four of the world’s top six smartphone makers – Huawei, Xiaomi, Oppo and Vivo – are Chinese. In 2018, the country produced 1.8 billion smartphones, accounting for 90 percent of global production, data from the Ministry of Industry and Information Technology showed.

Their decades of efforts have helped nurture the world’s largest online population in a single nation – the 854 million strong Chinese netizens (as of June). That is more than the combined population of European countries. More importantly, more than 99 per cent of netizens in China surf the internet through smartphones.

Vistors try 5G phones at an international expo on June 20, 2019. [Photo by Liu Chenghe/For China Daily]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Wu Jichuan, 82, a former head of the former Ministry of Posts and Telecommunications, said handsets are becoming almost omnipresent in the country. They can help users do almost everything from buying movie tickets, booking hospital or clinic appointments to ordering meals.

“That was in sharp contrast to 1980’s when mobile communication services were first brought to China. Back then, only successful Chinese businesspeople were able to use brick-sized, palm-filling mobile phones,” Wu recalled.

Such phones, however, were capable of just two functions: making and receiving calls. Yet, they were luxury products of the time. A handset could cost as much as about 20,000 yuan ($2,798). Consumers had to pay an extra fee of 6,000 yuan to sign up for the telecom network services. Calls cost 5 jiao a minute. In comparison, the average salary of ordinary people was no more than 100 yuan a month, Wu said.

According to Wu, one of the biggest contributions of China’s telecom industry is that it laid down a sound digital infrastructure for companies and consumers to access fast internet networks at affordable prices. They laid the foundation for China’s kaleidoscope of mobile applications and thriving digital economy.

Leveraging these achievements, the country’s telecom carriers are scrambling to establish a beachhead in the 5G era, in which almost everything can be connected to the internet.

As at the end of May, Chinese companies accounted for more than 30 percent of all patents essential to the global standards for 5G. After the country granted the commercial 5G licenses in June, local telecom carriers are working to build a sound network infrastructure to accelerate the technology’s commercialization.

Yang Jie, chairman of China Mobile, the world’s largest mobile operator, said the company plans to cover 50 cities across China with 5G signals by the end of this year.

“That will involve deploying 50,000 5G base stations across the country,” Yang said, adding that the company has already raised 7 billion yuan as the first phase of a 5G fund to promote the development of key technologies. The planned total size of the fund is 30 billion yuan.

Similarly, China Unicom said it will cover at least 40 cities with 5G signals by the end of this year and work together with all industry partners, including foreign companies, to accelerate 5G infrastructure construction.

Just a day after securing its 5G license, China Unicom announced it had opened experience stores across 40 cities to encourage consumers to try applications powered by the superfast technology.

Visitors can play with mechanical robotic arms, watch 4K high-definition live-streaming, wear virtual reality goggles to play 3-D games and learn that with 5G, doctors can complete surgeries on patients 2,500 kilometers away.

Lyu Tingjie, a telecom professor at the Beijing University of Posts and Telecommunications, said: “After all the hype about 5G, the new era has finally started. All the state-of-the-art applications are getting closer to the public than ever. The next question is: How to better time the rollout and partner with a wide range of traditional sectors to boost efficiency?”

The country’s telecom carriers are expected to spend 900 billion yuan to 1.5 trillion yuan on 5G network construction from 2020 to 2025, according to a report from the China Academy of Information and Communications Technology.

The first batch of 5G smartphones hit the market in August. China Unicom said its 5G data packages will cost a minimum of 190 yuan, arguably the world’s lowest price, in its first stage of application.

In comparison, the minimum cost in South Korea’s 5G data packages is about 325 yuan per month, while US telecom operator AT&T charges users $70 (equivalent to 498 yuan) for 15-gigabytes of 5G data every 30 days.

Consumers visit the booth of China Telecom as the company’s Shanghai branch launches a promotion called “Buy 5G mobile phones and enjoy 5G network.” [Photo by Ying Liqing/China News]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Meanwhile, Chinese telecom equipment makers are securing a growing number of 5G contracts to supply foreign telecom carriers. Huawei said it had signed 50 commercial contracts for 5G with carriers worldwide, with 28 contracts from Europe, 11 from the Middle East, six from the Asia-Pacific region, four from the Americas, and one from Africa.

According to a forecast by the Global System for Mobile Communications Association, an industry group, China is set to become the world’s largest 5G market by 2025, with 460 million 5G users.

……………………………………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Huawei

In 2003, when Huawei Technologies Co, then known more as a manufacturer of telecom equipment like switches, and base stations, decided to set up a mobile phones department, China was still using 2G, or the second-generation wireless technology. Back then, only a fraction of consumers could use cellular phones to surf the internet. And it took them about five seconds or longer to open a web page.

Sixteen years later, Huawei is the world’s second-largest smartphone maker. Its 5G-enabled handsets can download heavy data files – say, a 1 GB movie – in seconds. That’s just a glimpse of the commercial possibilities in the 5G era, which China kicked off in June.

From a virtual non-entity in the global mobile phones market to a world-renowned company, Huawei’s rise has been meteoric, and it coincided with the development of China’s telecommunications industry.

Huawei, however, is just one of the many Chinese telecom companies that have thrived on the global stage in recent years, helping the country to transform from a follower during the period of 2G and 3G to a pioneer in the 5G era.

William Xu, a director on Huawei’s board and president of the Institute of Strategic Research, said the company has had more than 200,000 5G base stations in shipment, which marked a steady step forward, compared with its earlier announcement of 150,000 base stations in late June.

Huawei has invested about $4 billion in all so far in the research and development of 5G since 2009.Founder and CEO Ren Zhengfei has said in an interview that other players will not be able to catch up with Huawei in 5G over the next two to three years.

http://www.chinadaily.com.cn/a/201909/16/WS5d7ee28ca310cf3e3556b8d9.html

……………………………………………………………………………………………………………………………………………………………………………………………………………………….

Senators Urge F.C.C. to Review Licenses of 2 Chinese Telecom Companies:

Senator Chuck Schumer of New York along with Senator Tom Cotton of Arkansas, cited national security concerns in a letter to the FCC which asked the commission to review the licenses that giveChina Telecom and China Unicom, the right to use networks in the United States. In the letter, they said that the two Chinese government-linked telecom operators could use that access to “target” Americans’ communications. And they warned that the companies could reroute communications traveling on their networks through China. The text of the letter was obtained by The New York Times.

Brian Hart, an F.C.C. spokesman, said that Ajit Pai, the F.C.C. chairman, had made it clear that the agency was “reviewing other Chinese communications companies such as China Telecom and China Unicom” but didn’t commit to opening a formal proceeding to look at the licenses.

China Telecom denied that it represents a national security threat to the United States. China Unicom did not respond to a request for comment.

“We make the protection of our customers’ data a priority, and have built a solid reputation as one of the best telecom companies in the world,” said Ge Yu, a spokesman for China Telecom’s Americas subsidiary, adding that the company is proud of “maintaining a good standing with all regulatory agencies.”

National security officials have been worried for years that the Chinese government could use its companies to gain access to crucial telecommunications infrastructure. Those concerns have become more prominent as carriers in the United States and in China race to launch next-generation 5G wireless networks — and American regulators have targeted Chinese telecom companies in the name of security.

In May the F.C.C. denied an application from China Mobile to operate in the United States. Ajit Pai, the commission’s chairman, said at the time that there was a risk that the Chinese state would use the carrier to “conduct activities that would seriously jeopardize the national security, law enforcement, and economic interests of the United States.”

So if the FCC bans China Telecom and China Unicom it will be a trifecta ban on all three state owned Chinese telecom operators!

https://www.nytimes.com/2019/09/15/business/federal-communications-commission-china.html

………………………………………………………………………………………………………………………………………………………………………………………………………………………..